Surge Energy Inc. (“Surge”, “SGY”, or the “Company”) (TSX: SGY) is

pleased to announce that it has entered into a definitive purchase

and sale agreement (the “Definitive Agreement”) with Enerplus

Corporation (“Enerplus” or “ERF”) pursuant to which Surge has

agreed to acquire from Enerplus (the “Acquisition”) long life,

operated, high operating netback1, waterflooded producing oil

assets focused entirely within Surge’s Sparky and SE Saskatchewan

core areas (the “Assets”).

Surge has agreed to purchase the Assets for

gross proceeds of $245 million (the “Purchase Price”) with an

effective date of May 1, 2022, payable to Enerplus by way of an

estimated $165 million of cash, $45 million in estimated interim

period adjustments, and $35 million of equity in the form of common

shares of SGY (“Common Shares”) issued from treasury to

Enerplus.

The Acquisition has an effective date of May 1,

2022 and is currently expected to close on or about December 19,

2022 (the “Closing”), with an estimated net purchase price after

interim period adjustments of $200 million (the “Net Purchase

Price”).

In conjunction with the Closing, Surge

anticipates increasing the Company’s annual cash dividend by 14

percent, from $0.42 per share to $0.48 per share (paid monthly).

Any dividend increase will be subject to the approval of Surge's

Board of Directors with consideration given to the business

environment at the time of Closing.

The Assets are currently producing more than

3,850 boepd (99 percent liquids) of predominantly light and medium

gravity crude oil, with synergistic operations entirely focused in

Surge’s existing Sparky and SE Saskatchewan core areas. With an

operating netback of more than $48 per boe in 2023 (at flat US$80

WTI per bbl pricing2), the Assets are forecast to deliver $68

million of cash flow from operating activities and more than $50

million of free cash flow1 (“FCF”) after expenditures on property,

plant, and equipment and abandonment expenditures required to

maintain current production levels from the Assets.

After giving effect to the Acquisition, Surge is

now forecasting upwardly revised exit 2022 production of more than

25,000 boepd, consisting of approximately 87 percent liquids, which

is made up of predominantly light and medium gravity crude oil.

ASSET & ACQUISITION

HIGHLIGHTS

- At flat US$80 WTI per bbl pricing,

the Acquisition is accretive to Surge as follows:

- 17 percent accretive to Surge’s

forecast 2023 FCF per share;

- 8 percent accretive to Surge’s

forecast 2023 annual cash flow per share; and

- 8 percent accretive to Surge’s

forecast 2023 annual production per share.

- The Assets are entirely focused in

Surge’s existing SE Saskatchewan and Sparky core areas, and provide

the following to Surge shareholders:

- Adds 3,850 boepd of sustainable,

high operating netback, waterflooded, light and medium gravity

crude oil production, with a low decline rate3 of approximately 12

percent;

- Fully waterflooded Assets reduce

Surge’s corporate decline rate to approximately 23 percent,

significantly enhancing corporate sustainability;

- Adds a high quality, synergistic

development drilling inventory, which can hold production flat at

the current rate of 3,850 boepd on the Assets for an estimated 7

years4;

- Adds approximately 400 million

barrels of internally estimated original oil in place (“OOIP)3 net

to Surge, with a low 14 percent recovery factor to date3; and

- Increases the Company’s total

estimated OOIP to approximately 3.1 billion barrels, with a low

combined recovery factor of 7.5 percent to date.

Paul Colborne, President and CEO of Surge, said:

“We are very excited about this accretive, strategic, long life,

core area Acquisition. This is one of the highest quality, low

decline, asset packages that we have seen in my nine years at

Surge. This Acquisition is consistent with Surge’s disciplined

strategy of acquiring high quality, operated, conventional crude

oil reservoirs with large original oil in place and low recovery

factors. The Assets are under successful waterflood, providing

significant proven developed producing (“PDP”) reserves, they

possess a combined low 12 percent annual production decline3, and

they provide a solid development drilling inventory which we

estimate can hold production flat on the acquired Assets for seven

years. In 2023, we estimate that production can be held flat using

approximately 20 percent of 2023 annual cash flow from operating

activities generated by the Assets at US$80 WTI flat pricing.”

“Over the past eight years, Surge has

established a dominant position in its Sparky core growth area.

With the Acquisition, we have added to that position and now have

ownership and control of more than one billion barrels of net OOIP

in the Company’s Sparky core area, with a 12 year drilling

inventory4,” said Colborne. “Since 2014, Surge has sequentially

grown production in the Sparky from 1,200 boepd to over 11,000

boepd by exit 2022.”

“More recently, Surge Management has

strategically targeted SE Saskatchewan as a new core area of

growth, based on its high value light oil operating netbacks, low

cost production efficiencies, quick drilling payouts, and

consolidation opportunities. Surge’s operational track record of

execution in SE Saskatchewan, combined with its proven in-house

technical expertise, make this an exciting growth area for the

Company. The Acquisition adds approximately 1,950 bopd in SE

Saskatchewan of 11 percent decline, light oil production that

enhances our area sustainability. Surge now projects that the

Company will exit 2022 with more than 7,500 boepd (94 percent light

oil) in SE Saskatchewan.”

STRATEGIC RATIONALE

- The Acquisition is consistent with

Surge’s disciplined return of capital business model, which is

intended to provide substantial FCF for continued net debt

repayment, sustainable dividend increases, sustainable production

per share growth, and share buybacks;

- The Acquisition adds highly

concentrated, long life, waterflooded, light and medium gravity

crude oil reserves, production, land, and infrastructure which are

synergistic with Surge’s Sparky and SE Saskatchewan core area

operations;

- Following the Acquisition, Surge

will exit 2022 with approximately 75 percent of the Company’s

production focused in its Sparky and SE Saskatchewan core

areas;

- Surge estimates that approximately

20 percent of the annual cash flow from operating activities

generated by the Assets is needed to hold the production flat at

approximately 3,850 boepd in 2023 at US$80 WTI per barrel;

- The Assets are very clean from an

environmental perspective with less than $10 million of

undiscounted inactive abandonment liabilities;

- The Assets have an attractive

Licensee Liability Rating of 4.4 in Alberta and 2.9 in

Saskatchewan; and

- The Assets include propriety

operated and non-operated seismic data totaling 2,793 square

kilometers of 3D data and 37,970 km of 2D data. This data

significantly increases Surge’s seismic data in its core operating

areas; increasing the Company’s 3D coverage by 2 times, and its 2D

coverage by 5 times.

ACQUISTION METRICS

|

Gross Purchase Price |

$245 million |

|

Estimated Net Purchase Price |

$200 million |

|

Annual Cash Flow from Operating Activitiesa |

$68 million |

|

Current Production Rate |

~3,850 boepd (99 percent light & medium oil) |

|

Proved Developed Producing Reservesb |

10.1 MMboe (99 percent light & medium oil) |

|

Total Proved plus Probable Reservesb |

15.0 MMboe (99 percent light & medium oil) |

|

Proved Developed Producing RLIc |

6.8 years |

|

Total Proved plus Probable RLIc |

10.1 years |

|

Estimated Net Purchase Price per boepd |

$51,950/boepd |

|

Operating Netback @ US$80 WTI |

>$48/boe |

|

Estimated Net Purchase Price over Proved Developed Producing

Reservesb per boe |

$19.80/boe |

|

Estimated Net Purchase Price over Total Proved plus Probable

Reservesb per boe |

$13.33/boe (prior to Future Development Capital) |

|

Proved Developed Producing Recycle Ratiod |

2.4x |

|

Proved plus Probable Recycle Ratioe |

3.6x |

a: Based on the following pricing assumptions:

US$80.00WTI/bbl; CAD$109.59WTI/bbl; EDM CAD$104.11/bbl; WCS CAD

$85.62/bbl; AECO CAD$5/mcfb: Based upon McDaniel’s 2021YE reserve

estimate as of January 1, 2022. c: Based upon McDaniel’s total

proved plus probable reserve estimate as of January 1, 2022 divided

by production of 4,053 boepd. d: Recycle ratio is calculated as

operating netback of $48/boe divided by the acquisition cost of

proved developed producing reserves of $19.80/boe. e: Recycle ratio

is calculated as operating netback of $48/boe divided by the

acquisition cost of proved plus probable reserves of

$13.33/boe.

PRELIMINARY 2023 CAPITAL AND OPERATING

BUDGET

In conjunction with the Acquisition, Surge’s

preliminary financial and operational estimates for 2023 are

detailed below:

|

Guidance |

@ US $80 WTI ($0.73 FX)a |

|

Exit 2022 Production |

>25,000 boepd (87% liquids) |

|

Average 2023 Production |

>25,000 boepd (87% liquids) |

|

2023(e) Expenditures on property, plant and equipment |

$190 million |

|

2023(e) Cash Flow from Operating Activities |

$360 million |

|

Per shareb |

$3.92/sh |

|

2023(e) Free Cash Flow Before Dividends |

$170 million |

|

Per share |

$1.85/sh |

|

2023(e) Dividend |

$44 million |

|

Per share |

$0.48/sh |

|

2023(e) All-in Payout Ratioc |

65% |

|

2023(e) Royalties as % of Petroleum and Natural Gas Revenue |

18.5% |

|

2023(e) Net Operating Expensesc |

$19.50 - $19.75 per boe |

|

2023(e) Transportation Expenses |

$1.25 - $1.50 per boe |

|

2023(e) General & Administrative Expenses |

$1.85 - $1.95 per boe |

a: Based on the following pricing assumptions:

US$80.00WTI/bbl; CAD$109.59WTI/bbl; EDM CAD$104.11/bbl; WCS CAD

$85.62/bbl; AECO $5/mcf b: Based on 84 million Common Shares

outstanding prior to the Acquisition, plus an estimated 7.8 million

Common Shares issued in conjunction with the Acquisition c: This is

a non-GAAP and other financial measure which is defined in the

Non-GAAP and Other Financial Measures section of this document

ANTICIPATED DIVIDEND

INCREASE

Given that the Assets generate a high percentage

of FCF and are very sustainable in nature (with a low annual

decline of 12 percent), Surge anticipates increasing the Company’s

annual base cash dividend by 14 percent, from $0.42 per share to

$0.48 per share (paid monthly), following the Closing of the

Acquisition. This upwardly revised base dividend is consistent with

Phase 1 of the Company’s previously announced return of capital

framework.

Any dividend increase will be subject to the

approval of Surge's Board of Directors with consideration given to

the business environment at the Closing of the Acquisition.

ACQUISITION DETAILS; TERM DEBT

FINANCING; EQUITY FINANCING

The Closing of the Acquisition is expected to

occur on or about December 19, 2022. The Net Purchase Price payable

by Surge at Closing is anticipated to be $200 million, and will be

funded by way of the following:

1) $38 million of net proceeds from the bought

deal common equity financing referenced below;

2) $100 million in amortizing term loans from existing first

lien and second lien lenders;

3) $27 million draw on the Company’s existing first lien credit

facility (which is expected to be drawn only $50 million at

Closing, with over $100 million of undrawn, available capacity);

and

4) $35 million in share consideration to Enerplus, from the

issuance of Common Shares of SGY at a price equal to the bought

deal common equity financing referenced below.

Concurrent with Closing, the Company expects to

expand its syndicated first lien credit facility to a total

of $210 million. This will be comprised of a $60 million term

loan due November 2023, and a $150 million revolving credit

facility. Additionally, the Company anticipates drawing a further

$40 million on its existing second lien term facility to partially

fund the Acquisition. This incremental second lien term debt is

expected to be due November, 2024.

In conjunction with the Acquisition, Surge has

entered into an agreement with a syndicate of underwriters led by

National Bank Financial Inc. and Peters & Co. Limited (the

"Underwriters"), pursuant to which the Underwriters have agreed to

purchase, for resale to the public, on a bought-deal basis,

approximately 4,325,000 Common Shares of Surge at a price

of $9.25 per Common Share for gross proceeds of approximately

$40 million (the "Offering"). The net proceeds from the Offering

will be used to partially fund the Acquisition. The Underwriters

will have an option to purchase up to an additional 15 percent of

the Common Shares issued under the Offering (the “Over-Allotment”)

on the same terms as the Offering to cover over-allotments

exercisable in whole or in part at any time until 30 days after the

closing.

The Common Shares issued pursuant to the

Offering will be distributed by way of a short form prospectus in

all provinces of Canada (excluding Québec) and may also be placed

privately in the United States to Qualified Institutional Buyers

(as defined under Rule 144A under the United States Securities Act

of 1933, as amended pursuant to an exemption under Rule 144A, and

may be distributed outside Canada and the United States on a basis

which does not require the qualification or registration of any of

the Company's securities under domestic or foreign securities laws.

Completion of the Offering is subject to customary closing

conditions, including the receipt of all necessary regulatory

approvals, including the approval of the Toronto Stock Exchange.

Closing of the Offering is expected to occur on November 22, 2022.

Closing of the Offering is not conditional upon completion of the

Acquisition. In the event the Acquisition is not completed, Surge

may use the net proceeds of the Offering to reduce indebtedness,

fund future acquisitions and for general corporate purposes. Prior

to the closing of the Acquisition, the net proceeds may, from time

to time, be invested in interest bearing deposits or in short-term

interest bearing or discount debt obligations or other short-term

investments (in each case, either Canadian or U.S. dollars).

Upon the Closing of the Acquisition, Surge will

have an estimated 92.1 million Common Shares issued and

outstanding inclusive of Common Shares issued in the Offering.

2023 OUTLOOK - STRONG OPERATIONAL

PERFORMANCE DRIVING FREE CASH FLOW

The Acquisition further concentrates the

Company’s focus within its Sparky and SE Saskatchewan core

operating areas and is consistent with its return of capital

business model. Surge will continue its disciplined development of

the Company’s high quality, low cost, conventional crude oil asset

base, including Surge’s premier Sparky play in Alberta, as well as

its high operating netback, light oil assets in SE Saskatchewan.

The addition of the acquired Assets further positions Surge to

provide shareholders with sustainable free cash flow generation in

2023 and beyond.

Following the Acquisition, Surge will possess

the following key operational and financial attributes:

- Over 3.1 billion barrels of net,

internally estimated, conventional OOIP - with a low recovery

factor to date of 7.5 percent;

- Combined Proven plus Probable year

end 2021 independently evaluated reserves of more than 115 million

boe;

- Average 2023 production estimated

at more than 25,000 boepd (87 percent liquids weighted);

- A low base corporate decline of 23

percent;

- A large development drilling

inventory of more than 1,000 net internally estimated locations4;

providing a development drilling inventory of more than 12

years;

- A 12.5 year reserve life index

(Total Proved plus Probable);

- Forecast cash flow from operating

activities in 2023 of $360 million at US$80 WTI per bbl flat

pricing;

- Forecasted FCF prior to dividends

of over $170 million in 2023 at US$80 WTI per bbl flat pricing;

and

- A large tax base with more than

$1.5 billion of tax pools as of December 31, 2021.

ADVISORS

Peters & Co. Limited and National Bank

Financial Inc. acted as financial advisors to Surge with respect to

the Acquisition. ATB Capital Markets has been appointed as

strategic advisors to Surge on the Acquisition. McCarthy Tétrault

LLP is acting as legal advisor to Surge with respect to the

Acquisition and the Offering.

FORWARD LOOKING STATEMENTS

This press release contains forward-looking

statements. The use of any of the words “anticipate”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “should”, “believe”

and similar expressions are intended to identify forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements.

More particularly, this press release contains

statements concerning management’s expectations and assumptions

concerning the anticipated benefits of the Acquisition and the

transaction metrics related thereto; the anticipated use of the net

proceeds from the Offering; the timing of various matters in

connection with the Acquisition and the Offering and the conditions

to completion of each, as applicable; the market value of the

consideration to be received by Enerplus in connection with the

Acquisition; the operational performance of the Company following

completion of the Acquisition; the approval of the dividend

increase by Surge's Board of Directors; and Surge’s revised

guidance for the remainder of 2022 and preliminary guidance for

2023.

The forward-looking statements are based on

certain key expectations and assumptions made by Surge, including

the Acquisition and Offering being completed on the timelines and

on the terms currently anticipated; all necessary regulatory

approvals being obtained on the timelines and in the manner

currently anticipated; the business and operations of both the

Company and the Assets, including that the Assets will continue to

operate and produce in a manner consistent with past results; the

anticipated benefits of the Acquisition and the Assets acquired in

connection therewith; the expansion of the Company's syndicated

first lien credit facility and any consents or approvals required

in connection therewith; expectations and assumptions around the

performance of existing wells and success obtained in drilling new

wells; anticipated expenses, cash flow and capital expenditures;

the application of regulatory and royalty regimes; prevailing

commodity prices and economic conditions; development and

completion activities; the performance of new wells; the successful

implementation of waterflood programs; the availability of and

performance of facilities and pipelines; the geological

characteristics of Surge’s properties and the Assets; the

successful application of drilling, completion and seismic

technology; the determination of decommissioning liabilities;

prevailing weather conditions; exchange rates; licensing

requirements; the impact of completed facilities on operating

costs; the availability and costs of capital, labour and services;

and the creditworthiness of industry partners.

Although Surge believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Surge can give no assurance that

they will prove to be correct. Since forward-looking statements

address future events and conditions, by their very nature they

involve inherent risks and uncertainties. Actual results could

differ materially from those currently anticipated due to a number

of factors and risks. These include, but are not limited to, the

risks associated with the Acquisition and Offering, including

timing of closing, if closing is completed, that the benefits

thereof will not be as anticipated, the conditions to closing are

not satisfied or waived and receipt of any regulatory approvals;

risks associated with the condition of the global economy,

including trade, public health (including the impact of COVID-19)

and other geopolitical risks; risks associated with the oil and gas

industry in general (e.g. operational risks in development,

exploration and production; delays or changes in plans with respect

to exploration or development projects or capital expenditures; the

uncertainty of reserve estimates; the uncertainty of estimates and

projections relating to production, costs and expenses, and health,

safety and environmental risks); commodity price and exchange rate

fluctuations and constraint in the availability of services,

adverse weather or break-up conditions; uncertainties resulting

from potential delays or changes in plans with respect to

exploration or development projects or capital expenditures; and

failure to obtain the continued support of the lenders under

Surge’s bank line. Certain of these risks are set out in more

detail in Surge’s Annual Information Form dated March 9, 2022 and

in Surge’s Management Discussion & Analysis for the year ended

December 31, 2021, both of which have been filed on SEDAR and can

be accessed at www.sedar.com.

The forward-looking statements contained in this

press release are made as of the date hereof and Surge undertakes

no obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities laws.

Oil and Gas Advisories

The term “boe” means barrel of oil equivalent on

the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be

misleading, particularly if used in isolation. A boe conversion

ratio of 1 boe for 6,000 cubic feet of natural gas is based on an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. “Boe/d” and “boepd” mean barrel of oil equivalent per

day. Bbl means barrel of oil and “bopd” means barrels of oil per

day. NGLs means natural gas liquids.

This press release contains certain oil and gas

metrics and defined terms which do not have standardized meanings

or standard methods of calculation and therefore such measures may

not be comparable to similar metrics/terms presented by other

issuers and may differ by definition and application. All oil and

gas metrics/terms used in this document are defined below:

OOIP means Discovered Petroleum Initially In

Place (“DPIIP”). DPIIP is derived by Surge’s internal Qualified

Reserve Evaluators (“QRE”) and prepared in accordance with National

Instrument 51-101 and the Canadian Oil and Gas Evaluations Handbook

(“COGEH”). DPIIP, as defined in COGEH, is that quantity of

petroleum that is estimated, as of a given date, to be contained in

known accumulations prior to production. The recoverable portion of

DPIIP includes production, reserves and Resources Other Than

Reserves (ROTR). OOIP/DPIIP and potential recovery rate estimates

are based on current recovery technologies. There is significant

uncertainty as to the ultimate recoverability and commercial

viability of any of the resource associated with OOIP/DPIIP, and as

such a recovery project cannot be defined for a volume of

OOIP/DPIIP at this time. “Internally estimated” means an estimate

that is derived by Surge’s internal QRE’s and prepared in

accordance with National Instrument 51-101 - Standards of

Disclosure for Oil and Gas Activities. All internal estimates

contained in this new release have been prepared effective as of

Jan 1, 2022.

Recovery factor is calculated by dividing the

total amount of produced barrels of oil from a particular reservoir

at a certain date by the original oil in place in the

reservoir.

After giving effect to the Acquisition, the

Company will have 2021YE TPP reserves of 120.4 mmboe. The reserves

associated with the Acquisition have been evaluated by McDaniel

& Associates Consultants Ltd. (“McDaniel”) for 2021YE (vs.

Surge’s 2021YE reserves evaluated by Sproule).

Surge’s total internal OOIP estimate of Cadogan

(Lloyd + SPKY), Freda Lake & Neptune (Ratcliff) and Giltedge

(Lloyd) is 389 mmbbls, which has a CUM to Sept 2021 of 55.4 mmbbls

(i.e. 14.2 percent recovery factor to date).

Surge’s evaluation of the Acquisition assets

generates a 12 percent decline as of Jan 2022 (on 4,080 boe/d).

McDaniel’s PDP decline is 14 percent and Proved plus PDP decline is

12 percent.

Drilling Inventory

This press release discloses drilling locations

in two categories: (i) booked locations; and (ii) unbooked

locations. Booked locations are proved locations and probable

locations derived from an internal evaluation using standard

practices as prescribed in the Canadian Oil and Gas Evaluations

Handbook and account for drilling locations that have associated

proved and/or probable reserves, as applicable.

Unbooked locations are internal estimates based

on prospective acreage and assumptions as to the number of wells

that can be drilled per section based on industry practice and

internal review. Unbooked locations do not have attributed reserves

or resources. Unbooked locations have been identified by Surge’s

internal certified Engineers and Geologists (who are also Qualified

Reserve Evaluators) as an estimation of our multi-year drilling

activities based on evaluation of applicable geologic, seismic,

engineering, production and reserves information. There is no

certainty that the Company will drill all unbooked drilling

locations, and if drilled there is no certainty that such locations

will result in additional oil and gas reserves, resources or

production. The drilling locations on which the Company actually

drills wells will ultimately depend upon the availability of

capital, regulatory approvals, seasonal restrictions, oil and

natural gas prices, costs, actual drilling results, additional

reservoir information that is obtained and other factors. While

certain that the unbooked drilling locations have been de-risked by

drilling existing wells in relative close proximity to such

unbooked drilling locations, the majority of other unbooked

drilling locations are farther away from existing wells where

management has less information about the characteristics of the

reservoir and therefore there is more uncertainty whether wells

will be drilled in such locations, and if drilled there is more

uncertainty that such wells will result in additional oil and gas

reserves, resources or production.

Surge’s review of the Acquisition’s inventory

supports ~60 gross (>45 net) internally estimated drilling

locations. The Acquisition’s 2021 Year End reserves has 13.0 net

booked locations (no SPKY locations booked). Of the 13 booked, 9.0

net are Proved locations and 4.0 net are Probable locations based

on McDaniel’s evaluation. Assuming an average number of net wells

drilled per year of 6.0, the Acquisition has more than 45 net

locations, providing approximately 7 years of drilling.

Assuming a January 1, 2022 reference date, and

after taking into account the Acquisition, the Company will have

over >1,125 gross (>1,025 net) drilling locations identified

herein, of these >600 gross (>550 net) are unbooked

locations. Of the 469 net booked locations identified herein, 371

net are Proved locations and 99 net are Probable locations based on

Sproule’s 2021YE reserves. Assuming an average number of net wells

drilled per year of 80, Surge’s >1,025 net locations provide

over 12 years of drilling.

Assuming a January 1, 2022 reference date, and

after taking into account the Acquisition, the Company’s Sparky

core area will have >450 net locations (165 net booked), 121 net

are Proved locations and 44 net are Probable locations based on

2021YE reserves. Assuming an average number of net SPKY Core wells

drilled per year of 40, Surge’s >450 net locations provide

approximately 11 years of drilling.

Surge’s internally developed type curves (for

both Surge and the Acquisition assets) were constructed using a

representative, factual and balanced analog data set, as of January

1, 2022 for Surge type curves and the Acquisition type curves. All

locations were risked appropriately, and estimated ultimate

recoveries were measured against OOIP estimates to ensure a

reasonable recovery factor was being achieved based on the

respective spacing assumption. Other assumptions, such as capital,

operating expenses, wellhead offsets, land encumbrances, working

interests and NGL yields were all reviewed, updated and accounted

for on a well by well basis by Surge’s Qualified Reserve

Evaluators. All type curves fully comply with Part 5.8 of the

Companion Policy 51 – 101CP.

Non-GAAP and Other Financial

Measures

Certain secondary financial measures in this

press release – including, “free cash flow”, “operating netback”,

“all-in payout ratio” and “net operating expenses” are not

prescribed by GAAP. These specified financial measures include

non-GAAP financial measures and non-GAAP ratios, are not defined by

IFRS and therefore are referred to as non-GAAP and other financial

measures. These non-GAAP and other financial measures are included

because management uses the information to analyze business

performance, cash flow generated from the business, leverage and

liquidity, resulting from the Company’s principal business

activities and it may be useful to investors on the same basis.

None of these measures are used to enhance the Company’s reported

financial performance or position. The non-GAAP and other financial

measures do not have a standardized meaning prescribed by IFRS and

therefore are unlikely to be comparable to similar measures

presented by other issuers. They are common in the reports of other

companies but may differ by definition and application. All

non-GAAP and other financial measures used in this document are

defined below:

Free Cash Flow

Free cash flow is a non-GAAP financial measure,

calculated as cash flow from operating activities, before changes

in non-cash working capital, less expenditures on property, plant,

equipment. Management uses free cash flow to determine the amount

of funds available to the Company for future capital allocation

decisions. Free cash flow per share is a non-GAAP ratio, calculated

using the same weighted average basic and diluted shares used in

calculating income per share.

Operating Netback

Operating netback is a non-GAAP financial

measure, calculated as petroleum and natural gas revenue and

processing and other income, less royalties, realized gain (loss)

on commodity and FX contracts, operating expenses, and

transportation expenses. Operating netback per boe is a non-GAAP

ratio, calculated as operating netback divided by total barrels of

oil equivalent produced during a specific period of time. There is

no comparable measure in accordance with IFRS. This metric is used

by management to evaluate the Company’s ability to generate cash

margin on a unit of production basis.

All-in payout ratio

All-in payout ratio is a non-GAAP ratio,

calculated as exploration and development expenditures, plus

dividends paid, divided by cash flow from operations. This capital

management measure is used by management to analyze allocated

capital in comparison to the cash being generated by the principal

business activities.

Net Operating Expenses

Net operating expenses is a non-GAAP financial

measure, determined by deducting processing and other revenue

primarily generated by processing third party volumes at processing

facilities where the Company has an ownership interest. It is

common in the industry to earn third party processing revenue on

facilities where the entity has a working interest in the

infrastructure asset. Under IFRS this source of funds is required

to be reported as revenue. However, the Company's principal

business is not that of a midstream entity whose activities are

dedicated to earning processing and other infrastructure payments.

Where the Company has excess capacity at one of its facilities, it

will look to process third party volumes as a means to reduce the

cost of operating/owning the facility. As such, third party

processing revenue is netted against operating costs when analyzed

by management.

Additional information relating to non-IFRS

measures can be found in the Company's most recent Management

Discussion and Analysis, which may be accessed through the SEDAR

website (www.sedar.com).

For more information about Surge, visit our website at

www.surgeenergy.ca

| Paul

Colborne, President & CEO |

Jared

Ducs, CFO |

| Surge Energy Inc. |

Surge Energy Inc. |

| Phone: (403) 930-1507 |

Phone: (403) 930-1046 |

| Fax: (403) 930-1011 |

Fax: (403) 930-1011 |

| Email: pcolborne@surgeenergy.ca |

Email: jducs@surgeenergy.ca |

Neither the

TSX nor its

Regulation Services

Provider (as

that term is

defined in the

policies of the

TSX) accepts

responsibility for

the adequacy or

accuracy of this

release.

For more information about Surge, visit our website at

www.surgeenergy.ca

_______________________________________1 This is a non-GAAP and

other financial measure which is defined in the Non-GAAP and Other

Financial Measures section of this document2 Based on the following

pricing assumptions: US$80.00WTI/bbl; CAD$109.59WTI/bbl; EDM

CAD$104.11/bbl; WCS CAD $85.62/bbl; AECO CAD$5/mcf.3 See the Oil

and Gas Advisories section of this document.4 See the Drilling

Inventory section of this document.

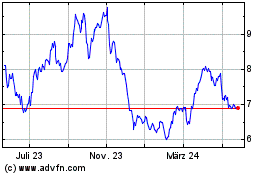

Surge Energy (TSX:SGY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

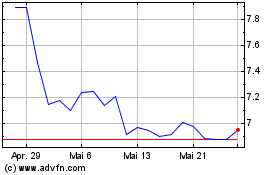

Surge Energy (TSX:SGY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025