false

0000814926

0000814926

2024-12-18

2024-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report: December 18, 2024

(Earliest Event Date requiring this Report: December

18, 2024)

CAPSTONE

COMPANIES, INC.

(EXACT

NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| Florida |

0-28331 |

84-1047159 |

| (State

of Incorporation or Organization) |

(Commission

File Number) |

(I.R.S.

Employer Identification No.) |

Number

144-V, 10 Fairway Drive Suite

100

Deerfield

Beach, Florida 33441

(Address of principal executive offices)

(954) 570-8889,

ext. 313

(Registrant’s telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of Class of Securities. |

Trading

Symbol(s). |

Name

of exchange on which registered |

| N/A |

N/A |

N/A |

The

Registrant’s Common Stock is quoted on the OTCQB Venture Market of the OTC Markets Group, Inc. under the trading symbol “CAPC.”

Item 7.01 Regulation D Disclosure.

On December 18, 2024, Capstone Companies, Inc. (“Company”)

issued a press release announcing the Company’s new strategic focus, namely the developing and operating of sports and entertainment

recreational facilities. The Company’s prior business line, which ceased during 2024, was development and production of consumer

products.

The information in this Item 7.01 of this Current

Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended. The information contained in this Item 7.01 and in the press release attached as Exhibit 99.1 to

this Current Report on Form 8-K shall not be incorporated by reference into any filing with the SEC made by the Company, whether made

before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financials and Exhibits.

(d) Exhibits. The following exhibit is furnished as

part of this Form 8-K:

Exhibit Number Exhibit Description

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

CAPSTONE

COMPANIES, INC., A FLORIDA CORPORATION

By:

/s/ Alexander Jacobs

Alexander Jacobs

Chief Executive Officer

Dated:

December 108, 2024

Exhibit Number Exhibit Description

FOR IMMEDIATE RELEASE

Capstone Companies’

Strategic Realignment:

Develop Sports-Entertainment

Centers for Children, Adults and Families

Deerfield Beach,

Florida, December 18, 2024: Capstone Companies, Inc. (OTCQB: CAPC) (“Company”) announced today a new strategic focus to develop

and operate in-person sports-entertainment recreational centers to provide social and health benefits to children, families and adults

through sports, exercise, and social group activities.

Under the new strategic

focus, the Company will seek to develop and operate facilities offering popular competitive sports, such as pickleball and padel, coupled

with a food-drink and entertainment center suitable for social activities : birthday parties, corporate events, graduation celebrations

and post-school or summer activities. Entertainment may consist of a combination of a small live music stage, sports bar with large screen

televisions, and interactive sports video gaming area. The addition of a soccer or other competitive sports field may be added to host

corporate or league sponsored tournaments. The centers would be designed to be a social and community activities magnet for the locality.

The initial geographic focus for the new strategic plan will be Virginia, North Carolina, Georgia, Florida and New Jersey.

With the Company’s

new Chief Executive Officer, Alexander Jacobs, having extensive experience in developing and operating sports entertainment recreational

centers for children, adults and families, and being tasked with developing a new business line for the Company, the strategic focus

on sports-entertainment center industry is deemed by the Company as the most promising path to creating a new business line for the Company.

“The sports-entertainment

industry is an expanding industry with promising opportunities for new ventures with the right concept and competent execution. We intend

to develop a concept that can be rolled out on a regional or national basis. Our ability to develop and execute the new strategic plan

will require adequate, timely, and affordable funding, possibly coupled with a strategic partnership or merger with another company capable

of financially supporting our strategic initiative,” said Alexander Jacobs, the Company’s CEO. “The challenge for the

Company in 2025 is to fund and then execute the new strategic plan.”

The Company has not

secured third party funding or entered into any agreement for a strategic partnership or merger as of the date of this press release.

The Company is currently seeking additional directors for the Company’s Board of Directors and other personnel to assist in the

efforts to secure funding and to implement the new strategic plan.

As previously announced,

Coppermine Ventures, LLC (“CVEN”), which is owned and managed by Alexander Jacobs, provided $125,914 in working capital funding

to the Company under an Unsecured Promissory Note in October 2024 and is obligated to provide $218,640 additional working capital funding

to the Company under an October 31, 2024, Management Transition Agreement (“MTA”) through the first fiscal quarter of 2025.

CVEN funded $50,018 of the MTA funding amount in late November 2024. Funding under the MTA is in return for right to nominate appointees

for CEO position and two board seats, which appointments are subject to verification of nominees’ qualifications to serve in those

positions by the Company’s Board of Directors and is not a loan or consideration for any equity interest in the Company. The financial

commitments of CVEN do not extend beyond the funding stated in this paragraph. The Company is seeking, and will require, additional third-party

funding for the new strategic plan and to cover essential corporate overhead funding for the remainder of 2025 in order to sustain the

Company as a going concern.

The Company’s

former business line of consumer products was closed in 2024 due to insufficient sales and the Company has no current revenue generating

operations. Developing and pursuing a new business line will require adequate, timely and affordable third-party funding, which the Company

may not be able to secure. Without revenues, the Company needs to develop a new business line with revenue generating operations to sustain

the Company as a going concern. There is no assurance that the Company can secure third party funding, a strategic partnership or a merger,

or otherwise implement the new strategic plan.

FORWARD LOOKING

STATEMENTS. Except for statements of historical fact in this press release, the information contained above contains forward-looking

statements, which statements are characterized by words like “should,” “may,” “intend,’ “expect,”

“hope,” “believe,” “anticipate” and similar words. Forward looking statements are not guarantees

of future performance and undue reliance should not be placed on them. Forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any statements

about future performance or results expressed or implied by such forward-looking statements. Capstone Companies, Inc. (“Company”)

is a public shell company without revenue generating revenues and relies on working capital funding from third parties to sustain its

corporate existence and fund meeting the compliance requirements as an SEC reporting company with its stock quoted on the OTC QB Venture

Market. The Company is also a “penny stock” company with limited public market liquidity and no primary market makers. As

such, Company may be unable to develop a new business line, or acquire or merge with an existing operating company, or, even if a new

business line or revenue generating operation is established, to fund and successfully operate that new business line or operation. Further,

the public auditors of the Company have expressed doubt as to the Company as a going concern. Company may be unable to obtain adequate,

affordable and timely funding to sustain any new business line. There is substantial doubt about the Company’s ability to establish

a new business line or sustain an operation. The business and financial results of another company, including Coppermine Ventures, LLC

or any affiliated company, is not relevant to, and not an indication of the future prospects of any future business, or the future financial

condition or performance of the Company, or future corporate transactions, and should not be relied upon or regarded as an indication

of future business and financial performance of the Company or its future corporate transactions. There is no existing agreement by the

Company and a third party for a strategic partnership with, or a merger or acquisition of, a company or business. Any investment in the

common stock of the Company is a highly risky investment that is not suitable for investors who cannot afford the total loss of the investment

and the inability to readily liquidate the investment. The risk factors in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, and other filings with the SEC should be carefully considered prior to any investment decision. The Company

undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change

except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

Contact information and media inquiries:

irinquiries@capstonecompaniesinc.com

954-570-8889 x 315

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

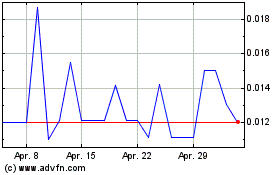

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Capstone Companies (QB) (USOTC:CAPC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025