(All metal prices reported in USD)

- Consolidated 2023 copper equivalent production of 76.7

million pounds, an increase of 37% over 2022 and meets 2023

production guidance.

- Bolivar achieved a 26% increase in copper equivalent pounds

production in Q4 2023 over Q3 2023, driven by a 13% increase in

throughput and improved grades. Copper equivalent pounds production

for Q4 2023 was 58% higher than the same quarter of 2022.

- Yauricocha continued its steady growth during Q4 2023

achieving a 2% increase in throughput and 5% increase in copper

equivalent pounds production as compared to Q3 2023. Copper

equivalent pounds production for Q4 2023 was 100% higher than the

same quarter of 2022.

- The Company expects 2024 to be a year of stable operations

while it positions its core mines for long term growth. Base metal

production for 2024 expected to be in line with 2023.

Sierra Metals Inc. (TSX: SMT | OTCQX: SMTSF) (“Sierra

Metals” or the “Company”) reports fourth quarter and full year 2023

production results from its two underground mines in Latin America:

The Yauricocha polymetallic mine in Peru and the copper-producing

Bolivar mine in Mexico.

Ernesto Balarezo, CEO of Sierra Metals, commented, “2023 was a

pivotal turnaround year for the Company as we successfully

fulfilled our commitment of achieving stability and maintained

focus on optimizing all facets of the business, particularly in the

production from our core mines, while prioritizing the safety

aspects of our operations.

The team at Yauricocha responded positively to our efforts

towards recovery to full production capacity. The increase of 2% in

Q4 2023 throughput over Q3 2023 may be marginal but marks an

important sequential increase for the fourth consecutive

quarter.

Our Bolivar mine achieved an average production of 4,686 tonnes

per day throughput in Q4 2023, which is near capacity and close to

the production levels not seen since Q3 2020. We have been

successful in reducing the backlog in drilling and mine

development, and this is reflected in our Q4 2023 and full year

2023 production performance.

Mr. Balarezo concluded, “The momentum we built from 2023 will

provide the foundation for the future years, as we continue to

operate at the highest safety levels while optimizing production

and improving our balance sheet.”

Consolidated Production

Results

Consolidated Production

Year Ended December

31,

Q4 2023

Q3 2023

Q4 2022

2023

2022

% Var.

Tonnes processed (t)

673,846

622,622

422,899

2,464,932

1,995,890

24

%

Daily throughput

7,701

7,116

4,833

7,043

5,703

24

%

Copper production (000 lb)

12,096

9,477

6,170

40,317

27,127

49

%

Zinc production (000 lb)

9,629

11,176

6,367

43,612

38,100

14

%

Silver production (000 oz)

468

458

227

1,838

1,218

51

%

Gold Production (oz)

4,708

3,651

3,240

16,461

9,361

76

%

Lead production (000 lb)

2,481

4,084

1,749

13,273

12,216

9

%

Copper equivalent pounds (000's)(1)

21,134

18,496

11,903

76,749

56,116

37

%

(1) Copper equivalent pounds were

calculated using the following realized prices:

Q4 2023 - $3.70/lb Cu, $1.13/lb Zn, $23.22/oz Ag, $0.96/lb Pb,

$1,976/oz Au. Q3 2023 - $3.78/lb Cu, $1.10/lb Zn, $23.56/oz Ag,

$0.98/lb Pb, $1,927/oz Au. Q4 2022 - $3.63/lb Cu, $1.37/lb Zn,

$21.21/oz Ag, $0.95/lb Pb, $1,730/oz Au. FY 2023 - $3.85/lb Cu,

$1.20/lb Zn, $23.38/oz Ag, $0.97/lb Pb, $1,943/oz Au. FY 2022 -

$3.99/lb Cu, $1.59/lb Zn, $21.77/oz Ag, $0.98/lb Pb, $1,802/oz Au.

Consolidated throughput during Q4 2023 was 673,846 tonnes, an 8%

increase when compared to Q3 2023, as throughput from both the

mines increased quarter over quarter. Grades for all metals at the

Bolivar mine and copper grades at the Yauricocha mine also

increased quarter over quarter. The Company achieved a consolidated

production of 21.1 million copper equivalent pounds, indicating a

14% increase compared to Q3 2023.

When compared to Q4 2022, consolidated throughput increased 59%

for Q4 2023. Higher throughputs for both the mines were further

supported by higher copper and gold grades at Yauricocha, resulting

in a 78% increase in copper equivalent produced pounds in Q4 2023

as compared to the same quarter of 2022.

For 2023, the increase in throughput and grades resulted in

higher production for all metals. Consolidated copper equivalent

production was 76.7 million pounds, a 37% increase over the full

year 2022 consolidated copper equivalent production.

Yauricocha Mine, Peru

The Yauricocha mine continued its momentum of steady increase in

throughput in Q4 2023. Throughput during Q4 2023 was 263,851

tonnes, a 2% increase when compared to Q3 2023, but a 73% increase

over the same quarter of 2022.

As compared to Q3 2023, copper grades increased in Q4 2023, due

to the mining in the copper-rich Esperanza and Fortuna zones.

Grades for lead, silver and zinc declined in Q4 2023 when compared

to Q3 2023, due to the lower contribution in Q4 2023 from the

Esparanza North zone and other small ore bodies.

In comparison with the same quarter of last year, Q4 2023 grades

for lead and zinc were lower while copper, gold and silver grades

were higher than Q4 2022.

Copper equivalent production of 10.9 million for Q4 2023 was a

100% increase over Q4 2022. Despite a continuous quarter over

quarter increase in throughput during 2023, annual throughput for

Yauricocha was 6% below the throughput achieved in 2022. Annual

copper equivalent production of 40.1 million pounds was in line

with the 2023 production guidance, and represented a 2% increase

when compared to 2022.

A summary of production from the Yauricocha Mine for Q4 and Full

Year 2023 is provided below:

Yauricocha Production

Year Ended December

31,

Q4 2023

Q3 2023

Q4 2022

2023

2022

% Var.

Tonnes processed (t)

263,851

259,732

152,586

987,043

1,053,980

-6

%

Daily throughput

3,015

2,968

1,744

2,820

3,011

-6

%

Silver grade (g/t)

48.29

58.72

42.25

52.24

43.49

20

%

Copper grade

1.09%

0.89%

0.66%

0.88%

0.81%

9

%

Lead grade

0.60%

0.86%

0.63%

0.76%

0.65%

17

%

Zinc grade

2.12%

2.36%

2.21%

2.41%

1.99%

21

%

Gold Grade (g/t)

0.51

0.41

0.41

0.45

0.48

-6

%

Silver recovery

70.72%

63.16%

64.35%

70.21%

62.01%

13

%

Copper recovery

79.75%

74.81%

72.57%

76.09%

76.55%

-1

%

Lead recovery

70.74%

83.09%

82.18%

80.39%

79.92%

1

%

Zinc recovery

78.08%

82.57%

85.69%

83.17%

81.94%

2

%

Gold Recovery

21.78%

19.95%

21.63%

21.38%

20.98%

2

%

Copper production (000 lb)

5,036

3,806

1,621

14,545

14,541

0

%

Zinc production (000 lb)

9,629

11,176

6,367

43,612

38,100

14

%

Silver production (000 oz)

289

310

134

1,164

913

27

%

Gold Production (oz)

951

686

439

3,024

3,418

-12

%

Lead production (000 lb)

2,481

4,084

1,749

13,273

12,216

9

%

Copper equivalent pounds (000's)(1)

10,946

10,396

5,471

40,105

39,185

2

%

(1) Copper equivalent pounds were

calculated using the following realized prices:

Q4 2023 - $3.70/lb Cu, $1.13/lb Zn,

$23.22/oz Ag, $0.96/lb Pb, $1,976/oz Au.

Q3 2023 - $3.78/lb Cu, $1.10/lb Zn,

$23.56/oz Ag, $0.98/lb Pb, $1,927/oz Au.

Q4 2022 - $3.63/lb Cu, $1.37/lb Zn,

$21.21/oz Ag, $0.95/lb Pb, $1,730/oz Au.

FY 2023 - $3.85/lb Cu, $1.20/lb Zn,

$23.38/oz Ag, $0.97/lb Pb, $1,943/oz Au.

FY 2022 - $3.99/lb Cu, $1.59/lb Zn,

$21.77/oz Ag, $0.98/lb Pb, $1,802/oz Au.

Bolivar Mine, Mexico

The Bolivar Mine processed 409,995 tonnes during Q4 2023.

Throughput for Q4 2023 was 13% higher than Q3 2023 as a result of

higher availability of stopes driven by improved drilling and

blasting, and better equipment performance. The incorporation of

the Dulce ore body in the production schedule drove a quarter over

quarter improvement in head grades. Higher throughput and grades

resulted in increased production for all metals and consequent 26%

increase in copper equivalent pounds production.

Throughput for Q4 2023 was 52% higher than the same quarter of

2022, as improved drilling performance allowed for better approach

to the mineable zones. Enhanced ore definition enabled the mine to

produce better copper and silver grades during Q4 2023. The

resultant copper equivalent pounds production for Q4 2023 was 58%

higher than Q4 2022.

During 2023, production for all metals increased at Bolivar due

to the higher throughput and grades as compared to the full year

2022, resulting in 36.6 million copper equivalent pounds produced,

an increase of 116%. Bolivar’s annual copper equivalent pound

production was within the annual guidance range for 2023.

A summary of production for the Bolivar Mine for Q4 and Full

Year 2023 is provided below:

Bolivar Production

Year Ended December

31,

Q4 2023

Q3 2023

Q4 2022

2023

2022

% Var.

Tonnes processed (t)

409,995

362,890

270,313

1,477,889

941,910

57

%

Daily throughput

4,686

4,147

3,089

4,223

2,691

57

%

Copper grade

0.84%

0.77%

0.82%

0.85%

0.67%

27

%

Silver grade (g/t)

16.56

15.44

13.25

17.30

12.29

41

%

Gold grade (g/t)

0.42

0.37

0.50

0.41

0.30

37

%

Copper recovery

92.62%

92.10%

92.70%

92.92%

90.48%

3

%

Silver recovery

82.38%

81.95%

81.43%

82.01%

82.39%

0

%

Gold recovery

68.39%

69.58%

64.52%

68.32%

64.81%

5

%

Copper production (000 lb)

7,060

5,671

4,549

25,772

12,586

105

%

Silver production (000 oz)

179

148

93

674

305

121

%

Gold production (oz)

3,757

2,965

2,801

13,437

5,943

126

%

Copper equivalent pounds (000's)(1)

10,188

8,100

6,432

36,644

16,931

116

%

(1) Copper equivalent pounds were

calculated using the following realized prices:

Q4 2023 - $3.70/lb Cu, $1.13/lb Zn,

$23.22/oz Ag, $0.96/lb Pb, $1,976/oz Au.

Q3 2023 - $3.78/lb Cu, $1.10/lb Zn,

$23.56/oz Ag, $0.98/lb Pb, $1,927/oz Au.

Q4 2022 - $3.63/lb Cu, $1.37/lb Zn,

$21.21/oz Ag, $0.95/lb Pb, $1,730/oz Au.

FY 2023 - $3.85/lb Cu, $1.20/lb Zn,

$23.38/oz Ag, $0.97/lb Pb, $1,943/oz Au.

FY 2022 - $3.99/lb Cu, $1.59/lb Zn,

$21.77/oz Ag, $0.98/lb Pb, $1,802/oz Au.

2024 Production Guidance

The Company expects 2024 to be a year of stable operations while

it positions its core mines for long term growth. The Company is in

the final stage of a very comprehensive and thorough process to

obtain the permit to operate below the 1120 level at the Yauricocha

Mine and anticipates receipt of this permit by the end of Q1 2024.

Thereafter the Company expects that it will take between six and

nine months during 2024 to reach full production below 1120,

providing access to a large ore body that should allow the mine to

increase production and lower costs in subsequent years. At

Bolivar, plans are underway to enhance the capacity of the tailings

dam which will enable the plant to increase production levels.

The Company will issue its 2024 cost guidance along with its

2023 full year financial results to be announced on March 12,

2024.

Consolidated(1)

2024 Guidance

2023

Low

High

Actual

Copper (000 lbs)

37,500

43,300

40,317

Zinc (000 lbs)

38,600

44,500

43,612

Silver (000 oz)

1,500

1,750

1,838

Gold (oz)

10,100

11,600

16,461

Lead (000 lbs)

10,200

11,800

13,273

(1) 2024 Production guidance and actual

production for 2023 exclude production from the Cusi mine, which is

under care and maintenance and which the Company has re-classified

as an ‘asset held for sale’.

By Mine

Yauricocha

2024 Guidance

2023

Low

High

Actual

Copper (000 lbs)

13,600

15,700

14,545

Zinc (000 lbs)

38,600

44,500

43,612

Silver (000 oz)

850

1,000

1,164

Gold (oz)

2,100

2,400

3,024

Lead (000 lbs)

10,200

11,800

13,273

Bolivar

2024 Guidance

2023

Low

High

Actual

Copper (000 lbs)

23,900

27,600

25,772

Silver (000 oz)

650

750

674

Gold (oz)

8,000

9,200

13,437

Conference Call and

Webcast

Management will host a conference call and webcast to discuss Q4

2023 and full year 2023 financial and operating results on March

12, 2024 at 11:00 am (Eastern). Details are as follows:

- Webcast:

https://services.choruscall.ca/links/sierrametals2023q4.html

- Dial-in: Canada/US toll free: 1-800-319-4610

- Other dial-in: +1-416-915-3239

About Sierra Metals

Sierra Metals is a Canadian mining company focused on copper

production with additional base and precious metals by-product

credits at its Yauricocha Mine in Peru and Bolivar Mine in Mexico.

The Company is intent on safely increasing production volume and

growing mineral resources. Sierra Metals has recently had several

new key discoveries and still has many more exciting brownfield

exploration opportunities in Peru and Mexico that are within close

proximity to the existing mines. Additionally, the Company has

large land packages at each of its mines with several prospective

regional targets providing longer-term exploration upside and

mineral resource growth potential.

Forward Looking

Statements

This news release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra Metals and reflects management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action

including the accuracy of the Company's current mineral resource

estimates, that the Company's activities will be conducted in

accordance with the Company's public statements and stated goals,

and that there will be no material adverse change affecting the

Company, its properties or its production estimates, the expected

trends in mineral prices, inflation and currency exchange rates,

that all required approvals will be obtained for the Company's

business operations on acceptable terms, and that there will be no

significant disruptions affecting the Company's operations. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", “should”, "would", "might", or "will be taken",

"occur" or "be achieved" or the negative of these words or

comparable terminology. Forward-looking statements include

statements with respect to the timing of the receipt of the permit

for Yauricocha to operate below the 1120 level, timing of the

development below the 1120 level and to increase production, and

the timing of expansion of the tailings dam at Bolivar. By its very

nature forward-looking information involves known and unknown

risks, uncertainties and other factors that may cause actual

performance of Sierra Metals to be materially different from any

anticipated performance expressed or implied by such

forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 28,

2023 for its fiscal year ended December 31, 2022 and other risks

identified in the Company's filings with Canadian securities

regulators, which filings are available at www.sedarplus.ca.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240201700271/en/

For further information regarding Sierra Metals, please visit

www.sierrametals.com or contact:

Investor Relations Sierra Metals Inc. Tel: +1 (866)

721-7437 Email: info@sierrametals.com

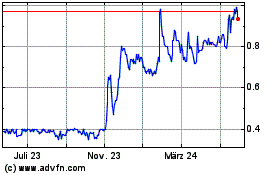

Sierra Metals (TSX:SMT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

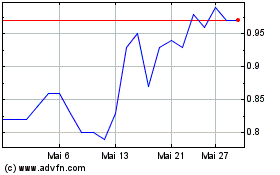

Sierra Metals (TSX:SMT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024