Bitcoin’s Liquidation Data Signals a Possible Trend Reversal—Here’s Why

27 September 2024 - 8:00AM

NEWSBTC

Bitcoin price movements and market sentiment have often been tied

to the positions held by traders across the board. Regarding that,

an insight shared by CryptoQuant analyst Amr Taha sheds light on

the potential significance of Bitcoin’s long/short liquidation

delta, hinting at a shift in market stance. This indicator,

according to the shared insight provides a deep dive into how the

balance between long and short positions can often foreshadow

significant price corrections or rallies. Related Reading: Bitcoin

Correlation With Gold Now At Highest Level Since March Bitcoin

Liquidation Suggest Imminent Market Shift Taha’s analysis centers

around Bitcoin’s delta value, which is derived from comparing long

versus short liquidations. In simple terms, if the delta is

positive, there is a larger proportion of long positions, whereas a

negative delta implies dominance by short positions. By examining

the spikes in this delta, Taha identifies crucial points where

notable liquidation events occurred, suggesting market sentiment

shifts and potential corrections. According to Taha’s observations,

a particularly significant event occurred when Bitcoin’s price was

hovering around $63.8,000. At this point, the delta value indicated

a substantial liquidation of short positions, exceeding roughly

-$664 million. The analyst notes that such a sharp spike in short

liquidations may indicate a shift in market sentiment. In other

words, the sudden liquidation of short positions might have forced

retail investors to close their positions at unfavorable prices.

Historically, these notable liquidation events tend to cause sharp

changes in market direction. A significant influx of liquidated

long or short positions can either reinforce or reverse a price

trend, driven by the sentiment of traders who may be compelled to

exit their positions under pressure. Taha’s analysis suggests that

the sizable liquidation of short positions during Bitcoin’s upward

trajectory hints at a broader correction phase, signaling that the

asset’s price may face volatility and potentially adjust downward

before any clear direction is established. Detailing The

Implications Of The Liquidation Delta To further understand the

implications of the long/short liquidation delta, it is worth

grasping the role of leverage trading within the crypto market.

Notably, traders often take leveraged positions to maximize

potential returns, but this also comes with heightened risks. When

the market moves against their positions, liquidations can occur

rapidly, leading to amplified price movements. In the case of

Bitcoin, the spike in liquidated short positions at $63.8K suggests

that a wave of traders holding short bets were squeezed out,

potentially adding upward momentum to Bitcoin’s price movement.

Related Reading: Bitcoin Price Sees Dip: Is the Uptrend Still Safe?

However, such short-term volatility can be an indication of a

potential market correction, as overleveraged traders on either

side can be swiftly wiped out when prices move against their

expectations. Featured image created with DALL-E, Chart from

TradingView

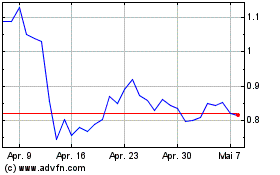

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Okt 2024 bis Okt 2024

Mina (COIN:MINAUSD)

Historical Stock Chart

Von Okt 2023 bis Okt 2024