UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

☐

Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒

Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended June 30, 2024

Commission File Number 001-40381

New Pacific Metals Corp.

(Exact name of Registrant as specified in its charter)

| British Columbia | | 1040 | | Not Applicable |

| (Province or Other Jurisdiction | | (Primary Standard Industrial | | (I.R.S. Employer |

| of Incorporation or Organization) | | Classification Code) | | Identification No.) |

1066 West Hastings Street

Suite 1750

Vancouver BC

Canada V6E 3X1

(604) 633-1368

(Address and telephone number of Registrant’s principal executive offices)

| DL Services Inc. Columbia Center 701 Fifth Avenue, Suite 6100 Seattle, WA 98104-7043 (206) 903-8800 (Name, address (including zip code) and telephone number (including area code) of agent for service in the United States) |

Securities registered or to be registered pursuant to Section 12(b)

of the Act:

| Title of Each Class: | | Trading Symbol: | | Name of Each Exchange On Which

Registered: |

| Common shares, no par value | | NEWP | | NYSE American LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section

15(d) of the Act: None

For annual reports, indicate by check mark the information filed with

this form:

| ☒ Annual Information Form | | ☒ Audited Annual Financial Statements |

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 171,299,119

Indicate by check mark whether the Registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such

shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past

90 days. ☒ Yes ☐

No

Indicate by check mark whether the Registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

☒ Yes ☐

No

Indicate by check mark whether the Registrant

is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging Growth Company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange

Act. ☐

† The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012.

Indicate by check mark whether the Registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY NOTE

New Pacific Metals Corp. (“we”,

“us”, “our”, the “Company” or the “issuer”) is a Canadian corporation that is permitted,

under a multijurisdictional disclosure system adopted by the United States, to prepare this annual report on Form 40-F (“Annual

Report”) pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in accordance

with disclosure requirements in effect in Canada, which are different from those of the United States.

FORWARD LOOKING STATEMENTS

This Annual Report, including

the Exhibits incorporated by reference into Annual Report, contains “forward-looking information” and “forward-looking

statements” within the meaning of applicable Canadian and U.S. securities legislation. The forward-looking statements herein are

made as of the respective dates set forth in the Exhibits incorporated by reference into this Annual Report, and the Company does not

assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise,

except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as

“plans”, “expects”, “is expected”, “budgets”, “scheduled”, “estimates”,

“forecasts”, “predicts”, “projects”, “intends”, “targets”, “aims”,

“anticipates” or “believes” or variations (including negative variations) of such words and phrases or may be

identified by statements to the effect that certain actions “may”, “could”, “should”, “would”,

“might” or “will” be taken, occur or be achieved. Estimates of mineral reserves and mineral resources are also

forward-looking statements because they represent estimates of mineralization that will be encountered if a property is mined, in addition

to involving projection relating to future economic conditions. Forward-looking statements and information are based on forecasts of future

results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently

subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information

are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict,

that may cause the Company’s actual results, performance or achievements to be materially different from those expressed or implied

thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited

to: the Company’s ability to carry on current and future operations, including: the effects of a public health crisis on our operations

and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy

and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates,

projections and forecasts; the stabilization of the political climate in Bolivia and/or other jurisdictions where the Company operates;

the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of

necessary approvals or permits, including the ratification and approval of the mining production contract with Corporación Minera

de Bolivia by the Plurinational Legislative Assembly of Bolivia; the ability of the Company’s Bolivian partner to convert the

exploration licenses at the Carangas project to an administrative mining contract; the ability to meet current and future obligations;

the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions;

silver and gold price volatility; uncertainty related to mineral exploration properties; lack of infrastructure at mineral exploration

properties; risks and uncertainties relating to the interpretation of drill results and the geology, grade and continuity of mineral deposits;

uncertainties related to title to mineral properties and the acquisition of surface rights; risks related to governmental regulations,

including environmental laws and regulations and liability and obtaining permits and licenses; future changes to environmental laws and

regulations; unknown environmental risks from past activities; commodity price fluctuations; risks related to reclamation activities on

mineral properties; risks related to political instability and unexpected regulatory change; currency fluctuations; influence of third

party stakeholders; conflicts of interest; risks related to dependence on key individuals; risks related to the involvement of some of

the directors and officers of the Company with other natural resource companies; enforceability of claims; the ability to maintain adequate

control over financial reporting; disruptions or changes in the credit or security markets; actual results of current exploration activities;

mineral reserve and mineral resource estimate risk; actual results of current reclamation activities; conclusions of economic evaluations;

changes in project parameters as plans continue to be refined; changes in labour costs or other costs of production; labour disputes and

other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction

activities; the ability to renew existing licenses or permits or obtain required licenses and permits; increased infrastructure and/or

operating costs; risks of not meeting production and cost targets; discrepancies between actual and estimated production; metallurgical

recoveries; mining operational and development risk; litigation risks; speculative nature of silver exploration; global economic climate;

dilution; environmental risks; community and nongovernmental

actions; regulatory risks; U.S. securities laws; and cyber-security risks; and other assumptions and factors generally associated with

the mining industry. The Company undertakes no obligation to update forward-looking information except as required by applicable law.

Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking

statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance

on forward-looking statements or information. Some of the disclosure in this Annual Report and the Exhibits incorporated by reference

to this Annual Report is based on information publicly disclosed by the owners or operators of these properties and information/data available

in the public domain as at the date hereof, and none of this information has been independently verified by the Company. Readers are cautioned

that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this Annual Report

and the Exhibits incorporated by reference to this Annual Report are qualified by these cautionary statements.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING

PRACTICES

The Company is permitted, under

a multijurisdictional disclosure system adopted by the United States, to prepare this Annual Report in accordance with Canadian disclosure

requirements, which are different from those of the United States. The Company prepares its financial statements, which are filed with

this Annual Report in accordance with International Financial Reporting Standards as issued by the International Accounting Standards

Board. Therefore, they are not comparable in all respects to financial statements of United States companies that are prepared in accordance

with United States generally accepted accounting principles.

MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Unless otherwise indicated,

all mineral resource and mineral reserve estimates included in the documents incorporated by reference into this Annual Report have been

prepared in accordance with Canadian National Instrument 43-101 (“NI 43-101”) and the Canadian Institute of Mining and Metallurgy

Classification System. NI 43-101 is a rule developed by the Canadian securities administrators, which establishes standards for all public

disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101,

differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”). Accordingly,

mineral resource and mineral reserve estimates, and other scientific and technical information, contained in the documents incorporated

by reference into this Annual Report may not be comparable to similar information disclosed by U.S. companies.

PRINCIPAL DOCUMENTS

The following documents, filed

as Exhibits 99.1, 99.2 and 99.3 to this Annual Report, are hereby incorporated by reference into this Annual Report on Form 40-F:

| |

(a) |

Annual Information Form for the fiscal year ended June 30, 2024; |

| |

(b) |

Management’s Discussion and Analysis for the fiscal year ended June 30, 2024; and |

| |

(c) |

Audited Consolidated Financial Statements for

the fiscal year ended June 30, 2024 and notes thereto, together with the report of the independent registered public accounting firm thereon.

As disclosed in Exhibit 99.1, the Silver Sand

preliminary economic assessment with an effective date of November 30, 2022 (the “Silver Sand PEA”) has been superseded by

the Silver Sand pre-feasibility study with an effective date of June 19, 2024 (the “Silver Sand PFS”). The Silver Sand PEA

should no longer be relied upon. To the extent Exhibit 99.2 includes a summary of the conclusions of the Silver Sand PEA, such summary

has been superseded by the Silver Sand PFS and should no longer be relied upon. |

CONTROLS AND PROCEDURES

| (a) |

Disclosure Controls and Procedures. See Exhibit 99.2, under the heading “Disclosure Controls and Procedures”. |

| (b) |

Management’s Annual Report on Internal Control Over Financial Reporting. See Exhibit 99.2, under the heading “Management’s Report on Internal Control Over Financial Reporting”. |

| (c) |

Attestation Report of the Independent Registered Public Accounting Firm. This Annual Report does not include an attestation report of the Company’s registered public accounting firm due to a transition period established by rules of the SEC for emerging growth companies. |

| (d) |

Changes in Internal Control Over Financial Reporting. See Exhibit 99.2, under the heading “Changes in Internal Control Over Financial Reporting”. |

NOTICES PURSUANT TO REGULATION BTR

The Company was not required

by Rule 104 of Regulation BTR to send any notices to any of its directors or executive officers during the fiscal year ended June 30,

2024.

AUDIT COMMITTEE FINANCIAL EXPERT

See Exhibit 99.1, under the

heading “11.3 Relevant Education and Experience”.

CODE OF ETHICS

The Board has adopted a written

code of ethics entitled, “Code of Business Conduct and Ethics” (the “Code”), by which it and all officers and

employees of the Company, including the Company’s principal executive officer, principal financial officer, principal accounting

officer or controller, and persons performing similar functions, are required to abide. The Code was most recently amended on October

24, 2023, to grant the authority to approve activities that could give rise to conflicts of interest to the Audit Committee of the Board,

to allow unrecorded or “off the books” funds or assets to be maintained if permitted by applicable laws or regulations, to

make certain references to the Company’s Whistleblower Policy and to make certain other non-material changes to the Code. There

were no waivers of the Code that apply to the Company’s principal executive officer, principal financial officer, principal accounting

officer or controller, or persons performing similar functions during the fiscal year ended June 30, 2024.

The Code is posted on the Company’s

website at https://newpacificmetals.com/company/corporate-governance, and a copy of the Code may be obtained, without charge, by contacting

the Corporate Secretary of the Company at the address or telephone number indicated on the cover page of this Annual Report. If there

is an amendment to the Code, or if a waiver of the Code is granted to any of the Company’s principal executive officer, principal

financial officer, principal accounting officer or controller, or persons performing similar functions, the Company intends to disclose

any such amendment or waiver by posting such information on the Company’s website. Unless and to the extent specifically referred

to herein, the information on the Company’s website shall not be deemed to be incorporated by reference in this Annual Report on

Form 40-F.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

See Exhibit 99.1, under the

heading “11.6 External Auditor Service Fees”.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

See Exhibit 99.1, under the

heading “11.5 Pre-Approval Policies and Procedures”. All audit-related fees, tax fees, or all other fees were approved by

the Audit Committee pursuant to Rule 2-01(c)(7)(i) of Regulation S-X. However, none of such fees were approved pursuant to the exemption

provided in Rule 2-01(c)(7)(i)(C) of Regulation S-X.

OFF BALANCE ARRANGEMENTS

The Company has no off-balance

sheet arrangements.

CONTRACTUAL AND OTHER OBLIGATIONS

Information regarding our contractual

and other obligations is included in the Management Discussion and Analysis incorporated herein by reference to Exhibit 99.2, under the

heading “Liquidity and Capital Resources” and “Financial Instruments”.

IDENTIFICATION OF THE AUDIT COMMITTEE

The Company’s Board has

a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Company’s

Audit Committee is comprised of Maria Tang, Dickson Hall and Paul Simpson. The Board has determined that each of the members of the Audit

Committee is independent as determined under Rule 10A-3 of the Exchange Act and Section 803 of the NYSE American Company Guide.

MINE SAFETY DISCLOSURE

The Company does not operate

any mine in the United States and has no mine safety incidents to report for the year ended June 30, 2024.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT

PREVENT INSPECTIONS

Not applicable.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

Since the beginning of the

last fiscal year, the Company has not been required to prepare an accounting restatement that required recovery of erroneously awarded

compensation pursuant to the Company’s Clawback Policy, nor was there an outstanding balance as of the end of the last completed

fiscal year of erroneously awarded compensation to be recovered from the application of the Clawback Policy to a prior restatement.

NYSE AMERICAN STATEMENT OF CORPORATE GOVERNANCE

DIFFERENCES

The common shares of the Company

are listed on the NYSE American. Section 110 of the NYSE American company guide permits NYSE American to consider the laws, customs and

practices of foreign issuers in relaxing certain NYSE American listing criteria, and to grant exemptions from NYSE American listing criteria

based on these considerations. A description of the significant ways in which the Company’s governance practices differ from those

followed by domestic companies pursuant to NYSE American standards is provided on the Company’s website at https://newpacificmetals.com/

company/corporate-governance/.

UNDERTAKINGS

The Company undertakes to make

available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested

to do so by the SEC staff, information relating to: the securities in relation to which the obligation to file an annual report on Form

40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has previously

filed with the SEC an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities

in relation to which the obligation to file this Form 40-F arises. Any change to the name or address of the Company’s agent for

service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

EXHIBITS

EXHIBIT INDEX

The following documents are being filed with the SEC as exhibits to

this Registration Statement on Form 40-F.

SIGNATURES

Pursuant to the requirements

of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual

Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

New Pacific Metals Corp. |

| |

|

| |

/s/ Andrew Williams |

| |

Name: Andrew Williams |

| |

Title: Chief Executive Officer |

| Date: September 24, 2024 |

|

Exhibit 97

NEW PACIFIC METALS CORP.

INCENTIVE COMPENSATION RECOVERY POLICY

The Board of Directors (the “Board”) of New Pacific Metals Corp. (the “Company”) believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity and accountability and that reinforces the Company’s compensation philosophy. The Board has therefore adopted this policy, which provides for the recovery of erroneously awarded Incentive Compensation (as defined below) in the event that the Company is required to prepare an Accounting Restatement (as defined below) due to material noncompliance of the Company with any financial reporting requirements under applicable Canadian or United States federal securities laws (this “Policy”). This Policy is designed to comply with Section 10D of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and listing standards of NYSE American LLC (the “NYSE American”) and the Toronto Stock Exchange (the “TSX”) or any other securities exchange on which the Company’s shares are listed in the future.

This Policy shall be administered by the Board or, if so designated by the Board, the Compensation Committee of the Company (the “Committee”), in which case, all references herein to the Board shall be deemed references to the Committee. Any determinations made by the Board shall be final and binding on all affected individuals.

Unless and until the Board determines otherwise, for purposes of this Policy, the term “Covered Executive” means a current or former employee who is or was identified by the Company as the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person (including any executive officer of the Company’s subsidiaries or affiliates) who performs similar policy-making functions for the Company. “Policy-making function” excludes policy-making functions that are not significant. “Covered Executives” will include, at minimum, the executive officers identified by the Company pursuant to Item 401(b) of Regulation S-K of the Exchange Act, if applicable.

This Policy covers Incentive Compensation received by a person after beginning service as a Covered Executive and who served as a Covered Executive at any time during the performance period for that Incentive Compensation.

1

|

|

| 4. |

Recovery: Accounting Restatement. |

In the event of an Accounting Restatement, the Company will recover reasonably promptly any excess Incentive Compensation received by any Covered Executive during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an Accounting Restatement, including transition periods resulting from a change in the Company’s fiscal year as provided in Rule 10D-1 of the Exchange Act. Incentive Compensation is deemed “received” in the Company’s fiscal period during which the Financial Reporting Measure (as defined below) specified in the Incentive Compensation award is attained, even if the payment or grant of the Incentive Compensation occurs after the end of that period.

|

|

|

|

(a) |

Definition of Accounting Restatement. |

|

|

|

|

|

For the purposes of this Policy, an “Accounting Restatement” means the Company is required to prepare an accounting restatement of its financial

statements filed with the United States Securities and Exchange Commission (the

“SEC”) due to the Company’s material noncompliance with any financial reporting requirements under applicable Canadian or United States federal securities laws (including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period).

The determination of the time when the Company is “required” to prepare an Accounting Restatement shall be made in accordance with applicable Canadian or United States federal securities laws and national securities exchange rules and regulations.

An Accounting Restatement does not include situations in which financial statement changes did not result from material non-compliance with financial reporting requirements, such as, but not limited to retrospective: (i) application of a change in accounting principles; (ii) revision to reportable segment information due to a change in the structure of the Company’s internal organization; (iii) reclassification due to a discontinued operation; (iv) application of a change in reporting entity, such as from a reorganization of entities under common control; (v) adjustment to provision amounts in connection with a prior business combination; and (vi) revision for stock splits, stock dividends, reverse stock splits or other changes in capital structure. |

|

|

|

|

(b) |

Definition of Incentive Compensation. |

|

|

|

|

|

For purposes of this Policy, “Incentive Compensation” means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure, including, for example, bonuses or awards under the Company’s short and long-term incentive plans, grants and awards under the Company’s equity incentive plans, and contributions of such bonuses or awards to the Company’s deferred compensation plans or other employee benefit plans. |

2

|

|

|

|

|

Incentive Compensation does not include awards which are granted, earned and vested without regard to attainment of Financial Reporting Measures, such as timevesting

awards, discretionary awards and awards based wholly on subjective standards, strategic measures or operational measures. |

|

|

|

|

(c) |

Financial Reporting Measures. |

|

|

|

|

|

“Financial Reporting Measures” are those that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements (including non-IFRS financial measures) and any measures derived wholly or in part from such financial measures. For the avoidance of doubt, Financial Reporting Measures include stock price and total shareholder return. A measure need not be presented within the financial statements or included in a filing with applicable securities regulatory authorities to constitute a Financial Reporting Measure for purposes of this Policy. |

|

|

|

|

(d) |

Excess Incentive Compensation: Amount Subject to Recovery. |

|

|

|

|

|

The amount(s) to be recovered from the Covered Executive will be the amount(s) by which the Covered Executive’s Incentive Compensation for the relevant period(s) exceeded the amount(s) that the Covered Executive otherwise would have received had such Incentive Compensation been determined based on the restated amounts contained in the Accounting Restatement. All amounts shall be computed without regard to taxes paid.

For Incentive Compensation based on Financial Reporting Measures such as stock price or total shareholder return, where the amount of excess compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement, the Board will calculate the amount to be reimbursed based on a reasonable estimate of the effect of the Accounting Restatement on such Financial Reporting Measure upon which the Incentive Compensation was received. The Company will maintain documentation of that reasonable estimate and will provide such documentation to the applicable national securities exchange or other regulator, upon request. |

|

|

|

|

(e) |

Method of Recovery. |

|

|

|

|

|

The Board will determine, in its sole discretion, the method(s) for recovering reasonably promptly excess Incentive Compensation hereunder. Such methods may include, without limitation: |

3

|

|

|

|

|

|

(i) |

requiring reimbursement of compensation previously paid; |

|

|

|

|

|

|

(ii) |

forfeiting any compensation contribution made under the Company’s

deferred compensation plans, as well as any matching amounts and earnings

thereon; |

|

|

|

|

|

|

(iii) |

offsetting the recovered amount from any compensation that the Covered

Executive may earn or be awarded in the future (including, for the avoidance of doubt, recovering amounts earned or awarded in the future to such individual equal to compensation paid or deferred into tax-qualified plans or plans subject to the Employee Retirement Income Security Act of 1974 (collectively, “Exempt Plans”); provided that, no such recovery will be made from amounts held in any Exempt Plan of the Company); |

|

|

|

|

|

|

(iv) |

taking any other remedial and recovery action permitted by law, as

determined by the Board; or |

|

|

|

|

|

|

(v) |

some combination of the foregoing. |

|

|

|

|

|

|

| 5. |

No Indemnification or Advance. |

Subject to applicable law, the Company shall not indemnify, including by paying or reimbursing for premiums for any insurance policy covering any potential losses, any Covered Executives against the loss of any erroneously awarded Incentive Compensation, nor shall the Company advance any costs or expenses to any Covered Executives in connection with any action to recover excess Incentive Compensation.

The Board is authorized to interpret and construe this Policy and to make all determinations necessary, appropriate or advisable for the administration of this Policy. It is intended that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act and any applicable rules or standards adopted by applicable securities regulatory authorities or any securities exchange on which the Company’s securities are listed.

The Board adopted this Policy on October 24, 2023. This Policy applies to Incentive

Compensation received by Covered Executives on or after October 24, 2023 (the “Effective

Date”) that results from attainment of a Financial Reporting Measure based on or derived from

financial information for any fiscal period ending on or after the Effective Date. In addition, this Policy is intended to be and will be incorporated as an essential term and condition of any Incentive

Compensation agreement, plan or program that the Company establishes or maintains on or after the Effective Date.

4

|

|

| 8. |

Amendment and Termination. |

The Board may amend this Policy from time to time in its discretion, and shall amend this Policy as it deems necessary to reflect changes in regulations adopted by applicable regulatory authorities, including under Section 10D of the Exchange Act and to comply with any rules or listing standards adopted by the NYSE American or the TSX or any other securities exchange on which the Company’s shares are listed in the future.

|

|

| 9. |

Other Recovery Rights. |

The Board intends that this Policy will be applied to the fullest extent of the law. The Board may require that any employment agreement or similar agreement relating to Incentive Compensation received on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree to abide by the terms of this Policy. Any right of recovery under this Policy is in addition to, and not in lieu of, any (i) other remedies or rights of compensation recovery that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, or similar agreement relating to Incentive Compensation, unless any such agreement expressly prohibits such right of recovery, and (ii) any other legal remedies available to the Company. The provisions of this Policy are in addition to (and not in lieu of) any rights to repayment the Company may have under Section 304 of the Sarbanes-Oxley Act of 2002 and other applicable laws.

The Company shall recover any excess Incentive Compensation in accordance with this Policy, except to the extent that certain conditions are met and the Board has determined that such recovery would be impracticable, all in accordance with applicable Canadian and United States federal securities laws, including Rule 10D-1 of the Exchange Act, and the rules and listing standards of the NYSE American and the TSX or any other securities exchange on which the Company’s shares are listed in the future.

This Policy shall be binding upon and enforceable against all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

5

Exhibit 99.1

ANNUAL INFORMATION FORM

For the year ended June 30, 2024

Dated as at September 24, 2024

NEW PACIFIC METALS CORP.

Suite 1750 - 1066 West Hastings Street

Vancouver, BC, Canada V6E 3X1

Tel: (604) 633-1368

Fax: (604) 669-9387

Email: info@newpacificmetals.com

Website: www.newpacificmetals.com

Table of Contents

All information in this Annual Information Form

(“AIF”) is as of June 30, 2024, unless otherwise indicated.

| 1.2 | Forward-Looking Statements |

Except for statements of historical fact relating

to New Pacific Metals Corp. (the “Company” or “New Pacific”), certain statements and information

contained in this AIF constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation

Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws

(collectively, "forward-looking statements"). Any statements or information that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but

not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”,

“plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”,

“targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”,

“potential” or variations thereof or stating that certain actions, events or results “may”, “could”,

“would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and

similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include,

but are not limited to: statements regarding anticipated exploration, drilling, development, construction, and other activities or achievements

of the Company; inferred, indicated or measured mineral resources or mineral reserves on the Company’s projects; the results of

any preliminary economic assessment (“PEA”), pre-feasibility study (“PFS”), mineral resource estimate

(“MRE”) and other technical reports; timing of receipt of permits and regulatory approvals, including approvals of

mining association contracts; estimates of the Company’s revenues and capital expenditures; the acquisition of other businesses,

assets or securities; the growth of Company's mineral resources through acquisitions and exploration; future securities offerings and

use of proceeds therefrom; the terms of the Company’s securities; use of proceeds; capital expenditures; success of exploration

activities; government regulation of mining operations; environmental risks; and other forecasts and predictions with respect to the Company

and its properties.

Forward-looking statements or information are

subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from

those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic and

social impact of public health crisis; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and

mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel;

conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future,

environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada, risks associated with community

relations and corporate social responsibility, and other factors described under the heading “Risk Factors” in this AIF. This

list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information.

The forward-looking statements are necessarily

based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this AIF that, while considered

reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These

estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company’s ability

to carry on current and future operations, including: public health crisis on our operations and workforce; development and exploration

activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections,

forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the stabilization

of the political climate in Bolivia; the Company’s ability to obtain and maintain social license at its mineral properties; the

availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary

approvals or permits, including the ratification and approval of the Mining Production Contract (“MPC”) with Corporación

Minera de Bolivia (“COMIBOL”), the Bolivian state mining corporation, by the Plurinational Legislative Assembly

of Bolivia; the ability of the Company’s Bolivian partner to convert the exploration licenses at the Carangas Project (as defined

below) to Administrative Mining Contract (“AMC”); the ability to meet current and future obligations; the ability to

obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other

assumptions and factors generally associated with the mining industry.

Although the forward-looking statements contained

in this AIF are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be

consistent with these forward-looking statements. All forward-looking statements in this AIF are qualified by these cautionary statements.

The forward-looking statements contained in this AIF are made as of the date of such document and, accordingly, is subject to change after

such date. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws,

the Company is under no obligation and

expressly disclaims any such obligation to update or alter the forward-looking statements whether

as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made

as of the date of this AIF.

| 1.3 | Cautionary Note to U.S. Investors Concerning Preparation of Mineral Resource and Mineral Reserve Estimates |

This AIF has been prepared in accordance with

the securities laws in effect in Canada which differ from the requirements of the United States of America (“U.S.”

or “United States”) securities laws. The technical and scientific information contained herein has been prepared in

accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”),

which differs from the standards adopted by the U.S. Securities and Exchange Commission (the “SEC”) under subpart 1300

of Regulation S-K (the “SEC Modernization Rules”). The Company is not currently subject to the SEC Modernization Rules.

Accordingly, the Company's disclosure of mineralization and other technical information herein may differ significantly from the information

that would be disclosed had the Company prepared such information under the standards adopted under the SEC Modernization Rules.

Readers are cautioned not to assume that all or

any part of mineral resources will ever be converted into reserves. Pursuant to the Canadian Institute of Mining Definition Standards

on Mineral Resources and Reserves (the “CIM Standards”), inferred mineral resources are that part of a mineral resource

for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence

is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence

than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected

that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian

rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.

Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable.

All sums of money which are referred to herein

are expressed in U.S. dollars, unless otherwise specified. The symbol “CAD$” denotes lawful money of Canada. The following

table sets forth, for each of the periods indicated, the year-end exchange rate, the average closing rate and the high and low closing

exchange rates for one Canadian dollar expressed in U.S. dollars, as quoted by the Bank of Canada:

| |

Year Ended June 30, |

| |

2024 |

|

2023 |

|

2022 |

| High |

0.7617 |

|

0.7841 |

|

0.8111 |

| Low |

0.7207 |

|

0.7217 |

|

0.7669 |

| Average |

0.7379 |

|

0.7467 |

|

0.7902 |

| Period End |

0.7306 |

|

0.7553 |

|

0.7760 |

The exchange rate for one Canadian dollar expressed in U.S. dollars

based upon the daily average exchange rate on June 30, 2024 provided by the Bank of Canada was $0.7306.

| Item 2: | CORPORATE STRUCTURE |

| 2.1 | Names, Current Address and Incorporation |

The Company was formed as a special limited company

under the Company Act (British Columbia) on April 19, 1972. By special resolution of its shareholders dated July 21, 1983, the

Company converted itself from a special limited company to a limited company. Subsequently, on November 6, 1997, the Company continued

in Bermuda by way of continuation as a foreign corporation. On November 5, 2003, the Company continued in British Columbia under the Company

Act (British Columbia). In 2004, the Company adopted new Articles consistent with the transition to the Business Corporations Act

(British Columbia). On July 1, 2016, the Company’s name was changed to “New Pacific Holdings Corp.” On July 20,

2017, the Company’s name was changed back to “New Pacific Metals Corp.” The head office, principal address, and registered

and records office of the Company is located at Suite 1750 – 1066 West Hastings Street, Vancouver, British Columbia, Canada V6E

3X1.

The Company is a reporting issuer in British Columbia,

Alberta, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland. The common shares

of the Company (the “Shares”) trade on the Toronto Stock Exchange (“TSX”) under the symbol “NUAG”

and on the NYSE American, LLC (the “NYSE American”) under the symbol “NEWP”.

| 2.2 | Intercorporate Relationships |

The corporate structure of the Company and its

subsidiaries, as of June 30, 2024, is as follows:

| Item 3: | GENERAL DEVELOPMENT OF THE BUSINESS |

| 3.1 | Business of New Pacific |

The Company is a Canadian mining issuer engaged

in exploring and developing mineral properties in Bolivia. The Company’s precious metal projects include the flagship Silver Sand

project (the “Silver Sand Project”), the Carangas project (the “Carangas Project”) and the Silverstrike project

(the “Silverstrike Project”). With experienced management and sufficient technical and financial resources, management believes

the Company is well positioned to create shareholder value through exploration and resource development.

| (a) | Events subsequent to June 30, 2024 |

On August 8, 2024, the Company reported the

filing of its independent NI 43-101 titled “Technical Report – Silver Sand Project Pre-Feasibility Study” dated

August 8, 2024 and with an effective date of June 19, 2024 (the “Silver Sand PFS Technical Report”). AMC Mining

Consultants (Canada) Ltd. (the “AMC Consultants”) (mineral resource and reserves, mining, infrastructure and

financial analysis) was contracted to conduct the Silver Sand PFS Technical Report in cooperation with Halyard Inc. (metallurgy and

processing), and NewFields Canada Mining & Environment ULC (tailings, water and waste management). The qualified persons for the

PFS for the purposes of NI 43-101 are Mr. Wayne Rogers, P.Eng, and Mr. Mo Molavi, P.Eng, both Principal Mining Engineers with AMC

Consultants, Mr. Eugene Tucker, Principal Mining Engineer and Regional Manager with AMC Consultants, Mr. Andrew Holloway P.Eng,

Process Director with Halyard Inc., and Mr. Leon Botham P.Eng., Principal Engineer with NewFields Canada Mining & Environment

ULC, in addition to Ms. Dinara Nussipakynova, P.Geo., Principal Geologist with BBA Engineering Ltd., formerly with AMC Consultants,

who estimated the mineral resources (collectively, the “Silver Sand PFS Technical Report Authors”). The Silver

Sand PFS Technical Report shows a post-tax net present value at a 5% discount rate of $740 million with an internal rate of return

of 37% at a base case

price of $24.00 per ounce (“oz”) of silver, underpinned by a production of approximately 157

million oz of silver over 13 years of mine life with average life of mine all-in sustaining cost of $10.69/oz silver. The PFS is

based on the mineral resource estimate dated November 28, 2022 and with an effective date of October 31, 2022 (the “Silver

Sand MRE”). The Silver Sand PFS Technical Report was filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and it can also be located on the Company’s website at

www.newpacificmetals.com.

| (b) | Year ended June 30, 2024 |

On December 1, 2023, the Company announced the

appointment of Mr. Myles Gao and Mr. Andrew Williams as directors of the Company.

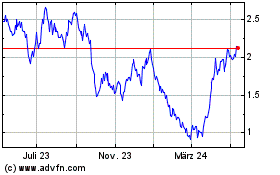

On September 29, 2023, the Company closed a bought

deal financing, where a total of 13,208,000 common shares of the Company were sold under the bought deal financing at a price of $1.96

(CAD $2.65) per common share for total gross proceeds of approximately $25.9 million (CAD $35 million) (the “Offering”).

The Offering was completed by way of a prospectus supplement dated September 26, 2023 (the “Prospectus Supplement”)

to the Company’s final short form base shelf prospectus dated August 16, 2023 (the “2023 Prospectus”). The underwriters’

fee and other issuance costs for the transaction were approximately $1.4 million. The Company intends to use the net proceeds of the Offering

to advance exploration and development at the Company’s Silver Sand and Carangas projects and for operating expenses, as disclosed

in the Prospectus Supplement.

On September 18, 2023, the Company filed its independent

technical report prepared in accordance with NI 43-101 titled “Carangas Silver-Gold Project – Department of Oruro, Bolivia

– NI 43-101 Mineral Resource Estimate Technical Report” with an effective date of August 25, 2023 (the “Carangas

MRE Technical Report”) and prepared by Anderson Goncalves Candido, FAusIMM, Principal Resource Geologist with RPMGlobal (Canada)

Ltd. (“RPM”). The qualified person for section 13 of the Carangas MRE Technical Report is Marcelo del Giudice, FAusIMM,

Principal Metallurgist with RPM.

On September 11, 2023,

the Company announced the appointment of Mr. Andrew Williams as Chief Executive Officer (“CEO”) and that Dr. Rui Feng,

founder of the Company, had stepped down as CEO. The Company also appointed Mr. Paul Simpson as a director of the Company.

On September 5, 2023,

the Company reported the inaugural independent NI 43-101 mineral resource estimate for its Carangas Project (the “Carangas MRE”).

The Carangas MRE was completed by RPM. The effective date of the Carangas MRE is August 25, 2023. Highlights of the Carangas MRE are as

follows:

| · | Total indicated mineral resources of 214.9 million

tonnes (“Mt”) containing 205.3 million ounces (“Mozs”) of silver (“Ag”), 1,588.2 thousand ounces (“Kozs”)

of gold (“Au”), 1,444.9 million pounds (“Mlbs”) of lead (“Pb”), 2,653.7 Mlbs of zinc (“Zn”),

and 112.6 Mlbs of copper (“Cu”); or collectively 559.8 Mozs silver equivalent (“AgEq”). |

| · | Total inferred mineral resources of 45.0 Mt containing

47.7 Mozs of silver, 217.7 Kozs of gold, 297.9 Mlbs of lead, 533.7 Mlbs of zinc, and 16.8 Mlbs of copper; or collectively 109.8 Mozs AgEq.

|

| · | Carangas is a globally significant Ag-Au polymetallic

discovery. |

| · | Mineralization starts at or near surface, potentially

allowing for open-pit mining with an average stripping ratio for the conceptual pit of approximately 1.8:1 (tonnes of waste : tonnes of

mineral resource). |

| · | Below the pit constraint, substantial gold-dominant

mineralization, similar in size and grade to the reported gold domain (as defined below), has the potential for conversion to underground

mineable resources pending further evaluation for reasonable prospects of eventual economic extraction. |

| · | Favorable initial metallurgical test work indicates

laboratory-based recoveries of up to 90% for silver and 98% for gold based on a combination of flotation and cyanide leaching. |

On August 16, 2023, the Company filed the 2023

Prospectus with the securities regulatory authorities in each of the provinces of Canada and a corresponding shelf registration statement

on Form F-10 with the United States Securities and Exchange Commission (the “Registration Statement”). The 2023 Prospectus

and the Registration Statement are expected to provide the Company with flexibility and efficiency in future financings, if and when needed,

and replaced the Company’s prior base shelf prospectus, which was filed in July 2021 and expired in August 2023. The 2023 Prospectus

and Registration Statement enable the Company to make offerings of up to US$200,000,000 of Shares, preferred shares, debt securities,

warrants, units or subscription receipts of the Company, or any combination thereof, from time to time, separately or together, in amounts,

at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus

supplement during the 25-month period that the 2023 Prospectus is effective. Copies of the Prospectus Supplement and 2023 Prospectus are

available under the Company’s profile on SEDAR+ at www.sedarplus.ca.

On July 6, 2023, the Company announced the

assay results of the last 18 drill holes from its 2023 dill program at its Carangas Project. The 2023 drill program was completed

with 17,623 m in 39 holes. For details of the 2023 drill program, please refer to the Company’s news releases dated July 6,

2023 and May 30, 2023, filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com

| (c) | Year ended June 30, 2023 |

On May 30, 2023, the Company reported assay results

of the first 21 drill holes from its 2023 Q1 drill program at its Carangas Project. The 2023 Q1 drilling was a continuation of the 2022

drilling campaign at the Carangas Project. It was originally budgeted as 15,000 meters of diamond core drilling, infilling areas drilled

in 2021-2022 and stepping out beyond these previously drilled areas. This drilling program started on schedule in January 2023 and was

expanded based on encouraging results and is now complete. A total of 17,623 meters in 39 holes was drilled up to the end of April 2023.

Each of the 39 holes intersected mineralization.

On April 6, 2023, the Company announced the assay

results of the last 29 drill holes from the 2022 drill program at its Carangas Project. The 2022 drill program was completed with 50,368

m drilled in 115 holes. For details of the 2022 drill program, please refer to the Company’s news releases dated April 6, 2023,

February 21, 2023, February 1, 2023, January 24, 2023, November 14, 2022, October 19, 2022, August 8, 2022, and July 13, 2022, filed under

the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website

at www.newpacificmetals.com

On February 16, 2023, the Company filed an independent

preliminary economic assessment and technical report prepared in accordance with NI 43-101 titled “Technical Report – Silver

Sand Deposit Preliminary Economic Assessment” dated February 16, 2023 and with an effective date of November 30, 2022 (the “Silver

Sand PEA Technical Report”). AMC Consultants (mineral resource, mining, infrastructure and financial analysis) was contracted

to conduct the Silver Sand PEA Technical Report in cooperation with Halyard Inc. (metallurgy and processing), and New Fields Canada Mining

& Environment ULC (tailings, water and water management). The Silver Sand PEA Technical Report is based on the Silver Sand MRE, which

was reported on November 28, 2022. The Silver Sand PEA Technical Report has been superseded by the Silver Sand PFS Technical Report, and

should no longer be relied upon.

On January 26, 2023, the Company announced the

appointment of Mr. Andrew Williams to the position of President.

On December 2, 2022, the Company approved the

appointment of Dr. Peter Megaw and Mr. Dickson Hall to the Board of Directors. Mr. Jack Austin and Mr. David Kong did not stand for re-election

as directors.

On November 28, 2022, the Company announced the

Silver Sand MRE. The Silver Sand MRE was reported in accordance with NI 43-101 and was completed by AMC Consultants.

On November 22, 2022, the Company announced the

filing of a technical report entitled “Carangas Project Technical Report” with an effective date of June 16, 2022. This report

has been superseded by the Carangas MRE Technical Report, and should no longer be relied upon.

On September 19, 2022, the Company announced the

receipt of assay results for all of the 86 drill holes completed under the 2022 resource infill and step-out drill program at the Silver

Sand Project (the “2022 Silver Sand Drill Program”). The 2022 Silver Sand Drill Program of 19,323 metres (“m”)

in 86 drill holes, together with the 55 drill holes completed in 2021, intended to expand and improve the confidence in the geological

model and the previous MRE is respect of the Silver Sand Project released in April 2020. For further details, please refer to the Company’s

news release dated September 19, 2022, filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at

www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com

| (d) | Year ended June 30, 2022 |

On June 25, 2022, the Qinghai Government

completed its approval process of the cash compensation to be paid to the Company’s subsidiary, Qinghai Found Mining Co., Ltd.

(“Qinghai Found”), pursuant to a compensation agreement for the RZY Project. Pursuant to the agreement, Qinghai

Found surrendered its title to the RZY Project to the Qinghai Government for one-time cash compensation of $2,986,188 (RMB ¥20

million), which is included in the receivables balance as of June 30, 2022.

On June 14, 2022, the Company announced the commencement

of a 6,000 m one rig drill program at the Silverstrike Project with the objective to test a broad gold zone identified by the Company

and by historical drilling. For further details, please refer to the Company’s news release dated June 14, 2022, filed under the

Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website

at www.newpacificmetals.com

On June 7, 2022, the Company announced the commencement

of a 2,000 m one rig drill program at the Jisas prospect, a satellite concession located in the north block, approximately 3 kilometres

north of the Silver Sand Project. For further details, please refer to the Company’s news release dated June 7, 2022, filed under

the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website

at www.newpacificmetals.com

On May 17, 2022, the Company announced the receipt

of assay results for all of the 35 drill holes completed under the Company’s 2021 discovery drill program at the Carangas Project

(the “2021 Carangas Drill Program”). Results from the 2021 Carangas Drill Program confirmed the broad silver-rich polymetallic

mineralization near surface and intersected a wide zone of gold mineralization below it. For further details, please refer to the Company’s

news release dated May 17, 2022, filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar,

and on the Company’s website at www.newpacificmetals.com

On February 8, 2022, the Company reported on the

status and plan for the ongoing work on the PEA study for the Silver Sand Project. To support the development of the MRE and PEA, the

Company planned to complete a further 15,000 m of exploration and in-fill drilling, including 2,500 m within the MPC properties and 12,500

m at the Silver Sand Project.

On January 24, 2022, the Company announced that

the board of directors (the “Board”) had accepted the resignation of Dr. Mark Cruise as CEO and as a director of New

Pacific and that the Board has appointed Dr. Rui Feng as the CEO. Dr. Feng is the founder of the Company and served as CEO until April

27, 2020. Following his appointment as the CEO, Dr. Feng stepped down as the Chairman of the Board and Terry Salman was appointed as the

Chairman of the Board.

On October 26, 2021, the Company announced the

expansion of its 2021 Carangas Drill Program by adding two drill rigs to complete an additional minimum of 7,500 m of drilling by the

end of 2021.

On August 12, 2021, the Company announced that

Bolivia’s Autoridad Jurisdictional Administrativa Minera (“AJAM”) granted an AMC for the Silver Sand Project.

All required registration, notarization and publication steps to perfect the title of the AMC in favour of Empresa Minera Alcira S.A.

(“Alcira”), the Company’s wholly-owned Bolivian subsidiary, were completed. The AMC established a clear title

to the Silver Sand Project mineral rights.

On July 27, 2021, the Company announced the commencement

of a planned 38,000 m diamond drill program at the Silver Sand Project with the objectives to expand the existing resource, which remains

open along strike and at depth, and to complete geotechnical drilling to support the PEA study.

PROJECT OVERVIEW

Bolivian Licence Tenure

A summary of current Bolivian mining laws with

respect to the AMC and exploration license is presented below.

Exploration and mining rights in Bolivia are granted

by the Ministry of Mines and Metallurgy through the AJAM. Under Bolivian mining laws, tenure is granted as either an AMC or an exploration

license. Tenure held under the previous legislation was converted to Autorización Transitoria Especiales (“ATEs”)

which are required to be consolidated into new 25-hectare sized cuadriculas (concessions) and converted to AMCs. AMCs created by conversion

recognize existing rights of exploration and/or exploitation and development, including treatment, metal refining, and/or trading. AMCs

have a fixed term of 30 years and can be extended for an additional 30 years if certain conditions are met. Each AMC requires ongoing

work and the submission of plans to AJAM.

Exploration licenses allow exploration activities

only and must be converted to AMCs to conduct exploitation and development activities. Exploration licenses are valid for a maximum of

five years and provide the holder with the preferential right to request an AMC. In specific areas, mineral tenure is owned by the COMIBOL.

In these areas, development and production agreements can be obtained by entering into a MPC with COMIBOL.

Silver Sand Project

The Silver Sand Project is located in the Colavi

District of Potosí Department in southwestern Bolivia at an elevation of 4,072 m above sea level, 33 kilometres (“km”)

northeast of Potosí City, the department capital.

The Silver Sand Project is comprised of two claim

blocks, the Silver Sand south and north blocks, which covers a total area of 5.42 km2. The Silver Sand south block, covering

an area of 3.17 km2 hosts the Silver Sand deposit. On August 12, 2021, the Company

announced the receipt of an AMC for the

Silver Sand south block from AJAM. The Silver Sand north block covers an area of 2.25 km2 and is comprised of two AMCs (Jisasjardan

and Bronce). The AMCs establish a clear title to the Silver Sand Project.

The Company has carried out extensive exploration

and resource definition drill programs on the Silver Sand Project between 2017 and 2022, completing a total of 139,920 m of diamond drilling

in 564 holes during the period. Silver Sand Project’s current MRE, Silver Sand MRE, is based on these extensive exploration programs.

Based on the Silver Sand MRE, the Silver Sand Project has an estimated measured and indicated mineral resource of 201.77 Moz of silver

at head grade of 116 g/t and an estimated inferred mineral resource of 12.95 Moz of silver at 88 g/t. For further details on the Silver

Sand MRE, please refer to the Company’s news release dated November 28, 2022 filed under the Company’s profile on SEDAR+ at

www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

On February 16, 2023, the Company filed the Silver

Sand PEA Technical Report. AMC Consultants (mineral resource, mining, infrastructure and financial analysis) was contracted to conduct

the Silver Sand PEA Technical Report in cooperation with Halyard Inc. (metallurgy and processing), and New Fields Canada Mining &

Environment ULC (tailings, water and water management). The Silver Sand PEA Technical Report is based on the Silver Sand MRE, which was

reported on November 28, 2022. The Silver Sand PEA Technical Report has been superseded by the Silver Sand PFS Technical Report, and should

no longer be relied upon.

On August 8, 2024, the Company reported the filing

of its independent NI 43-101 Silver Sand PFS Technical Report, with an effective date of June 19, 2024. AMC Mining Consultants (Canada)

Ltd. (mineral resource and reserves, mining, infrastructure and financial analysis) was contracted to conduct the Silver Sand PFS Technical

Report in cooperation with Halyard Inc. (metallurgy and processing), and NewFields Canada Mining & Environment ULC (tailings, water

and waste management). The Silver Sand PFS Technical Report is building on the Silver Sand PEA Technical Report.

Highlights of the Silver Sand PFS Technical Report

are as follows:

| § | Post-tax NPV at a 5% discount rate of $740 million

and IRR of 37% at a base case price of $24.00/oz silver; |

| § | 13 years mine life, excluding the 2 years pre-production

period, producing approximately 157 Moz of silver. Annual silver production exceeds 15 Moz in years one through three with LOM average

annual silver production exceeding 12 Moz; |

| § | Initial capital costs of $358 million and a post-tax

payback of 1.9 years (from the start of production) at $24.00/oz silver; and |

| § | Average LOM AISC of $10.69/oz silver. |

For

more details, please refer to the Company’s news releases dated June 26 and August 8, 2024, and the Silver Sand PFS Technical Report

filed on August 8, 2024 under the Company’s profile on SEDAR+ at www.sedarplus.ca,

with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website at www.newpacificmetals.com.

Permitting

In May 2023, the Silver Sand Project obtained

its environmental categorization as a proposed open pit operation from Bolivia’s Ministry of Environment and Water, formally commencing

the Environmental Impact Assessment Study (“EEIA”) process. The Company continues to advance its socialization process

with communities located within the Silver Sand Project’s area of influence and collect wet and dry season environmental baseline

data. In addition, the Company is establishing a development fund for sustainable development projects in partnership with local communities,

demonstrating its long-term commitment to the region. After completion of the socialization process, the Company plans to achieve the

following:

| § | obtain surface rights through long-term land

lease agreements; |

| § | finalize a resettlement and compensation plan

for impacted families; and |

| § | implement measures to safeguard cultural and

historical heritage. |

The Company is also pursuing compliance with the

International Finance Corporation's eight performance standards for sustainable development. This aligns with the Company’s commitment

to responsible mining while providing the ancillary benefit of positioning the project for development by the Company, or another party,

upon successful completion of the EEIA process.

Mining Production Contract

On

January 11, 2019, New Pacific announced that its 100% owned subsidiary, Alcira, entered into an MPC with COMIBOL granting Alcira

the right to carry out exploration, development and mining production activities in ATEs and cuadriculas owned by COMIBOL adjoining the

Silver Sand Project. An update to the MPC was made with COMIBOL on January 19, 2022. The MPC is comprised of two areas. The first

area is located to the south and west of the Silver Sand Project. The second area includes additional geologically

prospective ground

to the north, east and south of the Silver Sand Project, wherein COMIBOL is expected to apply for exploration and mining rights with AJAM.

Upon granting of the exploration and mining rights, COMIBOL will contribute these additional properties to the MPC.

A portion of the MPC

area contains approximately 10% of the mineral resource as part of the Silver Sand MRE. Other than that, there are no known economic mineral

deposits, nor any previous drilling or exploration discoveries within the remaining MPC area. The MPC presents an opportunity to explore

and evaluate the possible extensions and/or satellites of mineralization outside of the currently defined Silver Sand Project.

Since October 2023, the Company continues to engage

with COMIBOL to obtain the ratification and approval of the signed MPC by the Plurinational Legislative Assembly of Bolivia. The Company

and COMIBOL have refined the MPC to concentrate exclusively on claims immediately adjacent to the Silver Sand Project boundary. This streamlined

landholding, while maintaining the core value of the MPC to the Silver Sand Project, is anticipated to facilitate progress towards ratification

and approval of the MPC.

The MPC remains subject to ratification and approval

by the Plurinational Legislative Assembly of Bolivia. As of the date of this AIF, the MPC has not been ratified nor approved by the Plurinational

Legislative Assembly of Bolivia. The Company cautions that there is no assurance that the Company will be successful in obtaining ratification

of the MPC in a timely manner or at all, or that the ratification of the MPC will be obtained on reasonable terms. The Company cannot

predict the Bolivia government’s positions on foreign investment, mining concessions, land tenure, environmental regulation, community

relations, taxation or otherwise. A change in the government’s position on these issues could adversely affect the ratification

of the MPC and the Company’s business.

Carangas Project

In April 2021, the Company signed an agreement

with a private Bolivian company to acquire a 98% interest in the Carangas Project. The Carangas Project is located approximately 180 km

southwest of the city of Oruro and within 50 km from Bolivia’s border with Chile. The private Bolivian company is 100% owned by

Bolivian nationals and holds title to the three exploration licenses that cover an area of 40.75 km2.

Under the agreement, the Company is required to

cover 100% of the future expenditures on exploration, mining, development and production activities for the Carangas Project. The agreement

has a term of 30 years and is renewable for another 15 years.

The Company has carried out extensive exploration

and resource definition drill programs on the Carangas Project between 2021 and 2023, completed a total of 81,145 m of diamond drilling

in 189 holes during the period. On September 18, 2023, the Company filed its inaugural independent NI 43-101 Carangas MRE Technical Report

based on the results of these exploration programs. RPMGlobal (Canada) Ltd. (“RPM”) was contracted to conduct the Carangas

MRE Technical Report. Highlights from the Carangas MRE are as follows:

| § | Total indicated mineral resources of 214.9

Mt containing 205.3 Mozs of silver, 1,588.2 Kozs of gold, 1,444.9 Mlbs of lead (“Pb”), 2,653.7 Mlbs of zinc, and 112.6 Mlbs

of copper; or collectively 559.8 Mozs of AgEq. |

| § | Total inferred mineral resources of 45.0

Mt containing 47.7 Mozs of silver, 217.7 Kozs of gold, 297.9 Mlbs of lead, 533.7 Mlbs of zinc, and 16.8 Mlbs of copper; or collectively 109.8

Mozs of AgEq. |

| § | The Carangas Project is a globally significant

Ag-Au polymetallic discovery. |

| § | Mineralization starts at or near surface, potentially

allowing for open-pit mining with an average stripping ratio for the conceptual pit of approximately 1.8:1 (tonnes of waste: tonnes of

mineral resource). |

| § | Below the pit constraint, substantial gold-dominant

mineralization, similar in size and grade to the reported gold domain, has the potential for conversion to underground mineable resources

pending further evaluation for reasonable prospects of eventual economic extraction. |

| § | Favorable initial metallurgical test work indicates

laboratory-based recoveries of up to 90% for silver and 98% for gold based on a combination of flotation and cyanide leaching. |

For more details on the Carangas MRE, please refer

to the Company’s news releases dated September 5, 2023 and September 18, 2023 and the Carangas MRE Technical Report filed under

the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar, and on the Company’s website

at www.newpacificmetals.com..

The Preliminary Economic Assessment in respect

of the Carangas Project (the "Carangas PEA") will be completed by the fourth quarter of 2024. The Company and its independent

consultants led by RPM are currently undertaking trade-off studies based on the Carangas MRE. There are a variety of open pit mining options

under review, all focusing on the higher-grade, near-surface starter pit at the

Carangas Project that can be mined at a lower strip ratio.

Additionally, the Company is undertaking a metallurgical test program to enhance the processing flowsheet and gather valuable data to

support the Carangas PEA.

Silverstrike Project

The Silverstrike Project

is located approximately 140 km southwest of La Paz, Bolivia. In December 2019, the Company signed a mining association agreement

and acquired a 98% interest in the Silverstrike Project from a private Bolivian corporation that is owned 100% by Bolivian nationals and

holds the title to the nine ATEs (covering an area of approximately 13 km2) that comprise the Silverstrike Project.

Under the mining association

agreement, the Company is required to cover 100% of future expenditures, including exploration, contingent on results of development and

subsequent mining production activities at the Silverstrike Project. The agreement has a term of 30 years and is renewable for another

15 years.

During 2020, the Company’s exploration team

completed reconnaissance and detailed mapping and sampling programs on the northern portion of the Silverstrike Project. The results to

date identified near surface broad zones of silver mineralization in altered sandstones to the north, with similarities to that at the

Silver Sand Project; and in the Silverstrike Project’s central area, a near surface broad silver zone that occurs near the top of

a 900 m diameter volcanic dome of ignimbrite (volcaniclastic sediments) units with intrusion of rhyolite dyke swarm and andesite flows;

and a broad gold zone occurs half-way from the top of the dome.

In 2022, the Company completed a 3,200 m drill

program at the Silverstrike Project. Assay results for the two drill holes were released in the news releases dated November 1, 2022 and

September 12, 2022 filed under the Company’s profile on SEDAR+ at www.sedarplus.ca, with the SEC on EDGAR at www.sec.gov/edgar,

and on the Company’s website at www.newpacificmetals.com.

Further exploration activities remain on standby

as the Company focuses on the programs for the Silver Sand Project and Carangas Project, as outlined above.

Frontier Area – Carangas and Silverstrike

Projects

The Carangas Project

and the Silverstrike Project are located within 50 km of the Bolivian border with Chile. In line with many South American countries, Bolivia

does not permit foreign entities to own property within 50 km of international borders (the “Frontier Area”).

Property owners in the Frontier Area are, however, permitted to enter into mining association agreements with third parties, including

foreign entities, for the development of mining activities under Bolivian Law No. 535 on Mining and Metallurgy. Although the Company believes