TIDMAFRN

RNS Number : 3492V

Aferian PLC

13 December 2021

13 December 2021

AFERIAN PLC

("Aferian", the "Company" or the "Group")

Trading Update, Banking Facility & New Chairman

appointment

- Strong financial performance, with strong YoY exit ARR growth

of 42% -

- New multi bank committed loan facility of up to $100m -

Aferian plc (LSE AIM: AFRN), the B2B video streaming solutions

company, is pleased to provide a trading update for the year ended

30 November 2021.

Trading update

The Group expects to report that all its key financial metrics

have tracked ahead of the prior year, and in line with Board

expectations, representing an overall strong trading performance.

As well as delivering further progress against its stated 2025

growth strategy, the Group has also successfully navigated

well-documented global supply chain challenges.

At a headline level, the Group expects to report(1) :

-- total revenue of approximately $92.0m representing a c11% increase

on the previous year ended 30 November 2020 ("FY20");

-- adjusted operating profit(2) growth up over 10% on last year;

-- improved quality of earnings thanks to higher-margin software

and services revenue of approximately $22.5m: a c15% increase

on FY20. This includes recurring revenue of approximately $13m,

a c17% increase on FY20;

-- enhanced revenue visibility with an exit run rate Annual Recurring

Revenue ("ARR") of approximately $15.0m, up 42% from $10.6m ARR

as at 30 November 2020;

-- a strengthened net cash position of $14.0m at 30 November 2021

(30 November 2020: $9.5m).

This improved net cash position comes alongside the Group's

expectation that it will report a net working capital outflow for

the year as a whole. Whilst there is no underlying change to our

debtor profile or cash generated, navigating the well-known supply

chain issues in the period was challenging and the timing of some

device shipments was pushed very close to our year end. This means

cash will be collected after the end of the period.

In addition to the strong growth in exit ARR, the Group has

further visibility of next year's devices revenue as the Group's

customers place orders up to 60 weeks in advance in response to

extended lead times in the supply chain.

New banking facilities

The Group has agreed a new banking facility with Barclays Bank

plc, Silicon Valley Bank, and Bank of Ireland. This increased

facility of $50m, split evenly across the new three bank club, also

includes a further $50m available by way of an accordion. The

increased facility will support the Group in achieving its 2025

strategy, particularly with regards to the execution of targeted

acquisitions. The new facility has a three year term with options

to extend by a further one or two years.

The existing bank facility with Barclays Bank plc remains

undrawn and it is expected that the new facility, subject to the

closure of customary conditions, will be fully available to the

Group by the end of December 2021.

Appointment of new Chairman

As announced in June 2021, Karen Bach notified the Board of her

intentions to step down as Non-Executive Chairman following nearly

six years of service on the Group's Board of Directors.

The Group is pleased to announce that, following a rigorous

search process, the Board has appointed a new Non-Executive

Chairman, Mark Wells, who will take up the position and join the

Board of Directors on 1 January 2022. Mark brings a wealth of

experience, gained through his 30-year career, guiding UK growth

technology businesses in value creation. He brings extensive

boardroom experience, including as Non-Executive Chairman for the

inertial navigation specialists, Oxford Technical Solutions

Limited, and for the predictive maintenance software provider,

Senseye. In addition, Mark was a Non-Executive Director for Kofax,

where he supported the business in its transition from a hardware

company into a software-led business specialising in intelligent

automation for digital workflow transformation. He was previously

CEO of visual effects company, Image Metrics.

Notice of results

Further detail on the Group's performance for the year ended 30

November 2021 will be provided at the Company's full year results

for the year ended 30 November 2021 expected to be announced during

the week commencing 7 February 2022.

Donald McGarva, Chief Executive Officer of Aferian plc,

said:

"This financial year Aferian has delivered an overall strong

performance, with each of the key metrics tracking ahead of last

year. Our 2025 strategy continues to evolve our business into a

leading video streaming solutions company with more predictable and

higher-quality recurring software and services revenue. The

visibility we have into next year's performance is high. I am

particularly proud of our team's delivery here, especially given

the backdrop of tough supply chain challenges all organisations

have had to manage.

"On behalf of the Board and the entire Aferian team, I am

pleased to welcome Mark Wells to our business as Non-Executive

Chairman. He joins us on 1 January 2022 at a moment of real

strength and real ambition. We look forward to benefiting from his

contribution as we push on towards our 2025 goals. Mark will take

over from Karen Bach, who steps down on 31 December 2021. On behalf

of the Board, I would like to thank Karen for her service and

support. We have all benefitted from her energy and

perspective."

Mark Wells, Non-Executive Chairman Designate of Aferian plc,

said:

"I have a real enthusiasm for working with ambitious software

and technology companies and as such am excited to be joining the

board of Aferian. Their 2025 strategy for moving into the centre of

streaming services and pay TV is impressive, and I welcome the

opportunity to join the Company as it continues to make progress

executing its ambitious strategy and capitalising on structural

shifts in the TV market. I look forward to bringing my 30 years of

experience within the software industry to help the Company grow

and achieve its targets."

(1) All numbers in this section are unaudited.

(2) Adjusted operating profit is a non-GAAP measure and excludes

amortization of acquired intangible assets, exceptional items and

share-based payment charges.

The following information is disclosed pursuant to Rule 17 and

Schedule Two paragraph (g) of the AIM Rules for Companies.

Mark Benjamin Wells (66 years old) has been a director or

partner of the following companies during the five years preceding

the date of this announcement:

Current directorships and/or Past directorships and/or partnerships

partnerships

Cappfinity Limited Sky Futures Partners Limited

Invu Plc Romax Technology Limited

Oxford Technical Solutions Limited Cortexplus Limited

Senseye Limited

Visasset Limited

This announcement contains inside information and for the

purposes of MAR and Article 2 of Commission Implementing Regulation

(EU) 2016/1055 (as it forms part of the laws of the United Kingdom

by virtue of the European Union (Withdrawal) Act 2018, as amended

from time to time), the person responsible for arranging for the

release of this Announcement on behalf of the Company is Mark

Carlisle, Chief Financial Officer.

For further information please contact:

Aferian plc +44 (0)1223 598197

Donald McGarva, Chief Executive Officer

Mark Carlisle, Chief Financial Officer

Investec plc (NOMAD and Broker) +44 (0)20 7597 5970

David Anderson / Patrick Robb / Cameron MacRitchie

FTI Consulting LLP (Financial communications) +44 (0)20 3727 1000

Matt Dixon / Elena Kalinskaya / Gregory Hynes

About Aferian plc

Aferian plc (AIM: AFRN) is a B2B video streaming solutions

company. Our end-to-end solutions bring live and on-demand video to

every kind of screen. We create the forward-thinking solutions that

our customers need to drive subscriber engagement, audience

satisfaction, and revenue growth.

It is our belief that successful media companies and services

will be those that are most consumer-centric, data driven and

flexible to change. We focus on innovating technologies that enable

our customers stay ahead of evolving viewer demand by providing

smarter, more cost-effective ways of delivering end-to-end modern

TV and video experiences to consumers. By anticipating

technological and behavioural audience trends, our software

solutions empower our customers to heighten viewer enjoyment, drive

growth in audience share and ultimately their profitability.

Aferian plc has two operating companies: 24i, which focusses on

streaming video experiences, and Amino, which connects Pay TV to

streaming services. Our two complementary companies combine their

products and services to create solutions which ensure that people

can consume TV and video how and when they want it. Our solutions

deliver modern TV and video experiences every day to millions of

viewers globally, via our growing global customer base of over 500

service providers.

Aferian plc is listed on the London Stock Exchange Alternative

Investment Market (AIM: symbol AFRN). Headquartered in Cambridge,

UK, the company has over 350 staff located in offices in San

Francisco, Amsterdam, Helsinki, Copenhagen, Madrid, Porto, Brno,

Buenos Aires, and Hong Kong. For more information, please visit

www.aferian.com

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAPAEFFDFFFA

(END) Dow Jones Newswires

December 13, 2021 02:00 ET (07:00 GMT)

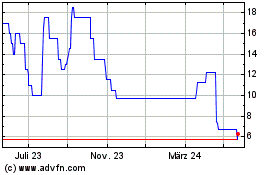

Aferian (AQSE:AFRN.GB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

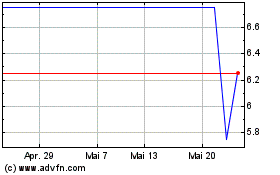

Aferian (AQSE:AFRN.GB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025