Touchstone Exploration Inc. (“Touchstone” or the “Company”) (TSX /

LSE: TXP) announces its financial and operating results for the

three and nine months ended September 30, 2018. Selected financial

and operational information is outlined below and should be read in

conjunction with Touchstone’s September 30, 2018 unaudited interim

consolidated financial statements and the related Management’s

discussion and analysis, both of which will be available under the

Company’s profile on SEDAR (www.sedar.com) and the Company’s

website (www.touchstoneexploration.com). Unless otherwise stated,

tabular amounts herein are in thousands of Canadian dollars, and

amounts in text are rounded to thousands of Canadian dollars.

Third Quarter Highlights

- Achieved average crude oil

production of 1,758 barrels per day (“bbls/d”), representing an

increase of 22% from the third quarter of 2017.

- Continued our 2018 development

program with total drilling and development capital expenditures of

$4,543,000, drilling three wells and performing 12 well

recompletions.

- Realized $12,890,000 in petroleum

sales, a 63% increase from the prior year third quarter.

- Generated an operating netback of

$37.13 per barrel, a 52% increase relative to the $24.46 per barrel

generated in the prior year comparative quarter.

- Delivered funds flow from

operations of $3,260,000 ($0.03 per basic share) compared to

$1,387,000 ($0.01 per basic share) in the third quarter of

2017.

- Recognized net earnings of $267,000

compared to a net loss of $1,203,000 reported in the equivalent

quarter of 2017.

- Exited the quarter with net debt of

$12,975,000, representing 1.0 times net debt to third quarter 2018

annualized funds flow from operations.

| |

| Financial and Operating Results

Summary |

| |

|

|

Three months ended |

|

Nine months ended |

|

|

|

September 30, |

% |

September 30, |

% |

| |

2018 |

2017 |

change |

2018 |

2017 |

change |

|

|

|

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average daily oil production (bbls/d) |

1,758 |

1,437 |

22 |

1,674 |

1,351 |

24 |

|

|

|

|

|

|

|

|

| Net

wells drilled |

3 |

1 |

200 |

8 |

4 |

100 |

| Net

wells recompleted |

12 |

3 |

300 |

21 |

13 |

62 |

|

|

|

|

|

|

|

|

| Brent

benchmark price (US$/bbl) |

75.10 |

52.10 |

44 |

72.15 |

51.75 |

39 |

|

|

|

|

|

|

|

|

|

Operating netback(1) ($/bbl) |

|

|

|

|

|

|

| Realized

sales price |

79.71 |

59.64 |

34 |

78.32 |

61.58 |

27 |

|

Royalties |

(20.52) |

(14.59) |

41 |

(21.46) |

(17.07) |

26 |

|

Operating expenses |

(22.06) |

(20.59) |

7 |

(20.46) |

(21.81) |

(6) |

|

|

37.13 |

24.46 |

52 |

36.40 |

22.70 |

60 |

|

|

|

|

|

|

|

|

|

Financial ($000’s except share and per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum sales |

12,890 |

7,885 |

63 |

35,782 |

22,712 |

58 |

|

|

|

|

|

|

|

|

| Funds

flow from operations |

3,260 |

1,387 |

135 |

9,119 |

2,218 |

311 |

| Per share

– basic(1) |

0.03 |

0.01 |

200 |

0.07 |

0.02 |

250 |

| Per share

– diluted(1) |

0.02 |

0.01 |

100 |

0.07 |

0.02 |

250 |

|

|

|

|

|

|

|

|

| Net

earnings (loss) |

267 |

(1,203) |

n/a |

(300) |

(4,600) |

n/a |

| Per share

– basic and diluted |

0.00 |

(0.01) |

n/a |

(0.00) |

(0.05) |

n/a |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

|

|

|

|

|

Exploration |

578 |

202 |

186 |

1,240 |

910 |

36 |

|

Development |

4,543 |

1,889 |

140 |

12,684 |

7,375 |

72 |

|

|

5,121 |

2,091 |

145 |

13,924 |

8,285 |

68 |

|

|

|

|

|

|

|

|

| Net

debt(1) – end of period |

|

|

|

|

|

|

| Working

capital surplus |

|

|

|

(2,025) |

(402) |

|

| Principal

long-term balance of loan |

|

|

|

15,000 |

15,000 |

|

|

|

|

|

|

12,975 |

14,598 |

(11) |

|

|

|

|

|

|

|

|

| Weighted

average shares outstanding (000’s) |

|

|

|

|

|

|

Basic |

129,021 |

103,137 |

25 |

129,021 |

90,243 |

43 |

|

Diluted |

130,728 |

103,137 |

27 |

129,021 |

90,243 |

43 |

| Outstanding

shares – end of period (000’s) |

|

|

129,021 |

103,137 |

25 |

|

|

|

|

|

|

|

|

| |

| Note: |

| (1) See “Advisories: Non-GAAP Measures”. |

| |

Operating Results

In the third quarter we continued with our

expanded 2018 drilling campaign by successfully drilling three

wells, bringing the total to eight development wells drilled

through September 30, 2018. Capital expenditures totaled

$5,121,000, of which $4,543,000 related to drilling and development

activities. We recompleted 12 wells in the quarter, with an

aggregate 21 wells recompleted through September 30, 2018.

Third quarter 2018 crude oil production averaged

1,758 bbls/d, a 22% increase relative to the 1,437 bbls/d produced

in the third quarter of 2017. Third quarter average daily

production increased 2% from the second quarter of 2018, with

growth slowed by weather based electrical supply disruptions and

higher than normal crude oil inventory held at September 30,

2018.

The eight wells drilled in 2018 combined to add

approximately 249 bbls/d of incremental production in the third

quarter, despite two new wells beginning to produce in mid-August

and one well initiating production at the end of September. The

four wells drilled in 2017 continued to perform above internal

expectations, contributing approximately 351 bbls/d of production

in the quarter.

Financial Results

Our third quarter operating netback was

$6,004,000 ($37.13 per barrel), an improvement of 86% compared to

$3,234,000 ($24.46 per barrel) recorded in the third quarter of

2017. Higher realized prices and production resulted in a

$5,005,000 increase in petroleum sales relative to the third

quarter of 2017. This was offset by higher royalties of $1,390,000

from increased production and the sliding scale effect of increased

commodity pricing to royalty rates. Operating costs increased by

$845,000 from the prior year comparative quarter based on variable

costs from increased production and increased well site security

and monitoring costs.

We generated funds flow from operations of

$3,260,000 in the third quarter of 2018 versus $1,387,000 in the

equivalent quarter of 2017. The increase in funds flow was largely

attributed to stronger realized crude oil pricing and operating

netback combined with a 22% increase in production. As a result, we

generated net earnings of $267,000 in the quarter, compared to a

net loss of $1,203,000 reported in the prior year comparative

quarter.

We maintained stable financial liquidity,

exiting the quarter with positive working capital of $2,025,000 and

a $15,000,000 principal term loan balance. Our September 30, 2018

net debt of $12,975,000 represented net debt to trailing

twelve-month funds flow from operations of 1.3 times and net debt

to third quarter 2018 annualized funds flow from operation of 1.0

times.

Operations

Touchstone delivered October 2018 crude oil

average sales volumes of 1,964 bbls/d at an average realized price

of $89.13 (US$68.48) per barrel. After achieving field estimated

peak production of 2,088 bbls/d buoyed by flush production from the

new WD-8 completed in early October, production volumes decreased

as the wells were converted from flowing to pumping production.

We spud the ninth well of our 2018 drilling

program on November 1, 2018, and we expect the well to reach total

depth within the next two days. The well is located on our WD-8

property and will be followed by the drilling of two additional

wells in WD-8 from a common surface location. The Company has

contracted a second third party rig to drill an additional WD-4

location, with spudding expected by the end of the month.

Touchstone anticipates that the four wells will be drilled and

completed by the end of the year.

We previously planned on utilizing a separate

rig to drill two shallow work commitment wells on our South Palo

Seco property prior to the end of the year. However, Petrotrin

identified internal surface lease issues with the two previously

approved locations. This will result in the Company drilling a

total of 12 wells by year-end, with the two Palo Seco wells likely

being pushed into the 2019 drilling program.

The Petroleum Company of Trinidad and

Tobago Limited (“Petrotrin”) Restructuring

On August 28, 2018, Petrotrin announced its

intention to discontinue refining operations and focus on upstream

production and exploration activities. This restructuring is

expected to be completed prior to the end of the year. The Company

subleases various petroleum production and exploration rights from

Petrotrin and the national oil company is currently the Company’s

sole purchaser of crude oil.

The Company has been officially informed that

Petrotrin will continue to meet its contractual operations and

commitments throughout the transition process. Petrotrin has

indicated that it will be meeting with all pertinent stakeholders

following completion of the restructuring to discuss future changes

and opportunities.

We do not expect the restructuring to impact our

current crude oil production and marketing arrangements and future

operations. We believe our crude oil will continue to be purchased

by Petrotrin and consolidated with all Trinidad production for

export. Touchstone is looking forward to working with the

restructured national oil company to grow crude oil production in

Trinidad.

About Touchstone

Touchstone Exploration Inc. is a Calgary based

company engaged in the business of acquiring interests in petroleum

and natural gas rights, and the exploration, development,

production and sale of petroleum and natural gas. Touchstone is

currently active in onshore properties located in the Republic of

Trinidad and Tobago. The Company's common shares are traded on the

Toronto Stock Exchange and the AIM market of the London Stock

Exchange under the symbol “TXP”.

Advisories

Non-GAAP Measures

This news release contains terms commonly used

in the oil and natural gas industry, including funds flow from

operations per share, operating netback and net debt. These terms

do not have a standardized meaning under International Financial

Reporting Standards and may not be comparable to similar measures

presented by other companies. Shareholders and investors are

cautioned that these measures should not be construed as

alternatives to cash provided by operating activities, net income,

total liabilities, or other measures of financial performance as

determined in accordance with Generally Accepted Accounting

Principles. Management uses these Non-GAAP measures for its own

performance measurement and to provide stakeholders with measures

to compare the Company’s operations over time.

The Company calculates funds flow from

operations per share by dividing funds flow from operations by the

weighted average number of common shares outstanding during the

applicable period.

The Company uses operating netback as a key

performance indicator of field results. Operating netback is

presented on an absolute and per barrel basis and is calculated by

deducting royalties and operating expenses from petroleum sales. If

applicable, the Company also discloses operating netback both prior

to realized gains or losses on derivatives and after the impacts of

derivatives are included. Realized gains or losses represent the

portion of risk management contracts that have settled in cash

during the period, and disclosing this impact provides Management

and investors with transparent measures that reflect how the

Company’s risk management program can impact netback metrics. The

Company considers operating netback to be a key measure as it

demonstrates Touchstone’s profitability relative to current

commodity prices.

The Company closely monitors its capital

structure with a goal of maintaining a strong financial position in

order to fund current operations and the future growth of the

Company. The Company monitors working capital and net debt as part

of its capital structure to assess its true debt and liquidity

position and to manage capital and liquidity risk. Net debt is

calculated by summing the Company’s working capital and the

principal (undiscounted) amount of long-term debt. Working capital

is calculated as current assets less current liabilities as they

appear on the statements of financial position.

Forward-Looking Statements

Certain information provided in this news

release may constitute forward-looking statements within the

meaning of applicable securities laws. Forward-looking information

in this news release may include, but is not limited to, statements

relating to field estimated production, Petrotrin’s restructuring

plans, timing thereof, and the effect on the Company’s operating

and marketing agreements and future operations, the potential

undertaking, timing, locations and costs of future well drilling

and completion activities, and the sufficiency of resources to fund

future well drilling operations. Although the Company believes that

the expectations and assumptions on which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because the Company can

give no assurance that they will prove to be correct. Since

forward-looking statements address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently

anticipated due to a number of factors and risks. Certain of these

risks are set out in more detail in the Company’s December 31, 2017

Annual Information Form dated March 26, 2018 which has been filed

on SEDAR and can be accessed at www.sedar.com. The forward-looking

statements contained in this news release are made as of the date

hereof, and except as may be required by applicable securities

laws, the Company assumes no obligation to update publicly or

revise any forward-looking statements made herein or otherwise,

whether as a result of new information, future events or

otherwise.

Contact

Mr. Paul Baay, President and Chief Executive

Officer; orMr. Scott Budau, Chief Financial Officer; orMr. James

Shipka, Chief Operating OfficerTelephone:

403.750.4487www.touchstoneexploration.com

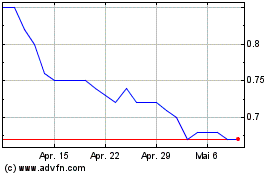

Touchstone Exploration (TSX:TXP)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Touchstone Exploration (TSX:TXP)

Historical Stock Chart

Von Mär 2024 bis Mär 2025