NZ Dollar Rebounds After Upbeat New Zealand Inflation Data

17 April 2024 - 4:26AM

RTTF2

The New Zealand dollar strengthened against other major

currencies in the Asian session on Wednesday, after data showed the

consumer prices in New Zealand rose on quarter in the first quarter

of 2024, as expected.

Data from Statistics New Zealand showed that the consumer prices

in New Zealand were up a seasonally adjusted 0.6 percent on quarter

in the first quarter of 2024. That was in line with expectations

and up from 0.5 percent in the three months prior.

On a yearly basis, inflation rose 4.0 percent - above forecasts

for 4.5 percent and down from 4.7 percent in the previous three

months.

The upbeat CPI data from New Zealand spurred the traders to

expect that the Reserve Bank of New Zealand is unlikely to lower

its Official Cash Rate soon.

Traders reacted to a report showing a continued increase in U.S.

industrial production in the month of March, which added to

concerns about the outlook for interest rates. Traders also

remained cautious amid the geopolitical tensions in the

middle-east.

U.S. Fed Chair Jerome Powell indicated in remarks that rates are

likely to remain higher for longer amid a "lack of progress" toward

reaching the central bank's inflation goal. Fed officials,

including Powell, have repeatedly stated they need "greater

confidence" inflation is slowing before they consider cutting

interest rates.

According to CME Group's FedWatch Tool, the chances of a 25

basis point rate cut in June have tumbled to 16.4 percent compared

to 56.1 percent just a week ago.

In the Asian trading now, the NZ dollar rose to a 2-day high of

91.37 against the yen, from a recent 5-month low of 1.8108. The

kiwi may test resistance near the 1.76 region.

In economic news, data from the Ministry of Finance showed that

Japan posted a merchandise trade surplus of 366.5 billion yen in

March. That beat forecasts for a surplus of 107.4 billion yen

following the upwardly revised 377.8 billion yen deficit in

February.

Exports were up 7.3 percent on year to 9.469 trillion yen after

adding 7.8 percent in the previous month. Meanwhile, imports

slumped an annual 4.9 percent to 9.103 trillion yen after rising

0.5 percent a month earlier.

Against the Australian dollar, the kiwi advanced to a 2-day high

of 1.0861 from a recent low of 1.0919. On the upside, 1.07 is seen

as the next resistance level for the kiwi.

The kiwi edged up to 0.5908 against the U.S. dollar, from a

recent low of 0.5861. The next upside resistance level for the kiwi

is seen around the 0.61 region.

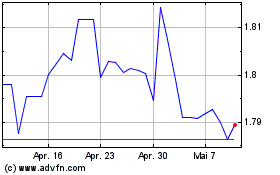

Moving away from nearly a 5-month low of 1.8108 against the

euro, the kiwi edged up to 1.7992. If the kiwi extends its uptrend,

it is likely to find resistance around the 1.76 region.

Looking ahead, Eurostat is scheduled to issue euro area final

consumer prices for March at 5:00 am ET in the European

session.

In the New York session, U.S. MBA mortgage approvals data, U.S.

EIA crude oil data and U.S. Fed Beige book report are slated for

release.

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Apr 2023 bis Apr 2024