false 0001869673 0001869673 2024-01-05 2024-01-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 5, 2024

Berenson Acquisition Corp. I

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40843 |

|

87-1070217 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

667 Madison Avenue, 18th Floor

New York, NY |

|

10065 |

| (Address of principal executive offices) |

|

(Zip Code) |

(212) 935-7676

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Common Stock, par value $0.0001 per share |

|

BACA |

|

The NYSE American LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Attached hereto as Exhibit 99.1 and incorporated herein by reference is the form of presentation to be used by Berenson Acquisition Corp. I (“BACA”) and Custom Health Inc., a Delaware corporation (“Custom Health”), in presentations for potential investors in connection with the transactions contemplated by the Business Combination Agreement (the “Proposed Transaction”), dated December 22, 2023, by and among BACA, Custom Health, and Continental Merger Sub Inc., a Delaware corporation and a direct, wholly owned subsidiary of BACA (the “Merger Sub”). Such exhibit and the information set forth therein is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act. The submission of the information set forth in this Item 7.01 shall not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented in Exhibit 99.1 that is provided solely in connection with Regulation FD.

Additional Information and Where to Find It

This Current Report on Form 8-K relates to the Proposed Transaction but does not contain all the information that should be considered concerning the Proposed Transaction and is not intended to form the basis of any investment decision or any other decision in respect of the Proposed Transaction. BACA intends to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 relating to the Proposed Transaction that will include a proxy statement of BACA and a prospectus of BACA. When available, the definitive proxy statement/prospectus and other relevant materials will be sent to all BACA stockholders as of a record date to be established for voting on the Proposed Transaction. BACA also will file other documents regarding the Proposed Transaction with the SEC. Before making any voting decision, investors and securities holders of BACA are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the Proposed Transaction as they become available because they will contain important information about BACA, Custom Health and the Proposed Transaction.

Investors and securities holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by BACA through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by BACA may be obtained free of charge from BACA’s website at https://berensonacquisitioncorp.com/ or by written request to BACA at Berenson Acquisition Corp. I, 667 Madison Avenue, 18th Floor, New York, New York 10065.

Participants in Solicitation

BACA, Custom Health and their respective directors and officers may be deemed to be participants in the solicitation of proxies from BACA’s stockholders in connection with the Proposed Transaction. Information about BACA’s directors and executive officers and their ownership of BACA’s securities is set forth in BACA’s filings with the SEC, including BACA’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 27, 2023. To the extent that such persons’ holdings of BACA’s securities have changed since the amounts disclosed in BACA’s Annual Report on Form 10-K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the names and interests in the Proposed Transaction of BACA’s and Custom Health’s respective directors and officers and other persons who may be deemed participants in the Proposed Transaction may be obtained by reading the proxy statement/prospectus regarding the Proposed Transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect to the Proposed Transaction between Custom Health and BACA, including statements regarding the benefits of the Proposed Transaction, the anticipated timing of the completion of the Proposed Transaction, the products offered by Custom Health, the ability to obtain additional financing, the listing of the post-combination company on the New York Stock Exchange (the “NYSE”) and the markets in which it

operates, the expected total addressable market for the products offered by Custom Health, the sufficiency of the net proceeds of the Proposed Transaction to fund Custom Health’s operations and business plan and Custom Health’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to material risks and uncertainties and other factors, many of which are outside the control of Custom Health. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including, but not limited to: (i) the risk that the Proposed Transaction may not be completed in a timely manner or at all; (ii) the risk that the Proposed Transaction may not be completed by BACA’s business combination deadline; (iii) the failure to satisfy the conditions to the consummation of the Proposed Transaction, including the adoption of the Business Combination Agreement by the stockholders of BACA and Custom Health, the satisfaction of the minimum trust account amount following redemptions by BACA’s public stockholders and the receipt of certain governmental and regulatory approvals, among other closing conditions; (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the Business Combination Agreement; (v) the effect of the announcement or pendency of the Proposed Transaction on Custom Health’s business relationships, performance, and business generally; (vi) risks that the Proposed Transaction disrupts current plans and operations of Custom Health; (vii) the outcome of any legal proceedings that may be instituted against Custom Health, BACA or others related to the Business Combination Agreement or the Proposed Transaction; (viii) the ability to meet the NYSE listing standards at or following the consummation of the Proposed Transaction; (ix) the ability to recognize the anticipated benefits of the Proposed Transaction, which may be affected by a variety of factors, including changes in the competitive and highly regulated industries in which Custom Health operates, variations in performance across competitors and partners, changes in laws and regulations affecting Custom Health’s business, the ability of Custom Health and the post-combination company to retain its management and key employees and general economic and financial market trends, disruptions and risks; (x) the ability to implement business plans, forecasts, and other expectations after the completion of the Proposed Transaction; (xi) the risk that Custom Health will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; (xii) the risk that the post-combination company experiences difficulties in managing its growth and expanding operations; (xiii) the risk of product liability or regulatory lawsuits or proceedings relating to Custom Health’s business; (xiv) the risk that Custom Health is unable to secure or protect its intellectual property; and (xv) costs related to the Proposed Transaction. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of BACA’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, the registration statement on Form S-4 and proxy statement/prospectus discussed above and other documents filed by BACA from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially adversely from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Custom Health and BACA assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Custom Health nor BACA gives or can give any assurance that either Custom Health or BACA will achieve its expectations.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Transaction and will not constitute an offer to sell or a solicitation of an offer to buy the securities of BACA, Custom Health, or Merger Sub, nor will there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities will be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or exemptions therefrom.

No Assurances

There can be no assurance that the Proposed Transaction will be completed, nor can there be any assurance, if the Proposed Transaction is completed, that the potential benefits of combining the companies will be realized.

Item 9.01. Financial Statements and Exhibits

(c) Exhibits:

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Investor presentation. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

| BERENSON ACQUISITION CORP. I |

|

|

| By: |

|

/s/ Amir Hegazy |

|

|

Name: |

|

Amir Hegazy |

|

|

Title: |

|

Chief Financial Officer |

Date: January 5, 2024

Exhibit 99.1 Stop guessing with medication INVESTOR PRESENTATION JANUARY

2024 https://customhealth.com/

Disclaimer & Forward-Looking Statements ABOUT THIS PRESENTATION This

investor presentation (this “Presentation”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between

Berenson Acquisition Corp. I (“BACA”) and Custom Health, Inc. (together with its direct and indirect subsidiaries, collectively, the “Company” or “Custom Health”). The information contained herein does not purport

to be all-inclusive or necessarily contain all the information that a prospective investor may desire in investigating a prospective investment in the securities of BACA or Custom Health, and none of BACA, the Company, or their respective

representatives or affiliates makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation (and any other information, whether written or oral, that has

been or will be provided to you). The information contained herein is preliminary and is subject to update, completion, revision, verification and amendment without notice, and such changes may be material. The attached material is provided to you

on the understanding that as a sophisticated investor, you will understand and accept its inherent limitations, will not rely on it in making any investment decision with respect to any securities that may be issued, and will use it only for purpose

of discussing with your advisors your preliminary interest in investing in BACA or Custom Health in connection with the proposed Business Combination. No statement contained herein should be considered binding on any party. This Presentation and the

information contained herein (and any other information, whether written or oral, that has been or will be provided to you) constitutes confidential information, is provided to you on the condition that you agree that you will hold it in strict

confidence and not reproduce, disclose, forward or distribute it in whole or in part without the prior written consent of BACA and the Company and is intended for the recipient hereof only. Completion of the proposed Business Combination is subject

to, among other matters, approval by the Company’s and BACA’s stockholders and the satisfaction of the closing conditions to be set forth in the business combination agreement. No assurances can be given that the proposed Business

Combination will be consummated on the terms or in the timeframe currently contemplated, if at all. FORWARD-LOOKING STATEMENTS This Presentation includes “forward-looking statements” within the meaning of the “safe harbor”

provisions of the United States private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,”

“intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target”, or negatives of these terms or other similar expressions that predict or indicate future

events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics, and projections of market

opportunity and market share. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the Company and its management and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual

events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and

uncertainties, including: (i) the risk that the Business Combination may not be completed in a timely manner or at all; (ii) the risk that the Business Combination may not be completed by BACA’s business combination deadline; (iii) the failure

to satisfy the conditions to the consummation of the Business Combination, including the adoption of the Business Combination Agreement by the stockholders of BACA and Custom Health, the satisfaction of the minimum trust account amount following

redemptions by BACA’s public stockholders and the receipt of certain governmental and regulatory approvals, among other closing conditions; (iv) the occurrence of any event, change or other circumstance that could give rise to the termination

of the Business Combination Agreement; (v) the effect of the announcement or pendency of the Business Combination on Custom Health’s business relationships, performance, and business generally; (vi) risks that the Business Combination disrupts

current plans and operations of Custom Health; (vii) the outcome of any legal proceedings that may be instituted against Custom Health, BACA or others related to the Business Combination Agreement or the Business Combination; (viii) the ability to

meet the NYSE listing standards at or following the consummation of the Business Combination; (ix) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by a variety of factors, including changes in the

competitive and highly regulated industries in which Custom Health operates, variations in performance across competitors and partners, changes in laws and regulations affecting Custom Health’s business, the ability of Custom Health and the

post-combination company to retain its management and key employees and general economic and financial market trends, disruptions and risks; (x) the ability to implement business plans, forecasts, and other expectations after the completion of the

Business Combination; (xi) the risk that Custom Health will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all; (xii) the risk that the post-combination company experiences

difficulties in managing its growth and expanding operations; (xiii) the risk of product liability or regulatory lawsuits or proceedings relating to Custom Health’s business; (xiv) the risk that Custom Health is unable to secure or protect its

intellectual property; and (xv) costs related to the Business Combination. The foregoing list of factors is not exhaustive. The recipient should carefully consider the foregoing factors and the other risks and uncertainties which will be more fully

described in the “Risk Factors” section of the proxy/registration statement discussed below and other documents filed by BACA from time to time with the Securities and Exchange Commission (the “SEC”). If any of these risks

materialize or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither BACA nor the Company presently know or

that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect BACA and Custom Health’s expectations, plans or

forecasts of future events and views as of the date of this Presentation. BACA, the Company, and their respective representatives and affiliates specifically disclaim any obligation to, and do not intend to, update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise. These forward-looking statements should not be relied upon as representing BACA’s, the Company’s, or any of their respective representatives’ or

affiliates’ assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. These forward-looking statements speak only as of the date of this

Presentation and none of the Company, BACA, or any of their respective representatives or affiliates have any obligation to update this Presentation. This Presentation contains preliminary information only, is subject to change at any time and is

not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding a potential investment in connection with the proposed Business Combination. 2

Disclaimer & Forward-Looking Statements (Continued) NO OFFER OR

SOLICITATION This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy

or a recommendation to purchase any security of BACA, the Company, or any of their respective affiliates. Any offer to sell securities will be made only pursuant to a definitive subscription or similar agreement and will be made in reliance on an

exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. You should not construe the contents of this Presentation as legal, tax, accounting or investment

advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein and, by accepting this Presentation, you confirm that you are not relying upon the

information contained herein to make any decision. No representations or warranties, express or implied are given in, or in respect of, this Presentation. No securities commission or securities regulatory authority in the United States or any other

jurisdiction has in any way passed upon the merits of the proposed Business Combination or the accuracy or adequacy of this Presentation. The distribution of this Presentation may also be restricted by law and persons into whose possession this

Presentation comes should inform themselves of and observe any such restrictions. The recipient acknowledges that it is (i) aware that the United States securities laws prohibit any person who has material, non-public information concerning a

company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and

(ii) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this

Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b-5 thereunder. IMPORTANT ADDITIONAL INFORMATION In connection with the proposed Business Combination, the Company and BACA

expect that BACA will file a proxy/registration statement with the SEC. The proxy/registration statement and other relevant documents will be sent or given to the stockholders of BACA and will contain important information about the proposed

Business Combination and related matters. This Presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other

decision in respect of the proposed Business Combination. BACA stockholders and other interested persons are advised to read, when available, the proxy/registration statement and other documents filed in connection with the proposed Business

Combination because these materials will contain important information about the parties to the business combination agreement, the Company, BACA and the proposed Business Combination. When available, the registration/proxy statement will be mailed

to BACA stockholders as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the proxy statement, without charge, once available, at the SEC’s website at

www.sec.gov. PARTICIPANTS IN SOLICITATION BACA and Custom Health and their respective directors and officers may be deemed to be participants in the solicitation of proxies from BACA’s stockholders in connection with the Business Combination.

Information about BACA’s directors and executive officers and their ownership of BACA’s securities is set forth in BACA’s filings with the SEC, including BACA’s Annual Report on Form 10-K for the fiscal year ended December

31, 2022, which was filed with the SEC on March 27, 2023. To the extent that such persons’ holdings of BACA’s securities have changed since the amounts disclosed in BACA’s Annual Report on Form 10-K, such changes have been or will

be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the names and interests in the Business Combination of BACA’s and Custom Health’s respective directors and officers and

other persons who may be deemed participants in the Business Combination may be obtained by reading the proxy statement/prospectus regarding the Business Combination when it becomes available. You may obtain free copies of these documents as

described in the preceding paragraph. Financial Information The financial information and data contained in this Presentation is unaudited and may not conform to Regulation S-X promulgated under the Securities Ac. Accordingly, such information and

data may not be included in, may be adjusted in or may be presented differently in, the registration statement, if any, to be filed by the Company and BACA with the SEC. Certain monetary amounts, percentages and other figures included in this

Presentation have been subject to rounding adjustments. Certain other amounts that appear in this Presentation may not sum due to rounding. Use of Projections This Presentation contains financial forecasts with respect to the Company’s

projected financial or operational results, including Revenue, Gross Profits, EBITDA and Number of Patients for the Company and its segments for fiscal years 2023 through 2025.The Company's independent auditors have not audited, reviewed, compiled

or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this

Presentation. These projections should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of

significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective

results are indicative of the future performance of the Company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation

should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. 3

Disclaimer & Forward-Looking Statements (Continued) Trademarks BACA

and the Company has proprietary rights to trademarks, service marks and trade names used in this presentation that are important to its business, many of which are registered under applicable intellectual property laws. This presentation also

contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this presentation may appear without the

®, ™or SM symbols, but such references are not intended to indicate, in any way, that BACA, the Company or any third party, as applicable, will not assert, to the fullest extent permitted under applicable law, its rights or the right of

the applicable licensor to these trademarks, trade names and service marks. BACA and the Company do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to

imply, a relationship with, or endorsement or sponsorship of us by, any other parties. Industry and Market Data In this Presentation, the Company relies on and refer to certain information and statistics obtained from third-party sources, which it

believes to be reliable. The Company has not independently verified the accuracy or completeness of any such third- party information. You are cautioned not to give undue weight to such industry and market data. 4

Today’s Presenters BACA Custom Health Jeffrey Berenson Mohammed

Ansari Amir Hegazy Shane Bishop Rahul Chopra Cathy Kuhn Mustafa BACA Chairman, BACA CEO, Berenson BACA CFO, CEO Chairman VP Clinical Offerings Muhammad Berenson Founder & Senior Managing Berenson Managing VP Engineering CEO Partner &

President Director 5

Chairman, Founder & CEO Over 30 years of experience structuring,

financing and § Co-founded Berenson Minella & Company in 1990, the predecessor firm to Berenson & Company negotiating M&A transactions representing well over $250 billion of public and private transaction value; including recent

§ Prior to founding the Firm, was the Head of Merrill Lynch’s Mergers and Acquisitions department and deSPAC processes and PIPE raises Co-Head of their Merchant Banking group § Joined White Weld & Co. in 1972, moving to the

Mergers and Acquisitions Department of Merrill Lynch § Rigorous analytical capabilities and understanding of following their acquisition of White Weld in 1978 key components of public market valuation § Previously served as Board member of

Epoch Investment Partners and Noble Energy, Inc. Jeffrey Berenson § History of advising companies on both add-on and transformational acquisitions and managing the Senior Managing Partner & President entire deal lifecycle § Over 20

years of experience in principal investing and investment banking § Extensive experience navigating market and § Joined Berenson in 1997 from Salomon Brothers, where he worked in merger and acquisition macroeconomic backdrops, as well as

assisting advisory for major U.S. and Canadian corporations companies to optimize their capital structure § Has completed over 50 investment banking transactions and principal investments during his career at Berenson § Sponsor of Berenson

Acquisition Corp. I (NYSE § Leads Berenson's principal investing activities; serves on the Boards of Collette Health, Skience and American: BACA) Mohammed Ansari as a Board Observer for Precision Concepts International “We believe that

our heritage as independent, objective Managing Director advisors and capable investors makes us a valuable § Over 15 years of experience in investment banking and principal investing partner to companies seeking focused, patient partners

§ Has worked on a variety of capital raise, restructuring, sell‐side and buy‐side assignments across who will work to support the implementation of software, tech-enabled services and media in the U.S., Europe and MENA § Prior

to joining Berenson, Amir worked at Tanaka Capital Management management’s long-term vision” § Board Member of Skience Amir Hegazy 6

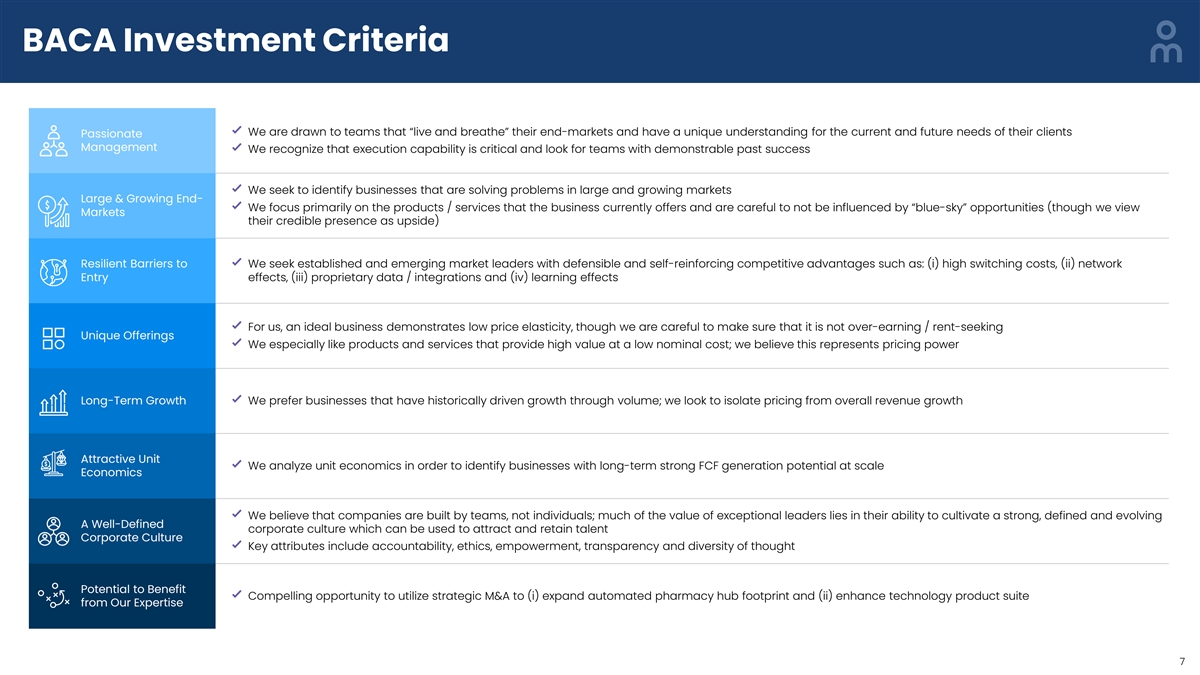

BACA Investment Criteria We are drawn to teams that “live and

breathe” their end-markets and have a unique understanding for the current and future needs of their clients Passionate Management We recognize that execution capability is critical and look for teams with demonstrable past success We seek to

identify businesses that are solving problems in large and growing markets Large & Growing End- We focus primarily on the products / services that the business currently offers and are careful to not be influenced by “blue-sky”

opportunities (though we view Markets their credible presence as upside) Resilient Barriers to We seek established and emerging market leaders with defensible and self-reinforcing competitive advantages such as: (i) high switching costs, (ii)

network Entry effects, (iii) proprietary data / integrations and (iv) learning effects For us, an ideal business demonstrates low price elasticity, though we are careful to make sure that it is not over-earning / rent-seeking Unique Offerings We

especially like products and services that provide high value at a low nominal cost; we believe this represents pricing power Long-Term Growth We prefer businesses that have historically driven growth through volume; we look to isolate pricing from

overall revenue growth Attractive Unit We analyze unit economics in order to identify businesses with long-term strong FCF generation potential at scale Economics We believe that companies are built by teams, not individuals; much of the value of

exceptional leaders lies in their ability to cultivate a strong, defined and evolving A Well-Defined corporate culture which can be used to attract and retain talent Corporate Culture Key attributes include accountability, ethics, empowerment,

transparency and diversity of thought Potential to Benefit Compelling opportunity to utilize strategic M&A to (i) expand automated pharmacy hub footprint and (ii) enhance technology product suite from Our Expertise 7

Table of Contents EXECUTIVE SUMMARY PLATFORM OVERVIEW FINANCIAL AND

TRANSACTION OVERVIEW

Executive Summary

Mission Statement & Vision MISSION Improve patient outcomes by

organizing and acting on real-time health data and insights VISION Transform the care experience for people at home 10

Custom Health at a Glance Vertically integrated virtual care and

medication adherence platform, serving patients through company- owned and network pharmacies, powered by proprietary AdhereNet® software By the Numbers Monitored med doses safely taken at home Med adherence Custom Health In-house (1) (2) 7.7

million 98% pharmacy hub clinical team in 2023 Patient Conversion rate from Reported Med average age referrals outcomes adherence Network Patient at (3) (3) pharmacy home ~53 60% PATIENT Payors Technology Vitals Nurse Drug administering wholesaler

Clinical Team meds Powered by AdhereNet® (1) 1.93 million drug doses administered June through August 2023 * 4 = 7.7 million drug doses administered in year 2023 (2) BMC Geriatrics, “Medication adherence support of an in-home electronic

medication dispensing system for individuals living with chronic conditions: a pilot randomized controlled trial” (3) Company data 11

The Problem (1) 68 Million adults in the U.S. alone have multiple

chronic conditions and rely on medication (2) Remembering to take medication on time and as prescribed is difficult: 75% of people in the U.S. have trouble following their medication schedule. Missing doses can be harmful, worrisome and can lead to

hospital stays and medical costs. (3) This is James He has 9 prescriptions At 52 he was diagnosed with Diabetes. He takes multiple meds and vitamins Parkinson’s at 59. He also has PTSD, several times each day. His care is Asthma &

Hypertension. complex, and he is not alone... (1) Prevalence of Multiple Chronic Conditions Among U.S. Adults, 2018, September 17, 2022, CDC; the data does not include Canada where Custom Health has an existing footprint (2) Medication Adherence:

Helping Patients Take Their Medicines As Directed, Jan-Feb 2012, National Library of Medicine 12 (3) Fictional customer, for illustrative purposes only

Custom Health Key Investment Highlights Mission-Critical Offerings

Large & Growing TAM Resilient Barriers to Entry (2) § Comprehensive managed care solution § 68 million U.S. adults are diagnosed with § Proprietary software, AdhereNet, improves patient health outcomes (98% multiple chronic

conditions, requiring a orchestrates (i) owned and network (1) medication adherence ) variety of medications on a daily basis pharmacy operations, (ii) medication packaging and logistics, (iii) at-home § Solution increases patient-clinician (3)

§ $550 billion annual medication medication adherence and (iv) data connectivity and gathers a stream of adherence cost to healthcare insurers collection, ingestion and insights ongoing critical data, reducing the cost of § U.S.

demographic and healthcare policy long-term care § Vertically integrated full suite of services trends provide massive tailwinds improves value proposition to (i) patients, (ii) payors and (iii) physicians Passionate Management & Robust

M&A Model Long-Term Growth Team § Proven strategy focused on acquiring § Attractive “Double-stack” (medication + § CEO and Chairman have 30+ years of combined pharmacies in proximity to significant payor technology)

revenue model central fill pharmacy operating and population centers management experience and are driven to § Active & in-pilot contracts with payors and § Demonstrable track record of execution, improve patient outcomes physician

groups for initial roll-out with achieving 1.9x aggregate topline growth significant opportunity to expand patient § Engineering leadership has enterprise hardware (4) within first 18 months population served and software experience (5) §

20k+ independent pharmacies across the § Seasoned healthcare professionals augment § Opportunity to partake in shared (value- U.S. and Canada tech-enabled solution with clinical expertise at based care) revenue models scale (1) Medication

adherence support of an in-home electronic medication dispensing system for individuals living with chronic conditions: a pilot randomized controlled trial, January 14, 2021, BMC Geriatrics; the data does not include Canada where Custom Health has

an existing footprint (2) Prevalence of Multiple Chronic Conditions Among U.S. Adults, 2018, September 17, 2022, CDC; the data does not include Canada where Custom Health has an existing footprint (3) Cost of Prescription Drug–Related

Morbidity and Mortality, March 26, 2018, Sage Journals; Cost-related nonadherence to prescription medications in Canada: a scoping review, Sep 6, 2018, National 13 Library of Medicine (4) Company data (5) New Data Reveal a Stable Independent

Pharmacy Market, August 1, 2022, PCMA

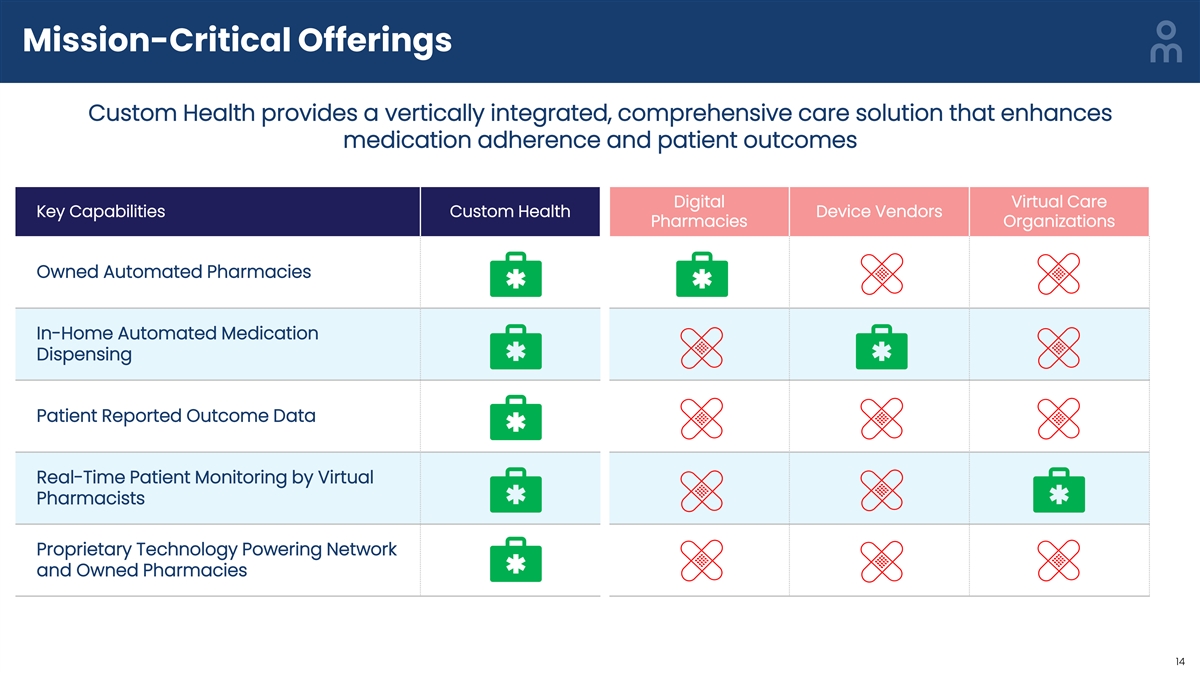

Mission-Critical Offerings Custom Health provides a vertically

integrated, comprehensive care solution that enhances medication adherence and patient outcomes Digital Virtual Care Key Capabilities Custom Health Device Vendors Pharmacies Organizations Owned Automated Pharmacies In-Home Automated Medication

Dispensing Patient Reported Outcome Data Real-Time Patient Monitoring by Virtual Pharmacists Proprietary Technology Powering Network and Owned Pharmacies 14

Market: Large & Growing TAM Custom Health’s comprehensive

tech-enabled care solutions serves a massive market with significant tailwinds Addressable Market Key U.S. Macro Trends $1.9 trillion Total Addressable o Remote Patient Monitoring (“RPM”) Adoption: In 2018, the Center for Market TAM

Medicaid and Medicare Services (“CMS”) introduced reimbursable codes for RPM and chronic care management to incentivize the • $395 billion global health IT $1.9 trillion (1) use and development of technology to manage patients at

home mobile health markets (6) effectively • $346 billion global market for chronic disease management therapeutics and device o Shift to Value-Based Care (“VBC”) Model: CMS has set a goal to (2) technology have every Medicare

beneficiary in a VBC relationship by 2030, replacing traditional fee-for-service models; VBC is a • $143 billion global telehealth (3) reimbursement approach focused on quality and efficiency of market SAM care; technology tools with proven

outcomes could augment • $1.2 trillion global pharmacy (7) $325 billion health system revenue in a VBC model significantly (4) market o Aging U.S. Demographic: 17% of people living in the U.S. were 65 or $325 billion Serviceable (8) older in

2020, an increase of 38% since 2010 Addressable Market (5) • U.S. annual recurring revenue o Healthcare Staffing shortage: Approximately 100,000 registered Adults with 2+ chronic nurses (“RNs”) left the workforce during the

Covid-19 pandemic; conditions; not including Custom Health’s traction with ~20% of RNs nationally are projected to leave the healthcare younger demographics workforce; staffing shortages have and are expected to continue (9) to plague the U.S.

healthcare system (1) Healthcare IT Market by Products & Services (Healthcare Provider Solutions, Healthcare Payer Solutions, & HCIT Outsourcing Services), Components (Services, Software, Hardware), End User (Hospitals, Pharmacies, Payers)

& Region – Global Forecast to 2027, January 2023, Markets and Markets (2) Chronic Disease Management: Therapeutics, Device Technologies and Global Markets, April 2022, BCC Research (3) Telehealth Market Size, Share & COVID-19 Impact

Analysis, By Type (Products and Services), By Application (Telemedicine, Patient Monitoring, Continuous Medical Education, and Others), By Modality (Real-time (Synchronous), Store-and forward (Asynchronous), and Remote Patient Monitoring), By

End-user (Hospital Facilities, Homecare, and Others), and Regional Forecast, 2023-2030, June 2023, Fortune Business Insights (4) Pharmacy Market (By Product: Prescription, and OTC; By Pharmacy: Retail, e-Pharmacy; By Application: Hospital-grade,

Personal Use) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023 – 2032, October 2023, Precedence Research, (5) Company estimate of total serviceable addressable market based on the following

calculation: 12 months * 68mm Managed Chronic Care patients * [(Technology Revenue: $150.00*35%+$125.00*35%+$89.00*30%) + (Medication revenue assuming 50-50 patient split between network and owned pharmacies: $550.00/2)]. (6) Medicare’s New

Chronic Care Remote Physiologic Monitoring Codes: Everything You Need to Know, August 1, 2018, Foley & Lardner LLP (7) The CMS Innovation Center’s Strategy to Support High-quality Primary Care, June 09, 2023, CMS Website (8) 2021 Profile

of Older Americans, November 2022, Administration for Community Living (9) Examining the Impact of the COVID-19 Pandemic on Burnout and Stress Among U.S. Nurses, April 5, 2023, National Council of State Boards of Nursing 15

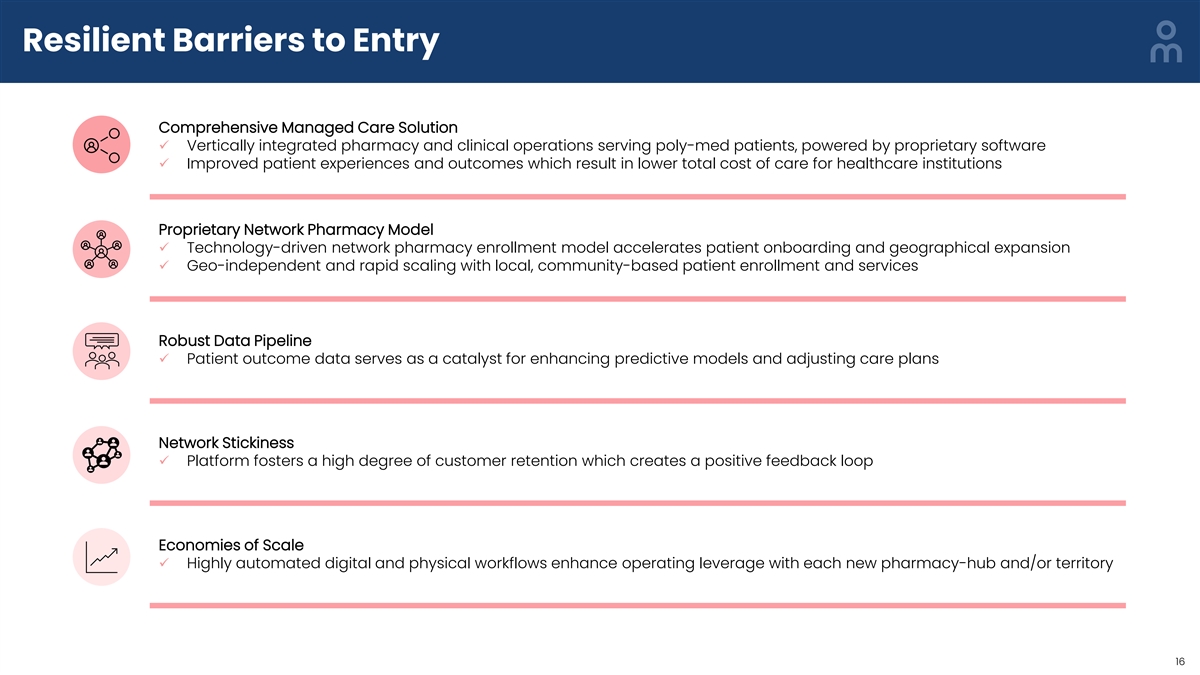

Resilient Barriers to Entry Comprehensive Managed Care Solution ü

Vertically integrated pharmacy and clinical operations serving poly-med patients, powered by proprietary software ü Improved patient experiences and outcomes which result in lower total cost of care for healthcare institutions Proprietary

Network Pharmacy Model ü Technology-driven network pharmacy enrollment model accelerates patient onboarding and geographical expansion ü Geo-independent and rapid scaling with local, community-based patient enrollment and services Robust

Data Pipeline ü Patient outcome data serves as a catalyst for enhancing predictive models and adjusting care plans Network Stickiness ü Platform fosters a high degree of customer retention which creates a positive feedback loop Economies

of Scale ü Highly automated digital and physical workflows enhance operating leverage with each new pharmacy-hub and/or territory 16

Defined M&A Playbook Add-on acquisition strategy focused on

strategic and accretive pharmacy hubs (1) M&A Playbook Success Scaling Acquired Pharmacy Revenue Management leverages network pharmacy 1 1.9x relationships to identify acquisition targets in strategic locations with large patient population

within Custom Health’s payor network 2 Pharmacies are acquired at attractive relative 1.0x valuations with a combination of cash and stock to align interests with existing owners Custom Health (i) enhances process automation, (ii) 3 drives

additional patient traffic through its payor and health system network and (iii) upsells its at- home medication adherence technology to patients Month 1 Month 18 Note: Includes revenue generated by acquired pharmacies. 4 Create “network

effect” and access larger cohorts of M&A pipeline of over 70 pharmacy hubs representing 200,000+ patients (2) payor population, while experience improved generating over $1 billion of standalone revenue financial efficiency through

operating leverage (2) 20,000+ independent pharmacies across the U.S. and Canada (1) For illustrative purposes only 17 (2) 2023 NCPA Digest: State of the industry, Cardinal Health; statistics provided in the box represent the potential acquisition

pool

Multiple Avenues for Long-Term Growth and Margin Expansion Step 1:

Roll-out existing contracts and pilots 1 Step 2: Expand into new territories with existing payors and continue to add additional payors and systems, 2 including shared-risk models Step 3: Continue M&A of strategic pharmacy hubs to capture

double-stack revenue (technology + 3 medication) Step 4: Expand the technology product offering to grow the technology revenue / patient over time 4 Step 5: Apply AI and Machine Learning to better serve patients while reducing execution costs and

creating 5 new revenue channels 18

Passionate Management & Team Co-founder & Chief Executive

Officer § Over 20 years of experience in pharmacy and technology fields § Prior to founding Custom Health, Shane founded Catalyst Healthcare, a pharmacy software company Custom Health’s 190-person team “live and breathe”

their end that includes an electronic medication administration record (eMAR) and served as the Chief market, bringing decades of resourceful leadership experience in technology-enabled healthcare Executive Officer for over 16 years § Shane

graduated from The University of British Columbia with a BSc Pharm in Pharmacy Shane Bishop § 50+ years of combined experience in related industries with a focus on promoting the Co-founder & Chairman technological application of healthcare

products to § Rahul serves as a Board Member at multiple technology companies, including Enzen and improve patients’ health outcomes SGH2 Energy Global § Previously, Rahul was a strategic advisor at Facebook, helping advise scalable

market-based § Expertise on running transformative businesses that infrastructure solutions for Internet are solving problems in large and growing markets § Rahul graduated from Columbia Business School with an MBA degree in Finance; he

also Rahul Chopra owns a Masters from UC Berkeley and Clemson University § Robust technology innovation with a proven capability of managing complex networks VP Clinical Offerings § 15+ years of pharmaceutical and clinical experience

§ Prior to Custom Health, Cathy served as the President and Chief Pharmacy Officer at Health in “The Company's commitment to keeping patients at home Motion Network after working as the President and Board Member at American Pharmacists

Association with services designed to improve our members' experience Cathy Kuhn § Cathy received a doctoral degree in Pharmacy from Ohio Northern University and health outcomes will serve those who are managing (1) chronic diseases with

complex medication regimens.” VP Engineering - Dr. Esguerra, Chief Medical Officer, San Mateo Health Plan § 25+ years of high-volume hardware, semiconductors, and systems experience § Prior to joining Custom Health, Mustafa was a Sr.

Director at Intel where he led development and deployment of 5G infrastructure across many service providers. He also led product strategy and delivery of Intel’s first NFC solution for PCs § Mustafa graduated from Columbia Business

school with an MBA Mustafa Muhammad 19 (1) https://customhealth.com/solutions/professional-solutions.html

Platform Overview

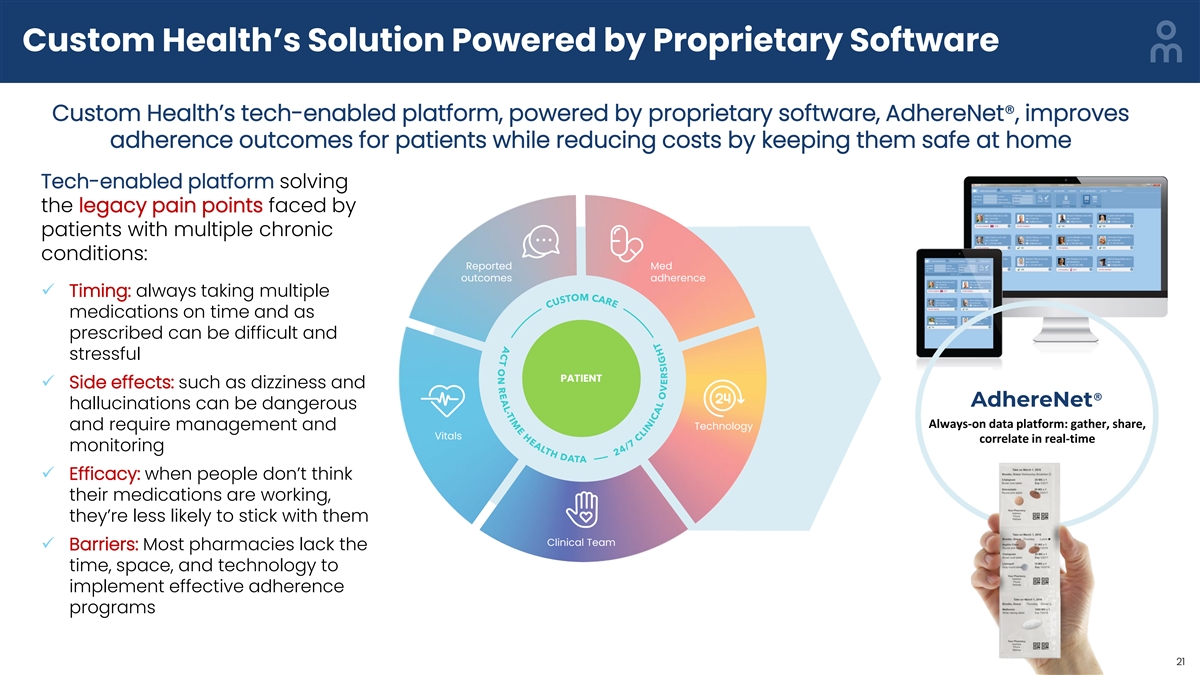

Custom Health’s Solution Powered by Proprietary Software Custom

Health’s tech-enabled platform, powered by proprietary software, AdhereNet®, improves adherence outcomes for patients while reducing costs by keeping them safe at home Tech-enabled platform solving the legacy pain points faced by patients

with multiple chronic conditions: Reported Med outcomes adherence ü Timing: always taking multiple medications on time and as prescribed can be difficult and stressful PATIENT ü Side effects: such as dizziness and AdhereNet®

hallucinations can be dangerous Always-on data platform: gather, share, and require management and Technology Vitals correlate in real-time monitoring ü Efficacy: when people don’t think their medications are working, they’re less

likely to stick with them Clinical Team ü Barriers: Most pharmacies lack the time, space, and technology to implement effective adherence programs 21

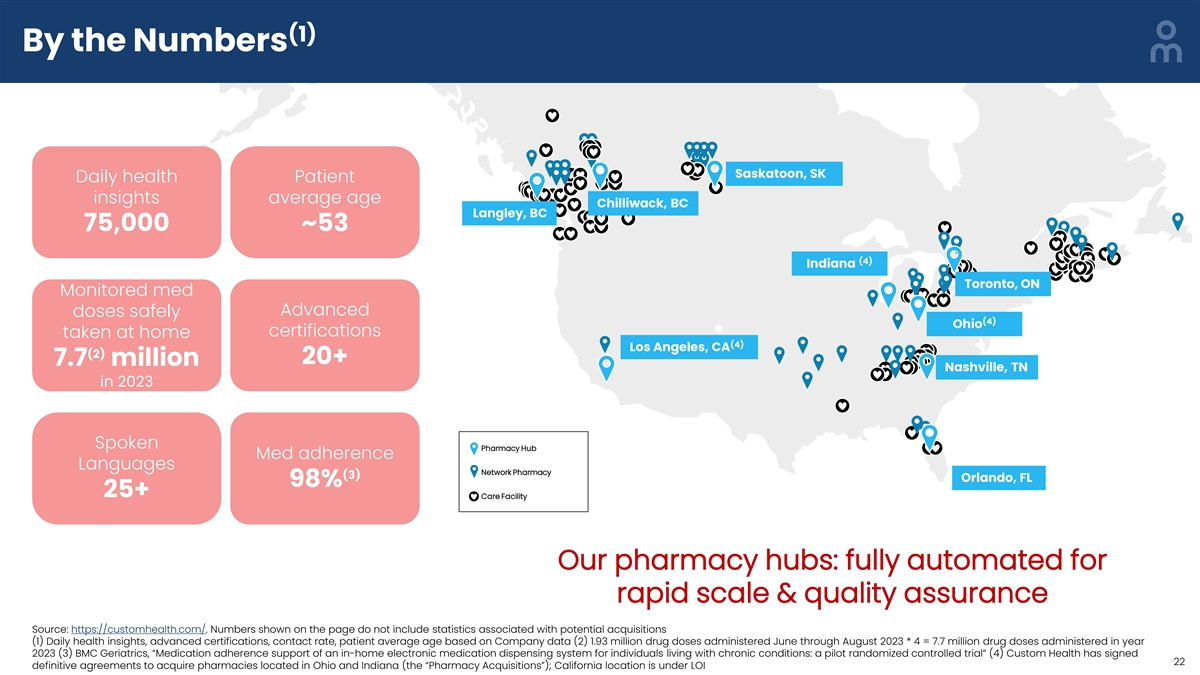

(1) By the Numbers Saskatoon, SK Daily health Patient insights average

age Chilliwack, BC Langley, BC 75,000 ~53 (4) Indiana Toronto, ON Monitored med Advanced doses safely (4) Ohio certifications taken at home (4) Los Angeles, CA (2) 20+ 7.7 million Nashville, TN in 2023 Spoken Pharmacy Hub Med adherence Languages

Network Pharmacy (3) Orlando, FL 98% 25+ Care Facility Our pharmacy hubs: fully automated for rapid scale & quality assurance Source: https://customhealth.com/. Numbers shown on the page do not include statistics associated with potential

acquisitions (1) Daily health insights, advanced certifications, contact rate, patient average age based on Company data (2) 1.93 million drug doses administered June through August 2023 * 4 = 7.7 million drug doses administered in year 2023 (3) BMC

Geriatrics, “Medication adherence support of an in-home electronic medication dispensing system for individuals living with chronic conditions: a pilot randomized controlled trial” (4) Custom Health has signed 22 definitive agreements to

acquire pharmacies located in Ohio and Indiana (the “Pharmacy Acquisitions”); California location is under LOI

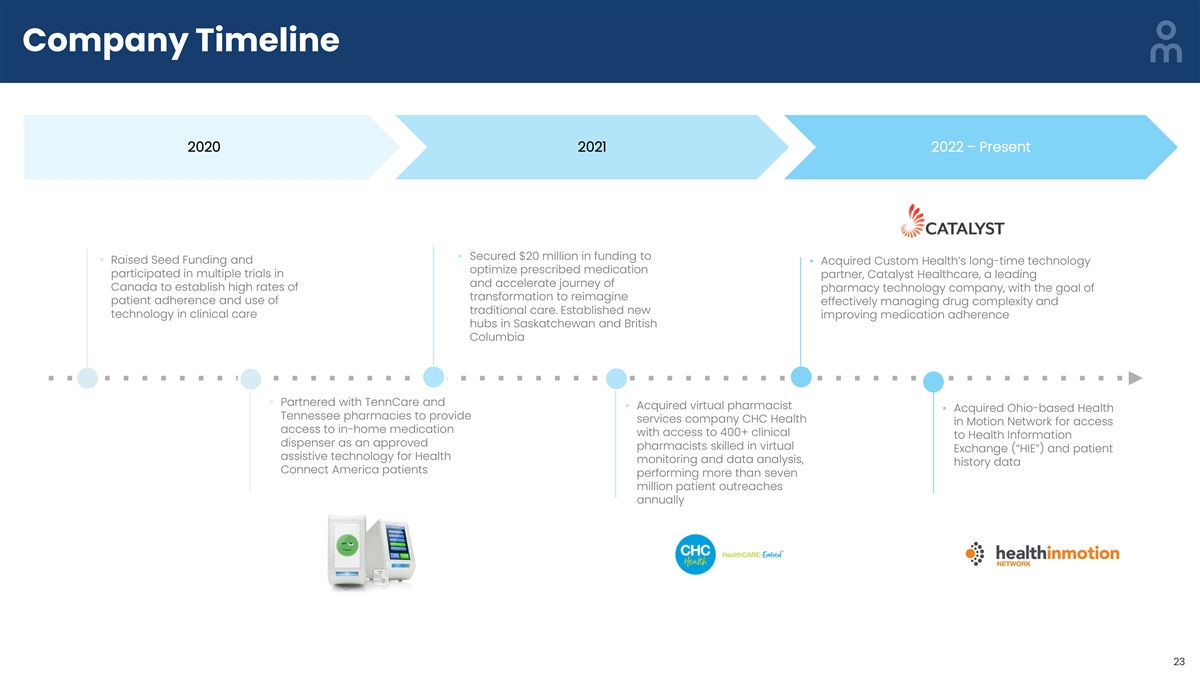

Company Timeline 2020 2021 2022 – Present ▪ Secured $20

million in funding to ▪ Raised Seed Funding and ▪ Acquired Custom Health’s long-time technology optimize prescribed medication participated in multiple trials in partner, Catalyst Healthcare, a leading and accelerate journey of

Canada to establish high rates of pharmacy technology company, with the goal of transformation to reimagine patient adherence and use of effectively managing drug complexity and traditional care. Established new technology in clinical care improving

medication adherence hubs in Saskatchewan and British Columbia ▪ Partnered with TennCare and ▪ Acquired virtual pharmacist ▪ Acquired Ohio-based Health Tennessee pharmacies to provide services company CHC Health in Motion Network

for access access to in-home medication with access to 400+ clinical to Health Information dispenser as an approved pharmacists skilled in virtual Exchange (“HIE”) and patient assistive technology for Health monitoring and data analysis,

history data Connect America patients performing more than seven million patient outreaches annually 23

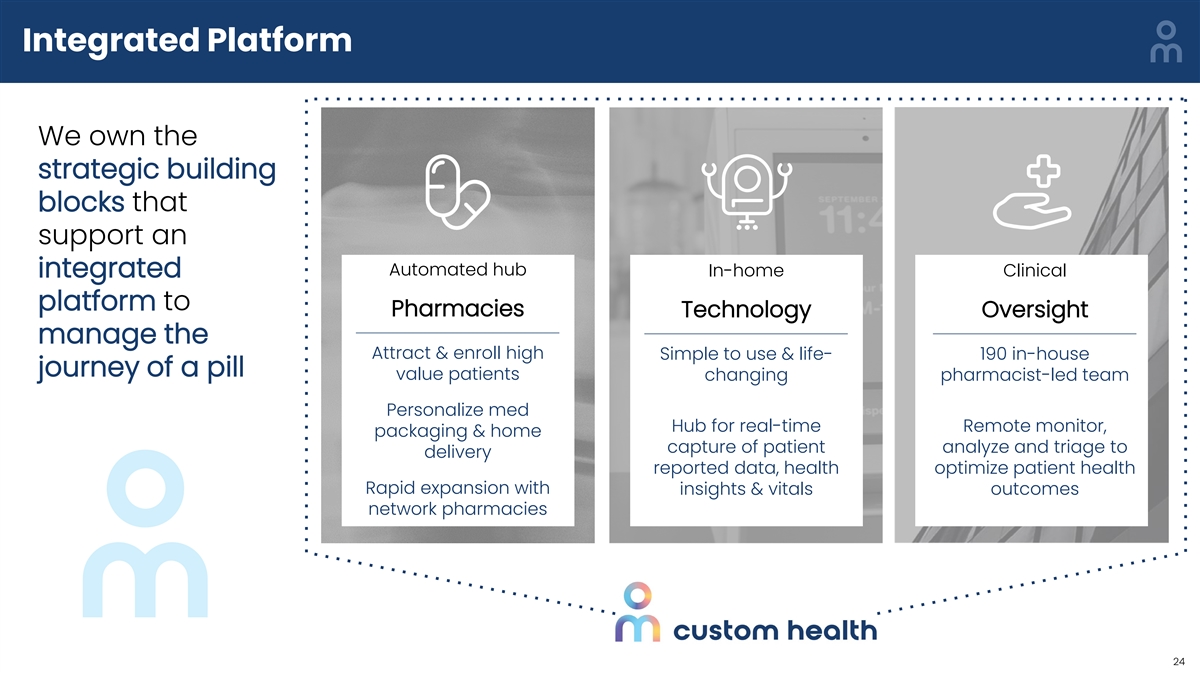

Integrated Platform We own the strategic building blocks that support

an Automated hub In-home Clinical integrated platform to Pharmacies Technology Oversight manage the Attract & enroll high Simple to use & life- 190 in-house journey of a pill value patients changing pharmacist-led team Personalize med Hub

for real-time Remote monitor, packaging & home capture of patient analyze and triage to delivery reported data, health optimize patient health Rapid expansion with insights & vitals outcomes network pharmacies 24

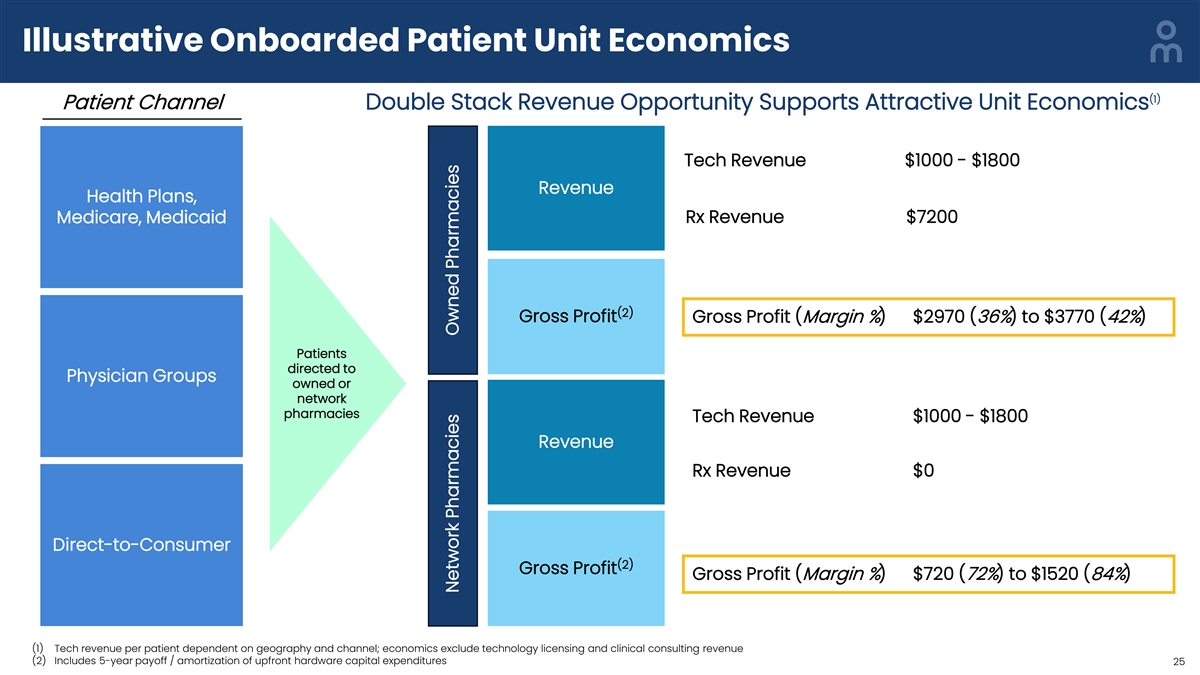

Illustrative Onboarded Patient Unit Economics (1) Patient Channel

Double Stack Revenue Opportunity Supports Attractive Unit Economics Tech Revenue $1000 - $1800 Revenue Health Plans, Rx Revenue $7200 Medicare, Medicaid (2) Gross Profit Gross Profit (Margin %) $2970 (36%) to $3770 (42%) Patients directed to

Physician Groups owned or network pharmacies Tech Revenue $1000 - $1800 Revenue Rx Revenue $0 Direct-to-Consumer (2) Gross Profit Gross Profit (Margin %) $720 (72%) to $1520 (84%) (1) Tech revenue per patient dependent on geography and channel;

economics exclude technology licensing and clinical consulting revenue (2) Includes 5-year payoff / amortization of upfront hardware capital expenditures 25 Network Pharmacies Owned Pharmacies

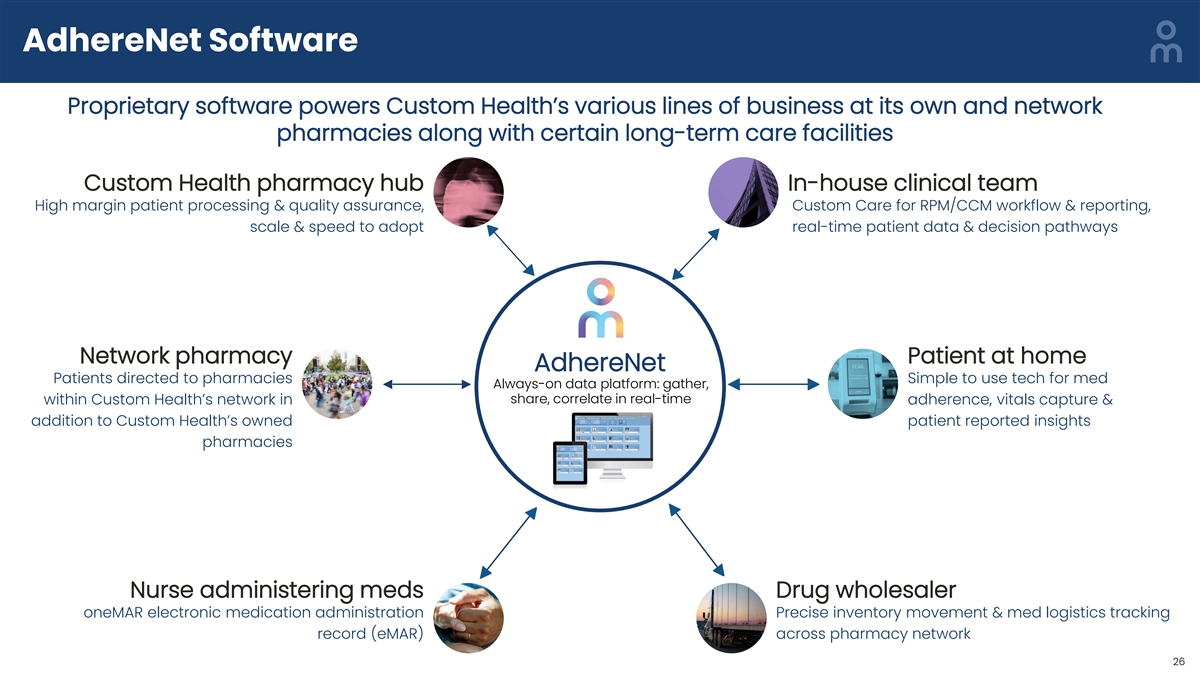

AdhereNet Software Proprietary software powers Custom Health’s

various lines of business at its own and network pharmacies along with certain long-term care facilities Custom Health pharmacy hub In-house clinical team High margin patient processing & quality assurance, Custom Care for RPM/CCM workflow &

reporting, scale & speed to adopt real-time patient data & decision pathways Network pharmacy Patient at home AdhereNet Patients directed to pharmacies Simple to use tech for med Always-on data platform: gather, share, correlate in real-time

within Custom Health’s network in adherence, vitals capture & addition to Custom Health’s owned patient reported insights pharmacies Nurse administering meds Drug wholesaler oneMAR electronic medication administration Precise

inventory movement & med logistics tracking record (eMAR) across pharmacy network 26

Strategy for AI-enabled Clinical Care at Scale 1 2 3 4 Build

Proprietary Health Create Operational Build Precision Medicine Develop Autonomous Care Dataset Efficiencies Capabilities Plan Tool § Real-time monitoring of § Automation of clinical tasks § Identification of gaps in care§

Customized, fully medication adherence and (assessment, transcription, § Disease diagnosis autonomous, clinician- vitals etc.)§ Disease risk prediction reviewed care plans § Fully-connected, company § Patient risk

stratification§ Health risk mitigation§ Dynamic plan monitoring managed, medical IOT § Rules-based care alerts & § Intervention and alteration devices prioritization recommendations § Unified medical, pharmacy §

Care cost prediction / and lab records reduction § Patient reported outcomes § High fidelity data wrangling Current / Near-Term Intermediate Term Medium-to-Long Term 27

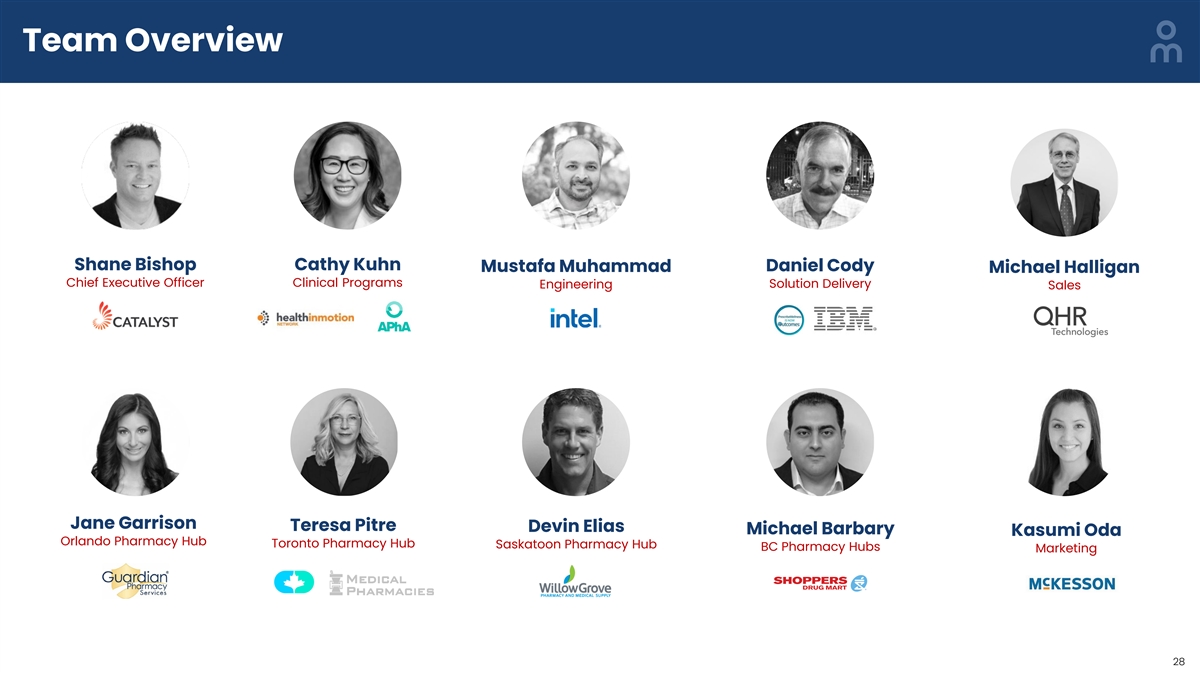

Team Overview Shane Bishop Cathy Kuhn Daniel Cody Mustafa Muhammad

Michael Halligan Chief Executive Officer Clinical Programs Solution Delivery Engineering Sales Jane Garrison Teresa Pitre Devin Elias Michael Barbary Kasumi Oda Orlando Pharmacy Hub Toronto Pharmacy Hub Saskatoon Pharmacy Hub BC Pharmacy Hubs

Marketing 28

Financial and Transaction Overview

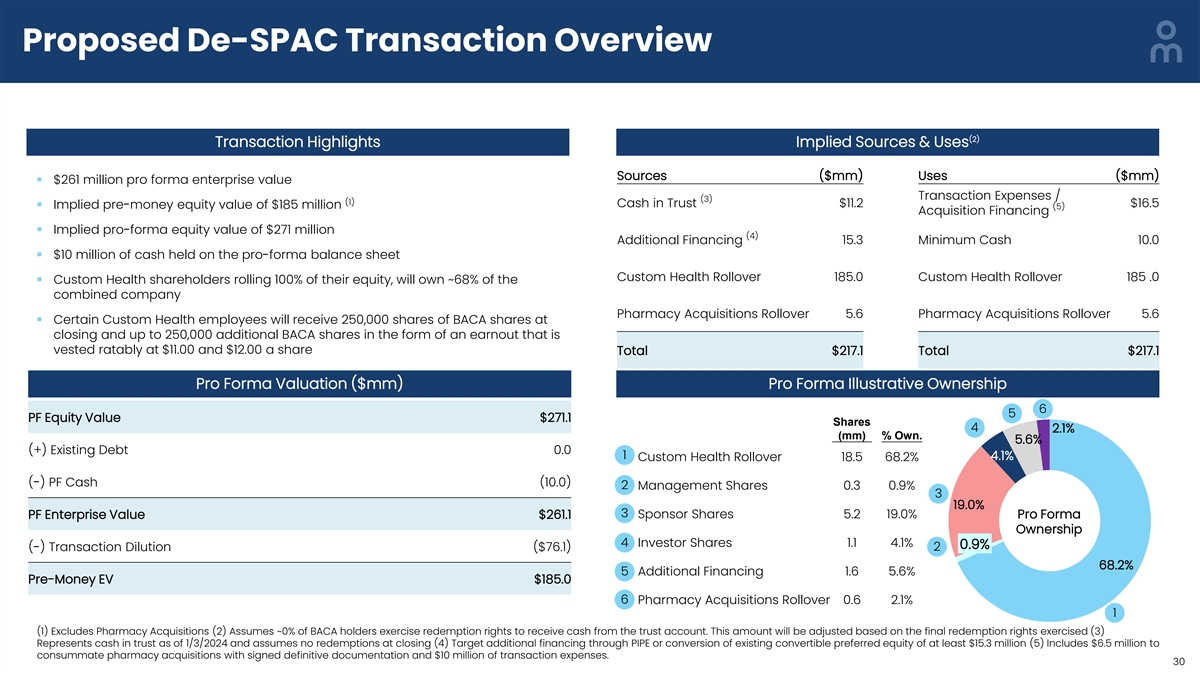

Proposed De-SPAC Transaction Overview (2) Transaction Highlights

Implied Sources & Uses Sources ($mm) Uses ($mm) § $261 million pro forma enterprise value Transaction Expenses / (3) (1) Cash in Trust $11.2 $16.5 § Implied pre-money equity value of $185 million (5) Acquisition Financing §

Implied pro-forma equity value of $271 million (4) Additional Financing 15.3 Minimum Cash 10.0 § $10 million of cash held on the pro-forma balance sheet Custom Health Rollover 185.0 Custom Health Rollover 185 .0 § Custom Health

shareholders rolling 100% of their equity, will own ~68% of the combined company Pharmacy Acquisitions Rollover 5.6 Pharmacy Acquisitions Rollover 5.6 § Certain Custom Health employees will receive 250,000 shares of BACA shares at closing and

up to 250,000 additional BACA shares in the form of an earnout that is vested ratably at $11.00 and $12.00 a share Total $217.1 Total $217.1 Pro Forma Valuation ($mm) Pro Forma Illustrative Ownership 6 5 PF Equity Value $271.1 Shares 4 2.1% (mm) %

Own. 5.6% (+) Existing Debt 0.0 1 4.1% Custom Health Rollover 18.5 68.2% (-) PF Cash (10.0) 2 Management Shares 0.3 0.9% 3 19.0% 3 PF Enterprise Value $261.1 Sponsor Shares 5.2 19.0% Pro Forma Ownership 4 Investor Shares 1.1 4.1% 0.9% (-)

Transaction Dilution ($76.1) 2 68.2% 5 Additional Financing 1.6 5.6% Pre-Money EV $185.0 6 Pharmacy Acquisitions Rollover 0.6 2.1% 1 (1) Excludes Pharmacy Acquisitions (2) Assumes ~0% of BACA holders exercise redemption rights to receive cash from

the trust account. This amount will be adjusted based on the final redemption rights exercised (3) Represents cash in trust as of 1/3/2024 and assumes no redemptions at closing (4) Target additional financing through PIPE or conversion of existing

convertible preferred equity of at least $15.3 million (5) Includes $6.5 million to consummate pharmacy acquisitions with signed definitive documentation and $10 million of transaction expenses. 30

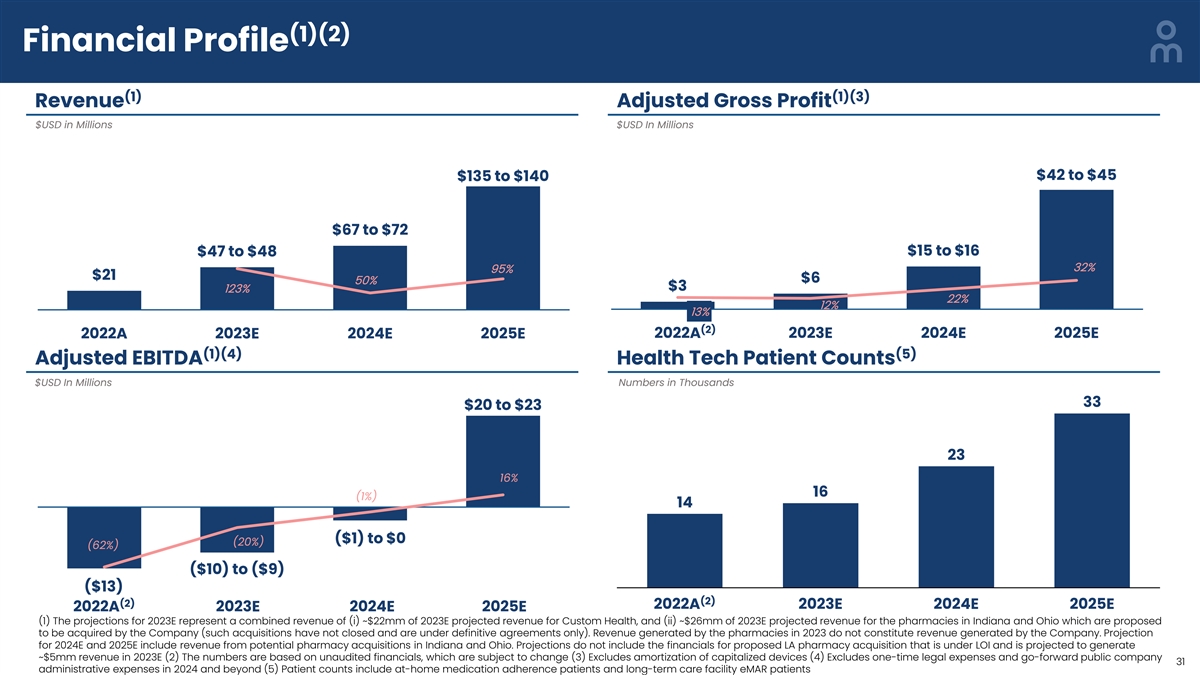

(1)(2) Financial Profile (1) (1)(3) Revenue Adjusted Gross Profit $USD

in Millions $USD In Millions $42 to $45 $135 to $140 $67 to $72 $47 to $48 $15 to $16 32% 95% $21 $6 50% $3 123% 22% 12% 13% (2) 2022A 2023E 2024E 2025E 2022A 2023E 2024E 2025E (1)(4) (5) Adjusted EBITDA Health Tech Patient Counts $USD In Millions

Numbers in Thousands 33 $20 to $23 23 16% 16 (1%) 14 ($1) to $0 (20%) (62%) ($10) to ($9) ($13) (2) (2) 2022A 2023E 2024E 2025E 2022A 2023E 2024E 2025E (1) The projections for 2023E represent a combined revenue of (i) ~$22mm of 2023E projected

revenue for Custom Health, and (ii) ~$26mm of 2023E projected revenue for the pharmacies in Indiana and Ohio which are proposed to be acquired by the Company (such acquisitions have not closed and are under definitive agreements only). Revenue

generated by the pharmacies in 2023 do not constitute revenue generated by the Company. Projection for 2024E and 2025E include revenue from potential pharmacy acquisitions in Indiana and Ohio. Projections do not include the financials for proposed

LA pharmacy acquisition that is under LOI and is projected to generate ~$5mm revenue in 2023E (2) The numbers are based on unaudited financials, which are subject to change (3) Excludes amortization of capitalized devices (4) Excludes one-time legal

expenses and go-forward public company 31 administrative expenses in 2024 and beyond (5) Patient counts include at-home medication adherence patients and long-term care facility eMAR patients

2023E-2025E Revenue and Gross Profit Bridge (1) Revenue Commentary $USD

in Millions o Current: $135 to $140 $1 to $1 $53 to $54 § Gross Margins have been burdened by the following: o Custom Health has procured a deep bench of skilled pharmacy-level human resources, in preparation for $14 to $14 $67 to $72

enrollment of large patient populations $1 to $2 $16 to $18 $3 to $4 $47 to $48 o Majority of patients enrolled in Custom Health’s at-home platform are located in Canada and pay ~$20 per month out of pocket; majority of margin is generated

through RX sales to these patients 2023 Technology Rx Clinical 2024 Technology Rx Clinical 2025 o Go-Forward Revenue and Gross Margin Expansion Revenue Services Revenue Services Revenue § Signed and late-stage pipeline MSAs with health plans

and providers, stipulating $80-150+ per patient per month for the at-home tech-enabled services vs. $20 in current state (1)(2) Adjusted Gross Margin § Patients directed to Custom-Health owned pharmacies will $USD in Millions generate an

incremental (to at-home technology revenue) $300-$550 per patient per month of medication revenue § Company is in discussions with existing health plan 32% customers to Increase number of medication therapy 5% 0% 5% management consultations

(clinical services) 22% 1% 5% § Limited direct pharmacy headcount additions will be needed 4% to support newly enrolled patients 12% 2023 Adj. Technology Rx Clinical 2024 Adj. Technology Rx Clinical 2025 Adj. Gross Margin Services Gross Margin

Services Gross Margin Note: Numbers do not include amortization of capitalized device costs over 60 months (1) The projections for 2023E represent a combined revenue of (i) ~$22mm of 2023E projected revenue for Custom Health, and (ii) ~$26mm of

2023E projected revenue for the pharmacies in Indiana and Ohio which are proposed to be acquired by the Company (such acquisitions have not closed and are under definitive agreements only). Revenue generated by the pharmacies in 2023 do not

constitute revenue generated by the Company. Projection for 2024E and 2025E include revenue from potential pharmacy acquisitions in Indiana and Ohio. Projections do not include the financials for proposed LA pharmacy acquisition that is under LOI

and is projected to generate 32 ~$5mm revenue in 2023E (2) Excludes amortization of capitalized devices

Near-Term Patient Population Pipeline Supports Growth Forecast Custom

Health’s patient pipeline is driven by pilots and contracts with large healthcare organizations that are expected to be rolled out over the next 24 months across the U.S. and Canada (1) Addressable Patient Population Commentary All Adults (2)

68 million Patients in Existing Geographies for (2) o All Patients: 68 million adults in the U.S. alone Existing Payors (3) have multiple chronic conditions and rely on 4.6 million consistent, on-time, and correct medication o Patients in Existing

Geographies for Existing Payors: (3) 4.6 million adults in Custom Health’s current Immediate Pipeline (3) territories that can be serviced by the Company’s ~23,000 platform o Immediate Pipeline: Roughly 23,000 patients by (3) 2024 in the

Company’s targeted markets (1) Excludes new relationships (2) Prevalence of Multiple Chronic Conditions Among U.S. Adults, 2018, September 17, 2022, CDC; the data does not include Canada where Custom Health has an existing footprint (3)

Company data 33

(1) Attractive Long-Term Financial Profile Long-Term Organic Financial

Algorithm (1) Revenue Growth 30%+ (1) Gross Profit Margin 30-45% (1) EBITDA Growth 40%+ (1) EBITDA Margin 25% Additional Potential Upside from Acquisitions ICHOM: International Consortium for Health Outcomes Management (1) The projections for 2023E

represent a combined revenue of (i) ~$22mm of 2023E projected revenue for Custom Health, and (ii) ~$26mm of 2023E projected revenue for the pharmacies in Indiana and Ohio which are proposed to be acquired by the Company (such acquisitions have not

closed and are under definitive agreements only). Revenue generated by the pharmacies in 2023 do not constitute revenue generated by the Company. Projection for 2024E and 2025E include revenue from potential pharmacy acquisitions in Indiana and

Ohio. Projections do not include the financials for proposed LA pharmacy acquisition that is under LOI and is projected to generate ~$5mm revenue in 2023E 34

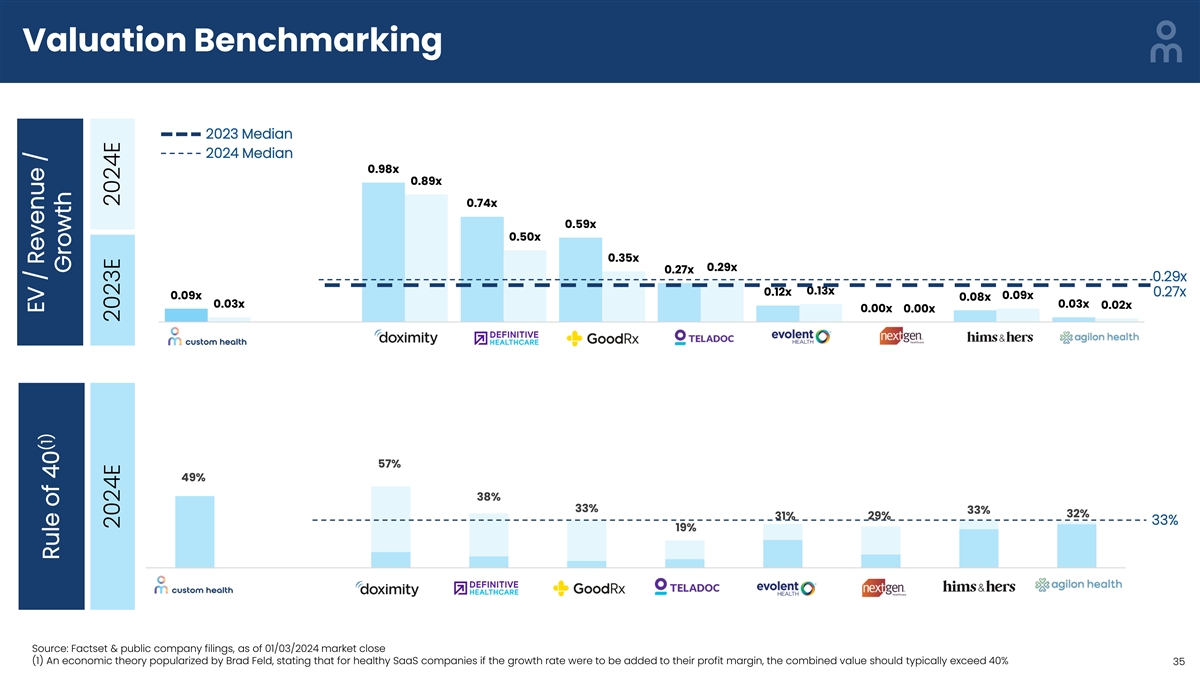

Valuation Benchmarking 2023 Median 2024 Median 0.98x 0.89x 0.74x 0.59x

0.50x 0.35x 0.29x 0.27x 0.29x 0.13x 0.12x 0.27x 0.09x 0.09x 0.08x 0.03x 0.03x 0.02x 0.00x 0.00x 57% 49% 38% 33% 33% 32% 31% 29% 33% 19% Source: Factset & public company filings, as of 01/03/2024 market close (1) An economic theory popularized by

Brad Feld, stating that for healthy SaaS companies if the growth rate were to be added to their profit margin, the combined value should typically exceed 40% 35 EV / Revenue / (1) Rule of 40 Growth 2024E 2023E 2024E

Operational Benchmarking 2024 Median 2025 Median 95% 50% 30% 31% 27%

19% 19% 15% 11% 11% 11% 9% 8% 8% 6% 5% 11% 5% 0% 10% 46% 45% 31% 30% 29% 28% 7% 19% 8% 16% 12% 11% 14% 13% 16% 14% 0% 3% (1%) 2% Source: Factset & public company filings, as of 01/03/2024 market close (1) Excludes one-time legal expenses and

go-forward public company administrative expenses in 2024 and beyond 36 Adjusted EBITDA Revenue Growth (1) Margin 2024E 2025E 2024E 2025E

Risk Factors All references to the “Company,”

“we,” “us” or “our” in this presentation refer to the business of the Company. GENERAL RISKS • Downturns or volatility in general economic conditions could have a material adverse effect on the

Company’s business, financial condition, results of operations and liquidity. • Industry consolidation may result in increased competition, which could result in a reduction in revenue. • The Company depends on growth in the end

markets that use its products. Any slowdown in the growth of these end markets could adversely affect its financial results. • The Company is dependent on a limited number of distributors and end customers. The loss of, or a significant

disruption in the relationships with any of these distributors or end customers, could significantly reduce the Company’s revenue and adversely impact the Company’s operating result. • If the Company fails to accurately anticipate

and respond to rapid technological change in the industries in which the Company operates, the Company’s ability to attract and retain customers could be impaired and its competitive position could be harmed. • The Company's competitive

position could be adversely affected if it is unable to meet customers’ or device manufacturers’ quality requirements. • If the Company is unable to expand or further diversify its customer base, its business, financial condition,

and results of operations could suffer. • If the Company’s products and services do not conform to, or are not compatible with, existing or emerging industry standards, demand for its products may decrease, which in turn would harm the

Company’s business and operating results. • The Company is subject to risks and uncertainties associated with international operations, which may harm its business. • The Company's company culture has contributed to its success and

if the Company cannot maintain this culture as it grows, its business could be harmed. • Loss of key management or other highly skilled personnel, or an inability to attract such management and other personnel, could adversely affect the

Company’s business. • The Company may not be able to effectively manage its growth and may need to incur significant expenditures to address the additional operational and control requirements of its growth, either of which could harm

the Company’s business and operating results. • Shifts in the Company’s product mix or customer mix may result in declines in gross margin. • The Company may pursue mergers, acquisitions, investments and joint ventures, which

could divert its management’s attention or otherwise disrupt its operations and adversely affect its results of operations. • The Company may not manage its growth effectively. • The Company may need additional capital to pursue

our business objectives and respond to business opportunities, challenges or unforeseen circumstances, and we cannot be sure that additional financing will be available. • Our forecasts and projections are based on assumptions, analyses and

internal estimates developed by our management. If these assumptions, analyses or estimates prove to be incorrect or inaccurate, our actual operating results may differ materially from those forecasted or projected. • The market adoption of

our product is evolving and may develop more slowly or differently than we expect. Our future success depends on the growth and expansion of these markets and our ability to adapt and respond effectively to evolving markets. • We rely on trade

secrets, designs, experiences, work flows, data processes, software and know-how. • We are subject to cybersecurity risks to operational systems, security systems, infrastructure, integrated software in our products and customer data processed

by us or third-party vendors or suppliers and any material failure, weakness, interruption, cyber event, incident or breach of security could hinder the effective operation of our business. • Both BACA and the Company will incur significant

transaction costs in connection the proposed acquisitions of the pharmacies in Ohio, Indiana and California. • The Company may not successfully or timely consummate the proposed acquisition of the pharmacies in Ohio, Indiana and California,

and the closing of such transactions are subject to a variety or risks, including, without limitation, the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely

affect the combined company or the expected benefits of the proposed acquisitions or that the approval of the stockholders of the pharmacy entities is not obtained. • The consummation of the proposed pharmacy acquisitions is subject to a

number of conditions and if those conditions are not satisfied or waived, the definitive agreement may be terminated in accordance with its terms and the acquisitions may not be completed. STOCK AND CAPITALIZATION RISKS • The Company has a

history of losses and may incur significant expenses and continuing losses for the foreseeable future. • The market price of the combined company’s common stock may be highly volatile. • The Company’s operating results may

have significant period-to-period fluctuations, which would make it difficult to predict our future performance. • Raising additional funds by issuing securities may cause dilution to existing stockholders or restrict the combined

company’s operations. • The combined company does not intend to pay cash dividends. Consequently, any gains from an investment in its securities will likely depend on whether the price of the common stock increases. • The combined

company’s executive officers and directors will own a significant percentage of the common stock and could exert significant influence over matters requiring stockholder approval, including takeover attempts. • Failure to meet the

maintenance criteria of the stock exchange may result in the delisting of the combined company’s common stock, which could result in lower trading volumes, liquidity and prices of the common stock and make it more difficult for the combined

company to raise capital. • If industry or financial analysts do not publish research or reports about the combined company’s business, or if they issue inaccurate or unfavorable research regarding the common stock, the share price and

trading volume could decline. 37

Risk Factors RISKS RELATED TO THE BUSINESS COMBINATION • The

Business Combination may disrupt current plans and operations of the Company. • If the Business Combination’s benefits do not meet the expectations of investors or securities analysts, the market price of BACA’s securities or,

following the consummation of the Business Combination, the combined company’s securities, may decline. • The valuation ascribed to the combined company may not be indicative of the price that will prevail in the trading market following

the Business Combination. If an active market for the combined company’s securities develops and continues, the trading price of the combined company’s securities following the Business Combination could be volatile and subject to wide

fluctuations in response to various factors, which could contribute to the loss of all or part of your investment. • The combined company may be required to take write-downs or write-offs, or be subject to restructuring, impairment or other

charges that could have a significant negative effect on the combined company’s financial condition, results of operations and the price of our common stock, which could cause you to lose some or all of your investment. • Both BACA and

the Company will incur significant transaction costs in connection with the Business Combination. • BACA and the Company may not successfully or timely consummate the Business Combination, including the risk that any required regulatory

approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Business Combination or that the approval of the stockholders of BACA is not

obtained. • The consummation of the Business Combination is subject to a number of conditions and if those conditions are not satisfied or waived, the Business Combination agreement may be terminated in accordance with its terms and the

Business Combination may not be completed. • Following the consummation of the Business Combination, the combined company will incur significant increased expenses and administrative burdens as a public company, which could have an adverse

effect on its business, financial condition and results of operations. • Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect the Company’s or the combined company’s business,

including the ability of the parties to consummate the Business Combination, and results of operations of the Company or the combined company. 38

Key Contacts Custom Health Berenson Acquisition Corp. I Shane Bishop

Amir Hegazy Chief Executive Officer Chief Financial Officer shane.bishop@customhealth.com ahegazy@berensonco.com irlabs Alyssa Barry Investor Relations alyssa@irlabs.ca

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |