Stratabound Minerals Corp. (TSXV: SB) (“Stratabound” or “the

Company”) is pleased to announce the closing of two private

placement offerings for a total of $251,200 and to provide an

update on its summer 2019 exploration program at the Golden Culvert

gold project in the southeast Yukon Territory.

The Private Placements

A $142,200 non-brokered private placement of

units (the “Unit Private Placement”) of 1,777,500 units at a price

of $0.08 per unit was closed with five subscribers. Each unit

consisted of one common share in the capital of the Company and one

common share purchase warrant. Each warrant entitles the

holder to purchase one share of the Company for a period of 24

months from the closing at an exercise price of $0.10 per share.

Additionally, the Company closed $109,000 in a non-brokered

flow-through private placement (the “Flow-Through Private

Placement”) of 1,211,111 flow-through units at a price of $0.09 per

flow-through unit. Each flow-through unit consisted of one common

share in the capital of the Company issued on a flow-through basis

and one common share purchase warrant. Each warrant entitles

the holder to purchase one share of the Company for a period of 12

months from the closing of the offering at an exercise price of

$0.12 per share.

The current number of issued and outstanding

securities after closing of these financings is 38,025,698

shares.

The proceeds of the private placements will be

used to fund the summer 2019 exploration program at the Golden

Culvert property, for other payments directly related to the

property and for working capital. All securities issued

pursuant to the private placements are subject to a statutory hold

period of four months plus a day from the date of issuance in

accordance with applicable securities legislation. The

Company paid Finder’s fees of $7,630 in cash and issued 84,777

finder’s warrants, each finder’s warrant exercisable at $0.09 for

18 months from the date of issue, in relation to the flow-through

private placement.

Yukon 2019 Exploration Program

The Company is very pleased to announce that the

2019 exploration program has started. Building on the

successful 2018 exploration campaign, the Company is currently

completing a first phase program of road building and trenching.

The Company plans to double the current 500 metres to 1,000

metres of direct road access along strike of the 25m-50m wide

Golden Culvert gold mineralized structural corridor. The

field team and contractor mobilized to site and work commenced July

15th. The previously announced 2019 exploration work program has

been modified to commence with in-fill trenching between the 2018

trenches and extend open-ended mineralization remaining in the 2018

trenching to firm up confidence in last year’s results. New

trenches will also be built to expose the two main gold-bearing

structures with 20 trenches at approximately 50m intervals

extending the 430 metre strike length exposed in 2018 out to at

least 1 kilometre of strike length. The diamond drilling

previously planned will be deferred pending completion of the

trenching program and improved market conditions for funding.

Prospecting, rock geochemistry and geological mapping are also

planned to extend up to 3 kilometres of strike to follow up on the

3km long +30 ppb gold in soil anomaly surrounding the work

completed last year. The objective of the 2019 program will

be to confirm gold grade continuity and target potential in

preparation towards a maiden inferred resource estimate.

Investor Relations Consultant

The Company is also pleased to announce that it

has engaged Toronto investor relations group, FronTier Flex

Marketing, to provide investor relations and promotional consulting

services to the Company. Under the terms of the agreement,

FronTier Flex has been retained for a one-year period for

C$90,000. The company has also granted an option to purchase

300,000 shares to FronTier Flex at an exercise price of US$0.10,

which expires five years from the date of grant.

FronTier Flex will provide a range of services,

including communication and marketing initiatives. This will

include facilitating in-person introductions with institutional and

retail brokers and other financial representatives, and media

distribution on national television, radio and online channels.

The Company also wishes to announce the granting

of a total of 2,000,000 stock options to officers and directors of

Stratabound. The option grants are for a five-year term at an

exercise price of $0.10 per share.

Stratabound President and CEO R. Kim Tyler

commented, “We are pleased to have completed the funding and are

now financed to complete our 2019 program of trenching and rock

geochemistry at Golden Culvert. Trenching has been selected

first as it provides excellent information much more cost

effectively than diamond drilling. The information derived

will better guide future diamond drilling programs. As

additional funds become available we will endeavour to conduct

additional diamond drilling to further delineate the vein structure

at the property. We remain optimistic that our planned 2019

program will build upon last year’s success. We are delighted

to bring FronTier Flex on board to help promote the Company and

increase awareness of the Golden Culvert project in the financial

marketplace.”

About the Golden Culvert and Little

Hyland Properties

Golden Culvert and Little Hyland cover 83.8

square kilometres in the southeast Yukon Territory across a

24-kilometre strike located approximately 20 kilometres northeast

of and parallel to Golden Predator Mining Corp.’s 3 Aces property.

Past work has outlined a northerly trending, 3 kilometre by

250 metre, +30 ppb Au up to 791 ppb Au gold-in-soil anomaly that

remains open at both ends. During 2018 samples were taken and

assayed from six trenches and eight drill holes (1,355 metres of

diamond drilling). Significant results from 2018 drilling

include 60.1 gpt Au over 0.9m within 2.53 gpt Au over 33.1 metres.

About Stratabound

Stratabound Minerals Corp. is a Canadian

exploration and development company focused on the Yukon Territory.

The Company also holds a significant land position that hosts

three base metals deposits in the Bathurst base metals camp of New

Brunswick featuring the Captain Copper-Cobalt Deposit that hosts an

NI 43-101 compliant Measured+Indicated resource.

Stratabound management has a diversified track

record of exploration, development and operating successes that

will facilitate the development of the Company’s exploration

projects.

Mr. R. Kim Tyler, P.Geo., President and CEO of

Stratabound, and a “Qualified Person” for the purpose of NI 43-101,

was responsible for managing and supervising the exploration

program and has verified the data disclosed, including sampling,

analytical, and test data underlying the information or opinions

contained in this disclosure. Mr. Tyler has reviewed and approved

the contents of this news release.

For further information, please see the Golden

Culvert presentation and the NI 43-101 technical report on the

Stratabound web site, www.stratabound.com.

For further information contact:

R. Kim Tyler, President and

CEO705-822-9771ktyler@stratabound.cominfo@stratabound.comwww.stratabound.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

WARNING: the Company relies upon litigation

protection for “forward looking” statements. The information in

this release may contain forward-looking information under

applicable securities laws. This forward-looking information is

subject to known and unknown risks, uncertainties and other factors

that may cause actual results to differ materially from those

implied by the forward-looking information. Factors that may cause

actual results to vary materially include, but are not limited to,

inaccurate assumptions concerning the exploration for and

development of mineral deposits, currency fluctuations,

unanticipated operational or technical difficulties, changes in

laws or regulations, failure to obtain regulatory, exchange or

shareholder approval, the risks of obtaining necessary licenses and

permits, changes in general economic conditions or conditions in

the financial markets and the inability to raise additional

financing. Readers are cautioned not to place undue reliance on

this forward-looking information. The Company does not assume the

obligation to revise or update this forward-looking information

after the date of this release or to revise such information to

reflect the occurrence of future unanticipated events, except as

may be required under applicable securities laws.

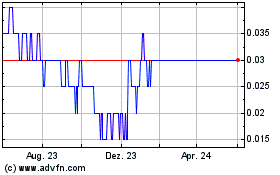

Stratabound Minerals (TSXV:SB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

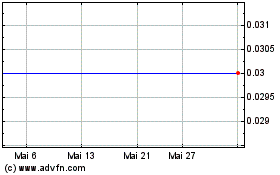

Stratabound Minerals (TSXV:SB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025