The recent surge in popularity of high yielding investment

avenues is not at all surprising, considering the desire for income

in this low rate environment. Fortunately, there are a number of

options available to investors from the ETF space to focus on

income.

While some of these ETFs provide a pure play in the income

investing space, others have a more holistic approach. There are

those which focus on income as well as appreciation, and thus could

be the best of both worlds.

Also, there are some others funds which do not limit themselves

to a particular asset class in order to generate steady streams of

income (read Junk Bond ETF Investing: Is It Too Late?).

With all this being said, it becomes extremely important for

investors to dive deep into the strategy employed, as well as the

holdings, expenses and performance of the prospective income ETFs

before choosing an investment option. In this article we compare

three ETFs, all of which primarily aim to generate income, but are

quite different in terms of strategy as well as their risk-return

tradeoff.

The ETFs in consideration are the, SPDR S&P Dividend

ETF (SDY),

Vanguard Dividend Appreciation ETF

(VIG) and the

Guggenheim Multi Asset Income

(CVY).

Equity Income ETFs and Their Strategies

SDY and VIG primarily focus on equities which have established a

historical trend of increasing their dividend payouts. For SDY, a

stock has to increase the dividend payout for at least 20

consecutive years, whereas for VIG, this period in consideration is

around 10 years (read Two Niche ETFs Beating SPY).

No matter how similar the strategy sounds, it actually has

tremendous impact on the underlying performance. This is because,

for a stock to consistently increase its dividend payout, the

fundamentals have to be extremely positive.

In fact, one could argue that the more consistent a company is

with its dividends, the better its underlying fundamentals and

operations are, which could enable it to generate steady

returns.

Having said this, the consistency factor is better suited for

SDY than VIG, since the consistency requirement for a stock to be

selected in SDY portfolio is around double than that of VIG i.e. 20

years as opposed to 10. In other words, it would be safe to argue

that SDY picks stocks of companies with a longer and more

established consistency trend.

Enter the Multi asset ETF

As far as CVY is concerned, it is exposed to a variety of asset

classes. CVY has exposure to high yielding equities, MLPs, REITs,

and preferred stocks.

It also gains exposure in various closed ended funds (CEFs) as

well as ADRs of high yielding foreign companies (see Is CVY The

Best Income ETF?).

In short, it provides a more holistic approach to investing.

Also, another worthwhile consideration in this regard would be the

fact that CVY would be free from any currency risk as the ETF holds

only U.S. dollar denominated assets. This is despite having

exposure to assets having an international flavor.

Consistent Performers: Best of Both Worlds?

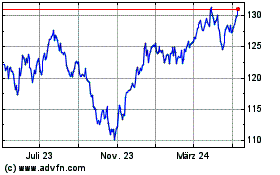

Consider the following two charts. The first chart depicts the 5

year comparative performance of the three ETFs in terms of total

returns whereas the second chart measures the comparative

performance excluding the dividend component in total returns.

Chart 1: Comparative Total Returns

Chart 2: Comparative (excluding

Dividends)

Not surprisingly, SDY is seen outperforming VIG and CVY, both in

terms of total returns as well as the appreciation only (i.e.

excluding dividend) parameters. This supports the ‘more

consistent performers in SDY portfolio’ argument that we put

forward in the earlier part of the article.

This is because the stocks in the portfolio of SDY have not only

outperformed in terms of dividend payments, but their consistent

performance has also priced in the sentiment factor that investors

show towards fundamentally strong consistent performance. This is

evident by the capital appreciation (see HYLD: Crushing the High

Yield ETF Competition).

The following table summarizes the risk return tradeoff of the

three ETFs

|

Returns Profile

|

|

ETFs

|

Total Returns

|

Capital Appreciation

|

Dividends

|

|

SDY

|

48.04%

|

23.64%

|

24.40%

|

|

VIG

|

35.44%

|

20.91%

|

14.53%

|

|

CVY

|

39.90%

|

3.36%

|

36.53%

|

|

Risk Profile (Volatility)

|

|

ETFs

|

5 Year Annualized

|

3 Year Annualized

|

|

SDY

|

26.57%

|

16.00%

|

|

VIG

|

21.91%

|

16.00%

|

|

CVY

|

27.58%

|

15.40%

|

| |

|

|

|

|

Here again we see SDY comfortably beating VIG in capital

appreciation as well as dividends. However, a closer look at the

traits of CVY reveals some very important facts. It almost entirely

depends on dividends in order to fetch returns.

This is primarily due to its large focus on income generating

sources and less on pure play equities which provide little

appreciation but robust dividends (read Gold ETFs in Focus: When to

Consider GLDI).

In other words, shares worth $100 of CVY might only appreciate

to $103.36 in 5 years’ time which is almost nothing compared to the

equity ETFs. But in these 5 years, the $100 investment would yield

$36.53 in dividends. A very important fact indeed, especially for

investors dependent on a timely and steady stream of cash flows and

less focused on growth.

The Bottom Line

The investment choice would almost entirely depend on the

requirement of the investors. For example, as we can see, investors

seeking more of current income and less of growth over the longer

term would be better off playing CVY.

However, for others seeking more of growth and relatively lower

levels of steady cash flows, any of the equity focused funds would

be better choices. Either way, it is clearly important to know what

is inside your income ETF and how it goes about buying securities,

as this can have a huge impact on overall returns.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

GUGG-MULTI-ASST (CVY): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

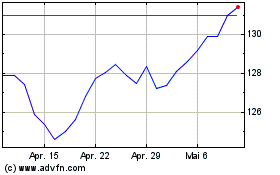

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Mär 2024 bis Mär 2025