Euro Climbs On Risk Appetite

22 Dezember 2014 - 2:01PM

RTTF2

The euro strengthened against its most major rivals on Monday's

European deals, as European markets rose amid rebound in oil prices

and on hopes of further stimulus measures from the European Central

Bank by early next year.

In an interview with La Libre Belgique, ECB governing council

member Luc Coene told that the ECB should step up the purchase of

government bonds, as low inflation could have serious effects on

the behaviour of households and businesses.

"In this context, the purchase of sovereign bonds could prove to

be an effective tool," he added.

Last week, ECB executive board member Benoît Coeuré spurred

hopes of a sovereign QE at the earliest when he told The Wall

Street Journal that it is "not that much of a question on whether

we should do something, but more a discussion on the best way to do

it."

The crude oil has been trading higher after Saudi Oil Minister

Ali Al-Naimi's remarks on Sunday at the 10th Arab Energy Conference

in Abu Dhabi that he's confident the oil market will recover and

fossil fuel will remain the main source of energy for decades to

come.

Blaming the recent fall in oil prices on speculators, he pledged

that Saudi Arabia, the world's largest oil producer, would not cut

production to prop up prices even if non-OPEC nations cut

output.

In economic news, Germany's import prices declined at a

faster-than-expected pace in November, figures from the statistical

office Destatis showed.

The import price index dropped 2.1 percent year-on-year in

November, faster than the 1.2 percent fall registered in the

previous month.

The euro was trading higher at 1.2265 against the greenback, off

early session's low of 1.2219. The next possible resistance for the

euro-greenback pair is seen around the 1.24 zone.

The single currency held firm near early 6-day high of 147.02

against the yen, after having fallen to 145.94 at 7:00 pm ET. The

next likely resistance for the euro-yen pair may be found around

the 148.00 level.

The Bank of Japan turned more upbeat on the economy, the Monthly

Report on Recent Economic and Financial Developments revealed.

Japan's economy has continued to recover moderately as a trend

as the effects of the decline in demand following the sales tax

hike have been waning on the whole, it said.

The European unit drifted up to a 4-day high of 0.7858 against

the pound, following a slide to 0.7816 in early deals. Continuation

of the euro's uptrend may take it to a resistance surrounding the

0.79 mark.

There is no strong case for the Bank of England to boost demand

and prices, Monetary Policy Committee member David Miles said in a

newspaper column on Sunday.

The bank is unlikely to change its path towards higher interest

rates as inflation is likely to remain below the 2 percent target,

he told The Sunday Telegraph.

The euro moved sideways against the franc, with the pair trading

in the 1.2038-1.2027 range. The euro-franc pair was worth 1.2033 at

last week's close.

Looking ahead, Eurozone flash consumer sentiment index for

December and U.S. existing home sales for November are due in the

New York session.

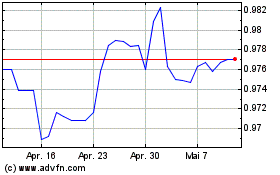

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Apr 2024 bis Mai 2024

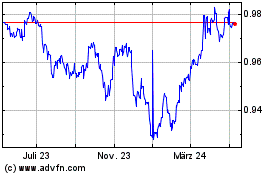

Euro vs CHF (FX:EURCHF)

Forex Chart

Von Mai 2023 bis Mai 2024