Janus Detroit Street Trust

Janus Henderson Short Duration Income ETF

Supplement dated April 30, 2020

to the Currently Effective Prospectus

On

April 23, 2020, the Board of Trustees (“Board”) of Janus Detroit Street Trust (the “Trust”) approved a number of changes for Janus Henderson Short Duration Income ETF (the “Fund”). These changes are described

below, along with the corresponding changes to the Fund’s Prospectus.

First, the Board approved an amendment (“Amendment”) to the

Investment Advisory and Management Agreement between the Trust and Janus Capital Management LLC (“Janus Capital”) on behalf of the Fund. The Amendment provides for a new management fee rate schedule that reduces the annual management fee

rate payable by the Fund to Janus Capital. The new annual management fee rate schedule is effective May 1, 2020. A comparison of the current and new management fee rate schedules (each expressed as an annual rate) is shown below.

|

|

|

|

|

|

|

|

|

CURRENT

Daily Net

Assets

|

|

NEW

Daily Net

Assets

|

|

|

|

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

0.35%

0.28%

0.20%

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

0.30%

0.25%

0.20%

|

Second, the Board authorized an expense limitation agreement for the Fund pursuant to which Janus Capital has contractually

agreed to waive and/or reimburse the Fund’s “Total Annual Fund Operating Expenses” for at least the period May 1, 2020 through February 28, 2021 as described further below.

The Fund’s Prospectus is supplemented as indicated below:

|

|

1.

|

Effective May 1, 2020, the following replaces the corresponding information under “Fund

Summary—Fees and Expenses of the Fund” for the Fund:

|

|

|

|

|

|

FEES AND EXPENSES OF THE FUND

|

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may pay brokerage

commissions on their purchases and sales of Fund shares, which are not reflected in the table or in the example below.

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

Management Fees(1)

|

|

|

0.28%

|

|

|

Other Expenses

|

|

|

0.00%

|

|

|

Total Annual Fund Operating Expenses(2)

|

|

|

0.28%

|

|

|

Fee Waiver(2)

|

|

|

0.02%

|

|

|

Total Annual Fund Operating Expenses After Fee Waiver(2)

|

|

|

0.26%

|

|

|

(1)

|

The Fund’s Management Fee is a “unitary” fee that is designed to pay substantially all operating

expenses, except for distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses not incurred in the ordinary course of

the Fund’s business. The Management Fee has been restated from 0.32% to 0.28% to reflect a new management fee rate schedule effective May 1, 2020.

|

|

(2)

|

Janus Capital has contractually agreed to waive and/or reimburse its Management Fee to the extent that the

Fund’s total annual fund operating expenses (excluding distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses

not incurred in the ordinary course of the Fund’s business) exceed 0.26% for at least the period May 1, 2020 through February 28, 2021. The contractual waiver may be terminated or modified prior to this date only at the discretion of

the Board of Trustees.

|

EXAMPLE:

The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest

$10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

|

$27

|

|

$88

|

|

$155

|

|

$354

|

|

|

2.

|

Effective May 1, 2020, the following replaces corresponding information appearing under

“Management of the Fund—Management Expenses”:

|

The following table reflects the Fund’s contractual Management

Fee rate (expressed as an annual rate) in effect through April 30, 2020. The rates shown were fixed rates based on the Fund’s daily net assets.

|

|

|

|

|

|

|

Daily

Net Assets

of the

Fund

|

|

|

Contractual

Management Fee (%)

(annual rate)

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.35

0.28

0.20

|

|

Effective May 1, 2020, the Fund has implemented a new management fee rate schedule, as shown in the table below

(expressed as an annual rate). The rates shown are fixed rates based on the Fund’s daily net assets.

|

|

|

|

|

|

|

Daily

Net Assets

of the

Fund

|

|

|

Contractual

Management Fee (%)

(annual rate)

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.30

0.25

0.20

|

|

The chart below shows the Fund’s hypothetical, blended fee rate based on the Fund’s daily net assets at varying

asset levels.

|

|

|

|

|

Fund Assets

|

|

Effective Blended Rate

Management Fee (%)

(annual rate)

|

|

|

|

|

$500 million

|

|

0.300%

|

|

|

|

|

$750 million

|

|

0.283%

|

|

|

|

|

$1.0 billion

|

|

0.275%

|

|

|

|

|

$1.25 billion

|

|

0.260%

|

|

|

|

|

$1.5 billion

|

|

0.250%

|

|

|

|

|

$2.0 billion

|

|

0.238%

|

|

|

|

|

$2.5 billion

|

|

0.230%

|

|

|

|

|

$3.0 billion

|

|

0.225%

|

|

|

|

|

$4.0 billion

|

|

0.219%

|

|

|

|

|

$5.0 billion

|

|

0.215%

|

|

|

|

|

$6.0 billion

|

|

0.213%

|

2

|

|

3.

|

Effective May 1, 2020, the following section is added to “Management of the Fund—Management

Expenses”:

|

Expense Limitation

Janus Capital has contractually agreed to waive and/or reimburse the management fee payable by the Fund in an amount equal to the amount, if any, that the

Fund’s total annual fund operating expenses (excluding distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses

not incurred in the ordinary course of the Fund’s business) exceed the annual rate shown below. For information about how the expense limit affects the total expenses of the Fund, if applicable, see the “Fees and Expenses of the Fund”

table in the “Fund Summary” section of the Prospectus. Janus Capital has agreed to continue the waiver for at least the period from May 1, 2020 through February 28, 2021.

|

|

|

|

|

Fund Name

|

|

Expense Limit Percentage

(%)

|

|

Janus Henderson Short Duration Income ETF

|

|

0.26

|

|

|

4.

|

“Market Risk” in the “Fund Summary—Principal Investment Risks” section

of the Fund’s summary prospectus is deleted in its entirety and replaced with the following:

|

Market

Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple companies or securities, in the portfolio decreases or if the portfolio managers’ belief about a

company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It is

important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole.

Market risk may be magnified if certain social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial

markets.

|

|

5.

|

“Market Risk” in the “Additional Information About the Fund—Principal Investment

Risks” section of the Fund’s statutory prospectus is deleted in its entirety and replaced with the following:

|

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple

companies or securities, in the portfolio decreases or if the portfolio managers’ belief about a company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the

Fund’s portfolio could also decrease if there are deteriorating economic or market conditions, including, but not limited to, a decline in commodities prices, or if the market favors different types of securities than the types of securities in

which the Fund invests. If the value of the Fund’s portfolio decreases, the Fund’s net asset value will also decrease, which means if you sell your shares in the Fund you may lose money. Market risk may affect a single issuer, industry,

economic sector, or the market as a whole.

The increasing interconnectivity between global economies and financial markets increases the likelihood that

events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Social, political, economic and other conditions and events, such as natural disasters, health emergencies (e.g.,

the COVID-19 outbreak, epidemics and other pandemics), terrorism, conflicts and social unrest, could reduce consumer demand or economic output, result in market closures, travel restrictions and/or

quarantines, and generally have a significant impact on the global economies and financial markets. The effects of COVID-19, which may be short-term or may last for an extended period of time, have contributed

to increased volatility in global financial markets and may affect certain countries, regions, issuers, industries and market sectors more dramatically than others. These conditions and events could have a significant impact on the Fund and its

investments.

3

|

|

6.

|

The following is inserted as the new, final paragraph in the “Additional Information About the

Fund—Risks of the Fund” section of the Fund’s statutory prospectus.

|

Operational Risk. An

investment in the Fund can involve operational risks arising from factors such as processing errors, human errors, inadequate or failed internal or external processes, failures in systems and technology, changes in personnel, and errors caused by

third party service providers. Among other things, these errors or failures, as well as other technological issues, may adversely affect a Fund’s ability to calculate its net asset value, process fund orders, execute portfolio trades or perform

other essential tasks in a timely manner, including over a potentially extended period of time. These errors or failures may also result in a loss or compromise of information, regulatory scrutiny, reputational damage or other events, any of which

could have a material adverse effect on the Fund. Implementation of business continuity plans by the Fund, the Adviser or third-party service providers in response to disruptive events such as natural disasters, epidemics and pandemics, terrorism,

conflicts and social unrest may increase these operational risks to the Fund. While the Fund seeks to minimize such events through internal controls and oversight of third-party service providers, there is no guarantee that the Fund will not suffer

losses if such events occur.

Please retain this Supplement with your records.

4

Janus Detroit Street Trust

Janus Henderson Small Cap Growth Alpha ETF

Janus Henderson Small/Mid Cap Growth Alpha ETF

The Long-Term Care ETF

Supplement

dated April 30, 2020

to the Currently Effective Prospectuses

On April 23, 2020, the Board of Trustees of Janus Detroit Street Trust (the “Trust”) approved an amendment (“Amendment”) to the

Investment Advisory and Management Agreement between the Trust and Janus Capital Management LLC (“Janus Capital”) on behalf of each of Janus Henderson Small Cap Growth Alpha ETF, Janus Henderson Small/Mid Cap Growth Alpha ETF, and The

Long-Term Care ETF (each a “Fund” and, together, the “Funds”). The Amendment provides for a new management fee rate schedule that reduces the annual management fee rate payable by the Funds to Janus Capital. The new annual

management fee rate schedule is effective May 1, 2020. A comparison of the current and new management fee rate schedules (each expressed as an annual rate) is shown below.

|

|

|

|

|

|

|

|

|

CURRENT

Daily Net

Assets

|

|

NEW

Daily Net

Assets

|

|

|

|

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

0.35%

0.28%

0.20%

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

0.30%

0.25%

0.20%

|

Each Fund’s Prospectus is supplemented as indicated below:

|

|

1.

|

Effective May 1, 2020, the following replaces the corresponding information under “Fund

Summary—Fees and Expenses of the Fund” for each of the Funds:

|

|

|

|

|

|

FEES AND EXPENSES OF THE FUND

|

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may pay brokerage

commissions on their purchases and sales of Fund shares, which are not reflected in the table or in the example below.

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

Management Fees(1)

|

|

|

0.30%

|

|

|

Other Expenses

|

|

|

0.00%

|

|

|

Total Annual Fund Operating

Expenses

|

|

|

0.30%

|

|

|

(1)

|

The Fund’s Management Fee is a “unitary” fee that is designed to pay substantially all operating

expenses, except for distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses not incurred in the ordinary course of

the Fund’s business. The Management Fee has been restated from 0.35% to 0.30% to reflect a new management fee rate schedule effective May 1, 2020.

|

EXAMPLE:

The Example is intended to help you compare the

cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also assumes

that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

|

$31

|

|

$97

|

|

$169

|

|

$381

|

|

|

2.

|

Effective May 1, 2020, the following replaces corresponding information appearing under

“Management of the Fund—Management Expenses” in each Fund’s prospectus:

|

The following table reflects the

Fund’s contractual Management Fee rate (expressed as an annual rate) in effect through April 30, 2020. The rates shown were fixed rates based on the Fund’s daily net assets.

|

|

|

|

|

|

|

Daily

Net Assets

of the

Fund

|

|

|

Contractual

Management Fee (%)

(annual rate)

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.35

0.28

0.20

|

|

Effective May 1, 2020, the Fund has implemented a new management fee rate schedule, as shown in the table below

(expressed as an annual rate). The rates shown are fixed rates based on the Fund’s daily net assets.

|

|

|

|

|

|

|

Daily

Net Assets

of the

Fund

|

|

|

Contractual

Management Fee (%)

(annual rate)

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.30

0.25

0.20

|

|

The chart below shows the Fund’s hypothetical, blended fee rate based on the Fund’s daily net assets at varying

asset levels.

|

|

|

|

|

Fund Assets

|

|

Effective Blended Rate

Management Fee (%)

(annual rate)

|

|

|

|

|

$500 million

|

|

0.300%

|

|

|

|

|

$750 million

|

|

0.283%

|

|

|

|

|

$1.0 billion

|

|

0.275%

|

|

|

|

|

$1.25 billion

|

|

0.260%

|

|

|

|

|

$1.5 billion

|

|

0.250%

|

|

|

|

|

$2.0 billion

|

|

0.238%

|

|

|

|

|

$2.5 billion

|

|

0.230%

|

|

|

|

|

$3.0 billion

|

|

0.225%

|

|

|

|

|

$4.0 billion

|

|

0.219%

|

|

|

|

|

$5.0 billion

|

|

0.215%

|

|

|

|

|

$6.0 billion

|

|

0.213%

|

|

|

3.

|

For Janus Henderson Small Cap Growth Alpha ETF, “Market Risk” in the “Fund Summary

– Principal Investment Risks” section of the Fund’s summary prospectus is deleted in its entirety and replaced with the following:

|

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple

companies or securities, in the portfolio decreases. Further, regardless of how well individual companies or securities perform, the value of the Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It

is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole.

The Underlying Index focuses on the small-sized capitalization sector of the stock market, and therefore at times the Fund may underperform the overall stock market. Market risk may be magnified if certain

social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial markets.

2

|

|

4.

|

For Janus Henderson Small/Mid Cap Growth Alpha ETF, “Market Risk” in the “Fund

Summary—Principal Investment Risks” section of the Fund’s summary prospectus is deleted in its entirety and replaced with the following:

|

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple

companies or securities, in the portfolio decreases. Further, regardless of how well individual companies or securities perform, the value of the Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It

is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole.

The Underlying Index focuses on the small- and medium-sized capitalization sector of the stock market, and therefore at times the Fund may underperform the overall stock market. Market risk may be magnified if

certain social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial markets.

|

|

5.

|

For The Long Term Care ETF, “Market Risk” in the “Fund Summary—Principal

Investment Risks” section of the Fund’s summary prospectus is deleted in its entirety and replaced with the following:

|

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple

companies or securities, in the portfolio decreases. Further, regardless of how well individual companies or securities perform, the value of the Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It

is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole.

Market risk may be magnified if certain social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial

markets.

|

|

6.

|

The following is inserted as a new paragraph immediately following “Trading Issues Risk” in

the “Additional Information About the Fund—Risks of the Fund” section in each Fund’s statutory prospectus.

|

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple companies or

securities, in the portfolio decreases. Further, regardless of how well individual companies or securities perform, the value of a Fund’s portfolio could also decrease if there are deteriorating economic or market conditions, including, but not

limited to, a general decline in prices on the stock markets, a general decline in real estate markets, a decline in commodities prices, or if the market favors different types of securities than the types of securities in which the Fund invests.

Market risk may affect a single issuer, industry, economic sector, or the market as a whole. To the extent that the Underlying Index focuses on a specific capitalization sector of the stock market (small-,

mid- or large-capitalization, as applicable), the Fund may underperform the overall stock market.

The increasing

interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Social, political,

economic and other conditions and events, such as natural disasters, health emergencies (e.g., the COVID-19 outbreak, epidemics and other pandemics), terrorism, conflicts and social unrest, could reduce

consumer demand or economic output, result in market closures, travel restrictions and/or quarantines, and generally have a significant impact on the global economies and financial markets. The effects of

COVID-19, which may be short-term or may last for an extended period of time, have contributed to increased volatility in global financial markets and may affect certain countries, regions, issuers, industries

and market sectors more dramatically than others. These conditions and events could have a significant impact on the Fund and its investments.

3

|

|

7.

|

The following is inserted as the new, final paragraph in the “Additional Information About the

Fund—Risks of the Fund” section in each Fund’s statutory prospectus.

|

Operational Risk. An

investment in the Fund can involve operational risks arising from factors such as processing errors, human errors, inadequate or failed internal or external processes, failures in systems and technology, changes in personnel, and errors caused by

third party service providers. Among other things, these errors or failures, as well as other technological issues, may adversely affect a Fund’s ability to calculate its net asset value, process fund orders, execute portfolio trades or perform

other core functions in a timely manner, including over a potentially extended period of time. These errors or failures may also result in a loss or compromise of information, regulatory scrutiny, reputational damage or other events, any of which

could have a material adverse effect on the Fund. Implementation of business continuity plans by the Fund, Adviser or third-party service providers in response to disruptive events such as natural disasters, epidemics and pandemics, terrorism,

conflicts and social unrest may increase these operational risks to the Fund. While the Fund seeks to minimize such events through internal controls and oversight of third-party service providers, there is no guarantee that the Fund will not suffer

losses if such events occur.

Please retain this Supplement with your records.

4

Janus Detroit Street Trust

Janus Henderson Mortgage-Backed Securities ETF

Supplement dated April 30, 2020

to the Currently Effective Prospectus

On

April 23, 2020, the Board of Trustees of Janus Detroit Street Trust (the “Trust”) approved an amendment (“Amendment”) to the Investment Advisory and Management Agreement between the Trust and Janus Capital Management LLC

(“Janus Capital”) on behalf of Janus Henderson Mortgage-Backed Securities ETF (the “Fund”). The Amendment provides for a new management fee rate schedule that reduces the annual management fee rate payable by the Fund to Janus

Capital. The new annual management fee rate schedule is effective May 1, 2020. A comparison of the current and new management fee rate schedules (each expressed as an annual rate) is shown below.

|

|

|

|

|

|

|

|

|

CURRENT

Daily Net

Assets

|

|

NEW

Daily Net

Assets

|

|

|

|

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

0.35%

0.28%

0.20%

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

0.30%

0.25%

0.20%

|

The Fund’s Prospectus is supplemented as indicated below:

|

|

1.

|

Effective May 1, 2020, the following replaces the corresponding information under “Fund

Summary-Fees and Expenses of the Fund” for the Fund:

|

|

|

|

|

|

FEES AND EXPENSES OF THE FUND

|

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may pay brokerage

commissions on their purchases and sales of Fund shares, which are not reflected in the table or in the example below.

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

Management Fees(1)

|

|

|

0.30%

|

|

|

Other Expenses

|

|

|

0.00%

|

|

|

Acquired Fund Fees and

Expenses(2)

|

|

|

0.02%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

0.32%

|

|

|

(1)

|

The Fund’s Management Fee is a “unitary” fee that is designed to pay substantially all operating

expenses, except for distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses not incurred in the ordinary course of

the Fund’s business. The Management Fee has been restated from 0.35% to 0.30% to reflect a new management fee rate schedule effective May 1, 2020.

|

|

(2)

|

Acquired Fund Fees and Expenses are indirect fees and expenses that the Fund incurs from investing in other

investment companies. Please note that the amount of Total Annual Fund Operating Expenses shown in the above table may differ from the ratio of gross expenses included in the “Financial Highlights” section of this prospectus, which

reflects the operating expenses of the Fund and does not include indirect expenses such as Acquired Fund Fees and Expenses.

|

EXAMPLE:

The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you

invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the

same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

|

$33

|

|

$103

|

|

$180

|

|

$406

|

|

|

2.

|

Effective May 1, 2020, the following replaces corresponding information appearing under

“Management of the Fund—Management Expenses”:

|

The following table reflects the Fund’s contractual Management

Fee rate (expressed as an annual rate) in effect through April 30, 2020. The rates shown were fixed rates based on the Fund’s daily net assets.

|

|

|

|

|

|

|

Daily

Net Assets

of the

Fund

|

|

|

Contractual

Management Fee (%)

(annual rate)

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.35

0.28

0.20

|

|

Effective May 1, 2020, the Fund has implemented a new management fee rate schedule, as shown in the table below

(expressed as an annual rate). The rates shown are fixed rates based on the Fund’s daily net assets.

|

|

|

|

|

|

|

Daily

Net Assets

of the

Fund

|

|

|

Contractual

Management Fee (%)

(annual rate)

|

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.30

0.25

0.20

|

|

The chart below shows the Fund’s hypothetical, blended fee rate based on the Fund’s daily net assets at varying

asset levels.

|

|

|

|

|

Fund Assets

|

|

Effective Blended Rate

Management Fee (%)

(annual rate)

|

|

|

|

|

$500 million

|

|

0.300%

|

|

|

|

|

$750 million

|

|

0.283%

|

|

|

|

|

$1.0 billion

|

|

0.275%

|

|

|

|

|

$1.25 billion

|

|

0.260%

|

|

|

|

|

$1.5 billion

|

|

0.250%

|

|

|

|

|

$2.0 billion

|

|

0.238%

|

|

|

|

|

$2.5 billion

|

|

0.230%

|

|

|

|

|

$3.0 billion

|

|

0.225%

|

|

|

|

|

$4.0 billion

|

|

0.219%

|

|

|

|

|

$5.0 billion

|

|

0.215%

|

|

|

|

|

$6.0 billion

|

|

0.213%

|

|

|

3.

|

“Market Risk” in the “Fund Summary—Principal Investment Risks” section

of the Fund’s summary prospectus is deleted in its entirety and replaced with the following:

|

Market

Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple companies or securities, in the portfolio decreases or if the portfolio managers’ belief about a

company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It is

important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole.

Market risk may be magnified if certain social, political, economic and other conditions and events (such as natural disasters, epidemics and pandemics, terrorism, conflicts and social unrest) adversely interrupt the global economy and financial

markets.

2

|

|

4.

|

“Market Risk” in the “Additional Information About the Fund – Principal

Investment Risks” section of the Fund’s statutory prospectus is deleted in its entirety and replaced with the following:

|

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple

companies or securities, in the portfolio decreases or if the portfolio managers’ belief about a company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the

Fund’s portfolio could also decrease if there are deteriorating economic or market conditions, including, but not limited to, a decline in commodities prices, or if the market favors different types of securities than the types of securities in

which the Fund invests. If the value of the Fund’s portfolio decreases, the Fund’s net asset value will also decrease, which means if you sell your shares in the Fund you may lose money. Market risk may affect a single issuer, industry,

economic sector, or the market as a whole.

The increasing interconnectivity between global economies and financial markets increases the likelihood that

events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Social, political, economic and other conditions and events, such as natural disasters, health emergencies (e.g.,

the COVID-19 outbreak, epidemics and other pandemics), terrorism, conflicts and social unrest, could reduce consumer demand or economic output, result in market closures, travel restrictions and/or

quarantines, and generally have a significant impact on the global economies and financial markets. The effects of COVID-19, which may be short-term or may last for an extended period of time, have contributed

to increased volatility in global financial markets and may affect certain countries, regions, issuers, industries and market sectors more dramatically than others. These conditions and events could have a significant impact on the Fund and its

investments.

|

|

5.

|

The following is inserted as the new, final paragraph in the “Additional Information About the

Fund—Risks of the Fund” section of the Fund’s statutory prospectus.

|

Operational Risk. An

investment in the Fund can involve operational risks arising from factors such as processing errors, human errors, inadequate or failed internal or external processes, failures in systems and technology, changes in personnel, and errors caused by

third party service providers. Among other things, these errors or failures, as well as other technological issues, may adversely affect a Fund’s ability to calculate its net asset value, process fund orders, execute portfolio trades or perform

other essential tasks in a timely manner, including over a potentially extended period of time. These errors or failures may also result in a loss or compromise of information, regulatory scrutiny, reputational damage or other events, any of which

could have a material adverse effect on the Fund. Implementation of business continuity plans by the Fund, the Adviser or third-party service providers in response to disruptive events such as natural disasters, epidemics and pandemics, terrorism,

conflicts and social unrest may increase these operational risks to the Fund. While the Fund seeks to minimize such events through internal controls and oversight of third-party service providers, there is no guarantee that the Fund will not suffer

losses if such events occur.

Please retain this Supplement with your records.

3

Janus Detroit Street Trust

Janus Henderson Short Duration Income ETF

Supplement dated April 30, 2020

to the Currently Effective Statement of Additional Information,

as Supplemented March 27, 2020

The

Statement of Additional Information for Janus Henderson Short Duration Income ETF is supplemented effective May 1, 2020, as follows:

|

|

1.

|

The following replaces the corresponding information under “Investment Adviser—Janus Capital

Management LLC”:

|

The Fund pays a monthly Management Fee to Janus Capital for its services based on the daily net assets of the

Fund. The fee was calculated at the following annual rate through April 30, 2020.

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

Janus

Henderson Short Duration Income ETF

|

|

$0-$500 million

Next $500 million

Over

$1 billion

|

|

|

0.35

0.28

0.20

|

|

Effective May 1, 2020, the Fund has implemented a new management fee rate schedule, based on the Fund’s daily net

assets, as shown in the table below (expressed as an annual rate).

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

Janus

Henderson Short Duration Income ETF

|

|

$0-$500 million

Next $500 million

Over

$1 billion

|

|

|

0.30

0.25

0.20

|

|

|

|

2.

|

The following section is added to “Investment Adviser – Janus Capital Management LLC”

immediately preceding “Payments to Financial Intermediaries by Janus Capital or its Affiliates”:

|

Janus Capital has contractually agreed to waive and/or reimburse the management fee payable by the Fund in an amount equal to

the amount, if any, that the Fund’s total annual fund operating expenses (excluding distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and

other extraordinary expenses not incurred in the ordinary course of the Fund’s business) exceed the annual rate shown below. For information about how the expense limit affects the total expenses of the Fund refer to the “Fees and Expenses

of the Fund” table in the “Fund Summary” section of the Prospectus. Janus Capital has agreed to continue the waiver for at least the period from May 1, 2020 through February 28, 2021.

|

|

|

|

|

Fund Name

|

|

Expense Limit

Percentage (%)

|

|

|

|

|

Janus Henderson Short Duration Income ETF

|

|

0.26

|

Please retain this Supplement with your records.

Janus Detroit Street Trust

Janus Henderson Small Cap Growth Alpha ETF

Janus Henderson Small/Mid Cap Growth Alpha ETF

Supplement dated April 30, 2020

to the Currently Effective Statement of Additional Information,

as Supplemented March 27, 2020

The

Statement of Additional Information for Janus Henderson Small Cap Growth Alpha ETF and Janus Henderson Small Mid/Cap Growth Alpha ETF (each a “Fund”) is supplemented effective May 1, 2020, as follows:

The following replaces the corresponding information under “Investment Adviser—Investment Adviser—Janus Capital Management LLC”:

Each Fund pays a monthly Management Fee to Janus Capital for its services based on the daily net assets of the Fund. The fee was calculated at the

following annual rate through April 30, 2020.

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net

Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

Janus

Henderson Small Cap Growth Alpha ETF

|

|

$0-$500 million

Next

$500 million

Over $1 billion

|

|

|

0.35

0.28

0.20

|

|

|

Janus

Henderson Small/Mid Cap Growth Alpha ETF

|

|

$0-$500 million

Next

$500 million

Over $1 billion

|

|

|

0.35

0.28

0.20

|

|

Effective May 1, 2020, each Fund has implemented a new management fee rate schedule, based on the Fund’s daily net

assets, as shown in the table below (expressed as an annual rate).

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net

Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

Janus

Henderson Small Cap Growth Alpha ETF

|

|

$0-$500 million

Next $500 million

Over

$1 billion

|

|

|

0.30

0.25

0.20

|

|

|

Janus

Henderson Small/Mid Cap Growth Alpha ETF

|

|

$0-$500 million

Next $500 million

Over

$1 billion

|

|

|

0.30

0.25

0.20

|

|

Please retain this Supplement with your records.

Janus Detroit Street Trust

The Long-Term Care ETF

Supplement dated April 30, 2020

to the Currently Effective Statement of Additional Information,

as Supplemented March 27, 2020

The

Statement of Additional Information for The Long-Term Care ETF is supplemented effective May 1, 2020, as follows:

The following replaces the

corresponding information under “Investment Adviser—Investment Adviser—Janus Capital Management LLC”:

The Fund pays a monthly

Management Fee to Janus Capital for its services based on the daily net assets of the Fund. The fee was calculated at the following annual rate through April 30, 2020.

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net

Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

The

Long-Term Care ETF

|

|

$0-$500 million

Next

$500 million

Over $1 billion

|

|

|

0.35

0.28

0.20

|

|

Effective May 1, 2020, the Fund has implemented a new management fee rate schedule, based on the Fund’s daily net

assets, as shown in the table below (expressed as an annual rate).

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net

Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

The

Long-Term Care ETF

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.30

0.25

0.20

|

|

Please retain this Supplement with your records.

Janus Detroit Street Trust

Janus Henderson Mortgage-Backed Securities ETF

Supplement dated April 30, 2020

to the Currently Effective Statement of Additional Information,

as Supplemented March 27, 2020

The

Statement of Additional Information for Janus Henderson Mortgage-Backed Securities ETF is supplemented effective May 1, 2020, as follows:

The

following replaces the corresponding information under “Investment Adviser—Investment Adviser—Janus Capital Management LLC”:

The Fund pays a monthly Management Fee to Janus Capital for its services based on the daily net assets of the Fund. The fee was calculated at the following

annual rate through April 30, 2020.

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net

Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

Janus

Henderson Mortgage-Backed Securities ETF

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.35

0.28

0.20

|

|

Effective May 1, 2020, the Fund has implemented a new management fee rate schedule, based on the Fund’s daily net

assets, as shown in the table below (expressed as an annual rate).

|

|

|

|

|

|

|

|

|

Fund Name

|

|

Daily Net

Assets of the Fund

|

|

|

Contractual

Management Fees (%)

(annual rate)

|

|

|

Janus

Henderson Mortgage-Backed Securities ETF

|

|

$0-$500 million

Next $500 million

Over $1 billion

|

|

|

0.30

0.25

0.20

|

|

Please retain this Supplement with your records.

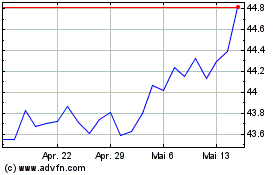

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

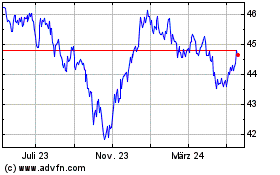

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024