TIDMAFRN

RNS Number : 1071E

Aferian PLC

28 June 2023

28 June 2023

AFERIAN PLC

("Aferian", the "Company" or the "Group")

Trading Update

- Continued strategic focus on software and services revenue growth in 24i

in fast growing video streaming market

- Focus on higher quality, higher margin streaming devices and

device management software in Amino

Aferian plc (LSE AIM: AFRN), the B2B video streaming solutions

company, announces a trading update for the six months ended 31 May

2023 (the "period"). Trading for the period was in line with the

trading and outlook communicated on the 31 May 2023.

Revenue performance

The Group has continued to make encouraging progress in

improving the quality of earnings and enhancing revenue visibility.

Aferian expects to report an improved exit run rate Annual

Recurring Revenue ("ARR") of c.$19.0m (31 May 2022: $15.8m),

representing 20% growth on the prior year, or 21% on a constant

currency basis. Higher margin software and services revenue for the

period is expected to be c.$13.7m (H1 2022: $12.0m), an increase of

14% versus the prior year, or 16% on a constant currency basis.

Device revenues in the first half are expected to be c.$9.4m,

representing a decrease of 71% year-on-year.

Consequently, Group revenue for the period is expected to be

c.$23.1m (H1 2022: $44.5m).

Cost reduction actions

As previously communicated, management actions taken in February

and June 2023 have reduced the Group's annualised cost base,

including capital expenditure, by c.$5m and a further c.$3m

respectively. This has saved a total of $3.4m operating costs and

$1.5m capital expenditure in the current financial year.

Balance sheet

Following proactive investment made in inventory within the

Amino business to de-risk supply chain delays, the Group's

inventory balance at 31 May 2023 was $8.6m (31 May 2022: $4.0m).

Net debt at 31 May 2023 was $13.0m (31 May 2022: $7.8m net cash).

Net debt is expected to reduce over the remainder of the current

financial year as inventory levels reduce. The Group remains in

compliance with its loan facilities covenants.

Outlook

For the full year ended 30 November 2023, 90% of management's

forecast Group revenues are contracted. The remaining 10% is

covered by a well-developed sales pipeline. Combined with the cost

reduction actions taken above, this provides the Board with

confidence in the expected outturn for the full year in which the

Group is expected to generate a positive material EBITDA.

The Group's strategy continues to be growing software and

services revenue in the fast-growing video streaming market through

the 24i division's streaming video platforms. Demand here remains

strong and the 24i management team are focused on accelerating

profitability in the second half of the financial year and

beyond.

The Amino division, which connects Pay TV to streaming services,

will now focus on higher quality, higher margin streaming devices

which can also be bundled with its SaaS device management platform.

This SaaS device management platform is also integrated with 3(rd)

party devices and sold on a standalone basis. With encouraging

initial traction, the Group will also look to continue to grow its

digital signage business.

At the Group level, the Board anticipates full year software and

services revenue growth of c.10% to 15% in this financial year. As

we move in to FY2024, the 24i business and management team will

focus primarily on the plan to deliver enhanced profitability and

cash generation.

Devices revenue in H2 2023 is expected to be higher than H1 2023

and this recovery is expected to continue in FY 2024 as inventory

levels continue to normalise within the supply chain.

Update on interim results announcement date

The Group expects to report its interim results for the six

months ended 31 May 2023 in August 2023.

-ENDS-

For further information please contact:

Aferian plc +44 (0)1954 234100

Mark Wells, Chairman

Donald McGarva, Chief Executive Officer

Mark Carlisle, Chief Financial Officer

Investec bank plc +44 (0)20 7597 5970

David Anderson / Patrick Robb / Nick Prowting / Cameron MacRitchie

FTI Consulting (Financial communications) +44 (0)20 3727 1000

Matt Dixon / Emma Hall / Tom Blundell / Aisha Hamilton

About Aferian plc

Aferian plc (AIM: AFRN) is a B2B video streaming solutions

company. Our end-to-end solutions bring live and on-demand video to

every kind of screen. We create the forward-thinking solutions that

our customers need to drive subscriber engagement, audience

satisfaction, and revenue growth.

It is our belief that successful media companies and services

will be those that are most consumer-centric, data driven and

flexible to change. We focus on innovating technologies that enable

our customers stay ahead of evolving viewer demand by providing

smarter, more cost-effective ways of delivering end-to-end modern

TV and video experiences to consumers. By anticipating

technological and behavioural audience trends, our software

solutions empower our customers to heighten viewer enjoyment, drive

growth in audience share and ultimately their profitability.

Aferian plc has two operating companies: 24i, which focusses on

streaming video experiences, and Amino, which connects Pay TV to

streaming services. Our two complementary companies combine their

products and services to create solutions which ensure that people

can consume TV and video how and when they want it. Our solutions

deliver modern TV and video experiences every day to millions of

viewers globally, via our growing global customer base of over 500

service providers.

Aferian plc is traded on the London Stock Exchange's AIM stock

market (AIM: symbol AFRN). Headquartered in Cambridge, UK, the

Company has over 300 staff located in 11 offices, including major

European cities as Amsterdam, Helsinki, Copenhagen and Brno, as

well as in San Francisco and Hong Kong. For more information,

please visit www.aferian.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUMWQUPWGQM

(END) Dow Jones Newswires

June 28, 2023 02:00 ET (06:00 GMT)

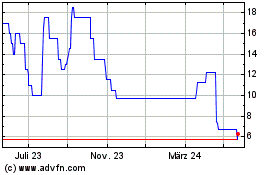

Aferian (AQSE:AFRN.GB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

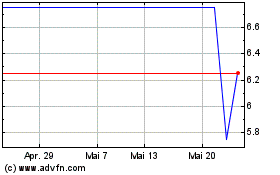

Aferian (AQSE:AFRN.GB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025