Janus Henderson Mortgage-Backed Securities ETF

Ticker: JMBS

Principal U.S. Listing

Exchange: NYSE Arca, Inc.

SUMMARY PROSPECTUS DATED

FEBRUARY 28, 2020

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the

Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund online at janushenderson.com/info. You can also get this information at no cost by calling a Janus Henderson representative at 1-877-335-2687 or by sending an email request to prospectusrequest@janushenderson.com.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder

reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your broker-dealer or other financial intermediary (such as a bank). Instead, the reports will be made

available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you

already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting

your broker-dealer or other financial intermediary.

You may elect to receive all future reports in paper

free of charge by contacting your broker-dealer or other financial intermediary. Your election to receive reports in paper will apply to all Funds held in your account at your

broker-dealer or other financial intermediary.

Janus Henderson Mortgage-Backed Securities ETF seeks a high level of total return consisting of income and capital

appreciation.

|

|

|

FEES AND EXPENSES OF THE FUND

|

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may pay brokerage

commissions on their purchases and sales of Fund shares, which are not reflected in the table or in the example below.

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

Management Fees(1)

|

|

|

0.35%

|

|

|

Other Expenses

|

|

|

0.00%

|

|

|

Acquired Fund Fees and Expenses(2)

|

|

|

0.02%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

0.37%

|

|

|

(1)

|

The Fund’s Management Fee is a “unitary” fee that is designed to pay substantially all operating

expenses, except for distribution fees (if any), brokerage expenses or commissions, interest, dividends, taxes, litigation expenses, acquired fund fees and expenses (if any), and other extraordinary expenses not incurred in the ordinary course of

the Fund’s business.

|

|

(2)

|

Acquired Fund Fees and Expenses are indirect fees and expenses that the Fund incurs from investing in other

investment companies. Please note that the amount of Total Annual Fund Operating Expenses shown in the above table may differ from the ratio of gross expenses included in the “Financial Highlights” section of this prospectus, which

reflects the operating expenses of the Fund and does not include indirect expenses such as Acquired Fund Fees and Expenses.

|

EXAMPLE:

The Example is intended to help you compare

the cost of investing in the Fund with the cost of investing in other funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your shares at the end of those periods. The Example also

assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

|

|

$

|

38

|

|

|

$

|

119

|

|

|

$

|

208

|

|

|

$

|

468

|

|

1½Janus Henderson Mortgage-Backed Securities ETF

Portfolio Turnover: The Fund pays transaction costs, such as commissions, when it buys and

sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in

annual fund operating expenses or in the Example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 348% of the average value of its portfolio.

|

|

|

PRINCIPAL INVESTMENT STRATEGY

|

The Fund seeks to achieve its investment objective by investing mainly in mortgage-related instruments. Under normal

circumstances, the Fund will invest at least 80%, and often times substantially all, of its net assets (plus any borrowings for investment purposes) in a portfolio of mortgage-related fixed income instruments of varying maturities. Mortgage-related

fixed income instruments include residential and commercial mortgage-backed securities (“MBS”), collateralized mortgage obligations, stripped mortgage-backed securities, mortgage pass-through

securities and other securities representing an interest in or secured by or related to mortgages, including asset-backed securities and securities issued by other ETFs that invest principally in MBS. Under normal circumstances, the Fund will invest

predominantly in mortgage-related securities issued by the U.S. government and its agencies, such as the Government National Mortgage Association (“GNMA” or “Ginnie Mae”), the Federal National Mortgage Association

(“FNMA” or “Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“FHLMC” or “Freddie Mac”). The Fund may also invest up to 20% of its net assets in non-agency, or

privately-issued, residential and commercial MBS, and other non-agency or privately issued mortgage-related and asset-backed securities. The Fund will typically enter into “to be announced” or

“TBA” commitments when purchasing MBS. In addition to its investments in mortgage-backed and mortgage-related securities, the Fund will from time to time also invest in certain other fixed-income

securities and/or hold cash and cash-equivalents (such as U.S. treasuries). The Fund will invest primarily in securities rated investment grade (that is, securities rated Baa3/BBB- or higher, or if unrated,

determined to be of comparable credit quality by Janus Capital). The Fund may also invest in lower-rated, higher-yielding securities, including securities rated below investment grade (sometimes referred to as

“junk” bonds), when Janus Capital believes that the increased risk of such lower rated securities is justified by the potential for increased return. The Fund invests only in U.S. dollar denominated securities. The Fund may invest its

uninvested cash in affiliated or non-affiliated money market funds.

As a general indication of the Fund’s targeted risk/return profile, the

Fund’s portfolio managers will seek to select mortgage-related instruments that can over time provide a return of 0.50% (net of fees) above the Bloomberg Barclays US MBS Index Total Return Value Unhedged

USD (“Bloomberg Barclays US MBS Index” or the “Index”), while generally maintaining an investment return with substantial correlation to the Index. There can be no assurance that the Fund will achieve this targeted risk/return.

Additionally, the Fund may invest in derivatives, which are instruments that have a value derived from, or directly linked to, an underlying asset, such

as fixed-income securities, interest rates, or market indices. In particular, the Fund may use swaps, futures, forward contracts and options. The Fund may use derivatives for various investment purposes, such as to manage or hedge portfolio risk,

including interest rate risk, or to manage duration. The Fund’s exposure to derivatives will vary. The Fund may also enter into short positions for hedging purposes.

The Fund is “actively managed” and does not seek to replicate the composition or performance of an index. In addition to considering economic factors

such as the effect of interest rates on the Fund’s investments, the portfolio managers apply a “bottom up” approach in choosing investments. This means that the portfolio managers look at securities one at a time to determine if a

security is an attractive investment opportunity and if it is consistent with the Fund’s investment policies. The portfolio managers additionally consider the expected risk-adjusted return on a particular investment and the Fund’s overall

target risk allocations and volatility.

The Fund may lend portfolio securities on a short-term or long-term basis, in an amount equal to up to one-third of its total assets as determined at the time of the loan origination.

2½Janus Henderson Mortgage-Backed Securities ETF

|

|

|

PRINCIPAL INVESTMENT RISKS

|

Although the Fund may be less volatile than funds that invest most of their assets in common stocks, the Fund’s returns

and yields will vary, and you could lose money. The principal risks and special considerations associated with investing in the Fund are set forth below.

Mortgage-Backed Securities Risk. Mortgage-backed securities are classified generally as either commercial mortgage-backed securities

or residential mortgage-backed securities, each of which is subject to certain specific risks. Mortgage-backed securities tend to be more sensitive to changes in interest rates than other types of debt securities. Investments in mortgage-backed

securities are subject to both extension risk, where borrowers extend the duration of their mortgages in times of rising interest rates, and prepayment risk, where borrowers pay off their mortgages sooner than expected in times of declining interest

rates. These risks may reduce the Fund’s returns. In addition, investments in mortgage-backed securities, including those comprised of subprime mortgages, may be subject to a higher degree of credit risk, valuation risk, and liquidity risk than

various other types of fixed-income securities.

Privately Issued Mortgage-Related Securities Risk. Privately issued

mortgage-related securities are not subject to the same underwriting requirements for the underlying mortgages that are applicable to those mortgage-related securities that have a government or government-sponsored entity guarantee. As a result, the

mortgage loans underlying privately issued mortgage-related securities may, and frequently do, have less favorable collateral, credit risk, or other underwriting characteristics than government or government-sponsored mortgage-related securities and have wider variances in a number of terms including interest rate, term, size, purpose, and borrower characteristics. The risk of nonpayment is greater for mortgage-related securities that are backed by loans that were originated under weak underwriting standards, including loans made to borrowers with limited means to make repayment. A level of risk exists for all

loans, although, historically, the poorest performing loans have been those classified as subprime. “Subprime” loans are loans made to borrowers with lower credit ratings and/or a shorter credit history, who are more likely to default on

their loan obligations as compared to more credit-worthy borrowers. Privately issued mortgage-related securities are not traded on an exchange and there may be a limited market for the securities, especially when there is a perceived weakness in the

mortgage and real estate market sectors. Without an active trading market, mortgage-related securities held in the Fund’s portfolio may be particularly difficult to value because of the complexities involved in assessing the value of the

underlying mortgage loans.

TBA Commitments Risk. The Fund will typically enter into “to be announced” or

“TBA” commitments for mortgage-backed securities and, at times, the portion of the Fund’s portfolio allocated to TBA securities may be significant. TBA commitments are forward agreements for the purchase or sale of securities,

including mortgage-backed securities, for a fixed price, with payment and delivery on an agreed upon future settlement date. Although the particular TBA securities must meet industry-accepted “good delivery” standards, there can be no

assurance that a security purchased on a forward commitment basis will ultimately be issued or delivered by the counterparty. During the settlement period, the Fund will still bear the risk of any decline in the value of the security to be

delivered. Because TBA commitments do not require the purchase and sale of identical securities, the characteristics of the security delivered to the Fund may be less favorable than the security delivered to the dealer. If the counterparty to a

transaction fails to deliver the securities, the Fund could suffer a loss. At the time of its acquisition, a TBA security may be valued at less than the purchase price.

Asset-Backed Securities Risk. Asset-backed securities may be adversely affected by changes in interest rates, underperformance of the

underlying assets, and the creditworthiness of the entities that provide any supporting letters of credit, surety bonds, or other credit or liquidity enhancements. In addition, most asset-backed securities are subject to prepayment risk in a

declining interest rate environment, and extension risk in an increasing rate environment.

Fixed-Income Securities Risk. The Fund

invests in a variety of fixed-income securities. Typically, the value of fixed-income securities changes inversely with prevailing interest rates. Therefore, a fundamental risk of fixed-income securities is interest rate risk, which is the risk that

the value of such securities will generally decline as prevailing interest rates rise, which may cause the Fund’s net asset value to likewise decrease. For example, while securities with longer maturities and durations tend to produce higher

yields, they also tend to be more sensitive to changes in prevailing interest rates and are therefore more volatile than shorter-term securities and are subject to greater market fluctuations as a result of changes in interest rates. Investments in

fixed-income securities with very low or negative interest rates may diminish the Fund’s yield and performance. Recent and potential future changes in government monetary policy may also affect the level of interest rates. These changes could

cause the Fund’s net asset value to fluctuate or make it more difficult for the Fund to accurately value its securities. How specific fixed-income securities may react to changes in interest rates will depend on the specific characteristics of

each security. Fixed-income

3½Janus Henderson Mortgage-Backed Securities ETF

securities are also subject to credit risk, prepayment risk, valuation risk, extension risk, and liquidity risk. Credit risk is the risk that the credit strength of an issuer of a fixed-income

security will weaken and/or that the issuer will be unable to make timely principal and interest payments and that the security may go into default. Prepayment risk is the risk that during periods of falling interest rates, certain fixed-income

securities with higher interest rates, such as mortgage- and asset-backed securities, may be prepaid by their issuers thereby reducing the amount of interest payments. Valuation risk is the risk that one or more of the

fixed-income securities in which the Fund invests are priced differently than the value realized upon such security’s sale. In times of market instability, valuation may be more difficult. Extension risk

is the risk that borrowers may pay off their debt obligations more slowly in times of rising interest rates. Liquidity risk is the risk that fixed-income securities may be difficult or impossible to sell at the time that the portfolio managers would

like or at the price the portfolio managers believe the security is currently worth.

High-Yield/High-Risk Bond

Risk. High-yield/high-risk bonds may be more sensitive than other types of bonds to economic changes, political changes, or adverse developments specific to the company that issued the bond, which may adversely affect their value.

High-yield/high-risk bonds (or “junk” bonds) are bonds rated below investment grade by the primary rating agencies such as S&P Global Ratings, Fitch, Inc., and Moody’s Investors Service, Inc. or are unrated bonds of similar

quality. The value of lower quality bonds generally is more dependent on credit risk than investment grade bonds. Issuers of high-yield/high-risk bonds may not be as strong financially as those issuing bonds with higher credit ratings and are more

vulnerable to real or perceived economic changes, political changes, or adverse developments specific to the issuer. In addition, the junk bond market is considered to be speculative in nature and can experience sudden and sharp price swings.

Market Risk. The value of the Fund’s portfolio may decrease if the value of an individual company or security, or multiple

companies or securities, in the portfolio decreases or if the portfolio managers’ belief about a company’s intrinsic worth is incorrect. Further, regardless of how well individual companies or securities perform, the value of the

Fund’s portfolio could also decrease if there are deteriorating economic or market conditions. It is important to understand that the value of your investment may fall, sometimes sharply, in response to changes in the market, and you could lose

money. Market risk may affect a single issuer, industry, economic sector, or the market as a whole.

Derivatives

Risk. Derivatives, such as swaps, forwards, futures, and options, involve risks in addition to the risks of the underlying referenced securities or asset. Gains or losses from a derivative investment can be substantially greater

than the derivative’s original cost and can therefore involve leverage and the potential for increased volatility. Because most derivatives are not eligible to be transferred in-kind, the Fund may be subject to increased liquidity risk to the

extent its derivative positions become illiquid. Derivatives also involve the risk that the counterparty to the derivative transaction will default on its payment obligations. While use of derivatives to hedge can reduce or eliminate losses, it can

also reduce or eliminate gains or cause losses if the market moves in a manner different from that anticipated by the portfolio managers or if the cost of the derivative outweighs the benefit of the hedge. Changes in laws or regulations may make the

use of derivatives more costly, may limit the availability of derivatives, or may otherwise adversely affect the use, value or performance of derivatives.

Management Risk. The Fund is an actively managed investment portfolio and is therefore subject to the risk that the investment

strategies employed for the Fund may fail to produce the intended results. Although the Fund seeks to provide long-term positive returns, market conditions or implementation of the Fund’s investment process may result in losses, and the Fund

may not meet its investment objective. As such, there can be no assurance of positive “absolute” returns.

Portfolio Turnover

Risk. Increased portfolio turnover may result in higher costs for brokerage commissions, dealer mark-ups, and other transaction costs, and may also result in taxable capital gains. Higher

costs associated with increased portfolio turnover also may have a negative effect on the Fund’s performance.

Market Trading

Risk. The Fund faces numerous market trading risks, including the potential lack of an active secondary trading market for Fund shares, losses from trading in secondary markets, and periods of high volatility and disruption in the

creation/redemption process of the Fund. Any of these factors, among others, may lead to the Fund’s shares trading at a premium or discount to its net asset value. Investors buying or selling Fund shares in the secondary market will pay

brokerage commissions or other charges imposed by brokers as determined by that broker. Brokerage commissions are often a fixed amount and may be a significant proportional cost for investors seeking to buy or sell relatively small amounts of Fund

shares. Although Fund shares are listed on an exchange, there can be no assurance that an active or liquid trading market for Fund shares will develop or be maintained. In addition, trading in Fund shares on an exchange may be halted.

4½Janus Henderson Mortgage-Backed Securities ETF

Trading Issues Risk. Although Fund shares are listed for trading on the NYSE Arca, Inc.

(“NYSE Arca”), there can be no assurance that an active trading market for such shares will develop or be maintained. The lack of an active market for Fund shares, as well as periods of high volatility, disruptions in the

creation/redemption process, or factors affecting the liquidity of the underlying securities held by the Fund, may result in the Fund’s shares trading at a premium or discount to its net asset value per share (“NAV”). If an investor

purchases shares at a time when the market price is at a premium to the NAV or sells at a time when the market price is at a discount to the NAV, the investor may sustain losses.

Trading in Fund shares may be halted due to market conditions or for reasons that, in the view of the NYSE Arca, make trading in Fund shares inadvisable. In

addition, trading is subject to trading halts caused by extraordinary market volatility pursuant to the NYSE Arca “circuit breaker” rules. There can be no assurance that the requirements of the NYSE Arca necessary to maintain the

Fund’s listing will continue to be met or will remain unchanged. During a “flash crash,” the market prices of the Fund’s shares may decline suddenly and significantly. Such a decline may not reflect the performance of the

portfolio securities held by the Fund. Flash crashes may cause Authorized Participants and other market makers to limit or cease trading in the Fund’s shares for temporary or longer periods. Shareholders could suffer significant losses to the

extent that they sell shares at these temporarily low market prices.

Fluctuation of NAV. The NAV of the Fund shares will

generally fluctuate with changes in the market value of the Fund’s securities holdings. The market prices of shares will generally fluctuate in accordance with changes in the Fund’s NAV and supply and demand of shares on the NYSE Arca. An

absence of trading in shares of the Fund, or a high volume of trading in the Fund, may result in trading prices that differ significantly from the Fund’s NAV. It cannot be predicted whether Fund shares will trade below, at or above the

Fund’s NAV. If an investor purchases shares at a time when the market price is at a premium to the NAV of the shares or sells at a time when the market price is at a discount to the NAV of the shares, then the investor may sustain losses.

Further, the securities held by the Fund may be traded in markets that close at a different time than the NYSE Arca. Liquidity in those securities may be reduced after the applicable closing times. Accordingly, during the time when NYSE Arca is open

but after the applicable market closing, fixing or settlement times, bid-ask spreads and the resulting premium or discount to the Fund shares’ NAV is likely to widen. Similarly, the NYSE Arca may be

closed at times or days when markets for securities held by the Fund are open, which may increase bid-ask spreads and the resulting premium or discount to the Fund shares’ NAV when the NYSE Arca re-opens. The Fund’s bid-ask spread and the resulting premium or discount to the Fund’s NAV may also be impacted by the liquidity of the underlying securities held

by the Fund, particularly in instances of significant volatility of the underlying securities.

Authorized Participant

Risk. The Fund may have a limited number of financial institutions that may act as Authorized Participants (“APs”). Only APs who have entered into agreements with the Fund’s distributor may engage in creation

or redemption transactions directly with the Fund. To the extent that those APs exit the business or are unable to process creation and/or redemption orders, and no other AP is able to step forward to create and redeem in either of these cases,

shares may trade like closed-end fund shares at a premium or a discount to NAV and possibly face delisting.

An

investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The following information provides some indication of the risks of investing in the Fund by showing how the Fund’s

performance has varied over time. The bar chart depicts performance for the last calendar year. The table compares the Fund’s average annual returns for the periods indicated to a broad-based securities market index. The index is not available

for direct investment. All figures assume reinvestment of dividends and distributions.

The Fund’s past performance (before and after taxes) does

not necessarily indicate how it will perform in the future. Updated performance information is available at janushenderson.com/performance or by calling

1-800-668-0434.

5½Janus Henderson Mortgage-Backed Securities ETF

Janus Henderson Mortgage-Backed Securities ETF

|

|

|

Annual Total Returns (calendar year-end)

|

|

|

|

Best Quarter: 1st Quarter

2019 2.30% Worst Quarter: 4th Quarter 2019 0.99%

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns – (periods ended 12/31/19)

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

Since

Inception

9/12/18

|

|

|

Janus Henderson Mortgage-Backed Securities ETF

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

6.99

|

%

|

|

|

6.67

|

%

|

|

Return After Taxes on Distributions

|

|

|

5.41

|

%

|

|

|

5.17

|

%

|

|

Return After Taxes on Distributions and Sale of Fund

Shares

|

|

|

4.12

|

%

|

|

|

4.45

|

%

|

|

Bloomberg Barclays U.S. Mortgage Backed Securities Index(1)

(reflects no deductions for fees, expenses or taxes)

|

|

|

6.35

|

%

|

|

|

6.35

|

%

|

|

(1)

|

Index performance shown in the table is the total return, which assumes reinvestment of any dividends and

distributions during the time periods shown.

|

After-tax returns in the table above are calculated

using the historical highest individual U.S. federal marginal income tax rates and do not reflect the impact of state or local taxes. Actual after-tax returns depend on your individual tax situation and may

differ from those shown in the preceding table. The after-tax return information shown above does not apply to Fund shares held through a tax-advantaged account, such as

a 401(k) plan or an IRA.

Investment Adviser: Janus Capital Management LLC

Portfolio Managers: John Kerschner, CFA, is Co-Portfolio Manager of the Fund, which he has co-managed since inception. Nick Childs, CFA, is Co-Portfolio Manager of the Fund, which he has co-managed since inception.

|

|

|

PURCHASE AND SALE OF FUND SHARES

|

The Fund is an actively-managed exchange-traded fund. Unlike shares of traditional mutual funds, shares of the Fund are not

individually redeemable and may only be purchased or redeemed directly from the Fund at NAV in large increments called “Creation Units” (25,000 or more shares per Creation Unit) through certain participants, known as “Authorized

Participants.” Janus Capital may modify the Creation Unit size with prior notification to the Fund’s Authorized Participants. See the ETF portion of the Janus Henderson website for the Fund’s current Creation Unit size. The Fund will

generally issue Creation Units in exchange for cash, and redeem Creation Units in exchange for portfolio securities (and an amount of cash) that the Fund specifies each day. Except when aggregated in Creation Units, Fund shares are not redeemable

securities of the Fund.

Shares of the Fund are listed and trade on NYSE Arca, and individual investors can purchase or sell shares in much smaller

increments for cash in the secondary market through a broker. These transactions, which do not involve the Fund, are made at market prices that may vary throughout the day and differ from the Fund’s NAV. As a result, you may pay more than NAV

(at a premium) when you purchase shares, and receive less than NAV (at a discount) when you sell shares, in the secondary market.

6½Janus Henderson Mortgage-Backed Securities ETF

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing

through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account (in which case you may be taxed at ordinary income tax rates upon withdrawal of your investment from such

account). A sale of Fund shares may result in a capital gain or loss.

|

|

|

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL

INTERMEDIARIES

|

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), Janus Capital and/or its

affiliates may pay broker-dealers or intermediaries for the sale and/or maintenance of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to

recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

7½Janus Henderson Mortgage-Backed Securities ETF

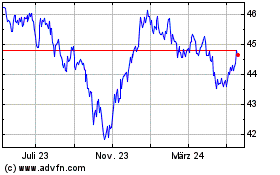

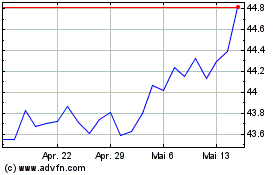

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Janus Henderson Mortgage... (AMEX:JMBS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024