As

filed with the Securities and Exchange Commission on December 13, 2024.

Registration

No. 333-282941

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

AMENDMENT NO.1

TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Alpha

One Inc.

(Exact

name of registrant as specified in its charter)

| Wyoming |

|

4899 |

|

27-1310226 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

No.

203, F2.62A, 2F, Tianzhan Building

No.

4 Tanran 5th Road, Tian’an Community

Shatou

Street, Futian District, Shenzhen, Guangdong Province

People’s

Republic of China 518000

+86

755 82794624

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cyndy

Jackson

1507

Lampman Ct

Cheyenne,

WY 82007

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

of all communications to:

Rockville

Law Group, LLC

Li Weng, Esq.

3635 Old Court Road, #208, Baltimore MD 21208

Telephone: US +1 (410) 243 5500

China: +86 1818 622 4565

Email:

wenglidk@foxmail.com

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement, as determined

by the selling shareholders.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| |

Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐.

CALCULATION

OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | |

Amount to be Registered | | |

Proposed Maximum Offering Price Per Share (1) | | |

Proposed Maximum Aggregate Offering Price | | |

Amount of Registration Fee (2) | |

| | |

| | |

| | |

| | |

| |

| Common Stock, $0.001 par value | |

| 10,000,000 | | |

$ | 2.38 | | |

| 23,800,000 | | |

| 3,643.78 | |

| (1) |

Estimated

solely for purposes of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933 based upon the

closing sale price of our shares of common stock of 2.38 on October 29, 2024. |

| |

|

| (2) |

The

fee is calculated by multiplying the aggregate offering amount by 0.0001531, pursuant to Section 6(b) of the Securities Act

of 1933. |

| |

|

| (3) |

Includes

2,493,514 shares of common stock that were issued to Sun Horn Limited sold from Zhuo Wang |

| |

|

| (4) |

Includes

2,558,200 shares of common stock that were issued to Lin Jianhui sold from Zhongyun Global International Group Limited |

| |

|

| (5) |

Includes

2,227,337 shares of common stock that were issued to Yu Xiaocai sold from Zhongyun Global International Group Limited |

| |

|

| (6) |

Includes

406,706 shares of common stock that were issued to Zhang Jinlin sold from Zhongyun Global International Group Limited |

| |

|

| (7) |

Includes

874,081 shares of common stock that were issued to Cao Yong sold from Zhongyun Global International Group Limited |

| |

|

| (8) |

Includes

1,440,162 shares of common stock that were issued to Lin Jiayao sold from Zhongyun Global International Group Limited |

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE

REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE

IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE

AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE

INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT

SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT

FOR THE OFFERING TO PROCEED.

PRELIMINARY

PROSPECTUS

Alpha

One Inc.

10,000,000

SHARES OF COMMON STOCK

$0.001

PAR VALUE PER SHARE

This

prospectus relates to shares of common stock of Alpha One Inc. which may be offered by the selling shareholders for their own account.

The

shares of common stock being offered by the selling shareholders pursuant to this prospectus are “restricted securities”

under the Securities Act of 1933, as amended (the “Securities Act”), before their sale under this prospectus. This prospectus

has been prepared for the purpose of registering these shares of common stock under the Securities Act to allow for a sale by the selling

shareholders to the public without restriction. Each of the selling shareholders and the participating brokers or dealers may be deemed

to be an “underwriter” within the meaning of the Securities Act, in which event any profit on the sale of shares by such

selling shareholder, and any commissions or discounts received by the brokers or dealers, may be deemed to be underwriting compensation

under the Securities Act. The selling shareholders must offer and sell their shares for the fixed price of $1.000 for the duration of

the offering.

The

registration of the shares of our common stock covered by this prospectus does not necessarily mean that any shares of our common stock

will be sold by any of the selling shareholders, and we cannot predict when or in what amounts any of the selling shareholders may sell

any of our shares of common stock offered by this prospectus.

Our

common stock is quoted on the OTC Pink Marketplace under the symbol “AOAO.” On October 29, 2024, the closing price

of our common stock was $2.38.

We

are not selling any shares of our common stock under this prospectus and will not receive any proceeds from any sale or disposition by

the selling shareholders of the shares of our common stock covered by this prospectus. We are paying the expenses incurred in registering

the shares.

Alpha

One Inc. (“AOAO”) is not an operating company but a holding company incorporated in the State of Wyoming. Substantially all

of the business operations are conducted in the People’s Republic of China (“PRC” or “China”) by our PRC

subsidiary. Shares of common stock registered in this prospectus are shares of a U.S. holding company, which does not conduct operations.

As used in this prospectus, “we,” “us,” “our” or “the Company” refers to Alpha One Inc.

Or the U.S. holding company.

We

face various legal and operational risks and uncertainties relating to our subsidiary’s operations in China. Because substantially

all of our operations are conducted in China through our PRC subsidiary, the Chinese government may intervene or influence the operation

of our PRC subsidiary and exercise significant oversight and discretion over the conduct of their business and may intervene in or influence

their operations at any time, or may exert more control over securities offerings conducted overseas and/or foreign investment in China-based

issuers, which could result in a material change in operations of our PRC subsidiary and/or the value of our common stock. Further, any

actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors

and cause the value of such securities to significantly decline or be worthless. See “Risk Factors - Risks Related to Doing

Business in China -Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas

and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors and cause the value of such securities to significantly decline or be worthless” on page 18.

In

recent years, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation

of business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based

companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly

enforcement. As of the date of this prospectus, we have not engaged in any monopolistic behavior and our business does not control more

than one million users’ personal information as of the date of this prospectus, implicate cybersecurity, or involve any other type

of restricted industry. However, we cannot affirm that PRC regulators share the same interpretation. Because these statements and regulatory

actions are new and subject to change, it is difficult for us to predict how quickly the legislative or administrative regulation making

bodies in China will respond to companies, or what existing or new laws or regulations will be amended or promulgated, if any, or the

potential impact such amended or new legislation will have on our daily business operations or our ability to accept foreign investments

and list on a U.S. stock exchange. See “Prospectus Summary — Recent PRC Regulatory Developments” beginning

on page 4 of this prospectus.

On

February 17, 2023, the CSRC released the New Overseas Listing Rules, which came into effect on March 31, 2023. The New Overseas

Listing Rules apply to overseas securities offerings and/or listings conducted by (i) companies incorporated in the PRC, or PRC

domestic companies, directly and (ii) companies incorporated overseas with operations primarily in the PRC and valued on the basis

of interests in PRC domestic companies, or indirect offerings. The New Overseas Listing Rules requires (1) the filings of the overseas

offering and listing plan by the PRC domestic companies with the CSRC under certain conditions, and (2) the filing of their underwriters

with the CSRC under certain conditions and the submission of an annual report to of such filed underwriters the CSRC within the required

timeline. The required filing scope is not limited to the initial public offering, but also includes subsequent overseas securities offerings,

single or multiple acquisition(s), share swap, transfer of shares or other means to seek an overseas direct or indirect listing, a secondary

listing or dual listing. On the same day, the CSRC also held a press conference for the release of the New Overseas Listing Rules

and issued the Overseas Listing Notice. Under the Overseas Listing Notice, a company that (i) has already completed overseas listing

or (ii) has already obtained the approval for the offering or listing from overseas securities regulators or exchanges but has not

completed such offering or listing before effective date of the New Overseas Listing Rules and also completes the offering or listing

before September 30, 2023 will be considered as an existing listed company and is not required to make any filing until it conducts

a new offering in the future. For the company that has already submitted offering and listing applications but not yet obtained the approvals

from overseas securities regulators or exchanges shall choose to make its filing with the CSRC at a reasonable time but before the completion

of the offering/listing. For the company that has already obtained CSRC approval, which was substituted by the filing requirements upon

the effectiveness of the Trial Measures, for overseas listing or offering can continue its process during the valid term of the CSRC

approval without additional filing and it shall make the CSRC filing pursuant to the New Overseas Listing Rules if it does not complete

the offering or listing before the expiration of the original approval from CSRC.

On

May 7, 2024, the CSRC released of the guidelines “Overseas Offering and Listing No. 7 Regulatory Requirements for Domestic Companies

Transferring Offering and Listing from overseas OTC Market to Overseas Stock Exchange”, rules are, (i) According to Article 1 and

Article 2 of new regulations, overseas offering and listing refers to offering and listing activities in overseas stock exchanges, and

listing of domestic companies in overseas OTC market is out of scope for the filing requirement; (ii) According to Article 16 of new

regulations, domestic companies that seek initial public offering or listing in overseas market shall file with CSRC within 3 working

days after the relevant application is submitted overseas, and offering and listing in other overseas market than where it has offered

and listed shall be filed with CSRC within 3 working days after the relevant application is submitted overseas; and (iii) According to

Notice of Filing Management Arrangements for Domestic Companies Seeking Offering and Listing in Overseas Market, since new regulations

came into effect (which is 31st March, 2023), domestic companies that have submitted application to overseas market other

than where it has offered and listed, but do not get approval from overseas regulator or stock exchanges yet, shall file with CSRC before

offering and listing procedures are completed. We are listing in overseas OTC market and not transferring Offering and Listing from Overseas

OTC Market to Overseas Stock Exchange currently. According to the CSRC Guidelines of Regulatory Rules, we are not subjected to the Trial

Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, which became effective

on March 31, 2023.

The

Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020, and was amended by the Consolidated Appropriations

Act, 2023 enacted on December 29, 2022. The amended HFCAA states if the SEC determines that we have filed audit reports issued by

a registered public accounting firm that has not been subject to inspection by the PCAOB for two consecutive years, the SEC shall

prohibit our Common stock from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

The Consolidated Appropriations Act, 2023 reduced the number of consecutive non-inspection years required for triggering the prohibitions

under the HFCAA from three years to two years. The PCAOB issued a Determination Report on December 16, 2021 (the “Determination

Report”) which found that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered

in mainland China and Hong Kong because of a position taken by one or more authorities in those jurisdictions. Furthermore, the

Determination Report identified the specific registered public accounting firms which are subject to these determinations (“PCAOB

Identified Firms”). Our auditor, Bush & Associates CPA LLC, the independent registered public accounting firm that issues the

audit report included elsewhere in this prospectus, as an auditor of companies that are traded publicly in the United States and

a firm registered with the PCAOB, is subject to laws in the U.S. pursuant to which the PCAOB conducts regular inspections to assess

its compliance with the applicable professional standards. Bush & Associates CPA LLC is headquartered in Nevada, and, as of the date

of this prospectus, was not included in the list of PCAOB Identified Firms in the Determination Report. On December 15, 2022, the

PCAOB issued a report that vacated its December 16, 2021, determination and removed mainland China and Hong Kong from the list

of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms.

Each

year, the PCAOB will determine whether it can inspect and investigate audit firms in mainland China and Hong Kong, among other jurisdictions.

If the PCAOB determines in the future that it no longer has full access to inspect and investigate accounting firms in mainland China

and Hong Kong and we use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial

statements filed with the SEC, we would be identified as a “Commission-Identified Issuer” following the filing of the annual

report on Form 10-K for the relevant fiscal year. There can be no assurance that we would not be identified as a “Commission-Identified

Issuer” for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the

prohibition on trading under the HFCAA. The delisting of our Common stock, or the threat of their being delisted, may materially

and adversely affect the value of your investment. These risks could result in a material adverse change in our operations and the value

of our Common stock, significantly limit or completely hinder our ability to offer or continue to offer securities to investors or cause

the value of such securities to significantly decline or become worthless.

Cash

may be transferred within our organization in the following manners: (i) we may transfer funds to our PRC subsidiary by way of capital

contributions or loans, through intermediate holding companies, such as our Hong Kong subsidiary; (ii) we or our intermediate holding

company may provide loans to our PRC operating subsidiary directly and vice versa; and (iii) our PRC subsidiary may make dividends or

other distributions to us through our intermediate holding subsidiaries.

As

of the date of this prospectus, we have not made dividend or other distributions to our shareholders. We may pay dividends to our

shareholders subject to our ability to service our debts as they become due and provided that our assets will exceed our liabilities

after the payment of such dividends. As a holding company, we may rely on dividends and other distributions on equity paid by our

subsidiaries for our cash and liquidity requirements, including payment of any debt we may incur outside of China and our expenses.

If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their

ability to pay dividends to us. To the extent cash or assets in the business is in the PRC or a PRC subsidiary, the cash or assets

may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of

restrictions and limitations on our or our subsidiaries’ ability by the PRC government to transfer cash or assets. PRC laws

and regulations applicable to our PRC subsidiaries permit payments of dividends only out of their retained earnings, if any,

determined in accordance with applicable accounting standards and regulations. Our PRC subsidiaries may pay dividends only out of

their respective accumulated after-tax profits as determined in accordance with PRC accounting standards and regulations. In

addition, our subsidiaries are required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund

certain statutory reserve funds, until the aggregate amount of such funds reaches 50% of its registered capital. At its discretion,

a wholly foreign-owned enterprise may allocate a portion of its after-tax profits to discretionary funds. These reserve funds and

discretionary funds are not distributable as cash dividends. Furthermore, dividends paid by our WFOE subsidiaries to their parent

companies will be subject to a 10% withholding tax, which can be reduced to 5% if certain requirements are met. The PRC government

also imposes restrictions on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. As such,

we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the

payment of dividends from our profits, if any. As of the date of this prospectus, none of our subsidiaries has made any dividends or

other distributions to us.

Investing

in our securities involves a high degree of risk. Before making any investment decision, you should carefully review and consider all

the information in this prospectus and the documents incorporated by reference herein, including the risks and uncertainties described

under “Risk Factors” beginning on page 10.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire

prospectus and any amendments or supplements carefully before you make your investment decision.

The

date of this prospectus is December 13, 2024.

Alpha

One Inc.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus or a supplement to this prospectus. We have not authorized anyone to

provide you with different information. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy

securities, in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this

prospectus or any supplement to this prospectus is accurate as of any date other than the date on the front cover of those documents.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains “forward-looking statements”. Forward-looking statements reflect the current view about future events.

When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,”

“future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate

to us or our management, identify forward-looking statements. Such statements include, but are not limited to, statements contained in

this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking

statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because

forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances

that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They

are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying

on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the

forward-looking statements include, without limitation, a continued decline in general economic conditions nationally and internationally;

decreased demand for our products and services; market acceptance of our products and services; the impact of any infringement actions

or other litigation brought against us; competition from other providers and products; our ability to develop and commercialize new and

improved products and services; our ability to raise capital to fund continuing operations; changes in government regulation that relate

to our business, and more specifically, how we market and sell products; our ability to complete customer transactions and capital raising

transactions; and other factors (including the risks contained in the section of this prospectus entitled “Risk Factors”)

relating to our industry, our operations and results of operations and any businesses that may be acquired by us. Should one or more

of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly

from those anticipated, believed, estimated, expected, intended or planned.

Factors

or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of

them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law we do

not intend to update any of the forward-looking statements to conform these statements to actual results.

PROSPECTUS

SUMMARY

This

summary only highlights the more detailed information appearing elsewhere in this prospectus. As this is a summary, it does not contain

all of the information that you should consider in making an investment decision. You should read this entire prospectus carefully, including

the information under “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus,

before investing.

In

this Prospectus, the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’

refer to Alpha One Inc. Or U.S. Holding Company, unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal

year’’ refers to our fiscal year ending March 31st. Unless otherwise indicated, the term ‘‘common stock’’

refers to shares of the Company’s common stock.

Corporate

History

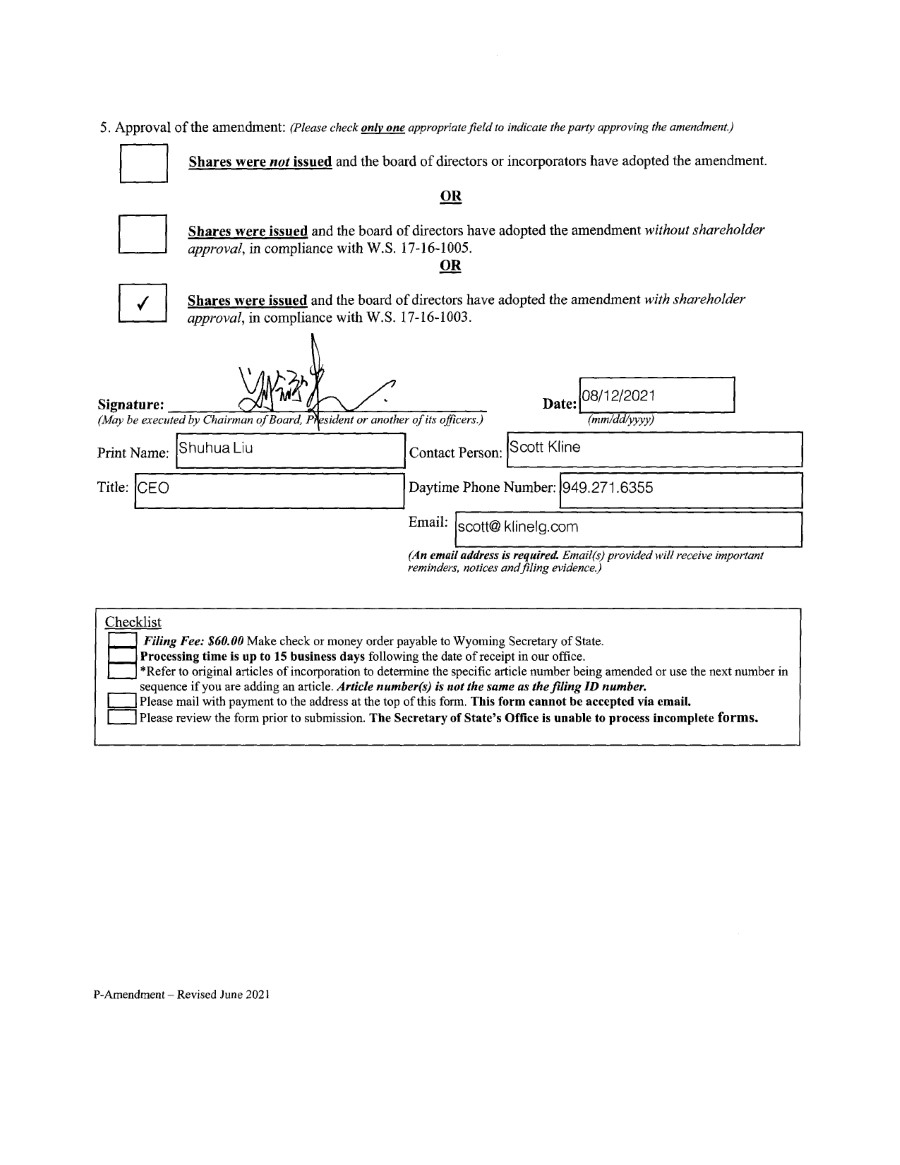

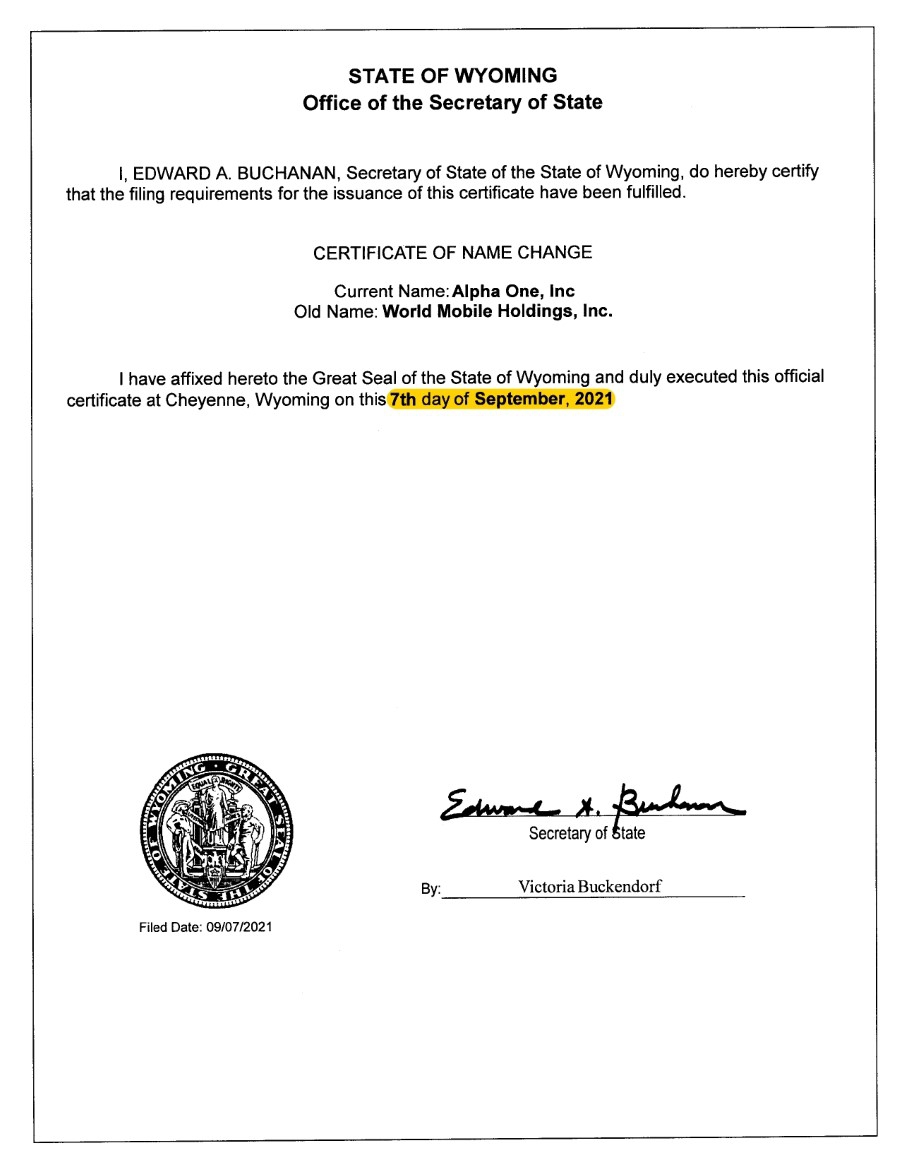

Alpha

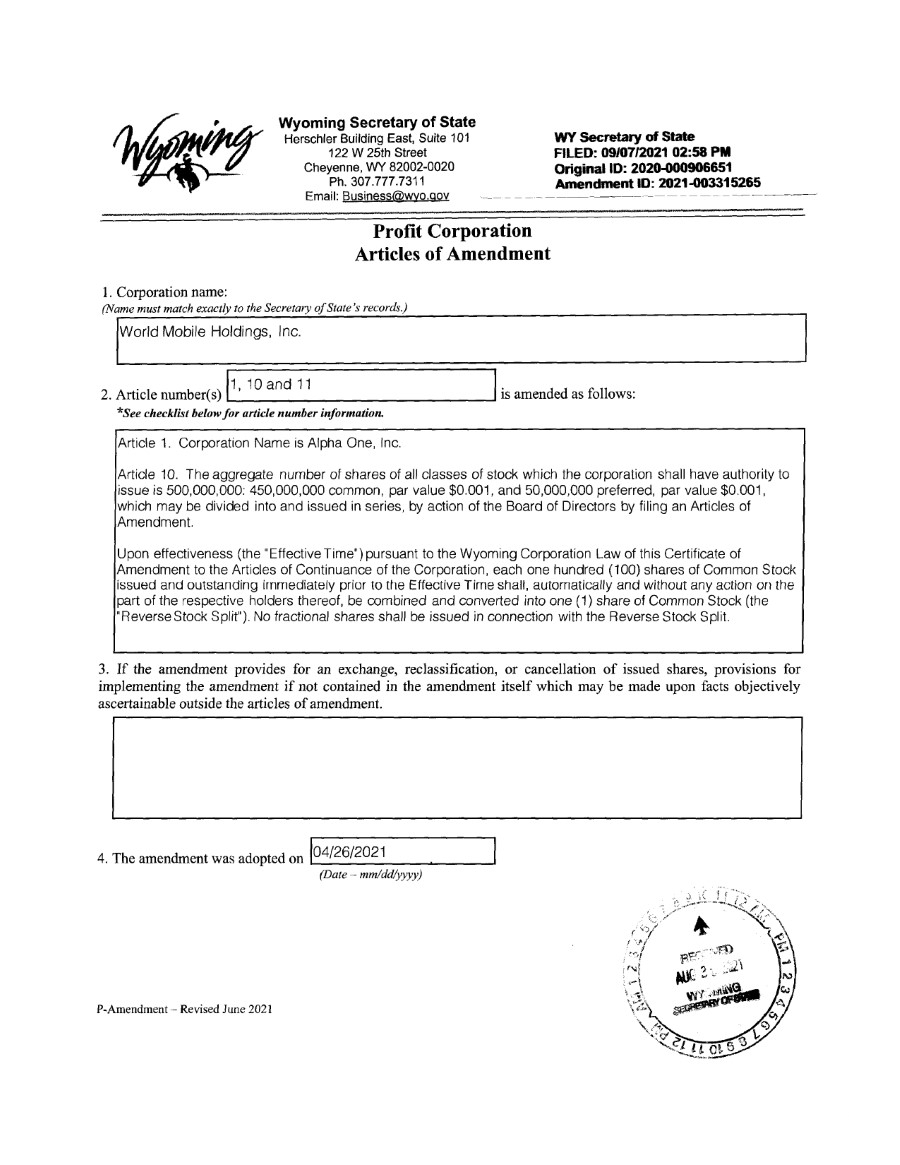

One Inc. (“we”, “us”, the “Company” or “AOAO”) was originally incorporated in State of

Nevada on May 5, 2006 under the name Microscints, Inc. On October 26, 2009 the Company filed the Certificate of Amendment

to change the name from Microscints, Inc. to World Mobile Holdings, Inc. On March 19, 2020, the Company redomiciled from the State of

Nevada to the State of Wyoming. On September 10, 2021, the Company’s name was changed from World Mobile Holdings, Inc. to Alpha

One Inc, The Company had been engaged in the various business since its incorporation. The Company was not successful and discontinued

the majority of its operation by December 31, 2016. Beginning from January 2017, the Company plans on providing business services and

financing to emerging growth entities.

On

October 8, 2019, Haining Zhang, filed a petition with the District Court, Clark County, Nevada, and the Court ordered that Mr. Zhang

was appointed as receiver for the Company. Consequently, Mr. Zhang is granted the authority to conduct business of the Company

pursuant to N.R.S. 78.630. Haining Zhang was appointed the sole officer and director at that time.

On

October 15, 2019, the Company issued 100,000,000 shares of common stock, with a par value of $0.001, to Mr. Zhang, our CEO, for $100,000,

$99,950 of which was subsequently expensed in its operation by December 31, 2019, and the balance was expensed in its operation in 2020.

On

February 8, 2021, the previously issued 100,000,000 shares of common stock were canceled in connection with changes in the Company’s

strategic direction.

On

March 30, 2021, 100,000,000 shares of common stock, under the control of Haining Zhang, were transferred to Zhuo Wang. As a result, Haining

Zhang resigned as the sole officer and director, and Shuhua Liu was appointed as the sole director and CEO of the Company.

On

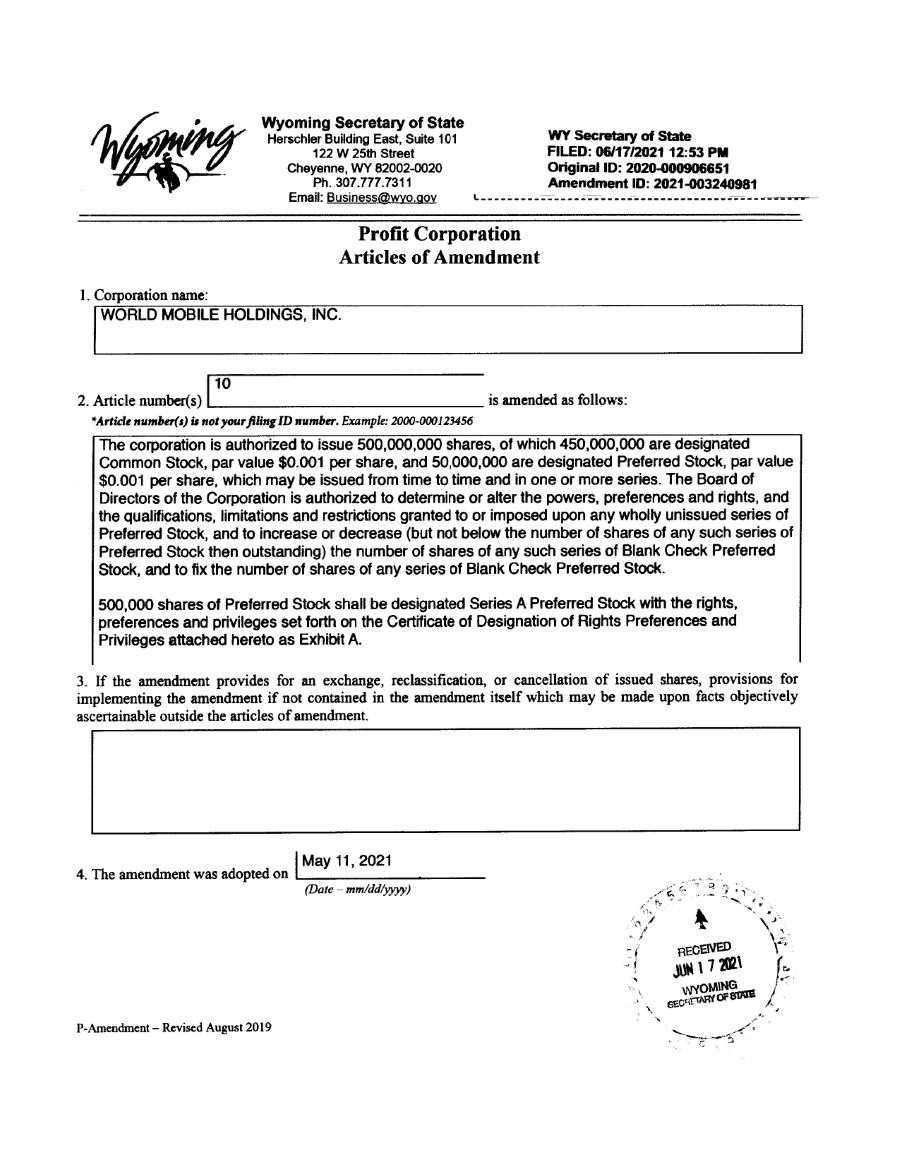

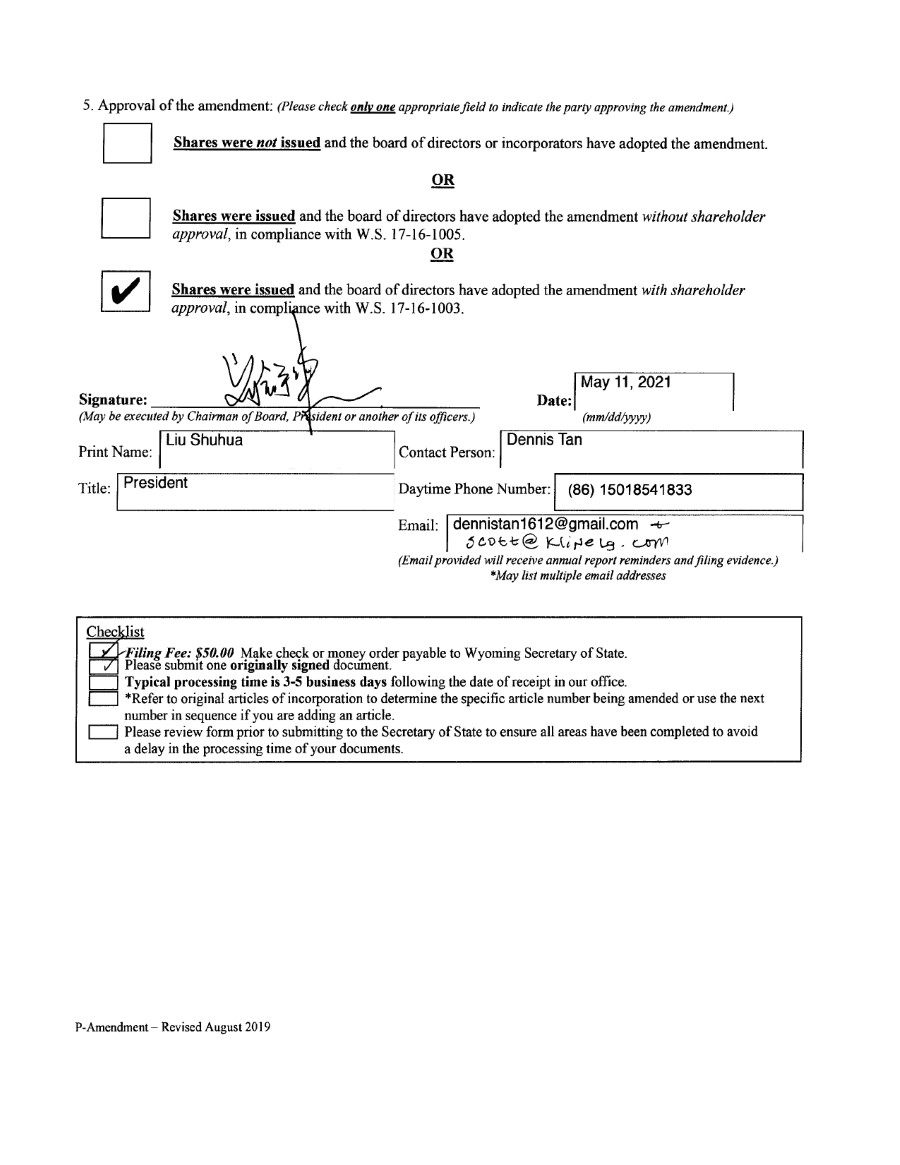

May 1, 2021 the Company amended its article of incorporation to change its authorized capital as following: 50,000,000 shares of preferred

stock, par value $0.001 per share; 450,000,000 shares of common stock, par value $0.001 per share. 500,000 shares of Preferred Stock

are designated Series A Preferred Stock. On June 17, 2021, the Company issued 245,000 shares of preferred stock to Zhuo Wang, 198,900

shares of preferred stock to Shuhua Liu, and 56,100 shares of preferred stock to Goldcrown International (HK) Limited, controlled by

Wei Chen, as compensation for services provided.

On

September 10, 2021, the Company effectuated a 100-for-1 reverse stock split, which resulted in a new total of 1,359,447 shares of common

stock.

On

February 8, 2022, the Company convert 500,000 of its Series A Preferred Stock into common stock with a ratio of 100 for 1.

On

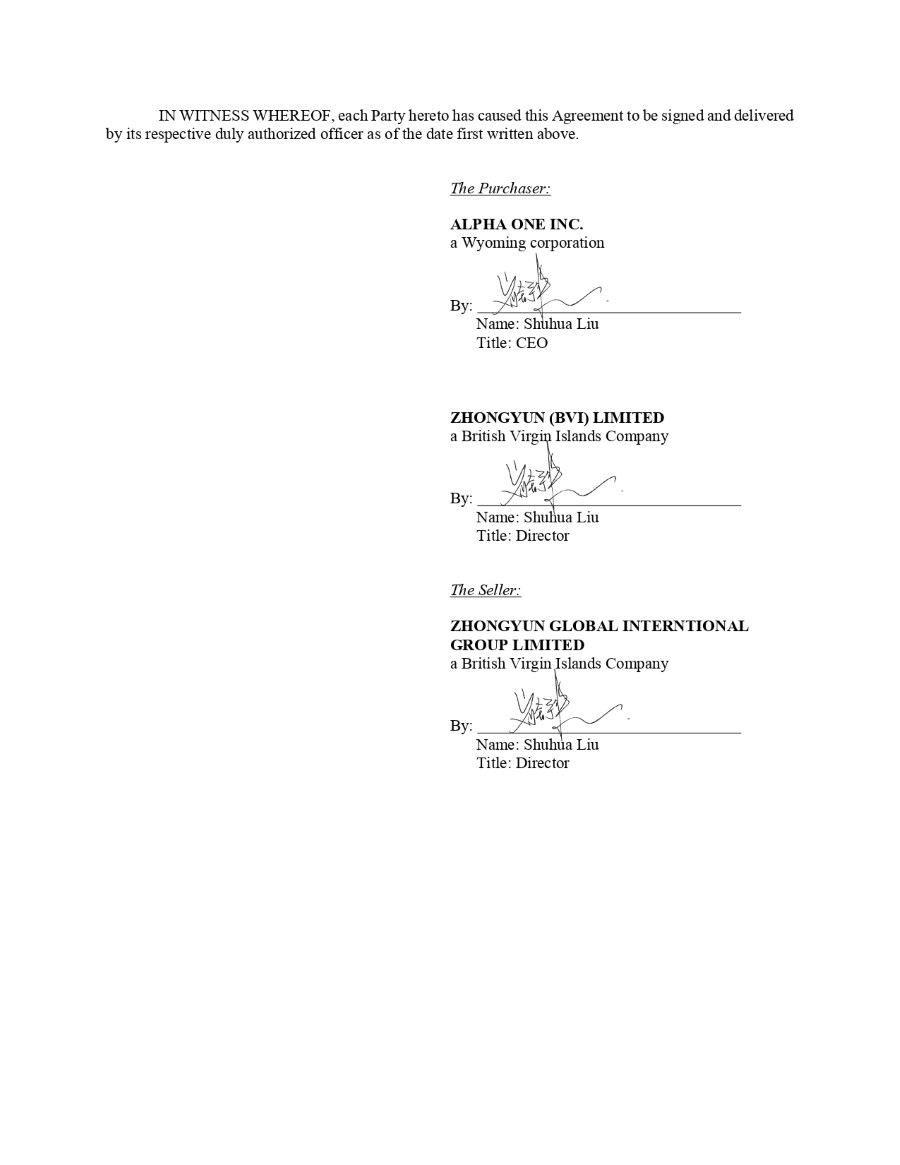

March 23, 2023, Alpha One Inc. (“AOAO,” or the “Company”) completed its merger with Zhongyun (BVI). (“Zhongyun

BVI”) and Zhongyun BVI’s wholly-owned subsidiary, Shenzhen Zhongyun Communication Technology Co., Ltd” (“Shenzhen

Zhongyun”), pursuant to the terms of a definitive share exchange agreement dated March 23, 2023.

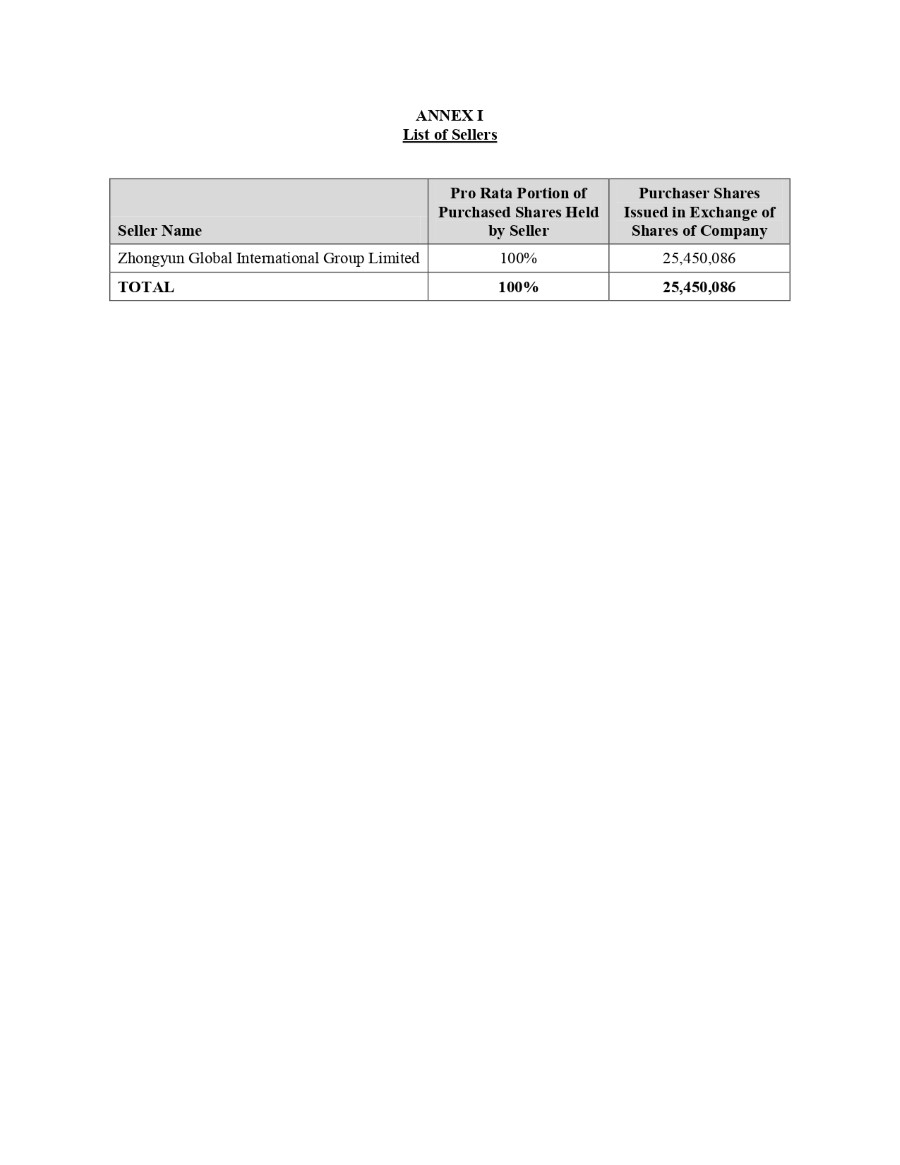

Upon completion of the merger, all of the outstanding

shares of Zhongyun BVI’s common stock were exchanged for 25,450,086 shares of common stock of AOAO. Prior to the merger, Shuhua

Liu and her spouse directly and indirectly obtained the total 49.65% controlled of AOAO, and 50% indirectly controlled of Zhongyun BVI

by Zhongyun Global International Group Limited. Shuhua Liu is the sole director of AOAO and Zhongyun BVI. As AOAO and Zhongyun BV were

under common control at the time of the share exchange, the transaction is accounted for as a combination of entities under common control

in a manner similar to the pooling-of-interests method of accounting. Following the Merger, Shuhua Liu and her spouse directly and indirectly

obtained the 49.77% controlled of AOAO. Immediately after completion of such share exchange, the Company has a total of 76,809,533 issued

and outstanding shares of common stock, with authorized common shares of 450,000,000.

Consequently, the Company has ceased to fall

under the definition of shell company as define in Rule 12b-2 under the Exchange Act of 1934, as amended (the “Exchange Act”)

and Zhongyun BVI is now a wholly owned subsidiary.

On November 16, 2023, the former director and

CEO Zhuo Wang transferred 19,890,000 shares to Sun Horn Limited, 4,239,742 shares to Shuhua Liu and 1,370,258 shares Xinli Chen for free.

On May 28, 2024, 25,450,086 shares of common stock of AOAO transferred from Zhongyun Global International Group

Limited to seventy-one individuals (including Shuhua Liu 1,561,033 shares) and two corporates, after the transferred, Shuhua Liu and

her spouse directly and indirectly held total 56,800,775 shares, or 66.646% of outstanding shares.

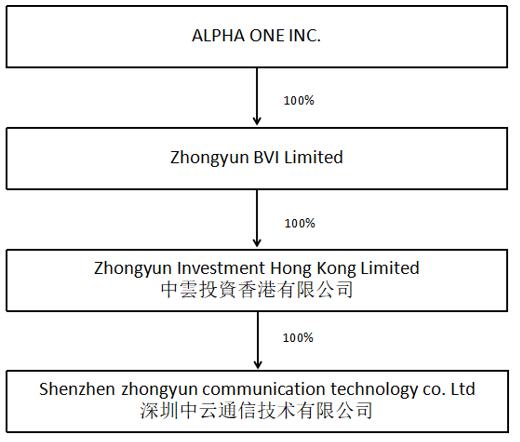

Our

Company structure is shown in the below chart. The percentages denote ownership.

Zhongyun

(BVI) Limited (“Zhongyun BVI”) was incorporated in the British Virgin Islands on December 6, 2022 with limited liability.

Zhongyun

Investment Hong Kong Limited (“Zhongyun HK”) which is 100% owned by Zhongyun BVI, was incorported in the HongKong on December

23, 2022, Zhongyun HK is an investment holding company with no operations. On March 2, 2023, Zhongyun HK acquired Shenzhen Zhongyun Communication

Technology Co., Ltd.

Shenzhen

Zhongyun Communication Technology Co., Ltd, a Chinese company, a wholly foreign owned enterprise (WFOE), also referred to herein as “Shenzhen

Zhongyun”, which was incorporated on August 25, 2020 by the controlling shareholder, Shuhua Liu. Shenzhen Zhongyun is principally

engaged in the electronic products trading and telecommunication engineering servicess in the People’s Republic of China (“PRC”).

Shenzhen

Zhongyun is the company through which we operate, and which shares our business plan with the goal of developing and providing modern

electronic products trading and telecommunication engineering services to our future clients.

The

Company’s mailing address is No. 203, F2.62A, 2F, Tianzhan Building, No. 4 Tanran 5th Road, Tian’an Community, Shatou Street,

Futian District, Shenzhen, Guangdong Province, China. The telephone number is +86 755 82794624.

Status

of “Smaller Reporting Company”

We

are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage

of certain reduced disclosure obligations. We have elected to comply with the scaled disclosure requirements applicable to “smaller

reporting companies,” including providing two years of audited financial statements. We will remain a smaller reporting company

until the last day of the fiscal year in which (1) the market value of our Common Stock held by non-affiliates is equal to or exceeds

$250 million and (2) our annual revenues were equal to or exceeded $100 million during such completed fiscal year and the market value

of our Common Stock held by non-affiliates is equal to or exceeds $700 million.

Recent

PRC Regulatory Developments

In

recent years, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation

of business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision over China-based

companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly

enforcement.

Among

other things, the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”)

and the Anti-Monopoly Law of the People’s Republic of China promulgated by the SCNPC which became effective in 2008 (“Anti-Monopoly

Law”), established additional procedures and requirements that could make merger and acquisition activities by foreign investors

more time-consuming and complex. Such regulation requires, among other things, that the Ministry of Commerce of the People’s Republic

of China (the “MOFCOM”) be notified in advance of any change-of-control transaction in which a foreign investor acquires

control of a PRC domestic enterprise or a foreign company with substantial PRC operations, if certain thresholds under the Provisions

of the State Council on the Standard for Declaration of Concentration of Business Operators, issued by the State Council in 2008, are

triggered. Moreover, the Anti-Monopoly Law requires that transactions which involve the national security, the examination on the national

security shall also be conducted according to the relevant provisions of the Measures for the Safety Examination of Foreign Investment.

In addition, the PRC Measures for the Security Review of Foreign Investment which became effective in January 2021 require acquisitions

by foreign investors of PRC companies engaged in military-related or certain other industries that are crucial to national security be

subject to security review before consummation of any such acquisition.

On

July 6, 2021, the relevant PRC government authorities made public the Opinions on Strictly Cracking Down on Illegal Securities Activities

in Accordance with the Law (the “Opinions”). These opinions emphasized the need to strengthen the administration over illegal

securities activities and the supervision on overseas listings by China-based companies and proposed to take effective measures, such

as promoting the construction of relevant regulatory systems to deal with the risks and incidents faced by China-based overseas-listed

companies. Pursuant to the Opinions, Chinese regulators are required to accelerate rulemaking related to the overseas issuance and listing

of securities, and update the existing laws and regulations related to data security, cross-border data flow, and management of confidential

information. Numerous regulations, guidelines and other measures are expected to be adopted under the umbrella of or in addition to the

Cybersecurity Law of the PRC (the “Cybersecurity Law”) and the Data Security Law. As of the date of this prospectus, no official

guidance or related implementation rules have been issued yet and the interpretation of these opinions remains unclear at this stage.

See “Risk Factors — Risks Related to Doing Business in China on page 15 to page 20, Any failure to

comply with applicable laws and requirements could have a material and adverse effect on our business.

On

December 28, 2021, the Cybersecurity Review Measures (2021 version), which were promulgated and became effective on February 15,

2022, provide that any “online platform operators” possessing personal information of more than one million users which seeks

to list in a foreign stock exchange should be subject to cybersecurity review. The Cybersecurity Review Measures (2021 version), further

list the factors to be considered when assessing the national security risks of the relevant activities, including, among others, (i) the

risk of core data, important data or a large amount of personal information being stolen, leaked, destroyed, and illegally used or exited

the country; and (ii) the risk of critical information infrastructure, core data, important data or a large amount of personal information

being affected, controlled, or maliciously used by foreign governments after listing abroad. The CAC requires that under the new rules,

companies possessing personal information of more than one million users must now apply for cybersecurity approval when seeking listings

in other nations because of the risk that such data and personal information could be “affected, controlled, and maliciously exploited

by foreign governments.” Any failure to comply with applicable laws and requirements could have a material and adverse effect on

our business.

As

of the date of this prospectus, we have not engaged in any monopolistic behavior and our business does not control more than one million

users’ personal information, implicate cybersecurity, or involve any other type of restricted industry. As advised by our PRC legal

counsel, Inner Mongolia Shuoda Law Firm, as of the date of this prospectus, we are not required to declare a cybersecurity review with

the CAC, according to the Measures for Cybersecurity Review, since we are not an online platform operator carrying out data processing

activities that affect or may affect national security, and currently do not have over one million users’ personal information

and do not anticipate that we will be collecting over one million users’ personal information in the foreseeable future, which

we understand might otherwise subject us to the Measures for Cybersecurity Review. As of the date of this prospectus, we have not received

any notice from any authorities identifying us as CIIOs or requiring us to undergo a cybersecurity review or network data security review

by the CAC. However, we cannot affirm that PRC regulators share the same interpretation. Because these statements and regulatory

actions are new and subject to change, it is difficult for us to predict how quickly the legislative or administrative regulation making

bodies in China will respond to companies, or what existing or new laws or regulations will be amended or promulgated, if any, or the

potential impact such amended or new legislation will have on our daily business operations or our ability to accept foreign investments

and list on a U.S. stock exchange.

On

February 17, 2023, the CSRC released the New Overseas Listing Rules, which came into effect on March 31, 2023. The New Overseas

Listing Rules apply to overseas securities offerings and/or listings conducted by (i) companies incorporated in the PRC, or PRC

domestic companies, directly and (ii) companies incorporated overseas with operations primarily in the PRC and valued on the basis

of interests in PRC domestic companies, or indirect offerings. The New Overseas Listing Rules requires (1) the filings of the overseas

offering and listing plan by the PRC domestic companies with the CSRC under certain conditions, and (2) the filing of their underwriters

with the CSRC under certain conditions and the submission of an annual report to of such filed underwriters the CSRC within the required

timeline. The required filing scope is not limited to the initial public offering, but also includes subsequent overseas securities offerings,

single or multiple acquisition(s), share swap, transfer of shares or other means to seek an overseas direct or indirect listing, a secondary

listing or dual listing.

On

the same day, the CSRC also held a press conference for the release of the New Overseas Listing Rules and issued the Overseas Listing

Notice. Under the Overseas Listing Notice, a company that (i) has already completed overseas listing or (ii) has already obtained

the approval for the offering or listing from overseas securities regulators or exchanges but has not completed such offering or listing

before effective date of the New Overseas Listing Rules and also completes the offering or listing before September 30, 2023 will

be considered as an existing listed company and is not required to make any filing until it conducts a new offering in the future. For

the company that has already submitted offering and listing applications but not yet obtained the approvals from overseas securities

regulators or exchanges shall choose to make its filing with the CSRC at a reasonable time but before the completion of the offering/listing.

For the company that has already obtained CSRC approval, which was substituted by the filing requirements upon the effectiveness of the

Trial Measures, for overseas listing or offering can continue its process during the valid term of the CSRC approval without additional

filing and it shall make the CSRC filing pursuant to the New Overseas Listing Rules if it does not complete the offering or listing before

the expiration of the original approval from CSRC.

On

May 7, 2024, the CSRC released of the guidelines “Overseas Offering and Listing No. 7 Regulatory Requirements for Domestic Companies

Transferring Offering and Listing from overseas OTC Market to Overseas Stock Exchange”, rules are, (i) According to Article 1 and

Article 2 of new regulations, overseas offering and listing refers to offering and listing activities in overseas stock exchanges, and

listing of domestic companies in overseas OTC market is out of scope for the filing requirement; (ii) According to Article 16 of new

regulations, domestic companies that seek initial public offering or listing in overseas market shall file with CSRC within 3 working

days after the relevant application is submitted overseas, and offering and listing in other overseas market than where it has offered

and listed shall be filed with CSRC within 3 working days after the relevant application is submitted overseas; and (iii) According to

Notice of Filing Management Arrangements for Domestic Companies Seeking Offering and Listing in Overseas Market, since new regulations

came into effect (which is 31st March, 2023), domestic companies that have submitted application to overseas market other

than where it has offered and listed, but do not get approval from overseas regulator or stock exchanges yet, shall file with CSRC before

offering and listing procedures are completed. We are listing in overseas OTC market and not transferring Offering and Listing from Overseas

OTC Market to Overseas Stock Exchange currently. According to the CSRC Guidelines of Regulatory Rules, we are not subjected to the Trial

Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, which became effective

on March 31, 2023.

We have been closely monitoring regulatory developments

in China regarding any necessary approvals from the CSRC, the CAC or other PRC regulatory authorities required for our operations and

overseas listings. However, there remains significant uncertainty as to the enactment, interpretation and implementation of regulatory

requirements related to overseas securities offerings and other capital markets activities. The PRC government may take actions to exert

more oversight and control over offerings by China-based issuers conducted overseas and/or foreign investment in such companies,

which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors outside China

and cause the value of our securities to significantly decline or become worthless. If it is determined in the future that the approval

or permissions of the CSRC, the CAC or any other regulatory authority is required for our operations through our PRC Subsidiaries and

this offering and we or our PRC Subsidiaries do not receive or maintain the approvals or permissions, or we or our PRC Subsidiaries inadvertently

conclude that such approvals or permissions are not required, or applicable laws, regulations, or interpretations change such that we

or our PRC Subsidiaries are required to obtain approvals or permissions in the future, we and our PRC Subsidiaries may be subject to

investigations by competent regulators, fines or penalties, ordered to suspend our PRC Subsidiaries’ relevant operations and rectify

any non-compliance, limit our ability to pay dividends outside of mainland China, delay or restrict the repatriation of the proceeds

from this offering into mainland China or take other actions prohibited from engaging in relevant business or conducting any offering,

and these risks could result in a material adverse change in our operations, significantly limit or completely hinder our ability to

offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless. See

“Risk Factors — Risks Related to Doing Business in China — Chinese government may intervene

or influence our operations in accordance with laws and regulations, or may exert more control over offerings conducted overseas and/or

foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our shares”

and “Risk Factors — Risks Related to Doing Business in China —Any actions by the Chinese government

to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could

significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such

securities to significantly decline or be worthless” on page 18, of this prospectus.

Cash

Transfers and Dividend Distributions

Cash

may be transferred within our organization in the following manners: (i) we may transfer funds to our PRC subsidiary by way of capital

contributions or loans, through intermediate holding companies, such as our Hong Kong subsidiary; (ii) we or our intermediate holding

company may provide loans to our PRC operating subsidiary directly and vice versa; and (iii) our PRC subsidiary may make dividends or

other distributions to us through our intermediate holding subsidiaries.

We

are a holding company with no material operations of our own and do not generate any revenue. We currently conduct substantially all

of our operations through our PRC operating subsidiary Shenzhen Zhongyun. We are permitted under PRC laws and regulations to provide

funding to PRC subsidiary through loans or capital contributions, only if we satisfy the applicable PRC government registration and approval

requirements. Any loans from us or our holding subsidiaries outside of China to our PRC subsidiary, which are treated as FIEs under PRC

law, are subject to PRC regulations and foreign exchange loan registration requirements. Under Wyoming law, we may pay dividends to our

shareholders subject to our ability to service our debts as they become due and provided that our assets will exceed our liabilities

after the payment of such dividends. As a holding company, we may rely on dividends and other distributions on equity paid by our subsidiaries

for our cash and liquidity requirements, including funds necessary to pay dividends and other cash distributions to our shareholders

or investors, or service any debt we may incur outside of China and pay our expenses. If any of our subsidiaries incurs debt on its own

behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. To the extent cash or assets

in the business is in the PRC or a PRC subsidiary, the cash or assets may not be available to fund operations or for other use outside

of the PRC due to interventions in or the imposition of restrictions and limitations on our or our subsidiaries’ ability by the

PRC government to transfer cash or assets. Under the PRC laws and regulations, our PRC subsidiaries may pay dividends only out of their

respective accumulated after-tax profits as determined in accordance with PRC accounting standards and regulations. In addition, each

of our PRC subsidiaries is required to set aside at least 10% of its accumulated after-tax profits each year, after making up for previous

year’s accumulated losses, to fund certain statutory reserve funds, until the aggregate amount of such funds reaches 50% of its

registered capital. At its discretion, a subsidiary may allocate a portion of its after-tax profits based on PRC accounting standards

to discretional funds. These reserve funds and discretional funds are prohibited from being distributed to their shareholders as dividends.

The

following table describes transfers among us and our subsidiaries made during the periods presented:

| |

|

For

the years ended

March 31 |

|

|

For

the six months ended

September

30 |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

RMB |

|

|

RMB |

|

|

RMB |

|

|

RMB |

|

| Capital

contributions from us to our offshore subsidiaries (1) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Loans

from us to our offshore subsidiaries |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Capital

contributions from our offshore subsidiaries to PRC operating subsidiary |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Loans

from our PRC operating subsidiaries to our offshore subsidiaries |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Other

amounts paid by our WFOE on our behalf of our offshore subsidiaries (2) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| |

(1)

|

“Offshore

subsidiaries” refer to all of our subsidiaries except our PRC subsidiary. |

| |

(2) |

Cash

paid by our PRC operating subsidiary to our Hong Kong subsidiaries for expenses. |

As of the date of this prospectus, our holding

company Alpha One Inc., has not declared or paid dividends, made distributions, or transferred assets to its subsidiaries in the past,

nor have any dividends, distributions or asset transfers been made by any our PRC Subsidiaries to Zhongyun HK, Zhongyun BVI or the Wyoming

holding company. For the years ended March 31, 2024 and 2023 and for the six months ended September 30, 2024 and 2023, there was

no cash transfer among our Wyoming holding company, Zhongyun BVI, Zhongyun HK and our PRC Subsidiary. Wyoming holding company’s

expenses paid by the sole director Shuhua Liu for the years ended March 31, 2024 and 2023 and for the six months ended September

30, 2024 and 2023.

Permission

Required from the PRC Authorities with respect to Operations and Securities Listing

As

of the date of this prospectus, we and our PRC subsidiary have received all requisite permits, approvals and certificates from the PRC

government authorities to conduct our business operations in China, and no permission or approval has been denied or revoked.

As

an enterprise engaged in intelligent product sales and telecommunication engineering services business, our PRC subsidiary is not operating

in an industry that prohibits or limits foreign investment. We and our PRC subsidiary are not required to obtain permissions from the

CSRC, the CAC or any other PRC authorities to operate, other than the permits and approvals our PRC subsidiary have already received.

However, if we or our subsidiary do not receive or maintain required permissions or approvals, inadvertently conclude that such permissions

or approvals are not required, or applicable laws, regulations, or interpretations change such that we are required to obtain such permissions

or approvals in the future, we may be subject to governmental investigations or enforcement actions, fines, penalties, suspension of

operations, or be prohibited from engaging in relevant business or conducting securities offering, and these risks could result in a

material adverse change in our operations, significantly limit or completely hinder our ability to offer or continue to offer securities

to investors, or cause such securities to significantly decline in value or become worthless.

Our

PRC subsidiaries are required to obtain certain permits and licenses from the PRC government agencies to operate our business in China,

including: (a) business licenses, (b) Construction Enterprise Qualification Certificate, and (c) Safety Production License. We have received

such licenses or certificates pursuant to PRC Law.

On

February 17, 2023, the CSRC promulgated Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic

Companies, or the Overseas Listing Trial Measures, and relevant five supporting guidelines, together as the New Overseas Listing Rules,

which became effective on March 31, 2023. According to the New Overseas Listing Rules, PRC domestic companies that seek to offer

and list securities in overseas markets, either in direct or indirect means, are required to complete the filing procedure with the CSRC

and report relevant information. The New Overseas Listing Rules provide that if the issuer meets the following criteria at the same time,

the overseas securities offering and listing conducted by such issuer will be deemed as an indirect overseas offering subject to the

filing procedures as set forth under the New Overseas Listing Rules: (i) 50% or more of any of the issuer’s operating revenue,

total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent fiscal year

is accounted for by domestic companies; and (ii) the issuer’s business activities are substantially conducted in mainland

China, or its principal place(s) of business are located in mainland China, or the majority of senior managers in charge of its

business operations and management are PRC citizens or domiciled in mainland China. According to the New Overseas Listing Rules, we shall

file with the CSRC within three (3) business days after our first submission of listing application documents overseas, and if we

apply for the CSRC to postpone to publicize our filing information, we shall report to the CSRC within three (3) business days since

our first public filing day. Furthermore, we shall also report to the CSRC with the offering after the overseas offering finished.

The New Overseas Listing Rules also require subsequent overseas securities offering in the same overseas market to be filed within three

(3) business days after the completion of such subsequent offering, and subsequent reports to be filed with the CSRC on material

events within three (3) business days after the occurrence and public disclosure of such material events, such as change of control,

investigations or sanctions imposed by overseas securities regulatory agencies or other competent authorities, change of listing status

or transfer of listing segment or voluntary or forced delisting of the issuer who have completed overseas offerings and listings.

On

the same day, the CSRC also held a press conference for the release of the New Overseas Listing Rules and issued the Notice on Administration

for the Filing of Overseas Offering and Listing by Domestic Companies (the “Overseas Listing Notice). Under the Overseas Listing

Notice, if company (i) has already completed overseas listing; or (ii) has already obtained the approval for the offering or

listing from overseas securities regulators or exchanges but has not completed such offering or listing before effective date of the

New Overseas Listing Rules and also completes the offering or listing before September 30, 2023, such company will be considered

as an “existing listed company” and is not required to make any filing until it conducts a new offering in the future. If

a company has already submitted offering and listing applications but has not obtained the approvals from overseas securities regulators

or exchanges, such company shall choose to make its filing with the CSRC at a reasonable time but before the completion of the offering/listing.

Companies that have already obtained CSRC approval for overseas listing or offering can continue its process during the valid term of

the CSRC approval without additional filing, and shall make the filing pursuant to the New Overseas Listing Rules if they do not complete

the offering or listing before the expiration of the original approval from CSRC.

On

May 7, 2024, the CSRC released of the guidelines “Overseas Offering and Listing No. 7 Regulatory Requirements for Domestic Companies

Transferring Offering and Listing from overseas OTC Market to Overseas Stock Exchange”, rules are, (i) According to Article 1 and

Article 2 of new regulations, overseas offering and listing refers to offering and listing activities in overseas stock exchanges, and

listing of domestic companies in overseas OTC market is out of scope for the filing requirement; (ii) According to Article 16 of new

regulations, domestic companies that seek initial public offering or listing in overseas market shall file with CSRC within 3 working

days after the relevant application is submitted overseas, and offering and listing in other overseas market than where it has offered

and listed shall be filed with CSRC within 3 working days after the relevant application is submitted overseas; and (iii) According to

Notice of Filing Management Arrangements for Domestic Companies Seeking Offering and Listing in Overseas Market, since new regulations

came into effect (which is 31st March, 2023), domestic companies that have submitted application to overseas market other

than where it has offered and listed, but do not get approval from overseas regulator or stock exchanges yet, shall file with CSRC before

offering and listing procedures are completed.

We

are listing in overseas OTC market and not transferring Offering and Listing from Overseas OTC Market to Overseas Stock Exchange currently.

According to the CSRC Guidelines of Regulatory Rules, we are not subjected to the Trial Administrative Measures of Overseas Securities

Offering and Listing by Domestic Companies, or the Trial Measures, which became effective on March 31, 2023.

SUMMARY

OF THE OFFERING

The

following is a summary of the shares being offered by the selling shareholders:

| Common

stock offered by selling shareholders |

Up

to 10,000,000 shares of common stock. This represents an aggregate of 13% of our outstanding common stock. (1) |

| |

|

| Common

stock outstanding prior to the offering |

76,809,533

shares |

| |

|

| Common

stock outstanding after the offering |

76,809,533

shares |

| |

|

| Terms

of the Offering |

The

Selling Shareholders will determine when and how they will sell the common stock offered in this prospectus. as more fully provided

in the Plan of Distribution section. of this prospectus commencing Page 38 |

| |

|

| Use

of proceeds |

We

are not selling any shares of the common stock covered by this prospectus. As such, we will not receive any of the offering proceeds

from the registration of the. shares of Common Stock covered by this prospectus. |

| |

|

| Risk

factors |

The

Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of

their entire investment. See “Risk Factors” beginning on page 10. |

| |

|

| OTC

Pink Trading Symbol |

“AOAO” |

(1)

Based on 76,809,533 shares of common stock outstanding as of September 30, 2024

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully consider the following risks, together with all of the other

information contained in this Registration Statement, including our consolidated financial statements and related notes, before making

a decision to invest in our common stock. Any of the following risks could have an adverse effect on our business, operating results,

financial condition and prospects, and could cause the trading price of our common stock to decline, which would cause you to lose all

or part of your investment. Our business, operating results, financial condition and prospects could also be harmed by risks and uncertainties

not currently known to us or that we currently do not believe are material.

We

consider the following to be the material risks for an investor regarding our common stock. Our Company should be viewed as a high-risk

investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount. An investment

in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You

should carefully consider the following risk factors and other information in this Registration Statement before deciding to become a

holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected

to a significant extent.

Risks

Related to Our Business and Industry

The

Company’s projects are concentrated in the South of China, in particular Guangdong Province, and any material change pertaining

to Guangdong Province may materially and adversely affect the Company’s business, results of operations and profitability

The

Company was founded and is based in Shenzhen City Guangdong

Province, there were thirteen contracts under construction, all the projects located at Guangdong Province (that including twenty-one

cities) during the year ended March 31,2023 and a new project located at Guangxi Province during the year ended March 31,2024 The revenue

derived from projects located in Guangdong Province during the year ended March 31,2023. and the majority of the revenue derived from

projects located in Guangdong Province and minority from Guangxi Province for the year ended March 31, 2024. Given the Company’s

concentration in revenue from Guangdong Province, the Company’s business is highly subject to the economic conditions and government

policies which affect the Company’s business, results of operations and profitability.

The

Company’s business operates on a non-recurring

and project by project basis, failure to obtain new projects, and uncertainties in achieving objective of annual output,

could materially affect the Company’s business and results of operations

The

Company’s business operates on a project by project basis, as such they are non-recurring in nature. The Company has planned the

annual output and profits according to the projects under construction and coming projects, in order for the Company to undertake new

projects, the Company must either participate in open tendering to compete for project made available by potential customers or await

customers to approach the Company to solicit its services. As such, given the non-recurring nature of the Company’s projects, the

Director believe that the Company’s future growth and success will depend on the Company’s ability to continue to secure

projects. The Company cannot assure you that it will be able to secure projects from the Company’s existing or potential customers.

In the event that there is a significant decrease in the number of projects or scale in terms of contract value of the projects awarded

by the Company’s customers, the Company’s business and results of operations may be materially and adversely affected.

We

are heavily dependent on one supplier on the supply of our intelligent products, the loss of which could adversely affect our business,

financial condition and results of operations

We

are heavily dependent on one supplier for the supply of our intelligent products. For the fiscal years ended March 31, 2024 and 2023,

the supplier accounted for approximately 81% and nil of our total purchases respectively.

We

have purchased, and expect to continue to purchase products from the supplier under our purchase agreements with it. Our agreement with

the supplier is valid for two years after the products acceptance is qualified. These agreements may be terminated or rescinded

earlier by mutual agreements to terminate, or occurrence of force majeure. In the event that we are unable to purchase products upon

early termination or expiration of our agreement with the supplier, our business would be harmed.

The

unavailability of certain products, delays in the delivery of certain products or the delivery of products that does not meet our specifications

could impair our ability to meet customers’ orders. We are also subject to credit risk with respect to our suppliers. If any such

suppliers become insolvent, an appointed trustee could potentially ignore the contracts we have in place with such party, resulting in

increased charges or the termination of the supply contracts. We may not be able to replace a supplier within a reasonable period of

time, on as favorable terms or without disruption to our operations. Any adverse changes to our relationships with suppliers could have

a material adverse effect on our image, brand and reputation, as well as on our business, financial condition and results of operations.

The

Company had operating cash outflows for the years ended March 31, 2024 and 2023, and the Company’s cash flows may deteriorate due

to potential mismatches in the time between receipt of payments from the Company’s customers, and payments to the Company’s

suppliers, which may impact its operating cash flow position

The

Company relies on its suppliers to provide the necessary labour and materials for its projects, and relies upon the cash inflow from

its customers to meet the payment obligations towards its suppliers. The Company’s cash inflows are dependent upon a variety of

factors including certification by its customers and the prompt settlement of its invoices. If such payment is delayed, the Company may

be required to fund the cost of works for a lengthy period of time until the Company’s payment application is approved and paid

for. As at March 31, 2024 and 2023, the Company’s accounts payable, accrued and other payables amounted to $5.66

million and $2.80 million respectively. Whereas for the corresponding dates, the Company’s account receivables amount to

$9.75 million and $5.72 million respectively. Nevertheless, even if the Company’s customers settle such payments on time and in

full, there can be no assurance that the Company would not experience any significant cash flow mismatch which would affect the Company’s

operating cash flow position as the Company may be required to provide prepayments pursuant to the arrangement with its suppliers. During

the Track Record Period, the Company would in certain circumstances, depending on the scale of works required, provide its material suppliers

with an advance payment of approximately 30% of the contract value as stipulated in the work order. Hence, if the Company undertakes

a large number of projects, it would pose significant pressure on its cash flow and the Company may record net operating cash outflow.

Failure

to properly estimate the risks, time and cost involved in a project or delays in completion may lead to cost overruns and affect the

Company’s financial conditions and profitability

When

determining the offer price for its projects, the Company generally adopts a cost-plus pricing model after taking into account

factors including, the nature, scale, complexity and location of the relevant project, as well as the estimated material, labour and

equipment cost. As such, whether the Company is able to achieve its target profitability in any project is significantly dependent

on its ability to accurately estimate and control these costs. The actual time taken and cost involved in implementing the

Company’s project may be adversely affected by a number of factors, such as shortage or cost escalation of materials and

labor, adverse weather conditions, accidents, and any other unforeseen problems and circumstances. As of the aforesaid factors may

give rise to delays in completion of works or cost overruns, which in turn result in a lower profit margin or even a loss for a

project, thereby materially and adversely affecting the Company’s financial condition, profitability or liquidity.

The

Company’s performance depends on prevailing market conditions and trends in the Telecommunications Infrastructure Services industry,

and Infrastructure Digitalisation Solution Services industry and in the overall state of economy in PRC

All

of the Company’s operations are based in, and all of the Company’s revenue was derived from the PRC during the Track Record

Period, and the Directors expect the Company’s business will continue to be based in the PRC. Accordingly, the Company’s

future performance depends on the prevailing market conditions and trends in the telecommunications industry in the PRC. The future growth

and level of profitability is likely to depend primarily upon the continued availability of large-scale projects, which will be determined

by the interplay of various factors. These factors include, in particular, the PRC government’s policies and initiatives, the spending

budgets and patterns of the Company’s customers, and the general conditions and prospects of the PRC economy. If the government

authorities adopt regulations that place additional restrictions or burdens on the telecommunications industry, the Company’s customers

may be more conservative in their spending budgets, and the demand for Telecommunications Infrastructure Services and Infrastructure

Digitalisation Solution Services in the PRC may deteriorate, which in turn materially and adversely affect the Company’s operations

and profitability. In addition, the Company’s performance and financial condition also depend on the state of the economy in the

PRC. If there is a downturn in the economy of the PRC, the Company’s results of operations and financial position may be adversely

affected. In addition to economic factors, social unrest or civil movements may also affect the state of the economy in the PRC, and

in such cases, the Company’s operations and financial position may also be adversely affected.

The

Company is exposed to claims arising from latent defects that may be caused by itself or its suppliers in the past, the discovery of

which may have material negative impact on the Company’s reputation, business and results of operations

The

Company may face claims arising from latent defects that might be existing but not yet discovered or developed. Such possible latent

defects may be caused by the Company itself or its suppliers in the past. If there are claims against the Company for such latent defects

when they are discovered, the Company may be held primarily liable even if the defects are caused by its suppliers without the Company’s

fault. Further, due to the passage of time, the Company may be unable to locate the relevant suppliers to hold them accountable, or to

procure them to rectify the defect (if it is rectifiable at all), or obtain compensation for any loss or damages caused by such defects.

Latent defects may include use of materials not meeting the specifications as stipulated in the relevant contracts, which may not be

discovered despite the inspection and acceptance by the customers of the works prior to completion, and remain undiscovered for years

after the completion of the relevant project.

In

the event that there are any significant claims against the Company by its customers or other party for any latent defects, the

Company’s results of operations and financial position may be materially and adversely affected. Even if such latent defects

do not involve any non-compliance with laws or regulations, or breach of any contractual obligations on the Company’s part, it

may be required to rectify such defects or take preventive or remedial measures, such as conducting reviews, tests or examinations

on the works in the past, because of the negative publicity or to prevent the reputation of the Company from being negatively

affected. As a result, the Company’s operation, business and results of operations may be materially and adversely

affected.

Legal

and arbitration proceedings may arise and affect the Company’s business, operations and financial results

The

Company may be subject to claims in respect of various matters from its customers, suppliers, workers and other parties concerned with

the Company’s projects from time to time. Such claims may include claims for compensation for late completion of works and delivery

of substandard works or, claims in respect of personal injuries and labour compensation in relation to the works, for which the Company