false

2024

Q2

Yes

--06-30

false

10-Q

0001882781

0001882781

2023-07-01

2023-12-31

0001882781

2023-12-31

0001882781

2023-06-30

0001882781

2023-10-01

2023-12-31

0001882781

2022-10-01

2022-12-31

0001882781

2022-07-01

2022-12-31

0001882781

us-gaap:CommonStockMember

2023-06-30

0001882781

us-gaap:AdditionalPaidInCapital

2023-06-30

0001882781

us-gaap:RetainedEarningsMember

2023-06-30

0001882781

us-gaap:CommonStockMember

2023-09-30

0001882781

us-gaap:AdditionalPaidInCapital

2023-09-30

0001882781

us-gaap:RetainedEarningsMember

2023-09-30

0001882781

2023-09-30

0001882781

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001882781

us-gaap:AdditionalPaidInCapital

2023-07-01

2023-09-30

0001882781

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001882781

2023-07-01

2023-09-30

0001882781

us-gaap:CommonStockMember

2023-10-01

2023-12-31

0001882781

us-gaap:AdditionalPaidInCapital

2023-10-01

2023-12-31

0001882781

us-gaap:RetainedEarningsMember

2023-10-01

2023-12-31

0001882781

us-gaap:CommonStockMember

2023-12-31

0001882781

us-gaap:AdditionalPaidInCapital

2023-12-31

0001882781

us-gaap:RetainedEarningsMember

2023-12-31

0001882781

us-gaap:CommonStockMember

2022-06-30

0001882781

us-gaap:AdditionalPaidInCapital

2022-06-30

0001882781

us-gaap:RetainedEarningsMember

2022-06-30

0001882781

2022-06-30

0001882781

us-gaap:CommonStockMember

2022-09-30

0001882781

us-gaap:AdditionalPaidInCapital

2022-09-30

0001882781

us-gaap:RetainedEarningsMember

2022-09-30

0001882781

2022-09-30

0001882781

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001882781

us-gaap:AdditionalPaidInCapital

2022-07-01

2022-09-30

0001882781

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001882781

2022-07-01

2022-09-30

0001882781

us-gaap:CommonStockMember

2022-10-01

2022-12-31

0001882781

us-gaap:AdditionalPaidInCapital

2022-10-01

2022-12-31

0001882781

us-gaap:RetainedEarningsMember

2022-10-01

2022-12-31

0001882781

us-gaap:CommonStockMember

2022-12-31

0001882781

us-gaap:AdditionalPaidInCapital

2022-12-31

0001882781

us-gaap:RetainedEarningsMember

2022-12-31

0001882781

2022-12-31

0001882781

2022-07-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| [X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR

THE QUARTERLY PERIOD ENDED December 31,

2023

OR

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER: 000-56340

C2

Blockchain,Inc.

(Exact name of registrant as specified in

its charter)

| |

Nevada |

00-0000000 |

|

| |

(State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

| |

|

|

|

| |

c/o Levi Jacobson

123 SE 3rd Ave, #130 Miami, Florida |

33131 |

|

| |

(Address of Principal Executive Offices) |

(Zip Code) |

|

Issuer's telephone number: (888) 437-3432

Indicate by check mark whether the registrant

(1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). [X] Yes [ ] No

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

| Smaller reporting company ☒ |

|

Emerging growth company ☒ |

|

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[X] Yes [ ] No

Indicate the number of shares outstanding of each of the issuer’s

classes of common stock, as of the latest practicable date.

As of February 2, 2024, there were 253,936,005

shares of common stock issued and outstanding.

-1-

INDEX

-2-

Table of Contents

PART I - FINANCIAL INFORMATION

C2 Blockchain, Inc.

Balance Sheet

| |

|

December 31, 2023 (Unaudited) |

|

|

June 30,

2023 |

| |

|

|

|

|

|

| ASSETS |

|

|

|

|

|

| Cash

and cash equivalents |

$ |

90 |

|

$ |

- |

| TOTAL

ASSETS |

$ |

90 |

|

$ |

- |

| |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

DEFICIT |

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

| Loan

to Company - related party |

$ |

44,764 |

|

$ |

31,164 |

| TOTAL

LIABILITIES |

$ |

44,764 |

|

$ |

31,164 |

| |

|

|

|

|

|

| Stockholders’

Equity (Deficit) |

|

|

|

|

|

| Preferred

stock ($.001 par

value, 20,000,000 shares

authorized; none issued and outstanding as of December 31, 2023 and June 30, 2023) |

|

- |

|

|

- |

| |

|

|

|

|

|

| Common

stock ($.001 par

value, 500,000,000 shares

authorized, 253,936,005 shares

issued and outstanding as of December 31, 2023 and June 30, 2023) |

|

253,936 |

|

|

253,936 |

| Additional

paid-in capital |

|

(252,601) |

|

|

(252,601) |

| Accumulated

deficit |

|

(46,009) |

|

|

(32,499) |

| Total

Stockholders’ Equity (Deficit) |

|

(44,674) |

|

|

(31,164) |

| |

|

|

|

|

|

| TOTAL

LIABILITIES & STOCKHOLDERS’ EQUITY (DEFICIT) |

$ |

90 |

|

$ |

- |

The

accompanying notes are an integral part of these unaudited financial statements.

F-1

Table of Contents

C2

Blockchain, Inc.

Statement

of Operations

(Unaudited)

| |

|

|

Three

Months Ended December 31, 2023 |

|

|

Three

Months Ended December 31, 2022 |

|

|

Six

Months Ended December 31, 2023 |

|

|

Six

Months Ended December 31, 2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| General

and administrative expenses |

|

$ |

3,960 |

|

$ |

2,419 |

|

$ |

13,510 |

|

$ |

7,288 |

|

| Total

operating expenses |

|

|

3,960 |

|

|

2,419 |

|

|

13,510 |

|

|

7,288 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(3,960) |

|

$ |

(2,419) |

|

$ |

(13,510) |

|

$ |

(7,288) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic

and Diluted net loss per common share |

|

$ |

(0.00) |

|

$ |

(0.00) |

|

$ |

(0.00) |

|

$ |

(0.00) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average number of common shares outstanding - Basic and Diluted |

|

|

253,936,005 |

|

|

253,936,005 |

|

|

253,936,005 |

|

|

253,936,005 |

|

The

accompanying notes are an integral part of these unaudited financial statements.

F-2

Table

of Contents

C2 Blockchain, Inc.

Statement of Changes is

Stockholder (Deficit)

For the Period June 30,

2023 to December 31, 2023

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Common Shares |

|

Par Value Common Shares |

|

|

Additional Paid-in Capital |

|

Accumulated Deficit |

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances, June 30, 2023 |

|

|

253,936,005 |

$ |

253,936 |

|

$ |

(252,601) |

$ |

(32,499) |

$ |

(31,164) |

|

| Net loss |

|

|

- |

|

- |

|

|

- |

|

(9,550) |

|

(9,550) |

|

| Balances, September 30, 2023 |

|

|

253,936,005 |

$ |

253,936 |

$ |

|

(252,601) |

$ |

(42,049) |

$ |

(40,714) |

|

| Net loss |

|

|

- |

|

- |

|

|

- |

|

(3,960) |

|

(3,960) |

|

| Balances, December 31, 2023 |

|

|

253,936,005 |

$ |

253,936 |

$ |

|

(252,601) |

$ |

(46,009) |

$ |

(44,674) |

|

C2 Blockchain, Inc.

Statement of Changes is

Stockholder (Deficit)

For the Period June 30,

2022 to December 31, 2022

(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Common Shares |

|

Par Value Common Shares |

|

|

Additional Paid-in Capital |

|

Accumulated Deficit |

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances, June 30, 2022 |

|

|

253,936,005 |

$ |

253,936 |

|

$ |

(252,601) |

$ |

(13,992) |

$ |

(12,657) |

|

| Net loss |

|

|

- |

|

- |

|

|

- |

|

(4,869) |

|

(4,869) |

|

| Balances, September 30, 2022 |

|

|

253,936,005 |

$ |

253,936 |

$ |

|

(252,601) |

$ |

(18,861) |

$ |

(17,526) |

|

| Net loss |

|

|

- |

|

- |

|

|

- |

|

(2,419) |

|

(2,419) |

|

| Balances, December 31, 2022 |

|

|

253,936,005 |

$ |

253,936 |

$ |

|

(252,601) |

$ |

(21,280) |

$ |

(19,945) |

|

The accompanying

notes are an integral part of these unaudited financial statements.

F-3

Table of Contents

C2 Blockchain,

Inc.

Statement

of Cash Flows

(Unaudited)

| |

|

For the Six Months Ended December 31, 2023 |

|

|

For the Six Months Ended December 31, 2022 |

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

| Net

loss |

$ |

(13,510) |

|

$ |

(7,288) |

| Adjustment

to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

| |

|

|

|

|

|

| Changes

in current assets and liabilities: |

|

|

|

|

|

| Net

cash used in operating activities |

|

(13,510) |

|

|

(7,288) |

| |

|

|

|

|

|

| CASH

FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

| Loan

to company - related party |

$ |

13,600 |

|

$ |

7,288 |

| Net

cash provided by financing activities |

|

13,600 |

|

|

7,288 |

| |

|

|

|

|

|

| Net

change in cash |

$ |

90 |

|

$ |

- |

| Beginning

cash balance |

|

- |

|

|

- |

| Ending

cash balance |

$ |

90 |

|

$ |

- |

| |

|

|

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

| Interest

paid |

$ |

- |

|

$ |

- |

| Income

taxes paid |

$ |

- |

|

$ |

- |

The accompanying

notes are an integral part of these unaudited financial statements.

F-4

Table of Contents

C2

Blockchain, Inc.

Notes

to the Unaudited Financial Statements

Note

1 - Organization and Description of Business

C2 Blockchain, Inc. was incorporated on June 30, 2021 in

the State of Nevada.

On

June 30, 2021, Levi Jacobson was appointed Chief Executive Officer, Chief Financial Officer, and Director of C2 Blockchain, Inc.

On

March 31, 2022, the Company entered into a “Agreement and Plan of Merger”, whereas it agreed to, and subsequently participated

in, a Nevada holding company reorganization pursuant to NRS 92A.180, NRS 92A.200, NRS 92A.230 and NRS 92A.250 (“Reorganization”).

The constituent corporations in the Reorganization were American Estate Management Company (“AEMC” or “Predecessor”),

C2 Blockchain, Inc. (“Successor” or “CBLO”), and AEMC Merger Sub, Inc. (“Merger Sub”). Our

director is, and was, the sole director/officer of each constituent corporation in the Reorganization.

C2

Blockchain, Inc. issued 1,000 common shares of its common stock to Predecessor and Merger Sub issued 1,000 shares of its common stock

to C2 Blockchain, Inc. immediately prior to the Reorganization. As such, immediately prior to the merger, C2 Blockchain, Inc. became a

wholly owned direct subsidiary of American Estate Management Company and Merger Sub became a wholly owned and direct subsidiary of C2

Blockchain, Inc.

On

March 31, 2022, Merger Sub filed Articles of Merger with the Nevada Secretary of State. The merger became

effective on April 1, 2022 at 4:00 PM PST (“Effective Time”). At the Effective Time, Predecessor was merged with and into

Merger Sub (the “Merger), and Predecessor became the surviving corporation. Each share of Predecessor common stock issued and outstanding

immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of C2 Blockchain, Inc.’s

(“Successors”) common stock.

On

May 23, 2022, C2 Blockchain, Inc., as successor issuer to American Estate Management Company began a quoted market in its

common stock which was the market effective date for our corporate action.

On

April 1, 2022, after the completion of the Holding Company Reorganization, we cancelled all of the stock we held in AEMC resulting in

AEMC as a stand-alone company. Pursuant to the holding company merger agreement and effects of merger, all of the assets and liabilities,

if any, remain with AEMC after the Reorganization. Levi Jacobson, the Director of AEMC, did not discover any assets of AEMC from the time

he was appointed Director until the completion of the Reorganization and subsequent separation of AEMC as a stand-alone company.

Given

that the former business plan and objectives of AEMC and the present day business plan and objectives of CBLO substantially differ from

one another, we conducted the corporate separation with AEMC immediately after the effective time of the Reorganization in order to avoid

any shareholder confusion. The former business plan of AEMC under the leadership of its former directors, does not, in any way, represent

the current day business plan of CBLO. The result of corporate separation ameliorated shareholder confusion about our identity and/or

corporate objectives. Furthermore, we wanted to continue trading in the OTC MarketPlace.

On

April 1, 2022, the Company transmuted its business plan from that of a blank check shell company to a business combination related shell

company with a holding company formation pursuant to a reorganization with American Estate Management Company.

FINRA

completed its review of our corporate action pursuant to our Reorganization. On April 26, 2022, CBLO was given a CUSIP number by CUSIP

Global Services of 12675R 109. The announcement of our Predecessor’s corporate action was posted on the FINRA daily list on May

20, 2022. The Market Effective date was May 23, 2022.

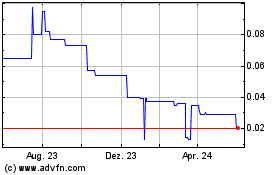

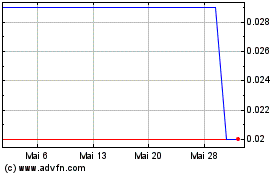

Our

Common Stock is currently quoted on the OTC Markets Group Inc’s Pink® Open Market under the symbol “CBLO”.

After

completion of the Holding Company Reorganization and separation of AEMC as a wholly owned subsidiary, the Company reverted back to a blank

check shell company.

Currently,

we no longer believe we are deemed to be a blank check shell company, but rather a shell company as we have a bona fide business plan

at this time. The Company’s business plan is to concentrate on cryptocurrency related investments and development opportunities

including but not limited to cryptocurrency mining, primarily for Bitcoin, for our own account, investments in private and/or public entities,

joint ventures and acquisitions of blockchain related companies. We have not commenced our planned principal operations.

Currently,

Mendel Holdings, LLC, a Delaware Limited Liability Company, owned and controlled by Levi Jacobson, our sole director is our controlling

shareholder, owning 200,000,000 shares of our common stock representing approximately 78.76 % voting control.

C2

Blockchain, Inc. has no material operations at this time but has a definitive business plan to become a bitcoin mining company. We

plan to buy real estate in the state of Georgia and construct a warehouse for hosting a data center to include an undetermined

certain number of application specific integrated circuit miners (“ASICs”). The number of ASIC’s we may purchase

in the future will depend upon our future financial condition.

The

Company has elected June 30th as its year end.

Note

2 - Summary of Significant Accounting Policies

Basis of Presentation

This summary of significant accounting

policies is presented to assist in understanding the Company's financial statements. These accounting policies conform to accounting principles,

generally accepted in the United States of America, and have been consistently applied in the preparation of the financial statements.

Use of Estimates

The preparation of financial statements

in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. In the opinion of management, all adjustments necessary in order

to make the financial statements not misleading have been included. Actual results could differ from those estimates.

Cash

and Cash Equivalents

The Company considers all

highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. Cash and cash

equivalents at December 31, 2023 and June 30, 2023 were $90 and $0,

respectively.

Income

Taxes

The Company accounts for income taxes

under ASC 740, “Income Taxes.” Under the asset and liability method of ASC 740, deferred tax assets and liabilities

are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing

assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates

expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A

valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets

through future operations. No deferred tax assets or liabilities were recognized at December 31, 2023 and June 30, 2023.

F-5

Table of Contents

Basic Earnings (Loss) Per Share

The Company computes basic and diluted

earnings (loss) per share in accordance with ASC Topic 260, Earnings per Share. Basic earnings (loss) per share is computed

by dividing net income (loss) by the weighted average number of common shares outstanding during the reporting period. Diluted earnings

(loss) per share reflects the potential dilution that could occur if stock options and other commitments to issue common stock were exercised

or equity awards vest resulting in the issuance of common stock that could share in the earnings of the Company.

The Company does not have any potentially

dilutive instruments as of December 31, 2023 and, thus, anti-dilution issues are not applicable.

Fair

Value of Financial Instruments

The Company’s

balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their

fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

ASC 820, Fair Value Measurements

and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an

exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants

on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions

developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions about

market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair

value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical

assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy

are described below:

- Level 1 - Unadjusted quoted prices

in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

- Level 2 - Inputs other than quoted

prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices

for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are

not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are

derived principally from or corroborated by observable market data by correlation or other means.

- Level 3 - Inputs that are both

significant to the fair value measurement and unobservable.

Fair value estimates discussed herein

are based upon certain market assumptions and pertinent information available to management as of December 31, 2023. The respective

carrying value of certain on-balance-sheet financial instruments approximated their fair values due to the short-term nature of these

instruments. These financial instruments include accrued expenses.

Related

Parties

The Company follows ASC 850, Related

Party Disclosures, for the identification of related parties and disclosure of related party transactions.

Share-Based

Compensation

ASC 718, “Compensation –

Stock Compensation”, prescribes accounting and reporting standards for all share-based payment transactions in which employee

services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments

such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee

stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized

over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period

(usually the vesting period).

The Company accounts for stock-based

compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, “Equity – Based

Payments to Non-Employees.” Measurement of share-based payment transactions with non-employees is based on the fair

value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair

value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

The Company had no stock-based compensation plans as of December 31, 2023 and June 30, 2023.

The Company’s stock-based compensation

for the periods ended December 31, 2023 and December 31, 2022 was $0 for both periods.

Recently

Issued Accounting Pronouncements

In

February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). ASU 2016-02 is amended by ASU 2018-01, ASU2018-10, ASU

2018-11, ASU 2018-20 and ASU 2019-01, which FASB issued in January 2018, July 2018, July 2018, December 2018 and March 2019, respectively

(collectively, the amended ASU 2016-02). The amended ASU 2016-02 requires lessees to recognize on the balance sheet a right-of-use asset,

representing its right to use the underlying asset for the lease term, and a lease liability for all leases with terms greater than 12

months. The recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly

changed from current GAAP. The amended ASU 2016-02 retains a distinction between finance leases (i.e. capital leases under current GAAP)

and operating leases. The classification criteria for distinguishing between finance leases and operating leases will be substantially

similar to the classification criteria for distinguishing between capital leases and operating leases under current GAAP. The amended

ASU 2016-02 also requires qualitative and quantitative disclosures designed to assess the amount, timing, and uncertainty of cash flows

arising from leases. A modified retrospective transition approach is permitted to be used when an entity adopts the amended ASU 2016-02,

which includes a number of optional practical expedients that entities may elect to apply.

We

have no assets and or leases and we do not believe we will be impacted in the foreseeable future by the newly adopted accounting

standard(s) mentioned above.

The Company has implemented all new

accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other

new pronouncements that have been issued that might have a material impact on its financial position or results of operations.

F-6

Table of Contents

Note

3 - Going Concern

The Company’s financial statements

are prepared in accordance with generally accepted accounting principles applicable to a going concern that contemplates the realization

of assets and liquidation of liabilities in the normal course of business.

The Company demonstrates adverse

conditions that raise substantial doubt about the Company's ability to continue as a going concern for one year following the issuance

of these financial statements. These adverse conditions are negative financial trends, specifically operating loss, working capital deficiency,

and other adverse key financial ratios.

The Company has not established

any source of revenue to cover its operating costs. Management plans to fund operating expenses with related party contributions to capital.

There is no assurance that management's plan will be successful. The financial statements do not include any adjustments relating to

the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in

the event that the Company cannot continue as a going concern.

Note

4 - Income Taxes

Potential benefits of income tax

losses are not recognized in the accounts until realization is more likely than not. In assessing

the realization of deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred

tax assets will be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income

during the periods in which those temporary differences become deductible. The Company has incurred a net operating loss carryforward

of $46,009 which begins expiring in 2041. The Company has adopted ASC 740, “Accounting for Income Taxes”, as of its inception.

Pursuant to ASC 740 the Company is required to compute tax asset benefits for non-capital losses carried forward. The potential benefit

of the net operating loss has not been recognized in these financial statements because the Company cannot be assured it is more likely

than not it will utilize the loss carried forward in future years.

Significant components of the Company’s

deferred tax assets are as follows:

The reconciliation of the

effective income tax rate to the federal statutory rate is as follows:

On December 22, 2017,

the Tax Cuts and Jobs Act of 2017 was signed into law. This legislation reduced the federal corporate tax rate from the previous 35% to

21%.

Due to the change

in ownership provisions of the Tax Reform Act of 1986, net operating loss carryforwards for Federal income tax reporting purposes are

subject to annual limitations. Should a change in ownership occur, net operating loss carryforwards may be limited as to use in future

years.

Note

5 - Commitments and Contingencies

The Company follows

ASC 450-20, Loss Contingencies, to report accounting for contingencies. Liabilities for loss contingencies

arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability

has been incurred and the amount of the assessment can be reasonably estimated. There were no commitments or contingencies as of December 31, 2023 and June 30, 2023.

Note

6 - Shareholder Equity

Preferred Stock

The authorized preferred stock of

the Company consists of 20,000,000 shares with a par value of $0.001. There were no shares issued and outstanding as of December 31,

2023 and June 30, 2023.

Common Stock

The authorized common stock of the

Company consists of 500,000,000 shares with a par value of $0.001. There were 253,936,005 shares of common stock issued and outstanding

as of December 31, 2023 and June 30, 2023 (See Note 1).

Note

7 - Related-Party Transactions

Loan

The Company’s sole officer

and director, Levi Jacobson, advanced cash to and paid expenses on behalf of the company totaling $13,600 during the period ended

December 31, 2023. These payments are considered as a loan to the Company which is noninterest-bearing, unsecured and payable on demand.

As of December 31, 2023, the related party loan to the Company totaled $44,764.

The Company’s sole officer

and director, Levi Jacobson, paid expenses on behalf of the company totaling $18,507 during the period ended June 30, 2023. These

payments are considered as a loan to the Company which is noninterest-bearing, unsecured and payable on demand. As of June 30, 2023, the

related party loan to the Company totaled $31,164.

Office Space

We utilize the home office space and equipment of our management at no

cost.

Note

8 - Subsequent Events

Management has reviewed financial transactions for the Company

subsequent to the period ended December 31, 2023 and has found that there was nothing material

to disclose.

F-7

Table of Contents

| ITEM

2 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS |

Forward-Looking Statements

Certain statements, other than purely historical

information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results,

and the assumptions upon which those statements are based, are “forward-looking statements.”

These forward-looking statements generally are identified

by the words “believes,” “project,” “expects,” “anticipates,” “estimates,”

“intends,” “strategy,” “plan,” “may,” “will,” “would,” “will

be,” “will continue,” “will likely result,” and similar expressions.

Forward-looking statements are based on current expectations

and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking

statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which

could have a material adverse effect on our operations and future prospects on a consolidated basis include, but are not limited to:

changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted

accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance

should not be placed on such statements.

Company Overview

Corporate History

C2 Blockchain, Inc. was incorporated on June 30, 2021 in the State of Nevada.

On June 30, 2021, Levi Jacobson was appointed Chief Executive Officer, Chief Financial Officer, and Director of C2 Blockchain, Inc.

On

March 31, 2022, the Company entered into a “Agreement and Plan of Merger”, whereas it agreed to, and subsequently participated

in, a Nevada holding company reorganization pursuant to NRS 92A.180, NRS 92A.200, NRS 92A.230 and NRS 92A.250 (“Reorganization”).

The constituent corporations in the Reorganization were American Estate Management Company (“AEMC” or “Predecessor”),

C2 Blockchain, Inc. (“Successor” or “CBLO”), and AEMC Merger Sub, Inc. (“Merger Sub”). Our director

is, and was, the sole director/officer of each constituent corporation in the Reorganization.

C2

Blockchain, Inc. issued 1,000 common shares of its common stock to Predecessor and Merger Sub issued 1,000 shares of its common stock

to C2 Blockchain, Inc. immediately prior to the Reorganization. As such, immediately prior to the merger, C2 Blockchain, Inc. became a

wholly owned direct subsidiary of American Estate Management Company and Merger Sub became a wholly owned and direct subsidiary of C2

Blockchain, Inc.

On

March 31, 2022, Merger Sub filed Articles of Merger with the Nevada Secretary of State. The merger became

effective on April 1, 2022 at 4:00 PM PST (“Effective Time”). At the Effective Time, Predecessor was merged with and into

Merger Sub (the “Merger), and Predecessor became the surviving corporation. Each share of Predecessor common stock issued and outstanding

immediately prior to the Effective Time was converted into one validly issued, fully paid and non-assessable share of C2 Blockchain, Inc.’s (“Successors”) common stock.

On

May 23, 2022, C2 Blockchain, Inc., as successor issuer to American Estate Management Company began a quoted market in its common

stock which was the market effective date for our corporate action.

The

Company believes that the Reorganization, deemed effective on April 1, 2022, was not a transaction of the type described in subparagraph

(a) of Rule 145 under the Securities Act of 1933 and the consummation of the Reorganization will not be deemed to involve an “offer”,

“offer to sell”, “offer for sale” or “sale” within the meaning of Section 2(3) of the Securities Act

of 1933. The Reorganization was consummated without the vote or consent of the Company’s stockholders. In addition, the provisions

of NRS 92A.180 did not provide a stockholder of the Company with appraisal rights in connection with the Reorganization. The Company believes

that in the absence of any right of any of the Company’s stockholders to vote with respect to the Reorganization or to insist that

their shares be purchased for fair value, the Reorganization could not be deemed to involve an “offer” “offer to sell”;

or “sale” within the meaning of Section 2(3) of the Securities Act of 1933.”

On

April 1, 2022, after the completion of the Holding Company Reorganization, we cancelled all of the stock we held in AEMC resulting in

AEMC as a stand-alone company. Pursuant to the holding company merger agreement and effects of merger, all of the assets and liabilities,

if any, remain with AEMC after the Reorganization. Levi Jacobson, the Director of AEMC, did not discover any assets of AEMC from the time

he was appointed Director until the completion of the Reorganization and subsequent separation of AEMC as a stand-alone company.

Given

that the former business plan and objectives of AEMC and the present day business plan and objectives of CBLO substantially differ from

one another, we conducted the corporate separation with AEMC immediately after the effective time of the Reorganization in order to avoid

any shareholder confusion. The former business plan of AEMC under the leadership of its former directors, does not, in any way, represent

the current day business plan of CBLO. The result of corporate separation ameliorated shareholder confusion about our identity

and/or corporate objectives. Furthermore, we wanted to continue trading in the OTC MarketPlace.

On April 1, 2022, the Company transmuted its business plan from that of

a blank check shell company to a business combination related shell company with a holding company formation pursuant to a reorganization

with American Estate Management Company.

The

corporate actions taken by the Company, including, but not limited to, the corporate structuring of the transactions, was deemed, in the

discretion of our sole director, to be for the benefit of the corporation and its shareholders. Former shareholders of AEMC are now the

shareholders of CBLO. Each and every shareholder of AEMC became a shareholder of CBLO with each share of capital stock of AEMC held by

former AEMC shareholder becoming an equivalent amount of capital stock held in CBLO. The former shareholders of AEMC now have the opportunity

to benefit under our business plan and we have the opportunity to grow organically from our shareholder base and new leadership under

our sole director.

FINRA

completed its review of our corporate action pursuant to our Reorganization. On April 26, 2022, CBLO was given a CUSIP number by CUSIP

Global Services of 12675R 109. The announcement of our Predecessor’s corporate action was posted on the FINRA daily list on May

20, 2022. The Market Effective date was May 23, 2022.

Our

Common Stock is currently quoted on the OTC Markets Group Inc’s Pink® Open Market under the symbol “CBLO”.

After completion of the Holding Company Reorganization and separation

of AEMC as a wholly owned subsidiary, the Company reverted back to a blank check company.

Currently, the Company no longer believes it is a blank check

shell company but rather a shell company. At this time, the Company plans to build a 14 MW Bitcoin mining facility in Georgia U.S.

specifically designed for hosting cryptocurrency mining equipment and mining Bitcoin for our own account. Cryptocurrency mining

(e.g. bitcoin mining) entails running ASIC (application-specific integrated circuit) servers or other specialized servers which

solve a set of prescribed complex mathematical calculations in order to add a block to a blockchain and thereby confirm digital

asset transactions. A party which is successful in adding a block to the blockchain is awarded a fixed number of digital assets in

return.

C2

Blockchain, Inc. has no material operations at this time but has a definitive business plan to become a bitcoin mining company. We

plan to buy real estate in the state of Georgia and construct a warehouse for hosting a data center to include an undetermined

certain number of application specific integrated circuit miners (“ASICs”). The number of ASIC’s we may purchase

in the future will depend upon our future financial condition.

In order to achieve the above, it is dependent on the

Company’s ability to raise capital pursuant to its Regulation A Offering, filed on July 5, 2023, which is not yet qualified

with the Securities and Exchange Commission. In order for the Company to move forward with its plans, a minimum of $200,000 in

funding is required. It should be noted that $200,000 may not cover all of the aforementioned plans, but would, in the

Company’s opinion, provide enough capital to at least begin some level of tangible operations.

We may decide to seek out other forms of financing not yet

identified in order to fulfill our business needs.

The scalability of our business depends entirely on our

ability to secure funds for future operations and the amount of funds we are able to secure. Any investment in our business is a

significant risk and should only be made by an investor who can afford the entire loss of their investment.

Currently,

Mendel Holdings, LLC, a Delaware Limited Liability Company, owned and controlled by Levi Jacobson, our sole director, is our controlling

shareholder, owning 200,000,000 shares of our common stock representing approximately 78.76 % voting control.

Liquidity and Capital Resources

Our cash balance is $90 as of December 31, 2023, and $0 as

of June 30, 2023.

We rely upon our sole officer and director, Levi

Jacobson, for funding. Mr. Jacobson has no formal commitment, arrangement or legal obligation to advance or loan funds to the

company. In order to implement our plan of operations for the next twelve-month period, we may require further funding. Being a

start-up stage company, we have very limited operating history. After a twelve-month period we may need additional financing but

currently do not have any arrangements for such financing.

On July 5, 2023, we filed a Regulation A Tier

II Offering, which is not yet qualified with the Securities and Exchange Commission, whereas we are seeking to raise capital from the

sale of our Common Stock. There is no guarantee however, that we will raise any monies from the offering.

If we need additional cash and cannot raise

it, we will either have to suspend operations until we do raise the cash we need, or cease operations entirely.

The Company’s sole officer and director, Levi Jacobson, paid

expenses on behalf of the company totaling $13,600 during the six month period ended December 31, 2023. These payments are

considered as a loan to the Company which is noninterest-bearing, unsecured and payable on demand. As of December 31, 2023, the

related party loan to the Company totaled $44,764.

The Company’s sole officer

and director, Levi Jacobson, paid expenses on behalf of the company totaling $18,507 during the period ended June 30, 2023. These

payments are considered as a loan to the Company which is noninterest-bearing, unsecured and payable on demand. As of June 30,

2023, the related party loan to the Company totaled $31,164.

Net Loss

We recorded a net income/ loss of $(3,960) for the

three months ended December 31, 2023 and $(2,419) for the three months ended December 31, 2022.

We recorded a net income/ loss of $(13,510) for the

six months ended December 31, 2023 and $(7,288) for the six months ended December 31, 2022.

Going Concern

The Company’s financial statements are prepared

in accordance with generally accepted accounting principles applicable to a going concern that contemplates the realization of assets

and liquidation of liabilities in the normal course of business.

The Company demonstrates adverse conditions that

raise substantial doubt about the Company's ability to continue as a going concern for one year following the issuance of these financial

statements. These adverse conditions are negative financial trends, no revenue, operating loss, working capital deficiency, and

other adverse key financial ratios.

The Company has not established a source of revenue

to cover its operating costs.

The financial statements do not include any adjustments

relating to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be

necessary in the event that the Company cannot continue as a going concern.

| ITEM

3 |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK |

As a smaller reporting company, as defined in Rule

12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

-3-

Table of Contents

| ITEM 4 |

CONTROLS AND PROCEDURES |

Management’s Report on Disclosure Controls

and Procedures

We maintain disclosure controls and procedures

that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of

1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange

Commission's rules and forms, and that such information is accumulated and communicated to our management, including our chief

executive officer and our chief financial officer, Levi Jacobson, (who is acting as our principal executive officer, principal

financial officer and principle accounting officer) to allow for timely decisions regarding required disclosure.

As of December 31,

2023, we carried out an evaluation, under the supervision of our chief executive officer, who also serves as our chief financial

officer, of the effectiveness of the design and the operation of our disclosure controls and procedures. Our sole officer concluded

that the disclosure controls and procedures were not effective as of the end of the period covered by this report due to material

weaknesses identified below.

The matters involving internal controls and procedures

that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: domination

of management by a single individual without adequate compensating controls, lack of a majority of outside directors on board of directors,

resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; inadequate segregation

of duties consistent with control objectives, and lack of an audit committee. These material weaknesses were identified by our Chief

Executive Officer who also serves as our Chief Financial Officer in connection with the above evaluation.

Inherent limitations on effectiveness of controls

Internal control over financial reporting has inherent

limitations which include but is not limited to the use of independent professionals for advice and guidance, interpretation of existing

and/or changing rules and principles, segregation of management duties, scale of organization, and personnel factors. Internal control

over financial reporting is a process which involves human diligence and compliance and is subject to lapses in judgment and breakdowns

resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management

override. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements on a

timely basis, however these inherent limitations are known features of the financial reporting process and it is possible to design into

the process safeguards to reduce, though not eliminate, this risk. Therefore, even those systems determined to be effective can provide

only reasonable assurance with respect to financial statement preparation and presentation. Projections of any evaluation of effectiveness

to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of

compliance with the policies or procedures may deteriorate.

Changes in Internal Control over Financial

Reporting

There have been no changes in our internal

controls over financial reporting that have occurred for the fiscal quarter ended December 31, 2023, that have materially or are

reasonably likely to materially affect, our internal controls over financial reporting.

-4-

Table of Contents

PART II-OTHER INFORMATION

There are no legal proceedings against the

Company and the Company is unaware of such proceedings contemplated against it.

As a smaller reporting company, as defined

in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

| ITEM 2 |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

None.

| ITEM 3 |

DEFAULTS UPON SENIOR SECURITIES |

None.

| ITEM 4 |

MINE SAFETY DISCLOSURES |

Not applicable.

None.

| (1) |

Filed as an exhibit to

the Company's Registration Statement on Form 10-12G, as filed with the SEC on September 16, 2021, and incorporated herein by this

reference. |

| (2) |

Filed as an exhibit to the

Company's Registration Statement on Form 1-A, as filed with the SEC on July 5, 2023 and incorporated herein by this reference. |

| (3) |

Filed herewith. |

-5-

Table of Contents

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant

caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

C2 Blockchain, Inc.

(Registrant)

By: /s/ Levi Jacobson

Name: Levi Jacobson

Chief Executive Officer and Chief Financial Officer

Dated:

February 2, 2024

-6-

EXHIBIT 31.1

C2 Blockchain, INC.

OFFICER'S CERTIFICATE PURSUANT TO SECTION 302

I, Levi Jacobson, certify that:

1. I have reviewed this report on Form 10-Q of C2 Blockchain, Inc.;

2. Based on my knowledge, this report does not contain any untrue

statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other

financial information included in this report, fairly present in all material respects the financial condition, results of operations

and cash flows of the small business issuer as of, and for, the periods presented in this report;

4. The small business issuer’s other certifying officer

and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e)

and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the

small business issuer and have:

a. Designed such disclosure controls and procedures, or caused

such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the

small business issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly

during the period in which this report is being prepared;

b. Designed such internal control over financial reporting,

or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

c. Evaluated the effectiveness of the small business issuer's

disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls

and procedures, as of the end of the period covered by this report based on such evaluation; and

d. Disclosed in this report any change in the registrant's internal

control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant’s fourth

fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the

registrant's internal control over financial reporting; and

5. The small business owner’s other certifying officer

and I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the small business issuer's

auditors and the audit committee of the small issuer's board of directors (or persons performing the equivalent functions):

a. All significant deficiencies and material weaknesses in the

design or operation of internal control over financial reporting which are reasonably likely to adversely affect the small business

issuer's ability to record, process, summarize and report financial information; and

b. Any fraud, whether or not material, that involves management

or other employees who have a significant role in the small business issuer's internal control over financial reporting.

Dated: February 2, 2024

By: /s/ Levi Jacobson

Levi Jacobson,

Chief Executive

Officer

(Principal

Executive Officer)

EXHIBIT 31.2

C2 Blockchain, INC.

OFFICER'S CERTIFICATE PURSUANT TO SECTION 302

I, Levi Jacobson, certify

that:

1. I have reviewed this report on Form 10-Q of C2 Blockchain, Inc.;

2. Based on my knowledge, this report does not contain any untrue

statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other

financial information included in this report, fairly present in all material respects the financial condition, results of operations

and cash flows of the small business issuer as of, and for, the periods presented in this report;

4. The small business issuer’s other certifying officer

and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e)

and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the

small business issuer and have:

a. Designed such disclosure controls and procedures, or caused

such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the

small business issuer, including its consolidated subsidiaries, is made known to us by others within those entities, particularly

during the period in which this report is being prepared;

b. Designed such internal control over financial reporting,

or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

c. Evaluated the effectiveness of the small business issuer's

disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls

and procedures, as of the end of the period covered by this report based on such evaluation; and

d. Disclosed in this report any change in the registrant's internal

control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant’s fourth

fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the

registrant's internal control over financial reporting; and

5. The small business owner’s other certifying officer

and I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the small business issuer's

auditors and the audit committee of the small issuer's board of directors (or persons performing the equivalent functions):

a. All significant deficiencies and material weaknesses in the

design or operation of internal control over financial reporting which are reasonably likely to adversely affect the small business

issuer's ability to record, process, summarize and report financial information; and

b. Any fraud, whether or not material, that involves management

or other employees who have a significant role in the small business issuer's internal control over financial reporting.

Dated: February 2, 2024

By: /s/ Levi Jacobson

Levi Jacobson,

Chief Financial

Officer

(Principal

Financial Officer)

EXHIBIT 32.1

C2 Blockchain, INC.

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF

THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of C2 Blockchain, Inc. (the Company) on Form 10-Q for

the quarterly period ended December 31, 2023, as filed with the Securities and Exchange Commission on the date hereof (the

Report), I, Levi Jacobson, Principal

Executive Officer of the Company, certify, pursuant to 18 U.S.C. ss.1350, as adopted pursuant to Section 906 of

the Sarbanes-Oxley Act of 2002, that:

(1) The Report fully complies with the requirements of section 13(a)

or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in

all material respects, the financial condition and results of operations of the Company.

A signed original of this written statement required

by Section 906 has been provided to Levi Jacobson

and will be retained by C2 Blockchain, Inc. and furnished to the Securities and Exchange Commission or its

staff upon request.

Dated: February 2, 2024

By: /s/ Levi Jacobson

Levi Jacobson,

Chief Executive Officer

(Principal Executive Officer)

EXHIBIT 32.2

C2 Blockchain, INC.

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO SECTION 906 OF

THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of C2 Blockchain, Inc. (the Company) on

Form 10-Q for the quarterly period ended December 31, 2023, as filed with the Securities and Exchange Commission on the date

hereof (the Report), I, Levi Jacobson, Principal

Financial Officer of the Company, certify, pursuant to 18 U.S.C. ss.1350, as adopted pursuant to Section 906

of the Sarbanes-Oxley Act of 2002, that:

(1) The Report fully complies with the requirements of section 13(a)

or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in

all material respects, the financial condition and results of operations of the Company.

A signed original of

this written statement required by Section 906 has been provided to Levi Jacobson and will

be retained by C2 Blockchain, Inc. and furnished to the Securities and Exchange

Commission or its staff upon request.

Dated: February 2, 2024

By: /s/ Levi Jacobson

Levi Jacobson,

Chief Financial

Officer

(Principal Financial Officer)

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an quarterly report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-Q

-Number 240

-Section 308

-Subsection a

| Name: |

dei_DocumentQuarterlyReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.0.1

Balance Sheet (Unaudited) - USD ($)

|

Dec. 31, 2023 |

Jun. 30, 2023 |

| ASSETS |

|

|

| Cash and cash equivalents |

$ 90

|

|

| TOTAL ASSETS |

90

|

|

| CURRENT LIABILITIES |

|

|

| Loan to Company - related party |

44,764

|

31,164

|

| TOTAL LIABILITIES |

44,764

|

31,164

|

| Stockholders’ Equity (Deficit) |

|

|

| Preferred stock ($.001 par value, 20,000,000 shares authorized; none issued and outstanding as of December 31, 2023 and June 30, 2023) |

|

|

| Common stock ($.001 par value, 500,000,000 shares authorized, 253,936,005 shares issued and outstanding as of December 31, 2023 and June 30, 2023) |

253,936

|

253,936

|

| Additional paid-in capital |

(252,601)

|

(252,601)

|

| Accumulated deficit |

(46,009)

|

(32,499)

|

| Total Stockholders’ Equity (Deficit) |

(44,674)

|

(31,164)

|

| TOTAL LIABILITIES & STOCKHOLDERS’ EQUITY (DEFICIT) |

$ 90

|

|

| X |

- DefinitionAmount of excess of issue price over par or stated value of stock and from other transaction involving stock or stockholder. Includes, but is not limited to, additional paid-in capital (APIC) for common and preferred stock. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Topic 946

-SubTopic 210

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.6-04(18))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147479617/946-210-S99-1

Reference 3: http://fasb.org/us-gaap/role/ref/legacyRef

-Topic 210

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.5-02(30)(a)(1))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480566/210-10-S99-1

| Name: |

us-gaap_AdditionalPaidInCapital |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionSum of the carrying amounts as of the balance sheet date of all assets that are recognized. Assets are probable future economic benefits obtained or controlled by an entity as a result of past transactions or events. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (bb)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481203/810-10-50-3

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Topic 810

-SubTopic 10

-Name Accounting Standards Codification

-Section 45

-Paragraph 25

-Subparagraph (a)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481231/810-10-45-25

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Topic 235

-SubTopic 10

-Name Accounting Standards Codification

-Section S99

-Paragraph 1

-Subparagraph (SX 210.4-08(g)(1)(ii))

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147480678/235-10-S99-1

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Topic 323

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 3

-Subparagraph (c)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481687/323-10-50-3

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Topic 825

-SubTopic 10

-Name Accounting Standards Codification

-Section 50

-Paragraph 28

-Subparagraph (f)

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147482907/825-10-50-28

Reference 6: http://www.xbrl.org/2003/role/exampleRef

-Topic 852

-SubTopic 10

-Name Accounting Standards Codification

-Section 55

-Paragraph 10

-Publisher FASB

-URI https://asc.fasb.org//1943274/2147481372/852-10-55-10

Reference 7: http://www.xbrl.org/2003/role/exampleRef

-Topic 946

-SubTopic 830

-Name Accounting Standards Codification

-Section 55

-Paragraph 12

-Publisher FASB