Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 November 2023 - 7:10PM

Edgar (US Regulatory)

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

September 30, 2023

(Unaudited)

Principal

Value

(Local

Currency)

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

(US Dollars)

|

| FOREIGN SOVEREIGN BONDS AND NOTES (a) – 73.3%

|

|

|

| Angola – 1.6%

|

|

|

|

|

|

|

| 1,444,000

|

| Angolan Government International Bond (USD) (b)

|

| 9.13%

|

| 11/26/49

|

| $1,038,118

|

|

|

| Argentina – 1.7%

|

|

|

|

|

|

|

| 383,926

|

| Argentine Republic Government International Bond (USD)

|

| 1.00%

|

| 07/09/29

|

| 107,500

|

| 385,881

|

| Argentine Republic Government International Bond (USD) (c)

|

| 0.75%

|

| 07/09/30

|

| 110,683

|

| 2,949,672

|

| Argentine Republic Government International Bond (USD) (c)

|

| 3.63%

|

| 07/09/35

|

| 734,927

|

| 543,200

|

| Argentine Republic Government International Bond (USD) (c)

|

| 4.25%

|

| 01/09/38

|

| 160,450

|

|

|

|

|

| 1,113,560

|

|

|

| Australia – 5.6%

|

|

|

|

|

|

|

| 7,000,000

|

| Treasury Corp. of Victoria (AUD)

|

| 1.50%

|

| 11/20/30

|

| 3,630,300

|

|

|

| Bahrain – 1.6%

|

|

|

|

|

|

|

| 700,000

|

| Bahrain Government International Bond (USD) (d)

|

| 4.25%

|

| 01/25/28

|

| 642,250

|

| 510,000

|

| Bahrain Government International Bond (USD) (b)

|

| 6.25%

|

| 01/25/51

|

| 391,606

|

|

|

|

|

| 1,033,856

|

|

|

| Brazil – 8.7%

|

|

|

|

|

|

|

| 5,079,000

|

| Brazil Notas do Tesouro Nacional, Series F (BRL)

|

| 10.00%

|

| 01/01/27

|

| 989,806

|

| 24,870,000

|

| Brazil Notas do Tesouro Nacional, Series F (BRL)

|

| 10.00%

|

| 01/01/29

|

| 4,717,131

|

|

|

|

|

| 5,706,937

|

|

|

| Canada – 1.2%

|

|

|

|

|

|

|

| 1,251,000

|

| CPPIB Capital, Inc. (CAD) (b)

|

| 1.95%

|

| 09/30/29

|

| 792,130

|

|

|

| Colombia – 1.8%

|

|

|

|

|

|

|

| 6,025,900,000

|

| Colombian TES (COP)

|

| 9.25%

|

| 05/28/42

|

| 1,175,370

|

|

|

| Dominican Republic – 1.6%

|

|

|

|

|

|

|

| 359,000

|

| Dominican Republic International Bond (USD) (d)

|

| 5.50%

|

| 02/22/29

|

| 329,442

|

| 25,050,000

|

| Dominican Republic International Bond (DOP) (d)

|

| 11.25%

|

| 09/15/35

|

| 456,055

|

| 340,000

|

| Dominican Republic International Bond (USD) (b)

|

| 5.88%

|

| 01/30/60

|

| 244,674

|

|

|

|

|

| 1,030,171

|

|

|

| Ecuador – 1.8%

|

|

|

|

|

|

|

| 3,169,400

|

| Ecuador Government International Bond (USD) (b) (c)

|

| 3.50%

|

| 07/31/35

|

| 1,186,353

|

|

|

| Egypt – 1.7%

|

|

|

|

|

|

|

| 1,223,000

|

| Egypt Government International Bond (USD) (d)

|

| 8.50%

|

| 01/31/47

|

| 656,298

|

| 928,000

|

| Egypt Government International Bond (USD) (b)

|

| 7.90%

|

| 02/21/48

|

| 478,152

|

|

|

|

|

| 1,134,450

|

|

|

| Georgia – 0.6%

|

|

|

|

|

|

|

| 418,000

|

| Georgia Government International Bond (USD) (d)

|

| 2.75%

|

| 04/22/26

|

| 373,961

|

|

|

| Ghana – 0.5%

|

|

|

|

|

|

|

| 662,000

|

| Ghana Government International Bond (USD) (b)

|

| 7.63%

|

| 05/16/29

|

| 295,101

|

|

|

| Hungary – 1.9%

|

|

|

|

|

|

|

| 243,430,000

|

| Hungary Government Bond (HUF)

|

| 2.50%

|

| 10/24/24

|

| 621,409

|

| 269,970,000

|

| Hungary Government Bond (HUF)

|

| 3.00%

|

| 10/27/27

|

| 617,965

|

|

|

|

|

| 1,239,374

|

|

|

| Indonesia – 0.4%

|

|

|

|

|

|

|

| 3,259,000,000

|

| Indonesia Treasury Bond (IDR)

|

| 8.38%

|

| 03/15/34

|

| 235,281

|

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

Principal

Value

(Local

Currency)

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

(US Dollars)

|

| FOREIGN SOVEREIGN BONDS AND NOTES (a) (Continued)

|

|

|

| Iraq – 1.3%

|

|

|

|

|

|

|

| 909,563

|

| Iraq International Bond (USD) (b)

|

| 5.80%

|

| 01/15/28

|

| $843,490

|

|

|

| Ivory Coast – 1.0%

|

|

|

|

|

|

|

| 919,000

|

| Ivory Coast Government International Bond (EUR) (b)

|

| 6.63%

|

| 03/22/48

|

| 670,695

|

|

|

| Kenya – 0.9%

|

|

|

|

|

|

|

| 873,000

|

| Republic of Kenya Government International Bond (USD) (b)

|

| 8.25%

|

| 02/28/48

|

| 597,062

|

|

|

| Malaysia – 2.1%

|

|

|

|

|

|

|

| 6,499,000

|

| Malaysia Government Bond (MYR)

|

| 3.89%

|

| 03/15/27

|

| 1,393,055

|

|

|

| Mexico – 8.6%

|

|

|

|

|

|

|

| 20,000,000

|

| Mexican Bonos (MXN)

|

| 10.00%

|

| 12/05/24

|

| 1,134,404

|

| 61,423,900

|

| Mexican Bonos (MXN)

|

| 5.75%

|

| 03/05/26

|

| 3,163,509

|

| 28,833,400

|

| Mexican Bonos (MXN)

|

| 7.75%

|

| 11/13/42

|

| 1,333,508

|

|

|

|

|

| 5,631,421

|

|

|

| Morocco – 0.9%

|

|

|

|

|

|

|

| 665,000

|

| Morocco Government International Bond (USD) (b)

|

| 2.38%

|

| 12/15/27

|

| 573,217

|

|

|

| New Zealand – 4.6%

|

|

|

|

|

|

|

| 3,708,000

|

| New Zealand Government Bond (NZD)

|

| 0.50%

|

| 05/15/24

|

| 2,152,113

|

| 2,337,000

|

| New Zealand Government Bond (NZD)

|

| 2.75%

|

| 05/15/51

|

| 854,319

|

|

|

|

|

| 3,006,432

|

|

|

| Nigeria – 0.7%

|

|

|

|

|

|

|

| 634,000

|

| Nigeria Government International Bond (USD) (d)

|

| 7.63%

|

| 11/28/47

|

| 424,153

|

|

|

| Oman – 2.3%

|

|

|

|

|

|

|

| 1,590,000

|

| Oman Government International Bond (USD) (d)

|

| 7.00%

|

| 01/25/51

|

| 1,503,180

|

|

|

| Peru – 3.3%

|

|

|

|

|

|

|

| 8,575,000

|

| Peruvian Government International Bond (PEN) (b)

|

| 6.90%

|

| 08/12/37

|

| 2,156,367

|

|

|

| Poland – 3.3%

|

|

|

|

|

|

|

| 12,836,000

|

| Republic of Poland Government Bond (PLN)

|

| 1.75%

|

| 04/25/32

|

| 2,146,125

|

|

|

| Qatar – 2.2%

|

|

|

|

|

|

|

| 1,733,000

|

| Qatar Government International Bond (USD) (b)

|

| 4.40%

|

| 04/16/50

|

| 1,418,055

|

|

|

| Rwanda – 0.6%

|

|

|

|

|

|

|

| 532,000

|

| Rwanda International Government Bond (USD) (d)

|

| 5.50%

|

| 08/09/31

|

| 415,234

|

|

|

| Saudi Arabia – 1.1%

|

|

|

|

|

|

|

| 745,000

|

| Saudi Government International Bond (USD) (d)

|

| 4.38%

|

| 04/16/29

|

| 711,374

|

|

|

| South Africa – 2.2%

|

|

|

|

|

|

|

| 37,211,600

|

| Republic of South Africa Government Bond (ZAR)

|

| 9.00%

|

| 01/31/40

|

| 1,450,827

|

|

|

| Turkey – 2.8%

|

|

|

|

|

|

|

| 1,817,000

|

| Turkey Government International Bond (USD)

|

| 9.38%

|

| 01/19/33

|

| 1,854,550

|

|

|

| Ukraine – 0.3%

|

|

|

|

|

|

|

| 572,000

|

| Ukraine Government International Bond (USD) (b)

|

| 7.75%

|

| 09/01/29

|

| 165,039

|

|

|

| United Kingdom – 2.7%

|

|

|

|

|

|

|

| 1,458,500

|

| United Kingdom Gilt (GBP) (b)

|

| 4.25%

|

| 06/07/32

|

| 1,770,885

|

|

|

| Uruguay – 1.0%

|

|

|

|

|

|

|

| 24,994,821

|

| Uruguay Government International Bond (UYU)

|

| 4.38%

|

| 12/15/28

|

| 682,226

|

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

Principal

Value

(Local

Currency)

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

(US Dollars)

|

| FOREIGN SOVEREIGN BONDS AND NOTES (a) (Continued)

|

|

|

| Uzbekistan – 0.7%

|

|

|

|

|

|

|

| 300,000

|

| National Bank of Uzbekistan (USD) (b)

|

| 4.85%

|

| 10/21/25

|

| $280,950

|

| 260,000

|

| Republic of Uzbekistan International Bond (USD) (d)

|

| 3.70%

|

| 11/25/30

|

| 203,734

|

|

|

|

|

| 484,684

|

|

|

| Total Foreign Sovereign Bonds and Notes

|

| 47,883,033

|

|

|

| (Cost $54,430,288)

|

|

|

|

|

|

|

| FOREIGN CORPORATE BONDS AND NOTES (a) (e) – 30.3%

|

|

|

| Barbados – 0.5%

|

|

|

|

|

|

|

| 337,000

|

| Sagicor Financial Co., Ltd. (USD) (d)

|

| 5.30%

|

| 05/13/28

|

| 316,854

|

|

|

| Brazil – 2.4%

|

|

|

|

|

|

|

| 440,000

|

| Banco do Brasil S.A. (USD) (b) (f)

|

| 6.25%

|

| (g)

|

| 407,037

|

| 228,000

|

| BRF S.A. (USD) (d)

|

| 5.75%

|

| 09/21/50

|

| 153,029

|

| 387,306

|

| Guara Norte Sarl (USD) (d)

|

| 5.20%

|

| 06/15/34

|

| 330,013

|

| 500,000

|

| Itau Unibanco Holding S.A. (USD) (b) (f)

|

| 4.63%

|

| (g)

|

| 411,149

|

| 291,000

|

| Minerva Luxembourg S.A. (USD) (d)

|

| 8.88%

|

| 09/13/33

|

| 289,187

|

| 1,550,000

|

| OAS Finance Ltd. (USD) (f) (h) (i) (j)

|

| 8.88%

|

| (g)

|

| 11,625

|

| 460,000

|

| OAS Investments GmbH (USD) (h) (i) (j)

|

| 8.25%

|

| 10/19/19

|

| 3,450

|

|

|

|

|

| 1,605,490

|

|

|

| Chile – 0.6%

|

|

|

|

|

|

|

| 468,000

|

| Empresa Nacional del Petroleo (USD) (d)

|

| 3.45%

|

| 09/16/31

|

| 375,086

|

|

|

| China – 1.3%

|

|

|

|

|

|

|

| 888,000

|

| Huarong Finance II Co., Ltd. (USD) (b)

|

| 5.50%

|

| 01/16/25

|

| 838,050

|

|

|

| Colombia – 2.2%

|

|

|

|

|

|

|

| 831,000

|

| Ecopetrol S.A. (USD)

|

| 5.38%

|

| 06/26/26

|

| 798,666

|

| 218,000

|

| Ecopetrol S.A. (USD)

|

| 8.88%

|

| 01/13/33

|

| 213,109

|

| 600,000

|

| Empresas Publicas de Medellin ESP (USD) (b)

|

| 4.38%

|

| 02/15/31

|

| 461,144

|

|

|

|

|

| 1,472,919

|

|

|

| Dominican Republic – 0.7%

|

|

|

|

|

|

|

| 491,000

|

| AES Espana BV (USD) (d)

|

| 5.70%

|

| 05/04/28

|

| 439,117

|

|

|

| Ecuador – 0.7%

|

|

|

|

|

|

|

| 465,770

|

| International Airport Finance S.A. (USD) (d)

|

| 12.00%

|

| 03/15/33

|

| 441,168

|

|

|

| Georgia – 0.5%

|

|

|

|

|

|

|

| 345,000

|

| Georgian Railway JSC (USD) (b)

|

| 4.00%

|

| 06/17/28

|

| 302,043

|

|

|

| Ghana – 1.1%

|

|

|

|

|

|

|

| 900,000

|

| Tullow Oil PLC (USD) (b)

|

| 7.00%

|

| 03/01/25

|

| 696,177

|

|

|

| India – 2.9%

|

|

|

|

|

|

|

| 160,000,000

|

| HDFC Bank Ltd. (INR) (b)

|

| 8.10%

|

| 03/22/25

|

| 1,909,295

|

|

|

| Israel – 1.4%

|

|

|

|

|

|

|

| 311,000

|

| Energean Israel Finance Ltd. (USD) (b) (d)

|

| 8.50%

|

| 09/30/33

|

| 310,767

|

| 600,000

|

| Teva Pharmaceutical Finance Netherlands III B.V. (USD)

|

| 7.13%

|

| 01/31/25

|

| 602,692

|

|

|

|

|

| 913,459

|

|

|

| Kazakhstan – 0.9%

|

|

|

|

|

|

|

| 806,000

|

| KazMunayGas National Co. JSC (USD) (b)

|

| 5.75%

|

| 04/19/47

|

| 628,487

|

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

Principal

Value

(Local

Currency)

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

(US Dollars)

|

| FOREIGN CORPORATE BONDS AND NOTES (a) (e) (Continued)

|

|

|

| Mexico – 3.4%

|

|

|

|

|

|

|

| 400,000

|

| BBVA Bancomer S.A. (USD) (b) (f)

|

| 5.13%

|

| 01/18/33

|

| $344,724

|

| 237,000

|

| Braskem Idesa S.A.P.I. (USD) (d)

|

| 6.99%

|

| 02/20/32

|

| 142,728

|

| 225,000

|

| Cemex SAB de CV (USD) (d) (f)

|

| 9.13%

|

| (g)

|

| 234,507

|

| 22,160,000

|

| Petroleos Mexicanos (MXN) (b)

|

| 7.19%

|

| 09/12/24

|

| 1,194,396

|

| 350,000

|

| Sixsigma Networks Mexico SA de CV (USD) (d)

|

| 7.50%

|

| 05/02/25

|

| 308,092

|

|

|

|

|

| 2,224,447

|

|

|

| Nigeria – 2.2%

|

|

|

|

|

|

|

| 526,000

|

| Access Bank PLC (USD) (d)

|

| 6.13%

|

| 09/21/26

|

| 447,337

|

| 464,000

|

| BOI Finance BV (EUR) (d)

|

| 7.50%

|

| 02/16/27

|

| 416,868

|

| 270,000

|

| IHS Netherlands Holdco BV (USD) (d)

|

| 8.00%

|

| 09/18/27

|

| 227,216

|

| 400,000

|

| SEPLAT Energy PLC (USD) (d)

|

| 7.75%

|

| 04/01/26

|

| 342,180

|

|

|

|

|

| 1,433,601

|

|

|

| Oman – 1.0%

|

|

|

|

|

|

|

| 250,000

|

| EDO Sukuk Ltd. (USD) (d)

|

| 5.88%

|

| 09/21/33

|

| 247,305

|

| 400,000

|

| Oryx Funding Ltd. (USD) (d)

|

| 5.80%

|

| 02/03/31

|

| 381,676

|

|

|

|

|

| 628,981

|

|

|

| Peru – 0.5%

|

|

|

|

|

|

|

| 522,000

|

| Petroleos del Peru S.A. (USD) (d)

|

| 5.63%

|

| 06/19/47

|

| 316,004

|

|

|

| Russia – 0.0%

|

|

|

|

|

|

|

| 500,000

|

| Sovcombank Via SovCom Capital DAC (USD) (f) (h)

|

| 7.75%

|

| (g)

|

| 9,700

|

|

|

| Singapore – 0.7%

|

|

|

|

|

|

|

| 520,000

|

| Puma International Financing S.A. (USD) (b)

|

| 5.00%

|

| 01/24/26

|

| 475,277

|

|

|

| South Africa – 2.6%

|

|

|

|

|

|

|

| 530,000

|

| Eskom Holdings SOC Ltd. (USD) (b)

|

| 7.13%

|

| 02/11/25

|

| 518,030

|

| 43,650,000

|

| Eskom Holdings SOC Ltd. (ZAR)

|

| (k)

|

| 12/31/32

|

| 494,892

|

| 400,000

|

| Liquid Telecommunications Financing PLC (USD) (d)

|

| 5.50%

|

| 09/04/26

|

| 257,634

|

| 300,000

|

| Sasol Financing USA LLC (USD)

|

| 6.50%

|

| 09/27/28

|

| 268,473

|

| 200,000

|

| Transnet SOC Ltd. (USD) (d)

|

| 8.25%

|

| 02/06/28

|

| 191,974

|

|

|

|

|

| 1,731,003

|

|

|

| Tanzania – 0.7%

|

|

|

|

|

|

|

| 452,000

|

| HTA Group Ltd. (USD) (d)

|

| 7.00%

|

| 12/18/25

|

| 436,553

|

|

|

| Trinidad And Tobago – 1.0%

|

|

|

|

|

|

|

| 632,000

|

| Heritage Petroleum Co., Ltd. (USD) (d)

|

| 9.00%

|

| 08/12/29

|

| 656,648

|

|

|

| Turkey – 0.5%

|

|

|

|

|

|

|

| 352,000

|

| We Soda Investments Holdings PLC (USD) (d)

|

| 9.50%

|

| 10/06/28

|

| 355,520

|

|

|

| Ukraine – 1.6%

|

|

|

|

|

|

|

| 467,000

|

| Kernel Holding S.A. (USD) (d)

|

| 6.75%

|

| 10/27/27

|

| 287,586

|

| 567,000

|

| MHP Lux S.A. (USD) (b)

|

| 6.95%

|

| 04/03/26

|

| 389,926

|

| 453,000

|

| NPC Ukrenergo (USD) (d)

|

| 6.88%

|

| 11/09/28

|

| 127,973

|

| 460,000

|

| Ukraine Railways Via Rail Capital Markets PLC (USD) (b)

|

| 8.25%

|

| 07/09/26

|

| 228,039

|

|

|

|

|

| 1,033,524

|

|

|

| Zambia – 0.9%

|

|

|

|

|

|

|

| 291,000

|

| First Quantum Minerals Ltd. (USD) (b)

|

| 7.50%

|

| 04/01/25

|

| 290,817

|

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

Principal

Value

(Local

Currency)

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

(US Dollars)

|

| FOREIGN CORPORATE BONDS AND NOTES (a) (e) (Continued)

|

|

|

| Zambia (Continued)

|

|

|

|

|

|

|

| 285,000

|

| First Quantum Minerals Ltd. (USD) (d)

|

| 8.63%

|

| 06/01/31

|

| $283,983

|

|

|

|

|

| 574,800

|

|

|

| Total Foreign Corporate Bonds and Notes

|

| 19,814,203

|

|

|

| (Cost $24,767,375)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CORPORATE BONDS AND NOTES (a) – 0.9%

|

|

|

| United States – 0.9%

|

|

|

|

|

|

|

| 24,587,000

|

| JPMorgan Chase Bank, N.A. (UAH) (d)

|

| 11.67%

|

| 11/27/23

|

| 549,125

|

|

|

| (Cost $930,663)

|

|

|

|

|

|

|

Principal

Value

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

|

| U.S. GOVERNMENT BONDS AND NOTES (a) – 18.8%

|

| $2,783,500

|

| United States Treasury Note

|

| 2.75%

|

| 07/31/27

|

| 2,593,330

|

| 9,432,200

|

| United States Treasury Note

|

| 2.38%

|

| 05/15/29

|

| 8,384,342

|

| 2,038,500

|

| United States Treasury Note

|

| 2.38%

|

| 05/15/51

|

| 1,293,333

|

|

|

| Total U.S. Government Bonds and Notes

|

| 12,271,005

|

|

|

| (Cost $14,079,013)

|

|

|

|

|

|

|

|

| Total Investments – 123.3%

| 80,517,366

|

|

| (Cost $94,207,339)

|

|

|

| Outstanding Loan – (25.4)%

| (16,600,000)

|

|

| Net Other Assets and Liabilities – 2.1%

| 1,391,598

|

|

| Net Assets – 100.0%

| $65,308,964

|

| Forward Foreign Currency Contracts

|

Settlement

Date

|

| Counterparty

|

| Amount

Purchased

|

| Amount

Sold

|

| Purchase

Value as of

9/30/2023

|

| Sale

Value as of

9/30/2023

|

| Unrealized

Appreciation/

(Depreciation)

|

| 10/18/23

|

| DB

|

| CAD

| 587,000

|

| USD

| 444,520

|

| $ 432,291

|

| $ 444,520

|

| $ (12,229)

|

| 10/18/23

|

| GS

|

| JPY

| 454,387,794

|

| USD

| 3,304,633

|

| 3,051,060

|

| 3,304,633

|

| (253,573)

|

| 10/18/23

|

| DB

|

| ZAR

| 23,422,868

|

| USD

| 1,222,307

|

| 1,234,981

|

| 1,222,307

|

| 12,674

|

| 10/18/23

|

| CIT

|

| USD

| 4,611,214

|

| AUD

| 6,875,000

|

| 4,611,214

|

| 4,423,437

|

| 187,777

|

| 11/22/23

|

| BAR

|

| USD

| 1,691,097

|

| BRL

| 8,460,000

|

| 1,691,097

|

| 1,671,081

|

| 20,016

|

| 10/18/23

|

| DB

|

| USD

| 882,901

|

| GBP

| 681,112

|

| 882,901

|

| 831,126

|

| 51,775

|

| 10/18/23

|

| GS

|

| USD

| 1,153,724

|

| NZD

| 1,865,000

|

| 1,153,724

|

| 1,117,792

|

| 35,932

|

| 10/18/23

|

| BAR

|

| USD

| 3,098,212

|

| ZAR

| 57,311,000

|

| 3,098,212

|

| 3,021,748

|

| 76,464

|

Net Unrealized Appreciation / (Depreciation)

|

| $118,836

|

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| (a)

| All of these securities are available to serve as collateral for the outstanding loan.

|

| (b)

| This security may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933, as amended (the “1933 Act”).

|

| (c)

| Step-up security. A security where the coupon increases or steps up at a predetermined date. Interest rate shown reflects the rate in effect at September 30, 2023.

|

| (d)

| This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the 1933 Act, and may be resold in transactions

exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be liquid by abrdn Inc., the

Fund’s sub-advisor (“abrdn” or the “Sub-Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is determined

based on security specific factors and assumptions, which require subjective judgment. At September 30, 2023, securities noted as such amounted to $14,581,811 or 22.3% of net assets.

|

| (e)

| Portfolio securities are included in a country based upon their underlying credit exposure as determined by abrdn.

|

| (f)

| Fixed-to-floating or fixed-to-variable rate security. The interest rate shown reflects the fixed rate in effect at September 30, 2023. At a predetermined date, the fixed rate will

change to a floating rate or a variable rate.

|

| (g)

| Perpetual maturity.

|

| (h)

| This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A of the 1933 Act, and may be resold in transactions

exempt from registration, normally to qualified institutional buyers. See Restricted Securities table.

|

| (i)

| This issuer is in default and interest is not being accrued by the Fund, nor paid by the issuer.

|

| (j)

| This issuer has filed for bankruptcy protection in a São Paulo state court.

|

| (k)

| Zero coupon bond.

|

| Abbreviations throughout the Portfolio of Investments:

|

| AUD

| Australian Dollar

|

| BAR

| Barclays Bank

|

| BRL

| Brazilian Real

|

| CAD

| Canadian Dollar

|

| CIT

| Citibank, NA

|

| COP

| Colombian Peso

|

| DB

| Deutsche Bank

|

| DOP

| Dominican Republic Peso

|

| EUR

| Euro

|

| GBP

| British Pound Sterling

|

| GS

| Goldman Sachs

|

| HUF

| Hungarian Forint

|

| IDR

| Indonesian Rupiah

|

| INR

| Indian Rupee

|

| JPY

| Japanese Yen

|

| MXN

| Mexican Peso

|

| MYR

| Malaysian Ringgit

|

| NZD

| New Zealand Dollar

|

| PEN

| Peruvian Nuevo Sol

|

| PLN

| Polish Zloty

|

| UAH

| Ukrainian Hryvnia

|

| USD

| United States Dollar

|

| UYU

| Uruguayan Peso

|

| ZAR

| South African Rand

|

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

| Credit Quality†

| % of Total

Investments

|

| AAA

| 20.0%

|

| AA

| 6.3

|

| AA-

| 2.2

|

| A+

| 0.9

|

| A

| 2.7

|

| A-

| 2.2

|

| BBB+

| 13.0

|

| BBB

| 4.5

|

| BBB-

| 4.6

|

| BB+

| 4.1

|

| BB

| 13.2

|

| BB-

| 4.3

|

| B+

| 4.2

|

| B

| 6.6

|

| B-

| 4.9

|

| CCC+

| 0.5

|

| CCC

| 1.1

|

| CCC-

| 1.4

|

| CC

| 1.6

|

| Not Rated

| 1.7

|

| Total

| 100.0%

|

| †

| The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations

(NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not

equivalent, the highest ratings are used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the

creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

| Industry Classification

| % of Total

Investments

|

| Sovereigns

| 74.7%

|

| Banks

| 5.1

|

| Integrated Oils

| 3.5

|

| Utilities

| 3.0

|

| Exploration & Production

| 2.5

|

| Refining & Marketing

| 1.5

|

| Metals & Mining

| 1.2

|

| Financial Services

| 1.0

|

| Food & Beverage

| 1.0

|

| Railroad

| 0.9

|

| Industrial Other

| 0.8

|

| Pharmaceuticals

| 0.8

|

| Transportation & Logistics

| 0.5

|

| Government Development Banks

| 0.5

|

| Chemicals

| 0.5

|

| Oil & Gas Services & Equipment

| 0.4

|

| Life Insurance

| 0.4

|

| Software & Services

| 0.4

|

| Retail - Consumer Staples

| 0.4

|

| Wireline Telecommunications Services

| 0.3

|

| Renewable Energy

| 0.3

|

| Construction Materials

| 0.3

|

| Total

| 100.0%

|

Currency Exposure

Diversification

| % of Total

Investments††

|

| USD

| 62.3%

|

| MXN

| 8.5

|

| BRL

| 5.0

|

| JPY

| 3.8

|

| PEN

| 2.7

|

| PLN

| 2.7

|

| INR

| 2.4

|

| NZD

| 2.3

|

| MYR

| 1.7

|

| HUF

| 1.5

|

| CAD

| 1.5

|

| COP

| 1.5

|

| EUR

| 1.3

|

| GBP

| 1.2

|

| UYU

| 0.8

|

| UAH

| 0.7

|

| DOP

| 0.6

|

| IDR

| 0.3

|

| ZAR

| 0.2

|

| AUD

| -1.0

|

| Total

| 100.0%

|

| ††

| The weightings include the impact of currency forwards.

|

First Trust/abrdn Global Opportunity

Income Fund (FAM)

Portfolio of Investments

(Continued)

September 30, 2023

(Unaudited)

Valuation Inputs

The Fund is subject to

fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

| •

| Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

|

| •

| Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived

from observable market data.)

|

| •

| Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in

pricing the investment.

|

The inputs or

methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

A summary of the inputs

used to value the Fund’s investments as of September 30, 2023 is as follows:

| ASSETS TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Foreign Sovereign Bonds and Notes*

| $ 47,883,033

| $ —

| $ 47,883,033

| $ —

|

Foreign Corporate Bonds and Notes*

| 19,814,203

| —

| 19,814,203

| —

|

U.S. Government Bonds and Notes

| 12,271,005

| —

| 12,271,005

| —

|

Corporate Bonds and Notes*

| 549,125

| —

| 549,125

| —

|

Total Investments

| 80,517,366

| —

| 80,517,366

| —

|

Forward Foreign Currency Contracts

| 384,638

| —

| 384,638

| —

|

Total

| $ 80,902,004

| $—

| $ 80,902,004

| $—

|

|

|

| LIABILITIES TABLE

|

|

| Total

Value at

9/30/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Forward Foreign Currency Contracts

| $ (265,802)

| $ —

| $ (265,802)

| $ —

|

| *

| See Portfolio of Investments for country breakout.

|

Restricted Securities

As of September 30, 2023,

the Fund held restricted securities as shown in the following table that abrdn has deemed illiquid.

| Security

| Acquisition

Date

| Principal

Value

| Current Price

| Carrying

Cost

|

| Value

|

| % of Net

Assets

|

| OAS Finance Ltd., 8.88%

| 4/18/2013

| $1,550,000

| $0.75

| $1,550,000

|

| $11,625

|

| 0.02%

|

| OAS Investments GmbH, 8.25%, 10/19/19

| 10/12/2012

| 460,000

| 0.75

| 460,000

|

| 3,450

|

| 0.01

|

| Sovcombank Via SovCom Capital DAC, 7.75%

| 2/19/2020

| 500,000

| 1.94

| 511,643

|

| 9,700

|

| 0.01

|

|

|

|

|

| $2,521,643

|

| $24,775

|

| 0.04%

|

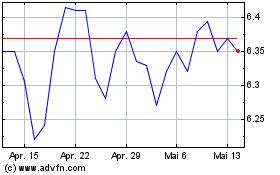

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

Von Jun 2023 bis Jun 2024