Adyton Resources Corporation (TSX Venture:

ADY) (OTCQB: ADYRF) (FSE: 701GR) has reported significant

copper assays from hole ADK004 at its 100% owned Feni Island

Project (Feni) in Papua New Guinea.

The Company's maiden drilling program of five diamond holes

(1,982m) at Feni was completed in September.

The initial objectives of the program were to expand the gold

resource as well as test various induced polarisation (IP)

anomalies for the potential of a copper porphyry system.

Multi-element assays have now been returned with significant

copper intersections being recorded from hole ADK004 in two zones –

a shallower disseminated zone of copper mineralization followed by

a zone of massive sulphide copper mineralization:

Disseminated Cu + Au:

- 35.9m (70.7 to 106.6m) @ 0.3% Cu & 1.1g/t Au

Massive sulphide Cu + Au:

- 6.4m (149.7 to 156.1m) @ 5.1% Cu & 1.6g/t

AuIncl

3.6m (151.5 to 155.1m) @ 6.9% Cu & 2.1g/t

AuIncl 0.7m (154.4

to 155.1m) @ 14.5% Cu & 2.4g/t Au

These results validate the company’s geological model that Feni

Island has the potential to host zones of significant copper

mineralization within the highly mineralized Kabang structural

corridor.

As previously reported, all five holes returned significant

intersections of gold mineralization including:

- Hole ADK001

intersected gold from surface 144.80m (1.0 –

145.8m) @ 0.8 g/t Au, including 42.70m (48.3 –

91.0m) @ 1.33 g/t Au; 28m (63.0 – 91.0m) @1.60 g/t Au and 5m (70.0

– 75.0m) @ 2.96 g/t Au and a shallow copper intersection of 16m

(7.0 – 23.0m) @ 0.3% Cu.

- Hole ADK003

intersected 84m (55.0 – 139.0m) @ 0.6 g/t

Au, including 2m (55.0 – 57.0) @ 1.36 g/t Au; 3m (61.0 –

64.0m) @ 1.16 g/t Au; 6m (93.0 – 99.0m) @ 0.96 g/t Au and 15m

(124.0m – 139.0m) @ 1.26 g/t Au.

- Hole ADK004

drilled 500m north of holes ADK001 and ADK003 intersected

84.10m (72.0 – 156.1m) @ 0.96 g/t

Au, including 10m (74.0 – 84.0m) @ 1.41 g/t Au; 15.60m

(91.0 – 106.6m) @ 1.20 g/t Au; 4.60m (151.5 – 156.1m) @ 2.00 g/t Au

and 1m (335.0 – 336.0m) @ 5.24 g/t Au.

Adyton Resources President, Executive Chairman and CEO, Mr Frank

Terranova, said the assay results demonstrated Feni’s significant

copper potential.

“The results confirm that Feni could contain zones of high-grade

copper within the extensive gold mineralization and this

confirmation of massive sulphide copper in the system justifies

more work which is currently being planned,” Mr Terranova said.

“The recent drilling program has highlighted the potential for a

significant discovery to be made in the 1.5km long Kabang

structural corridor. The corridor is lightly drilled, and going

north is covered by younger volcanic cover, which has hindered

previous exploration efforts – a focus of the next program will be

exploring under this younger cover.”

Located in a Tier 1 region along a mineral belt containing the

world class Simberi, Lihir, and Panguna gold and copper projects,

Mr Terranova added that the model at Feni was for a “Lihir-style”

epithermal gold overprint on a deeper porphyry copper system.

Figure 1: Kabang drilling area – other

prospects also shown

https://www.globenewswire.com/NewsRoom/AttachmentNg/cb9a46bc-8343-4bf3-a950-df815205eeaf

Drilling Summary

Hole ADK004 was drilled to test continuity

of mineralization further to the north-east 500m from the first

three holes drilled in the program (ADK001 – 003) and as such

represented a “step-out” to get a better understanding of the

mineralisation further along the Kabang structural zone (Figure 2).

This area is covered by 70m of younger cover (volcanics,

epiclastics and tephra). Beneath the younger cover from 72m depth,

ADK004 intersected strong Au and Cu mineralisation within

hydrothermal breccia. The breccias are phyllic altered, silicified,

with strong sulphide (pyrite, arsenopyrite and chalcopyrite)

mineralisation as breccia fill, stockworks and veining. Beneath the

volcanic breccia the hole passed into syenite intrusive.

Figure 2: Kabang drilling area showing IP

conductive channel, IP phase targets and location of the five

completed Adyton diamond drill holes. Note the prospective corridor

is > 1.5kms long, lightly drilled, and under younger volcanic

cover at the northern end which has hindered previous exploration

efforts. Hole ADK004 is shown.

https://www.globenewswire.com/NewsRoom/AttachmentNg/44527e83-4674-4628-aa31-acbfaeeff7aa

Figure 3: Location of ADK004 in

relation to the other Adyton drill holes within the Kabang

mineralized corridor, a zone of >1.5kms long. Note going to the

north (beyond ADK004 and 005) the surface gold mineralization

passes under younger volcanic cover – an area that hindered

previous explorers and remains untested.

https://www.globenewswire.com/NewsRoom/AttachmentNg/de429143-117d-4b82-b821-fbb545d71513

Hole ADK004 intersected

84.10m (72.0 – 156.1m) @ 0.97 g/t Au, including

10m (74.0 – 84.0m) @ 1.41 g/t Au; 15.60m (91.0 – 106.6m) @ 1.40 g/t

Au; 4.60m (151.5 – 156.1m) @ 2.03 g/t Au and 1m (335.0 – 336.0m) @

5.24 g/t Au.

The zones of copper (with associated

gold) from ADK004 are reported as:

Disseminated Cu + Au Zone:

- 35.9m (70.7 to 106.6m) @ 0.3% Cu & 1.1g/t

Au

Massive sulphide Cu + Au Zone:

- 6.4m (149.7 to 156.1m) @ 5.1% Cu & 1.6g/t

AuIncl

3.6m (151.5 to 155.1m) @ 6.9% Cu & 2.1g/t

AuIncl 0.7m (154.4

to 155.1m) @ 14.5% Cu & 2.4g/t Au

Significantly, from 149.7 to 156.1m down-hole a zone of massive

sulphide mineralisation was drilled with a significant gold

intersection and visible chalcopyrite. This zone

is exciting in the context of structurally controlled higher grade

zones that are going to be the focus of the next drilling program.

The zone is marked by sulphide flooding with pervasive pyrite,

pyrrhotite, chalcopyrite, arsenopyrite and magnetite which make up

30 - 40% of the interval. Below the massive sulphide-zone, the hole

passed into phyllic altered syenite / diorite porphyry to the end

of hole at 394.6m.

Figure 4: Cross section along ADK004 showing

copper (lhs) and gold (rhs) – disseminated copper is within the

volcanic breccia and the massive sulphide within the syenite

intrusive. Plan view on the right showing the orientation of the

holes.

https://www.globenewswire.com/NewsRoom/AttachmentNg/6ac220c0-dc47-4173-b880-5e6f2d8fad67

Figure 5: ADK004 – 155.1 – 156.1m showing

massive sulphide mineralization in hydrothermal breccia

https://www.globenewswire.com/NewsRoom/AttachmentNg/bd5c9a43-b90e-49f2-bb2b-5b0467b61e0e

Geological Overview

The Feni Island Group lies at the southeast end of the 250 km

long Tabar-Lihir-Tanga-Feni alkalic volcanic island chain, which is

largely Pliocene-Pleistocene in age. The chain lies 40 – 60 km off

the east coast of New Ireland, PNG.

Ambitle Island is the larger of the two islands comprising the

Feni Island Group. It is dominated by Ambitle volcano, which is a

collapsed stratovolcano (2 – 8 million years old) built on a

basement of early Tertiary sediments. The crater rim is interpreted

as a collapse-structure, of gravity-induced failure of the

southwest flanks of the Ambitle crater, as opposed to a large

caldera structure. It is composed of alkalic mafic to intermediate

volcanics and high-level alkalic intrusives, such as monzonites and

syenites.

The cone of Ambitle volcano is comprised mainly of vesicular

lavas, pyroclastic and epiclastic rocks. The lavas are intermediate

in composition and strongly undersaturated, including phonolites,

alkali basalts, basanite, trachybasalt and trachyandesite.

The main style of mineralisation on Ambitle Island is

low-sulphidation epithermal gold mineralisation associated with

quartz veining and sulphide mineralisation (e.g. pyrite,

chalcopyrite, arsenopyrite). The gold mineralisation is associated

with the Matangkaka Intrusive Complex, which lies at the southern

margin of the Ambitle volcanic crater.

The focus of the initial drilling program at Kabang was to test

both the shallow epithermal gold zones and deeper porphyry copper

potential. The program was focused in and around the Kabang

Prospect to test deeper extensions to previous drilling targeting

the IP models that are interpreted to indicate a poorly tested

chargeable body at depth underneath the shallower epithermal Kabang

mineralisation.

The gold mineralisation identified at Kabang is open in all

directions with the potential for a deeper copper-gold mineralised

system below the gold mineralisation at Kabang and elsewhere on the

tenement. There are multiple prospective gold and copper-gold

targets, with limited or no drill testing undertaken to date, that

demonstrate the potential to significantly grow the current mineral

resources for the Feni Project.

Drill Program Overview

An initial five hole drill program was completed in September at

Feni, totalling 1,962m, testing the highly prospective Kabang

mineralised corridor for continuity and extensions of the shallower

(0-250m) Lihir-style epithermal gold zone and deeper porphyry

copper-gold target.

- Drill targets were based on

interpreted chargeable bodies at depth from remodelled 3D IP data

from historical geophysical surveys.

- The initial results from the first

five holes are very encouraging, confirming the potential for

higher grade ore zones within a broader lower grade gold

envelope.

- The short programs at Kabang and

Matangkaka provide further impetus for the next drilling stage

which will be focussed on resource extensions and testing the depth

potential along the more than 1.5 kms strike extent.

- The IP modelling is clearly picking

out the strong “pyrite halo” around the porphyritic intrusive which

is encouraging as the gold appears to sit above and within this

zone.

- The company considers that following

the success of the short initial diamond drilling program, there is

a significant discovery to be made in the Kabang structural

corridor with a focused drilling program along the 1.5km long by

500m wide zone.

- There are a number of other prospects that also need following

up, which will be further defined in the next work program.

ON BEHALF OF THE BOARD OF ADYTON RESOURCES

CORPORATION

Frank Terranova, Chairman, President and Chief Executive

Officer

For further information please contact:

Frank Terranova, Chairman, President and Chief Executive

OfficerE-mail: fterranova@adytonresources.com Phone: +61 7 3854

2389

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the development of

gold and copper resources in world class mineral jurisdictions. It

currently has a portfolio of highly prospective mineral exploration

projects in Papua New Guinea on which it is exploring for copper

and gold. The Company’s mineral exploration projects are located on

the Pacific Ring of Fire which hosts several world class copper and

gold deposits.

Adyton was formed by a reverse takeover transaction completed

with XIB I Capital Corporation on February 17, 2021 and commenced

trading on the TSX Venture Exchange under the symbol “ADY” on

February 24, 2021.

Adyton is also quoted on the Frankfurt Stock Exchange under the

code 701:GR.

For more information about Adyton and its projects, visit

www.adytonresources.com.

https://www.globenewswire.com/NewsRoom/AttachmentNg/639738f3-f1d5-441d-bb4a-8d7b0d8ed53a

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release.

(1) Notes Regarding Inferred Mineral Resource

Estimates

- The Feni Island

Project currently has a mineral resource prepared in accordance

with NI 43-101 dated October 14, 2021, which has outlined an

initial inferred mineral resource of 60.4 million tonnes at an

average grade of 0.75 g/t Au, for contained gold of 1,460,000

ounces, assuming a cut-off grade of 0.5 g/t Au.

- See the NI

43-101 technical report entitled “NI 43-101 Technical Report on the

Feni Gold-Copper Property, New Ireland Province, Papua New Guinea”

(the “Feni Technical Report”) dated October 14, 2021 and prepared

for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo),

Matthew White (MAIG) and Andy Thomas (MAIG), each an independent

mining consultant and “qualified person” as defined in NI 43-101,

available under Adyton’s profile on SEDAR at www.sedar.com.

(2) Reported Copper and Gold Intersections in

this release:

|

Hole ID |

East |

North |

RL (m) |

Length (m) |

Az (deg) |

Dip (deg) |

From (m) |

To (m) |

Interval (m) |

Au g/t |

Cu % |

|

ADK004 |

567,650 |

9,548,230 |

151 |

394.6 |

313 |

-75 |

70.70 |

106.60 |

36.60 |

1.10 |

0.30 |

|

|

|

|

|

|

|

|

149.70 |

156.10 |

6.40 |

1.60 |

5.10 |

|

|

|

|

|

|

|

|

Incl 151.50 |

155.10 |

3.60 |

2.10 |

6.90 |

|

|

|

|

|

|

|

|

Incl 154.40 |

155.10 |

0.70 |

2.40 |

14.50 |

|

ADK001 |

567,260 |

9,548,072 |

92 |

432.0 |

130 |

-80 |

7.00 |

23.00 |

16.00 |

0.46 |

0.30 |

(3) Information regarding drill holes and exploration

results (Gold only) as previously released:

|

Hole ID |

East |

North |

RL (m) |

Length (m) |

Az (deg) |

Dip (deg) |

From (m) |

To (m) |

Interval (m) |

Au g/t |

|

ADK001 |

567,260 |

9,548,072 |

92 |

432.0 |

130 |

-80 |

1.00 |

145.80 |

144.80 |

0.81 |

|

|

Incl 48.30 |

91.00 |

42.70 |

1.33 |

|

|

Incl 63.00 |

91.00 |

28.00 |

1.60 |

|

|

Incl 70.00 |

75.00 |

5.00 |

2.96 |

|

|

Incl 112.00 |

130.00 |

18.00 |

1.21 |

|

ADK002 |

567,236 |

9,548,023 |

97 |

452.4 |

185 |

-85 |

45.00 |

55.00 |

10.00 |

0.60 |

|

ADK003 |

567,260 |

9,548,072 |

92 |

449.2 |

255 |

-75 |

55.00 |

139.00 |

84.00 |

0.60 |

|

|

Incl 55.00 |

57.00 |

2.00 |

1.36 |

|

|

Incl 61.00 |

64.00 |

3.00 |

1.16 |

|

Incl 93.00 |

99.00 |

6.00 |

0.96 |

|

Incl 106.00 |

107.00 |

1.00 |

1.22 |

|

Incl 124.00 |

139.00 |

15.00 |

1.26 |

|

ADK004 |

567,650 |

9,548,230 |

151 |

394.6 |

313 |

-75 |

72.00 |

156.10 |

84.10 |

0.96 |

|

|

|

|

|

|

|

|

Incl 72.00 |

137.00 |

65.00 |

1.00 |

|

|

|

|

|

|

|

|

Incl 74.00 |

84.00 |

10.00 |

1.41 |

|

|

|

|

|

|

|

|

Incl 74.00 |

106.60 |

32.60 |

1.19 |

|

|

|

|

|

|

|

|

Incl 91.00 |

106.60 |

15.60 |

1.20 |

|

|

|

|

|

|

|

|

Incl 120.00 |

126.00 |

6.00 |

1.40 |

|

|

|

|

|

|

|

|

Incl 120.00 |

137.00 |

17.00 |

1.08 |

|

|

|

|

|

|

|

|

Incl 151.50 |

156.10 |

4.60 |

2.00 |

|

|

|

|

|

|

|

|

329.00 |

336.00 |

7.00 |

1.41 |

|

|

|

|

|

|

|

|

Incl 329.00 |

331.00 |

2.00 |

1.45 |

|

|

|

|

|

|

|

|

Incl 335.00 |

336.00 |

1.00 |

5.24 |

|

ADK005 |

567,704 |

9,548,293 |

162 |

234.0 |

323 |

-80 |

89.00 |

92.30 |

3.30 |

1.27 |

|

|

|

|

|

|

|

|

168.00 |

173.00 |

5.00 |

0.81 |

- All drilling has been carried out by Diamond Drilling, in PQ,

HQ and NQ core size.

- AKD001 to AKD005 to the extent known have been drilled

perpendicular to / across the interpreted mineralised zone.

- Core recovery has generally been very good >95%.

- Sampling has been carried out on split core, with half being

sent for assay and half core remaining in the core trays.

- Nominal sampling intervals are 1.0m.

- Assays are not capped.

(4) Information regarding QA / QC procedures in

relation to exploration results reported in this

release

Gold assays have been carried out by Lead collection 50g charge

Fire Assay with AAS finish at Intertek Laboratories, Lae, PNG, an

accredited laboratory to ISO/IEC 17025 (2005) for quantitative gold

determination. Multi element analysis is analysed following four

acid digestion for multi element (48 element) analysis followed by

ICP-MS at Intertek Laboratories, located at Bohle, Townsville,

Queensland, Australia, an accredited laboratory to ISO/IEC 17025.

Intertek Global Minerals laboratories are established under the

guidelines of the ISO17025 standard testing and calibration and all

laboratories comply with Intertek’s quality and management

systems.

All assays have been subject to quality control measures

appropriate for diamond drilling where certified reference

materials / standards have been included in each batch of samples

submitted as part of the quality assurance / quality control

process.

Qualified Person

The scientific and technical information contained in this press

release has been prepared, reviewed, and approved by Rod Watt, BSc

Hons (Geo), FAusIMM, Chief Geologist and a director of Adyton, who

is a "Qualified Person" as defined by National Instrument 43-101 -

Standards of Disclosure for Mineral Projects ("NI 43-101"). Adyton

Resources Corp press release dated October 13 2021: “The technical

information in this press release has been reviewed and approved by

Rod Watt, who is a Fellow of the Australian Institute of Mining and

Metallurgy (FAusIMM) and a Qualified Person as defined by National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

(NI43-101). Mr. Watt consents

to the inclusion of his name

in this release. Mr Watt verified the data disclosed in

this press release in accordance with industry standard best

practices, including sampling, analytical, and test data underlying

the information or opinions contained herein.”

Forward looking statements

This press release includes “forward-looking statements”,

including forecasts, estimates, expectations, and objectives for

future operations that are subject to several assumptions, risks,

and uncertainties, many of which are beyond the control of Adyton.

Forward-looking statements and information can generally be

identified by the use of forward-looking terminology such as "may",

"will", "should", "expect", "intend", "estimate", "anticipate",

"believe", "continue", "plans" or similar terminology. Forward

looking statements in this news release include plans for

additional drill testing, the intention to prepare additional

technical studies, the timing of additional drill results, and the

preparation of a resource upgrade in Q3 2021. The forward-looking

information contained herein is provided for the purpose of

assisting readers in understanding management's current

expectations and plans relating to the future. Readers are

cautioned that such information may not be appropriate for other

purposes. Forward-looking information are based on management of

the parties' reasonable assumptions, estimates, expectations,

analyses and opinions, which are based on such management's

experience and perception of trends, current conditions and

expected developments, and other factors that management believes

are relevant and reasonable in the circumstances, but which may

prove to be incorrect. Such factors, among other things, include:

impacts arising from the global disruption caused by the Covid-19

coronavirus outbreak, changes in general macroeconomic conditions;

changes in securities markets; changes in the price of gold or

certain other commodities; change in national and local government,

legislation, taxation, controls, regulations and political or

economic developments; risks and hazards associated with the

business of mineral exploration, development and mining (including

environmental hazards, industrial accidents, unusual or unexpected

formations pressures, cave-ins and flooding); discrepancies between

actual and estimated metallurgical recoveries; inability to obtain

adequate insurance to cover risks and hazards; the presence of laws

and regulations that may impose restrictions on mining; employee

relations; relationships with and claims by local communities and

indigenous populations; availability of and changes in the costs

associated with mining inputs and labour; the speculative nature of

mineral exploration and development (including the risks of

obtaining necessary licenses, permits and approvals from government

authorities); and title to properties. Investors are cautioned that

any such statements are not guarantees of future performance and

that actual results or developments may differ materially from

those projected in the forward-looking statements. Such

forward-looking information represents management’s best judgment

based on information currently available. No forward-looking

statement can be guaranteed, and actual future results may vary

materially. Readers are cautioned not to place undue reliance on

forward looking statements or information. Adyton Resources

Corporation undertakes no obligation to update forward-looking

information except as required by applicable law.

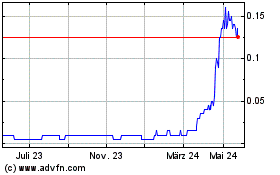

Adyton Resources (TSXV:ADY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

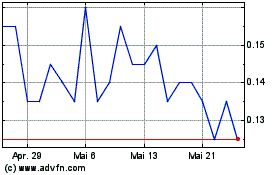

Adyton Resources (TSXV:ADY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025