false

0001001115

0001001115

2023-11-16

2023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2023

GEOSPACE TECHNOLOGIES CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

Texas

|

001-13601

|

76-0447780

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

7007 Pinemont,

Houston, Texas

|

|

77040

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (713) 986-4444

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

GEOS

|

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On November 16, 2023, Geospace Technologies Corporation issued a press release regarding its operating results for its fourth quarter and fiscal year 2023. The press release is attached hereto as Exhibit 99.1. The foregoing description is qualified by reference in its entirety to such exhibit.

Item 9.01. Financial Statements and Exhibits

Exhibit 104 Cover Page Interactive Data (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GEOSPACE TECHNOLOGIES CORPORATION

|

|

Date: November 17, 2023

|

|

| |

By: /s/ Robert L. Curda

|

| |

Robert L. Curda

|

| |

Vice President, Chief Financial Officer & Secretary

|

Exhibit 99.1

NEWS RELEASE

FOR IMMEDIATE RELEASE

GEOSPACE TECHNOLOGIES REPORTS PROFITABLE FOURTH QUARTER

AND FISCAL YEAR 2023 RESULTS

Houston, Texas – November 16, 2023 – Geospace Technologies Corporation (NASDAQ: GEOS) (“the “Company") today announced net income of $12.2 million, or $0.92 per diluted share, on revenue of $124.5 million for its fiscal year ended September 30, 2023. This compares with a net loss of $22.9 million, or ($1.76) per diluted share, on revenue of $89.3 million for the comparable year-ago period.

For the fourth quarter ended September 30, 2023, Geospace Technologies (the “Company”) reported revenue of $29.3 million and net income of $4.4 million, or $0.33 per diluted share. For the comparable period last year, the Company recorded revenue of $25.9 million and a net loss of $8.0 million, or ($0.62) per diluted share.

Management’s Comments

Walter R. (“Rick”) Wheeler, President and CEO of the Company said, “We’re incredibly pleased to announce yet another quarter of positive earnings to our shareholders. Combined with the successful quarters earlier in the year, fiscal year 2023 closed with an overall net income of $12.2 million. Moreover, revenue for the full year of $124.5 million represents the largest figure recorded since 2014. Our improved performance is the result of accelerated efforts by our dedicated employees in reducing costs and streamlining operations, as well as better market conditions for our products in both the Oil and Gas and Adjacent Markets segments. Increases in utilization and rentals of our OBX ocean bottom nodes were the largest revenue driver in fiscal year 2023. In fact, the company’s total revenue from rentals more than doubled from last year’s figure. Our conservative management and preservation of a strong balance sheet with zero debt has given us the essential tools necessary to maintain leadership in technology innovations, even in depressed markets. We believe this has strengthened our ability to take advantage of improving market conditions and will continue to do so in the future. This is strongly evidenced by recent developments in our Oil and Gas Markets segment. In the fourth quarter, we announced a $3 million rental agreement for our highly advanced Mariner™ product, a shallow water seabed seismic data acquisition node. In addition, we announced a $5.7 million contract with an international seismic company for specialized geophones designed for use in their proprietary system. Prior to both of these announcements was one in June of a $20 million rental contract for our Mariner ocean bottom nodes. The delivery of this system is expected to complete in the next few weeks with the rental term commencing thereafter. Although gaps are expected to occur in some of our OBX rental contracts, we anticipate the ocean bottom node market will remain strong over the coming fiscal year.

Results from our Adjacent Markets segment proved equally compelling as total revenue for the fourth quarter and full fiscal year ending September 30, 2023, came in at $10.6 and $49.0 million respectively. The full year amount for the segment sets yet another new record. Our efforts toward revenue diversification have seen some success in the Adjacent Markets segment where several new records were set over the course of fiscal year 2023. The outstanding industrial product performance this year stems largely from greater demand for our water meter cables and connectors, which were the largest factor in pushing overall revenue growth of the segment 25% over last year’s result.

The Company’s Emerging Markets segment generated $0.8 million in the fourth quarter and $1.2 million over the full 2023 fiscal year. During the second fiscal quarter, we announced a $1.5 million contract with the Defense Advanced Projects Research Agency, otherwise known as DARPA. The contract is a Phase II Small Business Innovative Research (SBIR) contract to explore a new SADAR capability designed to monitor energy sources of interest on nearby land, water and air environments. Revenue over the course of the fiscal year includes amounts derived from this contract as well as fulfillment of a separate unrelated contract with a major defense contractor. We continue to explore further opportunities for contracts with DARPA and other governmental agencies as well as new private sector applications for SADAR and Quantum’s analytics in the energy transition market.

Complementing our operational success in fiscal year 2023 were substantive gains on the Company’s balance sheet. In addition to increasing stockholder equity by more than $11 million, we ended fiscal 2023, with a total of $33.7 million in cash, cash equivalents and short-term investments. We further maintained an additional borrowing availability of $13.1 million under an unused bank credit agreement with no borrowings outstanding. As a result, our total liquidity, as of September 30, 2023, was $46.8 million. In addition, we wholly own unencumbered properties and real estate in both domestic and international locations.

As our new fiscal year begins, we’re enthusiastic about the plans we have in motion to continue our profitability. While the variability of our seismic industry contracts may result in uneven quarterly revenue in the coming year, we remain encouraged by the volume of planned exploration activity. Further, we intend to regularly evaluate each business segment where those efforts are focused on driving revenue opportunities while assessing additional areas where costs can be reduced. We believe our strong balance sheet and technological leadership will be pivotal to our success in fiscal year 2024.”

Oil and Gas Markets Segment

Revenue from the Company’s Oil and Gas Markets segment totaled $17.8 million for the three months ended September 30, 2023. This compares to $14.8 million in revenue, an increase of 20% for the same period a year ago. For the fiscal year, revenue from this segment totaled $74.0 million versus $49.1 million for the same prior year period. The increase for the three-month period is due to higher utilization of our ocean bottom node rental fleet, higher demand for our wireless seismic products and increased sales of our marine products. The twelve-month increase in revenue is due to higher utilization of our ocean bottom node rental fleet and sales of our seismic sensors and marine products.

Revenue from the Company’s traditional exploration products totaled $2.7 million and $12.2 million respectively for the three-month and twelve-month periods ended September 30, 2023. This compares to $3.2 million and $6.6 million, respectively to the same periods a year ago.

Revenue from the Company’s wireless seismic products totaled $14.9 million and $61.5 million respectively for the three- and twelve-month periods ended September 30, 2023. This equates to a 33% increase and a 50% increase compared to the corresponding respective year ago periods.

The Company’s reservoir seismic products generated $0.2 million and $1.0 million in total revenue for the three-month and full year periods ended September 30, 2023. This compares with $0.5 million and $1.9 million for the equivalent periods one year earlier.

Adjacent Markets Segment

Revenue from the Company’s Adjacent Markets segment totaled $10.6 million and $49.0 million for the three- and twelve-month periods ended September 30, 2023. This compares with $10.9 million and $39.2 million for the equivalent year ago periods. The slight decrease for the three-month period is due to essentially the same sales of the Company’s smart water meter cable and connector products partially attributable to decreased sales of seismic sensors to industrial customers, lower demand for the Company’s contract manufacturing services and imaging products. The increase in the 12-months period is the result of increased sales of the Company’s smart water meter cable and connector products, increased sales of seismic sensors to industrial customers, partially offset by lower demand for contract manufacturing services and imaging products.

Emerging Markets Segment

The Company’s Emerging Markets segment generated revenue of $0.8 million and $1.2 million for the three-month and full year periods ended September 30, 2023. This compares with $0.1 million and $0.7 million for the similar three- and twelve-month periods of the previous year. The Emerging Market segment has a backlog of approximately $2.0 million that will be recognized in fiscal year 2024.

Balance Sheet and Liquidity

For the fiscal year ended September 30, 2023, the Company generated $15.6 million in cash and cash equivalents from operating activities. The Company used $11.9 million of cash from investing activities with sources of cash that included $11.5 million in proceeds from the sale of rental equipment, and $4.4 million for net sales of property, plant and equipment. These sources of cash were partially offset by net disbursements of $13.9 million for purchases of short-term investments, $9.9 million for additions to our rental fleet and $4.0 million in the purchase of property, plant and equipment. As of September 30, 2023, the Company had $33.7 million in cash, cash equivalents and short-term investments, and maintained an additional borrowing availability of $13.1 million under its bank credit agreement with no borrowings outstanding. In fiscal year 2024, management anticipates a capital expenditure budget of $13 million including $9 million earmarked for additions to its rental equipment.

Conference Call Information

Geospace Technologies will host a conference call to review its fourth quarter and fiscal year 2023 financial results on November 17, 2023, at 10:00 a.m. Eastern Time (9 a.m. Central). Participants can access the call at (800) 225-9448 (US) or (203) 518-9848 (International). Please reference the conference ID: GEOSQ423 prior to the start of the conference call. A replay will be available for approximately 60 days and may be accessed through the Investor Relations tab of our website at www.geospace.com.

About Geospace Technologies

Geospace principally designs and manufactures seismic instruments and equipment. We market our seismic products to the oil and gas industry to locate, characterize and monitor hydrocarbon-producing reservoirs. We also market our seismic products to other industries for vibration monitoring, border and perimeter security and various geotechnical applications. We design and manufacture other products of a non-seismic nature, including water meter products, imaging equipment, remote shutoff water values and Internet of Things (IoT) platform and provide contract manufacturing services.

Media Contact: Caroline Kempf, ckempf@geospace.com, 321.341.9305

Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by terminology such as “may”, “will”, “should”, “could”, “intend”, “expect”, “plan”, “budget”, “forecast”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue”, “evaluating” or similar words. Statements that contain these words should be read carefully because they discuss future expectations, contain projections of our future results of operations or of our financial position or state other forward-looking information. Examples of forward- looking statements include, statements regarding our expected operating results and expected demand for our products in various segments. These forward-looking statements reflect our current judgment about future events and trends based on currently available information. However, there will likely be events in the future that we are not able to predict or control. The factors listed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K which is on file with the Securities and Exchange Commission, as well as other cautionary language in such Annual Report, any subsequent Quarterly Report on Form 10- Q, or in our other periodic reports, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements.

Such examples include, but are not limited to, the failure of the Quantum or OptoSeis® or Aquana technology transactions to yield positive operating results, decreases in commodity price levels, the continued adverse impact of COVID-19, which could reduce demand for our products, the failure of our products to achieve market acceptance (despite substantial investment by us), our sensitivity to short term backlog, delayed or cancelled customer orders, product obsolescence resulting from poor industry conditions or new technologies, bad debt write-offs associated with customer accounts, inability to collect on promissory notes, lack of further orders for our OBX systems, failure of our Quantum products to be adopted by the border and security perimeter market or a decrease in such market due to governmental changes, potential impact of the ongoing armed conflict between Russia and Ukraine, and infringement or failure to protect intellectual property. The occurrence of the events described in these risk factors and elsewhere in our most recent Annual Report on Form 10-K or in our other periodic reports could have a material adverse effect on our business, results of operations and financial position, and actual events and results of operations may vary materially from our current expectations. We assume no obligation to revise or update any forward- looking statement, whether written or oral, that we may make from time to time, whether as a result of new information, future developments or otherwise, except as required by applicable securities laws and regulations.

# # #

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(unaudited)

| |

|

Three Months Ended

|

|

|

Year Ended |

|

| |

|

September 30, 2023

|

|

|

September 30, 2022

|

|

|

September 30, 2023

|

|

|

September 30, 2022 |

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products

|

|

$ |

16,357 |

|

|

$ |

16,049 |

|

|

$ |

73,333 |

|

|

$ |

64,109 |

|

|

Rental

|

|

|

12,958 |

|

|

|

9,822 |

|

|

|

51,176 |

|

|

|

25,144 |

|

|

Total revenue

|

|

|

29,315 |

|

|

|

25,871 |

|

|

|

124,509 |

|

|

|

89,253 |

|

|

Cost of revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products

|

|

|

12,053 |

|

|

|

14,339 |

|

|

|

55,136 |

|

|

|

51,649 |

|

|

Rental

|

|

|

3,047 |

|

|

|

5,652 |

|

|

|

17,683 |

|

|

|

19,561 |

|

|

Total cost of revenue

|

|

|

15,087 |

|

|

|

19,991 |

|

|

|

72,819 |

|

|

|

71,210 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

14,228 |

|

|

|

5,880 |

|

|

|

51,690 |

|

|

|

18,043 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

6,475 |

|

|

|

5,374 |

|

|

|

25,952 |

|

|

|

23,482 |

|

|

Research and development

|

|

|

3,766 |

|

|

|

4,054 |

|

|

|

15,863 |

|

|

|

18,104 |

|

|

Goodwill impairment

|

|

|

— |

|

|

|

4,336 |

|

|

|

— |

|

|

|

4,336 |

|

|

Change in estimated fair value of contingent consideration

|

|

|

— |

|

|

|

7 |

|

|

|

— |

|

|

|

(5,035 |

)

|

|

Bad debt expense (recovery)

|

|

|

(97 |

)

|

|

|

176 |

|

|

|

(138 |

)

|

|

|

292 |

|

|

Total operating expenses

|

|

|

10,144 |

|

|

|

13,947 |

|

|

|

41,677 |

|

|

|

41,179 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on disposal of property

|

|

|

— |

|

|

|

— |

|

|

|

1,315 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

4,084 |

|

|

|

(8,067 |

)

|

|

|

11,328 |

|

|

|

(23,136 |

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(34 |

)

|

|

|

(39 |

)

|

|

|

(134 |

)

|

|

|

(65 |

) |

|

Interest income

|

|

|

168 |

|

|

|

253 |

|

|

|

539 |

|

|

|

976 |

|

|

Foreign currency transaction gains (losses), net

|

|

|

401 |

|

|

|

(168 |

)

|

|

|

994 |

|

|

|

(22 |

)

|

|

Other, net

|

|

|

(86 |

)

|

|

|

(15 |

)

|

|

|

(158 |

)

|

|

|

(39 |

)

|

|

Total other income, net

|

|

|

449 |

|

|

|

30 |

|

|

|

1,241 |

|

|

|

453 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

4,533 |

|

|

|

(8,037 |

)

|

|

|

12,569 |

|

|

|

(22,683 |

)

|

|

Income tax expense

|

|

|

95 |

|

|

|

3 |

|

|

|

363 |

|

|

|

173 |

|

|

Net income (loss)

|

|

$ |

4,438 |

|

|

$ |

(8,040 |

)

|

|

$ |

12,206 |

|

|

$ |

(22,856 |

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.34 |

|

|

$ |

(0.62 |

)

|

|

$ |

0.93 |

|

|

$ |

(1.76 |

)

|

|

Diluted

|

|

$ |

0.33 |

|

|

$ |

(0.62 |

)

|

|

$ |

0.92 |

|

|

$ |

(1.76 |

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

13,188,489 |

|

|

|

13,020,191 |

|

|

|

13,146,085 |

|

|

|

12,987,996 |

|

|

Diluted

|

|

|

13,399,442 |

|

|

|

13,020,191 |

|

|

|

13,215,066 |

|

|

|

12,987,996 |

|

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

(unaudited)

| |

|

AS OF SEPTEMBER 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

18,803 |

|

|

$ |

16,109 |

|

|

Short-term investments

|

|

|

14,921 |

|

|

|

894 |

|

|

Trade accounts and notes receivable, net

|

|

|

21,373 |

|

|

|

20,886 |

|

|

Inventories, net

|

|

|

18,430 |

|

|

|

19,995 |

|

|

Prepaid expenses and other current assets

|

|

|

2,251 |

|

|

|

2,077 |

|

|

Total current assets

|

|

|

75,778 |

|

|

|

59,961 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current inventories, net

|

|

|

24,888 |

|

|

|

12,526 |

|

|

Rental equipment, net

|

|

|

21,587 |

|

|

|

28,199 |

|

|

Property, plant and equipment, net

|

|

|

24,048 |

|

|

|

26,598 |

|

|

Operating right-of-use assets

|

|

|

714 |

|

|

|

957 |

|

|

Goodwill

|

|

|

736 |

|

|

|

736 |

|

|

Other intangible assets, net

|

|

|

4,805 |

|

|

|

5,573 |

|

|

Other non-current assets

|

|

|

486 |

|

|

|

506 |

|

|

Total assets

|

|

$ |

153,042 |

|

|

$ |

135,056 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable trade

|

|

$ |

6,659 |

|

|

$ |

5,595 |

|

|

Contingent consideration

|

|

|

— |

|

|

|

175 |

|

|

Operating lease liabilities

|

|

|

257 |

|

|

|

241 |

|

|

Other current liabilities

|

|

|

12,882 |

|

|

|

6,616 |

|

|

Total current liabilities

|

|

|

19,798 |

|

|

|

12,627 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current operating lease liabilities

|

|

|

512 |

|

|

|

769 |

|

|

Deferred tax liabilities, net

|

|

|

16 |

|

|

|

13 |

|

|

Total liabilities

|

|

|

20,326 |

|

|

|

13,409 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, 1,000,000 shares authorized, no shares issued and outstanding

|

|

|

— |

|

|

|

— |

|

|

Common stock, $.01 par value, 20,000,000 shares authorized, 14,030,481 and 13,863,233 shares issued, respectively; and 13,188,489 and 13,021,241 shares outstanding, respectively

|

|

|

140 |

|

|

|

139 |

|

|

Additional paid-in capital

|

|

|

96,040 |

|

|

|

94,667 |

|

|

Retained earnings

|

|

|

61,860 |

|

|

|

49,654 |

|

|

Accumulated other comprehensive loss

|

|

|

(17,824 |

)

|

|

|

(15,313 |

)

|

|

Treasury stock, at cost, 841,992 shares

|

|

|

(7,500 |

)

|

|

|

(7,500 |

)

|

|

Total stockholders’ equity

|

|

|

132,716 |

|

|

|

121,647 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

153,042 |

|

|

$ |

135,056 |

|

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| |

|

YEAR ENDED SEPTEMBER 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

12,206 |

|

|

$ |

(22,856 |

)

|

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Deferred income tax expense (benefit)

|

|

|

3 |

|

|

|

(17 |

)

|

|

Rental equipment depreciation

|

|

|

11,766 |

|

|

|

13,740 |

|

|

Property, plant and equipment depreciation

|

|

|

3,704 |

|

|

|

4,143 |

|

|

Amortization of intangible assets

|

|

|

768 |

|

|

|

1,677 |

|

|

Goodwill impairment expense

|

|

|

— |

|

|

|

4,336 |

|

|

Property, plant and equipment impairment expense

|

|

|

— |

|

|

|

401 |

|

|

Amortization of premiums (accretion of discounts) on short-term investments

|

|

|

(144 |

)

|

|

|

96 |

|

|

Stock-based compensation expense

|

|

|

1,374 |

|

|

|

1,734 |

|

|

Bad debt expense (recovery)

|

|

|

(138 |

)

|

|

|

292 |

|

|

Inventory obsolescence expense

|

|

|

2,229 |

|

|

|

3,222 |

|

|

Change in estimated fair value of contingent consideration

|

|

|

— |

|

|

|

(5,035 |

)

|

|

Gross profit from sale of used rental equipment

|

|

|

(4,424 |

)

|

|

|

(11,061 |

)

|

|

Loss (gain) on disposal of equipment

|

|

|

244 |

|

|

|

(54 |

)

|

|

Gain on disposal of property

|

|

|

(1,315 |

)

|

|

|

— |

|

|

Realized loss on short-term investments

|

|

|

— |

|

|

|

— |

|

|

Realized foreign currency translation loss from dissolution of foreign subsidiary

|

|

|

38 |

|

|

|

22 |

|

|

Effects of changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trade accounts and notes receivable

|

|

|

(5,561 |

)

|

|

|

1,751 |

|

|

Unbilled receivables

|

|

|

— |

|

|

|

1,051 |

|

|

Inventories

|

|

|

(11,026 |

)

|

|

|

(2,357 |

)

|

|

Other assets

|

|

|

442 |

|

|

|

349 |

|

|

Accounts payable trade

|

|

|

41 |

|

|

|

(786 |

)

|

|

Other liabilities

|

|

|

5,351 |

|

|

|

(683 |

)

|

|

Net cash used provided by (used in) operating activities

|

|

|

15,558 |

|

|

|

(10,035 |

)

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment

|

|

|

(3,964 |

)

|

|

|

(1,130 |

)

|

|

Investment in rental equipment

|

|

|

(9,920 |

)

|

|

|

(4,832 |

)

|

|

Proceeds from the sale of equipment

|

|

|

724 |

|

|

|

54 |

|

|

Proceeds from the sale of property

|

|

|

3,682 |

|

|

|

— |

|

|

Proceeds from the sale of used rental equipment

|

|

|

11,478 |

|

|

|

11,583 |

|

|

Purchase of short-term investments

|

|

|

(24,782 |

)

|

|

|

(450 |

)

|

|

Proceeds from the sale of short-term investments

|

|

|

10,900 |

|

|

|

8,924 |

|

|

Net cash provided by (used in) investing activities

|

|

|

(11,882 |

)

|

|

|

14,149 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Payments of contingent consideration

|

|

|

(175 |

)

|

|

|

(807 |

)

|

|

Debt issuance costs

|

|

|

(350 |

)

|

|

|

(211 |

)

|

|

Purchase of treasury stock

|

|

|

— |

|

|

|

(695 |

)

|

|

Net cash used in financing activities

|

|

|

(525 |

)

|

|

|

(1,713 |

)

|

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash

|

|

|

(457 |

)

|

|

|

(358 |

)

|

|

Increase in cash and cash equivalents

|

|

|

2,694 |

|

|

|

2,043 |

|

|

Cash and cash equivalents, beginning of fiscal year

|

|

|

16,109 |

|

|

|

14,066 |

|

|

Cash and cash equivalents, end of fiscal year

|

|

$ |

18,803 |

|

|

$ |

16,109 |

|

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

SUMMARY OF SEGMENT REVENUE AND OPERATING INCOME (LOSS)

(in thousands)

(unaudited)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

September 30, 2023

|

|

|

September 30, 2022

|

|

|

September 30, 2023

|

|

|

September 30, 2022

|

|

|

Oil and Gas Markets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Traditional seismic exploration product revenue

|

|

$ |

2,674 |

|

|

$ |

3,169 |

|

|

$ |

12,183 |

|

|

$ |

6,597 |

|

|

Wireless seismic exploration product revenue

|

|

|

14,928 |

|

|

|

11,200 |

|

|

|

60,848 |

|

|

|

40,667 |

|

|

Reservoir product revenue

|

|

|

152 |

|

|

|

455 |

|

|

|

962 |

|

|

|

1,877 |

|

| |

|

|

17,754 |

|

|

|

14,824 |

|

|

|

73,993 |

|

|

|

49,141 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjacent Markets segment revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial product revenue

|

|

|

7,609 |

|

|

|

7,169 |

|

|

|

36,859 |

|

|

|

25,640 |

|

|

Imaging product revenue

|

|

|

3,038 |

|

|

|

3,690 |

|

|

|

12,180 |

|

|

|

13,531 |

|

| |

|

|

10,647 |

|

|

|

10,859 |

|

|

|

49,039 |

|

|

|

39,171 |

|

|

Emerging Markets segment revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Border and perimeter security product revenue

|

|

|

841 |

|

|

|

140 |

|

|

|

1,234 |

|

|

|

711 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate

|

|

|

73 |

|

|

|

48 |

|

|

|

243 |

|

|

|

230 |

|

|

Total revenue

|

|

$ |

29,315 |

|

|

$ |

25,871 |

|

|

$ |

124,509 |

|

|

$ |

89,253 |

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30, 2023

|

|

|

September 30, 2022

|

|

|

September 30, 2023

|

|

|

September 30, 2022

|

|

|

Operating income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and Gas Markets segment

|

|

$ |

5,939 |

|

|

$ |

(1,330 |

) |

|

$ |

15,759 |

|

|

$ |

(7,539 |

) |

|

Adjacent Markets segment

|

|

|

2,342 |

|

|

|

1,680 |

|

|

|

11,490 |

|

|

|

6,021 |

|

|

Emerging Markets segment

|

|

|

(736 |

) |

|

|

(5,519 |

) |

|

|

(4,003 |

) |

|

|

(9,128 |

) |

|

Corporate

|

|

|

(3,461 |

) |

|

|

(2,898 |

) |

|

|

(11,918 |

) |

|

|

(12,490 |

) |

|

Total operating income (loss)

|

|

$ |

4,084 |

|

|

$ |

(8,067 |

) |

|

$ |

11,328 |

|

|

$ |

(23,136 |

) |

v3.23.3

Document And Entity Information

|

Nov. 16, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

GEOSPACE TECHNOLOGIES CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 16, 2023

|

| Entity, Incorporation, State or Country Code |

TX

|

| Entity, File Number |

001-13601

|

| Entity, Tax Identification Number |

76-0447780

|

| Entity, Address, Address Line One |

7007 Pinemont

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77040

|

| City Area Code |

713

|

| Local Phone Number |

986-4444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

GEOS

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001001115

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

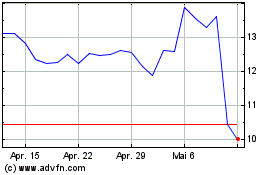

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024