Altarea and Tikehau Capital Join Forces to Launch a European Real Estate Credit Platform

01 Juni 2023 - 6:30PM

Business Wire

Investors will benefit from leading and

complementary expertise of both groups in Real Estate and Private

Credit

Regulatory News:

Altarea and Tikehau Capital (Paris:TKO) announce today the

launch of a Real Estate Credit platform targeting €1bn with €200m

already secured from both sponsors ensuring strong alignment of

interest.

The fund’s strategy will aim at bridging an anticipated wide

liquidity gap in the market across a range of property types that

will potentially include office, retail, industrial, residential,

logistic and hospitality.

The platform will address a broad array of situations by

providing flexible capital solutions to real estate sponsors and

corporates, with a primary focus on asset-backed and traditional

corporate financings, notably through junior mezzanine or whole

loan debt instruments.

This platform will leverage on Tikehau Capital and Altarea’s

complementary expertise in private credit and real estate asset

classes, providing investors with unique access to the groups’

pipelines and strong networks to identify the most attractive

investment opportunities. Altarea and Tikehau Capital have

long-standing relationships and successful experience, investing

together or in similar strategies.

"We are excited to launch our Real Estate Credit platform as we

see a number of upcoming potential attractive opportunities

throughout Europe," said Antoine Flamarion, co-founder of

Tikehau Capital. "Tikehau Capital has a strong track record in

real estate and private credit, and we believe that this platform

will offer investors potential attractive returns while providing

much-needed financing solutions for European property owners and

developers, in particular in an environment where interest rates

are rising sharply and liquidity dries up."

"We believe there is a strong momentum to initiate this strategy

today. Real Estate companies and sponsors are still adjusting to

the new environment with higher interest rates, more difficult

refinancing ahead and progressive price discovery on asset values

across all asset classes." said Alain Taravella, Executive

Chairman and Founder of Altarea. "Altarea brings a wealth of

expertise in Real Estate from an equity perspective as an investor

and a developer, providing deep insight into project risk

assessment and the capacity to manage complex situations."

Tikehau Capital already has a solid track record in real estate

credit through its special opportunities franchise and has

completed 15 investments to date in the space, for a total of

c.€500m. The platform and investment process will be guided by

Maxime Laurent-Bellue, Head of Tactical Strategies at Tikehau

Capital1.

***

ABOUT TIKEHAU CAPITAL– FR0013230612 – TKO.FP Tikehau

Capital is a global alternative asset management group with €39.7

billion of assets under management (at 31 March 2023). Tikehau

Capital has developed a wide range of expertise across four asset

classes (private debt, real assets, private equity and capital

markets strategies) as well as multi-asset and special

opportunities strategies. Tikehau Capital is a founder led team

with a differentiated business model, a strong balance sheet,

proprietary global deal flow and a track record of backing high

quality companies and executives. Deeply rooted in the real

economy, Tikehau Capital provides bespoke and innovative

alternative financing solutions to companies it invests in and

seeks to create long-term value for its investors, while generating

positive impacts on society. Leveraging its strong equity base

(€3.1 billion of shareholders’ equity at 31 December 2022), the

firm invests its own capital alongside its investor-clients within

each of its strategies. Controlled by its managers alongside

leading institutional partners, Tikehau Capital is guided by a

strong entrepreneurial spirit and DNA, shared by its 742 employees

(at 31 December 2022) across its 14 offices in Europe, Asia and

North America. Tikehau Capital is listed in compartment A of the

regulated Euronext Paris market (ISIN code: FR0013230612; Ticker:

TKO.FP). For more information, please visit:

www.tikehaucapital.com.

ABOUT ALTAREA – FR0000033219 - ALTA Altarea is the French

leader in low-carbon urban transformation, with the most

comprehensive real estate offering to serve the city and its users.

In each of its activities, the Group has all the expertise and

recognised brands needed to design, develop, market and manage

tailor-made real estate products. Altarea is listed in compartment

A of Euronext Paris. For more information, please visit:

www.altarea.com.

1 Through Tikehau Investment Management, as management

company

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230601005800/en/

Press contacts Tikehau Capital – Valérie Sueur: +33 1 40

06 39 30 UK, Prosek Partners – Matthieu Roussellier: +44 (0) 7843

279 966 USA, Prosek Partners – Trevor Gibbons: +1 646 818 9238

press@tikehaucapital.com

Altarea – Denise Rodrigues-Vielliard: +33 6 37 36 24 14 –

drodrigues@altarea.com AGENCE SHAN – Marion LEBEL: +33 6 76 02 57

47 – marion.lebel@shan.fr

Shareholders and investors contacts Tikehau Capital:

Louis Igonet: +33 1 40 06 11 11 Théodora Xu: +33 1 40 06 18 56

shareholders@tikehaucapital.com

Altarea: Eric Dumas, Chief Financial Officer: +33 1 44 95 51 42

– edumas@altarea.com Pierre Perrodin, Deputy Chief Financial

Officer: +33 6 43 34 57 13 – pperrodin@altarea.com

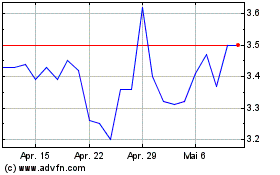

Taseko Mines (TSX:TKO)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Taseko Mines (TSX:TKO)

Historical Stock Chart

Von Feb 2024 bis Feb 2025