Victoria Gold Corp. (TSX-VGCX) (“Victoria” or the “Company”)

announces that is has executed a definitive asset purchase

agreement dated June 24, 2024 (the “Purchase Agreement”) for the

sale (the “Transaction”) of its Clear Creek Property to Sitka Gold

Corp. (“Sitka”).

The Clear Creek Property claims adjoin Sitka’s

road accessible RC Gold Project, located approximately 100

kilometers east of Dawson City, Yukon and cover the southern

portion of the Clear Creek Intrusive Complex.

“We have been impressed with the exploration

success that Sitka has demonstrated at its RC Gold Project,” stated

John McConnell, President and CEO of Victoria. “Combining the RC

Gold Project and Victoria’s Clear Creek Property consolidates this

new Yukon gold camp. Sitka has a strong exploration team with

decades of experience in Yukon. We expect Sitka will have further

success exploring the combined project and Victoria will benefit as

a significant Sitka shareholder.”

Transaction TermsPursuant to

the Purchase Agreement, Sitka issued to Victoria an aggregate of

21,843,401 common shares in the capital of Sitka (the “Shares”) as

an initial payment, representing 8% of the issued and outstanding

shares of Sitka after giving effect to the issuance of the Shares.

In order to complete the Transaction, Sitka is required to make the

following additional payments (each a “Deferred Payment”):

- $2,000,000 on or before August 30,

2025;

- $3,000,000 on or before June 24,

2026; and

- $6,000,000 on or before June 24,

2027.

During the term of the Purchase Agreement while

the Deferred Payments are pending, Sitka will act as operator of

the Clear Creek Property and have control over its work programme.

Sitka may, in its sole discretion, satisfy any Deferred Payment in

cash or through the issuance of such number of Shares as is equal

to the amount of the applicable Deferred Payment based on the

volume weighted average price of the Shares on the TSX Venture

Exchange (the “Exchange”) (or such other exchange upon which the

Shares are then listed) for the 20 consecutive trading days

immediately prior to the due date of the applicable Deferred

Payment, provided however that in the event that any such Share

issuance would result in Victoria holding greater than 19.9% of the

issued and outstanding Shares, Sitka must first obtain: (i) the

written consent of Victoria to receive such Shares; and (ii)

approval of the shareholders of Sitka in accordance with Exchange

policies.

As additional consideration, upon completion of

the Transaction, Sitka will grant to Victoria a 5.0% net smelter

return royalty on the Clear Creek Property (the “NSR Royalty”).

Sitka shall have the right at any time following the grant of the

NSR Royalty to purchase from Victoria 60% of the NSR Royalty by way

of a one-time cash payment of $10,000,000.

In the event that Sitka publicly delineates

proven and probable mineral reserves (within the meaning of

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) of 2,000,000 ounces or more of gold or gold

equivalent on the Clear Creek Property, then Sitka shall make an

additional payment of $10,000,000 in cash to Victoria within 60

business days of such public delineation. In the event that Sitka

has not made such public delineation before the fifth anniversary

of the Purchase Agreement, then Victoria shall have the right to

cause an evaluation by an independent qualified person (within the

meaning of NI 43-101) to be conducted as to the extent of the

mineral resources on the Clear Creek Property, and, in the event

such qualified person determines the existence of measured and/or

indicated resources (within the meaning of NI 43-101) of 2,000,000

ounces or more of gold or gold equivalent on the Clear Creek

Property, then Sitka shall make the $10,000,000 cash payment to

Victoria within 60 business days.

In connection with the Purchase Agreement, the

parties have entered into an investor rights agreement pursuant to

which, among other things: (i) at any time in which Victoria shall

have beneficial ownership of at least 15% of the issued and

outstanding Shares of Sitka, Victoria shall have the right to

nominate one director to the board of directors of Sitka; and (ii)

Victoria has been granted certain customary anti-dilution and

registration rights.

Qualified PersonThe technical

content of this news release has been reviewed and approved by Paul

D. Gray, P.Geo., who is a “Qualified Person” as defined in National

Instrument 43-101 - Standards of Disclosure for Mineral

Projects.

About the Dublin Gulch

PropertyVictoria Gold's 100%-owned Dublin Gulch gold

property (the “Property”) is situated in central Yukon Territory,

Canada, approximately 375 kilometers north of the capital city of

Whitehorse, and approximately 85 kilometers from the town of Mayo.

The Property is accessible by road year round, and is located

within Yukon Energy's electrical grid.

The Property covers an area of approximately 555

square kilometers, and is the site of the Company's Eagle and Olive

Gold Deposits. As at December 31, 2023, and adjusting for mining

depletion through this date, the Eagle and Olive Deposits include

Proven and Probable Reserves of 2.3 million ounces of gold from 114

million tonnes of ore with a grade of 0.63 grams of gold per tonne.

As at December 31, 2023, and adjusting for mining depletion through

this date, the Mineral Resource for the Eagle and Olive Gold

Deposits are estimated to host 234 million tonnes averaging 0.59

grams of gold per tonne, containing 4.4 million ounces of gold in

the "Measured and Indicated" category, inclusive of Proven and

Probable Reserves, and a further 36 million tonnes averaging 0.63

grams of gold per tonne, containing 0.7 million ounces of gold in

the "Inferred" category.

Cautionary Language and Forward-Looking

StatementsThis press release includes certain statements

that may be deemed "forward-looking statements". Except for

statements of historical fact relating to Victoria, information

contained herein constitutes forward-looking information, including

any information related to the intended use of proceeds from the

Term Facility and the Revolving Credit Facility, the amended terms

and conditions of the Loan Facility, and Victoria's strategy, plans

or future financial or operating performance. Forward-looking

information is characterized by words such as “plan”, “expect”,

“budget”, “target”, “project”, “intend”, “believe”, “anticipate”,

“estimate” and other similar words, or statements that certain

events or conditions “may”, “will”, “could” or “should” occur, and

includes any guidance and forecasts set out herein (including, but

not limited to, production and operational guidance of the

Corporation). In order to give such forward-looking information,

the Corporation has made certain assumptions about its business,

operations, the economy and the mineral exploration industry in

general, in particular in light of the impact of the novel

coronavirus and the COVID-19 disease (“COVID-19”) on each of the

foregoing. In this respect, the Corporation has assumed that

production levels will remain consistent with management’s

expectations, contracted parties provide goods and services on

agreed timeframes, equipment works as anticipated, required

regulatory approvals are received, no unusual geological or

technical problems occur, no material adverse change in the price

of gold occurs and no significant events occur outside of the

Corporation's normal course of business. Forward-looking

information is based on the opinions, assumptions and estimates of

management considered reasonable at the date the statements are

made, and are inherently subject to a variety of risks and

uncertainties and other known and unknown factors that could cause

actual events or results to differ materially from those described

in, or implied by, the forward-looking information. These factors

include the impact of general business and economic conditions,

risks related to COVID-19 on the Company, global liquidity and

credit availability on the timing of cash flows and the values of

assets and liabilities based on projected future conditions,

anticipated metal production, fluctuating metal prices, currency

exchange rates, estimated ore grades, possible variations in ore

grade or recovery rates, changes in accounting policies, changes in

Victoria's corporate resources, changes in project parameters as

plans continue to be refined, changes in development and production

time frames, the possibility of cost overruns or unanticipated

costs and expenses, uncertainty of mineral reserve and mineral

resource estimates, higher prices for fuel, steel, power, labour

and other consumables contributing to higher costs and general

risks of the mining industry, failure of plant, equipment or

processes to operate as anticipated, final pricing for metal sales,

unanticipated results of future studies, seasonality and

unanticipated weather changes, costs and timing of the development

of new deposits, success of exploration activities, requirements

for additional capital, permitting time lines, government

regulation of mining operations, environmental risks, unanticipated

reclamation expenses, title disputes or claims, limitations on

insurance coverage and timing and possible outcomes of pending

litigation and labour disputes, risks related to remote operations

and the availability of adequate infrastructure, fluctuations in

price and availability of energy and other inputs necessary for

mining operations. Although Victoria has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in, or implied

by, the forward-looking information, there may be other factors

that cause actions, events or results not to be anticipated,

estimated or intended. There can be no assurance that

forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. The reader is cautioned not to

place undue reliance on forward-looking information. The

forward-looking information contained herein is presented for the

purpose of assisting investors in understanding Victoria's expected

financial and operational performance and Victoria's plans and

objectives and may not be appropriate for other purposes. All

forward-looking information contained herein is given as of the

date hereof, as the case may be, and is based upon the opinions and

estimates of management and information available to management of

the Corporation as at the date hereof. The Corporation undertakes

no obligation to update or revise the forward-looking information

contained herein and the documents incorporated by reference

herein, whether as a result of new information, future events or

otherwise, except as required by applicable laws.

For Further Information

Contact:John McConnellPresident & CEOVictoria Gold

CorpTel: 604-695-6605ceo@vgcx.com

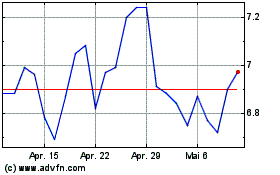

Victoria Gold (TSX:VGCX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

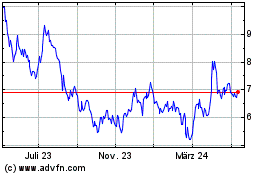

Victoria Gold (TSX:VGCX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025