Know Labs, Inc. (NYSE American: KNW), a leading developer of

non-invasive medical diagnostic technology, today reported

financial results for the third quarter of the fiscal year 2024

ended June 30, 2024.

Financial Highlights:

- In Q3 FY 2024, Know Labs reported a net loss of $4.10 million

dollars, compared to a net loss of $3.60 million dollars in Q3 FY

2023, an increase in net loss of 13.9%. This translates to earnings

per share of a loss of $0.05, better than the prior year earnings

per share loss of $0.07, before preferred stock dividends.

- Recorded a non-cash charge to earnings of $1.58 million dollars

principally related to stock-based compensation of $1.0 million

dollars, amortization of operating lease right-of-use asset of

$276,000, and interest expense for the extension of notes and

warrants of $240,000.

- Research and development expense for Q3 FY 2024 was $1.35

million dollars as compared to $1.88 million dollars in Q3 FY 2023,

a decrease of 28.2% year over year. The decrease was due primarily

to the completion of hardware and software product development

milestones and continued use of consultants to reduce the cost of

product development.

- Selling, general and administrative expenses for Q3 FY 2024 was

$2.49 million dollars, which was higher by $1.13 million dollars

than the $1.36 million dollars in the year ago period. The increase

was due primarily to salary expenses for several key hires, legal

expenses related to financing activities and intellectual property

assets, and an increase in stock-based compensation.

- As of June 30, 2024, Know Labs had cash and cash equivalents of

$2.13 million dollars, as compared to $8.02 million dollars at the

end of September 30, 2023. Net cash used in operations for the

first nine months of FY 2024 was $9.57 million dollars compared

with $8.98 million dollars in the same nine-month period of FY

2023.

- The Company is undertaking initiatives to significantly reduce

fixed expenses and monthly burn rate. Subsequent to the end of Q3

FY 2024, on August 9, 2024, Know Labs closed a firm commitment

underwritten public offering of $3.45 million dollars; which with

the cash on hand, the Company believes that it has enough available

cash and flexibility with its operating expenses to operate until

at least December 31, 2024.

- As noted in the Q3 FY 2024 10-Q, the Company plans to seek

additional funding under the effective S-3 shelf registration

statement to ensure operations well into 2025.

- Shareholder equity for Q3 FY 2024 was a negative $4.60 million

dollars versus $3.74 million dollars in FY 2023, ending September

30, 2023. The Company is actively taking steps to address its

negative shareholder equity through the conversion of convertible

debt to equity.

As previously disclosed in its annual report on Form 10-K for

the fiscal year ended September 30, 2023, which was filed with the

Securities and Exchange Commission on December 19, 2023, the audit

opinion contained a going concern qualification from the Company's

independent registered public accounting firm. This announcement is

being made solely to comply with the New York Stock Exchange's

Company Guide Sections 401(h) and 610(b), which require separate

disclosure of receipt of an audit opinion that contains a going

concern qualification. This announcement does not represent any

change or amendment to the Company's 2023 audited financial

statements or to its 2023 annual report on Form 10-K.

Conference Call:

Know Labs will host an audio webcast to discuss its results and

provide a business update today, August 14, 2024, at 4:30 pm ET

(1:30 pm PT). The live webcast will be available on the Investors

page of the Company’s website, https://ir.knowlabs.co/, and a

replay will be available for six months.

Participant Dial-In: 877-514-3621 / +1 215-268-9856

Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=bN3zHkNr

A copy of the form 10-Q filed with the SEC can also be

downloaded from the Company’s website.

Income Statement:

Three Months Ended, Nine Months Ended, June 30, 2024 June 30, 2023

June 30, 2024 June 30, 2023 OPERATING EXPENSES- RESEARCH AND

DEVELOPMENT EXPENSES

$

1,348,985

$

1,879,519

$

5,010,618

$

6,186,039

SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

2,486,846

1,359,782

7,025,503

5,507,511

Total operating expenses

3,835,831

3,239,301

12,036,121

11,693,550

OPERATING LOSS

(3,835,831)

(3,239,301)

(12,036,121)

(11,693,550)

OTHER INCOME (EXPENSE), NET Interest income

30,619

23,511

126,872

114,325

Interest expense

(298,248)

-

(1,038,499)

(389,626)

Other (expense)

-

(384,137)

-

(384,137)

Total other expense, net

(267,629)

(360,626)

(911,627)

(659,438)

LOSS BEFORE INCOME TAXES

(4,103,460)

(3,599,927)

(12,947,748)

(12,352,988)

Income tax expense

-

-

-

-

NET LOSS

(4,103,460)

(3,599,927)

(12,947,748)

(12,352,988)

Deemed dividends on Series C and D Preferred Stock

(100,045)

(3,337,494)

(262,283)

(3,337,494)

Common stock dividends on Series D Preferred Stock

-

(1,627,230)

-

(1,627,230)

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS

$

(4,203,505)

$

(8,564,651)

$

(13,210,031)

$

(17,317,712)

Basic and diluted loss per share

$

(0.05)

$

(0.18)

$

(0.16)

$

(0.36)

Weighted average shares of common stock outstanding- basic

and diluted

83,038,866

48,928,911

82,314,925

48,604,274

Balance Sheet:

June 30, 2024 September 30, 2023 (1)

ASSETS (Unaudited)

CURRENT ASSETS: Cash and cash equivalents

$

2,129,954

$

8,023,716

Total current assets

2,129,954

8,023,716

PROPERTY AND EQUIPMENT, NET

88,668

81,325

OTHER ASSETS Other assets

159,244

15,766

Operating lease right-of-use asset

364,342

145,090

TOTAL ASSETS

$

2,742,208

$

8,265,897

LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY

CURRENT LIABILITIES: Accounts payable - trade

$

1,255,888

$

1,292,861

Accrued expenses

116,666

94,062

Accrued expenses - related parties

99,692

218,334

Current portion of convertible notes payable, net

4,539,818

2,761,931

Current portion of operating lease right-of-use liability

105,653

154,797

Total current liabilities

6,117,717

4,521,985

NON-CURRENT LIABILITIES: Operating lease liability, net of

current portion

280,714

-

Non-current portion of convertible notes payable, net

945,258

-

Total liabilities

7,343,689

4,521,985

COMMITMENTS AND CONTINGENCIES (Note 11) STOCKHOLDERS’

(DEFICIT) EQUITY Preferred stock - $0.001 par value,

5,000,000 shares authorized, Series C and D shares issued and

outstanding as follows: Series C Convertible Preferred stock

$0.001 par value, 30,000 shares authorized, 17,858 shares issued

and outstanding at 6/30/2024 and 9/30/2023, respectively

1,790

1,790

Series D Convertible Preferred stock $0.001 par value, 20,000

shares authorized, 10,161 shares issued and outstanding at

6/30/2024 and 9/30/2023, respectively

1,015

1,015

Common stock - $0.001 par value, 200,000,000 shares authorized,

86,368,897 and 80,358,463 shares issued and outstanding at

6/30/2024 and 9/30/2023, respectively

86,369

80,358

Additional paid in capital

130,360,164

125,501,537

Accumulated deficit

(135,050,819)

(121,840,788)

Total stockholders' (deficit) equity

(4,601,481)

3,743,912

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY

$

2,742,208

$

8,265,897

Cash Flow:

Nine Months Ended, June 30, 2024 June 30, 2023 CASH FLOWS FROM

OPERATING ACTIVITIES: Net loss

$

(12,947,748)

$

(12,352,988)

Adjustments to reconcile net loss to net cash (used in) operating

activities Depreciation and amortization

59,009

259,541

Stock based compensation - stock option grants

2,331,516

2,464,045

Issuance of common stock for services

277,010

-

Loss on disposal of assets

-

384,137

Amortization of operating lease right-of-use asset

162,647

96,161

Amortization of debt issuance costs

375,859

-

Interest expense for extension of notes and warrants

594,761

349,721

Changes in operating assets and liabilities: Other long-term assets

(143,478)

(1,999)

Operating lease right-of-use liability

(150,329)

(99,803)

Accounts payable - trade and accrued expenses

(133,011)

(74,866)

NET CASH (USED IN) OPERATING ACTIVITIES

(9,573,764)

(8,976,051)

CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of research

and development equipment

(66,352)

(80,798)

NET CASH (USED IN) INVESTING ACTIVITIES:

(66,352)

(80,798)

CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from debt

offering

3,805,699

-

Proceeds from issuance of common stock offering, net

203,105

-

Payments for debt offering

(262,450)

-

Proceeds from issuance of common stock for stock options exercise

-

4,687

Proceeds from issuance of common stock for warrant exercise

-

387,335

NET CASH PROVIDED BY FINANCING ACTIVITIES

3,746,354

392,022

NET (DECREASE) IN CASH AND CASH EQUIVALENTS

(5,893,762)

(8,664,827)

CASH AND CASH EQUIVALENTS, beginning of period

8,023,716

12,593,692

CASH AND CASH EQUIVALENTS, end of period

$

2,129,954

$

3,928,865

Supplemental disclosure of non-cash financing activity:

Deemed dividends on Series C and D Preferred Stock

$

262,283

$

3,337,494

Common stock dividends on Series D Preferred Stock

$

-

$

1,627,230

Warrants issued for debt offering

$

1,536,743

$

-

Common stock issued for debt payment

$

240,000

$

-

About Know Labs, Inc.

Know Labs, Inc. is a public company whose shares trade on the

NYSE American Exchange under the stock symbol “KNW.” The Company’s

platform technology uses spectroscopy to direct electromagnetic

energy through a substance or material to capture a unique

molecular signature. The technology can be integrated into a

variety of wearable, mobile or bench-top form factors. This

patented and patent-pending technology makes it possible to

effectively identify and monitor analytes that could only

previously be performed by invasive and/or expensive and

time-consuming lab-based tests. The first application of the

technology will be in a product marketed as a non-invasive glucose

monitor. The device will provide the user with accessible and

affordable real-time information on blood glucose levels. This

product will require U.S. Food and Drug Administration clearance

prior to its introduction to the market.

Safe Harbor Statement

This release contains statements that constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. These statements appear in a number of places in this

release and include all statements that are not statements of

historical fact regarding the intent, belief or current

expectations of Know Labs, Inc., its directors or its officers with

respect to, among other things: (i) financing plans; (ii) trends

affecting its financial condition or results of operations; (iii)

growth strategy and operating strategy; and (iv) performance of

products. You can identify these statements by the use of the words

“may,” “will,” “could,” “should,” “would,” “plans,” “expects,”

“anticipates,” “continue,” “estimate,” “project,” “intend,”

“likely,” “forecast,” “probable,” “potential,” and similar

expressions and variations thereof are intended to identify

forward-looking statements. Investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, many of which are beyond Know

Labs, Inc.’s ability to control, and actual results may differ

materially from those projected in the forward-looking statements

as a result of various factors. These risks and uncertainties also

include such additional risk factors as are discussed in the

Company’s filings with the U.S. Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

September 30, 2023, Forms 10-Q and 8-K, and in other filings we

make with the Securities and Exchange Commission from time to time.

These documents are available on the SEC Filings section of the

Investor Relations section of our website at www.knowlabs.co. The

Company cautions readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date made.

The Company undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240814552248/en/

For Know Labs Media Inquiries Contact: Matter Health Abby

Mayo Knowlabs@matternow.com Ph. (617) 272-0592 Know Labs, Inc.

Contact: Jess English jess@knowlabs.co Ph. (206) 629-6414

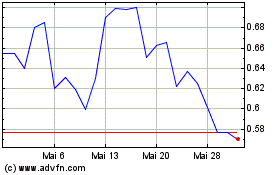

Know Labs (AMEX:KNW)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Know Labs (AMEX:KNW)

Historical Stock Chart

Von Dez 2023 bis Dez 2024