SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-163

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2024

Alterity

Therapeutics Limited

(Name

of Registrant)

Level 14, 350 Collins Street,

Melbourne, Victoria 3000 Australia

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

Form 6-K is being incorporated by reference into our Registration Statement on Form S-8 (Files No. 333-251073, 333-248980

and 333-228671) and our

Registration Statements on Form F-3 (Files No. 333-274816, 333-251647, 333-231417

and 333-250076)

ALTERITY

THERAPEUTICS LIMITED

(a

development stage enterprise)

The

following exhibits are submitted:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Alterity Therapeutics Limited |

| |

|

|

| |

By: |

/s/ Geoffrey P. Kempler |

| |

|

Geoffrey P. Kempler |

| |

|

Chairman |

Date:

October 23, 2024

2

Exhibit

99.1

ALTERITY

THERAPEUTICS LIMITED

ACN

080 699 065

Notice

of Annual General Meeting

and Explanatory Memorandum

| Time

and Date of Meeting: |

9.00am

(AEDT) on Friday, 22 November 2024 |

| |

Registration

from 8.30am |

| |

|

| Location: |

Deloitte

Australia Offices

Level 30, 477 Collins Street,

Melbourne VIC 3000

|

| Voting

ahead of attending the Meeting |

Shareholders

are strongly encouraged to vote by lodging a directed proxy appointing the Chair before 9.00am

(AEDT) on Wednesday, 20 November 2024. Instructions for lodging proxies are included on your

personalised proxy form, or in the link that you received if you provided an email address.

Alternatively, you are able to vote ahead of the Meeting via https://investor.automic.com.au/#/loginsah |

This

is an important document. It should be read in its entirety. |

If

you are in doubt as to the course you should follow, consult your financial or other professional

adviser. |

| NOTICE

OF 2024 ANNUAL GENERAL MEETING |  |

ALTERITY

THERAPEUTICS LIMITED

ACN

080 699 065

Notice

is given that the 2024 Annual General Meeting of Alterity Therapeutics Limited (“the Company” or “Alterity”)

will be held at Deloitte Australia Offices, L30, 477 Collins Street, Melbourne VIC at 9.00am (AEDT) on Friday, 22 November 2024, for

the purposes of considering and, if thought fit, passing each of the resolutions referred to in this Notice of Annual General Meeting.

Further

details in respect of each of the resolutions proposed in this Notice of Annual General Meeting are set out in the Explanatory Memorandum

accompanying this Notice of Annual General Meeting. The details of the resolutions contained in the Explanatory Memorandum should be

read together with, and form part of, this Notice of Annual General Meeting.

Please

read this Notice of Annual General Meeting carefully and consider directing your proxy on how to vote on each resolution by marking the

appropriate box on the proxy form included with this Notice of Annual General Meeting. Shareholders who intend to appoint the Chair as

proxy (including appointment by default) should have regard to Proxy and Voting Instructions on page 7 of this Notice of Annual General

Meeting.

2024

Annual Reports

To

receive and consider the 2024 Annual Financial Statements of the Company in respect of the year ended 30 June 2024 comprising the Annual

Financial Report, the Directors’ Report and the Auditor’s Report. At the meeting, a representative of the Company’s

auditors, PricewaterhouseCoopers, will be invited to attend to answer questions about the audit of the Company’s 2024 Annual Financial

Statements.

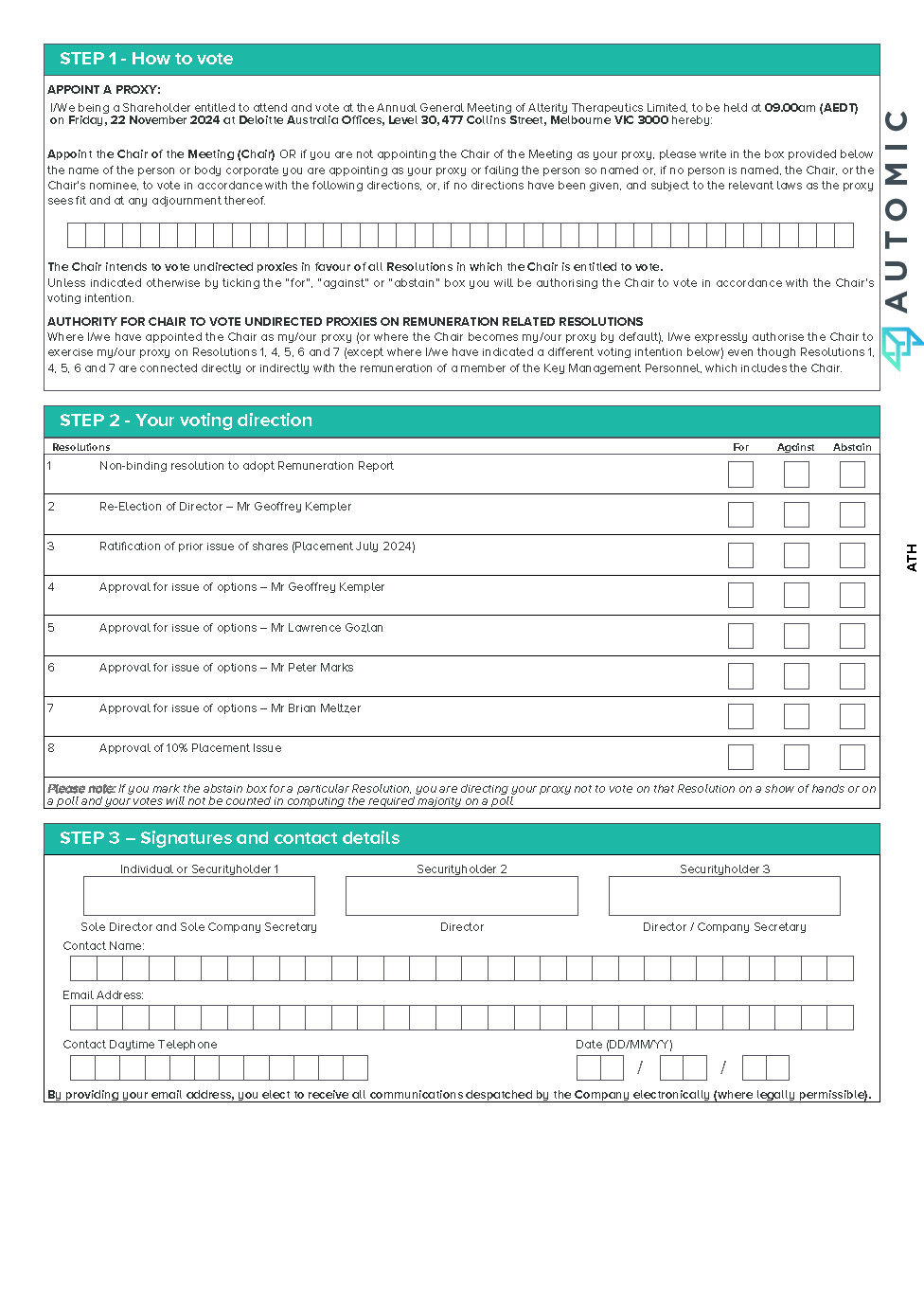

Resolution

1 – Non-binding resolution to adopt Remuneration Report

To

consider and, if thought fit, to pass the following resolution as an advisory and non-binding ordinary resolution:

“THAT

for the purposes of section 250R(2) of the Corporations Act, the Remuneration Report for the financial year ended 30 June 2024 as disclosed

in the Directors’ Report is adopted.”

Voting

Prohibition – Corporations Act

A

vote on Resolution 1 must not be cast (in any capacity) by or on behalf of either of the following persons:

| ● | a

member of the key management personnel, details of whose remuneration are included in the

Remuneration Report; or |

| ● | a

closely related party of such a member (referred to herein as Restricted Voters). |

However,

a person (voter) may cast a vote on Resolution 1 as a proxy if the vote is not cast on behalf of a Restricted Voter and the voter

is appointed as a proxy in writing that specifies the way the proxy is to vote on Resolution 1. The Chair may also exercise undirected

proxies if the vote is cast on behalf of a person entitled to vote on Resolution 1 and the proxy appointment expressly authorises the

Chair to exercise the proxy even if Resolution 1 is connected directly or indirectly with the remuneration of members of the key management

personnel of the Company.

Voting

Note:

Directors

of the Company who are key management personnel whose remuneration details are included in the 2024 Remuneration Report, any other key

management personnel whose remuneration details are included in the 2024 Remuneration Report, or any of their closely related parties,

will not be able to vote on Resolution 1 or to vote undirected proxies held by them on Resolution 1.

| NOTICE

OF 2024 ANNUAL GENERAL MEETING |  |

Resolution

2 – Re-Election of Director – Mr Geoffrey Kempler

To

consider and, if thought fit, pass as an ordinary resolution, the following:

“THAT:

Mr Geoffrey Kempler, a Director of the Company, who retires by rotation in accordance with the Company’s Constitution and, being

eligible, offers himself for re-election, be re-elected as a Director of the Company.”

Resolution

3 – Ratification of prior issue of shares (Placement July 2024)

To

consider and, if thought fit, pass as an ordinary resolution, the following:

“THAT

for the purposes of ASX Listing Rule 7.4 and for all other purposes, shareholders ratify the prior issue of 75,220,800 fully paid ordinary

shares at A$0.0054 (0.54 Australian cents) per share to unrelated professional, sophisticated and other investors exempt from the disclosure

requirements of Ch 6D of the Corporations Act as described in the Explanatory Memorandum which accompanied and formed part of the Notice

of Annual General Meeting.”

Voting

Exclusion Statement – ASX Listing Rules

The

Company will disregard any votes cast in favour of Resolution 3 by or on behalf of a person who participated in the issue or is a counterparty

to the agreement being approved or any associate of that person.

However,

this does not apply to a vote cast in favour of Resolution 3 by:

| ● | a

person as proxy or attorney for a person who is entitled to vote on the resolution, in accordance

with the directions given to the proxy or attorney to vote on the resolution in that way;

or |

| ● | the

chair of the Meeting as proxy or attorney for a person who is entitled to vote on the resolution,

in accordance with a direction given to the chair to vote on the resolution as the chair

decides; or |

| ● | a

holder acting solely as nominee, trustee, custodial or other fiduciary capacity on behalf

of a beneficiary provided the following conditions are met: |

| o | the

beneficiary provides written confirmation to the holder that the beneficiary is not excluded

from voting, and is not an associate of a person excluded from voting, on the resolution;

and |

| o | the

holder votes on the resolution in accordance with directions given by the beneficiary to

the holder to vote in that way. |

Resolution

4 – Approval for issue of options – Mr Geoffrey Kempler

To

consider and, if thought fit, pass as an ordinary resolution, the following:

“THAT

for the purposes of Listing Rule 10.11, Chapter 2E and section 195(4) of the Corporations Act and for all other purposes, shareholders

approve the issue of 60,000,000 unlisted options (each with an exercise price of A$0.01 (1 Australian cent), expiring three years from

issue and, upon exercise, entitling the holder to one fully paid ordinary share in the Company) to Mr Geoffrey Kempler (and/or his nominee(s))

as described in the Explanatory Memorandum which accompanied and formed part of the Notice of Annual General Meeting.”

A

voting exclusion statement, voting prohibition and proxy voting prohibition applies to this Resolution. Please see below.

| NOTICE

OF 2024 ANNUAL GENERAL MEETING |  |

Resolution

5 – Approval for issue of options – Mr Lawrence Gozlan

To

consider and, if thought fit, pass as an ordinary resolution, the following:

“THAT

for the purposes of Listing Rule 10.11, Chapter 2E and section 195(4) of the Corporations Act and for all other purposes, shareholders

approve the issue of 50,000,000 unlisted options (each with an exercise price of A$0.01 (1 Australian cent), expiring three years from

issue and, upon exercise, entitling the holder to one fully paid ordinary share in the Company) to Mr Lawrence Gozlan (and/or his nominee(s))

as described in the Explanatory Memorandum which accompanied and formed part of the Notice of Annual General Meeting.”

A

voting exclusion statement, voting prohibition and proxy voting prohibition applies to this Resolution. Please see below.

Resolution

6 – Approval for issue of options – Mr Peter Marks

To

consider and, if thought fit, pass as an ordinary resolution, the following:

“THAT

for the purposes of Listing Rule 10.11, Chapter 2E and section 195(4) of the Corporations Act and for all other purposes, shareholders

approve the issue of 30,000,000 unlisted options (each with an exercise price of A$0.01 (1 Australian cent), expiring three years from

issue and, upon exercise, entitling the holder to one fully paid ordinary share in the Company) to Mr Peter Marks (and/or his nominee(s))

as described in the Explanatory Memorandum which accompanied and formed part of the Notice of Annual General Meeting.”

A

voting exclusion statement, voting prohibition and proxy voting prohibition applies to this Resolution. Please see below.

Resolution

7 – Approval for issue of options – Mr Brian Meltzer

To

consider and, if thought fit, pass as an ordinary resolution, the following:

“THAT

for the purposes of Listing Rule 10.11, Chapter 2E and section 195(4) of the Corporations Act and for all other purposes, shareholders

approve the issue of 30,000,000 unlisted options (each with an exercise price of A$0.01 (1 Australian cent), expiring three years from

issue and, upon exercise, entitling the holder to one fully paid ordinary share in the Company) to Mr Brian Meltzer (and/or his nominee(s))

as described in the Explanatory Memorandum which accompanied and formed part of the Notice of Annual General Meeting.”

A

voting exclusion statement, voting prohibition and proxy voting prohibition applies to this Resolution. Please see below.

Voting

Exclusion Statement – ASX Listing Rules - Resolutions 4 to 7

The

Company will disregard any votes cast in favour of Resolutions 4 to 7 respectively by or on behalf of the person who is to receive the

securities in question and any other person who will obtain a material benefit as a result of the issue of the securities (except a benefit

solely by reason of being a holder of ordinary securities in the entity) and any of their associates.

However,

this does not apply to a vote cast in favour of Resolutions 4 to 7 respectively by:

| ● | a

person as proxy or attorney for a person who is entitled to vote on the resolution, in accordance

with the directions given to the proxy or attorney to vote on the resolution in that way;

or |

| ● | the

chair of the Meeting as proxy or attorney for a person who is entitled to vote on the resolution,

in accordance with a direction given to the chair to vote on the resolution as the chair

decides; or |

| NOTICE

OF 2024 ANNUAL GENERAL MEETING |  |

| ● | a

holder acting solely as nominee, trustee, custodial or other fiduciary capacity on behalf

of a beneficiary provided the following conditions are met: |

| o | the

beneficiary provides written confirmation to the holder that the beneficiary is not excluded

from voting, and is not an associate of a person excluded from voting, on the resolution;

and |

| o | the

holder votes on the resolution in accordance with directions given by the beneficiary to

the holder to vote in that way. |

Voting

Prohibition – Chapter 2E of the Corporations Act – Resolutions 4 to 7

In

accordance with section 224 of the Corporations Act, a vote on Resolutions 4 to 7 (which seek shareholder approval for the purposes of

Chapter 2E of the Corporations Act) must not be cast (in any capacity) by or on behalf of:

| ● | a

related party of the Company to whom Resolutions 4 to 7 respectively would permit a financial

benefit to be given; or |

| ● | an

associate of such a related party. |

However,

the above does not prevent the casting of a vote if:

| ● | it

is cast by a person as proxy appointed by writing that specifies how the proxy is to vote

on the proposed resolution; and |

| ● | it

is not cast on behalf of a related party or associate of a kind referred to above. |

Proxy

Voting Prohibition – Restricted Voters – Corporations Act – Resolutions 4 to 7

Other

than as set out below, a vote on Resolutions 4 to 7 respectively must not be cast as proxy by a Restricted Voter (defined above).

A

Restricted Voter may cast a vote on Resolutions 4 to 7 respectively as a proxy if either:

| ● | the

Restricted Voter is appointed as a proxy by writing that specifies the way the proxy is to

vote on this resolution; or |

| ● | the

Restricted Voter is the chair and the written appointment of the chair as proxy: |

| o | does

not specify the way the proxy is to vote on this resolution; and |

| o | expressly

authorises the chair to exercise the proxy even though this resolution is connected directly

or indirectly with the remuneration of a member of the Key Management Personnel. |

Resolution

8 – Approval of 10% Placement Issue

To

consider and, if thought fit, pass the following as a special resolution:

“THAT,

pursuant to and in accordance with ASX Listing Rule 7.1A and for all other purposes, the Company may elect to issue equity securities

up to 10% of the issued capital of the Company (at the time of issue) calculated in accordance with the formula prescribed in ASX Listing

Rule 7.1A.2 and on the terms and conditions described in the Explanatory Memorandum which accompanied and formed part of this Notice

of Annual General Meeting.”

Voting

Exclusion Statement – ASX Listing Rules

The

Company will disregard any votes cast in favour of Resolution 8 by or on behalf of any person who is expected to participate in, or who

will obtain a material benefit as a result of, the proposed issue (except a benefit solely by reason of being a holder of ordinary securities

in the entity) or any associate of that person.

However,

this does not apply to a vote cast in favour of Resolution 8 by:

| ● | a

person as proxy or attorney for a person who is entitled to vote on the resolution, in accordance

with the directions given to the proxy or attorney to vote on the resolution in that way;

or |

| NOTICE

OF 2024 ANNUAL GENERAL MEETING |  |

| ● | the

chair of the Meeting as proxy or attorney for a person who is entitled to vote on the resolution,

in accordance with a direction given to the chair to vote on the resolution as the chair

decides; or |

| ● | a

holder acting solely as nominee, trustee, custodial or other fiduciary capacity on behalf

of a beneficiary provided the following conditions are met: |

| o | the

beneficiary provides written confirmation to the holder that the beneficiary is not excluded

from voting, and is not an associate of a person excluded from voting, on the resolution;

and |

| o | the

holder votes on the resolution in accordance with directions given by the beneficiary to

the holder to vote in that way. |

To

consider any other business that may be brought before the Meeting in accordance with the Constitution of the Company and the Corporations Act.

Further

details in respect of these Resolutions are set out in the Explanatory Memorandum accompanying this Notice of Annual General Meeting.

By

the order of the Board:

Geoffrey

Kempler

Chairman

Alterity

Therapeutics Limited

Dated:

23 October 2024

The

accompanying Explanatory Memorandum, Proxy Form |

and

Voting Instructions form part of this Notice of Annual General Meeting. |

| NOTICE

OF 2024 ANNUAL GENERAL MEETING |  |

PROXY

AND VOTING INSTRUCTIONS

Proxy

Instructions

A

Shareholder who is entitled to attend and vote at this meeting may appoint:

(a) one

proxy if the Shareholder is only entitled to one vote; and

(b) one

or two proxies if the Shareholder is entitled to more than one vote.

Where

more than one proxy is appointed each proxy may be appointed to represent a specific proportion of the Shareholder’s voting

rights. If the appointment does not specify the proportion or number of votes each proxy may exercise, each proxy may exercise half

of the votes, in which case any fraction of votes will be disregarded.

The

proxy may, but need not, be a member of the Company.

Where

a Shareholder appoints two proxies, on a poll each

proxy may only exercise votes in respect of those shares or voting rights the proxy represents.

Proxies

may be lodged using any of the following methods:

- online

by visiting https://investor.automic.com.au/#/loginsah o

- by

returning a completed Proxy Form by post to:

- Automic,

GPO Box 5193 Sydney NSW 2001

- by

faxing a completed Proxy Form to +61 2 8583 3040 by email to meetings@automicgroup.com.au

not

less than 48 hours before the time for holding the Meeting, or adjourned meeting as the case may be, at which the individual named

in the proxy form proposes to vote.

The

proxy form must be signed by the Shareholder (or in the case of a joint holding, by each joint holder) or his/her attorney duly authorised

in writing or, if the member is a corporation, in a manner permitted by the Corporations Act. A proxy given by a foreign corporation

must be executed in accordance with the laws of that corporation’s place of incorporation.

If

you sign the proxy form and do not appoint a proxy, you will have appointed the Chair of the Meeting as your proxy.

The

appointment of one or more duly appointed proxies will not preclude a Shareholder from attending this meeting and voting personally.

If the Shareholder votes on a resolution, the proxy must not vote as the Shareholder’s proxy on that resolution. A proxy form

is attached to this Notice. |

|

How

the Chair will vote undirected proxies

Subject

to the restrictions set out in the Notice, the Chair of the meeting will vote undirected proxies on, and in favour of, all of

the proposed resolutions.

Corporate

Representatives

Any

corporation which is a Shareholder of the Company may appoint a proxy, as set out above, or authorise (by certificate under common

seal or other form of execution authorised by the laws of that corporation’s place of incorporation, or in any other manner

satisfactory to the Chairperson of the meeting) a natural person to act as its representative at any general meeting.

Corporate

representatives are requested to bring appropriate evidence of appointment as a representative in accordance with the constitution

of the Company. Attorneys are requested to bring the original or a certified copy of the power of attorney pursuant to which they

were appointed. Proof of identity will also be required for corporate representatives and attorneys.

Voting

Entitlement

For the purposes of section 1074E(2)(g)(i) of the Corporations Act and Regulation 7.11.37 of the Corporations Regulations, the Board has

determined that Shareholders entered on the Company’s Register of Members as at20 November 2024 at 7:00 pm (AEDT) are entitled to

attend and vote at the meeting. Transactions registered after that time will be disregarded in determining the Shareholders entitled to

attend and vote at the meeting.

On

a poll, Shareholders have one vote for every fully paid ordinary share held. Holders of options are not entitled to vote.

In

the case of joint holders of shares, if more than one holder votes at any meeting, only the vote of the first named of the joint

holders in the share register of the Company will be counted.

Special Resolution

Resolution 8 is proposed as special resolution. For a special resolution to be passed, at least 75% of the votes validly

cast on the resolution by shareholders (by number of shares) must be in favour of the resolution. |

|

EXPLANATORY MEMORANDUM

|  |

ALTERITY

THERAPEUTICS LIMITED

ACN

080 699 065

(“the

Company”)

2024

ANNUAL GENERAL MEETING

PURPOSE

OF INFORMATION

This

Explanatory Memorandum (“Memorandum”) accompanies and forms part of the Company’s Notice of the 2024 Annual

General Meeting (“Meeting”) to be held at Deloitte Australia Offices, L30, 477 Collins Street, Melbourne VIC, at 9.00am

(AEDT) on Friday, 22 November 2024. The Notice of the 2024 Annual General Meeting (“the Notice”) incorporates, and

should be read together with, this Memorandum.

2024

Annual Reports

The

2024 Annual Financial Statements, comprising the Financial Report, Directors’ Report and Auditor’s Report for the year ended

30 June 2024 will be laid before the meeting. Shareholders will have the opportunity to ask questions about or make comments on the 2024

Annual Financial Statements and the management of the Company. A representative of the auditor will be invited to attend to answer questions

about the audit of the Company’s 2024 Annual Financial Statements.

The

Company’s 2024 Annual Financial Statements are set out in the Company’s 2024 Annual Report which can be obtained from the

Company’s website, www.alteritytherapeutics.com or upon request to the Company Secretary by email to info@alteritytherapeutics.com.

There

is no requirement for these reports to be formally approved by Shareholders. No resolution is required to be moved in respect of this

item.

Resolution

1: Non-binding Resolution - Remuneration Report

Background

Pursuant

to the Corporations Act 2001 (Cth) (“Corporations Act”) at the Annual General Meeting (“AGM”)

of a listed company, that company must propose a resolution that the Remuneration Report be adopted.

The

purpose of this resolution is to present to the Shareholders the Company’s Remuneration Report so that Shareholders may ask questions

about or make comments on the management of the Company in accordance with the requirements of the Corporations Act and vote on whether

to adopt the Remuneration Report for the year ended 30 June 2024.

This

resolution is advisory only and does not bind the Company, however the Board will consider the outcome of the vote made by Shareholders

on the remuneration report at the meeting when reviewing the Company’s remuneration policies. Under the Corporations Act, if 25%

or more of votes that are cast are voted against the adoption of the Remuneration Report at two consecutive AGMs (treating this AGM as

the first such meeting), shareholders will be required to vote at the second of those AGM’s on a resolution (a “spill resolution”)

that another meeting be held within 90 days at which all of the Company’s Directors (other than the Managing Director and CEO)

must be put up for re-election. The vote on the Remuneration Report contained in the Company’s 2023 Annual Financial Statement

was passed with the support of more than 75% of votes thus a spill resolution will not be required in the event 25% or more of the votes

that are cast at the 2024 AGM are against the adoption of the 2024 Remuneration Report. However, in the event that 25% or more of votes

that are cast are against the adoption of the 2024 Remuneration Report, shareholders should be aware if there is a ‘no’ vote

of 25% or more for the same resolution at the 2025 AGM it may result in the re-election of the Board.

The

Remuneration Report is contained within the 2024 Annual Report. You may access the Annual Report by visiting the Company’s website

www.alteritytherapeutics.com.

|

EXPLANATORY MEMORANDUM

|  |

Resolution

2: Re-Election of Director – Mr. Geoffrey Kempler

At

each AGM of the Company, one third of the Directors of the Company must retire from office by rotation, in accordance with the Company’s

Constitution. The Managing Director is not subject to rotation. No Director (except the Managing Director) shall retain office for a

period in excess of three years without submitting himself or herself for re-election. A Director who retires from office by rotation

and is eligible for re-election may offer him or herself for re-election.

Mr

Geoffrey Kempler retires by rotation and, being eligible, offer himself for re-election. A biography for Mr Geoffrey Kempler is set out

below:

Mr.

Geoffrey Kempler has served as Chairman of the Board of Directors since November 1997; between November 1997 and August 2004 he served

as the Chief Executive Officer and again assumed the position of Chief Executive Officer from June 2005 until January 2021. Mr. Kempler

is one of the founders of our company.

Mr.

Kempler qualified as psychologist with extensive experience in investment and business development. He served as a Chairman and Non-Executive

Director of Opthea Limited (NASDAQ:OPT), from November 2015 until October 2020, is immediate past Chairman of Ausbiotech, Australia’s

biotechnology organization, and is a member of the Industry Advisory Board at the Turner Institute of Brain and Mental Health at Monash

University, and Chair of Hexima Ltd. Mr. Kempler holds a B.Sc degree in science from Monash University, Grad. Dip. App. Soc. Psych. degree

from Swinburne University.

The

board of Directors (with Mr Geoffrey Kempler abstaining from making a recommendation) recommend that shareholders vote in favour of Resolution

2.

Resolution

3 – Ratification of prior issue of shares (Placement July 2024)

Resolution

3 seeks shareholder ratification for the purposes of ASX Listing Rule 7.4 for the prior issue of the 75,220,800 fully paid ordinary shares

at an issue price of A$0.0054 (0.54 Australian cents) per share to unrelated sophisticated, professional and other investors exempt from

the disclosure requirements of Chapter 6D of the Corporations Act who were identified by the Company, raising approximately A$406,192.32

before costs.

The

shares were issued under the placement capacity available to the Company under ASX Listing Rule 7.1A on 18 July 2024 and an Appendix

2A for the issue of the shares was released to ASX on 19 July 2024. The Company obtained shareholder approval to make issues under the

placement capacity available under ASX Listing Rule 7.1A at its 2023 AGM held on 29 November 2023.

ASX

Listing Rule 7.4 provides that where a company’s shareholders ratify the prior issue of securities made pursuant to ASX Listing

Rule 7.1 and/or 7.1A (provided that the previous issue of securities did not breach ASX Listing Rule 7.1 and/or 7.1A) those securities

will be deemed to have been issued with shareholder approval for the purposes of ASX Listing Rule 7.1 and/or 7.1A. The Company seeks

approval under Listing Rule 7.4 to refresh its capacity to make further issues without shareholder approval under Listing Rule 7.1 and/or

Listing Rule 7.1A.

If

shareholders pass Resolution 3 then the fully paid ordinary shares the subject of Resolution 3 will be treated as not having used the

placement capacity of the Company available under the ASX Listing Rules. The fully paid ordinary shares will also increase the placement

capacity available to the Company under the ASX Listing Rules. If shareholders do not pass Resolution 3 then the fully paid ordinary

shares the subject of Resolution 3 will continue to use the placement capacity available to the Company under the ASX Listing Rules.

|

EXPLANATORY MEMORANDUM

|  |

The

following information is provided in accordance with the requirements of ASX Listing Rule 7.5:

| ● | The

securities were issued to unrelated sophisticated, professional and other investors exempt

from the disclosure requirements of Chapter 6D of the Corporations Act who were identified

by the Company. |

| ● | The

total number of securities issued was 75,220,800 fully paid ordinary shares. |

| ● | The

shares issued have the same terms and rights as, and rank equally with, the Company’s

other fully paid ordinary shares on issue. |

| ● | The

shares were issued on 18 July 2024 and an Appendix 2A was released to ASX on 19 July 2024. |

| ● | The

shares were issued at A$0.0054 (0.54 Australian cents) per share. |

| ● | A$406,192.32

was raised from the issue of the shares the subject of Resolution 3. Funds raised have been,

or will be, used for further research and development activities and to provide ongoing working

capital. |

| ● | A

voting exclusion statement for Resolution 3 is contained in the Notice accompanying this

Memorandum. |

The

Directors unanimously recommend shareholders vote in favour of Resolution 3.

Resolutions

4 to 7 – Approval for issue of options - related parties

Resolutions

4 to 7 seek shareholder approval for the purposes of ASX Listing Rule 10.11, Chapter 2E and section 195(4) of the Corporations Act and

for all other purposes to issue an aggregate of 170,000,000 unlisted options (each with an exercise price of A$0.01 (1 Australian cent),

expiring three (3) years from issue and which, upon exercise, entitle the holder to one fully paid ordinary share in the capital of the

Company) to the Directors of the Company (and/or their nominee(s)). The full terms of the unlisted options A.

The

proposed recipient, number of unlisted options they are proposed to receive are set out in the table below:

| Res

# |

Proposed

recipient* |

Number

of options |

| 4 |

Geoffrey

Kempler |

60,000,000 |

| 5 |

Lawrence

Gozlan |

50,000,000 |

| 6 |

Peter

Marks |

30,000,000 |

| 7 |

Brian

Meltzer |

30,000,000 |

| TOTAL |

|

170,000,000 |

| * | unlisted

options may be issued to nominee(s) as advised to the Company. |

|

EXPLANATORY MEMORANDUM

|  |

ASX Listing Rules

ASX Listing Rule 10.11 requires a company to

obtain shareholder approval by ordinary resolution prior to the issue of securities to a related party of the company or any of

their associates or any person whose relationship with either of those persons is such that in ASX’s opinion the acquisition

should be approved by shareholders.

Shareholder approval is being sought under Listing Rule 10.11 for Resolutions 4 to 7 and as such

approval is not required under ASX Listing Rule 7.1.

If shareholders:

| ● | Pass all of Resolutions 4 to 7, the Company will be able

to issue all of the unlisted options the subject of those Resolutions. In addition, shares issued on exercise of these unlisted options

(if any) will increase the placement capacity available to the Company. |

| ● | Pass some, but not all, of Resolutions 4 to 7, the Company

will be able to issue the unlisted options the subject of the Resolution(s) passed by shareholders, but will not be able to issue the

unlisted options the subject of the Resolution(s) not passed by shareholders. In addition, shares issued on exercise of unlisted options

issued in respect of Resolution(s) approved by shareholders will increase the placement capacity of the Company. |

| ● | Do not pass Resolutions 4 to 7, the Company will not be able

to issue the unlisted options the subject of Resolutions 4 to 7. |

The following information is provided

in accordance with the requirements of ASX Listing Rule 10.13:

| ● | The proposed recipients and the maximum number of securities

to be acquired by each person for whom approval under ASX Listing Rule 10.11 is sought under 4 to 7 is set out in the table below: |

| Resolution |

Proposed recipient* |

Number of options |

| 4 |

Geoffrey Kempler |

60,000,000 |

| 5 |

Lawrence Gozlan |

50,000,000 |

| 6 |

Peter Marks |

30,000,000 |

| 7 |

Brian Meltzer |

30,000,000 |

| TOTAL |

|

170,000,000 |

*unlisted options may be issued

to nominee(s) as advised to the Company.

| ● | Each of the proposed recipients of unlisted options under

Resolutions 4 to 7 is a director of the Company and is therefore a related party to whom ASX Listing Rule 10.11.1 applies. |

| ● | The full terms of the unlisted options are set out in Annexure

A. |

| ● | The unlisted options are proposed to be issued shortly after

the Meeting and in any event no later than one (1) month after the date of the Meeting. |

| ● | No funds are payable for the issue of the unlisted options,

which are being issued as incentive options to incentivise and remunerate each of the proposed recipients. |

| ● | The purpose of the issue is to incentivise the proposed recipients.

No funds will be raised from issue of the unlisted options. Funds raised on exercise of the unlisted options (if any) will be applied

to meeting the working capital requirements of the Company at the time of exercise of the unlisted options. |

|

EXPLANATORY MEMORANDUM

|  |

| ● | Details of the total remuneration packages of each of the

proposed recipients of unlisted options the subject of Resolutions 4 to 7 are set out below: |

| o | Geoffrey Kempler: A$280,000 per annum. |

| o | Lawrence Gozlan: A$70,000 per annum. |

| o | Peter Marks: A$70,000 per annum. |

| o | Brian Meltzer: A$70,000 per annum. |

| ● | A voting exclusion statement for Resolutions 4 to 7 respectively

is contained in the Notice accompanying this Memorandum. |

Corporations Act – Chapter

2E

Under Chapter 2E of the Corporations

Act, a public company cannot give a “financial benefit” to a “related party” unless one of the exceptions contained

in Chapter 2E of the Corporations Act apply or the shareholders have in a general meeting approved the giving of that financial benefit

to the related party.

Each of the proposed recipients

of unlisted options the subject of Resolutions 4 to 7 is a related party of the Company under the Corporations Act and the issue of unlisted

options to each of the proposed recipients (and/or their nominee(s)) constitutes the giving of a financial benefit to a related party.

Accordingly, Resolutions 4 to

7 seek shareholder approval for the issue of the unlisted options the subject of Resolutions 4 to 7 for the purposes of Chapter 2E of

the Corporations Act.

A voting prohibition and proxy

voting prohibition in accordance with the Corporations Act in respect of Resolutions 4 to 7 is contained in the Notice accompanying this

Memorandum.

Recipients of options

The proposed related party recipients

of unlisted options and the number of unlisted options to be issued to each is set out in the table below:

|

Resolution |

Proposed recipient* |

Number of options |

| 4 |

Geoffrey Kempler |

60,000,000 |

| 5 |

Lawrence Gozlan |

50,000,000 |

| 6 |

Peter Marks |

30,000,000 |

| 7 |

Brian Meltzer |

30,000,000 |

| TOTAL |

|

170,000,000 |

*unlisted options may be issued

to nominee(s) as advised to the Company.

Nature of financial benefit

Each of the proposed related party

recipients of options will have a relevant interest in the number of options set out against their name in the above table upon the issue

of those options the subject of Resolutions 4 to 7 (which are subject to receipt of shareholder approval). The full terms of options are

set out in Annexure A.

|

EXPLANATORY MEMORANDUM

|  |

The options are proposed to be

issued to the proposed recipients as incentive securities in connection with their respective roles within the Company, as a means of

preserving the cash reserves of the Company whilst providing valuable remuneration to the recipients that further aligns their interests

with those of shareholders.

The number of options was determined

having regard to the capital structure of the Company and the desire to provide balanced incentives to the proposed related party recipients

of unlisted options.

Valuation of options

A Black-Scholes valuation of the

options by the Company as at 30 September 2024 (such Black-Scholes valuation calculated at a 225.9% volatility rate and 3.58% risk free

rate) attributed a value of A$0.0027 (0.27 Australian cents) for each option. The total aggregate value of options proposed to be issued

to the proposed recipients (and/or their respective nominee(s)) based on this Black-Scholes valuation is set out in the table below:

|

Resolution |

Proposed recipient* |

Number of options |

Aggregate option value |

| 4 |

Geoffrey Kempler |

60,000,000 |

A$164,772.35 |

| 5 |

Lawrence Gozlan |

50,000,000 |

A$137,310.29 |

| 6 |

Peter Marks |

30,000,000 |

A$82,386.17 |

| 7 |

Brian Meltzer |

30,000,000 |

A$82,286.17 |

| TOTAL |

|

170,000,000 |

A$466,854.99 |

| * | unlisted options may be issued to nominee(s) as advised

to the Company. |

| ** | based on a Black-Scholes value per option of A$0.0027

(0.0027 Australian cents). All amounts are in Australian dollars (AUD). |

Related party remuneration

As set out above, the annual

remuneration packages of each of the proposed recipients of the unlisted options the subject of Resolutions 4 to 7 exclusive of those

unlisted options are set out below:

| ● | Geoffrey Kempler: A$280,000 per annum. |

| ● | Lawrence Gozlan: A$70,000 per annum. |

| ● | Peter Marks: A$70,000 per annum. |

| ● | Brian Meltzer: A$70,000 per annum. |

The remuneration packages of

each of the proposed recipients of unlisted options the subject of Resolutions 4 to 7 inclusive of those unlisted options are set out

below:

| ● | Geoffrey Kempler: A$444,772.35 per annum (includes A$164,772.35

for the unlisted options under Resolution 4). |

| ● | Lawrence Gozlan: A$207,310.29 per annum (includes A$137,310.29

for the unlisted options under Resolution 4). |

| ● | Peter Marks: A$152,286.17 per annum (includes A$82,286.17

for the unlisted options under Resolution 4). |

| ● | Brian Meltzer: A$152,286.17 per annum (includes A$82,286.17

for the unlisted options under Resolution 4). |

|

EXPLANATORY MEMORANDUM

|  |

Existing interests of related

party recipients

The existing direct and indirect

interests in the securities of the Company at the date of the Notice of the proposed related party recipients of the options the subject

of Resolutions 4 to 7 are set out in the table below:

|

Proposed Recipient |

Shares held |

Current % * |

Options held ** |

| Geoffrey Kempler |

18,011,000 |

0.34% |

14,000,000 |

| Lawrence Gozlan |

Nil |

Nil |

7,000,000 |

| Peter Marks |

7,185,968 |

0.14% |

9,380,952 |

| Brian Meltzer |

7,469,523 |

0.14% |

9,380,952 |

| Total |

32,666,491 |

0.62% |

39,761,904 |

| * | all percentages are subject to rounding. |

| ** | does not include the unlisted options the subject of resolutions

4 to 7. |

If shareholders approve resolutions

4 to 7 and the unlisted options the subject of those resolutions are issued to the proposed related party recipients, the direct and indirect

interests of those proposed related party recipients in the securities of the Company would be as set out in the table below:

|

Proposed Recipient |

Shares held |

Current % * |

Options held |

| Geoffrey Kempler |

18,011,000 |

0.34% |

74,000,000 |

| Lawrence Gozlan |

Nil |

Nil |

57,000,000 |

| Peter Marks |

7,185,968 |

0.14% |

39,380,952 |

| Brian Meltzer |

7,469,523 |

0.14% |

39,380,952 |

| Total |

32,666,491 |

0.62% |

209,761,904 |

| * | all percentages are subject to rounding. Assumes no further

shares are issued between the date of the notice and the issue of the unlisted options the subject of resolutions 4 to 7. |

|

EXPLANATORY MEMORANDUM

|  |

For indicative purposes, the below

shows the direct and indirect interests of each of the proposed related party recipients in the securities of the Company based on their

existing holdings in the Company plus the number of shares issued on conversion of all of the options the subject of resolutions 4 to

7:

|

Proposed Recipient |

Shares held |

Current % * |

Shares after

option exercise |

% of total post-exercise

of options |

| Geoffrey Kempler |

18,011,000 |

0.34% |

78,011,000 |

1.42% |

| Lawrence Gozlan |

Nil |

Nil |

50,000,000 |

0.91% |

| Peter Marks |

7,185,968 |

0.14% |

37,185,968 |

0.68% |

| Brian Meltzer |

7,469,523 |

0.14% |

37,469,523 |

0.68% |

| Total |

32,666,491 |

0.62% |

202,666,491 |

3.69% |

| * | all percentages are subject to rounding. Assumes no further

shares are issued between the date of the notice and the issue of the unlisted options the subject of resolutions 4 to 7. The above table

only takes into account the issue of shares on conversion of the unlisted options the subject of Resolutions 4 to 7 and does not take

into account the issue of any other shares (whether on conversion of options or otherwise). |

Potential dilutive effect of

the issue of options

The issue of the options the subject

of Resolutions 4 to 7 will not result in dilution of the interests of shareholders of the Company until such time as those options (or

part thereof) are exercised into fully paid ordinary shares in the capital of the Company. There is no guarantee that a certain number

of options will be exercised into fully paid ordinary shares, or any at all.

For indicative purposes, an example

of the potential dilutive impact if all of the options the subject of resolution 4 to 7 were exercised into fully paid ordinary shares

is set out in the table below:

|

Example shareholder |

Shares held |

Current % * |

% post-exercise of options |

| A |

10,000,000 |

0.19% |

0.18% |

| B |

25,000,000 |

0.47% |

0.46% |

| C |

50,000,000 |

0.94% |

0.91% |

| D |

100,000,000 |

1.88% |

1.82% |

| E |

250,000,000 |

4.70% |

4.55% |

All percentages in the above table

are subject to rounding. The above table only takes into account the issue of fully paid ordinary shares upon the exercise of the unlisted

options the subject of resolutions 4 to 7 and does not take into account the issue of any other shares (whether on conversion of options

or otherwise).

Corporations Act – Section

195(4)

Although no Director participated

in the discussion or decision making process in respect of the unlisted options proposed to be issued to them, the Directors acknowledge

that Resolutions 4 to 7 separately relate to each of them. Accordingly, Directors propose that Resolutions 4 to 7 each also be put to

shareholders for the purposes of section 195(4) of the Corporations Act such that shareholders determine whether the named related parties

will be issued the respective securities the subject of Resolutions 4 to 7.

|

EXPLANATORY MEMORANDUM

|  |

Director recommendations

The Directors do not make any

recommendations with respect to resolutions 4 to 7 as such recommendations are in connection with the remuneration of each of the Directors

of the Company and therefore may be considered to be a conflict of interest as set out in ASIC guidance in ASIC Regulatory Guide 76.

SPECIAL BUSINESS

Resolution 8 – Approval of 10% placement facility

ASX Listing Rule 7.1A enables

eligible entities to issue equity securities (as that term is defined in the ASX Listing Rules) up to 10% of its issued share capital

through placements over a 12 month period after the Annual General Meeting (10% Placement Facility). The 10% Placement Facility

is in addition to the Company’s 15% placement capacity under ASX Listing Rule 7.1. An eligible entity for the purposes of ASX Listing

Rule 7.1A is an entity that is not included in the S&P/ASX 300 Index and has a market capitalisation of A$300 million or less. The

Company is an eligible entity as at the date of the Notice.

The Company seeks Shareholder

approval by way of a special resolution to have the ability to issue equity securities under the 10% Placement Facility. The exact number

of equity securities (if any) to be issued under the 10% Placement Facility will be determined in accordance with the formula prescribed

in ASX Listing Rule 7.1A.2 (refer to section 2(c) below). Equity securities under the 10% Placement Facility may only be issued for cash

consideration. The Company may use funds raised from any 10% Placement Facility for funding of specific projects and/or general working

capital.

If shareholders pass Resolution

8, the Company will be able to issue up to the number of equity securities under the 10% Placement Facility for cash in accordance with

the formula prescribed by ASX Listing Rule 7.1A.2 (as set out below). If Resolution 8 is not passed by shareholders then the Company will

not be able to issue Equity Securities under the 10% Placement Facility.

The Directors of the Company

believe that Resolution 8 is in the best interests of the Company and unanimously recommend that Shareholders vote in favour of Resolution

8.

| 2. | Description of ASX Listing Rule 7.1A |

The ability to issue equity

securities under the 10% Placement Facility is subject to shareholder approval by way of a special resolution at an AGM.

Any equity securities issued

under the 10% Placement Facility must be in the same class as an existing quoted class of equity securities of the Company.

The Company, as at the date

of the Notice, has on issue two classes of quoted equity securities, being fully paid ordinary Shares (ATH) and options expiring

31 August 2026 (ATHO).

|

EXPLANATORY MEMORANDUM

|  |

| (c) | Formula for calculating 10% Placement Facility |

ASX Listing Rule 7.1A.2 provides

that eligible entities which have obtained shareholder approval at an AGM may issue or agree to issue, during the 12-month period after

the date of the 2024 AGM, a number of equity securities calculated in accordance with the following formula:

(A x D) – E

A is the number of shares

on issue 12 months before the date of the issue or agreement:

| (A) | plus the number of fully paid shares issued in the 12 months

under an exception in ASX Listing Rule 7.2 other than Exception 9, 16 or 17; |

| (B) | plus the number of fully paid ordinary shares issued in the relevant period on

the conversion of convertible securities within ASX Listing Rule 7.2 Exception 9 where: |

| ● | the convertible securities were issued or agreed to be issued

before the commencement of the relevant period; or |

| ● | the issue of, or agreement to issue, the convertible securities was approved,

or taken under those rules to have been approved, under ASX Listing Rule 7.1 or 7.4; |

| (C) | plus the number of fully paid ordinary shares issued in the relevant period under

an agreement to issue securities within ASX Listing Rule 7.2 Exception 16 where: |

| ● | the agreement was entered into before the commencement of the relevant period;

or |

| ● | the agreement or issue was approved, or taken under those rules to have been approved,

under ASX Listing Rule 7.1 or 7.4; |

| (D) | plus the number of partly paid shares that became fully paid in the 12 months; |

| (E) | plus the number of fully paid shares issued in the 12 months with approval of holders

of shares under ASX Listing Rules 7.1 and 7.4; and |

| (F) | less the number of fully paid shares cancelled in the 12 months. |

Note that A has the

same meaning in ASX Listing Rule 7.1 when calculating an entity’s 15% placement capacity.

| E | is the number of equity securities issued or agreed to be

issued under ASX Listing Rule 7.1A.2 in the 12 months before the date of the issue or agreement to issue that has not been subsequently

approved and ratified by shareholders under ASX Listing Rules 7.4. |

| (d) | ASX Listing Rule 7.1 and ASX Listing Rule 7.1A |

The ability of an entity to issue

equity securities under ASX Listing Rule 7.1A is in addition to the entity’s 15% placement capacity under ASX Listing Rule 7.1.

The actual number of equity securities

that the Company will have capacity to issue under ASX Listing Rule 7.1A will be calculated at the date of issue of the equity securities

in accordance with the formula prescribed in ASX Listing Rule 7.1A.2 (refer to section 2(c) above).

|

EXPLANATORY MEMORANDUM

|  |

The issue price of equity securities

issued under ASX Listing Rule 7.1A must be not less than 75% of the VWAP of equity securities in the same class calculated over the 15

trading days on which trades in that class were recorded immediately before:

| (A) | the date on which the price at which the equity securities

are to be issued is agreed by the Company and the recipient of the relevant equity securities; or |

| (B) | if the equity securities are not issued within 10 trading

days of the date in paragraph (A) above, the date on which the equity securities are issued. |

Shareholder approval of the 10% Placement Facility

under ASX Listing Rule 7.1A is valid from the date of the AGM at which the approval is obtained and expires on the earlier to occur of:

| (A) | the date that is 12 months after the date of the AGM at which

the approval is obtained; or |

| (B) | the date and time of the subsequent AGM after the AGM at which

the approval is obtained; or |

| (C) | the date and time of the approval by shareholders of a transaction

under ASX Listing Rules 11.1.2 (a significant change to the nature or scale of activities) or 11.2 (disposal of main undertaking), |

(10% Placement Period).

The effect of Resolution 8 will

be to allow the Directors to issue the equity securities under ASX Listing Rule 7.1A during the 10% Placement Period without using the

Company’s 15% placement capacity under ASX Listing Rule 7.1.

Resolution 8 is a special resolution

and therefore requires approval of 75% of the votes cast by Shareholders present and eligible to vote (in person, by proxy, by attorney

or, in the case of a corporate Shareholder, by a corporate representative).

| 4. | Specific Information required by ASX Listing Rule 7.3A |

Pursuant to and in accordance

with ASX Listing Rule 7.3A, information is provided in relation to the approval of the 10% Placement Facility as follows:

| (a) | The equity securities will be issued at an issue price of

not less than 75% of the VWAP for the Company’s equity securities over the 15 trading days on which trades in that class were recorded

immediately before: |

| (A) | the date on which the price at which the equity securities

are to be issued is agreed by the Company and the recipient of the relevant equity securities; or |

| (B) | if the equity securities are not issued within 10 trading

days of the date in paragraph (A) above, the date on which the equity securities are issued. |

|

EXPLANATORY MEMORANDUM

|  |

| (b) | If Resolution 8 is approved by the Shareholders and the Company issues equity

securities under the 10% Placement Facility, the existing Shareholders’ voting power in the Company will be diluted. Indicative

examples of the potential dilutive impact of the issue of equity securities under the 10% Placement Facility is shown in the table set

out in section (f) below. |

| (A) | the market price for the Company’s equity securities

may be significantly lower on the date of the issue of the equity securities than on the date of the Annual General Meeting; and |

| (B) | the equity securities may be issued at a price that is at

a discount to the market price for the Company’s equity securities on the issue date, |

which may have an effect on the amount

of funds raised by the issue of the equity securities.

The table below shows the dilution

of existing Shareholders on the basis of the current market price of Shares and the current number of ordinary shares for variable “A”

calculated in accordance with the formula in ASX Listing Rule 7.1A(2) as at the date of the Notice.

The table below also shows:

| (i) | two examples where variable “A” has increased

by 50% and 100%. Variable “A” is based on the number of ordinary shares the Company has on issue at the date of the Notice.

The number of ordinary securities on issue may increase as a result of issues of ordinary shares that do not require Shareholder approval

(for example, a pro rata entitlements issue or scrip issued under a takeover offer) or future specific placements under ASX Listing Rule

7.1 that are approved at a future Shareholders’ meeting; and |

| (ii) | two examples of where the price of ordinary securities has

decreased by 50% and increased by 50% as against the Deemed Price (defined below). |

|

Variable “A” in ASX

Listing Rule 7.1A.2 |

Dilution |

|

50% decrease in

Deemed Price

$0.0015 |

Deemed Price

$0.0030 |

50% Increase in

Deemed Price

$0.0045 |

|

Current Variable A

5,320,336,118 Shares |

10% Voting Dilution

532,033,611 Shares |

| Funds raised |

$798,050.42 |

$1,596,100.83 |

$2,394,151.25 |

|

50% increase in current Variable A

7,980,504,177 Shares |

10% Voting Dilution

798,050,417 Shares |

| Funds raised |

$1,197,075.63 |

$2,394,151.25 |

$3,591,226.88 |

|

100% increase in current

Variable A

10,640,672,236 Shares |

10% Voting Dilution

1,064,067,223 Shares |

| Funds raised |

$1,596,100.83 |

$3,192,201.67 |

$4,788,302.50 |

| * | Please note that the current number of shares on issue shown

above is as at the date of the Notice. |

|

EXPLANATORY MEMORANDUM

|  |

The table has been prepared on the

following assumptions:

| (i) | The share figures are as at close of trade on 30 September 2024; |

| (ii) | The Company issues the maximum securities available under the ASX Listing Rule

7.1A being 10% of the Company’s shares on issue at the date of the Meeting; |

| (iii) | No options are exercised into fully paid ordinary securities before the date of

the issue of securities under ASX Listing Rule 7.1A; |

| (iv) | The table does not demonstrate an example of dilution that may be caused to a particular

shareholder by reason of placements under ASX Listing Rule 7.1A, based on that shareholder’s holding at the date of the Meeting; |

| (v) | The table only demonstrates the effect of issues of securities under ASX Listing

Rule 7.1A. It does not consider placements made under ASX Listing Rule 7.1, the “15% rule”; |

| (vi) | The price of ordinary securities is deemed for the purposes of the table above

to be $0.003, being the closing price of the Company’s fully paid ordinary shares on ASX 30 September 2024 (Deemed Price).

The Deemed Price is indicative only and does not consider any discount to market that the securities may be placed at; and |

| (vii) | The table does not demonstrate the effect of listed or unlisted options being

issued under ASX Listing Rule 7.1A, it only considers the issue of the fully paid ordinary securities. |

| (d) | The Company will only issue and allot the equity securities

during the 10% Placement Period. |

| (e) | The Company may only seek to issue the equity securities

under the 10% Placement Facility for cash consideration. The Company may use the funds raised towards advancing specific Company projects

and/or general working capital. |

The Company will comply with

the disclosure obligations under ASX Listing Rules 7.1A(4) upon issue of any equity securities.

The Company’s allocation

policy is dependent on the prevailing market conditions at the time of any proposed issue pursuant to the 10% Placement Facility. The

identity of the allottees of equity securities will be determined on a case-by-case basis having regard to factors including but not limited

to the following:

| (i) | the methods of raising funds that are available to the Company,

including but not limited to, rights issue or other issue in which existing security holders can participate; |

| (ii) | the effect of the issue of the equity securities on the control

of the Company; |

| (iii) | the financial situation and solvency of the Company; and |

| (iv) | advice from corporate, financial and broking advisers (if

applicable). |

The allottees under the 10%

Placement Facility have not been determined as at the date of the Notice but may include existing substantial Shareholders and/or new

Shareholders who are not related parties or associates of a related party of the Company.

|

EXPLANATORY MEMORANDUM

|  |

| (f) | The Company previously obtained approval for the 10% Placement

Facility at its 2012, 2013, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022 and 2023 AGMs. |

In the 12 months prior to the

Meeting, the Company has issued 75,220,800 equity securities (ordinary shares) under the 10% Placement Facility approved by shareholders

at the 2023 AGM. These aggregate of 75,220,800 equity securities issued in the 12 months preceding the Meeting represent 2.29% of the

total number of equity securities on issue in the Company (being 3,284,135,277 total equity securities comprising 2,439,897,618 ordinary

shares and 844,237,659 unlisted options) at the commencement of the 12 month period preceding the Meeting (being 22 November 2023).

The issue of securities by the

Company under its 10% Placement Facility in the 12 months prior to the Meeting is set out below:

| Date of issue |

18 July 2024 |

| Number issued |

75,220,800 |

| Total consideration received |

A$406,192.32 before costs, being an issue price of A$0.0054 per share. |

| Class and type of equity security |

Ordinary fully paid shares. |

| Summary of terms |

Ranking pari passu with all other fully paid ordinary shares on issue in the Company. |

| Persons who received securities or basis on which those persons

were determined |

Unrelated sophisticated, professional and other investors exempt from the disclosure requirements of Chapter 6D of the Corporations Act who were identified by the Company. |

| Discount |

Shares issued at $0.0054 per share. Closing price on date of issue of $0.006. 10% discount. |

| Use of funds raised |

Funds raised are to be used for working capital and to progress research and development activities. Amount raised: A$406,192.32 Amount spent: $0.00 Amount remaining: A$406,192.32 |

| (g) | A voting exclusion statement is included in the Notice. At

the date of the Notice, the Company has not approached any particular existing Shareholder or security holder or an identifiable class

of existing security holder to participate in the issue of the Equity Securities, and it is not proposed to do so between the date of

the Notice and the date of the Meeting. No existing Shareholder’s votes will therefore be excluded under the voting exclusion in

the Notice. |

|

EXPLANATORY MEMORANDUM

|  |

ANNEXURE A

TERMS OF OPTIONS

The terms of the issue of the Options

are:

| 1. | Each Option entitles the holder to one fully paid ordinary share in the capital

of Alterity Therapeutics Limited [ABN 37 080 699 065] (the Company) (each a Share). |

| 2. | The Options may be exercised at any time prior to 5.00pm Melbourne time on the

date that is three (3) years from issue of the Options (Expiry Date). |

| 3. | The exercise price of the Options is A$0.01 (1 Australian cents) each (Exercise

Price). |

| 4. | The Options will not be listed. |

| 5. | The Options are transferable, subject at all times to the requirements of the

Australian Corporations Act 2001 and any other applicable law or regulation. |

| 6. | To exercise the Options, each Option holder must duly complete, execute and deliver

to the Company an exercise notice in the form provided to the Option holder or as otherwise acceptable to the Company (Notice of Exercise).

Options may be exercised by the Option holder in whole or in part by completing the Notice of Exercise (or such other form of written

notice of exercise acceptable to the Company) and delivering it to the Company Secretary at its registered office or to its designated

registry (which may include delivery or giving by electronic means), to be received prior to the Expiry Date. The Notice of Exercise must,

among other things, state the number of Options exercised, the consequent number of Shares to be allotted and the identity of the proposed

allottee. The Notice of Exercise by an Option holder must be accompanied by payment (which may be made by electronic funds transfer by

prior arrangement in writing with the Company or its designated registry) in full for the relevant number of Shares being subscribed,

being an amount of the Exercise Price per Option exercised. |

| 7. | All Shares issued upon the exercise of the Options will rank equally in all respects

with the Company’s then issued Shares. The Company will apply to the Australian Securities Exchange (ASX) for all Shares issued

pursuant to the exercise of the Options to be admitted to quotation. |

| 8. | In the event of a pro rata entitlements issue to the Company’s shareholders, the

Exercise Price shall be reduced in accordance with the formula set out in ASX Listing Rule 6.22.2. |

| 9. | In the event of a bonus issue the number of Shares over which the Option is exercisable

shall be increased by the number of Shares which the Option holder would have received if the Option had been exercised before the record

date for the bonus issue. |

| 10. | In the event of any reorganisation of the capital of the Company (including consolidation,

subdivisions, reduction or return) prior to the Expiry Date the rights of an Option holder will be changed to the extent necessary to

comply with the Listing Rules of the ASX applying to a reorganisation of the capital at the time of the reorganisation. |

| 11. | There are no participating rights or entitlements inherent in the Options and

an Option holder will not be entitled to participate in new issues of capital offered to the Company’s shareholders during the term

of the Options. However, the Company will if required by the Listing Rules of ASX send a notice to the Option holder at least 3 business

days (or such longer period as the Listing Rules of ASX require) before the record date of any new issues of capital offered to the Company’s

shareholders in order to give the Option holder the opportunity to exercise their Options prior to the date for determining entitlements

to participate in any such issue. Notice may be sent to the last email address advised by the Option holder. |

| 12. | The Options will not give any right to participate in dividends until Shares are

issued pursuant to the exercise of the relevant Options. |

| 13. | The Options may not be exercised by or on behalf of a person in the United States

unless the Options and the underlying Shares have been registered under the US Securities Act of 1933, as amended, and applicable state

securities laws, or exemptions from such registration requirements are available. |

Alterity Therapeutics (PK) (USOTC:PRNAF)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Alterity Therapeutics (PK) (USOTC:PRNAF)

Historical Stock Chart

Von Mär 2024 bis Mär 2025