Slate Office REIT Announces 10-Year Lease Renewal with Government Tenant for Over 100,000 Square Feet

06 Mai 2021 - 2:00PM

Business Wire

Slate Office REIT (TSX: SOT.UN) (the "REIT"), an owner and

operator of North American office real estate, announced today the

completion of a 10-year lease renewal with a government tenant for

over 100,000 square feet in Atlantic Canada.

“We are pleased to report this significant long-term lease

renewal with one of our key government tenants. This is an

excellent outcome that further enhances the durability of the

REIT’s income and supports our net asset value,” said Steve

Hodgson, Chief Executive Officer of Slate Office REIT. “This

transaction highlights the improving market fundamentals in

Atlantic Canada and is reflective of the long-term commitment to

office we are seeing from tenants across our portfolio.”

Renewal Highlights

- The Province of New Brunswick is a key tenant and represents

35% of the gross leasable area at Kings Place in Fredericton

- Completed with a rental rate increase that is consistent with

other increases the REIT has seen across its portfolio

- Increases the REIT’s weighted average lease term (“WALT”) in

Atlantic Canada to 5.8 years from 5.2 years

- Increases the REIT’s WALT for the total portfolio to 5.5 years

from 5.3 years

About Slate Office REIT (TSX: SOT.UN) Slate Office REIT

is an owner and operator of North American office real estate. The

REIT owns interests in and operates a portfolio of 34 strategic and

well-located real estate assets across Canada's major population

centres and includes two assets in downtown Chicago, Illinois. 60%

of the REIT’s portfolio is comprised of government or credit rated

tenants. The REIT acquires quality assets at a discount to

replacement cost and creates value for unitholders by applying

hands-on asset management strategies to grow rental revenue, extend

lease term and increase occupancy. Visit slateofficereit.com to

learn more.

About Slate Asset Management Slate Asset Management is a

leading real estate focused alternative investment platform with

approximately $6.5 billion in assets under management. Slate is a

value-oriented manager and a significant sponsor of all of its

private and publicly traded investment vehicles, which are tailored

to the unique goals and objectives of its investors. The firm's

careful and selective investment approach creates long-term value

with an emphasis on capital preservation and outsized returns.

Slate is supported by exceptional people, flexible capital and a

demonstrated ability to originate and execute on a wide range of

compelling investment opportunities. Visit slateam.com to learn

more.

Forward-Looking Statements Certain information herein

constitutes “forward-looking information” as defined under Canadian

securities laws which reflect management’s expectations regarding

objectives, plans, goals, strategies, future growth, results of

operations, performance, business prospects and opportunities of

the REIT. The words “plans”, “expects”, “does not expect”,

“scheduled”, “estimates”, “intends”, “anticipates”, “does not

anticipate”, “projects”, “believes”, or variations of such words

and phrases or statements to the effect that certain actions,

events or results “may”, “will”, “could”, “would”, “might”,

“occur”, “be achieved”, or “continue” and similar expressions

identify forward-looking statements. Such forward-looking

statements are qualified in their entirety by the inherent risks

and uncertainties surrounding future expectations.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management as of the date hereof, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. When relying on forward-looking statements to make

decisions, the REIT cautions readers not to place undue reliance on

these statements, as forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results, and will not necessarily be accurate

indications of whether or not the times at or by which such

performance or results will be achieved. A number of factors could

cause actual results to differ, possibly materially, from the

results discussed in the forward-looking statements. Additional

information about risks and uncertainties is contained in the

filings of the REIT with securities regulators.

SOT-SA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210506005371/en/

For Further Information Investor Relations +1 416 644

4264 ir@slateam.com

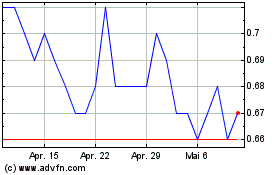

Slate Office REIT (TSX:SOT.UN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Slate Office REIT (TSX:SOT.UN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024