RM plc (RM.) RM plc: Proposed sale of the RM Integris and RM

Finance Business 28-Nov-2022 / 07:00 GMT/BST Dissemination of a

Regulatory Announcement, transmitted by EQS Group. The issuer is

solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/ 2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("UK MAR"), and is disclosed in accordance

with the Company's obligations under Article 17 of UK MAR. Upon the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain. The person responsible for making this disclosure on

behalf of the Company is Mark Lagler, Group General Counsel and

Company Secretary of the Company.

28 November 2022

RM plc Proposed sale of the RM Integris and RM Finance

Business

Continuation of RM's transformation strategy

Cash proceeds intended to reduce debt and strengthen the balance

sheet

RM plc, a leading supplier of technology and resources to the

education sector (LSE: RM) ("RM", the "Company" or, together with

its subsidiary undertakings, the "Group"), today announces that it

has conditionally agreed to sell the RM Integris and RM Finance

Business and related assets of its principal trading subsidiary, RM

Education Limited ( "RMEL"), (the "RM Integris and RM Finance

Business") to The Key Support Services Limited ("The Key").

Total consideration for the Sale, which will constitute a Class

1 transaction, will be up to GBP16.0 million in cash on a

cash-free/debt-free basis and subject to customary normalised

working capital adjustments (the "Sale"). This agreement follows

the strategic review outlined earlier this year. Completion of the

Sale ("Completion") is expected to take place during the first half

of 2023.

Highlights:

-- Sale of the RM Integris and RM Finance Business to The Key

for a consideration of up to GBP16.0 million incash.

-- Initial consideration of GBP12.0 million in cash will be paid

on completion, adjusted to reflect thenormalised working capital

position of the RM Integris and RM Finance Business.

-- The remaining consideration will be paid in cash subject to

the satisfaction of certain conditions,including those relating to

competition clearance.

-- The net proceeds of the Sale will be used to reduce Group

indebtedness and strengthen its balance sheet.

-- The Sale executes against the previously outlined strategy to

restructure the RM Technology Division andto refocus its strategy

on its core Managed Services business.

-- The Sale constitutes a Class 1 transaction under the Listing

Rules of the Financial Conduct Authority(the "FCA"), (the "Listing

Rules") and is therefore conditional upon, amongst other things,

shareholder approval.

Neil Martin, Chief Executive Officer of RM plc, commented:

"This Sale allows RM to better focus our resources and efforts

within RM Technology to take greater advantage of the market

opportunity presented by the growth in larger school groups and the

increasing use of technology. In addition to its strategic

importance, the net proceeds of the Sale will reduce our debt

levels across the Group, thereby supporting our transformation

strategy to deliver long term value for our stakeholders.

"RM Integris and RM Finance are both good products and will be

well placed to develop as part of The Key, which we believe is a

good outcome for our customers, employees, and other stakeholders.

We thank all our employees for their excellent work, especially

those in the RM Integris and RM Finance Business."

Enquiries:

RM plc

Neil Martin, Chief Executive Officer Tel: +44 (0)1235 401 805

Emmanuel Walter, Chief Financial Officer (interim) investorrelations@rm.com

Cynthia Alers, Investor Relations Director (interim)

Headland Consultancy Tel: +44 (0)203 805 4822

Stephen Malthouse smalthouse@headlandconsultancy.com

Jemma Savage

Notes to Editors:

RM plc is a leading supplier to the international education

sector, with a turnover of GBP211m and approximately 2,000

employees globally. Established in 1973, RM provides market-leading

products and services to educational institutions, exam bodies and

international governments which improve, simplify and support

education and learning. The education sector is transforming, and

RM is well positioned to capitalise on this through its three

divisions:

-- RM Resources, an established provider of education resources

for early years, primary schools, andsecondary schools across the

UK and to eighty countries internationally.

-- RM Assessment, a leading provider of assessment software,

supporting exam awarding bodies, universities,and governments

worldwide to digitise their assessment delivery.

-- RM Technology, a market-leading supplier of ICT software,

technology and services to UK schools andcolleges.

Further Information on the Sale 1. Background to, and reasons

for, the Sale

Technology is playing an ever-greater role in education - from

the classroom to the way schools and trusts are managed. Schools

and trusts are asking for more advice, guidance, and support to

realise the benefits that technology can bring. RM's expertise in

the education sector and its national scale mean it can deliver

value for customers in this market by being a platform-led managed

services company.

The continued conversion to Academy status and the growth of

Multi-Academy Trusts are changing the landscape of English schools.

RM's target customers are mid-sized Multi-Academy Trusts, which it

expects will make up most of the market within the next few years.

In contrast, RM Integris and RM Finance are popular with

single-site primary schools, and the product is not developed to

meet the growing requirements of the Group's target Multi-Academy

Trust customers. The Sale of the RM Integris and RM Finance

Business is a strategic decision to enable the Group to focus on

meeting the growing demand from its target customer base. It is

part of the wider restructure of the RM Technology business, as set

out in the Group's transformation plan announced in February 2022.

2. Principal terms of the Sale

The Sale Agreement

The Company (as guarantor), RMEL and The Key have entered into a

sale and purchase agreement (the "Sale Agreement") pursuant to

which RMEL has conditionally agreed to sell the entire issued share

capital of a newly incorporated, wholly owned subsidiary of RMEL,

Schools Educational Software Limited ("Newco"), to The Key.

Newco will acquire the RM Integris and RM Finance Business as

part of the hive-down transaction prior to Completion.

The initial consideration payable under the Sale Agreement is

GBP12.0 million in cash (the "Initial Consideration"). The Initial

Consideration will be paid on a cash-free/debt-free basis and

adjusted to reflect the normalised working capital position of the

RM Integris and RM Finance Business.

The total consideration will increase by up to an additional

GBP4.0 million (the "Additional Consideration") to GBP16.0 million

subject to satisfaction of certain conditions, including those

related to competition clearance. This includes deferred cash

consideration of GBP550,000, which will be payable subject to set

thresholds relating to hosting uptime and assistance in transfer of

services from RM's India subsidiary.

If the Additional Consideration is not payable, but The Key

divests Newco (or all, or substantially all, of its business and

assets) within a defined period following Completion a divestment

fee of up to GBP4.0 million will be payable to RMEL subject to

certain conditions being met.

The Sale Agreement contains certain warranties, undertakings,

covenants, and indemnities from RMEL to The Key in respect of the

RM Integris and RM Finance Business which are in a customary form

for such a transaction.

The Sale constitutes a Class 1 transaction under the Listing

Rules and, as such, the Sale Agreement is conditional upon the

approval of the Company's shareholders in a general meeting (the

"General Meeting"). A Class 1 circular (the "Circular") which is

required to be approved by the FCA, containing, amongst other

things, further details of the Sale, the Company's board of

directors' (the "Board") recommendation to vote in favour of the

resolution approving the Sale (the "Resolution") and the notice

convening the General Meeting will be published by the Company in

due course and will be available for inspection at

https://www.rmplc.com/announcements in due course.

In the event that the Resolution is not approved by shareholders

at the General Meeting on or before the date falling 12 months from

the date of the Sale Agreement (the "Longstop Date") and Completion

does not occur, the Company has agreed to pay The Key a break fee

of GBP343,887 in cash.

Further details of the Sale Agreement will be set out in the

Circular.

The TSA

Prior to Completion, RMEL and Newco will also enter into a

transitional services agreement (the "TSA"). The services under the

TSA will generally be provided for up to one year following

Completion.

Further details of the TSA will be set out in the Circular. 3.

Information on the RM Integris and RM Finance Business RM Integris

is a leading school management information system in England.

Flexible and easy-to-use, RM Integris is designed to give teachers

and administration staff the tools they need for flexible,

efficient working. RM Finance is a financial management system for

administering school finances and budgeting. Together, this

business has approximately 3,000 customers. 4. Information on the

continuing Group

(MORE TO FOLLOW) Dow Jones Newswires

November 28, 2022 02:00 ET (07:00 GMT)

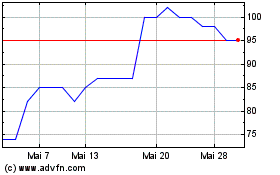

RM (AQSE:RM.GB)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

RM (AQSE:RM.GB)

Historical Stock Chart

Von Mär 2024 bis Mär 2025