Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

11 März 2024 - 9:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

13D

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 9)

| Applied Minerals, Inc. |

| (Name of Issuer) |

| Common Stock, $0.001 par value per share |

| (Title of Class of Securities) |

|

Michael B. Barry

Samlyn Capital, LLC

500 Park Avenue, 2nd Floor

New York, NY 10022

Tel: +1 (212) 588-9098 |

|

(Name, Address and Telephone Number of Person Authorized

to Receive

Notices and Communications) |

| March 7, 2024 |

| (Date of Event Which Requires Filing of this Statement) |

| If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of ss.240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [_]. |

| 1. |

NAME OF REPORTING PERSONS |

|

| |

Samlyn Capital, LLC |

|

| |

|

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

|

(a) |

[_] |

| |

|

(b) |

[_] |

| |

|

|

| 3. |

SEC USE ONLY |

|

| |

|

|

| |

|

|

| 4. |

SOURCE OF FUNDS |

|

| |

|

|

| |

AF |

|

| |

|

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| |

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH

|

| 7. |

SOLE VOTING POWER |

|

| |

|

|

| |

0 |

|

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| |

|

|

| 10. |

SHARED DISPOSITIVE POWER |

|

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON |

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES |

|

[_] |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

17.6%* |

|

| |

|

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

IA, OO |

|

* Based upon 484,371,194 shares outstanding as of

the date hereof, as adjusted for a convertible note and stock options beneficially owned by Samlyn Capital, LLC.

| 1. |

NAME OF REPORTING PERSONS |

|

| |

Samlyn, LP |

|

| |

|

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

|

(a) |

[_] |

| |

|

(b) |

[_] |

| |

|

|

| 3. |

SEC USE ONLY |

|

| |

|

|

| |

|

|

| 4. |

SOURCE OF FUNDS |

|

| |

|

|

| |

AF |

|

| |

|

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| |

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH

|

| 7. |

SOLE VOTING POWER |

|

| |

|

|

| |

0 |

|

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| |

|

|

| 10. |

SHARED DISPOSITIVE POWER |

|

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON |

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES |

|

[_] |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

17.6%* |

|

| |

|

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

PN |

|

* Based upon 484,371,194 shares outstanding as of

the date hereof, as adjusted for a convertible note and stock options beneficially owned by Samlyn, LP.

| 1. |

NAME OF REPORTING PERSONS |

|

| |

Samlyn Partners, LLC |

|

| |

|

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

|

(a) |

[_] |

| |

|

(b) |

[_] |

| |

|

|

| 3. |

SEC USE ONLY |

|

| |

|

|

| |

|

|

| 4. |

SOURCE OF FUNDS |

|

| |

|

|

| |

AF |

|

| |

|

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| |

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH

|

| 7. |

SOLE VOTING POWER |

|

| |

|

|

| |

0 |

|

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

29,962,222 |

|

| |

|

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| |

|

|

| 10. |

SHARED DISPOSITIVE POWER |

|

|

| |

|

|

| |

29,962,222 |

|

| |

|

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON |

|

| |

|

|

| |

29,962,222 |

|

| |

|

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES |

|

[_] |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

6.9%* |

|

| |

|

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

OO |

|

* Based upon 435,672,531 shares outstanding as of

the date hereof, as adjusted for a convertible note and stock options beneficially owned by Samlyn Partners, LLC.

| 1. |

NAME OF REPORTING PERSONS |

|

| |

Samlyn Onshore Fund, LP |

|

| |

|

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

|

(a) |

[_] |

| |

|

(b) |

[_] |

| |

|

|

| 3. |

SEC USE ONLY |

|

| |

|

|

| |

|

|

| 4. |

SOURCE OF FUNDS |

|

| |

|

|

| |

WC |

|

| |

|

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| |

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH

|

| 7. |

SOLE VOTING POWER |

|

| |

|

|

| |

0 |

|

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

29,962,222 |

|

| |

|

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| |

|

|

| 10. |

SHARED DISPOSITIVE POWER |

|

|

| |

|

|

| |

29,962,222 |

|

| |

|

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON |

|

| |

|

|

| |

29,962,222 |

|

| |

|

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES |

|

[_] |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

6.9%* |

|

| |

|

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

PN |

|

* Based upon 435,672,531 shares outstanding as of

the date hereof, as adjusted for a convertible note and stock options directly owned by Samlyn Onshore Fund, LP.

| 1. |

NAME OF REPORTING PERSONS |

|

| |

Samlyn Offshore Master Fund, Ltd. |

|

| |

|

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

|

(a) |

[_] |

| |

|

(b) |

[_] |

| |

|

|

| 3. |

SEC USE ONLY |

|

| |

|

|

| |

|

|

| 4. |

SOURCE OF FUNDS |

|

| |

|

|

| |

WC |

|

| |

|

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Cayman Islands |

|

| |

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING

PERSON WITH

|

| 7. |

SOLE VOTING POWER |

|

| |

|

|

| |

0 |

|

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

55,182,106 |

|

| |

|

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| |

|

|

| 10. |

SHARED DISPOSITIVE POWER |

|

|

| |

|

|

| |

55,182,106 |

|

| |

|

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON |

|

| |

|

|

| |

55,182,106 |

|

| |

|

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES |

|

[_] |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

12.0%* |

|

| |

|

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

CO |

|

* Based upon 458,436,945 shares outstanding as of

the date hereof, as adjusted for a convertible note and stock options directly owned by Samlyn Offshore Master Fund, Ltd.

| 1. |

NAME OF REPORTING PERSONS |

|

| |

|

|

| |

Robert Pohly |

|

| |

|

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

| |

|

(a) |

[_] |

| |

|

(b) |

[_] |

| 3. |

SEC USE ONLY |

|

| |

|

|

| |

|

|

| 4. |

SOURCE OF FUNDS |

|

| |

|

|

| |

AF |

|

| |

|

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

|

[_] |

| |

|

|

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States of America |

|

| |

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

| |

|

|

| 7. |

SOLE VOTING POWER |

|

| |

|

|

| |

0 |

|

| |

|

|

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| |

|

|

| 10. |

SHARED DISPOSITIVE POWER |

|

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING |

|

| |

PERSON |

|

| |

|

|

| |

85,144,328 |

|

| |

|

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES |

|

| |

CERTAIN SHARES |

|

[_] |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

17.6%* |

|

| |

|

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

IN, HC |

|

* Based upon 484,371,194 shares outstanding as of

the date hereof, as adjusted for a convertible note and stock options beneficially owned by Robert Pohly.

This Schedule 13D is Amendment No. 9 with respect

to (i) Samlyn Capital, LLC; (ii) Samlyn Partners, LLC; (iii) Samlyn Onshore Fund, LP; (iv) Samlyn Offshore Master Fund, Ltd.; and (v)

Robert Pohly.

This Schedule 13D is Amendment No. 7 with respect

to Samlyn, LP.

| Item 1. |

Security and Issuer. |

|

| |

The name of the issuer is Applied Minerals, Inc., a Delaware corporation (the “Issuer”). The address of the Issuer’s principal executive offices is 1200 Silver City Road, PO Box 432, Eureka, Utah 84628. This is Amendment No. 9 to Schedule 13D relates to the Issuer's Common Stock, $0.001 par value per share (the “Shares”). |

|

| |

|

|

| |

|

|

| Item 2. |

Identity and Background. |

|

| |

(a), (f) |

The persons filing this statement are: (i) Samlyn Capital, LLC, a Delaware limited liability company (“Samlyn Capital”); (ii) Samlyn, LP, a Delaware limited partnership (“Samlyn LP”); (iii) Samlyn Partners, LLC, a Delaware limited liability company (“Samlyn Partners”); (iv) Samlyn Onshore Fund, LP, a Delaware limited partnership (“Samlyn Onshore Fund”); (v) Samlyn Offshore Master Fund, Ltd., a Cayman Islands exempted company (“Samlyn Offshore Master Fund”); and (vi) Robert Pohly, a United States citizen (“Mr. Pohly”, and collectively with Samlyn Capital, Samlyn LP, Samlyn Partners, Samlyn Onshore Fund and Samlyn Offshore Master Fund, the “Reporting Persons”). |

|

| |

|

|

|

| |

(b), (c) |

Samlyn Capital is an investment adviser registered with the Securities and Exchange Commission (the “SEC”) that is principally engaged in the business of providing investment management services to its advisory clients, including, without limitation, Samlyn Onshore Fund and Samlyn Offshore Master Fund. Samlyn LP is the sole owner of Samlyn Capital. Mr. Pohly indirectly controls Samlyn Capital through his ownership interests in Samlyn LP and its general partner, Samlyn GP, LLC, a Delaware limited liability company for which Mr. Pohly serves as the managing member. Mr. Pohly is also the managing member of Samlyn Partners, which serves as the general partner of Samlyn Onshore Fund. Samlyn Onshore Fund and Samlyn Offshore Master Fund are each principally engaged in the business of investing in securities. The principal business address of Samlyn Capital, Samlyn LP, Samlyn Partners, Samlyn Onshore Fund and Mr. Pohly is c/o 500 Park Avenue, 2nd Floor, New York, New York 10022. The principal business address of Samlyn Offshore Master Fund is c/o Intertrust Corporate Services (Cayman) Limited, One Nexus Way, Camana Bay, Grand Cayman, KY1-9005, Cayman Islands. The board of directors of the Master Fund consists of Mr. Pohly, Scott Dakers and Julie Hughes. |

|

| |

|

|

|

| |

(d) |

None of the Reporting Persons have, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

|

| |

|

|

|

| |

(e) |

None of the Reporting Persons have, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

|

| |

|

|

| Item 3. |

Source and Amount of Funds or Other Consideration. |

|

| |

|

|

| |

The funds for the purchase of the 85,144,328 Shares

beneficially owned by Samlyn Capital, Samlyn LP and Mr. Pohly came from the working capital of Samlyn Onshore Fund and Samlyn Offshore

Master Fund, which are the direct owners of the Shares. No borrowed funds were used to purchase the Shares, other than any borrowed funds

used for working capital purposes (including certain leverage arrangements) in the ordinary course of business.

The funds for the purchase of the 29,962,222 Shares

beneficially owned by Samlyn Partners and Samlyn Onshore Fund came from the working capital of Samlyn Onshore Fund, which is the direct

owner of the Shares. No borrowed funds were used to purchase the Shares, other than any borrowed funds used for working capital purposes

(including certain leverage arrangements) in the ordinary course of business.

The funds for the purchase of the 55,182,106 Shares

beneficially owned by Samlyn Offshore Master Fund came from its working capital. No borrowed funds were used to purchase the Shares, other

than any borrowed funds used for working capital purposes (including certain leverage arrangements) in the ordinary course of business. |

|

| |

|

|

| Item 4. |

Purpose of Transaction. |

|

| |

|

|

| |

The Reporting Persons are filing this Amendment

No. 9 to Schedule 13D to report a change in their respective beneficial ownership percentages of the Shares, as indicated in Item 5 below.

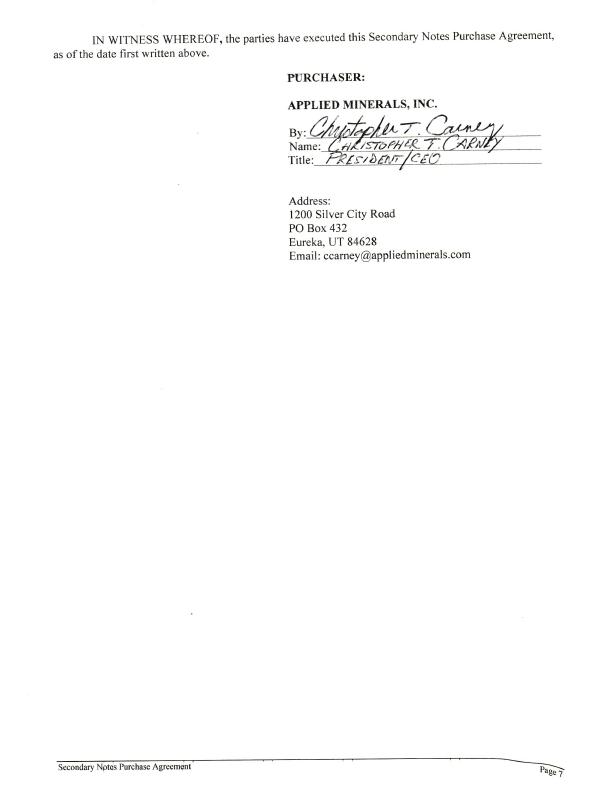

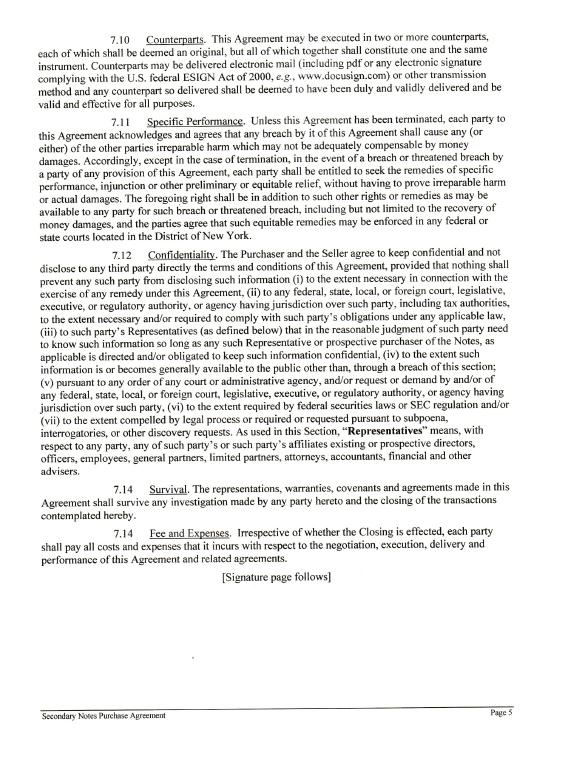

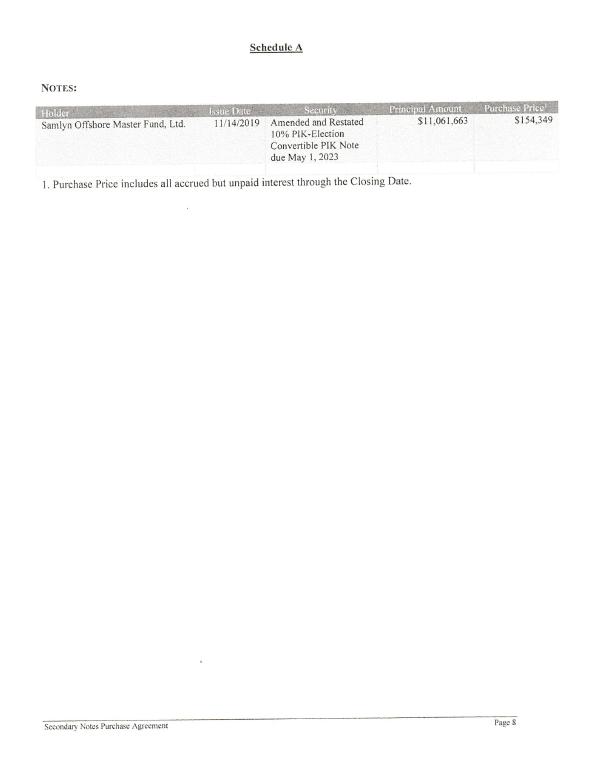

In addition, on March 8, 2024, Samlyn

Onshore Fund and Samlyn Offshore Master Fund entered into separate Secondary Notes Purchase Agreements with the Issuer (together, the

“Note Purchase Agreements”). Pursuant to the Note Purchase Agreements, the Issuer agreed to acquire all of the Amended and

Restated 10% PIK-Election Convertible Notes issued by the Issuer (the “Series A Convertible Notes”) and owned by Samlyn Onshore

Fund and Samlyn Offshore Master Fund, respectively, for a purchase price of: (i) $82,382 in respect of Samlyn Onshore Fund; and (ii)

$154,349 in respect of Samlyn Offshore Master Fund. The Note Purchase Agreements provide for a closing of the contemplated purchases

and sales to occur on or before March 31, 2024 or at such other time as may be agreed by the parties (the “Closing”), subject

to certain closing conditions as set forth in the Note Purchase Agreements. In addition, under the terms of the Note Purchase Agreements,

each of Samlyn Onshore Fund and Samlyn Offshore Master Fund is subject to a “standstill” provision that prohibits Samlyn

Onshore Fund, Samlyn Offshore Master Fund and their respective affiliates from directly or indirectly taking any action against the Issuer

with respect to the Issuer’s default under the Series A Convertible Notes that existed as of March 8, 2024 until the earlier of:

(i) March 31, 2024; (ii) the Closing; and (iii) the termination of the Issuer’s “Wasatch Proposal”.

The foregoing was a summary of certain material

terms of the Note Purchase Agreements. The foregoing description is not, and does not purport to be, complete and, except as otherwise

described above, is qualified in its entirety by reference to the full text of the Note Purchase Agreements, which have been

filed as Exhibits B and C, and are incorporated herein by reference.

Except as otherwise set forth herein, the Reporting

Persons do not have any present plans or proposals which would relate to, or result in, the matters set forth in subparagraphs (a) –

(j) of Item 4 of Schedule 13D. However, subject to market conditions and in compliance with applicable securities laws, the Reporting

Persons reserve the right, at a later date, to effect one or more of such changes or transactions in the number of Shares they may be

deemed to beneficially own in open-market or privately-negotiated transactions. The Reporting Persons may also communicate with the Issuer’s

management, the Issuer’s board of directors and other holders of Shares from time to time. |

|

| |

|

|

| Item 5. |

Interest in Securities of the Issuer. |

|

| |

|

|

| |

(a) - (d) |

As of the date hereof, Samlyn Capital, Samlyn LP and

Mr. Pohly may each be deemed to be the beneficial owner of 85,144,328 Shares, constituting 17.6% of the Shares, based upon 484,371,194

Shares outstanding as of the date hereof, as adjusted for a Series A Convertible Note and stock options of the Issuer beneficially owned

by Samlyn Capital, Samlyn LP and Mr. Pohly. Each of Samlyn Capital, Samlyn LP and Mr. Pohly has the sole power to vote or direct the vote

of 0 Shares and the shared power to vote or direct the vote of 85,144,328 Shares. Each of Samlyn Capital, Samlyn LP and Mr. Pohly has

the sole power to dispose or direct the disposition of 0 Shares and the shared power to dispose or direct the disposition of 85,144,328

Shares.

As of the date hereof, Samlyn Partners and Samlyn

Onshore Fund may each be deemed to be the beneficial owner of 29,962,222 Shares, constituting 6.9% of the Shares, based upon 435,672,531

Shares outstanding as of the date hereof, as adjusted for a Series A Convertible Note and stock options of the Issuer beneficially owned

by Samlyn Partners and Samlyn Onshore Fund. Each of Samlyn Partners and Samlyn Onshore Fund has the sole power to vote or direct the vote

of 0 Shares and the shared power to vote or direct the vote of 29,962,222 Shares. Each of Samlyn Partners and Samlyn Onshore Fund has

the sole power to dispose or direct the disposition of 0 Shares and the shared power to dispose or direct the disposition of 29,962,222

Shares.

As of the date hereof, Samlyn Offshore Master Fund

may be deemed to be the beneficial owner of 55,182,106 Shares, constituting 12.0% of the Shares, based upon 458,436,945 Shares outstanding

as of the date hereof, as adjusted for a Series A Convertible Note and stock options of the Issuer beneficially owned by Samlyn Offshore

Master Fund. Samlyn Offshore Master Fund has the sole power to vote or direct the vote of 0 Shares and the shared power to vote or direct

the vote of 55,182,106 Shares. Samlyn Offshore Master Fund has the sole power to dispose or direct the disposition of 0 Shares and the

shared power to dispose or direct the disposition of 55,182,106 Shares.

Other than as set forth in Item 4 above, there have

been no transactions in the Shares by the Reporting Persons during the past sixty days.

|

|

| |

(e) |

N/A

|

|

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

|

| |

|

|

| |

The information set forth in Item 4 above is incorporated by reference in its entirety in this Item 6. The Reporting Persons do not have any contract, arrangement, understanding or relationship with any person with respect to securities of the Issuer that is not described herein, attached hereto and/or incorporated herein by reference or in a prior Schedule 13D filed by the Reporting Persons in respect of the Issuer. |

|

| |

|

|

| Item 7. |

Material to be Filed as Exhibits. |

|

| |

Exhibit A: Joint Filing Agreement

Exhibit B: Secondary Notes Purchase Agreement

between Samlyn Onshore Fund, L.P. and the Issuer

Exhibit C: Secondary Notes Purchase Agreement

between Samlyn Offshore Master Fund, Ltd. and the Issuer

|

| |

|

|

SIGNATURE

After reasonable inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

SAMLYN CAPITAL, LLC*

By: Samlyn, LP, its sole member

By: Samlyn GP, LLC, its general partner |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN, LP*

By: Samlyn GP, LLC, its general partner |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN PARTNERS, LLC*

|

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN ONSHORE FUND, LP*

By: Samlyn Partners, LLC, its general partner |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN OFFSHORE MASTER FUND, LTD.* |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Director |

| |

ROBERT POHLY* |

| |

|

| |

By: |

/s/ Robert Pohly |

* The Reporting Person disclaims beneficial ownership

of the reported securities except to the extent of his or its pecuniary interest therein, and this report shall not be deemed an admission

that such Reporting Person is the beneficial owner of the securities for purposes of Section 16 of the Securities Exchange Act of 1934,

as amended, or for any other purpose.

Attention: Intentional misstatements or omissions

of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

Exhibit A

JOINT FILING AGREEMENT

The undersigned agree that this

Amendment No. 9 to Schedule 13D, dated March 11, 2024, relating to the Common Stock, $0.001 par value per share of Applied Minerals, Inc.

shall be filed on behalf of the undersigned.

| |

SAMLYN CAPITAL, LLC

By: Samlyn, LP, its sole member

By: Samlyn GP, LLC, its general partner |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN, LP

By: Samlyn GP, LLC, its general partner |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN PARTNERS, LLC

|

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN ONSHORE FUND, LP

By: Samlyn Partners, LLC, its general partner |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Managing Member |

| |

SAMLYN OFFSHORE MASTER FUND, LTD. |

| |

|

| |

By: |

/s/ Robert Pohly |

| |

|

Name: |

Robert Pohly |

| |

|

Title: |

Director |

| |

ROBERT POHLY |

| |

|

| |

By: |

/s/ Robert Pohly |

Exhibit B

Exhibit C

Applied Minerals (CE) (USOTC:AMNL)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Applied Minerals (CE) (USOTC:AMNL)

Historical Stock Chart

Von Nov 2023 bis Nov 2024