false

0001001115

0001001115

2023-08-10

2023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 10, 2023

GEOSPACE TECHNOLOGIES CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

Texas

|

001-13601

|

76-0447780

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

|

7007 Pinemont

Houston, Texas

|

|

77040

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (713) 986-4444

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

GEOS

|

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On August 10, 2023, Geospace Technologies Corporation issued a press release regarding its operating results for its second quarter 2023. The press release is attached hereto as Exhibit 99.1. The foregoing description is qualified by reference in its entirety to such exhibit.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

Exhibit 104 Cover Page Interactive Data (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GEOSPACE TECHNOLOGIES CORPORATION

|

| |

|

|

Date: August 10, 2023

|

|

| |

By: /s/ Robert L. Curda

|

| |

Robert L. Curda

|

| |

Vice President, Chief Financial Officer & Secretary

|

Exhibit 99.1

NEWS RELEASE

FOR IMMEDIATE RELEASE

GEOSPACE TECHNOLOGIES CORPORATION REPORTS PROFITABLE THIRD QUARTER

AND NINE-MONTH 2023 EARNINGS

Q3 Produced Highest Quarterly Revenue Recorded in Nine Years

HOUSTON, TX – August 10, 2023 - Geospace Technologies Corporation (NASDAQ: GEOS) (the “Company”) today announced results for its third quarter ended June 30, 2023. For the three-months ended June 30, 2023, Geospace reported revenue of $32.7 million, a 58% increase compared to revenue of $20.7 million for the comparable year-ago quarter. Net income for the three-months ended June 30, 2023 was $3.2 million, or $0.24 per diluted share, compared to a net loss of $6.6 million, or ($0.51) per diluted share, for the quarter ended June 30, 2022.

For the nine-months ended June 30, 2023, Geospace reported revenue of $95.2 million, a 50% increase compared to revenue of $63.4 million for the comparable year-ago period. Net income for the nine-months ended June 30, 2023 was $7.8 million, or $0.59 per diluted share, compared to a net loss of $14.8 million, or ($1.14) per diluted share, for the nine-months ended June 30, 2022.

Management’s Comments

Rick Wheeler, President, and Chief Executive Officer of Geospace Technologies said, “We’re very excited to see our third quarter performance further extend profitability for fiscal year 2023 by $0.24 per share. Moreover, total revenue for the quarter of $32.7 million represents the highest quarterly figure recorded in nine years. These results offer evidence of the intended positive impact our longstanding diversification efforts and recent cost control measures were designed to achieve.

A combination of increased demand for our Oil and Gas segment products and continued growth in our Adjacent Markets segment fueled both third quarter and nine-month results. In the Oil and Gas segment, our rental fleet of OBX ocean bottom nodes is near full utilization, reliably collecting high-resolution seismic data for clients around the globe. This growing demand and our innovation in this product domain were the impetus leading to our recently announced $20 million contract with a major contractor for the rental of our new shallow water Mariner® nodal system. Under current market conditions, we believe demand for our Oil and Gas segment products will remain strong into fiscal year 2024.

Our Adjacent Market segment had a notably great quarter, setting yet another record with the highest quarterly revenue figure ever reported. In just the first nine months of fiscal year 2023, revenue is just short of last year’s full total and beats all other prior fiscal year totals. Compared to last year, both the three-month and nine-month periods ended June 30, 2023, grew by almost 36%. The increase is driven largely by water meter cables and industrial sensor products. Also during the quarter, our Aquana subsidiary announced the release of its Actuator Valve Serial (AVS), a remote shut-off valve designed to reduce the cost of operations and enhance the safety of employees for water utilities. As domestic municipalities continue to update their smart water meter systems, we believe the long-term increase in demand for these Adjacent Markets products will persist.

Our Emerging Markets segment contributed a small portion of revenue during the three- and nine-month periods, primarily related to previously announced government and defense industry contracts. Further efforts remain ongoing to secure additional contracts in perimeter security and energy transition applications such as carbon storage, geothermal and mining. There may be more clarity on some of these endeavors in the near future.

As was noted, from a financial perspective, Geospace delivered its most successful quarter in many years, with quarterly revenue outpacing that of the past nine years. We not only achieved positive net income for the second consecutive quarter, but in addition, we strengthened our balance sheet, garnering approximately $27 million in cash and cash equivalents with approximately $42 million in total liquidity. Also, we recently completed a credit agreement with Woodforest National Bank that will provide borrowings to significantly boost our liquidity. However, we don’t anticipate a need for borrowing in the foreseeable future. We look forward to a continuation of favorable performance throughout fiscal year 2023 and into 2024, even though there may be lulls in some elements of our commerce.”

Oil and Gas Markets Segment

Revenue from the Oil and Gas Markets segment totaled $17.7 million for the three-month ended June 30, 2023. Revenue from the same period of the prior fiscal year was $9.5 million, an increase of 85.7%. Revenue for the nine-month period ended June 30, 2023, is $56.2 million, an increase of 63.9% over the equivalent prior year period. The increase in revenue for both periods was due to higher rental revenue from increased utilization of our marine OBX rental fleet and higher demand for our seismic sensors. In addition to ocean bottom node revenue, we recorded profitable revenue for our traditional seismic exploration products for the first time in nearly seven years due to the sale of marine streamer products.

Adjacent Markets Segment

Revenue from our Adjacent Markets products for the three months ended June 30, 2023, is $14.9 million an increase of $3.9 million, representing an increase of 35.9% from the corresponding period of the prior fiscal year. The revenue for the nine-month period ended June 30, 2023, was $38.4 million, an increase of 35.6%, from the same period of the prior fiscal year. The increase in revenue is attributable in part to a recent decision to increase manufacturing capacity to meet demand for our water meter cable and connector products. Revenue remains stable in our imaging product line where efforts are underway to introduce new products to market at strategically affordable price points for the multi-billion-dollar screen print industry.

Emerging Markets

For the three-and nine-month periods ended June 30, 2023, the Company’s Emerging Markets segment generated revenue of $0.1 million and $0.4 million respectively. For the similar periods from fiscal year 2022, the Emerging Markets segment produced revenue of $0.1 million and $0.6 million, respectively. Revenue from this segment consists of on-going service and maintenance related to our completed U.S. Customs and Border Protection contract as well as other government contracts.

Balance Sheet and Liquidity

For the nine-month period ended June 30, 2023, the Company generated $3.1 million in cash and cash equivalents from operating activities. The Company generated $8.3 million of cash from investing activities that included $11.1 million in proceeds from the sale of rental equipment and $4.4 million in proceeds from the sale of property and equipment. These increases in cash are offset by $6.2 million invested in rental equipment and $1.9 million invested in property, plant and equipment. The majority of additions to the Company’s rental equipment come as a result of the recently announced Mariner® rental agreement. As of June 30, 2023, the Company had $27.3 million in cash and cash equivalents with no borrowings outstanding. Additionally, the Company recently completed a credit agreement with Woodforest National Bank that will provide borrowings of up to $15 million. Effective July 26, 2023, the total liquidity was approximately $42 million. The Company additionally owns unencumbered property and real estate in both domestic and international locations.

Conference Call Information

The Company will host a conference call to review its third quarter fiscal year 2023 financial results on August 11, 2023, at 10:00 a.m. Eastern Time (9:00 a.m. Central Time). Participants can access the call at (800) 225-9448 (US) or (203) 518-9848 (International). Please reference the conference ID: GEOSQ323 prior to the start of the conference call. A replay will be available for approximately 60 days and may be accessed through the Investor Relations tab of the Company’s website at www.geospace.com.

About Geospace Technologies

Geospace Technologies is a global technology and instrumentation manufacturer specializing in vibration sensing and highly ruggedized products which serve energy, industrial, government and commercial customers worldwide. The Company’s products blend engineering expertise with advanced analytic software to optimize energy exploration, enhance national and homeland security, empower water utility and property managers, and streamline electronic printing solutions. With more than four decades of excellence, the Company’s more than 600 employees across the world are dedicated to engineering and technical quality. Geospace is traded on the U.S. NASDAQ stock exchange as GEOS. For more information, visit www.geospace.com.

Media Contact: Caroline Kempf, ckempf@geospace.com, 321.341.9305

Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by terminology such as “may”, “will”, “should”, “could”, “intend”, “expect”, “plan”, “budget”, “forecast”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue”, “evaluating” or similar words. Statements that contain these words should be read carefully because they discuss future expectations, contain projections of our future results of operations or of our financial position or state other forward-looking information. Examples of forward- looking statements include, statements regarding our expected operating results and expected demand for our products in various segments. These forward-looking statements reflect our current judgment about future events and trends based on currently available information. However, there will likely be events in the future that we are not able to predict or control. The factors listed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K which is on file with the Securities and Exchange Commission, as well as other cautionary language in such Annual Report, any subsequent Quarterly Report on Form 10- Q, or in our other periodic reports, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Such examples include, but are not limited to, the failure of the Quantum or OptoSeis® or Aquana technology transactions to yield positive operating results, decreases in commodity price levels, the continued adverse impact of COVID-19, which could reduce demand for our products, the failure of our products to achieve market acceptance (despite substantial investment by us), our sensitivity to short term backlog, delayed or cancelled customer orders, product obsolescence resulting from poor industry conditions or new technologies, bad debt write-offs associated with customer accounts, inability to collect on promissory notes, lack of further orders for our OBX systems, failure of our Quantum products to be adopted by the border and security perimeter market or a decrease in such market due to governmental changes, and infringement or failure to protect intellectual property. The occurrence of the events described in these risk factors and elsewhere in our most recent Annual Report on Form 10-K or in our other periodic reports could have a material adverse effect on our business, results of operations and financial position, and actual events and results of operations may vary materially from our current expectations. We assume no obligation to revise or update any forward- looking statement, whether written or oral, that we may make from time to time, whether as a result of new information, future developments or otherwise, except as required by applicable securities laws and regulations.

# # #

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

June 30, 2023

|

|

|

June 30, 2022

|

|

|

June 30, 2023

|

|

|

June 30, 2022

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products

|

|

$ |

19,727 |

|

|

$ |

13,463 |

|

|

$ |

56,976 |

|

|

$ |

48,060 |

|

|

Rental

|

|

|

12,988 |

|

|

|

7,228 |

|

|

|

38,218 |

|

|

|

15,322 |

|

|

Total revenue

|

|

|

32,715 |

|

|

|

20,691 |

|

|

|

95,194 |

|

|

|

63,382 |

|

|

Cost of revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Products

|

|

|

14,522 |

|

|

|

12,460 |

|

|

|

43,083 |

|

|

|

37,310 |

|

|

Rental

|

|

|

4,214 |

|

|

|

4,580 |

|

|

|

14,649 |

|

|

|

13,909 |

|

|

Total cost of revenue

|

|

|

18,736 |

|

|

|

17,040 |

|

|

|

57,732 |

|

|

|

51,219 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

13,979 |

|

|

|

3,651 |

|

|

|

37,462 |

|

|

|

12,163 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

6,655 |

|

|

|

6,373 |

|

|

|

19,477 |

|

|

|

18,108 |

|

|

Research and development

|

|

|

4,356 |

|

|

|

4,108 |

|

|

|

12,097 |

|

|

|

14,050 |

|

|

Change in estimated fair value of contingent consideration

|

|

|

— |

|

|

|

(384 |

) |

|

|

— |

|

|

|

(5,042 |

) |

|

Bad debt expense (recovery)

|

|

|

(178 |

) |

|

|

88 |

|

|

|

(41 |

) |

|

|

116 |

|

|

Total operating expenses

|

|

|

10,833 |

|

|

|

10,185 |

|

|

|

31,533 |

|

|

|

27,232 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on disposal of property

|

|

|

— |

|

|

|

— |

|

|

|

1,315 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

3,146 |

|

|

|

(6,534 |

) |

|

|

7,244 |

|

|

|

(15,069 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(22 |

) |

|

|

(26 |

) |

|

|

(100 |

) |

|

|

(26 |

) |

|

Interest income

|

|

|

88 |

|

|

|

402 |

|

|

|

371 |

|

|

|

722 |

|

|

Foreign exchange gains (losses), net

|

|

|

301 |

|

|

|

(341 |

) |

|

|

593 |

|

|

|

(230 |

) |

|

Other, net

|

|

|

(66 |

) |

|

|

(7 |

) |

|

|

(72 |

) |

|

|

(43 |

) |

|

Total other income, net

|

|

|

301 |

|

|

|

28 |

|

|

|

792 |

|

|

|

423 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

3,447 |

|

|

|

(6,506 |

) |

|

|

8,036 |

|

|

|

(14,646 |

) |

|

Income tax expense

|

|

|

219 |

|

|

|

68 |

|

|

|

268 |

|

|

|

170 |

|

|

Net income (loss)

|

|

$ |

3,228 |

|

|

$ |

(6,574 |

) |

|

$ |

7,768 |

|

|

$ |

(14,816 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.25 |

|

|

$ |

(0.51 |

) |

|

$ |

0.59 |

|

|

$ |

(1.14 |

) |

|

Diluted

|

|

$ |

0.24 |

|

|

$ |

(0.51 |

) |

|

$ |

0.59 |

|

|

$ |

(1.14 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

13,171,654 |

|

|

|

13,013,616 |

|

|

|

13,131,795 |

|

|

|

12,977,146 |

|

|

Diluted

|

|

|

13,320,881 |

|

|

|

13,013,616 |

|

|

|

13,157,919 |

|

|

|

12,977,146 |

|

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands except share amounts)

(unaudited)

| |

|

June 30, 2023

|

|

|

September 30, 2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

27,264 |

|

|

$ |

16,109 |

|

|

Short-term investments

|

|

|

— |

|

|

|

894 |

|

|

Trade accounts and notes receivable, net

|

|

|

26,309 |

|

|

|

20,886 |

|

|

Inventories, net

|

|

|

19,603 |

|

|

|

19,995 |

|

|

Prepaid expenses and other current assets

|

|

|

3,200 |

|

|

|

2,077 |

|

|

Total current assets

|

|

|

76,376 |

|

|

|

59,961 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current inventories, net

|

|

|

22,311 |

|

|

|

12,526 |

|

|

Rental equipment, net

|

|

|

18,381 |

|

|

|

28,199 |

|

|

Property, plant and equipment, net

|

|

|

21,919 |

|

|

|

26,598 |

|

|

Operating right-of-use assets

|

|

|

776 |

|

|

|

957 |

|

|

Goodwill

|

|

|

736 |

|

|

|

736 |

|

|

Other intangible assets, net

|

|

|

4,951 |

|

|

|

5,573 |

|

|

Other non-current assets

|

|

|

233 |

|

|

|

506 |

|

|

Total assets

|

|

$ |

145,683 |

|

|

$ |

135,056 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable trade

|

|

$ |

6,884 |

|

|

$ |

5,595 |

|

|

Contingent consideration

|

|

|

— |

|

|

|

175 |

|

|

Operating lease liabilities

|

|

|

253 |

|

|

|

241 |

|

|

Other current liabilities

|

|

|

8,990 |

|

|

|

6,616 |

|

|

Total current liabilities

|

|

|

16,127 |

|

|

|

12,627 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current operating lease liabilities

|

|

|

583 |

|

|

|

769 |

|

|

Deferred tax liabilities, net

|

|

|

16 |

|

|

|

13 |

|

|

Total liabilities

|

|

|

16,726 |

|

|

|

13,409 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, 1,000,000 shares authorized, no shares issued and outstanding

|

|

|

— |

|

|

|

— |

|

|

Common Stock, $.01 par value, 20,000,000 shares authorized; 14,028,481 and 13,863,233 shares issued, respectively; and 13,186,489 and 13,021,241 shares outstanding, respectively

|

|

|

140 |

|

|

|

139 |

|

|

Additional paid-in capital

|

|

|

95,741 |

|

|

|

94,667 |

|

|

Retained earnings

|

|

|

57,422 |

|

|

|

49,654 |

|

|

Accumulated other comprehensive loss

|

|

|

(16,846 |

) |

|

|

(15,313 |

) |

|

Treasury stock, at cost, 841,992 shares

|

|

|

(7,500 |

) |

|

|

(7,500 |

) |

|

Total stockholders’ equity

|

|

|

128,957 |

|

|

|

121,647 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

145,683 |

|

|

$ |

135,056 |

|

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| |

|

Nine Months Ended

|

|

| |

|

June 30, 2023

|

|

|

June 30, 2022

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

7,768 |

|

|

$ |

(14,816 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Deferred income tax expense (benefit)

|

|

|

1 |

|

|

|

(12 |

) |

|

Rental equipment depreciation

|

|

|

9,204 |

|

|

|

10,500 |

|

|

Property, plant and equipment depreciation

|

|

|

2,785 |

|

|

|

3,112 |

|

|

Amortization of intangible assets

|

|

|

622 |

|

|

|

1,365 |

|

|

Amortization of premiums (accretion of discounts) on short-term investments

|

|

|

(50 |

) |

|

|

89 |

|

|

Stock-based compensation expense

|

|

|

1,074 |

|

|

|

1,342 |

|

|

Bad debt expense (recovery)

|

|

|

(41 |

) |

|

|

116 |

|

|

Inventory obsolescence expense

|

|

|

2,131 |

|

|

|

2,310 |

|

|

Change in estimated fair value of contingent consideration

|

|

|

— |

|

|

|

(5,042 |

) |

|

Gross profit from sale of used rental equipment

|

|

|

(4,318 |

) |

|

|

(10,801 |

) |

|

Gain on disposal of property

|

|

|

(1,315 |

) |

|

|

— |

|

|

Gain on disposal of equipment

|

|

|

(432 |

) |

|

|

(9 |

) |

|

Realized loss on short-term investments

|

|

|

— |

|

|

|

22 |

|

|

Realized foreign currency translation loss from dissolution of foreign subsidiary

|

|

|

38 |

|

|

|

— |

|

|

Effects of changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trade accounts and notes receivable

|

|

|

(10,561 |

) |

|

|

1,455 |

|

|

Unbilled receivables

|

|

|

— |

|

|

|

1,051 |

|

|

Inventories

|

|

|

(7,175 |

) |

|

|

(1,705 |

) |

|

Other assets

|

|

|

453 |

|

|

|

(250 |

) |

|

Accounts payable trade

|

|

|

1,290 |

|

|

|

(2,223 |

) |

|

Other liabilities

|

|

|

1,654 |

|

|

|

215 |

|

|

Net cash provided by (used in) operating activities

|

|

|

3,128 |

|

|

|

(13,281 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment

|

|

|

(1,862 |

) |

|

|

(913 |

) |

|

Proceeds from the sale of equipment

|

|

|

724 |

|

|

|

9 |

|

|

Proceeds from the sale of property

|

|

|

3,682 |

|

|

|

— |

|

|

Investment in rental equipment

|

|

|

(6,213 |

) |

|

|

(4,121 |

) |

|

Proceeds from the sale of used rental equipment

|

|

|

11,095 |

|

|

|

5,929 |

|

|

Purchases of short-term investments

|

|

|

— |

|

|

|

(450 |

) |

|

Proceeds from the sale of short-term investments

|

|

|

900 |

|

|

|

8,224 |

|

|

Net cash provided by investing activities

|

|

|

8,326 |

|

|

|

8,678 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Payments on contingent consideration

|

|

|

(175 |

) |

|

|

(807 |

) |

|

Debt issuance costs

|

|

|

— |

|

|

|

(211 |

) |

|

Purchase of treasury stock

|

|

|

— |

|

|

|

(695 |

) |

|

Net cash used in financing activities

|

|

|

(175 |

) |

|

|

(1,713 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash

|

|

|

(124 |

) |

|

|

(282 |

) |

|

Increase (decrease) in cash and cash equivalents

|

|

|

11,155 |

|

|

|

(6,598 |

) |

|

Cash and cash equivalents, beginning of fiscal year

|

|

|

16,109 |

|

|

|

14,066 |

|

|

Cash and cash equivalents, end of fiscal period

|

|

$ |

27,264 |

|

|

$ |

7,468 |

|

| |

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes

|

|

$ |

111 |

|

|

$ |

168 |

|

|

Issuance of note receivable related to sale of used rental equipment

|

|

|

— |

|

|

|

11,745 |

|

|

Inventory transferred to rental equipment

|

|

|

117 |

|

|

|

1,194 |

|

|

Inventory transferred to property, plant and equipment

|

|

|

— |

|

|

|

172 |

|

GEOSPACE TECHNOLOGIES CORPORATION AND SUBSIDIARIES

SUMMARY OF SEGMENT REVENUE AND OPERATING INCOME (LOSS)

(in thousands)

(unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

June 30, 2023

|

|

|

June 30, 2022

|

|

|

June 30, 2023

|

|

|

June 30, 2022

|

|

|

Oil and Gas Markets segment revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Traditional seismic exploration product revenue

|

|

$ |

3,363 |

|

|

$ |

1,592 |

|

|

$ |

9,509 |

|

|

$ |

3,428 |

|

|

Wireless seismic exploration product revenue

|

|

|

13,786 |

|

|

|

7,233 |

|

|

|

45,920 |

|

|

|

29,467 |

|

|

Reservoir product revenue

|

|

|

523 |

|

|

|

692 |

|

|

|

810 |

|

|

|

1,422 |

|

| |

|

|

17,672 |

|

|

|

9,517 |

|

|

|

56,239 |

|

|

|

34,317 |

|

|

Adjacent Markets segment revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial product revenue

|

|

|

11,678 |

|

|

|

7,465 |

|

|

|

29,250 |

|

|

|

18,471 |

|

|

Imaging product revenue

|

|

|

3,184 |

|

|

|

3,473 |

|

|

|

9,142 |

|

|

|

9,841 |

|

| |

|

|

14,862 |

|

|

|

10,938 |

|

|

|

38,392 |

|

|

|

28,312 |

|

|

Emerging Markets segment revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Border and perimeter security product revenue

|

|

|

109 |

|

|

|

135 |

|

|

|

393 |

|

|

|

571 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate

|

|

|

72 |

|

|

|

101 |

|

|

|

170 |

|

|

|

182 |

|

|

Total revenue

|

|

$ |

32,715 |

|

|

$ |

20,691 |

|

|

$ |

95,194 |

|

|

$ |

63,382 |

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

June 30, 2023

|

|

|

June 30, 2022

|

|

|

June 30, 2023

|

|

|

June 30, 2022

|

|

|

Operating income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and Gas Markets segment

|

|

$ |

3,238 |

|

|

$ |

(3,695 |

) |

|

$ |

9,820 |

|

|

$ |

(6,209 |

) |

|

Adjacent Markets segment

|

|

|

4,346 |

|

|

|

1,841 |

|

|

|

9,148 |

|

|

|

4,341 |

|

|

Emerging Markets segment

|

|

|

(1,047 |

) |

|

|

(1,405 |

) |

|

|

(3,267 |

) |

|

|

(3,609 |

) |

|

Corporate

|

|

|

(3,391 |

) |

|

|

(3,275 |

) |

|

|

(8,457 |

) |

|

|

(9,592 |

) |

|

Total operating income (loss)

|

|

$ |

3,146 |

|

|

$ |

(6,534 |

) |

|

$ |

7,244 |

|

|

$ |

(15,069 |

) |

v3.23.2

Document And Entity Information

|

Aug. 10, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

GEOSPACE TECHNOLOGIES CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 10, 2023

|

| Entity, Incorporation, State or Country Code |

TX

|

| Entity, File Number |

001-13601

|

| Entity, Tax Identification Number |

76-0447780

|

| Entity, Address, Address Line One |

7007 Pinemont

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77040

|

| City Area Code |

713

|

| Local Phone Number |

986-4444

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

GEOS

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001001115

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

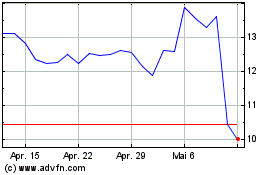

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024