Euro Mixed After ECB Rate Decision; Awaits Draghi's Speech For Addl. Measures

22 Januar 2015 - 2:28PM

RTTF2

The euro traded mixed against its major counterparts in European

deals on Thursday, after the European Central Bank left its key

interest rates steady at a record low for a fourth straight month.

Meanwhile, the ECB indicated that it will flesh out further details

regarding monetary policy measures at the President Draghi's press

conference, due shortly.

The Governing Council, led by President Mario Draghi, held the

refinancing rate at a record low 0.05 percent, following the

meeting in Frankfurt. The decision was in line with economists'

expectations.

The bank also left the deposit rate unchanged at -0.20 percent

and the marginal lending rate at 0.30 percent. The three main

interest rates were lowered by 10 basis points in September.

Since the ECB has given no indications on its planned QE

programme in the initial policy statement, investors await Draghi's

speech for more on it.

In his customary post-decision press conference at 8.30 am ET,

Draghi is expected to unveil a massive quantitative easing plan,

widely seen to exceed EUR 1 trillion. The QE programme, which was

initially seen to be around EUR 500-550 billion, could include

buying government bonds despite strong criticism from Germany.

Reports citing ECB sources said the bank may opt to buy EUR 50

billion of bonds per month. The plan was also rumored to run

through 2016.

The euro has been trading in a negative territory in January,

amid uncertainty regarding the consequences of the Greek elections

on January 25, speculation that the ECB would launch sovereign bond

purchases at the earliest and on plunging oil prices that raises

the prospect of outright deflation.

The euro bounced off to 1.1649 against the U.S. dollar, up by

0.6 percent from a low of 1.1575 hit at 2:30 am ET. The euro is

likely to find resistance around the 1.20 zone.

The euro slipped to a 2-day low of 0.7613 against the Sterling,

compared to 0.7665 hit late New York Wednesday. The euro is poised

to find support around the 0.75 mark.

U.K. budget deficit increased in December from last year, data

from the Office for National Statistics showed.

Public sector net borrowing excluding public sector banks

totaled GBP 13.1 billion, an increase of GBP 2.9 billion or 27.8

percent from last year.

Having advanced to a 2-day high of 137.30 against the yen in

Asian deals, the euro eased with pair trading at 136.86. Next key

support for the euro may be located around the 135.6 region.

The Bank of Japan assessed that the Japanese economy is

recovering at a moderate pace, but inflation is likely to slow,

according to the Monthly Report on Recent Economic and Financial

Developments.

Japan's economy has continued to recover moderately as a trend

as the effects of the decline in demand following the sales tax

hike have been waning on the whole, it said.

The euro reversed from an early high of 1.0031 against the Swiss

franc and was trading lower at 0.9930. If the euro slides further,

0.965 is likely seen as its next downside level.

Looking ahead, U.S. weekly jobless claims for the week ended

January 17 and house price index for November are due in the New

York session.

At 10:00 am ET, Eurozone flash consumer sentiment index for

January is to be released.

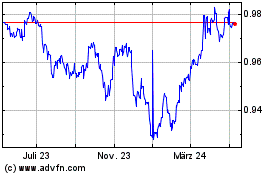

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Apr 2024 bis Mai 2024

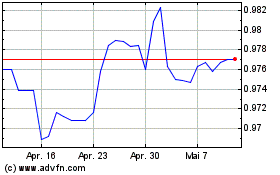

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Mai 2023 bis Mai 2024