Touchstone Exploration Inc. (“Touchstone” or the “Company”) (TSX /

LSE: TXP) announces its financial and operating results for the

three and six months ended June 30, 2018. Selected financial and

operational information is outlined below and should be read in

conjunction with Touchstone’s June 30, 2018 unaudited interim

consolidated financial statements and the related Management’s

discussion and analysis, both of which will be available under the

Company’s profile on SEDAR (www.sedar.com) and the Company’s

website (www.touchstoneexploration.com). Tabular amounts herein are

in thousands of Canadian dollars, and the amounts in text are

rounded to thousands of Canadian dollars unless otherwise

stated.

Highlights

- Achieved quarterly average crude oil production of 1,717

barrels per day (“bbls/d”), representing increases of 11% and 29%

from the first quarter of 2018 and the second quarter of 2017,

respectively.

- Continued our 2018 development program with total drilling and

development capital expenditures of $4,520,000, drilling three

wells and performing four well recompletions.

- Realized $12,508,000 in petroleum

sales, a 68% increase from the prior year second quarter.

- Generated an operating netback of $38.19 per barrel, a 92%

increase relative to the $19.88 per barrel generated in the prior

year comparative quarter.

- Delivered funds flow from operations of $3,258,000 ($0.03 per

basic share) compared to $438,000 ($0.01 per basic share) in the

second quarter of 2017.

- Recognized a reduced net loss of $692,000 ($0.01 per basic

share) compared to a net loss of $1,848,000 ($0.02 per basic share)

realized in the equivalent quarter of 2017.

- Extended our $15 million term loan maturity date and initial

principal repayments by one year.

- Maintained balance sheet strength with second quarter cash of

$10,556,000 and net debt of $11,266,000, representing 1.0 times net

debt to first half 2018 annualized funds flow from operations.

- Expanded our 2018 drilling program from ten to fourteen

wells.

Financial and Operating Results Summary

|

|

Three months ended |

Six months ended |

|

|

June 30, 2018 |

March 31, 2018 |

June 30, 2017 |

June 30, 2018 |

June 30, 2017 |

| |

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

|

|

|

|

|

|

|

Average daily oil production (bbls/d) |

1,717 |

|

1,543 |

|

1,334 |

|

1,631 |

|

1,307 |

|

|

|

|

|

|

|

|

| Net

wells drilled |

3 |

|

2 |

|

3 |

|

5 |

|

3 |

|

| Net

wells recompleted |

4 |

|

5 |

|

5 |

|

9 |

|

10 |

|

|

|

|

|

|

|

|

| Brent

benchmark price (US$/bbl) |

74.53 |

|

66.86 |

|

49.55 |

|

70.67 |

|

51.57 |

|

|

|

|

|

|

|

|

|

Operating netback(1) ($/bbl) |

|

|

|

|

|

|

Realized sales price |

80.04 |

|

74.76 |

|

61.26 |

|

77.55 |

|

62.67 |

|

|

Royalties |

(22.59 |

) |

(21.27 |

) |

(16.03 |

) |

(21.97 |

) |

(18.46 |

) |

|

Operating expenses |

(19.26 |

) |

(19.96 |

) |

(25.35 |

) |

(19.59 |

) |

(22.49 |

) |

|

|

38.19 |

|

33.53 |

|

19.88 |

|

35.99 |

|

21.72 |

|

|

|

|

|

|

|

|

|

Financial ($000’s except share and per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

Petroleum sales |

12,508 |

|

10,384 |

|

7,436 |

|

22,892 |

|

14,827 |

|

|

|

|

|

|

|

|

| Funds

flow from operations |

3,258 |

|

2,601 |

|

438 |

|

5,859 |

|

831 |

|

|

Per share – basic and diluted(1) |

0.03 |

|

0.02 |

|

0.01 |

|

0.05 |

|

0.01 |

|

|

|

|

|

|

|

|

| Net

(loss) earnings |

(692 |

) |

125 |

|

(1,848 |

) |

(567 |

) |

(3,397 |

) |

|

Per share – basic and diluted |

(0.01 |

) |

0.01 |

|

(0.02 |

) |

(0.01 |

) |

(0.04 |

) |

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

|

|

|

|

Exploration |

434 |

|

228 |

|

520 |

|

662 |

|

708 |

|

|

Development |

4,520 |

|

3,621 |

|

4,940 |

|

8,141 |

|

5,486 |

|

|

|

4,954 |

|

3,849 |

|

5,460 |

|

8,803 |

|

6,194 |

|

|

|

|

|

|

|

|

| Net

debt(1) – end of period |

|

|

|

|

|

|

Working capital surplus |

(3,734 |

) |

(4,922 |

) |

(1,186 |

) |

(3,734 |

) |

(1,186 |

) |

|

Principal long-term balance of loan |

15,000 |

|

14,190 |

|

15,000 |

|

15,000 |

|

15,000 |

|

|

|

11,266 |

|

9,268 |

|

13,814 |

|

11,266 |

|

13,814 |

|

|

|

|

|

|

|

|

| Weighted

average shares outstanding |

|

|

|

|

|

Basic |

129,021,428 |

|

129,021,428 |

|

84,236,044 |

|

129,021,428 |

|

83,689,629 |

|

|

Diluted |

130,022,267 |

|

129,691,693 |

|

84,236,044 |

|

129,841,928 |

|

83,689,629 |

|

|

Outstanding shares – end of period |

129,021,428 |

|

129,021,428 |

|

103,137,143 |

|

129,021,428 |

|

103,137,143 |

|

|

|

|

|

|

|

|

Note:

- See “Advisories: Non-GAAP Measures”.

Operating Results

Our operating results in the second quarter were

consistent with our expectations, as we continued with our ten well

drilling campaign by successfully drilling three development wells

and spudding the sixth well of the program on June 15, 2018.

Capital expenditures totaled $4,954,000, of which $4,520,000

related to drilling and development activities. We recompleted four

wells in the quarter, with an aggregate nine wells recompleted in

the first half of 2018.

Second quarter 2018 crude oil production

averaged 1,717 bbls/d, a 29% increase relative to the 1,334 bbls/d

produced in the second quarter of 2017 and a 11% increase relative

to the 1,543 bbls/d produced in the first quarter of 2018. The five

wells drilled to date in 2018 combined to add 183 bbls/d of

incremental production in the second quarter. Our four well 2017

program continued to perform above internal expectations,

contributing approximately 351 bbls/day of production in the

quarter.

Financial Results

Our second quarter operating netback improved

92% to $38.19 per barrel, as compared to $19.88 per barrel in the

second quarter of 2017. Realized second quarter 2018 crude oil

pricing was $80.04 (US$61.79) per barrel, 31% greater than the

$61.26 (US$45.51) per barrel received in the equivalent quarter of

2017. In comparison to the second quarter of 2017, royalty expenses

per barrel increased 41% based on the rising scale effect of

increased commodity prices to royalty rates. Second quarter 2018

operating costs per barrel decreased 24% from the corresponding

quarter of 2017, predominantly from increased production over a

fixed operating cost base and increased operating efficiencies.

We generated funds flow from operations of

$3,258,000 ($0.03 per basic share) in the second quarter of 2018

versus $438,000 ($0.01 per basic share) in the second quarter of

2017. The increase in funds flow was largely attributed to stronger

oil price realizations and operating netbacks. Excluding realized

financial derivative gains, our second quarter 2018 funds flow was

the highest since the third quarter of 2014. As a result, the

Company decreased its net loss by 63% from the prior year second

quarter, recording a net loss of $692,000 ($0.01 per basic share)

during the three months ended June 30, 2018. We maintained strong

financial liquidity, exiting the quarter with a cash balance of

$10,556,000, a working capital surplus of $3,734,000 and a

$15,000,000 principal term loan balance. Our June 30, 2018 net debt

of $11,266,000 represented net debt to trailing twelve-month funds

flow from operations of 1.4 times and net debt to year to date

second quarter 2018 annualized funds flow from operations of 1.0

times. We expect our liquidity position to be stable going forward

as the new wells drilled in the quarter are placed onto production

and optimized.

On June 13, 2018, we extended the maturity of

our $15 million term loan by one year to November 23, 2022, with no

mandatory principal payments until January 1, 2020. In addition,

the amended agreement removed the minimum $5 million quarterly cash

reserves financial covenant. The credit facility is covenant

based and does not require annual or semi-annual reviews. We were

well within the financial covenants as at June 30, 2018. The

one-year deferral of principal payments will allow us to continue

our near-term development strategy into 2019.

On June 21, 2018, we entered an agreement to

dispose of our 50% operating working interest in our non-core

Icacos block to our third-party partner for minimum consideration

of US$500,000. Consideration will be paid based on the Company’s

working interest net revenue it would have received had it retained

such interest through December 2021. The property averaged 10

bbls/d of net crude oil production in the second quarter of 2018.

The agreement was effective April 1, 2018 and remains subject to

local regulatory approvals.

Increase in 2018 Drilling

Program

We are increasing our 2018 capital program by

US$4.8 million, which will result in four additional wells drilled

prior to year-end. The Company expects to drill the four additional

wells on our WD-4 and WD-8 properties. The additional fourth

quarter capital is expected to add incremental production volumes

in early 2019 and further improve the Company’s growth plans.

About Touchstone

Touchstone Exploration Inc. is a Calgary based

company engaged in the business of acquiring interests in petroleum

and natural gas rights, and the exploration, development,

production and sale of petroleum and natural gas. Touchstone is

currently active in onshore properties located in the Republic of

Trinidad and Tobago. The Company's common shares are traded on the

Toronto Stock Exchange and the AIM market of the London Stock

Exchange under the symbol “TXP”.

Advisories

Non-GAAP Measures

This news release contains terms commonly used

in the oil and natural gas industry, including funds flow from

operations per share, operating netback and net debt. These terms

do not have a standardized meaning under International Financial

Reporting Standards and may not be comparable to similar measures

presented by other companies. Shareholders and investors are

cautioned that these measures should not be construed as

alternatives to cash provided by operating activities, net income,

total liabilities, or other measures of financial performance as

determined in accordance with Generally Accepted Accounting

Principles. Management uses these Non-GAAP measures for its own

performance measurement and to provide stakeholders with measures

to compare the Company’s operations over time.

The Company calculates funds flow from

operations per share by dividing funds flow from operations by the

weighted average number of common shares outstanding during the

applicable period.

The Company uses operating netback as a key

performance indicator of field results. Operating netback is

presented on a per barrel basis and is calculated by deducting

royalties and operating expenses from petroleum sales. If

applicable, the Company also discloses operating netback both prior

to realized gains or losses on derivatives and after the impacts of

derivatives are included. Realized gains or losses represent the

portion of risk management contracts that have settled in cash

during the period, and disclosing this impact provides Management

and investors with transparent measures that reflect how the

Company’s risk management program can impact netback metrics. The

Company considers operating netback to be a key measure as it

demonstrates Touchstone’s profitability relative to current

commodity prices.

Net debt is calculated by summing the Company’s

working capital and the principal (undiscounted) amount of

long-term debt. Working capital is calculated as current assets

less current liabilities as they appear on the statements of

financial position. The Company uses this information to assess its

true debt and liquidity position and to manage capital and

liquidity risk.

Forward-Looking Statements

Certain information provided in this news

release may constitute forward-looking statements within the

meaning of applicable securities laws. Forward-looking information

in this news release may include, but is not limited to, statements

relating to the Company’s future liquidity position, the potential

undertaking, timing, locations and costs of future well drilling

and recompletion activities and the sufficiency of resources to

fund future well drilling and recompletion operations. Although the

Company believes that the expectations and assumptions on which the

forward-looking statements are based are reasonable, undue reliance

should not be placed on the forward-looking statements because the

Company can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. Actual results could differ materially from those

currently anticipated due to a number of factors and risks. Certain

of these risks are set out in more detail in the Company’s December

31, 2017 Annual Information Form dated March 26, 2018 which has

been filed on SEDAR and can be accessed at www.sedar.com. The

forward-looking statements contained in this news release are made

as of the date hereof, and except as may be required by applicable

securities laws, the Company assumes no obligation to update

publicly or revise any forward-looking statements made herein or

otherwise, whether as a result of new information, future events or

otherwise.

Contact

Mr. Paul Baay, President and Chief Executive

Officer; orMr. Scott Budau, Chief Financial Officer; orMr. James

Shipka, Chief Operating OfficerTelephone:

403.750.4487www.touchstoneexploration.com

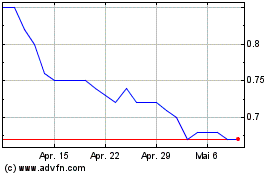

Touchstone Exploration (TSX:TXP)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

Touchstone Exploration (TSX:TXP)

Historical Stock Chart

Von Mär 2024 bis Mär 2025