Desert Gold Targets Three Mineralized Zones On Its Farabantourou Prospect for 2017 Exploration Program

07 Juni 2017 - 2:40PM

InvestorsHub NewsWire

Delta, British Columbia - June

7, 2017 - InvestorsHub NewsWire - Desert Gold Ventures

Inc. (“Desert Gold” or

“the Company”)(TSX.V: DAU, FF:QXR2, OTC:DAUGF) is please to provide

the following update regarding its planned exploration program at

its Farabantourou prospect in Western Mali.

HIGHLIGHTS:

- Two historically defined mineralization zones,

Barani and Keniegoulou, will be retested and incorporated into the

company’s broader understanding of Farabantourou’s

geology.

- The third prospect, Barani East, contains a

resource of 69,900 oz Au (cut-off grade, 0.5 g/t Au). This

mineralization occurs in an eastward steeply dipping (55 to 60),

tabular body, ranging in width of 4.5m to 15m with a NNE strike.

The average grades vary between 2.22 to 2.29 g/t Au with tonnage of

652,080 and 317,021 for the indicated and inferred categories,

respectively.

- Approximately 5,000m of drilling to begin in

June of this year on these three targets and completed by

year-end.

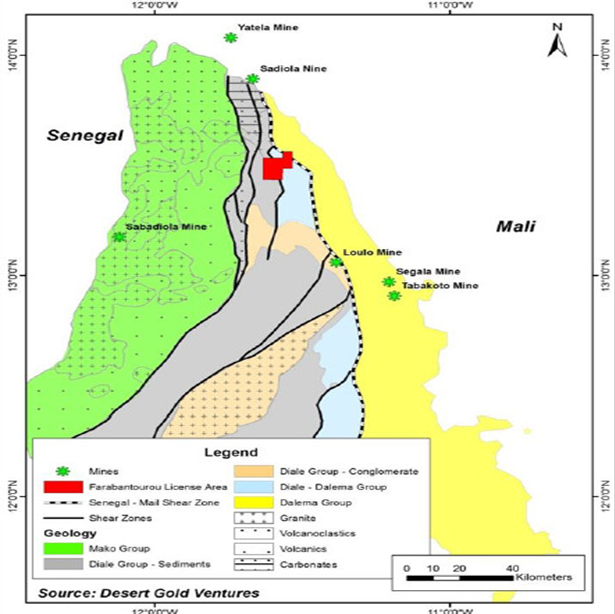

The Farabantourou exploration permit lies approximately 40 km south

and 50 km north of the world-class gold mines of Sadiola and Loulo

(Fig.1), respectively. These mines are situated on second order

splays off the regional North-South trending Senegal-Mali Fault

Zone (“SMFZ”), which the Farabantourou tenement straddles. The

present geological interpretation within Farabantourou is that

there is a hydrothermal alteration at a contact between two

dominant lithologies, namely, sedimentary siliciclastic lithologies

to the west and volcano-sedimentary units to the east; the contact

is thought to form part of the SMFZ, trending NNW.

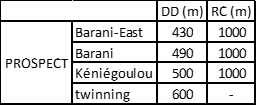

Below is the meterage apportioned to each prospect for this year’s

exploration program:

Figure 1. Regional locality plan showing the

Farabantourou permit in relation to other mines, Western

Mali.

Drilling will be conducted in two phases. Approximately 2,000

meters of diamond core drilling is planned for the first phase,

starting June 2017, to be completed before the start of the wet

season. The second phase of drilling will comprise approximately

3000 meters using a RC rig, which will resume at the start of the

dry season, early November 2017. Table 1 summarizes the

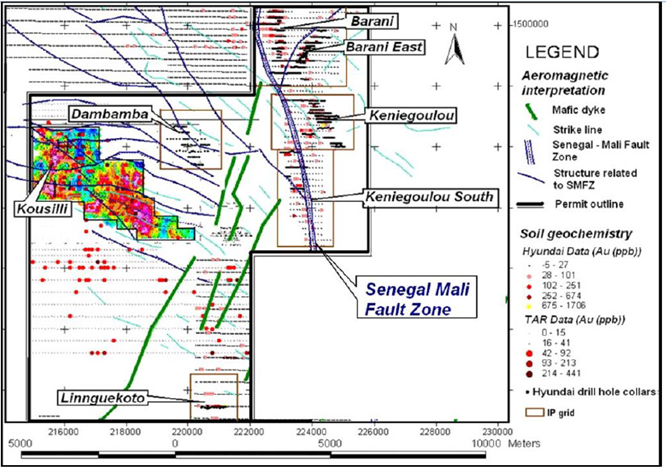

approximate drilling apportioned to the three prospects. The focus

of the drilling is on the three significantly mineralized zones

(prospects) in the northeastern part of the property (Fig. 2),

namely Barani, Barani East and Keniegoulou.

Figure 2. Past exploration summary plan including the

location of the various prospects within the Farabantourou

permit.

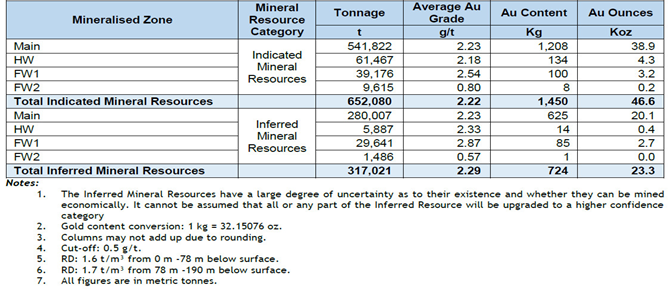

At the Barani East prospect, a resource of 69.9 koz gold (cut-off

grade, 0.5 g/t Au) was estimated by Minxcon Consulting (cf. Table 2

and Fig. 3). This mineralization occurs in an eastward steeply

dipping (55 to 60), tabular body ranging in width of 4.5m to 15m

with a NNE strike. The average grades vary between 2.22 to 2.29 g/t

Au for the indicated and inferred categories, respectively.

Table 2. Barani East mineral resource statement made by

Minxcon Consulting, November 2015. This resource statement was made

in compliance with the specifications set out by the Canadian Code

for reporting of resources and reserves as prescribed in the

National Instrument 43-101.

At the other two prospects, Barani and Keniegoulou, significant

gold intersections were made in previous RC drill programs (cf.

Figs 4 & 5). The company will use the diamond drill rig at both

prospects to twin some of the previous RC drill holes in addition

to exploratory core drilling to better evaluate the geology and the

controls to the mineralized zones intersected. Twin holes will be

drilled to a greater depth than the originals given our hypothesis

that gold mineralization continues at depth.

At Barani East mineralization remains open ended at depth and

possibly on strike, to the north and south. The deepest

intersect of mineralization at Barani-East was made at a depth of

120m, whilst the deepest end-of-hole reached 190m terminating

within oxidized material, suggesting the oxidation zone may extend

beyond 200m. The drilling program for Barani-East will probe those

extensions to the mineralization down dip at depth and along the

strike both to the north and to the south.

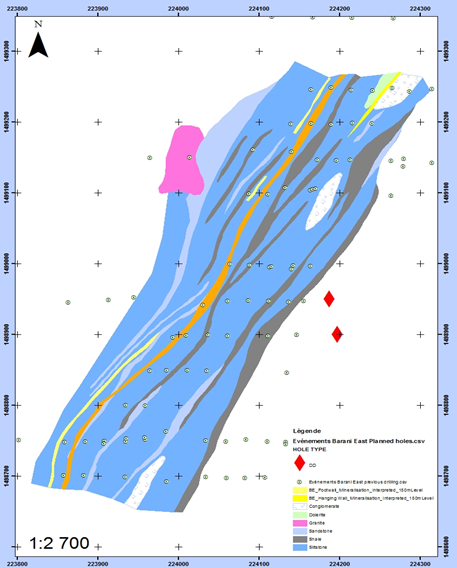

Figure 3. The Locality plan of past and the planned

diamond boreholes at the Barani East prospect.

The Barani prospect shows a North-South mineralized envelope,

approximately 1600 meters in strike length, delineated from RC

drill intersects. The mineralized zone appears to be a

sub-vertical tabular body with pinch and swell characteristics,

varying in thickness between 7m and 5m, on average 6m. The initial

drill program will focus on evaluating the geology, particularly

recognizing the controls to the mineralization. The follow up

infill RC drilling will be used to improve data density towards the

estimation of resources planned for Q1 2018. The planned DD holes

are marked by red diamonds below.

Figure 4. Locality plan of the Barani prospect showing

past RC drill positions, the envelope of mineralization and the

future diamond drill program excluding the holes to be

twinned.

Cross sections views of Barani historical RC holes and

planned diamond core holes (Marked in red):

At Keniegoulou (Fig. 5) the mineralization delineated from the past

RC drill intersects show two sub-parallel zones at 400 meters and

350 meters in strike lengths, oriented in a NNW direction. The

Keniegoulou mineralization is seemingly in sub-vertical tabular

bodies, varying in thickness from 10m to 5m, on average 5m. Core

drilling will focus on providing further insight on the geology and

the controls to the mineralization. The follow up RC drilling will

contribute to an improvement in data density, needed to estimate

the resources, planned for Q1 2018.

Figure 5. Locality plan of the

Keniegoulou

prospect showing the envelope of mineralization from past RC drill

intersects and the planned diamond drill program, excluding the

holes to be twinned.

Desert Gold’s President Jared Scharf commented, “We are very

excited to begin this program. Farabantourou is a great prospect

hosting several mineralized areas that we are undertaking to expand

and get a better understanding of structurally speaking.

The three mineralized zones being

explored this year are orogenic, and considering their relative

proximity we believe it is worth testing the thesis that they are

part of a larger continuous system. We've just scratched the

surface here. The deepest intersect is only at 120m at Barani East

for example. Structural measurements are key to gaining a better

understanding of these ore bodies. The most effective way of doing

this is through diamond core drilling. The commencement and

completion of this program are major steps forward towards our

ultimate goal of profitable commercial mining.”

This note was reviewed by Dr. Luc Antoine who is a director of the

Company and is registered as a Member of the Geological Society of

South Africa (MGSSA 967397). He has the necessary experience

relevant to the style of mineralization and types of deposits under

consideration and to the activity that he is undertaking to qualify

as a Qualified Person as defined in the National Instrument

43-101.

ON BEHALF OF THE

BOARD

“Jared Scharf”

___________________________

Jared Scharf

President & Director

+1 (858) 247-8195

For further information please visit www.SEDAR.com under the

company’s profile.

This news release contains

forward-looking statements respecting the Company's ability to

successfully complete the Offering. These forward-looking

statements entail various risks and uncertainties that could cause

actual results to differ materially from those reflected in these

forward-looking statements. Such statements are based on current

expectations, are subject to a number of uncertainties and risks,

and actual results may differ materially from those contained in

such statements, including the inability of the Company to

successfully complete the Offering. These uncertainties and risks

include, but are not limited to, the strength of the capital

markets, the price of gold; operational, funding, and liquidity

risks; the degree to which mineral resource estimates are

reflective of actual mineral resources; and the degree to which

factors which would make a mineral deposit commercially viable are

present; the risks and hazards associated with mining operations.

Risks and uncertainties about the Company's business are more fully

discussed in the company's disclosure materials filed with the

securities regulatory authorities in Canada and available

at www.sedar.com

and readers are urged to read

these materials. The Company assumes no obligation to update any

forward-looking statement or to update the reasons why actual

results could differ from such statements unless required by

law.

Neither the TSX Venture Exchange

nor its regulation services provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

This news release does not

constitute an offer to sell or a solicitation of an offer to buy

the securities described herein in the United States. The

securities described herein have not been and will not be

registered under the united states securities act of 1933, as

amended, and may not be offered or sold in the united states or to

the account or benefit of a U.S. person absent an exemption from

the registration requirements of such act.

Common Shares (TSXV:DAU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Common Shares (TSXV:DAU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024