Conference Call

Scheduled for 4:30 p.m. EST Today, November 7th

MENLO PARK, Calif., November

7, 2013 -- Geron Corporation (Nasdaq: GERN) today reported

financial results for the third quarter ended September 30,

2013.

For the third quarter of 2013, the company

reported a net loss of $8.3 million, or $0.06 per share, compared

to $16.0 million, or $0.13 per share, for the comparable 2012

period. Net loss for the first nine months of 2013 was $29.1

million, or $0.23 per share, compared to $53.0 million, or $0.42

per share, for the comparable 2012 period. The company ended the

third quarter of 2013 with $67.0 million in cash and

investments.

Revenues for the third quarter of 2013 were

$181,000, compared to $636,000 for the comparable 2012 period.

Revenues for the first nine months of 2013 were $1.1 million,

compared to $2.0 million for the comparable 2012 period. The

decrease in revenues for the three and nine month periods ending

September 30, 2013, compared to the same periods in 2012, primarily

reflects the recognition of a license payment from GE Healthcare

UK, Limited in the third quarter of 2012 and termination of the

company's license agreement with Asia Biotech Corporation in

December 2012. The license agreement with GE Healthcare UK, Limited

was transferred to Asterias Biotherapeutics, Inc. upon the closing

of the divestiture of the company's stem cell assets.

Total operating expenses for the third quarter of

2013 were $8.9 million, compared to $16.5 million for the

comparable 2012 period. Research and development expenses for the

third quarter of 2013 were $5.3 million, compared to $11.7 million

for the comparable 2012 period. General and administrative expenses

for the third quarter of 2013 were $3.5 million, compared to $4.8

million for the comparable 2012 period.

Total operating expenses for the first nine months

of 2013 were $30.7 million, compared to $55.3 million for the

comparable 2012 period. Research and development expenses for the

first nine months of 2013 were $18.1 million, compared to $39.6

million for the comparable 2012 period. General and administrative

expenses for the first nine months of 2013 were $11.6 million,

compared to $15.7 million for the comparable 2012 period.

Operating expenses for the 2013 third quarter and

year-to-date periods also included restructuring charges of

$116,000 and $1.0 million, respectively, related to the company's

decisions in April 2013 to discontinue its discovery research

programs and companion diagnostics program based on telomere

length, as well as close its research laboratory facility and

reduce its workforce.

The decrease in research and development expenses

for the three and nine month periods ending September 30, 2013,

compared to the same periods in 2012, primarily reflects reduced

personnel-related costs resulting from recent restructurings, lower

manufacturing costs for drug products and reduced clinical trial

expenses in connection with the wind-down of the imetelstat trials

in metastatic breast cancer and advanced non-small cell lung cancer

and GRN1005 trials in patients with brain metastases. The decrease

in general and administrative expenses for the three and nine month

periods ending September 30, 2013, compared to the same periods in

2012, primarily reflects reduced personnel-related costs resulting

from recent restructurings, lower costs for consulting services and

reduced costs for legal services associated with the company's

patent portfolio.

Non-cash operating expenses, which primarily

included stock-based compensation and depreciation, were

approximately $1.4 million and $4.6 million for the three and nine

month periods ended September 30, 2013, respectively, compared to

$2.0 million and $6.4 million for the comparable 2012 periods.

Interest and other income for the third quarter of

2013 amounted to $699,000, compared to $140,000 for the comparable

2012 period. Interest and other income for the first nine months of

2013 was $836,000, compared to $481,000 for the comparable 2012

period. The increase in interest and other income for the three and

nine month periods ending September 30, 2013, compared to the same

periods in 2012, primarily reflects a net gain on the sale of

excess laboratory equipment in connection with the closure of the

company's research laboratory facility, partially offset by a

decline in interest income due to lower cash and investment

balances in 2013. The company has not incurred any impairment

charges on its investment portfolio.

Company Events

Investigator-Sponsored Trial in

Myelofibrosis. In November 2012, Dr. Ayalew Tefferi at Mayo

Clinic initiated an investigator-sponsored trial (IST) to evaluate

the safety and efficacy of imetelstat in patients with

myelofibrosis (MF) and to determine an appropriate dose and

schedule for further evaluation. The trial is an open-label study

in patients with primary MF, post-essential thrombocythemia MF or

post-polycythemia vera MF who have two to three risk factors

(intermediate-2) or four or more risk factors (high risk) as

defined by the Dynamic International Prognostic Scoring System Plus

(DIPSS Plus) described by Gangat, et al, in the Journal of Clinical

Oncology (2011). The primary endpoint is overall response rate,

which is defined by the proportion of patients who are classified

as "responders", which means that they have achieved either a

clinical improvement (CI), partial remission (PR) or complete

remission (CR), consistent with the criteria of the 2013

International Working Group for Myeloproliferative Neoplasms

Research and Treatment (IWG-MRT). Secondary endpoints include

reduction of spleen size, improvement in anemia or inducement of

red blood cell transfusion independence, safety and

tolerability.

The investigator has informed Geron that more than

fifty patients have been enrolled in the IST. Enrollment of the

first 11 patients in the first cohort of MF patients (Cohort A) in

which the dose of imetelstat is given once every three weeks was

completed at the end of March 2013 and the pre-specified criteria

in the clinical protocol of at least two responders in the first 11

patients were met to enable expanded enrollment. Enrollment of the

first 11 patients of the second cohort of MF patients (Cohort B)

in which imetelstat was given weekly for four weeks, followed

by one dose every three weeks, was completed in May 2013 and the

pre-specified criteria in the clinical protocol of at least two

responders in the first 11 patients were met to enable expanded

enrollment. In addition, the investigator has informed the company

that enrollment has commenced in additional cohorts to evaluate the

safety and efficacy of imetelstat using different dosing

algorithms, as well as to evaluate imetelstat in different patient

populations, including patients with MF that has transformed into

AML, or blast-phase MF, and certain subpopulations of

myelodysplastic syndromes/myeloproliferative neoplasms (MDS/MPN),

or MDS.

Certain preliminary data from patients enrolled in

Cohort A and Cohort B of the ongoing IST have been selected for

presentation in an oral session at the 55th American Society of

Hematology (ASH) Annual Meeting and Exposition to be held in New

Orleans, Louisiana from December 7-10, 2013. The presentation is

scheduled to occur on Monday, December 9, 2013 at 4:45 p.m. CST.

The preliminary data selected by the investigator was submitted as

an abstract by the investigator to ASH in August 2013.

John A. Scarlett, Geron's Chief Executive Officer

commented, "Pending additional input from regulators, investigators

and other experts, as well as further potential insights from the

ongoing IST, we expect to initiate a Geron-sponsored, multi-center

trial of imetelstat in MF in the first half of 2014."

Completion of Divestiture of

Human Embryonic Stem Cell Assets. On October 1, 2013, the

transaction to divest Geron's human embryonic stem cell assets

pursuant to the terms of the previously announced Asset

Contribution Agreement that was entered into in January 2013 with

BioTime, Inc. and BioTime's subsidiary, Asterias Biotherapeutics,

Inc. (formerly known as BioTime Acquisition Corporation) was

completed.

Conference Call

At 4:30 p.m. EST on November 7, 2013, Geron's

management will host a conference call to discuss the company's

third quarter results and recent events.

Participants can access the conference call live

via telephone by dialing 877-303-9139 (U.S.); 760-536-5195

(international). The passcode is 95357406. A live audio-only

webcast is also available at

http://edge.media-server.com/m/p/a6skpm7i/lan/en. The audio webcast

of the conference call will be available for replay approximately

one hour following the live broadcast through December 8, 2013.

About Geron

Geron is a clinical stage biopharmaceutical

company developing a first-in-class telomerase inhibitor,

imetelstat, in hematologic myeloid malignancies. For more

information about Geron, visit www.geron.com.

Use of Forward-Looking

Statements

Except for the historical information contained

herein, this press release contains forward-looking statements made

pursuant to the "safe harbor" provisions of the Private Securities

Litigation Reform Act of 1995. Investors are cautioned that

statements in this press release regarding Geron's plans or

expectations for or of: (a) initiation or timing of a

Geron-sponsored, multi-center trial of imetelstat in myelofibrosis

and (b) clinical development plans or success of imetelstat,

including imetelstat possibly having applicability for the

treatment of any hematologic myeloid malignancies, including

myelofibrosis, constitute forward-looking statements. These

statements involve risks and uncertainties that can cause actual

results to differ materially from those in such forward-looking

statements. These risks and uncertainties, include without

limitation, those risks and uncertainties inherent in the

development of potential therapeutic products, including without

limitation, that: since the data in the ASH abstract is preliminary

data, additional and updated safety and efficacy data from the IST

and other clinical trials may be negative; institutional review

boards or regulatory agencies may cause delays or prohibit any

clinical trials for imetelstat; there may be a shortage of drug

supply; the company may not have adequate financial resources;

clinical trial collaborators may not be willing to participate in a

clinical trial; there may be critical regulatory, commercial,

competitive, technical or scientific challenges; results from the

IST may not mean that imetelstat has applicability for the

treatment of myelofibrosis or any other hematologic myeloid

malignancies; there may be limitations on freedom to operate

arising from intellectual property of others; and it may not be

possible to protect Geron's intellectual property rights.

Additional information on the above risks and uncertainties and

additional risks, uncertainties and factors that could cause actual

results to differ materially from those in the forward-looking

statements are contained in Geron's periodic reports filed with the

Securities and Exchange Commission under the heading "Risk

Factors," including Geron's quarterly report on Form 10-Q for the

quarter ended September 30, 2013. Undue reliance should not be

placed on forward-looking statements, which speak only as of the

date they are made, and the facts and assumptions underlying the

forward-looking statements may change. Except as required by law,

Geron disclaims any obligation to update these forward-looking

statements to reflect future information, events or

circumstances.

CONTACT:

Anna Krassowska, Ph.D.

Investor and Media Relations

650-473-7765

investor@geron.com

media@geron.com

Financial table follows.

GERON

CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

|

THREE

MONTHS ENDED |

NINE MONTHS

ENDED |

|

SEPTEMBER

30, |

SEPTEMBER

30, |

| (In thousands, except share and per share

data) |

2013 |

2012 |

2013 |

2012 |

|

|

|

|

|

| Revenues: |

|

|

|

|

| License fees and royalties |

$ |

181 |

$ |

636 |

$ |

1,058 |

$ |

2,020 |

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Research and development |

|

5,338 |

|

11,684 |

|

18,066 |

|

39,568 |

| Restructuring charges |

|

116 |

|

- |

|

1,032 |

|

- |

| General and administrative |

|

3,460 |

|

4,829 |

|

11,643 |

|

15,726 |

| Total operating expenses |

|

8,914 |

|

16,513 |

|

30,741 |

|

55,294 |

| Loss from operations |

|

(8,733) |

|

(15,877) |

|

(29,683) |

|

(53,274) |

|

|

|

|

|

|

|

|

|

| Unrealized loss on derivatives |

|

(208) |

|

(44) |

|

(207) |

|

(10) |

| Interest and other income |

|

699 |

|

140 |

|

836 |

|

481 |

| Interest and other expense |

|

(12) |

|

(172) |

|

(44) |

|

(215) |

| Net loss |

$ |

(8,254) |

|

(15,953) |

$ |

(29,098) |

$ |

(53,018) |

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per share |

$ |

(0.06) |

$ |

(0.13) |

$ |

$(0.23) |

$ |

(0.42) |

|

|

|

|

|

|

|

|

|

| Shares used in computing basic and diluted net |

|

|

|

|

|

|

|

|

| loss per share |

|

128,293,074 |

|

127,236,993 |

|

128,146,333 |

|

126,833,916 |

CONDENSED

CONSOLIDATED BALANCE SHEETS

| (In thousands) |

SEPTEMBER

30, |

DECEMBER

31, |

|

2013 |

2012 |

|

(Unaudited) |

(Note

1) |

|

|

|

| Current assets: |

|

|

| Cash, restricted cash and cash equivalents |

$ |

10,386 |

$ |

22,857 |

| Marketable securities |

|

56,617 |

|

73,472 |

| Other current assets |

|

1,399 |

|

2,088 |

| Total current assets |

|

68,402 |

|

98,417 |

|

|

|

|

|

| Property and equipment, net |

|

116 |

|

974 |

| Deposits and other assets |

|

195 |

|

410 |

|

$ |

68,713 |

$ |

99,801 |

|

|

|

|

|

| Current liabilities |

$ |

6,837 |

$ |

14,148 |

| Stockholders' equity |

|

61,876 |

|

85,653 |

|

$ |

68,713 |

$ |

99,801 |

Note 1:

Derived from audited financial statements

included in the company's Annual Report on Form 10-K for the year

ended December 31, 2012.

###

This

announcement is distributed by Thomson Reuters on behalf of Thomson

Reuters clients.

The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the

information contained therein.

Source: Geron Corp. via Thomson Reuters ONE

HUG#1741337

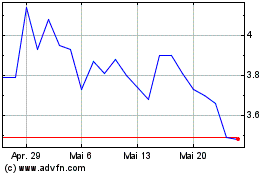

Geron (NASDAQ:GERN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Geron (NASDAQ:GERN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024