Apogee Minerals Ltd. (“

Apogee” or the

“

Company”) (TSXV: APMI) is pleased to announce

that, further to its press release dated January 25th 2022, the

Company has entered into a definitive agreement dated March 17th,

2022 (the “

Definitive Agreement”) with Alto Verde

Copper Inc. (“

Alto Verde”) and 1000136714 Ontario

Inc. (“

APMI Subco”), a

wholly-owned subsidiary of the Company, pursuant to which the

Company will acquire all of the issued and outstanding shares in

the capital of Alto Verde (the “

Transaction”). The

Definitive Agreement replaces the letter of intent between the

Company and Alto Verde with respect to the Transaction.

Transaction Structure

In accordance with the terms of the Definitive

Agreement, following the consolidation of the Company’s common

shares (“Common Shares”) on a

4.25:1 basis (the “Consolidation”), the

Transaction will be effected by way of a “three-cornered”

amalgamation (the “Amalgamation”), in which: (a)

APMI Subco will amalgamate with Alto Verde to form an amalgamated

company (“Amalco”); (b) all issued and outstanding

common shares of Alto Verde will be exchanged for

post-Consolidation Common Shares on a 1:1 basis (“Resulting

Issuer Shares”); (c) all outstanding convertible

securities to purchase Alto Verde common shares will be exchanged,

on a 1:1 post-Consolidation basis, for equivalent securities; and

(d) Amalco will become a wholly-owned subsidiary of the Company.

Upon completion of the Transaction, the Company will change its

name to “Alto Verde Copper Inc.” (the “Name

Change”) and will carry on the business carried on by Alto

Verde (the “Resulting Issuer”).

In addition to securities of the Resulting

Issuer to be issued upon conversion of the Subscription Receipts

(as defined below), upon closing of the Transaction, it is expected

that the Resulting Issuer will issue approximately 18,438,996

Resulting Issuer Shares to shareholders of Alto Verde.

Additionally, it is anticipated that 6,011,729 common share

purchase warrants of Alto Verde will be exchanged or replaced with

equivalent securities of the Resulting Issuer.

The completion of the Transaction is subject to

a number of conditions precedent, including: (i) completion of the

Financing (as defined below); (ii) approval of the shareholders of

Alto Verde and the Company; (iii) completion of the Consolidation

and the Name Change; (iv) the Company having a minimum of $750,000

in cash immediately prior to closing; and (v) receipt of all

requisite regulatory and third party approvals (including the

conditional approval of the TSX Venture Exchange (the

“TSXV”). There can be no assurance that the

Transaction will be completed on the terms set out in the

Definitive Agreement or at all.

Upon closing of the Transaction, the Company

will pay a finder’s fee of 917,385 post-Consolidation Resulting

Issuer Shares to an arm’s length party. The Company intends to

receive shareholder approval of the Transaction through written

consent of its shareholders. Certain directors, officers and

shareholders of the Company whom currently hold approximately 62.7%

of the outstanding Common Shares have each entered into voting

support agreements to vote their shares in favour of the

Transaction.

Further details regarding the Transaction and

Alto Verde are disclosed in the Company’s news release dated

January 25, 2022.

The Financing

Prior to the completion of the Transaction, Alto

Verde is expected to complete a non-brokered private placement of a

minimum of 6,153,846 subscription receipts (“Subscription

Receipts”) at a price of $0.65 per Subscription Receipt

for aggregate gross proceeds to Alto Verde of a minimum of

$4,000,000 (the “Financing”). The Subscription

Receipts will be issued pursuant to subscription agreements entered

into by Alto Verde and each of the subscribers. Each Subscription

Receipt will be automatically converted, without payment of

additional consideration or further action by the holder thereof,

into one Alto Verde common share and one warrant to purchase one

additional Alto Verde common share, at an exercise price of $0.85

per Alto Verde common share for a period of 24 months from the

Financing closing date, upon satisfaction of the escrow release

conditions in accordance with the subscription agreements, which

conditions include: (i) satisfaction or waiver of all conditions

precedent to the completion of the business combination pursuant to

the Definitive Agreement and to the Amalgamation (in each case,

other than the release of escrowed funds); (ii) receipt of

conditional approval from the TSXV to list the Resulting Issuer

Shares pursuant to the Transaction; (iii) distribution, upon

conversion of the Subscription Receipts, of Resulting Issuer Shares

and warrants to purchase Resulting Issuer Shares; and (iv) the

delivery of an escrow release notice to the subscription receipt

agent. If the escrow release conditions are not satisfied on or

before 5:00 p.m. (Toronto time) on the date that is 120 days after

the Financing closing date, which date may be extended for a period

of 30 days (the “Deadline”), or the Company or

Alto Verde terminate the Transaction prior to the Deadline, then

the Subscription Receipts will be cancelled and the aggregate

subscription price paid by each of the subscribers will be returned

to each of the subscribers, inclusive of their pro rata portion of

interest earned thereon, if any.

The Financing will be completed on a

non-brokered basis. It is anticipated that a finders’ fee will be

paid to certain arm’s length finders in relation to the Financing

consisting of: (i) a cash payment in an amount equal to 7% of the

gross proceeds of the Financing directly resulting from the

introductions of such finders; and (ii) that number of Resulting

Issuer Share purchase warrants as is equal to 7% of the

Subscription Receipts sold pursuant to the Financing directly

resulting from the introductions of such finders (the

“Finder Warrants”). The Finder Warrants will be

exercisable at a price of $0.65 per Resulting Issuer Share for a

period of 24 months from the Financing closing date. The finders

will consist of registered arm’s length dealers or other permitted

individuals under Canadian securities laws.

It is intended that the net proceeds from the

Financing will be used for mineral resource exploration activities

and general working capital purposes of the Resulting Issuer

following completion of the Transaction. The finder’s fee and the

Financing are subject to TSXV approval.

Filing Statement and Information

Circular:

In connection with the Transaction and pursuant

to the requirements of the TSXV, the Company will file a filing

statement on its issuer profile on SEDAR at www.sedar.com, which

will contain details regarding the Transaction, the Consolidation,

the Name Change, the Financing and Alto Verde.

About Alto

Verde:

Alto Verde Copper Inc. is a private mining

company focused on its portfolio of prospective exploration assets

located in the Central Volcanic Zone, within the prolific Chilean

Copper belt.

Alto Verde’s portfolio includes three copper

exploration projects: Pitbull in the Tarapaca Region and Tres

Marias and Zenaida in the Antofagasta Region. Alto Verde holds a

significant land package covering an area of 19,850 hectares with

the projects situated proximal to several of the world’s largest

mines.

Alto Verde’s leadership team is comprised of

senior mining industry executives who have a wealth of technical

and capital markets experience and a strong track record of

discovering, financing, developing, and operating mining projects

on a global scale. Alto Verde is committed to sustainable and

responsible business activities in line with industry best

practices, supportive of all stakeholders, including the local

communities in which it operates.

Pitbull, Tres Marías, and

Zenaida Projects:

All three of the Alto Verde copper projects are

located in northern Chile within the Central Volcanic Zone, home to

a majority of the country’s production of copper, with much coming

from porphyry-style deposits that are rich in copper, molybdenum,

gold and silver by-products. Notable copper miners in the region

include Antofagasta Minerals, BHP Billiton, Glencore and

Freeport-McMoRan Inc., among others. With its well-developed

sector, Chile is also known as a favourable mining jurisdiction

within South America, with a long history of strong mining laws and

support for foreign direct investment.

Pitbull is an early-stage exploration group of

concessions comprising 2,000 ha and located about 25 km north of

Anglo American & Glencore’s Collahuasi mine, which in 2019

produced more than 565 kt of fine copper with revenues of US$ 3.1

billion. The group of concessions lies within the Upper

Eocene-Lower Oligocene (Mid-Tertiary) Metallogenic Belt, a similar

geological zone to that of Collahuasi. Initial plans at the Pitbull

property include a high resolution UAV magnetometry survey over 14

km2, an Induced Polarization and Resistivity GSDAS (3D) comprising

32 linear km and covering 14 km2, a photogrammetric survey,

Magnetovariational Profiling (MVP), and a 3D Resistivity Inversion

study. Data from these studies will determine the drill hole collar

locations for a follow-on drilling campaign. The Pitbull property

will serve as the “qualifying property” of the Resulting Issuer (as

described below) and as that term is defined under TSX Policy

1.1.

Tres Marías is a prospective mid-stage

exploration group of concessions covering an area of 16,050 ha and

is located within the Paleocene-Lower Eocene Central Metallogenic

Belt at a 1,600 m elevation with year-round access in the

Antofagasta Region. There is a visible hydrothermal alteration in

the outcrops that, based on geological mapping, corresponds to

continental clastic sedimentary rocks of the Jurassic Quehuita

Formation. Freeport-McMoRan Inc. previously completed 2,800 m of

drilling in 2015 and 2018, performed in the eastern portion of the

Tres Marías property, including 6 diamond drill holes (DDH) and

1,000 m in 2 reverse circulation (RC) holes completed, and there

remains much to be followed up on. Highlights from these historical

drill holes include TMD-15-02 with 2.4 m of 3.10% Cu and 19 ppm Ag,

and TMRC-18-01 with 4.0 m of 4.50% Cu and 121.5 ppm Ag. Drilling

also indicated anomalous polymetallic zinc, silver, lead and copper

potential.

The Tres Marías property is subject to a

purchase option by Freeport such that upon completing US$5 million

of qualifying exploration expenditures on the Tres Marías property

within 5 years of September 23rd, 2021, Freeport shall have the

right and option to (i) acquire a 51% interest in the Tres Marías

property for US$12.5 million, or (ii) acquire a 49% interest in the

Tres Marías property for US$250,000 (collectively with (i), the

“Purchase Option”), or (iii) not acquire any

interest in the Tres Marías property. If Freeport exercises the

Purchase Option to acquire a 51% interest in the Tres Marías

property, Alto Verde will be granted a 0.5% NSR royalty over the

Tres Marías property. If Freeport exercises the Purchase Option to

acquire a 49% interest in the Tres Marías property, Freeport will

be granted a 1.0% NSR royalty over the Tres Marías property.

Freeport may also elect not to participate in the property, in

which case it will be granted a 1.0% NSR royalty over the Tres

Marías property.

Zenaida is an early-stage exploration group of

concessions comprising 1,800 ha, and is also located on the Upper

Eocene-Lower Oligocene (Mid-Tertiary) Metallogenic Belt located in

the Antofagasta Region. Although Alto Verde has no current plans

for Zenaida, preliminary results indicate the potential for

mineralization and may warrant further analysis and follow-up by

Alto Verde in the future.

The information and data referred to above,

including the drilling results, are historical in nature. A

qualified person, as defined in National Instrument 43-101 –

Standards of Disclosure for Mineral Projects, has not completed

sufficient work to independently verify the historical information

and data disclosed and neither the Company nor Alto Verde is

treating the historical data as current.

Mineralization hosted on adjacent and/or nearby

properties is not necessarily indicative of mineralization hosted

on the Company’s properties.

Proposed Management and

Directors:

Subject to TSXV approval, on completion of the

Proposed Transaction, the board of the Resulting Issuer will be

comprised of five directors nominated for appointment by Alto

Verde. It is expected that at closing of the Transaction, the

following Alto Verde board members and officers will be appointed

as directors and officers of the Resulting Issuer:

Rick Gittleman, Director and Chairman of the

Board

Mr. Gittleman is a mining executive with over 40

years of experience working on mining projects across the globe. He

started as a lawyer working on mining projects in central Africa.

During his 25-year career at Akin Gump Strauss Hauer & Feld, he

managed the energy and mining practice groups of the firm and

undertook M&A and Project Finance assignments on behalf of

energy and mining clients. In 2009 he joined Freeport McMoRan as a

Senior Vice President for Africa and was part of the leadership

team that brought the Tenke Fungurume mine in the Democratic

Republic of Congo into production. He also worked at Glencore in

its copper division. He is currently the Managing Partner of RMG

Minerals, a consulting company providing advice to the mining

community.

Chris Buncic, MBA, CFA, P.Eng, President, CEO

and Director

Chris Buncic is one of the founding partners in

the formation of Alto Verde Copper Inc. Most recently, Chris was

President and CEO of Ascendant Resources Inc. (TSX: ASND) where he

and the team acquired and restored profitability to the El Mochito

mine in Honduras and greatly advanced the exploration efforts of

the Lagoa Salgada project in Portugal. Chris has served in senior

management roles at several Canadian corporations in the technology

and resources sectors. His depth of experience also includes six

years in Institutional Equity Research at leading Canadian

independent full-service brokerage firms Cormark Securities Inc.

and Mackie Research Capital Corporation. Mr. Buncic is a CFA

Charterholder, has an MBA from Schulich School of Business and

B.A.Sc. from the University of Toronto. Mr. Buncic is a member of

the Professional Engineers of Ontario and the CFA Society.

Mike Ciricillo, Director

Mr. Ciricillo is a mining executive with almost

30 years of operational and project experience, having lived and

worked on five continents over the span of his career. Mike began

his career in 1991 at INCO Ltd in Canada and later joined Phelps

Dodge in 1995, which was later acquired by Freeport-McMoRan. There

he served in positions of increasing responsibility in the United

States, Chile, The Netherlands, and the Democratic Republic of

Congo (“DRC”). In the DRC, Mike served as President of Freeport

McMoRan Africa and spent 5 years at Tenke Fungurume from the

construction phase into the operations phase. Mike then joined

Glencore in 2014 as Head of Copper Operations in Peru, followed by

the role of Head of Copper Smelting Operations, and eventually, he

was placed in the role as Head of Glencore’s Worldwide Copper

Assets.

Dr. Mark Cruise, Ph.D, P.Geo, Director

Dr. Cruise is an exploration and mining

professional with over 25 years of global experience, having

discovered, developed and operated mines in Europe, South America,

Canada and Africa. Dr. Cruise currently serves as CEO of New

Pacific Metals Corp., having previously founded Trevali Mining

where he grew the Company from an initial discovery to a global

leading zinc producer. He has held a variety of professional and

executive positions with Anglo American plc and various publicly

listed exploration and development stage companies. Dr. Cruise

holds a Bachelor of Geology and a Doctorate of Geology from the

University of Dublin, Trinity College. He is a professional member

of the Institute of Geologists and the European Federation of

Geologists.

Rich Leveille, P.Geo, Director

Mr. Leveille has a lifetime’s worth of

experience in the mining sector, having grown up in major copper

camps in the western US where his father worked for Kennecott. He

has a B.S. Geology from the University of Utah and an M.S. in

geology at the University of Alaska, Fairbanks. He worked for a

progression of companies including AMAX, Kennecott, Rio Tinto,

Phelps Dodge and Freeport-McMoRan in the US and internationally,

where he was directly involved with and/or managed teams that made

several major discoveries. His last corporate position was Sr VP

Exploration for Freeport-McMoRan, based in Phoenix. Mr. Leveille

retired in September 2017 and has devoted his time since then to

hiking, backpacking, fishing, writing, advocacy for immigrants and

geological consulting.

Paul Robertson, Chief Financial Officer

Mr. Robertson is a Chartered Accountant with

extensive experience in the mining sector, including assisting

junior resource companies with their financial reporting and

regulatory requirements. He has over sixteen years of accounting,

auditing, and tax experience including working with Ernst &

Young from 1999 to 2005. Currently, he is the managing partner of

Quantum Advisory Partners LLP, a professional services firm

dedicated to assisting publicly listed companies with their

financial reporting, taxation and regulatory requirements. He was

previously the CFO of Grayd Resource Corporation that was acquired

by Agnico Eagle in 2011. Mr. Robertson holds a BA from the

University of Western Ontario (1993) and obtained his Chartered

Accountant designation from the British Columbian Institute of

Chartered Accountants in 1997.

David Garofalo, Special Advisor to the Board of

Directors

David Garofalo, currently a special advisor of

Alto Verde, will remain involved as Special Advisor to the Board of

Directors of the Resulting Issuer. Mr. Garofalo is an accomplished

mining executive with 30 years of experience in the creation and

growth of multi-billion-dollar mining businesses across multiple

continents. Mr. Garofalo has served as Chairman, President and CEO

of Gold Royalty Corp. since August 2020. Formerly, he was the

President and CEO of Goldcorp Inc., a position he held from 2016

until its sale to Newmont Corporation in 2019. Prior to Goldcorp,

he was President, CEO and Director of Hudbay Minerals Inc,

(2010-2016), Senior Vice President, Finance and CFO and Director of

Agnico-Eagle Mines Limited (1998-2010) and Treasurer of Inmet

Mining Corporation (1990-1998). Mr. Garofalo was recognized as the

Mining Person of the Year by the Northern Miner in 2012 and was

named Canada’s CFO of the Year by Financial Executives

International Canada in 2009. He holds a B. Comm with distinction

from the University of Toronto, is a fellow of Chartered

Professional Accountants (FCPA, FCA) and a Certified Director of

the Institute of Corporate Directors (ICD.D). He is also a Director

of the great Vancouver Board of Trade and the Vancouver Symphony

Orchestra.

Selected Financial Information of

Alto Verde:

The following selected financial information is

taken from the audited consolidated financial statements of Alto

Verde as at and for the years ended December 31, 2021 and 2020:

|

Selected Financial Information |

As of and for the year ended

31-Dec-21($)(Audited) |

As of and for the year ended

31-Dec-20($)(Audited) |

|

Revenue |

Nil |

Nil |

|

Total Comprehensive Loss |

(1,473,947 |

) |

(5,640 |

) |

|

Total Assets |

1,087,757 |

|

251,343 |

|

|

Total Liabilities |

91,772 |

|

242,494 |

|

|

Total Shareholder’s Equity |

995,985 |

|

8,849 |

|

Qualified Person:

The scientific and technical information in this

press release has been reviewed and approved by Scott Jobin-Bevans,

Ph.D., PMP, P.Geo., Principal Geoscientist and Managing Director at

Caracle Creek International Consulting Inc., who is an independent

consultant and Qualified Person as defined in National Instrument

43-101 – Standards of Disclosure for Mineral Projects.

About Apogee Minerals

Ltd.:

Apogee Minerals Ltd. is a mineral exploration

company. Our goal is to build shareholder value through mineral

project acquisitions and advancement, as well as new mineral

discoveries.

To find out more about Apogee Minerals Ltd.

(TSX-V: APMI) visit the Company’s website:

www.apogeemineralsltd.com

Apogee Minerals Ltd.

“Jim

Pettit”

James PettitCEO and Director

For further information, please contact:

Apogee Minerals Ltd. Riley Trimble,

DirectorEmail: rtrimble@sentinelmarket.com Tel: (604) 416-2978

Alto Verde Copper Inc. Chris Buncic, President,

CEO, & DirectorEmail: investors@altoverdecopper.com

Completion of the Transaction is subject to a

number of conditions, including but not limited to, TSXV acceptance

and if applicable, disinterested shareholder approval. Where

applicable, the Transaction cannot close until the required

shareholder approval is obtained. There can be no assurance that

the transaction will be completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the management information circular or filing

statement to be prepared in connection with the Transaction, any

information released or received with respect to the Transaction

may not be accurate or complete and should not be relied upon.

Trading in the securities of Apogee Minerals Ltd. should be

considered highly speculative. The TSXV has in no way passed upon

the merits of the proposed transaction and has neither approved nor

disapproved the contents of this news release.

The TSXV has in no way passed upon the merits of

the Transaction and has neither approved nor disapproved the

contents of this news release.

Neither the TSXV nor its

Regulation Services Provider (as that term

is defined in the policies of the TSXV) accepts responsibility for

the adequacy or accuracy of this news release.

Cautionary Statements Regarding

Forward-Looking Information

This news release contains forward-looking

information within the meaning of Canadian securities laws. Such

information includes, without limitation, information regarding the

structure of the Transaction, the terms and conditions of the

Transaction, the Consolidation, the Name Change, the terms of the

Financing, the composition of the board of directors and officers

of the Resulting Issuer upon completion of the Transaction, and

Alto Verde’s future exploration plans. Although the Company

believes that such information is reasonable, it can give no

assurance that such expectations will prove to be correct.

Forward looking information is typically

identified by words such as: “believe”, “expect”, “anticipate”,

“intend”, “estimate”, “postulate” and similar expressions, or are

those, which, by their nature, refer to future events. The Company

cautions investors that any forward-looking information provided by

the Company is not a guarantee of future results or performance,

and that actual results may differ materially from those in forward

looking information as a result of various factors, including, but

not limited to: the Company’s ability to complete the Transaction;

the expected timing and terms of the Transaction and the Financing;

the state of the financial markets for the Company’s securities;

the state of the natural resources sector in the event the

Transaction is completed; recent market volatility and potentially

negative capital raising conditions resulting from the continued

COVID-19 pandemic and risks relating to the extent and duration of

such pandemic and its impact on global markets; the conflict in

Eastern Europe; the Company’s ability to raise the necessary

capital or to be fully able to implement its business strategies;

and other risks and factors that the Company is unaware of at this

time.

The forward-looking statements contained in this

news release are made as of the date of this news release. The

Company disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

The securities referred to in this news

release have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold within the United States or to, or for the account

or benefit of, U.S. persons absent U.S. registration or an

applicable exemption from the U.S. registration

requirements.

This news release does not constitute an

offer for sale of securities, nor a solicitation for offers to buy

any securities.

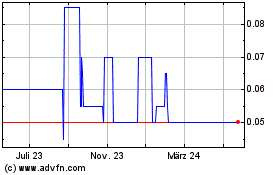

Apogee Minerals (TSXV:APMI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Apogee Minerals (TSXV:APMI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025