Competent Person's Report

28 Oktober 2010 - 8:00AM

UK Regulatory

TIDMCHAR

RNS Number : 1288V

Chariot Oil & Gas Ld

28 October 2010

For immediate release

28 October 2010

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

CPR confirms Chariot's estimate of gross mean prospective resource volumes

Chariot Oil & Gas Limited (AIM: CHAR), the Africa focused oil and gas

exploration company, is pleased to announce the results from its independent

Competent Person's Report ("CPR") from Netherland Sewell & Associates Inc.

("NSAI") which reports a gross P50 unrisked prospective resource volumes of 9.03

billion barrels with a gross mean unrisked prospective resource volumes of 10.08

billion barrels for its 4 licences offshore Namibia. This compares with and

supports Chariot's internal gross mean unrisked prospective resource figure of

10.06 billion barrels, as announced in its resource update on 6 September 2010.

Highlights:

· Gross mean risked resource potential of 1.13 billion bbls (Net to Chariot

- 0.85 billion bbls)

· Chariot determines an Expected Monetary Value ("EMV") of GBP4.6 billion

(P50) - corresponding to GBP5.98/bbl (US$9.27/bbl) per net risked bbl

· Probabilities of Success marginally higher - average up from 10.7% to

11.3%

· Underpins investment case and supports the excellent work undertaken by

Chariot's in-house technical team

The CPR was independently compiled by industry specialist Netherland Sewell &

Associates Inc. and this corroboration of volume potential is both a strong

endorsement of work undertaken by Chariot to date and underscores the

significant value held within the Company's licence areas. NSAI performed

evaluation work on the original CPR undertaken for Chariot at the time of its

admission to trading on AIM in May 2008 and is highly regarded in its field for

work of this nature.

As part of the new CPR, NSAI undertook a geologic risk assessment on the 11

prospects and 6 lead inventory as identified by Chariot and conducted an

independent review of the individual prospect and lead risking. NSAI's risking

was slightly improved from the Chariot risking in that the average Probabilities

of Success increased from 10.7% to 11.3%. In addition, NSAI commented "Chariot

is currently conducting 3-D seismic analysis, and we believe the results of this

analysis may further reduce prospect risk". The results of this analysis are

expected to be completed during the 4th Qtr of 2010.

On receiving the report, the Company has calculated a total risked EMV of GBP4.6

billion, equivalent to GBP5.98 / bbl (US$9.27/bbl). This is the first time that

an EMV has been placed on the assets to date.

As noted in the NSAI report, "Chariot's technical evaluation and documentation

are comprehensive and high quality," and it is a testament to the work that has

been undertaken to date that resource figures similar to Chariot's own

calculations were generated by a third party. Please see table below for a

breakdown of the key figures from the CPR.

Paul Welch, CEO of Chariot commented:

"I am delighted to report that the CPR has confirmed our previous resource

estimates and has also provided a representative value for our assets. The

validation of our resource potential not only consolidates our investment case

but is also indicative of the excellent work carried out by our in-house

technical team. The risking and subsequent value that is now attributable to our

assets underpins our conviction that Chariot continues to offer huge upside

potential."

+---------------+----------+----------+----------+--------+------+----------+--------+

| | Unrisked Gross (100 Percent) | | Prospective |

| | Prospective Oil Resources | | Post-Tax |

| | (MMBBL) | | Cash Flow(2) |

| | | | Discounted |

| | | | at 10%(MM$) |

+---------------+-----------------------------------------+------+-------------------+

| Licence Area | Low | Best | High | Mean | Pg |Unrisked |Risked |

| / |Estimate |Estimate |Estimate | (1) | % | | |

| Prospect or | | | | | | | |

| Lead | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Northern | | | | | | | |

| Licences | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Tapir North | 166 | 278 | 451 | 294 | 14 | 2,725 | 382 |

| Prospect | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Tapir | 89 | 139 | 211 | 146 | 14 | 964 | 135 |

| Prospect | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Tapir South | 122 | 190 | 277 | 196 | 14 | 1,830 | 256 |

| Prospect | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Tapir South | 83 | 175 | 319 | 190 | 12 | 1,402 | 168 |

| Fan Prospect | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Zamba North | 53 | 91 | 141 | 95 | 12 | 711 | 85 |

| Prospect | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Tapir | 180 | 296 | 449 | 306 | 12 | 2,877 | 345 |

| Northeast | | | | | | | |

| Lead | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Zamba Lead | 350 | 667 | 1,145 | 713 | 15 | 6,862 | 1,029 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Total - | 1,043 | 1,836 | 2,993 | 1,940 | | | |

| Northern | | | | | | | |

| Licences | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Southern | | | | | | | |

| Licences | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| A Prospect | 126 | 215 | 339 | 225 | 16 | 2,292 | 367 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| B Prospect | 197 | 301 | 448 | 313 | 16 | 3,168 | 507 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| C Prospect | 149 | 326 | 620 | 361 | 16 | 3,312 | 530 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| G Prospect | 394 | 712 | 1,192 | 759 | 16 | 7,661 | 1,226 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| H Prospect | 273 | 450 | 714 | 475 | 16 | 4,891 | 783 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| K Prospect | 248 | 518 | 979 | 571 | 16 | 5,438 | 870 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| C | 321 | 942 | 2,153 | 1,118 | 12 | 10,397 | 1,248 |

| Stratigraphic | | | | | | | |

| Lead | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Total - | 1,709 | 3,465 | 6,445 | 3,821 | | | |

| Southern | | | | | | | |

| Licences | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Central | | | | | | | |

| Licences (3) | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Hartebeest | 502 | 1,489 | 3,287 | 1,720 | 7 | 15,491 | 1,084 |

| Lead | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Klipspringer | 587 | 1,772 | 3,916 | 2,055 | 7 | 17,770 | 1,244 |

| Lead | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Oryx Lead | 157 | 467 | 1,025 | 543 | 6 | 4,625 | 278 |

+---------------+----------+----------+----------+--------+------+----------+--------+

| | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| Total Central | 1,246 | 3,728 | 8,228 | 4,318 | | | |

| Licences | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| | | | | | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

| TOTAL: | 3,998 | 9,028 | 17,666 |10,079 | | | |

+---------------+----------+----------+----------+--------+------+----------+--------+

Totals are the arithmetic sum of multiple probability distributions and may not

add up because of rounding.

(1) Mean values are reported in addition to the low, best and high estimates

for each prospect and lead.

(2) NSAI have not summed post-tax cash flows because of the expected

interdependence of prospects and leads.

(3) Leads in the Central Licences were assessed with 2D seismic data only; all

other prospects and leads were assessed with 3D seismic data.

The resources in the report were estimated using a combination of deterministic

and probabilistic methods and are dependent on a petroleum discovery being made.

These estimates were prepared in accordance with generally accepted petroleum

engineering and evaluation principles and in accordance with the 2007 PRMS

definitions and guidelines as approved by the SPE.

QUALIFIED PERSON

Martin Richards, Chariot's Chief Reservoir Engineer, is the

qualified person for the purpose of this release. Martin has worked in the oil

and gas industry for over 30 years and has an in-depth experience of all aspects

of subsurface management, reservoir engineering and petroleum economics. He has

an MA in Physics from Oxford University, an MSc in Geophysics and Planetary

Physics from Newcastle University and an MEng in Petroleum Engineering from

Heriot-Watt University. He has read and approved the technical disclosures in

this announcement.

+-----------------------------------------------------------------------------+----------+

| For further information please contact: | |

| | |

+-----------------------------------------------------------------------------+----------+

| Chariot Oil & Gas Limited +44 (0)20 7318 0450 | |

| Paul Welch, CEO | |

| +44 (0)20 7634 4856 | |

| Ambrian Partners Limited (Joint | |

| Broker and NOMAD) | |

| Richard Swindells | |

| RBC Capital Markets (Joint Broker) +44 | |

| Josh Critchley, Martin Eales (0)20 7653 4000 | |

| Buchanan Communications +44 (0)20 7466 5000 | |

| Bobby Morse, Ben Romney, Chris | |

| McMahon | |

| | |

+-----------------------------------------------------------------------------+----------+

NOTES TO EDITORS

About Chariot

Chariot Oil & Gas Limited is an independent oil and gas exploration group. The

Group currently holds licences covering eight blocks in Namibia, all of which

are offshore. All of these blocks are currently in the exploration phase.

Shares in Chariot Oil & Gas limited are admitted to trading on the AIM Market of

the London Stock Exchange under the symbol 'CHAR'.

Neither the contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDDLFLBBFBFBX

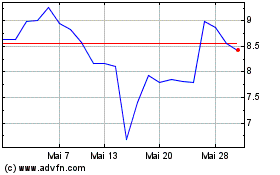

Chariot (LSE:CHAR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Chariot (LSE:CHAR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024