Jericho

Energy Ventures Leads Investment into New Class of Electrolyzer for

Hydrogen Production with Chris Sacca's Lowercarbon Capital and New

Energy Technology

Jericho's

Investment Highlights Differentiated Deal Flow and Public Investor

Access to Early-stage, High-growth, Hydrogen-related

Companies

NEWTOWN, PA and VANCOUVER, BC -- January

19, 2022 -- InvestorsHub NewsWire -- Jericho

Energy Ventures (TSXV: JEV)(Frankfurt:

JLM0)(OTC: JROOF) ("Jericho" or "JEV" or the

"Company") is pleased to announce it has led a Seed Series

fundraising round for Supercritical

Solutions, Ltd.,

("Supercritical"), a Company focused on developing its new class of

water electrolyzer for the production of low-cost clean

hydrogen.

Jericho's USD$1.78 million lead

investment is joined by Chris Sacca's Lowercarbon

Capital and

New

Energy Technology for a

total commitment of USD$3.6 million, which Supercritical intends to

use to support ongoing development of its disruptive electrolyzer

technology. Existing investors include global mining company

Anglo

American and

Deep

Science Ventures.

An underappreciated and

fundamental flaw in electrolyzer design is the inability to output

hydrogen at the pressures required for storage, transportation, and

most end-use-cases. This is due to a number of factors, including

the sensitivity of most electrolyzers' membranes to high pressures.

As a result, expensive and maintenance-intensive compressors are

required to be co-located with almost all electrolyzers, increasing

the true cost and complexity of clean hydrogen. Supercritical has developed a new class of

electrolyzer who's proprietary membraneless design enables it to

exploit the benefits of supercritical water, outputting gases at

over 200 bar of pressure. This delivers a step-change in efficiency

for the production of hydrogen and eliminates expensive hydrogen

compressors in most applications. Supercritical's technology takes direct aim

at decarbonizing industrial hydrogen use cases – already a $120

billion market today. Hydrogen for use in ammonia production and

hydrocarbon refining requires pressures of 70-230 bar, with most

gaseous storage applications ranging from 350-700 bar.

Big

Picture

Hydrogen is a required molecule for our

global Net Zero ambition – that's why over 70 Countries have

outlined Hydrogen Roadmaps for their decarbonization goals to

utilize hydrogen as a fuel, feedstock, and store of

energy.

Bank of America¹ estimates that

hydrogen could inhabit 24% of total global energy needs by 2050,

creating as much as $11 trillion in investment opportunities over

the next few decades.

Clean hydrogen is produced by splitting water

(H2O) via renewable supplies of electricity in an

electrolyzer.

While the market for hydrogen is

expected to grow 8x by 2050, with <1% of hydrogen

production currently "clean," electrolyzer markets have the

capacity to grow 800x, based only on replacing the current carbon

emitting hydrogen production used in industrial

applications (e.g.,

ammonia and refining). Increasing applications to include heating

gas, biofuels or in mobile or stationary power drives a further

potential growth 1000x-4000x larger than current demand, according

to a November 2021 report by Jefferies Equity

Research².

Current industrial hydrogen

demand equates to 550-1800GW of electrolysis while global total

electrolyzer capacity is estimated at only 3GW today.

Why

is this technology disruptive to the Hydrogen ecosystem?

Today's electrolyzers largely use a

traditional membrane-based architecture and output hydrogen in the

10-40 bar pressure range. However, the set of applications for

low-pressure hydrogen is limited. Almost every hydrogen

storage, transportation, or application modality requires expensive

multi-stage gaseous compression which can represent

$1-1.50 / kg

or upwards of 25% of the delivered

cost of

clean hydrogen. For example, in the generation of ammonia

(NH3), a $70 billion market representing 55% of today's hydrogen

utilization, 200 bar pressure hydrogen is required at the input of

the Haber-Bosch conversion

process. Similar

200-250 bar pressures are seen throughout industry, and 300-700 bar

pressures are common in storage and transportation

applications.

Takeaway: Due to its low volumetric density (read: it

takes up a lot of space), the storage, transportation, and

utilization of hydrogen are nearly universally combined with

compression for higher pressures. Fully eliminating or

significantly reducing the need for costly and fault prone gaseous

compression is critical to achieving the lowest cost of pressurized

clean hydrogen for most applicable use cases. Supercritical's

electrolyzer is the only technology to solve this.

How

does the technology actually work?

Supercritical's unique electrolyzer design is

able to tolerate and exploit the benefits of electrolysis of water

under thermodynamic supercritical conditions – that is, water at

high temperature and pressure. Importantly, the bonds between the hydrogen

and oxygen atoms of water are weakened and as such require less

electrical energy (i.e., lower cost) to split the bonds and free

hydrogen atoms. This is important because 70-80% of the

levelized cost of generated hydrogen is operating expenses,

primarily driven by the cost of electricity.

The challenge traditional electrolyzers face,

operating at supercritical conditions, is that their membranes or

diaphragms would disintegrate, and their physical structure would

fail under these relatively high pressures and temperatures,

resulting in failure of the electrolyzer.

Takeaway:

Supercritical's innovative design

enables the pressurization and heating of the feed water, the

performance of electrolysis with reduced electrical energy, while

separating the gases and recovering both the oxygen and hydrogen at

high pressure.

A video

highlighting Supercritical's breakthrough technology can be

viewed

here.

Don't

just take our word for it, other groups are taking notice…

Supercritical has already won multiple

government grants and accolades with participating partners

including the UK Governments Green Distilleries Program with Beam

Suntory for USD$3.97 million, OZ Minerals Experiment "Hydrogen

Hypothesis" finalist, "Top 50 to watch for climate action"

(Cleantech Group), Top5 Zero Emission Solution to watch in 2022

(StartUS Insights) and Runner-up and People's Choice in Shell's

2021 New Energy Challenge.

Quote

"Jericho Energy Ventures provides a unique

opportunity for retail investors to gain exposure to and support

innovative, early-stage companies that are on the leading edge of

the energy transition. Our emphasis on high-growth hydrogen related

themes with a global reach makes sustainable investing simple for

every investor," said Ryan Breen, Head of Corporate Strategy at

Jericho Energy Ventures. "We are thrilled to lead the Seed fundraising

round for Supercritical Solutions and believe the company's new

class of electrolyzer has the potential to disrupt the large

incumbent industrial hydrogen market, in addition to the

exponential opportunity associated with increasing global clean

hydrogen production. The blend of world-class co-investors,

seasoned management team and first-of-its-kind technology at

Supercritical provides a rare investment opportunity that we look

forward to supporting and growing."

###

¹ "The Special 1 – Hydrogen primer," BofA

Securities, September 23, 2020

² "Plugging into the Hydrogen Ecosystem,"

Jefferies International, November 9, 2021

About Jericho

Energy Ventures

Jericho Energy Ventures (JEV) is

a publicly traded, deep-tech venture capital and incubator

platform, backing world-class Companies, founders, and

technologies, leveraged to long-term decarbonization themes

including hydrogen, carbon capture and energy

storage.

We believe the energy transition

is complex and needs a specialist approach – making sustainable

investing simple for every investor.

Website: https://jerichoenergyventures.com/

Twitter: https://twitter.com/JerichoEV

LinkedIn: https://www.linkedin.com/company/jericho-energy-ventures

YouTube: https://www.youtube.com/c/JerichoEnergyVentures

CONTACT:

Adam Rabiner

Director of IR

Jericho Energy

Ventures

604.343.4534

adam@jerichoenergyventures.com

This news

release contains certain "forward-looking information" within the

meaning of applicable Canadian securities legislation and may also

contain statements that may constitute "forward-looking statements"

within the meaning of the safe harbor provisions of the United

States Private Securities Litigation Reform Act of 1995. Such

forward-looking information and forward-looking statements are not

representative of historical facts or information or current

condition, but instead represent only Jericho's beliefs regarding

future events, plans or objectives, many of which, by their nature,

are inherently uncertain and outside of Jericho's control.

Generally, such forward-looking information or forward-looking

statements can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or variations of such words and phrases or may contain statements

that certain actions, events or results "may", "could", "would",

"might" or "will be taken", "will continue", "will occur" or "will

be achieved". Although Jericho believes that the assumptions and

factors used in preparing, and the expectations contained in, the

forward-looking information and statements are reasonable, undue

reliance should not be placed on such information and statements,

and no assurance or guarantee can be given that such

forward-looking information and statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information and

statements. Forward-looking information and statements are subject

to a variety of risks and uncertainties and other factors that

could cause actual events or results to differ materially from

those anticipated in the forward-looking information and statements

which include, but are not limited to:

the effects of and risks associated with the ongoing COVID-19

pandemic, the impact

of general economic conditions, industry conditions and current and

future commodity prices including sustained low oil prices,

significant and ongoing stock market volatility, currency and

interest rates, governmental regulation of the oil and gas

industry, including environmental regulation; geological, technical

and drilling problems; unanticipated operating events; competition

for and/or inability to retain drilling rigs and other services;

the availability of capital on acceptable terms; the need to obtain

required approvals from regulatory authorities; liabilities

inherent in oil and gas exploration, development and production

operations; liabilities inherent in Jericho's low-carbon energy

transition with investments in hydrogen technologies, energy

storage, carbon capture and new energy systems; that Jericho's

wholly owned subsidiary,

Hydrogen Technologies,

will deliver zero-emission boiler technology to the $30 Billion

Commercial & Industrial heat and steam industry; the

performance of

H2U's

electrocatalyst and low-cost electrolyzer platform and

the other factors described in our public filings available at

www.sedar.com. Readers

are cautioned that this list of risk factors should not be

construed as exhaustive. The forward-looking information and

forward-looking statements contained in this news release are made

as of the date of this news release, and Jericho does not undertake

to update any forward-looking information and/or forward-looking

statements that are contained or referenced herein, except in

accordance with applicable securities laws.

Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this

release.

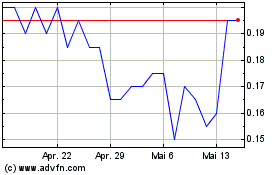

Jericho Energy Ventures (TSXV:JEV)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Jericho Energy Ventures (TSXV:JEV)

Historical Stock Chart

Von Jan 2024 bis Jan 2025