AMCON Distributing Company (“AMCON” or “Company”) (NYSE

American: DIT), an Omaha, Nebraska based consumer products company,

is pleased to announce fully diluted earnings per share of $10.27

on net income available to common shareholders of $6.0 million for

its third fiscal quarter ended June 30, 2022.

“We are pleased with our results for the third fiscal quarter.

Our strategic plan, with its consistent focus on customer service,

has furthered AMCON’s industry leadership in a highly challenging

operating environment,” said Christopher H. Atayan, AMCON’s

Chairman and Chief Executive Officer. Mr. Atayan further noted,

“AMCON continues to seek out acquisition opportunities for

convenience and food service distributors who want to align with

the Company’s growing platform and customer centric management

philosophy.”

The wholesale distribution segment reported revenues of $539.2

million and operating income of $9.4 million for the third quarter

of fiscal 2022 which includes $108.7 million of revenue and $1.6

million of operating income related to the Company’s majority

investment in Team Sledd, LLC (“Team Sledd”). The retail health

food segment reported revenues of $11.4 million and operating

income of $0.2 million for the third quarter of fiscal 2022.

“After a considerable search, we have acquired and are

developing a new 160,000 square foot distribution center located

near Springfield, Missouri to support the growth of our customer

base,” said Andrew C. Plummer, AMCON’s President and Chief

Operating Officer. Mr. Plummer further noted, “We continue to

search for facilities in, and adjacent to, the geographic markets

we serve.”

“AMCON acquired a controlling interest in Team Sledd during the

period. As a result, we are now consolidating Team Sledd into our

financial statements and recorded a $2.4 million gain related to

the Company’s ownership interest in Team Sledd. We have been

delighted with our partnership with Team Sledd since our initial

investment,” said Charles J. Schmaderer, AMCON’s Chief Financial

Officer. Mr. Schmaderer further noted, “During the period, AMCON

amended and expanded its revolving credit facility with Bank of

America and BMO Harris Bank to support strategic growth initiatives

including the development of our new warehouse facility near

Springfield, Missouri. As a core operating principle, we continue

to maintain high levels of liquidity and ended the quarter with

$99.1 million of consolidated shareholders’ equity.”

AMCON’s Healthy Edge Retail Group plays an important role in the

health and wellness of the communities it serves. Our long-term

relationship with the organic/natural products vendor community has

enabled our stores to meet the demands of our customers for total

wellness solutions. Our strategy is to offer a broad selection of

the highest quality organic and natural merchandise available

supported by a high degree of customer service not found at other

big box retailers within our industry.

AMCON is a leading wholesale distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and refrigerated foods, automotive supplies and health and beauty

care products with distribution locations in Illinois, Missouri,

Nebraska, North Dakota, South Dakota, Tennessee and West Virginia.

AMCON, through its Healthy Edge Retail Group, operates nineteen

(19) health and natural product retail stores in the Midwest and

Florida. The retail stores operate under the names Akin’s Natural

Foods www.akins.com in its Midwest market, and Chamberlin's Natural

Foods www.chamberlins.com and Earth Origins Market

www.earthoriginsmarket.com in its Florida market.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated Balance

Sheets

June 30, 2022 and September

30, 2021

June

September

2022

2021

(Unaudited)

ASSETS

Current assets:

Cash

$

600,936

$

519,591

Accounts receivable, less allowance for

doubtful accounts of $2.6 million at June 2022 and $0.9 million

September 2021

66,500,582

35,844,163

Inventories, net

142,093,610

95,212,085

Income taxes receivable

468,289

—

Prepaid expenses and other current

assets

10,343,497

4,999,125

Total current assets

220,006,914

136,574,964

Property and equipment, net

48,452,634

16,012,524

Operating lease right-of-use assets,

net

19,672,900

17,846,529

Note receivable, net of current

portion

—

3,325,000

Goodwill

5,277,950

4,436,950

Other intangible assets, net

2,135,645

500,000

Equity method investment

—

9,380,343

Other assets

2,749,360

334,819

Total assets

$

298,295,403

$

188,411,129

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

40,975,820

$

24,235,042

Accrued expenses

13,339,837

11,468,955

Accrued wages, salaries and bonuses

7,346,300

4,489,852

Income taxes payable

—

867,160

Current operating lease liabilities

6,204,257

5,513,390

Current maturities of long-term debt

1,204,348

561,202

Total current liabilities

69,070,562

47,135,601

Credit facilities

101,228,521

43,650,865

Deferred income tax liability, net

2,938,240

1,531,228

Long-term operating lease liabilities

13,759,819

12,669,157

Long-term debt, less current

maturities

12,159,895

5,054,265

Other long-term liabilities

66,694

757,387

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized

—

—

Common stock, $.01 par value, 3,000,000

shares authorized, 584,789 shares outstanding at June 2022 and

551,369 shares outstanding at September 2021

9,168

8,834

Additional paid-in capital

26,729,124

24,918,781

Retained earnings

92,210,760

83,552,298

Treasury stock at cost

(30,867,287

)

(30,867,287

)

Total parent shareholders’ equity

88,081,765

77,612,626

Non-controlling interest

10,989,907

—

Total shareholders’ equity

99,071,672

77,612,626

Total liabilities and shareholders’

equity

$

298,295,403

$

188,411,129

AMCON Distributing Company and Subsidiaries

Condensed Consolidated

Unaudited Statements of Operations

for the three and nine months

ended June 30, 2022 and 2021

For the three months ended

June

For the nine months ended

June

2022

2021

2022

2021

Sales (including excise taxes of $129.2

million and $104.9 million, and $315.5 million and $297.4 million,

respectively)

$

550,584,152

$

438,313,030

$

1,365,043,621

$

1,221,571,294

Cost of sales

516,907,540

412,771,324

1,277,757,425

1,149,594,823

Gross profit

33,676,612

25,541,706

87,286,196

71,976,471

Selling, general and administrative

expenses

25,862,325

20,501,117

70,168,415

58,123,100

Depreciation and amortization

912,501

741,180

2,514,968

2,295,390

26,774,826

21,242,297

72,683,383

60,418,490

Operating income

6,901,786

4,299,409

14,602,813

11,557,981

Other expense (income):

Interest expense

655,811

329,929

1,222,829

1,016,902

Other (income), net

(2,417,252

)

(43,437

)

(2,518,320

)

(169,525

)

(1,761,441

)

286,492

(1,295,491

)

847,377

Income from operations before income

taxes

8,663,227

4,012,917

15,898,304

10,710,604

Income tax expense

2,397,000

1,076,000

4,987,000

2,916,000

Equity method investment earnings, net of

tax

307,973

754,293

1,670,133

1,403,124

Net income

6,574,200

3,691,210

12,581,437

9,197,728

Less: Net income attributable to

non-controlling interest

(591,369

)

—

(591,369

)

—

Net income available to common

shareholders

$

5,982,831

$

3,691,210

$

11,990,068

$

9,197,728

Basic earnings per share available to

common shareholders

$

10.50

$

6.69

$

21.15

$

16.71

Diluted earnings per share available to

common shareholders

$

10.27

$

6.48

$

20.62

$

16.37

Basic weighted average shares

outstanding

569,689

551,369

567,026

550,276

Diluted weighted average shares

outstanding

582,370

569,481

581,578

561,940

Dividends paid per common share

$

0.18

$

0.18

$

5.54

$

5.54

AMCON Distributing Company and Subsidiaries

Condensed Consolidated

Unaudited Statements of Shareholders’ Equity

for the three and nine months

ended June 30, 2022 and 2021

Common Stock

Treasury Stock

Additional Paid-in

Retained

Non-controlling

Shares

Amount

Shares

Amount

Capital

Earnings

Interest

Total

THREE MONTHS ENDED JUNE 2021

Balance, April 1, 2021

883,589

$

8,834

(332,220

)

$

(30,867,287

)

$

24,917,765

$

73,724,722

$

—

$

67,784,034

Dividends on common stock, $0.18 per

share

—

—

—

—

—

(105,586

)

—

(105,586

)

Compensation expense and settlement of

equity-based awards

—

—

—

—

25,527

—

—

25,527

Net income

—

—

—

—

—

3,691,210

—

3,691,210

Balance, June 30, 2021

883,589

$

8,834

(332,220

)

$

(30,867,287

)

$

24,943,292

$

77,310,346

$

—

$

71,395,185

THREE MONTHS ENDED JUNE 2022

Balance, April 1, 2022

917,009

$

9,168

(332,220

)

$

(30,867,287

)

$

26,555,046

$

86,336,525

$

—

$

82,033,452

Dividends on common stock, $0.18 per

share

—

—

—

—

—

(108,596

)

—

(108,596

)

Compensation expense and settlement of

equity-based awards

—

—

—

—

174,078

—

—

174,078

Fair value measurement of non-controlling

interest

—

—

—

—

—

—

10,419,138

10,419,138

Distributions

—

—

—

—

—

—

(20,600

)

(20,600

)

Net income

—

—

—

—

—

5,982,831

591,369

6,574,200

Balance, June 30, 2022

917,009

$

9,168

(332,220

)

$

(30,867,287

)

$

26,729,124

$

92,210,760

$

10,989,907

$

99,071,672

Common Stock

Treasury Stock

Additional Paid-in

Retained

Non-controlling

Shares

Amount

Shares

Amount

Capital

Earnings

Interest

Total

NINE MONTHS ENDED JUNE 2021

Balance, October 1, 2020

869,867

$

8,697

(332,152

)

$

(30,861,549

)

$

24,282,058

$

71,362,334

$

—

$

64,791,540

Dividends on common stock, $5.54 per

share

—

—

—

—

—

(3,249,716

)

—

(3,249,716

)

Compensation expense and settlement of

equity-based awards

13,722

137

—

—

661,234

—

—

661,371

Repurchase of common stock

—

—

(68

)

(5,738

)

—

—

—

(5,738

)

Net income

—

—

—

—

—

9,197,728

—

9,197,728

Balance, June 30, 2021

883,589

$

8,834

(332,220

)

$

(30,867,287

)

$

24,943,292

$

77,310,346

$

—

$

71,395,185

NINE MONTHS ENDED JUNE 2022

Balance, October 1, 2021

883,589

$

8,834

(332,220

)

$

(30,867,287

)

$

24,918,781

$

83,552,298

$

—

$

77,612,626

Dividends on common stock, $5.54 per

share

—

—

—

—

—

(3,331,606

)

—

(3,331,606

)

Compensation expense and settlement of

equity-based awards

33,420

334

—

—

1,810,343

—

—

1,810,677

Fair value measurement of non-controlling

interest

—

—

—

—

—

—

10,419,138

10,419,138

Distributions

—

—

—

—

—

—

(20,600

)

(20,600

)

Net income

—

—

—

—

—

11,990,068

591,369

12,581,437

Balance, June 30, 2022

917,009

$

9,168

(332,220

)

$

(30,867,287

)

$

26,729,124

$

92,210,760

$

10,989,907

$

99,071,672

AMCON Distributing Company and

Subsidiaries

Condensed Consolidated

Unaudited Statements of Cash Flows

for the nine months ended June

30, 2022 and 2021

June

June

2022

2021

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

12,581,437

$

9,197,728

Adjustments to reconcile net income to net

cash flows from (used in) operating activities:

Depreciation

2,486,613

2,295,390

Amortization

28,355

—

Equity method investment earnings, net of

tax

(1,670,133

)

(1,403,124

)

Gain on re-valuation of equity method

investment to fair value

(2,387,411

)

—

Gain on sales of property and

equipment

(133,639

)

(8,057

)

Equity-based compensation

1,903,884

1,819,272

Deferred income taxes

1,407,012

(220,693

)

Provision for losses on doubtful

accounts

83,000

86,000

Inventory allowance

688,902

238,148

Changes in assets and liabilities net of

effects of business acquisition:

Accounts receivable

(1,215,238

)

(2,334,341

)

Inventories

(4,674,292

)

3,093,184

Prepaid and other current assets

(2,986,167

)

(3,677,421

)

Equity method investment distributions

1,095,467

828,466

Other assets

(728,596

)

34,647

Accounts payable

1,313,711

2,680,540

Accrued expenses and accrued wages,

salaries and bonuses

1,926,479

804,983

Other long-term liabilities

(690,693

)

(169,854

)

Income taxes payable and receivable

(1,890,449

)

(537,548

)

Net cash flows from (used in) operating

activities

7,138,242

12,727,320

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property and equipment

(13,940,428

)

(1,254,958

)

Proceeds from sales of property and

equipment

145,500

39,728

Principal payment received on note

receivable

175,000

—

Cash acquired in business acquisition

7,958

—

Net cash flows from (used in) investing

activities

(13,611,970

)

(1,215,230

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings under revolving credit

facilities

1,393,048,057

1,217,375,073

Repayments under revolving credit

facilities

(1,381,508,745

)

(1,227,854,771

)

Proceeds from borrowings on long-term

debt

—

3,000,000

Principal payments on long-term debt

(524,874

)

(373,216

)

Proceeds from exercise of stock

options

173,590

—

Repurchase of common stock

—

(5,738

)

Dividends on common stock

(3,331,606

)

(3,249,716

)

Settlement and withholdings of

equity-based awards

(1,280,749

)

(365,022

)

Distributions to non-controlling

interest

(20,600

)

—

Net cash flows from (used in) financing

activities

6,555,073

(11,473,390

)

Net change in cash

81,345

38,700

Cash, beginning of period

519,591

661,195

Cash, end of period

$

600,936

$

699,895

Supplemental disclosure of cash flow

information:

Cash paid during the period for

interest

$

1,201,073

$

1,031,457

Cash paid during the period for income

taxes

5,468,488

3,667,036

Supplemental disclosure of non-cash

information:

Equipment acquisitions classified in

accounts payable

$

123,801

$

—

Effect of business acquisition (see Note

2)

23,308,624

—

Issuance of common stock in connection

with the vesting and exercise of equity-based awards

2,280,783

949,812

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220718005507/en/

Christopher H. Atayan AMCON Distributing Company Ph

402-331-3727

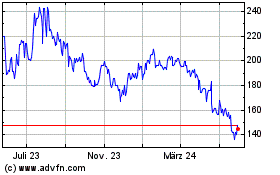

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025