Euro Rises Amid Risk Appetite

20 Mai 2016 - 8:15AM

RTTF2

The euro strengthened against the other major currencies in

early European session on Friday amid risk appetite, as oil and

metal prices rose and investors turned their attention to the G7

meeting of central bankers and finance ministers that could provide

some clarity over the conduct of global monetary and fiscal

policies.

The U.K.'s FTSE 100 index is currently up 1.38 percent or 83.71

points at 6,137, France's CAC 40 index is up 1.36 percent or 58.10

points at 4,340 and Germany's DAX is up 1.05 percent or 103.25

points at 9,899.

Crude oil for July delivery are currently up $0.10 at $48.77 a

barrel. Crude oil price rose due to supply disruptions in Nigeria,

Canada and Libya that softened global supply glut.

The markets are recovering after a subdued start in response to

hawkish comments from Fed officials and in the aftermath of the

FOMC April meeting minutes.

In other economic news, data from Destatis showed that the

German producer prices declined 3.1 percent in April from last

year, the same pace of decrease as seen in March but slightly

faster than the 3 percent fall forecast by economists. Producer

prices have been falling since August 2013. The 3.1 percent

decrease was the biggest since January 2010 when prices slid 3.5

percent.

Data from the European Central Bank showed that the euro zone's

current account surplus increased to a 4-month high in March. The

current account surplus rose to EUR 27.3 billion in March from EUR

19.2 billion in February. This was the highest level since

November. On an unadjusted basis, the current account surplus

surged to EUR 32.3 billion from EUR 11.2 billion in February.

In the Asian trading today, the euro held steady against its

major rivals.

In the European trading, the euro rose to more than a 3-month

high of 1.1121 against the Swiss franc and a 2-day high of 0.7712

against the pound, from yesterday's closing quotes of 1.1091 and

0.7663, respectively. If the euro extends its uptrend, it is likely

to find resistance around 1.12 against the franc and 0.80 against

the pound.

Against the Canadian dollar, the U.S. dollar and the yen, the

euro edged up to 1.4702, 1.1228 and 123.76 from yesterday's closing

quotes of 1.4646, 1.1196 and 123.05, respectively. On the upside,

1.51 against the loonie, 1.14 against the greenback and 128.00

against the yen are seen as the next resistance levels for the

euro.

Against the Australian and the New Zealand dollars, the euro

edged up to 1.5521 and 1.6610 from an early 2-day low of 1.5466 and

more than a 2-week low of 1.6535, respectively. The euro may test

resistance around 1.60 against the aussie and 1.70 against the

kiwi.

Looking ahead, Canada CPI for April and retail sales data for

March and U.S. existing home sales data for April and weekly rig

count data are slated for release in the New York session.

At 9:00 am ET, Federal Reserve Governor Daniel Tarullo is

scheduled to deliver a speech titled "Insurance Company Supervision

and Regulation" at the National Association of Insurance

Commissioners International Insurance Forum in Washington DC.

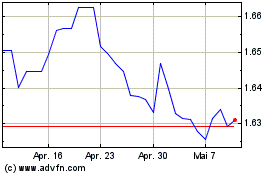

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

Von Apr 2023 bis Apr 2024