Ur-Energy's Shirley Basin In Situ

Uranium Project Receives All Major Permits

Effectively Doubling Licensed and

Permitted Production Capacity of Company

Littleton,

CO -- May 6, 2021 -- InvestorsHub NewsWire

-- Ur-Energy

Inc. (NYSE American: URG) (TSX: URE) (the "Company" or "Ur-Energy")

is pleased

to announce

that

the

State of Wyoming and the

EPA have completed their

respective reviews of the Shirley Basin In Situ

Uranium Project (the

"Project") and have issued the

final

Source and

Byproduct Material License, Permit to

Mine, and Aquifer Exemption

for the

Project. These three approvals

represent the final major permits required

to begin construction of the Shirley Basin

project. We received

BLM final

approval of the Project, following its NEPA review

process, in April

2020.

In addition

to the recent receipt of

a

License Amendment to include the LC East and KM amendment

areas in our existing Lost Creek

license

(See

Ur-Energy News

Release, March 29, 2021), these Shirley Basin license

and

permit

approvals effectively

double our authorized

Wyoming-based uranium

recovery production

capacity.

The

Shirley Basin Project hosts 8.8M

pounds of Measured and Indicated Uranium Resources contained in

1.915M short tons at an average grade of 0.23% U3O8

as disclosed in

our Preliminary Economic Assessment Shirley Basin Uranium Project

(January 27, 2015). The Company plans three relatively shallow

mining units at the Project, where we have the option of either

building out a complete processing plant with drying facilities or a

satellite plant with the ability to send loaded ion exchange resin

to our Lost Creek

Project for processing.

The Shirley

Basin processing facility throughput shall not exceed an average

daily flow rate equivalent to 6,000 gallons per minute or a maximum

instantaneous flow rate of 6,500 gallons per minute, excluding

restoration flow. The annual production of

dried

yellowcake (U3O8)

from wellfield production and toll processing of loaded resin or

yellowcake slurry shall not exceed 2M pounds equivalent of

dried U3O8

product. The brownfield Project is

within an historic mining district with existing

access,

power, waste disposal facility and shop buildings onsite.

The

Project

is construction

ready, since delineation

and

exploration drilling

were

completed historically.

Additionally,

all

wellfield,

pipeline

and header house layouts are finalized. Historic production from the Shirley

Basin mine, including 1.5M pounds U3O8

from in situ

mining, was 28.3M pounds U3O8.

Company

Chairman

and CEO Jeff Klenda stated, "The in situ technology

now used to recover

uranium across the globe

was

likely

first commercially

utilized

at the Shirley

Basin Mine beginning in 1963 with two successful mine

units. We are excited to bring this technology

back to

its

birthplace and believe our

predecessors

would be proud of how far their

technology has come."

The Company remains prepared to expand

wellfield

production

within the

already fully permitted areas of

Lost

Creek to

an annualized run rate of approximately

one

million

pounds when

conditions warrant. Our long-tenured

operational and professional

staff

have significant

levels of experience and

adaptability which will

allow for an

easier transition back to full operations. Lost Creek

operations can increase to full

production rates in as

little as six

months following a

"go" decision, simply by

developing additional header houses within the fully permitted

Mine

Unit 2 ("MU2"). Development expenses during

the six-month

ramp up period

in MU2 are estimated to be

approximately $14 million and

are

almost

entirely related to

further

well

installation and header house

construction costs. We are prepared to ramp up

and to deliver our Lost Creek production inventory to the

national uranium

reserve being established by

the U.S. Department

of

Energy

pursuant to funding and directive of

Congress. (See

Ur-Energy News Release,

December 22, 2020.)

In February

2021, we raised gross proceeds of $15.2 million

through

an underwritten

public offering. Our

cash position

as of February

24, 2021, was $18.6

million.

In addition to

our strong cash position, we

have nearly 285,000 pounds of finished, ready-to-sell inventory,

worth approximately

$8.6 million at

recent

spot prices.

The financing

allows us to preserve

our

existing inventory for higher

prices. The financing

provides

us

adequate funds to maintain and

enhance operational readiness, for possible future acquisitions, and for general

working capital purposes.

John

K. Cooper,

Ur-Energy Senior

Geologist,

SME

Registered

Member,

and

a

Qualified

Person

as

defined

by NI 43-101,

has reviewed

and approved

the technical

disclosure

contained in this news release.

About

Ur-Energy:

Ur-Energy

is a

uranium mining

company operating the Lost Creek in-situ

recovery

uranium

facility

in south-central

Wyoming. We have produced, packaged, and shipped

approximately

2.6 million pounds from Lost Creek since

the commencement of operations.

Ur-Energy

now

has all

major

permits and

authorizations

to begin

construction at

Shirley

Basin, the Company's second in

situ recovery uranium facility in Wyoming and is in the

process of obtaining remaining amendments

to Lost Creek

authorizations for expansion of

Lost

Creek. Ur-Energy is engaged in uranium

mining, recovery and processing activities, including

the acquisition,

exploration, development, and operation of

uranium

mineral properties

in the United

States. The primary trading

market for Ur-Energy's common shares is

on the

NYSE American under the symbol

"URG." Ur-Energy's common shares also

trade on the Toronto Stock

Exchange under the symbol "URE." Ur-Energy's

corporate

office is located in Littleton,

Colorado and its registered

office is located in Ottawa,

Ontario.

For

further information, please contact:

Jeffrey T. Klenda,

Chairman and CEO

+1 720-981-4588

Jeff.Klenda@Ur-Energy.com

Cautionary

Note

Regarding

Forward-Looking Statements:

This release may contain

"forward-looking statements" within the meaning of applicable

securities laws regarding

events or conditions

that

may

occur in the future (e.g.,

the

timing for

remaining authorizations

amending

the

Lost Creek

permits, to allow for recovery in

the

KM horizon and

LC East Project; the timing for establishment

of

the

national

uranium

reserve, its impact on the domestic

uranium

market, and the Company's role in the

program;

the timing to determine future operational

plans to

ramp up

production at Lost Creek and/or

to develop and construct for operations at Shirley Basin; the

ability to readily and

cost-effectively

ramp up

at

Lost

Creek at

currently

projected development expenses; anticipated life of mine at Shirley Basin

Project; and whether the Company's recent financing provides

adequate funds to maintain operational readiness and support

possible acquisitions) and are

based

on

current expectations

that, while

considered reasonable by

management at this time,

inherently involve a number of significant business,

economic, technical

and competitive

risks, uncertainties and contingencies. Generally, forward-looking

statements can be

identified

by the use

of

forward-looking terminology such as

"plans," "expects," "does not expect,"

"is expected," "is likely," "estimates,"

"intends," "anticipates," "does not anticipate," or

"believes," or variations

of

the

foregoing, or statements that

certain

actions,

events or

results "may," "could," "might"

or

"will

be taken," "occur," "be achieved"

or

"have

the

potential to." All statements, other than statements of historical

fact, are considered to be

forward-looking statements.

Forward-looking

statements

involve

known and unknown

risks,

uncertainties and

other

factors which may cause the actual

results, performance or achievements of

the Company to be materially different from any future

results,

performance

or achievements express or

implied by the

forward-looking

statements. Factors that could cause actual

results to

differ materially from any forward-looking statements include, but

are not limited to, capital and other costs varying

significantly from

estimates; fluctuations in commodity

prices; failure to establish

estimated

resources;

the grade and recovery

of

mineral

resources which are mined varying from estimates; production

rates, methods and amounts varying from estimates; delays in

obtaining or failures to obtain required

governmental,

environmental

or other

project

approvals;

changes to regulatory

and

legal

requirements; inflation;

changes

in

exchange rates; delays in

development, and other factors

described in the

public filings made by the Company at www.sedar.com

and

www.sec.gov. Readers should

not place undue

reliance on forward-looking statements. The forward-looking

statements contained herein are based on the beliefs, expectations

and opinions of management as of the

date

hereof and

Ur-Energy

disclaims any intent

or

obligation to update them

or revise them to

reflect any change in circumstances or in management's

beliefs, expectations or opinions that occur in the

future.

10758 W. Centennial Rd. Suite

200

Littleton, CO 80127

Phone: 720.981.4588

Fax:

720.981.5643

www.ur-energy.com

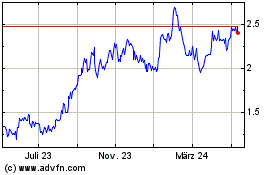

Ur Energy (TSX:URE)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

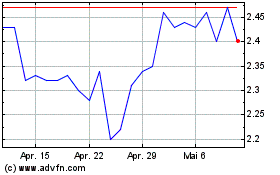

Ur Energy (TSX:URE)

Historical Stock Chart

Von Feb 2024 bis Feb 2025