Janus Henderson Small Cap Growth Alpha ETF

Ticker: JSML

Principal U.S. Listing

Exchange: The NASDAQ Stock Market LLC

SUMMARY PROSPECTUS DATED

FEBRUARY 28, 2020

AS SUPPLEMENTED APRIL 30, 2020

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the

Fund’s Prospectus and other information about the Fund online at janushenderson.com/info. You can also get this information at no cost by calling a Janus Henderson representative at 1-877-335-2687 or by sending an email request to prospectusrequest@janushenderson.com.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder

reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your broker-dealer or other financial intermediary (such as a bank). Instead, the reports will be made

available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you

already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting

your broker-dealer or other financial intermediary.

You may elect to receive all future reports in paper

free of charge by contacting your broker-dealer or other financial intermediary. Your election to receive reports in paper will apply to all Funds held in your account at your

broker-dealer or other financial intermediary.

Janus Henderson Small Cap Growth Alpha ETF seeks investment results that correspond generally, before fees and expenses,

to the performance of its underlying index, the Janus Henderson Small Cap Growth Alpha Index (the “Underlying Index”).

|

|

|

FEES AND EXPENSES OF THE FUND

|

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may pay brokerage

commissions on their purchases and sales of Fund shares, which are not reflected in the table or in the example below.

|

|

|

|

|

|

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

Management Fees(1)

|

|

|

|

|

|

|

|

|

0.30%

|

|

|

Other Expenses

|

|

|

|

|

|

|

|

|

0.00%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

|

|

|

0.30%

|

|

|

(1)

|

The Fund’s Management Fee is a “unitary” fee that is designed to pay substantially all operating

expenses, except for distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses not incurred in the ordinary course of

the Fund’s business. The Management Fee has been restated from 0.35% to 0.30% to reflect a new management fee rate schedule effective May 1, 2020.

|

EXAMPLE:

The Example is intended to help you compare

the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also

assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

|

|

$

|

31

|

|

|

|

$

|

97

|

|

|

|

$

|

169

|

|

|

|

$

|

381

|

|

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund

operating expenses or in the Example,

1½Janus Henderson Small Cap Growth Alpha ETF

affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 104% of the average value of its portfolio.

|

|

|

PRINCIPAL INVESTMENT STRATEGIES

|

The Fund pursues its investment objective by normally investing at least 80% of its net assets (plus any borrowings for

investment purposes) in the securities that comprise the Janus Henderson Small Cap Growth Alpha Index (“Underlying Index”).

The Underlying Index

is composed of common stocks of small-sized companies that are included in the Solactive Small Cap Index, a universe of 2,000 small-sized capitalization stocks. The Solactive Small Cap Index uses the total public market value, or

“free-float,” capitalization of a stock to determine whether to include such stock in the Solactive Small Cap Index. The Underlying Index is designed to select small-sized capitalization stocks that are poised for “smart growth”

by evaluating each company’s performance in three critical areas: growth, profitability, and capital efficiency. Using a proprietary quantitative methodology, such stocks are scored based on fundamental measures of their growth, profitability,

and capital efficiency, and the top 10% of such eligible stocks scoring the highest become the constituents of the Underlying Index. To arrive at the top 10%, for each security in the stated universe, the quantitative methodology assigns a score in

each of 10 different fundamental factors, relative to other eligible securities. The fundamental factors include measures that Janus Capital believes are tied to a stock’s outperformance relative to other small cap stocks, and indicate a

company’s performance with respect to growth (such as the revenue growth rate over 2- 5- and 8- year periods), profitability (such as margin expansion, profit margin and earnings per share over time)

and capital efficiency (such as returns on invested capital). The scores for each stock within a factor are then added together across the 10 factors, with equal weighting, to arrive at an overall score for each stock. The stocks with the highest

10% of scores are then weighted within the Underlying Index according to their market capitalization. Finally, the stocks are sector-weighted to reflect the sector allocation weight of Janus Henderson Venture Fund, based on its most recent publicly

available holdings. A stock may not represent more than 3% of the Underlying Index. The Underlying Index seeks risk adjusted outperformance relative to a market capitalization weighted universe of small-sized capitalization growth stocks. Market

capitalizations within the Underlying Index will vary, but as of February 1, 2020, they ranged from approximately $94 million to $3.3 billion. The Underlying Index is rebalanced on a quarterly basis based on the methodology

described above.

The Fund uses a “passive,” index-based approach in seeking performance that corresponds to the performance of the Underlying

Index. The Fund generally will use a replication methodology, meaning it will invest in the securities composing the Underlying Index in proportion to the weightings in the Underlying Index. However, the Fund may utilize a sampling methodology under

various circumstances in which it may not be possible or practicable to purchase all of the securities in the Underlying Index. Janus Capital expects that over time, if the Fund has sufficient assets, the correlation between the Fund’s

performance, before fees and expenses, and that of the Underlying Index will be 95% or better. A figure of 100% would indicate perfect correlation.

The

Fund may also invest in investments that are not included in the Underlying Index, but which Janus Capital believes will help the Fund track the Underlying Index. Such investments include stocks, shares of other investment companies, cash and cash

equivalents, including money market funds.

To the extent the Underlying Index concentrates (i.e., holds 25% or more of its total assets) in the securities

of a particular industry or group of industries, the Fund will concentrate its investments to approximately the same extent as the Underlying Index. As of February 1, 2020, the Underlying Index did not concentrate in a particular industry

or group of industries. For more recent information, see the Fund’s daily portfolio holdings posted on the ETF portion of the Janus Henderson website.

The Fund may lend portfolio securities on a short-term or long-term basis, in an amount equal to up to one-third of its total assets as determined at the time

of the loan origination.

The Underlying Index is compiled and administered by Janus Henderson Indices LLC (“JH Indices” or the “Index

Provider”). JH Indices is affiliated with the Fund and Janus Capital.

|

|

|

PRINCIPAL INVESTMENT RISKS

|

The Fund’s returns and yields will vary, and you could lose money. The principal risks and special considerations

associated with investing in the Fund are set forth below.

Market Risk. The value of the Fund’s portfolio may decrease if

the value of an individual company or security, or multiple companies or securities, in the portfolio decreases. Further, regardless of how well individual companies or securities perform,

2½Janus Henderson Small Cap Growth Alpha ETF

the value of the Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It is important to understand that the value of your investment may fall,

sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole. The Underlying Index focuses on the small-sized capitalization sector of

the stock market, and therefore at times the Fund may underperform the overall stock market. Market risk may be magnified if certain social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics,

terrorism, conflicts and social unrest) adversely interrupt the global economy and financial markets.

Equity Investing Risk. The

Fund’s investment in the securities composing the Underlying Index involves risks of investing in a portfolio of equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices.

Small-Sized Companies Risk. The Fund’s investments in securities issued by small-sized companies, which can include smaller, start-up companies offering emerging products or services, may involve greater risks than are customarily associated with larger, more established companies. Securities issued by small-sized companies tend to be

more volatile and somewhat more speculative than securities issued by larger or more established companies and may underperform as compared to the securities of larger companies. Securities issued by micro-capitalization companies tend to be

significantly more volatile, and more vulnerable to adverse business and economic developments, than those of larger companies.

Growth Securities

Risk. Securities of companies perceived to be “growth” companies may be more volatile than other stocks and may involve special risks. If the perception of a company’s growth potential, based on the quantitative

methodology applied in constructing the Underlying Index, is not realized, the securities purchased may not perform as expected, reducing the Fund’s returns. In addition, because different types of stocks tend to shift in and out of favor

depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole and other types of securities.

Investment Style Risk. Returns from small-sized capitalization stocks may trail returns from the overall stock market. Small-cap

stocks may go through cycles of doing better or worse than other segments of the stock market or the stock market in general. These cycles may continue for extended periods of time.

Concentration Risk. The Fund’s assets will generally be concentrated in an industry or group of industries to the extent that the

Fund’s Underlying Index concentrates in a particular industry or group of industries. To the extent the Fund invests a substantial portion of its assets in an industry or group of industries, market or economic factors impacting that industry

or group of industries could have a significant effect on the value of the Fund’s investments. Companies in the same or similar industries may share common characteristics and are more likely to react similarly to industry-specific market or

economic developments. The Fund’s performance may be more volatile when the Fund’s investments are less diversified across industries. The Fund’s assets will not be concentrated if the Underlying Index does not concentrate in a

particular industry or group of industries.

Early Close/Trading Halt Risk. An exchange or market may close or issue trading halts

on specific securities, or the ability to buy or sell certain securities or financial instruments may be restricted, which may result in the Fund being unable to buy or sell certain securities or financial instruments. In such circumstances, the

Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and/or may incur substantial trading losses.

Index

Tracking Risk. The Fund’s return may not match or achieve a high degree of correlation with the return of the Underlying Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a

greater extent than if the Fund sought to replicate the Underlying Index. In addition, the Fund may hold fewer than the total number of securities in the Underlying Index. Further, the Fund may hold securities or other investments not included in

the Underlying Index but which Janus Capital believes will help the Fund track the Underlying Index. Such investments may not perform as expected.

Index Provider Risk. The Fund seeks to achieve returns that generally correspond, before fees and expenses, to the performance of the

Underlying Index, as published by the Index Provider. There is no assurance that the Index Provider will compile the Underlying Index accurately, or that the Underlying Index will be determined, composed or calculated accurately. While the Index

Provider gives descriptions of what the Underlying Index is designed to achieve, the Index Provider generally does not provide any warranty or accept any liability in relation to the quality, accuracy or completeness of data in such index, and it

generally does not guarantee that the Underlying Index will be in line with its methodology. Errors made by the Index Provider with respect to the quality, accuracy and completeness of the data within the Underlying Index may occur from time to time

and may not be identified and corrected by the Index Provider for a period of time, if at all. Therefore, gains, losses or costs associated with Index Provider errors will generally be borne by the Fund and its shareholders.

3½Janus Henderson Small Cap Growth Alpha ETF

Methodology and Model Risk. Neither the Fund nor Janus Capital can offer assurances that

tracking the Underlying Index will maximize returns or minimize risk, or be appropriate for every investor seeking a particular risk profile. Underlying Index risks include, but are not limited to, the risk that the factors used to determine the

components of the Underlying Index, as applied by the Index Provider in accordance with the Underlying Index methodology, might not select securities that individually, or in the aggregate, outperform the broader small-sized capitalization universe.

In addition, the Underlying Index was designed based on historically relevant fundamental factors and may not provide risk-adjusted outperformance in the future.

Passive Investment Risk. The Fund is not actively managed and therefore the Fund might not sell shares of a security due to current or

projected underperformance of a security, industry or sector, unless that security is removed from the Underlying Index or the selling of shares is otherwise required upon a rebalancing of the Underlying Index.

Securities Lending Risk. The Fund may seek to earn additional income through lending its securities to certain qualified

broker-dealers and institutions. There is the risk that when portfolio securities are lent, the securities may not be returned on a timely basis, and the Fund may experience delays and costs in recovering the security or gaining access to the

collateral provided to the Fund to collateralize the loan. If the Fund is unable to recover a security on loan, the Fund may use the collateral to purchase replacement securities in the market. There is a risk that the value of the collateral could

decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Fund.

Trading Issues

Risk. Although Fund shares are listed for trading on The NASDAQ Stock Market LLC (“NASDAQ”), there can be no assurance that an active trading market for such shares will develop or be maintained. The lack of an active

market for Fund shares, as well as periods of high volatility, disruptions in the creation/redemption process, or factors affecting the liquidity of the underlying securities held by the Fund, may result in the Fund’s shares trading at a

premium or discount to its net asset value per share (“NAV”). If an investor purchases shares at a time when the market price is at a premium to the NAV or sells at a time when the market price is at a discount to the NAV, the investor may

sustain losses.

Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of the NASDAQ, make trading in Fund shares

inadvisable. In addition, trading is subject to trading halts caused by extraordinary market volatility pursuant to the NASDAQ “circuit breaker” rules. There can be no assurance that the requirements of the NASDAQ necessary to maintain the

Fund’s listing will continue to be met or will remain unchanged. During a “flash crash,” the market prices of the Fund’s shares may decline suddenly and significantly. Such a decline may not reflect the performance of the

portfolio securities held by the Fund. Flash crashes may cause Authorized Participants and other market makers to limit or cease trading in the Fund’s shares for temporary or longer periods. Shareholders could suffer significant losses to the

extent that they sell shares at these temporarily low market prices.

Fluctuation of NAV. The net asset value (“NAV”) of

the Fund shares will generally fluctuate with changes in the market value of the Fund’s securities holdings. The market prices of shares will generally fluctuate in accordance with changes in the Fund’s NAV and supply and demand of shares

on the NASDAQ. An absence of trading in shares of the Fund, or a high volume of trading in the Fund, may result in trading prices that differ significantly from the Fund’s NAV. It cannot be predicted whether Fund shares will trade below, at or

above the Fund’s NAV. If an investor purchases shares at a time when the market price is at a premium to the NAV of the shares or sells at a time when the market price is at a discount to the NAV of the shares, then the investor may sustain

losses. Further, the securities held by the Fund may be traded in markets that close at a different time than the NASDAQ. Liquidity in those securities may be reduced after the applicable closing times. Accordingly, during the time when the NASDAQ

is open but after the applicable market closing, bid-ask spreads and the resulting premium or discount to the Fund shares’ NAV may widen. Similarly, the NASDAQ may be closed at times or days when markets for securities held by the Fund are

open, which may increase bid-ask spreads and the resulting premium or discount to the Fund shares’ NAV when the NASDAQ re-opens.

Authorized

Participant Risk. The Fund may have a limited number of financial institutions that may act as Authorized Participants (“APs”). Only APs who have entered into agreements with the Fund’s distributor may engage in

creation or redemption transactions directly with the Fund. To the extent that those APs exit the business or are unable to process creation and/or redemption orders, and no other AP is able to step forward to create and redeem in either of these

cases, shares may trade like closed-end fund shares at a premium or a discount to NAV and possibly face delisting.

An investment in the Fund is not a

bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

4½Janus Henderson Small Cap Growth Alpha ETF

The following information provides some indication of the risks of investing in the Fund by showing how the Fund’s

performance has varied over time. The bar chart depicts the change in performance from year to year during the periods indicated. The table compares the Fund’s average annual returns for the periods indicated to a broad-based securities market

index and the index the Fund seeks to track. The indices are not available for direct investment. All figures assume reinvestment of dividends and distributions.

The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Updated performance information

is available at janushenderson.com/performance or by calling 1-800-668-0434.

Janus Henderson Small Cap Growth Alpha ETF

|

|

|

Annual Total Returns (calendar year-end)

|

|

|

|

Best Quarter: 1st Quarter

2019 15.85% Worst Quarter: 4th Quarter 2018 –20.84%

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns (periods ended 12/31/19)

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

Since

Inception

2/23/2016

|

|

|

Janus Henderson Small Cap Growth Alpha ETF

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

31.06

|

%

|

|

|

18.45

|

%

|

|

Return After Taxes on Distributions

|

|

|

30.97

|

%

|

|

|

18.30

|

%

|

|

Return After Taxes on Distributions and Sale of Fund

Shares

|

|

|

18.45

|

%

|

|

|

14.75

|

%

|

|

Janus Henderson Small Cap Growth Alpha Index(1)

(reflects no deductions for fees, expenses or taxes)

|

|

|

31.75

|

%

|

|

|

18.82

|

%

|

|

Russell

2000TM Growth Index(1)

(reflects no deductions for fees, expenses or taxes)

|

|

|

28.48

|

%

|

|

|

16.97

|

%

|

|

(1)

|

Index performance shown in the table is the total return, which assumes reinvestment of any dividends and

distributions during the time periods shown.

|

After-tax returns are calculated using the historical highest individual federal marginal

income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your individual tax situation and may differ from those shown in the preceding table. The after-tax return information shown above does not

apply to Fund shares held through a tax-advantaged account, such as a 401(k) plan or an IRA.

Investment Adviser: Janus Capital Management LLC

Portfolio Managers: Benjamin Wang, CFA, is Co-Portfolio Manager of the Fund, which he has co-managed since inception. Scott M.

Weiner, DPhil, is Co-Portfolio Manager of the Fund, which he has co-managed since inception.

5½Janus Henderson Small Cap Growth Alpha ETF

|

|

|

PURCHASE AND SALE OF FUND SHARES

|

Unlike shares of traditional mutual funds, shares of the Fund are not individually redeemable and may only be purchased or

redeemed directly from the Fund at NAV in large increments called “Creation Units” (25,000 or more shares per Creation Unit) through certain participants, known as “Authorized Participants.” Janus Capital may modify the Creation

Unit size with prior notification to the Fund’s Authorized Participants. See the ETF portion of the Janus Henderson website for the Fund’s current Creation Unit size. The Fund will generally issue or redeem Creation Units in exchange for

portfolio securities (and an amount of cash) that the Fund specifies each day. Except when aggregated in Creation Units, Fund shares are not redeemable securities of the Fund.

Shares of the Fund are listed and trade on the NASDAQ, and individual investors can purchase or sell shares in much smaller increments for cash in the

secondary market through a broker. These transactions, which do not involve the Fund, are made at market prices that may vary throughout the day and differ from the Fund’s NAV. As a result, you may pay more than NAV (at a premium) when you

purchase shares, and receive less than NAV (at a discount) when you sell shares, in the secondary market.

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing

through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account (in which case you may be taxed at ordinary income tax rates upon withdrawal of your investment from such account). A sale of Fund shares may result in a

capital gain or loss.

|

|

|

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL

INTERMEDIARIES

|

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), Janus Capital and/or its

affiliates may pay broker-dealers or intermediaries for the sale and/or maintenance of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to

recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

6½Janus Henderson Small Cap Growth Alpha ETF

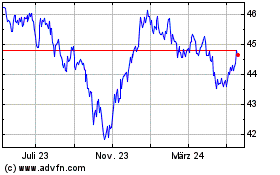

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Mär 2025 bis Apr 2025

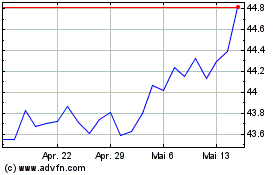

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Apr 2024 bis Apr 2025