Adyton Resources Corporation (TSX Venture: ADY)

has reported an 88% increase in total gold ounces across the

company’s 100% owned Fergusson Island Gold Project and Feni Gold

and Copper Project, located within Papua New Guinea’s renowned “Rim

of Fire”.

Fergusson Island maiden Indicated Resource of

175,000 gold ounces at 1.33 grams/tonne (g/t) and Inferred Resource

increased by 33% to 540,000 gold ounces at 1.08 g/t.

Feni Island Inferred Resource increased by 123%

to 1,460,000 gold ounces at 0.75 g/t.

Adyton Chairman, President and Chief Executive

Officer, Mr Frank Terranova said the updated resource estimates

would provide a strong basis for technical studies to be undertaken

in preparation for submitting a Mining Lease Application for the

Fergusson Island Project by the end of calendar 2022.

“When we acquired the Fergusson

Island and Feni Island Projects, we saw a unique opportunity to

create a portfolio of complementary projects, each of which

demonstrated clear pathways for accelerated development,” Mr

Terranova said.

“Fergusson Island Project provides a relatively

simple pathway to near term production while Feni Project has the

potential to be a project of international significance.

“With a relatively modest drill program at

Gameta and a re-assessment of the economic cut-off grade based on a

conceptual mining study we have significantly increased the size of

our overall mineral resource estimate, which leaves the company

confident for the future,” he said.

Mr Terranova was confident that future

exploration programs would continue to grow the mineral resources

on Fergusson Island with the resource being close to surface, and

open in multiple directions including at depth. He added that Feni

Island’s resource estimate upgrade was also very encouraging.

“The recent drilling at Feni has confirmed our

belief that this project is geologically analogous to the

neighbouring Lihir and Simberi deposits and demonstrates its

potential to be a major gold discovery with copper porphyry

potential,” he said.

Consolidated Group mineral resource

estimates

Table 1 presents a summary of the updated

mineral resources for the consolidated Fergusson Island and Feni

Island Projects.

|

Project |

Indicated |

Inferred |

|

Au(g/t) |

Tonnes(million) |

Au(koz) |

Au(g/t) |

Tonnes(million) |

Au(koz) |

|

Fergusson Island - Gameta Project |

1.33 |

4.0 |

173 |

1.01 |

10.5 |

340 |

|

Fergusson Island – Wapolu Project |

- |

- |

- |

1.06 |

5.8 |

200 |

|

Fergusson Island total |

1.33 |

4.0 |

173 |

1.02 |

16.3 |

540 |

|

Feni Island |

- |

- |

- |

0.75 |

60.4 |

1.460 |

|

Total |

1.33 |

4.0 |

173 |

0.81 |

76.7 |

2,000 |

Table 1: Gameta, Wapolu and Feni combined Adyton group

resources at 0.5g/t gold cut-off

Mineral Resource Estimate

Parameters

- Mineral Resources were prepared in

accordance with NI 43-101 and the CIM Definition Standards for

Mineral Resources and Mineral Reserves (2014) and the CIM

Estimation of Mineral Resources and Reserves Best Practice

Guidelines (2019) prepared by the Standing Committee on Reserve

Definitions and adopted by the CIM Council.

- These Mineral Resources are not

Mineral Reserves and do not have demonstrated economic viability.

This estimate of Mineral Resources may be materially affected by

environmental, permitting, legal, title, taxation, sociopolitical,

marketing, or other relevant issues. The quantity and grade of

reported Inferred Resources in the mineral resource estimates are

uncertain in nature and there has been insufficient exploration to

define these resources as Indicated or Measured; however, it is

reasonably expected that the majority of Inferred Mineral Resources

could be upgraded to Indicated Mineral Resources with continued

exploration.

- All Mineral Resources estimates are

reported at a cut-off grade of 0.5 g/t gold. The cut-off grade has

been determined based on conceptual pit optimisations developed

using Whittle software, an assumed gold price of US$1,800 per ounce

and mining, processing and other cost assumptions derived from

published cost data for comparable Papua New Guinea gold

projects.

- In estimating the Gameta Resources:

- The core areas drilled to a 40 m

spacing or less were considered sufficient for Indicated Mineral

Resource classification based on a combination of confidence in

data inputs, geological interpretation, and sample variography.

Indicated classification was restricted to interpreted

mineralisation domains and interpreted separately for the

Detachment Fault Zone (DFZ) & DFZ transition zones, and the

footwall metamorphic as the drill spacing changes with depth and

drill hole orientation.

- High grade caps were applied for

estimation to remove undue effects from outliers and skewed grade

distributions. Most caps relate to the 99.5th percentile of the

distributions.

- Domaining of the hanging wall,

mineralised shear zone and footwall ore types was carried out, with

variogram correlogram modelling being undertaken for each domain

using unfolding for most domains for lateral orientations and down

hole variograms for the cross-strike orientations.

- Bulk density measurements were

carried out on a representative number of core samples and assigned

based on rock classification into the tock types - oxide domain,

partial oxide and fresh shear zone hosted mineralisation domain,

and a lower footwall domain.

- Gold grades were estimated by

Ordinary Kriging for blocks within each domain.

- The effective date of the updated

estimate is 14 October 2021

Cut-Off Grade Sensitivity The

following tables tabulate the Adyton Group resources at different

cut-off grades across the three projects covered in this release

(highlighted at a 0.5 g/t cut-off).

|

Gameta Resources - October 2021 |

|

Cut-off |

Indicated |

Inferred |

|

(g/t Au) |

Tonnes |

Au |

Au |

Tonnes |

Au |

Au |

|

|

(million) |

(g/t) |

(koz) |

(million) |

(g/t) |

(koz) |

|

0.3 |

4.5 |

1.24 |

179 |

16.9 |

0.78 |

423 |

|

0.4 |

4.3 |

1.29 |

178 |

13.1 |

0.9 |

379 |

|

0.5 |

4.0 |

1.33 |

173 |

10.5 |

1.01 |

340 |

|

0.6 |

3.8 |

1.39 |

168 |

8.5 |

1.12 |

305 |

|

0.7 |

3.4 |

1.46 |

162 |

7.0 |

1.22 |

274 |

|

0.8 |

3.1 |

1.54 |

154 |

5.8 |

1.32 |

245 |

|

0.9 |

2.8 |

1.63 |

145 |

4.8 |

1.42 |

219 |

|

1.0 |

2.5 |

1.71 |

135 |

4.0 |

1.51 |

195 |

Table 2: Gameta Indicated and Inferred Resources

reported using various cut-off criteria.

|

Wapolu Resources – October 2021 |

|

Cut-off |

Inferred |

|

(g/t Au) |

Tonnes |

Au |

Au |

|

|

(million) |

(g/t) |

(koz) |

|

0.3 |

9.3 |

0.81 |

240 |

|

0.4 |

7.3 |

0.93 |

220 |

|

0.5 |

5.8 |

1.06 |

200 |

|

0.6 |

4.7 |

1.18 |

180 |

|

0.7 |

3.8 |

1.3 |

160 |

|

0.8 |

3.1 |

1.42 |

140 |

|

0.9 |

2.6 |

1.55 |

125 |

|

1.0 |

2.1 |

1.67 |

115 |

Table 3: Wapolu Inferred Resources reported

using various cut-off criteria.

|

Feni Resources – October 2021 |

|

Cut-off |

Inferred |

|

(g/t Au) |

Tonnes |

Au |

Au |

|

|

(million) |

(g/t) |

(koz) |

|

0.3 |

104.2 |

0.6 |

2,000 |

|

0.4 |

78.4 |

0.68 |

1,710 |

|

0.5 |

60.4 |

0.75 |

1,460 |

|

0.6 |

40.9 |

0.85 |

1,100 |

|

0.7 |

28.2 |

0.94 |

850 |

|

0.8 |

19.9 |

1.01 |

650 |

|

0.9 |

11.0 |

1.14 |

400 |

|

1.0 |

6.7 |

1.27 |

270 |

Table 4: Feni Inferred Resources reported using

various cut-off criteria.

Resource ModellingThe following

figures show a slice through the existing Resource block models for

the three projects.

Figure 1 Gameta resource block model

outline at RL-20m – showing central resource area and drill holes

and areas for future exploration.

https://www.globenewswire.com/NewsRoom/AttachmentNg/094fa315-8e28-4e68-98f0-2bf606680d8b

Figure 2 Gameta cross sectional slice

through block model – showing high grade for the northern area and

open at depth and down dip

https://www.globenewswire.com/NewsRoom/AttachmentNg/6247917e-e1c3-41f1-aa33-144519ceda63

Figure 3 Long section along Feni

inferred resource block model

https://www.globenewswire.com/NewsRoom/AttachmentNg/9a46a5ba-1264-4260-89f4-43e9625af8ce

Figure 4 plan view of the Wapolu

inferred resource model and drill holes. Areas of exploration

targeting along strike to the east and west beneath shallow

historical drill holes

https://www.globenewswire.com/NewsRoom/AttachmentNg/cf8fa02f-58f2-47d2-82e6-a8ccfcb7d4ad

Technical Report and Qualified

PersonsThe mineral resource estimates for the Gameta,

Wapolu and Feni projects included in this press release were

prepared under the supervision of Mr Mark Berry (MAIG) of Derisk

Geomining Consultants, an Independent Qualified Person as defined

by NI 43-101. The technical content has also been reviewed by Rod

Watt, BSc Hons (Geo), FAusIMM, Chief Geologist and a director of

Adyton Resources Corporation, who is a "Qualified Person" as

defined by National Instrument 43-101 - Standards of Disclosure for

Mineral Projects ("NI 43-101").

A Technical Report to support the updated

mineral resource estimates for the Gameta, Wapolu and Feni

projects, prepared in accordance with NI 43-101, will be filed on

SEDAR (www.sedar.com) within 45 days of this news release.

ON BEHALF OF THE BOARD OF ADYTON RESOURCES

CORPORATIONFrank Terranova, Chairman, President and Chief

Executive Officer

For further information please contact:Frank

Terranova, Chairman, President and Chief Executive OfficerE-mail:

fterranova@adytonresources.com Phone: +61 7 3854 2389

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release.

Forward looking statements

This press release includes “forward-looking

statements”, including forecasts, estimates, expectations, and

objectives for future operations that are subject to several

assumptions, risks, and uncertainties, many of which are beyond the

control of Adyton. Forward-looking statements and information can

generally be identified by the use of forward-looking terminology

such as "may", "will", "should", "expect", "intend", "estimate",

"anticipate", "believe", "continue", "plans" or similar

terminology. Forward looking statements in this news release

include plans for additional drill testing, the intention to

prepare additional technical studies, the timing of additional

drill results, and the preparation of a resource upgrade in Q3

2021. The forward-looking information contained herein is provided

for the purpose of assisting readers in understanding management's

current expectations and plans relating to the future. Readers are

cautioned that such information may not be appropriate for other

purposes. Forward-looking information are based on management of

the parties' reasonable assumptions, estimates, expectations,

analyses, and opinions, which are based on such management's

experience and perception of trends, current conditions and

expected developments, and other factors that management believes

are relevant and reasonable in the circumstances, but which may

prove to be incorrect. Such factors, among other things, include:

impacts arising from the global disruption caused by the Covid-19

coronavirus outbreak, changes in general macroeconomic conditions;

changes in securities markets; changes in the price of gold or

certain other commodities; change in national and local government,

legislation, taxation, controls, regulations and political or

economic developments; risks and hazards associated with the

business of mineral exploration, development and mining (including

environmental hazards, industrial accidents, unusual or unexpected

formations pressures, cave-ins and flooding); discrepancies between

actual and estimated metallurgical recoveries; inability to obtain

adequate insurance to cover risks and hazards; the presence of laws

and regulations that may impose restrictions on mining; employee

relations; relationships with and claims by local communities and

indigenous populations; availability of and changes in the costs

associated with mining inputs and labour; the speculative nature of

mineral exploration and development (including the risks of

obtaining necessary licenses, permits and approvals from government

authorities); and title to properties. Investors are cautioned that

any such statements are not guarantees of future performance and

that actual results or developments may differ materially from

those projected in the forward-looking statements. Such

forward-looking information represents management’s best judgment

based on information currently available. No forward-looking

statement can be guaranteed, and actual future results may vary

materially. Readers are cautioned not to place undue reliance on

forward looking statements or information. Adyton Resources

Corporation undertakes no obligation to update forward-looking

information except as required by applicable law.

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the

development of gold and copper resources in world class mineral

jurisdictions. It currently has a portfolio of highly prospective

mineral exploration projects in Papua New Guinea on which it is

exploring for copper and gold. The Company’s mineral exploration

projects are located on the Pacific Ring of Fire which hosts

several world class copper and gold deposits. Adyton was formed by

a reverse takeover transaction completed with XIB I Capital

Corporation on 17 February 2021 and commenced trading on the TSX

Venture Exchange under the symbol “ADY” on February 24, 2021.

Adyton is also quoted on the Frankfurt Stock Exchange under the

code 701: GR. Further as of 1 August 2021 Adyton

is also quoted on the OTCQB market under the code

ADYRF. For more information about Adyton and its

projects, visit www.adytonresources.com.

Map showing the location of Adyton’s Papua New Guinea

exploration projectsrelative to significant PNG gold projects.

https://www.globenewswire.com/NewsRoom/AttachmentNg/12e165e3-9bb4-4e96-aaf6-936895cba0c9

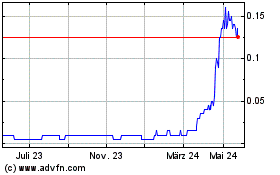

Adyton Resources (TSXV:ADY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

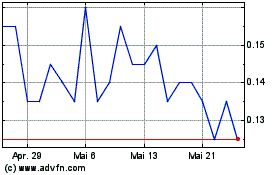

Adyton Resources (TSXV:ADY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025