Lithium Demand,

Prices Skyrocketing: New Sources Needed

April 19, 2022 -- InvestorsHub

NewsWire -- via ROBIN

LEFFERTS -- Demand for

lithium is increasing rapidly due to the proliferation of electric

batteries dependent on the mineral. McKinsey

forecasts the battery cell

market will grow at a minimum of 20% per year through 2030, which

would put the global value at $360 billion. Depending on market

conditions and the possible positive impacts of economies of scale,

the firm believes the global electric battery market could

plausibly reach $410 billion by that time.

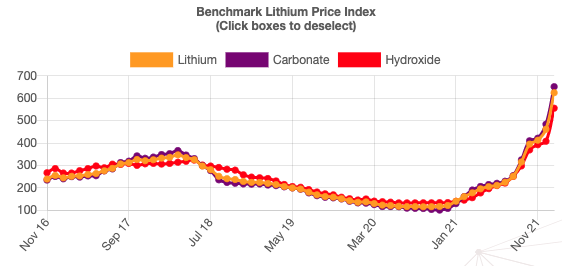

Along with rising demand and in

conjunction with a relatively capped supply, lithium prices have of

course skyrocketed. According to Benchmark Mineral Intelligence,

the price of raw lithium rose 344.9% between January 2021 and

January 2022.

Source:

Benchmark Mineral Intelligence

Companies around the world are

scrambling to secure existing supply and create new sources for

lithium. Australia, Chile, and China are currently the largest

producers of lithium, with Australia greatly expanding production

over the last four years or so. Argentina currently rates fourth in

lithium production, increasing output by 60% in 2016 alone. The

country, known for its favorable regulatory environment, may be

poised for an even bigger leap over the next several years as

claims increase to meet demand while neighboring Chile

simultaneously debates its

approach to mining.

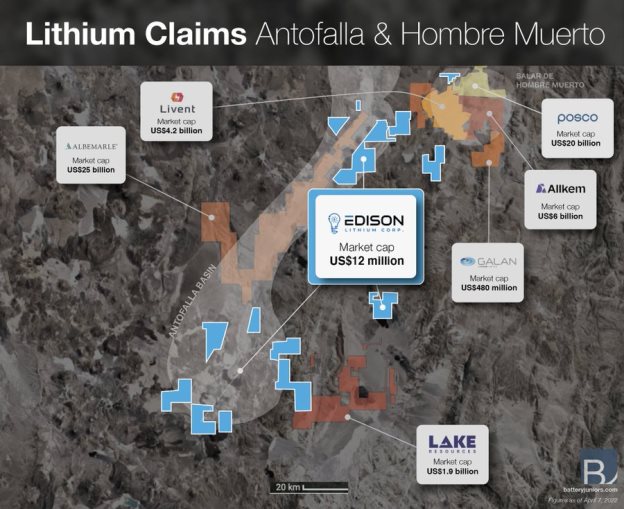

One prospective lithium miner

positioned to help drive increased production in Argentina

is Edison

Lithium Corp. (TSX-V: EDDY) (OTCQB:

EDDYF) (FSE: VVO). Edison holds a total of over 148,000 hectares

(~366,000 acres) of lithium claims in two prime areas of the

country.

Lithium

in Chile and Argentina

Chile produces about 25% of the

world's lithium supply and sits on almost half of the

world's proven reserves. The country has historically

been committed to mining at almost any cost, but a recent election

of a new government there, combined with issues

raised by indigenous populations regarding mining practices on or near their

lands, has created an air of uncertainty in the country. In fact,

the country is in the midst of rewriting

its constitution and some

of the central issues surround the influence of the

country's powerful mining industry. Though mining in

resource-rich Chile will undoubtedly remain, the regulatory

landscape around the industry is in question.

Argentina's lithium zones lie just on the other side of

the border with Chile, and its reserves haven't been proven or its resources exploited nearly

to the extent of its neighbors to the west. But the potential is

clearly there.

One of Edison

Lithium's areas of focus is the Salar de Antofalla, in

the highlands near the border of Argentina and Chile. Edison

acquired claims here as part of their purchase of Resource Ventures

S.A. Several other companies have claims in the area as

well.

In 2016 Albemarle,

the world's second largest lithium producing company,

acquired claims in the Antofalla region from Bolland Minera S.A.

Bolland's drill program had identified a substantial

resource of both lithium and potassium (potash) to over 500 meters

depth, suggesting that Antofalla is one of the deepest basins in

the region. At the time, Albemarle believed its resource would

prove to be Argentina's largest lithium resource. The company has not

announced further development of the property as it tends to more

advanced operations in other regions.

Edison Lithium's claims in the Antofalla basically surround

Albemarle's, and previous transient electromagnetic (TEM)

geophysical studies of some of Edison's claims indicate potential brine resources

down to a similar depth of 500 meters. To date, there has not been

a NI 43-101 technical report conducted on the claims to prove the

resource. Edison's Antofalla claims total about 107,000

hectares, or about 264,000 acres.

The company has completed

an Environmental Impact Assessment for the prospecting phase of exploration of its

Antofalla claims. The submission is basically a plan of work for

the next phase of development as Edison moves toward confirming the

lithium resources on its claims.

New Sources

Needed

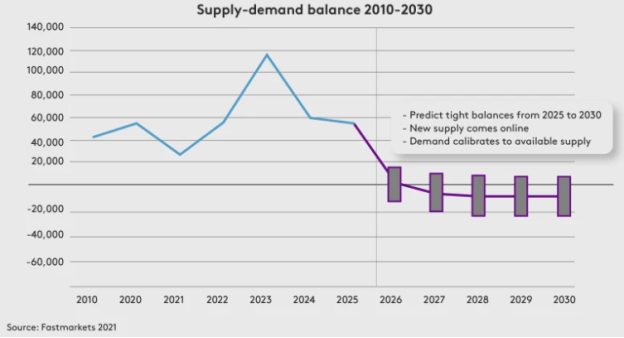

According to Fastmarkets, new

projects coming online will be able to meet demand through 2025,

but the next five years there could be a deficit as demand

continues to skyrocket while new production levels struggle to keep

up. The research firm points to Australia and the Lithium Triangle

(Argentina, Chile, and Bolivia) as the most likely areas for new

production. That's where a company like Edison Lithium comes

into the picture.

Source:

Fastmarkets

Such

forecasts always lead to deals and consolidation as investors look

to capitalize. In 2021, large mining companies

closed over $9 billion worth of M&A

deals for Latin American assets, and almost half of those targeted

lithium. Three of the top six deals on the linked list were for

Argentinian lithium assets.

Edison

Lithium (TSX-V: EDDY) (OTCQB: EDDYF) (FSE: VVO) is positioned at

the nexus of several enticing trends. Lithium demand is through the

roof with no signs of slowing down. Companies are racing to bring

new production online to take advantage of the favorable market

conditions. The Lithium Triangle is one of the

world's

prime locations for lithium production. Edison's

claims need to be proven but have shown great potential for deep

reserves, surrounding claims held by the second largest lithium

supplier in the world that are thought to represent

Argentina's

largest lithium resource.

Keep an

eye out on the lithium market in general, and Edison Lithium Corp.

in particular. Its ~$13 million market capitalization belies the

tremendous potential of its holdings.

SOURCE: ROBIN

LEFFERTS