Richland Resources Ltd Quarterly Operational and Sales Update (6123C)

19 Oktober 2015 - 8:00AM

UK Regulatory

TIDMRLD

RNS Number : 6123C

Richland Resources Ltd

19 October 2015

19 October 2015

Richland Resources Ltd

("Richland" or "the Company") (AIM: RLD)

Quarterly Operational and Sales Update

Richland Resources Ltd, the gemstones producer and developer,

today announces its quarterly operational, sales and market update

for Q3 2015. All figures are unaudited.

Highlights

-- Approximately 156,000 carats, larger than 4mm, produced

during Q3 2015 as part of production start-up and ramp-up

process

-- 21,628 tonnes of sapphire bearing alluvials mined and processed

-- Economical cut-off size currenty set at 4mm and material

smaller than 4mm in diameter is stock-piled for future sorting and

grading

-- Average grade of 7 carats per tonnes achieved for mined material larger than 4mm

-- Current estimated cash cost per carat of less than US$3 / carat

-- First sapphire parcel sale concluded in September

o 1,200 carats sold at US$14.30 per carat

Post-period Summary

-- Q4 production target set at 250,000 carats

-- Size and colour sorting as well as quality grading of the

material mined during Q3 currently being completed in preparation

for larger and ongoing parcel sales process

Commenting on the results, Chief Executive Officer, Bernard

Olivier said: "I am pleased with the progress achieved during Q3

with over 150k carats produced of which more than half was produced

in September following extensive work and modifications to the

processing plant. We also achieved our first sapphire parcel sale.

It should be noted that the parcel sold during late September at

US$14.3 / carat was a customer specific parcel and does not

represent run-of-mine material. Our sales strategy currently

focuses on customer specific parcels to ensure that we get as much

down-stream commitments and market penetration as possible for our

material and I look forward to commenting in the coming weeks on

further progress on the sales and marketing process. We continue to

keep a tight control on costs as evident from the estimated total

cash cost per carat of less than $3 / carat."

For more information please contact:

Bernard Olivier Edward Nealon Mike Allardice

Chief Executive Officer Chairman Group Company secretary

+61 4089 48182 +61 409 969 955 +852 91 864 854

------------------------- ------------------------ -------------------------

Laurence Read Nominated Advisor (AIM) Broker (AIM)

Corporate Development RFC Ambrian Limited Shore Capital

and Communications Samantha Harrison Jerry Keen (corporate

Officer +44 (0) 20 7634 4700 broking)

+44 (0)20 3289 9923 Toby Gibbs / Mark Percy

(corporate finance)

+44 (0) 20 7408 4090

------------------------- ------------------------ -------------------------

Notes to the Editor:

Further information is available on the Company's website:

www.richlandresourcesltd.com. Neither the contents of the Company's

website nor the contents of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this announcement.

Production and Sales

Richland's wholly owned subsidiary, Capricorn Sapphire Pty Ltd

("Capricorn"), achieved sapphire production totalling approximately

156,000 carats in the third quarter of 2015 as part of the mine

start-up and ramp-up process. 21,628 tonnes of sapphire-bearing

alluvial gravels were extracted and processed at an average grade

of approximately 7 carats per tonne. All concentrate smaller than

4mm are not currently deemed economical and are therefore

stockpiled for future sorting and grading. All production figures

and cost calculation are therefore based on material larger than

4mm.

All mined material needs to undergo detailed sorting and grading

into various size, colour and quality fractions before it can be

incorporated into a parcel that is available for sale and the

process can create a delay between mining and sales. During the

last week of September the first parcel of sapphires mined during

the quarter, weighing 1200 carats were sold at US$14.3 / carat. The

Company also achieved approximately US$39,828 of revenues for the

third quarter from its online retail division

(richlandgemstones.com).

The average cash-cost per carat for September, which represents

the first full month of uninterrupted production, is estimated at

less than US$3 / carat.

Post Period

The Company has set an internal production target of 250,000

carats for Q4 as part of the mine ramp-up process. The sorting and

grading of material mined during Q3 is currently being completed

and various customer specific parcels are ready for the sales

process, which is currently ongoing.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGBBDGSXBBGUC

(END) Dow Jones Newswires

October 19, 2015 02:00 ET (06:00 GMT)

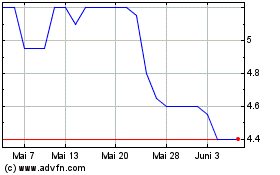

Lexington Gold (LSE:LEX)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

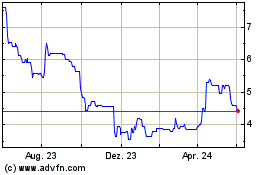

Lexington Gold (LSE:LEX)

Historical Stock Chart

Von Jun 2023 bis Jun 2024