Russel Metals Inc. (TSX: RUS) today announced second quarter

earnings of $19 million or $0.31 per share, an improvement from the

results reported for the first quarter of 2010 of $0.28 per share.

These results were stronger than both the comparable adjusted net

earnings for the second quarter of 2009 of $0.10 per share and the

reported loss of $0.41 per share.

Our strong results in the second quarter of 2010, resulted in

year to date earnings of $35 million or $0.59 per share. Revenues

for the six months to June 30, 2010 were $1.0 billion.

Consolidated revenues for the second quarter of 2010 were $506

million, up 9% from the second quarter of 2009. Our volumes

increased from both the first quarter of 2010 and the second

quarter of 2009. The improved operating results compared to the

first quarter of 2010 were primarily generated by stronger gross

margins on higher average selling prices.

Metals service centers volumes increased 14% from the comparable

quarter in 2009 and 4% from the first quarter of 2010 resulting in

revenues for the quarter of $312 million. Improved gross margin

dollars due to higher selling prices resulted in an operating

profit of $19 million for the second quarter of 2010 compared to $2

million in the second quarter of 2009 and $15 million in the first

quarter of 2010.

Energy tubular products revenues were $129 million in the second

quarter of 2010, a decline from the first quarter of 2010 due to

seasonality and consistent with the second quarter of 2009.

Operating profits were $11 million for the second quarter of 2010

and were consistent with the first quarter of 2010 due to improved

selling prices offsetting the lower volumes.

Revenues for our steel distributors operations increased to $61

million, the highest level in the past year. Demand from our

customers and rising selling prices contributed to the increased

revenue and operating profit. Operating profits for the second

quarter of 2010 were $7 million, up from $4 million in the first

quarter of 2010.

Brian R. Hedges, President and CEO, stated "Our second quarter

continued to improve from the first quarter. Improved volumes,

margins and higher selling prices all contributed to stronger

results. We will be challenged to maintain this momentum,

particularly in our service center operations in the summer months,

but anticipate an improvement in the fall. We continue to look at

potential acquisitions, green fields and operational savings."

The Board of Directors approved a quarterly dividend of $0.25

per common share payable September 15, 2010 to shareholders of

record as of August 30, 2010.

The Company will be holding an Investor Conference Call on

Thursday, August 12, 2010 at 9:00 a.m. ET to review its second

quarter results for 2010. The dial-in telephone numbers for the

call are 416-695-6617 (Toronto and International callers) and

1-800-355-4959 (U.S. and Canada). Please dial in 10 minutes prior

to the call to ensure that you get a line.

A replay of the call will be available at 416-695-5800 (Toronto

and International callers) and 1-800-408-3053 (U.S. and Canada)

until midnight, Thursday, August 26, 2010. You will be required to

enter pass code 8424727 in order to access the call. Additional

supplemental financial information is available in our investor

conference call package located on our website at

www.russelmetals.com.

Russel Metals is one of the largest metals distribution

companies in North America. It carries on business in three

distribution segments: metals service centers, energy tubular

products and steel distributors, under various names including

Russel Metals, A.J. Forsyth, Acier Leroux, Acier Loubier, Acier

Richler, Arrow Steel Processors, B&T Steel, Baldwin

International, Comco Pipe and Supply, Fedmet Tubulars, JMS Russel

Metals, Leroux Steel, McCabe Steel, Megantic Metal, Metaux Russel,

Metaux Russel Produits Specialises, Milspec, Norton Metals, Pioneer

Pipe, Russel Metals Specialty Products, Russel Metals Williams

Bahcall, Spartan Steel Products, Sunbelt Group, Triumph Tubular

& Supply, Wirth Steel and York-Ennis.

Statements contained in this press release or on the related

conference call that relate to Russel Metals' beliefs or

expectations as to certain future events are not statements of

historical fact and are forward-looking statements. Russel Metals

cautions readers that there are important factors, risks and

uncertainties, including but not limited to economic, competitive

and governmental factors affecting Russel Metals' operations,

markets, products, services and prices that could cause its actual

results, performance or achievements to be materially different

from those forecasted or anticipated in such forward-looking

statements.

The forward-looking statements in this document reflect

management's current beliefs and are based on information currently

available to management. The material assumptions applied in making

the forward-looking statements in this document include the

following: demand from the manufacturing, resource and construction

segments of the Canadian economy and oil and gas prices have all

been significantly negatively impacted by the economic conditions

and these conditions will improve at a slow pace through out 2010;

the price of steel which saw improvement during the second quarter

of 2010 will decline due to lack of demand; and the value of the

Canadian dollar relative to the U.S. dollar will be range bound

consistent with the first half of 2010. Although the

forward-looking statements contained in this document are based

upon what management believes to be reasonable estimates and

assumptions, Russel Metals cannot ensure that actual results will

not be materially different from those expressed or implied by

these forward-looking statements.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

December

June 30 31

(millions) 2010 2009

----------------------------------------------------------------------------

ASSETS

Current

Cash and cash equivalents $ 283.8 $ 359.6

Accounts receivable 279.9 217.8

Inventories 538.3 517.9

Prepaid expenses and other assets 5.1 4.9

Income taxes 46.7 53.0

----------------------------------------------------------------------------

1,153.8 1,153.2

Property, Plant and Equipment 224.1 231.9

Future Income Tax Assets 5.5 5.9

Pensions and Benefits 7.9 8.0

Other Assets 3.9 8.3

Goodwill and Intangibles 28.3 28.4

----------------------------------------------------------------------------

$ 1,423.5 $ 1,435.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current

Accounts payable and accrued liabilities $ 268.3 $ 252.3

Income taxes payable 1.4 1.4

Current portion long-term debt 1.3 1.3

----------------------------------------------------------------------------

271.0 255.0

Derivatives - 30.9

Long-Term Debt 335.7 340.8

Pensions and Benefits 6.0 5.9

Future Income Tax Liabilities 10.0 9.9

----------------------------------------------------------------------------

622.7 642.5

----------------------------------------------------------------------------

Shareholders' Equity

Common shares 478.9 478.9

Retained earnings 320.7 315.3

Contributed surplus 12.5 11.4

Accumulated other comprehensive income (loss) (22.9) (24.0)

Equity component of convertible debenture 11.6 11.6

----------------------------------------------------------------------------

800.8 793.2

----------------------------------------------------------------------------

$ 1,423.5 $ 1,435.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF EARNINGS (LOSS) (UNAUDITED)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Quarters ended June Six months ended June

(millions, except per share 30 30

data) 2010 2009 2010 2009

----------------------------------------------------------------------------

Revenues $ 506.1 $ 462.5 $ 1,032.0 $ 1,104.8

Cost of sales 398.9 440.7 829.9 1,087.3

----------------------------------------------------------------------------

Gross margin 107.2 21.8 202.1 17.5

Operating expenses 72.4 66.0 141.0 142.6

----------------------------------------------------------------------------

Earnings (loss) before the

following 34.8 (44.2) 61.1 (125.1)

Other income (expense) (0.2) 4.3 1.3 4.3

Interest expense, net (6.5) (4.4) (13.2) (9.2)

----------------------------------------------------------------------------

Earnings (loss) before income

taxes 28.1 (44.3) 49.2 (130.0)

(Provision for) recovery of

income taxes (9.4) 19.7 (14.0) 50.4

----------------------------------------------------------------------------

Net earnings (loss) for the

period $ 18.7 $ (24.6) $ 35.2 $ (79.6)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings (loss) per common

share $ 0.31 $ (0.41) $ 0.59 $ (1.33)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Diluted earnings (loss) per

common share $ 0.31 $ (0.41) $ 0.59 $ (1.33)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS (UNAUDITED)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Six months ended June

Quarters ended June 30 30

(millions) 2010 2009 2010 2009

----------------------------------------------------------------------------

Retained earnings, beginning of

the period $ 316.9 $ 397.1 $ 315.3 $ 467.0

Net earnings (loss) for the

period 18.7 (24.6) 35.2 (79.6)

Dividends on common shares (14.9) (14.9) (29.8) (29.8)

----------------------------------------------------------------------------

Retained earnings, end of the

period $ 320.7 $ 357.6 $ 320.7 $ 357.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Quarters Six months

Ended June 30 Ended June 30

(millions) 2010 2009 2010 2009

----------------------------------------------------------------------------

Net earnings (loss) for the

period $ 18.7 $ (24.6) $ 35.2 $ (79.6)

----------------------------------------------------------------------------

Other comprehensive income

(loss)

Unrealized foreign exchange

gains (losses) on translation

of self-sustaining U.S.

operations 15.0 (34.9) 4.8 (21.3)

Unrealized gains (losses) on

items designated as net

investment hedges (6.4) 5.3 (0.8) 3.4

Unrealized gains (losses) on

items designated as cash flow

hedges - 3.0 (2.5) 5.2

Losses (gains) on derivatives

designated as cash flow

hedges transferred to net

income in the current period 0.3 (1.7) (0.4) (4.7)

----------------------------------------------------------------------------

Other comprehensive income

(loss) 8.9 (28.3) 1.1 (17.4)

----------------------------------------------------------------------------

Comprehensive income (loss) $ 27.6 $ (52.9) $ 36.3 $ (97.0)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Quarters Six months

Ended June 30 Ended June 30

(millions) 2010 2009 2010 2009

----------------------------------------------------------------------------

Accumulated net unrealized

foreign currency translation

gains and losses

Balance, beginning of period $ (40.2) $ 50.5 $ (30.0) $ 36.9

Unrealized foreign exchange

gains (losses) on translation

of self-sustaining U.S.

operations 15.0 (34.9) 4.8 (21.3)

----------------------------------------------------------------------------

Balance, end of period (25.2) 15.6 (25.2) 15.6

----------------------------------------------------------------------------

Accumulated net unrealized gains

(losses) on cash flow and net

investment hedges

Balance, beginning of period 8.4 (9.3) 6.0 (12.0)

Transitional adjustment - - - 5.4

Unrealized gains (losses) on

items designated as net

investment hedges (6.4) 5.3 (0.8) 3.4

Unrealized gains (losses) on

items designated as cash flow

hedges - 3.0 (2.5) 5.2

Losses (gains) on derivatives

designated as cash flow

hedges transferred to net

income in the current period 0.3 (1.7) (0.4) (4.7)

----------------------------------------------------------------------------

Balance, end of period 2.3 (2.7) 2.3 (2.7)

----------------------------------------------------------------------------

Accumulated other comprehensive

income (loss) $ (22.9) $ 12.9 $ (22.9) $ 12.9

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED CASH FLOW STATEMENTS (UNAUDITED)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Quarters ended June Six months ended June

30 30

(millions) 2010 2009 2010 2009

----------------------------------------------------------------------------

Operating activities

Net earnings (loss) for the

period $ 18.7 $ (24.6) $ 35.2 $ (79.6)

Depreciation and amortization 6.2 6.5 12.5 13.0

Future income taxes 1.2 1.9 3.0 4.0

Gain on investment and sale of

long-lived assets - (4.3) (1.5) (4.5)

Stock-based compensation 0.7 0.5 1.1 0.9

Difference between pension

expense and amount funded - (0.2) 0.2 (0.3)

Other 0.9 0.1 1.3 0.4

----------------------------------------------------------------------------

Cash from (used in) operating

activities before non-cash

working capital 27.7 (20.1) 51.8 (66.1)

----------------------------------------------------------------------------

Changes in non-cash working

capital items

Accounts receivable 14.9 77.0 (60.8) 182.2

Inventories (65.4) 155.3 (18.7) 264.8

Accounts payable and accrued

liabilities 6.9 (115.4) 15.1 (172.2)

Current income taxes 4.7 (16.2) 11.2 (84.9)

Other (0.7) 0.8 (0.2) 1.9

----------------------------------------------------------------------------

Change in non-cash working

capital (39.6) 101.5 (53.4) 191.8

----------------------------------------------------------------------------

Cash (used in) from operating

activities (11.9) 81.4 (1.6) 125.7

----------------------------------------------------------------------------

Financing activities

Increase (decrease) in bank

borrowings - 7.0 - (17.9)

Dividends on common shares (14.9) (14.9) (29.8) (29.8)

Repayment of long-term debt (8.1) (0.3) (8.5) (0.7)

Deferred financing (0.7) (2.3) (0.7) (2.3)

Swap termination - - (35.2) -

----------------------------------------------------------------------------

Cash used in financing

activities (23.7) (10.5) (74.2) (50.7)

----------------------------------------------------------------------------

Investing activities

Purchase of property, plant

and equipment (2.1) (2.9) (3.4) (6.7)

Proceeds on sale of property,

plant and equipment 0.3 5.0 0.3 5.6

Proceeds on sale of investment 6.0 - 6.0 -

----------------------------------------------------------------------------

Cash from (used in) investing

activities 4.2 2.1 2.9 (1.1)

----------------------------------------------------------------------------

Effect of exchange rates on cash

and cash equivalents 4.1 (6.4) (2.9) (5.1)

----------------------------------------------------------------------------

(Decrease) increase in cash and

cash equivalents (27.3) 66.6 (75.8) 68.8

Cash and cash equivalents,

beginning of the period 311.1 47.1 359.6 44.9

----------------------------------------------------------------------------

Cash and cash equivalents, end

of the period $ 283.8 $ 113.7 $ 283.8 $ 113.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contacts: Russel Metals Inc. Marion E. Britton, C.A. Vice

President and Chief Financial Officer (905) 819-7407

info@russelmetals.com www.russelmetals.com

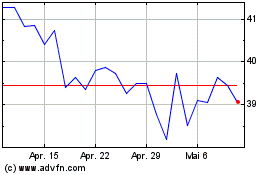

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024