Slate Office REIT Announces Senior Management Change

10 Januar 2022 - 2:00PM

Business Wire

Slate Office REIT (TSX: SOT.UN) (the “REIT”), an owner and

operator of office real estate, announced today that, upon

completion of the Proposed Acquisition (as defined below), Charles

Peach will assume the role of Chief Financial Officer (“CFO”) of

Slate Office REIT. He will replace Michael Sheehan, who is stepping

down from his role as CFO to pursue other opportunities.

Peach currently serves as CFO of Yew Grove REIT plc (“Yew

Grove”), an Irish-incorporated real estate investment trust that is

dual-listed on Euronext Dublin (Ireland) and the AIM market of the

London Stock Exchange. Slate Office REIT has made a firm offer to

acquire all of the issued and outstanding shares of Yew Grove (the

“Proposed Acquisition”), which was approved by the shareholders of

Yew Grove on December 23, 2021. Subject to and upon completion of

the Proposed Acquisition, which is expected to occur in February

2022, Peach will step into the role of CFO of Slate Office REIT. No

additional remuneration or incentive will be payable to Peach upon

him taking on this role.

“Charles is a deeply experienced financial executive with an

impressive track record of driving growth and operational

excellence,” said Steve Hodgson, Chief Executive Officer of Slate

Office REIT. “His global experience, deep knowledge of the office

and lite-industrial sectors, and capital markets expertise will be

invaluable as we continue to grow our platform, further enhance the

stability and quality of our portfolio and create value for our

investors.”

Hodgson added: “We are very grateful to Michael for his many

contributions over the last several years, and we wish him all the

best in his future endeavors.”

Peach has nearly three decades of experience in capital markets,

including structuring and raising capital for companies and funds.

He started his career with Bear Stearns’ Financial Analytics and

Structured Transactions group before joining Nomura’s Exotic Credit

Trading Group. In addition to raising and structuring financing for

funds and corporate borrowers, he has advised pension schemes and

banks on their funding requirements and strategies.

In 2012, Peach joined the Parapet Capital Advisors management

team. He and the team established the Yew Tree Investment Fund

(“Yew Tree Fund”) targeting Irish office and industrial property

and acted as investment adviser to the Yew Tree Fund’s Alternative

Investment Fund Manager. The Yew Tree Fund portfolio was purchased

by Yew Grove at IPO. In April of 2018, Peach became a Director of

Yew Grove and was appointed as CFO in June of that same year. He

served on the Investment Committees of both the Yew Tree Fund and

Yew Grove.

Peach will work closely with the REIT’s senior management team

to ensure a seamless transition in the coming weeks.

About Slate Office REIT (TSX: SOT.UN) Slate Office REIT

is an owner and operator of office real estate. The REIT owns

interests in and operates a portfolio of 32 strategic and

well-located real estate assets across Canada's major population

centres and includes two assets in downtown Chicago, Illinois. 61%

of the REIT’s portfolio is comprised of government or credit rated

tenants. The REIT acquires quality assets and creates value for

unitholders by applying hands-on asset management strategies to

grow rental revenue, extend lease term and increase occupancy.

Visit slateofficereit.com to learn more.

About Slate Asset Management Slate Asset Management is a

global alternative investment platform focused on real estate. We

focus on fundamentals with the objective of creating long-term

value for our investors and partners. Slate’s platform spans a

range of investment strategies, including opportunistic, value add,

core plus and debt investments. We are supported by exceptional

people and flexible capital, which enables us to originate and

execute on a wide range of compelling investment opportunities.

Visit slateam.com to learn more.

Statements required by the Irish Takeover Rules The

trustees of the REIT accept responsibility for the information

contained in this announcement. To the best of the knowledge and

belief of the trustees of the REIT (who have taken all reasonable

care to ensure that this is the case) the information contained in

this announcement is in accordance with the facts and does not omit

anything likely to affect the import of such information.

Forward-Looking Statements Certain information herein

constitutes “forward-looking information” as defined under Canadian

securities laws which reflect management’s expectations regarding

objectives, plans, goals, strategies, future growth, results of

operations, performance, business prospects and opportunities of

the REIT. Some of the specific forward-looking statements contained

herein include, but are not limited to, statements with respect to

the completion of the Proposed Acquisition and the expected timing

for completion of the Proposed Acquisition. The words “plans”,

“expects”, “does not expect”, “scheduled”, “estimates”, “intends”,

“anticipates”, “does not anticipate”, “projects”, “believes”, or

variations of such words and phrases or statements to the effect

that certain actions, events or results “may”, “will”, “could”,

“would”, “might”, “occur”, “be achieved”, or “continue” and similar

expressions identify forward-looking statements. Such

forward-looking statements are qualified in their entirety by the

inherent risks and uncertainties surrounding future

expectations.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management as of the date hereof, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. When relying on forward-looking statements to make

decisions, the REIT cautions readers not to place undue reliance on

these statements, as forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results and will not necessarily be accurate

indications of whether or not the times at or by which such

performance or results will be achieved. A number of factors could

cause actual results to differ, possibly materially, from the

results discussed in the forward-looking statements. Additional

information about risks and uncertainties is contained in the

filings of the REIT with securities regulators.

SOT-Appt

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220110005393/en/

For Further Information Investor Relations +1 416 644

4264 ir@slateam.com

Press Inquiries +1 312 847 1486 pressinquiries@slateam.com

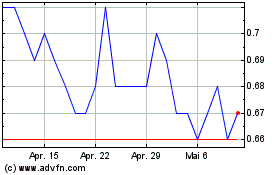

Slate Office REIT (TSX:SOT.UN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Slate Office REIT (TSX:SOT.UN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024