The Organics ETF

Ticker: ORG

Principal U.S. Listing

Exchange: The NASDAQ Stock Market LLC

SUMMARY PROSPECTUS DATED

FEBRUARY 28, 2020

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the

Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund online at janushenderson.com/info. You can also get this information at no cost by calling a Janus Henderson representative at 1-877-335-2687 or by sending an email request to prospectusrequest@janushenderson.com.

The Board of Trustees of Janus Detroit Street Trust (the “Trust”) approved a plan to liquidate and terminate The Organics ETF (the

“Fund”), effective on or about March 17, 2020 (the “Liquidation Date”). After the close of business on or about March 12, 2020, the Fund will no longer accept creation orders. Trading in the Fund will be halted prior to market

open on or about March 13, 2020. Proceeds of the liquidation are currently scheduled to be sent to shareholders on or about March 18, 2020. Termination of the Fund is expected to occur as soon as practicable following the liquidation. Prior to and

through the close of trading on The NASDAQ Stock Market LLC (“NASDAQ”) on March 12, 2020, the Fund will undertake the process of closing down and liquidating its portfolio. This process may result in the Fund holding cash and

securities that may not be consistent with its investment objective and strategies. During this period, the Fund is likely to incur higher tracking error than is typical for the Fund. Furthermore, during the time between market open on March 13,

2020 and the Liquidation Date, because shares will not be traded on NASDAQ, there may not be a trading market for the Fund’s shares. Shareholders may sell shares of the Fund on NASDAQ until the market close on March 12, 2020 and may incur

typical transaction fees from their broker-dealer. Shares held as of the close of business on the Liquidation Date will be automatically redeemed for cash at the current net asset value. Proceeds of the redemption will be paid through the

broker-dealer with whom you hold shares of the Fund. Shareholders will generally recognize a capital gain or loss on the redemptions. The Fund may or may not, depending upon the Fund’s circumstances, pay one or more dividends or other

distributions prior to or along with the redemption payments. Please consult your personal tax advisor about the potential tax consequences.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder

reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your broker-dealer or other financial intermediary (such as a bank). Instead, the reports will be made

available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you

already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting

your broker-dealer or other financial intermediary.

You may elect to receive all future reports in paper

free of charge by contacting your broker-dealer or other financial intermediary. Your election to receive reports in paper will apply to all Funds held in your account at your

broker-dealer or other financial intermediary.

The Organics ETF seeks investment results that correspond generally to the performance, before fees and expenses, of an

index which is designed to track the performance of companies globally that are positioned to profit from increasing demand for organic products, including companies which service, produce, distribute, market or sell organic food, beverages,

cosmetics, supplements, or packaging. The Adviser believes organic products are generally environmentally responsible and more likely to be sustainable.

|

|

|

FEES AND EXPENSES OF THE FUND

|

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may pay brokerage

commissions on their purchases and sales of Fund shares, which are not reflected in the table or in the example below.

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

Management Fees(1)

|

|

|

0.35%

|

|

|

Other Expenses

|

|

|

0.00%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

0.35%

|

|

|

(1)

|

The Fund’s Management Fee is a “unitary” fee that is designed to pay substantially all operating

expenses, except for distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses not incurred in the ordinary course of

the Fund’s business.

|

1½The Organics ETF

EXAMPLE:

The Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest

$10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same.

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

|

|

$36

|

|

$113

|

|

$197

|

|

$443

|

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities

(or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund

operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 33% of the average value of its portfolio.

|

|

|

PRINCIPAL INVESTMENT STRATEGIES

|

The Fund pursues its investment objective by investing at least 80% of its net assets (plus any borrowings for investment

purposes) in the stocks that comprise the Solactive Organics Index (“Underlying Index”). The Underlying Index is designed to track the performance of companies globally that are positioned to profit from increasing demand for organic

products, including companies which service, produce, distribute, market or sell organic food, beverages, cosmetics, supplements, or packaging. Under normal circumstances, the Fund expects to invest substantially all of its assets in securities

included in the Underlying Index, using a replication strategy as discussed below. The Fund may invest in companies of any capitalization, although at least 90% of the companies will have a capitalization of at least $100 million. The Fund may

invest in foreign issuers, including emerging markets. Stocks included in the Underlying Index may include common shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”).

ADRs and GDRs represent ownership interests in shares of foreign companies that are held in financial institution custodial accounts, and are traded on exchanges in the United States and around the world.

The Fund is classified as nondiversified, which allows it to hold larger positions in a smaller number of companies, compared to a fund that is classified as

diversified.

The Underlying Index, the Solactive Organics Index, was created by and is maintained by Solactive AG (“Solactive” or the

“Index Provider”). The Underlying Index is reconstituted on a semi-annual basis, rebalanced on a quarterly basis, and the Fund is rebalanced quarterly based on changes to the Underlying Index. The Fund uses a “passive,”

index-based approach in seeking performance that corresponds to the performance of the Underlying Index. The underlying securities are weighted according to their market capitalization relative to other securities in the Underlying Index, and capped

so that no security will represent more than 20% of the Underlying Index at the time of an index reconstitution or rebalance. Due to market movement between rebalancing and reconstitution of the Underlying Index, an underlying security may represent

more than 20% of the Underlying Index at any given time, and thus may represent more than 20% of the Fund’s assets at any given time.

The Fund will

generally use a replication methodology, meaning it will invest in the securities composing the Underlying Index in proportion to the weightings in the Underlying Index. However, the Fund may utilize a sampling methodology under various

circumstances in which it may not be possible or practicable to purchase all of the securities in the Underlying Index. Janus Capital expects that over time, if the Fund has sufficient assets, the correlation between the Fund’s performance,

before fees and expenses, and that of the Underlying Index will be 95% or better. A figure of 100% would indicate perfect correlation.

Under normal

circumstances, the Fund expects to invest substantially all of its assets in securities included in the Underlying Index, although it may invest up to 20% its assets in other securities that Janus Capital believes will help the Fund track the

Underlying Index. Such investments include stocks, shares of other investment companies, cash and cash equivalents, including money market funds.

To the

extent the Underlying Index concentrates (i.e., holds 25% or more of its total assets) in the securities of a particular industry or group of industries, the Fund will concentrate its investments to approximately the same extent as the Underlying

Index. As of February 1, 2020, approximately 37% and 26.5% of the Underlying Index was represented by companies in the Food, Beverage & Tobacco and Materials industries, respectively. For more recent information, see the Fund’s daily

portfolio holdings posted on the ETF portion of the Janus Henderson website.

2½The Organics ETF

The Fund may lend portfolio securities on a short-term or long-term basis, in an amount equal to up to one-third

of its total assets as determined at the time of the loan origination.

|

|

|

PRINCIPAL INVESTMENT RISKS

|

The Fund’s returns and yields will vary, and you could lose money. The principal risks and special considerations

associated with investing in the Fund are set forth below.

Market Risk. The value of the Fund’s portfolio may decrease if

the value of an individual company or security, or multiple companies or securities, in the portfolio decreases. Further, regardless of how well individual companies or securities perform, the value of the Fund’s portfolio could also decrease

if there are deteriorating economic or market conditions. It is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose money. Market risk may affect a single

issuer, industry, economic sector, or the market as a whole. The Underlying Index has exposure to the small-, mid- and/or large capitalization sectors of the stock market, and therefore at times the Fund may underperform the overall stock market.

Equity Investing Risk. The Fund’s investment in the securities composing the Underlying Index involves risks of investing in

a portfolio of equity securities, such as market fluctuations, changes in interest rates and perceived trends in stock prices.

Concentration

Risk. The Fund focuses its investments in organic products companies. Because of this, companies in the Fund’s portfolio may share common characteristics and may be more sensitive to factors such as consumer demand, consumer

confidence and spending, environmental factors and production costs. As a result, the Fund may be subject to greater risks and the value of its investments may fluctuate more than a fund that does not focus its investments. In addition, the

Fund’s assets will generally be concentrated in an industry or group of industries to the extent that the Fund’s Underlying Index concentrates in a particular industry or group of industries. To the extent the Fund invests a substantial

portion of its assets in an industry or group of industries, market or economic factors impacting that industry or group of industries could have a significant effect on the value of the Fund’s investments. Companies in the same or similar

industries may share common characteristics and are more likely to react similarly to industry-specific market or economic developments. Additionally, the Fund’s performance may be more volatile when the Fund’s investments are less

diversified across industries. The Fund’s assets will not be concentrated if the Underlying Index does not concentrate in a particular industry or group of industries.

|

•

|

|

Food, Beverage & Tobacco Industry Group Risk: Demographic and product trends,

changing consumer preferences, nutritional and health-related concerns, competitive pricing, marketing campaigns, environmental factors, adverse changes in general economic conditions, government regulation, food inspection and processing control,

consumer boycotts, risks of product tampering, product liability claims, and the availability and expense of liability insurance can affect the demand for, and success of, such companies’ products in the marketplace. Such companies also face

risks associated with changing market prices as a result of, among other things, changes in government support and trading policies and agricultural conditions influencing the growth and harvest seasons.

|

|

•

|

|

Materials Industry Risk – The Fund is subject to risks faced by companies in the

materials sector, including: adverse effects from commodity price volatility, exchange rates, import controls and increased competition; the possibility that production of industrial materials will exceed demand as a result of overbuilding or

economic downturns, leading to poor investment returns; risk for environmental damage and product liability claims; and adverse effects from depletion of resources, technical progress, labor relations and government regulations.

|

Small- and Mid-Sized Companies Risk. The Fund’s investments in securities issued by small- and mid-sized

companies, which can include smaller, start-up companies offering emerging products or services, may involve greater risks than are customarily associated with larger, more established companies. Securities issued by small- and mid-sized companies

tend to be more volatile and somewhat more speculative than securities issued by larger or more established companies and may underperform as compared to the securities of larger companies. Securities issued by micro-capitalization companies tend to

be significantly more volatile, and more vulnerable to adverse business and economic developments, than those of larger companies. For example, small- and micro-capitalization companies may be more likely to merge with or be acquired by another

company, resulting in de-listing of the securities held by the Fund.

Growth Securities Risk. Securities of companies perceived to

be “growth” companies may be more volatile than other stocks and may involve special risks. If the perception of a company’s growth potential is not realized, the securities purchased may not perform as expected, reducing the

Fund’s returns. In addition, because different types of stocks tend to shift in and out of favor

3½The Organics ETF

depending on market and economic conditions, “growth” stocks may perform differently from the market as a whole, and other types of securities.

Foreign Exposure Risk. The Fund may have exposure to foreign markets as a result of its investments in foreign securities, including

investments in emerging markets, which can be more volatile than the U.S. markets. As a result, its returns and net asset value per share (“NAV”) may be affected to a large degree by fluctuations in currency exchange rates or political or

economic conditions in a particular country. In some foreign markets, there may not be protection against failure by other parties to complete transactions. It may not be possible for the Fund to repatriate capital, dividends, interest, and other

income from a particular country or governmental entity. In addition, a market swing in one or more countries or regions where the Fund has invested a significant amount of its assets may have a greater effect on the Fund’s performance than it

would in a more geographically diversified portfolio.

Eurozone Risk. A number of countries in the European Union (“EU”)

have experienced, and may continue to experience, severe economic and financial difficulties. In particular, many EU nations are susceptible to economic risks associated with high levels of debt, notably due to investments in sovereign debt. As a

result, financial markets in the EU have been subject to increased volatility and declines in asset values and liquidity. Responses to these financial problems by European governments, central banks, and others, including austerity measures and

reforms, may not work, may result in social unrest, and may limit future growth and economic recovery or have other unintended consequences. The risk of investing in securities in the European markets may also be heightened due to the referendum in

which the United Kingdom voted to exit the EU (known as “Brexit”). There is considerable uncertainty about how Brexit will be conducted, how negotiations of necessary treaties and trade agreements will conclude, or how financial markets

will react. To the extent that the Fund has exposure to European markets or to transactions tied to the value of the euro, these events could negatively affect the value and liquidity of the Fund’s investments. All of these developments may

continue to significantly affect the economies of all EU countries, which in turn may have a material adverse effect on the Fund’s investments in such countries, other countries that depend on EU countries for significant amounts of trade or

investment, or issuers with exposure to debt issued by certain EU countries.

Geographic Investment Risk. To the extent that the

Fund invests a significant portion of its assets in a particular country or geographic region, the Fund will generally have more exposure to certain risks due to possible political, economic, social, or regulatory events in that country or region.

Adverse developments in certain regions could also adversely affect securities of other countries whose economies appear to be unrelated and could have a negative impact on the Fund’s performance.

Nondiversification Risk. The Fund is classified as nondiversified under the Investment Company Act of 1940, as amended (“1940

Act”). This gives the Fund’s portfolio managers more flexibility to hold larger positions in a smaller number of securities. As a result, an increase or decrease in the value of a single security held by the Fund may have a greater impact

on the Fund’s NAV and total return.

Methodology and Model Risk. Neither the Fund nor Janus Capital can offer assurances that

tracking the Underlying Index will capture the growth of companies positioned to benefit from the growing demand in organic goods and services, or be appropriate for every investor seeking a particular risk profile. Underlying Index risks include,

but are not limited to, the risk that the factors used to determine the components of the Underlying Index, as applied by the Index Provider in accordance with the Underlying Index methodology, might not select securities that individually, or in

the aggregate, are positioned to benefit from the growing demand for organic goods and services.

Passive Investment Risk. The

Fund is not actively managed and therefore the Fund might not sell shares of a security due to current or projected underperformance of a security, industry or sector, unless that security is removed from the Underlying Index or the selling of

shares is otherwise required upon a rebalancing of the Underlying Index.

Early Close/Trading Halt Risk. An exchange or market may

close or issue trading halts on specific securities, or the ability to buy or sell certain securities or financial instruments may be restricted, which may result in the Fund being unable to buy or sell certain securities or financial instruments.

In such circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and/or may incur substantial trading losses.

Index Tracking Risk. The Fund’s return may not match or achieve a high degree of correlation with the return of the Underlying

Index. To the extent the Fund utilizes a sampling approach, it may experience tracking error to a greater extent than if the Fund sought to fully replicate the Underlying Index. In addition, the Fund may hold fewer than the total number of

securities in the Underlying Index. Further, the Fund may hold securities or other investments not included in the Underlying Index but which Janus Capital believes will help the Fund track the Underlying Index. Such investments may not perform as

expected.

4½The Organics ETF

Index Provider Risk. The Fund seeks to achieve returns that generally correspond, before

fees and expenses, to the performance of the Underlying Index, as published by the Index Provider. There is no assurance that the Index Provider will compile the Underlying Index accurately, or that the Underlying Index will be determined, composed

or calculated accurately. While the Index Provider gives descriptions of what the Underlying Index is designed to achieve, the Index Provider generally does not provide any warranty or accept any liability in relation to the quality, accuracy or

completeness of data in such index, and it generally does not guarantee that the Underlying Index will be in line with its methodology. Errors made by the Index Provider with respect to the quality, accuracy and completeness of the data within the

Underlying Index may occur from time to time and may not be identified and corrected by the Index Provider for a period of time, if at all. Therefore, gains, losses or costs associated with Index Provider errors will generally be borne by the Fund

and its shareholders.

Trading Issues Risk. Although Fund shares are listed for trading on The NASDAQ Stock Market LLC

(“NASDAQ”), there can be no assurance that an active trading market for such shares will develop or be maintained. The lack of an active market for Fund shares, as well as periods of high volatility, disruptions in the creation/redemption

process, or factors affecting the liquidity of the underlying securities held by the Fund, may result in the Fund’s shares trading at a premium or discount to its NAV. If an investor purchases shares at a time when the market price is at a

premium to the NAV or sells at a time when the market price is at a discount to the NAV, the investor may sustain losses.

Trading in Fund shares may be

halted due to market conditions or for reasons that, in the view of the NASDAQ, make trading in Fund shares inadvisable. In addition, trading is subject to trading halts caused by extraordinary market volatility pursuant to the NASDAQ “circuit

breaker” rules. There can be no assurance that the requirements of the NASDAQ necessary to maintain the Fund’s listing will continue to be met or will remain unchanged.

During a “flash crash,” the market prices of the Fund’s shares may decline suddenly and significantly. Such a decline may not reflect the

performance of the portfolio securities held by the Fund. Flash crashes may cause Authorized Participants and other market makers to limit or cease trading in the Fund’s shares for temporary or longer periods. Shareholders could suffer

significant losses to the extent that they sell shares at these temporarily low market prices.

Fluctuation of NAV. The NAV of the

Fund shares will generally fluctuate with changes in the market value of the Fund’s securities holdings. The market prices of shares will generally fluctuate in accordance with changes in the Fund’s NAV and supply and demand of shares on

the NASDAQ. An absence of trading in shares of the Fund, or a high volume of trading in the Fund, may result in trading prices that differ significantly from the Fund’s NAV. It cannot be predicted whether Fund shares will trade below, at or

above the Fund’s NAV. If an investor purchases shares at a time when the market price is at a premium to the NAV of the shares or sells at a time when the market price is at a discount to the NAV of the shares, then the investor may sustain

losses. Further, the securities held by the Fund may be traded in markets that close at a different time than the NASDAQ. Liquidity in those securities may be reduced after the applicable closing times. Accordingly, during the time when the NASDAQ

is open but after the applicable market closing, bid-ask spreads and the resulting premium or discount to the Fund shares’ NAV may widen. Similarly, the NASDAQ may be closed at times or days when markets for securities held by the Fund are

open, which may increase bid-ask spreads and the resulting premium or discount to the Fund shares’ NAV when the NASDAQ re-opens.

Authorized

Participant Risk. The Fund may have a limited number of financial institutions that may act as Authorized Participants (“APs”). Only APs who have entered into agreements with the Fund’s distributor may engage in

creation or redemption transactions directly with the Fund. To the extent that those APs exit the business or are unable to process creation and/or redemption orders, and no other AP is able to step forward to create and redeem in either of these

cases, shares may trade like closed-end fund shares at a premium or a discount to NAV and possibly face delisting.

Securities Lending

Risk. The Fund may seek to earn additional income through lending its securities to certain qualified broker-dealers and institutions. There is the risk that when portfolio securities are

lent, the securities may not be returned on a timely basis, and the Fund may experience delays and costs in recovering the security or gaining access to the collateral provided to the Fund to collateralize the loan. If the Fund is unable to recover

a security on loan, the Fund may use the collateral to purchase replacement securities in the market. There is a risk that the value of the collateral could decrease below the cost of the replacement security by the time the replacement investment

is made, resulting in a loss to the Fund.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency.

5½The Organics ETF

The following information provides some indication of the risks of investing in the Fund by showing how the Fund’s

performance has varied over time. The bar chart depicts the change in performance from year to year during the periods indicated. The table compares the Fund’s average annual returns for the periods indicated to a broad-based securities market

index and the index the Fund seeks to track. The indices are not available for direct investment. All figures assume reinvestment of dividends and distributions.

The Fund’s past performance (before and after taxes) does not necessarily indicate how it will perform in the future. Updated performance information

is available at janushenderson.com/performance or by calling 1-800-668-0434.

The Organics ETF

|

|

|

Annual Total Returns (calendar year-end)

|

|

|

|

Best Quarter: 2nd Quarter

2017 17.02% Worst Quarter: 4th Quarter 2018 –21.69%

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns (periods ended 12/31/19)

|

|

|

|

|

|

|

|

|

|

1 year

|

|

|

Since

Inception

6/8/2016

|

|

|

The Organics ETF

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

–0.17

|

%

|

|

|

–0.26

|

%

|

|

Return After Taxes on Distributions

|

|

|

–0.76

|

%

|

|

|

–0.54

|

%

|

|

Return After Taxes on Distributions and Sale of Fund Shares(1)

|

|

|

0.28

|

%

|

|

|

–0.15

|

%

|

|

Solactive Organics Index(2)

(reflects no deductions for fees, expenses or taxes)

|

|

|

–0.74

|

%

|

|

|

–0.20

|

%

|

|

MSCI All Country World Index(2)

(reflects no deductions for fees, expenses or taxes, except foreign withholding taxes)

|

|

|

26.60

|

%

|

|

|

11.60

|

%

|

|

(1)

|

If the Fund incurs a loss, which generates a tax benefit, the Return After Taxes on Distributions and Sale of

Fund Shares may exceed the Fund’s other return figures.

|

|

(2)

|

Index performance shown in the table is the total return, which assumes reinvestment of any dividends and

distributions during the time periods shown.

|

After-tax returns in the table above are calculated

using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on your individual tax situation and may

differ from those shown in the preceding table. The after-tax return information shown above does not apply to Fund shares held through a tax-advantaged account, such as

a 401(k) plan or an IRA.

Investment Adviser: Janus Capital Management LLC

Portfolio Managers: Benjamin Wang, CFA, is Co-Portfolio Manager of the Fund, which he has co-managed since inception. Scott M.

Weiner, DPhil, is Co-Portfolio Manager of the Fund, which he has co-managed since inception.

6½The Organics ETF

|

|

|

PURCHASE AND SALE OF FUND SHARES

|

Unlike shares of traditional mutual funds, shares of the Fund are not individually redeemable and may only be purchased or

redeemed directly from the Fund at NAV in large increments called “Creation Units” (25,000 or more shares per Creation Unit) through certain participants, known as “Authorized Participants.” Janus Capital may modify the Creation

Unit size with prior notification to the Fund’s Authorized Participants. See the ETF portion of the Janus Henderson website for the Fund’s current Creation Unit size. The Fund will generally issue or redeem Creation Units in exchange for

portfolio securities (and an amount of cash) that the Fund specifies each day. Except when aggregated in Creation Units, Fund shares are not redeemable securities of the Fund.

Shares of the Fund are listed and trade on the NASDAQ, and individual investors can purchase or sell shares in much smaller increments for cash in the

secondary market through a broker. These transactions, which do not involve the Fund, are made at market prices that may vary throughout the day and differ from the Fund’s NAV. As a result, you may pay more than NAV (at a premium) when you

purchase shares, and receive less than NAV (at a discount) when you sell shares, in the secondary market.

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing

through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account (in which case you may be taxed at ordinary income tax rates upon withdrawal of your investment from such account). A sale of Fund shares may result in a

capital gain or loss.

|

|

|

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL

INTERMEDIARIES

|

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), Janus Capital and/or its

affiliates may pay broker-dealers or intermediaries for the sale and/or maintenance of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to

recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

7½The Organics ETF

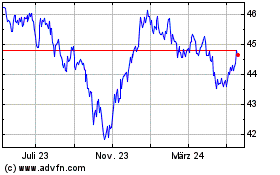

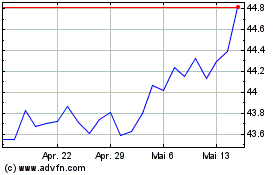

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024