NZ Dollar Falls On Soft Jobs Data, Weak China PMI

01 November 2023 - 3:27AM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Wednesday, after data showed that the

unemployment rate in New Zealand increased in the third quarter of

2023. The unexpected contraction in China's Caixin manufacturing

PMI also weighed on the currency.

Data from Statistics New Zealand showed that the unemployment

rate in New Zealand came in at a seasonally adjusted 3.9 percent in

the third quarter of 2023. That was in line with expectations and

up from 3.6 percent in the previous three months.

The New Zealand employment change was down 0.2 percent on

quarter versus forecasts for an increase of 0.4 percent and down

from 1.0 percent in the three months prior.

Data from S&P Global showed that the China's Caixin

manufacturing PMI fell to 49.5 in October, from 50.6 in the

previous month. The economists had expected the PMI to increase to

50.8, although it remains beneath the boom-or-bust line of 50 that

separates expansion from contraction.

Traders seemed reluctant to make significant moves and will pay

close attention to the Fed's accompanying statement for clues about

the outlook for interest rates.

The Fed is widely expected to leave interest rates unchanged.

CME Group's FedWatch Tool is currently indicating a 97.1 percent

chance the Fed will leave rates unchanged on Wednesday and a 68.9

percent chance rates will remain unchanged in December.

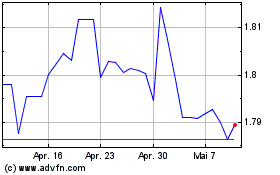

In the Asian trading today, the NZ dollar fell to 6-day lows of

0.5789 against the U.S. dollar and 1.8256 against the euro, from

yesterday's closing quotes of 0.5825 and 1.8153, respectively. If

the kiwi extends its downtrend, it is likely to find support around

0.56 against the greenback and 1.83 against the euro.

Against the Australian dollar, the kiwi dropped to a 2-day low

of 1.0922 from Tuesday's closing value of 1.0875. On the downside,

1.10 is seen as the next support level for the kiwi.

The kiwi edged down to 87.56 against the yen, from yesterday's

closing value of 88.35. The next possible downside target level for

the kiwi is seen around the 86.00 region.

Looking ahead, U.K. Nationwide house price index for October,

PMI reports from various European economies and U.K. for October

are due to be released in the European session.

In the New York session, U.S. MBA mortgage approvals data, U.S.

and Canada PMI reports for October, U.S. construction spending data

for September, U.S. EIA crude oil data are slated for release.

At 2:00 pm ET, the Federal Reserve is set to announce its rate

decision.

The U.S. central bank is widely expected to leave interest rates

unchanged at 5.5 percent, but traders will pay close attention to

the accompanying statement for clues about the outlook for

rates.

Half-an-hour later, Fed Chair Jerome Powell will speak at the

press conference following the rate decision.

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Jun 2024 bis Jul 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

Von Jul 2023 bis Jul 2024