Aequus Reports Third Quarter 2021 Financial Highlights

03 November 2021 - 10:00AM

Aequus Pharmaceuticals Inc. (TSX-V: AQS, OTCQB: AQSZF) (“Aequus” or

the “Company”), a specialty pharmaceutical company with a focus on

developing, advancing and promoting differentiated products, today

reported financial results for the quarter ended September 30, 2021

(“Third Quarter 2021”) and associated Company developments. Unless

otherwise noted, all figures are in Canadian currency.

“We are pleased to report another quarter with

positive overall revenue growth, including a 131% increase in

direct-to-clinic sales over the last quarter. Aequus’ overall gross

revenue grew 9% in the Third Quarter compared to Q2, and grew 15%

compared to the same quarter last year. I am proud of the

consistent performance and dedication of our Sales and Corporate

Teams,” said Doug Janzen, Chairman and CEO. “We are also pleased to

report progress towards a definitive agreement with reVision

Therapeutics, and ongoing progress with reVision in building the

REV-0100 development plan.”

Grant Larsen, the Chief Commercial Officer added

that “customer feedback for Evolve dry eye drops has been very

positive and we are pleased with the impact of launch initiatives

on sales. I am also optimistic at the progress made in preparation

for the full Zimed™ PF filing with Health Canada, with the

final requested materials to be filed in the coming weeks. Timing

of a potential launch is dependent on Health Canada’s review

timelines but commercial planning has already begun. Tacrolimus, an

immunosuppressant drug for transplant patients, has performed

extremely well despite significant reductions in organ donors due

to Covid restrictions and lockdowns nationally. We expect revenue

growth to accelerate as market conditions improve and transplants

return to pre-pandemic levels."

"While our losses compared to the same period

last year look larger than normal by comparison, we want to remind

investors that Q3 and Q2 of 2020 coincided with the onset of

COVID-19 and were the only atypical quarters last year.”

Financial Report Highlights

Aequus reported its second highest revenue

quarter to date, with $712,036 in revenue during Third Quarter 2021

compared to revenue of $618,984 generated during the same period in

2020. During the nine months ended September 30, 2021 (“YTD 2021”).

Aequus achieved $1,855,373 in revenues compared to $1,741,426

generated during the nine months ended September 30, 2020 (“YTD

2020”) – an increase of $113,947, or 6%. Product sales of Evolve

began just over six months ago.

Net losses increased by 51% in Third Quarter

2021 compared to the same period last year, with the Third Quarter

2021 net loss of $381,536 versus a $251,921 loss in the three

months ended September 30, 2020 (“Third Quarter 2020”). The loss

for YTD 2021 was $1,482,235 which is 68% higher than the $879,984

loss YTD 2020 primarily due to investments in R&D related to

Zimed PF and increased sales and marketing activities which

included the launch of the Evolve products. We remind investors

that Covid-related restrictions and response in Third Quarter 2020

have skewed the comparable period loss reporting. When comparing to

previous non-Covid impacted quarters, our current operating

expenses are comparable to historical levels.

Highlights from the quarter are as follows:

- Sales and marketing expenses for

Third Quarter 2021 were $551,966 compared to $292,343 in Third

Quarter 2020, an increase of $259,623. This difference was mainly

driven by an expansion to the sales and marketing team, as well as

the lifting of operational restrictions related to COVID-19.

Relative to the same time last year, during the Third Quarter 2021

the Company expanded its marketing team to include specialists and

consultants to focus on refining the Company’s sales, marketing and

operational strategies.

- The Company incurred research and

development (“R&D”) expenses of $49,122 in Third Quarter 2021

compared to $12,997 in Third Quarter 2020. The Company incurred

R&D expenses of $243,415 in YTD 2021 compared to $41,054 in YTD

2020. The majority of the increase was mainly attributable to

strategic consulting services on quality assurance support, work

related to market access, and preparation for authorization

submissions to Health Canada.

- General administration (“G&A”)

expenses were $488,039 in Third Quarter 2021 compared to $582,525

in Third Quarter 2020, a decrease of $94,486. G&A expenses were

$1,532,548 in YTD 2021 compared to $1,586,826 in YTD 2020, a

decrease of $54,278. The decrease was mainly driven by lower

accretion expense related to the convertible debt.

ABOUT AEQUUS PHARMACEUTICALS

INC.

Aequus Pharmaceuticals Inc. (TSX-V: AQS, OTCQB:

AQSZF) is a growing specialty pharmaceutical company focused on

developing and commercializing high quality, differentiated

products. Aequus has grown its sales and marketing efforts to

include several commercial products in ophthalmology and

transplant. Aequus plans to build on its Canadian commercial

platform through the launch of additional products that are either

created internally or brought in through an acquisition or license;

remaining focused on highly specialized therapeutic areas. For

further information, please visit www.aequuspharma.ca.

FORWARD-LOOKING STATEMENT

DISCLAIMER

This release may contain forward-looking

statements or forward-looking information under applicable Canadian

securities legislation that may not be based on historical fact,

including, without limitation, statements containing the words

“believe”, “may”, “plan”, “will”, “estimate”, “continue”,

“anticipate”, “intend”, “expect”, “potential” and similar

expressions. Forward-looking statements are necessarily based on

estimates and assumptions made by us in light of our experience and

perception of historical trends, current conditions and expected

future developments, as well as the factors we believe are

appropriate. Forward-looking statements include but are not limited

to statements relating to: the implementation of our business model

and strategic plans; revenue growth trends into the future;

expected timing for product launches; the Company’s expected

revenues; the regulatory approval of its products; the Company’s

ability to attract international partners; and ongoing discussions

with and the Company’s ability to secure potential partners to

further grow our product portfolio. Such statements reflect our

current views with respect to future events and are subject to

risks and uncertainties and are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by

Aequus, are inherently subject to significant business, economic,

competitive, political and social uncertainties and contingencies.

Many factors could cause our actual results, performance or

achievements to be materially different from any future results,

performance, or achievements that may be expressed or implied by

such forward-looking statements. In making the forward looking

statements included in this release, the Company has made various

material assumptions, including, but not limited to: obtaining

regulatory approvals; general business and economic conditions; the

Company’s ability to successfully out license or sell its current

products and in-license and develop new products; the assumption

that the Company’s current good relationships with third parties

will be maintained; the availability of financing on reasonable

terms; the Company’s ability to attract and retain skilled staff;

market competition; the products and technology offered by the

Company’s competitors; the impact of the coronavirus (COVID-19) on

the Company’s operations; and the Company’s ability to protect

patents and proprietary rights. In evaluating forward looking

statements, current and prospective shareholders should

specifically consider various factors set out herein and under the

heading “Risk Factors” in the Company’s Annual Information Form

dated April 30, 2021, a copy of which is available on Aequus’

profile on the SEDAR website at www.sedar.com, and as otherwise

disclosed from time to time on Aequus’ SEDAR profile. Should one or

more of these risks or uncertainties, or a risk that is not

currently known to us materialize, or should assumptions underlying

those forward-looking statements prove incorrect, actual results

may vary materially from those described herein. These

forward-looking statements are made as of the date of this release

and we do not intend, and do not assume any obligation, to update

these forward-looking statements, except as required by applicable

securities laws. Investors are cautioned that forward-looking

statements are not guarantees of future performance and are

inherently uncertain. Accordingly, investors are cautioned not to

put undue reliance on forward looking statements.

Vistitan™: Trademark owned or used under license

by Sandoz Canada Inc.

CONTACT INFORMATION Aequus Investor Relations

Email: investors@aequuspharma.ca Phone: 604-336-7906

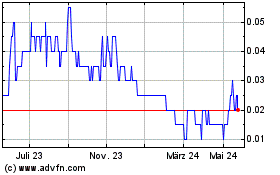

Aequus Pharmaceuticals (TSXV:AQS)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

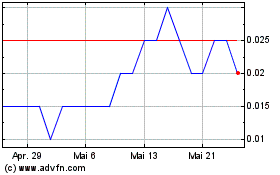

Aequus Pharmaceuticals (TSXV:AQS)

Historical Stock Chart

Von Jan 2024 bis Jan 2025