Alianza Minerals Arranges $250,000 Financing

30 Januar 2020 - 10:20PM

Alianza Minerals Ltd. (TSXV: ANZ OTC: TARSF)

(“Alianza” or the

“Company”) is pleased

to report that it has arranged a financing of $250,000 to further

advance its projects in BC, Yukon, Nevada and Peru. The financing

is comprised of 5 million units at 5 cents per unit.

Alianza has three very active projects in Yukon and Nevada, two

of which are funded by by partners Coeur Mining and Hochschild

Mining. Hochschild will fund drilling at the Horsethief gold

project in south-eastern Nevada this spring.

Jason Weber, President and CEO of Alianza, noted that “this year

we are building off of a very successful 2019, where we delivered

on our key projects. We made a new silver-bearing vein discovery at

Haldane in Yukon’s famous Keno Hill Silver District. And

together with our partner Hochschild Mining, we defined targets for

our spring drill program at Horsethief to test this sediment-hosted

gold target and its potential to host Long Canyon-style gold

mineralization. With Coeur advancing our Tim Project, just 12 km

north of their Silvertip Mine and exploration of some of our

earlier-stage projects, we anticipate another very busy year for

Alianza with plenty of opportunity for positive results to deliver

to investors.”

Financing Terms – 5,000,000 Units

Each Unit is comprised of one common share and one common share

purchase warrant at $0.05 per unit. The warrant is valid for three

years from the date of closing of the offering and is exercisable

at $0.10 to acquire one common share.

Finder’s fees of 7.5% in cash and 7.5% in finder’s warrants will

be paid to eligible parties. Members of Alianza’s board of

directors and management team may be participating in this

offering. All securities are subject to a four-month hold

from the date of closing.

About Alianza Minerals Ltd.

Alianza employs a hybrid business model of joint venture funding

and self-funded exploration to maximize opportunity for exploration

success. The Company currently has gold, silver and base metal

projects in Yukon Territory, British Columbia, Nevada and Peru.

Alianza currently has three projects optioned/leased out in Nevada

and Yukon Territory, and is actively exploring on two others.

Alianza’s current partners include Hochshild Mining PLC (LON: HOC)

and Coeur Mining, Inc. (NYSE: CDE).

The Company has 82.4 million shares issued and outstanding and

is listed on the TSX Venture Exchange under the symbol “ANZ” and

trades on the OTC market in the US under the symbol TARSF.

Mr. Jason Weber, P.Geo., President and CEO of Alianza Minerals

Ltd. is a Qualified Person as defined by National Instrument

43-101. Mr. Weber supervised the preparation of the technical

information contained in this release.

For further information, contact:

|

Jason Weber, President and CEOSandrine Lam, Shareholder

Communications Tel: (604) 687-3520 Fax: (888) 889-4874

Renmark Financial Communications Inc.Melanie Barbeau

mbarbeau@renmarkfinancial.comTel: (416) 644-2020 or (514)

939-3989www.renmarkfinancial.com To learn more

visit: www.alianzaminerals.com |

|

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE. STATEMENTS IN THIS NEWS

RELEASE, OTHER THAN PURELY HISTORICAL INFORMATION, INCLUDING

STATEMENTS RELATING TO THE COMPANY'S FUTURE PLANS AND OBJECTIVES OR

EXPECTED RESULTS, MAY INCLUDE FORWARD-LOOKING STATEMENTS.

FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS AND

ARE SUBJECT TO ALL OF THE RISKS AND UNCERTAINTIES INHERENT IN

RESOURCE EXPLORATION AND DEVELOPMENT. AS A RESULT, ACTUAL RESULTS

MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING

STATEMENTS.

Alianza Minerals (TSXV:ANZ)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

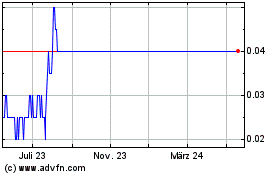

Alianza Minerals (TSXV:ANZ)

Historical Stock Chart

Von Dez 2023 bis Dez 2024