- Capital increase of around €32m,

which may be increased to a maximum of around €37m if the

over-allotment option is exercised in full1

- Indicative price range: €13.50 to

€16.50 per share

- Closing of the Open Price Offer: May

28, 2018 (at 8.00 p.m.)

- Closing of the Global Placement: May

29, 2018 (at 12.00 p.m.)

- Subscription commitments of

€6.3m

Regulatory News:

Not for release, directly or indirectly, in the

United States of America, Canada, Australia or Japan.

Voluntis (Paris:VTX) (the “Company” or

“Voluntis”), a company specialized in digital therapeutics,

today announces the launch of its initial public offering on

Euronext’s regulated market in Paris.

The Autorité des Marchés Financiers (AMF) granted visa number

18-169 on May 14, 2018 for the prospectus relating to the initial

public offering of Voluntis shares, comprising a document de base

registered on April 17, 2018 under number I.18-016 and a note

d’opération (including the summary of the prospectus).

Voluntis, a digital therapeutics pioneer

Voluntis’ primary mission is to empower people suffering from

chronic conditions to self-manage their treatment every day, thus

improving real-world outcomes. To do so, Voluntis develops and

markets digital therapeutics, which personalize treatment and

support patients in the day-to-day management of their condition.

Its therapeutic solutions, which work in real time thanks to

digitized clinical algorithms, provide patients with tailored

recommendations via a mobile app and equip their care team with

patient data via a web app (so they can adjust treatment dosage,

manage related symptoms, etc.). Voluntis’ digital therapeutics can

enhance real life treatment efficacy and patient adherence,

addressing a major medico-economic challenge.

Voluntis’ digital therapeutics are next-generation health

solutions that:

- have undergone clinical

evaluation,

- are subject to regulatory approvals

(FDA, CE),

- require a medical prescription and aim

to be reimbursed by payers (as in France, where its diabetes

solutions are covered by the French national health insurance

system).

Leveraging its Theraxium platform, the technological cornerstone

underpinning its solutions, Voluntis has developed digital

therapeutics primarily targeting diabetes and cancer.

Voluntis, as part of the emerging digital health sector, which

aims to transform the healthcare industry, possesses strong assets

to become one of its world leaders.

Reasons for the offer

The offer and admission to trading of the Company’s shares on

Euronext’s regulated market in Paris are intended to give the

Company additional resources to finance its operations and

expansion.

Estimated net proceeds from the offer (i.e. around €29m on the

basis of a price equal to the median of the indicative price range

for the offer excluding exercise of the over-allotment option)

shall be used as follows:

- 60% to strengthen the Voluntis’ group’s

commercial offering in North America and Europe, by:

- further building up the sales,

marketing and medical team in charge of direct marketing of

therapeutic software for diabetes patients to payers;

- growth in field operations and support

teams, in charge of backing the local rollout of the Voluntis

group’s solutions in the various countries targeted;

- 20% to continue with technological,

clinical and regulatory developments of its proprietary

multi-cancer solution, with a view to obtaining regulatory

authorization prior to marketing; and

- the remaining 20% to consolidate the

Voluntis group’s organizational structure, primarily by developing

the Company’s US subsidiary and further investing in the Voluntis

group’s technological platform.

The offer and admission to trading of the Company’s shares on

Euronext’s regulated market in Paris will also enable the Company

to increase its awreness in France and abroad.

Voluntis’ principal assets

Relying on its 120 employees located in Paris and Boston and its

advanced software and medical expertise (over 10 years of clinical

trials), Voluntis has built several key assets:

A portfolio of solutions targeting the world’s two top

therapy areas: diabetes and cancer

About 425 million people around the world suffered from

diabetes in 2017. Voluntis has developed two distinct solutions to

meet patient needs at key points during their insulin therapy

pathway. Insulia® supports type II diabetes patients treated with

long-acting basal insulin (the first phase of insulin therapy).

Diabeo® supports type I and II diabetes sufferers treated with

basal and bolus insulins (the second phase of insulin therapy).

Cancer is one of the world’s leading causes of morbidity and

mortality. According to World Health Organization estimates, it

causes almost 1 in 6 deaths around the world. In oncology,

Voluntis’ digital therapeutics aim to enhance patient care through

daily symptom management, which contributes to improving treatment

adherence. They help to meet a major challenge for cancer treatment

centers: the frequent symptoms caused by treatments and their

consequent effect on patients’ quality of life, interruptions to

treatment regimens and unscheduled hospital admissions.

Accordingly, Voluntis is developing a proprietary multi-cancer

solution as well as specific solutions under agreements with

pharmaceutical groups. Examples of this approach include the ZEMY

solution for breast cancer, developed in partnership with Roche,

and the eCO solution for ovarian cancer, developed in partnership

with AstraZeneca.

Partnerships with leading players in several areas:

Scientific development: Development

strategy and clinical algorithms are elaborated with scientific

advisors and highly renowned institutions such as the CERITD

(Centre d’Études et de Recherches pour l’Intensification du

Traitement du Diabète - a leading French not-for-profit

organization active in diabetes prevention and treatment), chaired

by Dr. Guillaume Charpentier, and the National Cancer Institute

(NCI) in the United States.

Business development and

commercialization: Voluntis has entered into major

partnerships with global healthcare industry players that have

unparalleled clinical development and distribution capabilities

such as Sanofi, Roche, AstraZeneca and Onduo, a joint venture

between Sanofi and Verily (formerly Google Life Sciences).

Technological development:

Voluntis’ solutions can be integrated with existing suppliers’

technological ecosystems, such as blood glucose meters, including

those of Livongo and Ascensia, thus automating the collection of

blood glucose data.

Theraxium, the digital therapeutics technology

platform:

Voluntis’ digital therapeutics are all founded on the Theraxium

platform, designed and developed by Voluntis. This platform

delivers the features common to all of their digital therapeutics,

such as the algorithm engine and software security components, and

facilitates the rapid development of new solutions, including for

new indications.

A vast program of clinical trials, with 5 successfully

completed and 2 in progress:

In diabetes, Voluntis’ solutions have undergone several

multi-center randomized clinical trials. Between 2006 and 2013,

Voluntis and the CERITD enrolled 370 patients in the Telediab1 and

Telediab2 studies. The highly positive results of these studies,

with a significant reduction in A1C, the glycemic control marker,

demonstrated the clinical efficacy of Voluntis’ therapeutic

solutions. In addition, Sanofi is conducting the Telesage study,

one of the largest medico-economic and clinical trials in diabetes

leveraging telemedicine, on 667 patients. Building on these solid

foundations, Voluntis has secured regulatory clearances and already

started the commercialization of its therapeutic solutions for

people with diabetes.

In oncology, the eCO solution developed by Voluntis is being

assessed in ovarian cancer, with clinical trials conducted by the

National Cancer Institute under a cooperation agreement with

AstraZeneca. An initial study revealed a high level of patient

adherence and satisfaction. In breast cancer, the medical,

organizational and economic benefits of the ZEMY app will be

assessed in 2018 through a clinical trial in six French

hospitals.

Commercial launch underway for Diabeo® and

Insulia®:

Diabeo® is being introduced in France under the national

telemedicine trial program to improve healthcare treatment

pathways, after receiving the first reimbursement approval for a

software medical device from the Haute Autorité de Santé (the

French national health authority). Diabeo® is marketed in France by

Sanofi under an exclusive partnership.

Insulia® has been launched in France and North America by

Voluntis and its non-exclusive partners Sanofi and Onduo. Voluntis

also plans to launch Insulia® in Europe’s main markets.

During the commercialization phase, Voluntis earns revenue

arising from the reimbursement of its solutions by payers, either

directly from them, or indirectly from the royalties paid by its

industrial partners for the use of its digital therapeutics.

Terms of the Offer

The Company’s shares for which admission to trading on

Euronext’s regulated market in Paris is requested are:

- all shares that make up Voluntis’ share

capital, i.e. a maximum of 4,802,084 existing shares;

- a maximum of 638,376 new shares to be

issued upon automatic conversion, at the same time as the

settlement-delivery of the Company’s shares on Euronext’s regulated

market in Paris on May 31, 2018, according to the indicative

timetable, of the 71,000,000 bonds convertible into shares issued

by the Company (assuming conversion on May 31, 2018 and on the

basis of the lower end of the indicative price range for the Offer,

i.e. €13.50); and

- a maximum of 2,472,500 shares offered

if the over-allotment option is fully exercised.

The offer price may be within a range of €13.50 to €16.50 per

share. This range may be amended at any time up to (and including)

the scheduled closing date of the offer.

Structure of the Offer

The new shares will be issued as part of a global offer (the

“Offer”), comprising:

- an offer to the public in France in the

form of an open price offer, intended primarily for natural persons

(the “Open Price Offer” or the “OPO”), it being

specified that:

- orders will be broken down according to

the number of shares requested: order fraction A1 (5 shares up to

250 shares inclusive) and order fraction A2 (above 250

shares);

- A1 order fractions will benefit from

preferential treatment over A2 order fractions if it is not

possible for all orders to be fulfilled;

- a global placement intended primarily

for institutional investors in France and in certain countries (the

“Global Placement”).

If demand expressed within the framework of the OPO allows, the

number of new shares allocated in response to orders issued within

the framework of the OPO shall be at least equal to 10% of the

total number of shares offered before any exercise of the

over-allotment option.

Over-allotment option

In order to cover any over-allotments, the Company shall grant

the joint lead managers and joint bookrunners – Bryan Garnier &

Co and Oddo BHF SCA – an over-allotment option allowing for the

subscription to additional new shares up to 15% of the number of

new shares, equal to a maximum of 322,500 shares at the price of

the shares offered within the framework of the Offer.

This over-allotment option may be exercised by the joint lead

managers and joint bookrunners on one occasion at any time, in

whole or in part, during a period of 30 calendar date from the date

the Offer price is set or, by way of indication, no later than June

28, 2018 (inclusive).

If the over-allotment option is exercised, information relating

to this exercise and the number of additional new shares to be

issued shall be brought to the attention of the public by means of

a press release distributed by the Company.

Amount of the Offer

For information only, gross proceeds and net proceeds of the

issue are likely to be as follows:

(€ million)

Grossproceeds

Net proceeds After issuance of 2,150,000 new shares

(1) 32.25 29.39 After issuance of 2,472,500 new

shares and additional new shares if the over-allotment option is

exercised in full (1) 37.09 33.90 After issuance of

1,612,500 new shares if the Offer is reduced to 75.0%(2)

21.77 19.56

(1) On the basis of a price equal to the median of the

indicative price range for the Offer (i.e. €15.00 per

share).

(2) On the basis of the lower end of the indicative price range

for the Offer, i.e. €13.50 per share.

The Company’s abstention commitment

As of the signing of the placement and underwriting agreement

and for a period of 180 calendar days from the settlement-delivery

date, subject to certain usual exceptions.

Shareholders’ lockup agreement representing 99.57% of the

Company’s share capital

As of the date of the AMF visa for the prospectus and up to 360

calendar days following the settlement-delivery date of the

Company’s shares, for 100% of their shares, subject to certain

usual exceptions; it being specified that this undertaking concerns

all Company shares held on the date of the initial public offering

(but not those owned subsequently, if applicable, within the

framework of or after the initial public offering).

Subscription commitments

CM-CIC Innovation, SHAM Innovation Santé, Bpifrance

Participations, Services Innovants Santé et Autonomie (SISA) and

Vesalius Biocapital II SA Sicar have agreed to place subscription

orders in cash provided that the Offer Price is within the

indicative Offer Price range for a total amount of €6.3 million,

equal to 19.50% of the gross amount of the Offer (on the basis of

the median of the indicative price range and excluding exercise of

the Over-allotment Option). These orders shall be allocated as a

priority and in full, it being specified that they may nevertheless

be reduced in accordance with the usual allotment principles

(primarily assuming that subscriptions received within the

framework of the Offer are well above the number of Shares

Offered).

The table below gives details of subscription commitments:

Amount of subscription commitments

(€)

CM-CIC Innovation 800,000 SHAM Innovation Santé

500,000 Bpifrance Participations 3,000,000 SISA

1,000,000 Vesalius Biocapital II SA Sicar 1,000,000

Total 6,300,000

Provisional timetable

May 14, 2018

- AMF’s approval of the Prospectus (visa)

May 15, 2018

- Distribution of the press release announcing the Offer and

availability of the Voluntis prospectus

- Publication by Euronext of the notice of opening of the Open

Price Offer

- Opening of the Open Price Offer and the Global Placement

May 28, 2018

- Closing of the Open Price Offer at 5.00 p.m. (Paris time) for

subscriptions placed at counters and 8.00 p.m. (Paris time) for

online subscriptions

May 29, 2018

- Closing of the Global Placement at 12.00 p.m. (Paris time)

- Setting of the Offer price

- Signing of the placement and underwriting agreement between the

Company and Bryan, Garnier & Co and Oddo BHF SCA as joint lead

managers and joint bookrunners

- Distribution of the press release stating the Offer Price, the

definitive number of new shares and the results of the Offer

- Publication by Euronext of the notice of the results of the

Offer

- Start of trading of the Company’s shares on Euronext’s

regulated market in Paris

- Start of exercise period for the over-allotment option

- Start of any stabilization period

May 30, 2018

- Start of trading of the Company’s shares in the form of

promissory notes on Euronext’s regulated market in Paris (up to May

31, 2018 inclusive)

May 31, 2018

- Settlement-delivery of the OPO and the Global Placement

June 1, 2018

- Start of trading of the Company’s shares on Euronext’s

regulated market in Paris on a listing line titled “Voluntis”

June 28, 2018

- Deadline for exercise of the over-allotment option

- End of any stabilization period

Procedures for subscription

Persons wishing to take part in the OPO must place their orders

with an approved financial intermediary in France no later than May

28, 2018 at 5.00 p.m. (Paris time) for subscriptions placed at

counters and 8.00 p.m. (Paris time) for online subscriptions.

To be taken into account, orders issued within the framework of

the Global Placement must be received exclusively by one or more

joint lead managers and joint bookrunners no later than May 29,

2018 at 12.00 p.m. (Paris time), apart from in the case of early

closing.

Important – it is specified that:

- each order must be for a minimum of 5

shares;

- each ordering party can only issue one

subscription order. This must be given to a single financial

intermediary;

- if application of the discount rate or

rates does not result in a whole number of shares, this number

shall be rounded down to the next whole number; and

- subscription orders can be revoked

online up to the closing of the Open Price Offer on May 28, 2018 at

8.00 p.m. (Paris time). It is up to the investors to contact their

financial intermediary in order to check the procedure for revoking

orders placed online and whether orders sent by other channels can

be revoked and subject to what terms.

Voluntis shares identification codes

- Name: Voluntis

- ISIN code: FR0004183960

- Ticker: VTX

- Compartment: Euronext Paris

(Compartment C)

- Business sector: 9537 - Software

Financial intermediaries

BRYAN, GARNIER & CO

ODDO BHF

Joint Lead Managers and Joint Bookrunners

Availability of the prospectus

Copies of the prospectus approved by the AMF on May 14, 2018

under visa number 18-169, comprising the document de base

registered on April 17, 2018 under number I.18-016 and a note

d’opération (including the summary of the prospectus), are

available free of charge and on request from Voluntis, 58 avenue de

Wagram, 75017 Paris, France - as well as on the Voluntis website

(www.voluntis.com) and the AMF website (www.amf-france.org).

Risk factors

Voluntis draws investors’ attention to Section 4 “Risk factors”

of the document de base registered with the AMF and Section 2 “Risk

factors relating to the offer” of the note d’opération and in

particular that relating to liquidity. The Company believes that it

is in a position to meet its commitments up to September 2018

(without taking into account the net proceeds of this offer).

Disclaimer

No communication and no information in respect of the offering

by Voluntis of the shares (the “Shares”) may be distributed

to the public in any jurisdiction where a registration or approval

is required. No steps have been or will be taken outside of France

in any jurisdiction where such steps would be required. The

offering and subscription of the Shares may be subject to specific

legal or regulatory restrictions in certain jurisdictions. Voluntis

assumes no responsibility for any violation of any such

restrictions by any person.

This announcement is not a prospectus within the meaning of

Directive 2003/71/EC of the European Parliament ant the Council of

November 4th, 2003, as amended, in particular, by Directive

2010/73/EC of the European Parliament and the Council of November

24th, 2010, as amended and as implemented in each member State of

the European Economic Area (the “Prospectus Directive”).

The offer will be open solely to the public in France after the

delivery by the AMF of a visa on the Prospectus.

With respect to the member States of the European Economic Area

other than France which have implemented the Prospectus Directive

(each, a “relevant member State”) no action has been

undertaken or will be undertaken to make an offer to the public of

the securities requiring a publication of a prospectus in any

relevant member State. As a result, the Shares may only be offered

in relevant member States: (a) to legal entities that are qualified

investors as defined in the Prospectus Directive; (b) in any other

circumstances that do not require the publication by Voluntis of a

prospectus pursuant to Article 3(2) of the Prospectus

Directive.

For the purposes of this paragraph, the notion of an “offer

to the public of Shares” in each of the relevant member States,

means any communication, to individuals or legal entities, in any

form and by any means, of sufficient information on the terms and

conditions of the offering and on the Shares to be offered, thereby

enabling an investor to decide to purchase or subscribe for the

Shares, as the same may be varied in that Member State by any

measure implementing the Prospectus Directive.

This selling restriction comes in addition to the other selling

restrictions applicable in the other member states.

The distribution of this press release is not made, and has not

been approved, by an “authorised person” within the meaning of

Article 21(1) of the Financial Services and Markets Act 2000. As a

consequence, this press release is directed only at persons who (i)

are located outside the United Kingdom, (ii) have professional

experience in matters relating to investments and fall within

Article 19(5) (“investment professionals”) of the Financial

Services and Markets Act 2000 (Financial Promotions) Order 2005 (as

amended) (the “Order”), (iii) are persons falling within

Article 49(2)(a) to (d) (high net worth companies, unincorporated

associations, etc.) of the Order or (iv) are persons to whom this

press release may otherwise lawfully be communicated (all such

persons together being referred to as “Relevant Persons”).

The securities are directed only at Relevant Persons and no

invitation, offer or agreements to subscribe, purchase or otherwise

acquire securities may be proposed or made other than with Relevant

Persons. Any person other than a Relevant Person may not act or

rely on this document or any provision thereof. This press release

is not a prospectus which has been approved by the Financial

Services Authority or any other United Kingdom regulatory authority

for the purposes of Section 85 of the Financial Services and

Markets Act 2000.

This press release does not constitute or form a part of any

offer or solicitation to purchase or subscribe for securities nor

of any offer or solicitation to sell securities in the United

States. The securities mentioned herein have not been and will not

be registered under the U.S. Securities Act of 1933, as amended

(the “U.S. Securities Act”), and may not be offered or sold,

directly or indirectly, within the United States except pursuant to

an exemption from or in a transaction not subject to, the

registration requirements of the Securities Act. Voluntis does not

intend to register any portion of the proposed offering in the

United States nor to conduct a public offering of securities in the

United States.

The distribution of this document in certain countries may

constitute a breach of applicable law. The information contained in

this document does not constitute an offer of securities for sale

in the United States, Canada, Australia or Japan.

This press release may not be published, forwarded or

distributed, directly or indirectly, in the United States, Canada,

Australia or Japan.

The prospectus registered with the Autorité des marchés

financiers contains forward-looking statements. No guarantee is

given as to these forecasts being achieved, which are subject to

risks, including those described in the prospectus, and to the

development of economic conditions, the financial markets and the

markets in which Voluntis operates.

Oddo BHF SCA, acting as stabilising agent, or any institution

acting on its behalf may, during a period of 30 days following

the date on which the Offering Price is determined, i.e., according

to the indicative timetable, from May 29to June 28 2018 (included),

effect transactions with a view to maintaining the market price of

the Voluntis shares in a manner consistent with applicable laws and

regulations. These activities are intended to support the market

price of the Voluntis’ shares and may affect the share price.

1 On the basis of the median of the indicative price range for

the offer, i.e. €15.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180514006538/en/

VoluntisMatthieu PlessisChief Financial

Officerinvestisseurs@voluntis.com+33 (0)1 41 38 39

20orNewCapInvestor relationsMarc Willaume / Tristan Roquet

Montégonvoluntis@newcap.eu01 44 71 94 94orNewCapMedia

relationsNicolas Merigeauvoluntis@newcap.eu01 44 71 94 98

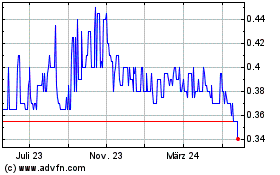

Vertex Resource (TSXV:VTX)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

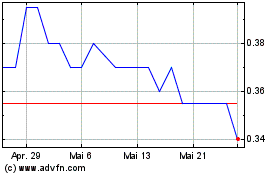

Vertex Resource (TSXV:VTX)

Historical Stock Chart

Von Nov 2023 bis Nov 2024