Russel Metals Announces $150 Million Public Offering of Convertible Debentures

21 September 2009 - 2:04PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE U.S.

Russel Metals Inc. (TSX:RUS) today announced that it has entered into an

agreement with a syndicate of underwriters co-led by GMP Securities L.P. and RBC

Capital Markets and including, Scotia Capital Inc. and TD Securities Inc.,

pursuant to which the underwriters will purchase $150 million principal amount

of convertible unsecured subordinated debentures at a price of $1,000 per

debenture.

The convertible debentures will mature on September 30, 2016 and will accrue

interest at the rate of 7.75% per annum payable on a semi-annual basis. At the

holder's option, the convertible debentures may be converted into common shares

of Russel Metals at any time up to the maturity date. The conversion price will

be $25.75 for each common share, subject to adjustment in certain circumstances.

The convertible debentures will be direct, unsecured obligations of Russel

Metals, subordinated to other indebtedness of the Company for borrowed money and

ranking equally with all other unsecured subordinated indebtedness.

The convertible debentures will not be redeemable before September 30, 2015.

From September 30, 2015 through the maturity date, Russel Metals may, at its

option, redeem the convertible debentures, in whole or in part, at par plus

accrued and unpaid interest.

Subject to specified conditions, Russel Metals will have the right to repay the

outstanding principal amount of the convertible debentures, on maturity or

redemption, through the issuance of common shares of the Company. Russel Metals

will also have the option to satisfy its obligation to pay interest through the

issuance and sale of common shares of the Company. Additionally, Russel Metals

will have the option, subject to prior agreement of the holders, to settle its

obligations on conversion by way of a cash payment of equal value.

Russel Metals will use the net proceeds of the offering for working capital,

potential acquisitions and general corporate purposes.

The offering is scheduled to close on or about October 8, 2009 and is subject to

certain conditions including, but not limited to, the receipt of all necessary

approvals including the approval of the Toronto Stock Exchange.

A preliminary short-form prospectus will be filed by September 25, 2009 with the

securities regulatory authorities in all provinces of Canada. The securities

offered have not been and will not be registered under the U.S. Securities Act

of 1933, as amended, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registrations requirements of

such Act. This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities in any jurisdiction.

Russel Metals is one of the largest metals distribution companies in North

America. It carries on business in three distribution segments: metals service

centers, energy tubular products and steel distributors, under various names

including Russel Metals, A.J. Forsyth, Acier Leroux, Acier Loubier, Acier

Richler, Arrow Steel Processors, B&T Steel, Baldwin International, Comco Pipe

and Supply, Fedmet Tubulars, JMS Russel Metals, Leroux Steel, McCabe Steel,

Megantic Metal, Metaux Russel, Metaux Russel Produits Specialises, Milspec

Industries, Norton Metals, Pioneer Pipe, Russel Metals Specialty Products,

Russel Metals Williams Bahcall, Spartan Steel Products, Sunbelt Group, Triumph

Tubular & Supply, Wirth Steel and York-Ennis.

This news release contains certain statements that constitute forward-looking

information within the meaning of applicable securities laws ("forward-looking

statements"). Such forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause the actual results, performance

or achievements of Russel Metals, or developments in Russel Metals' business or

in its industry, to differ materially from the anticipated results, performance,

achievements or developments expressed or implied by such forward-looking

statements. Forward-looking statements include all disclosure regarding possible

events, conditions or results of operations that is based on assumptions about

future economic conditions and courses of action. Forward-looking statements may

also include, without limitation, any statement relating to future events,

conditions or circumstances. Russel Metals cautions you not to place undue

reliance upon any such forward-looking statements, which speak only as of the

date they are made. Forward-looking statements relate to, among other things,

the expected use of proceeds of the offering and the expected closing date of

the offering. The risks and uncertainties that may affect forward-looking

statements include, among others: economic market conditions; and other risks

detailed from time to time in Russel Metals' filings with Canadian provincial

securities regulators. Forward-looking statements are based on management's

current plans, estimates, projections, beliefs and opinions, and, except as

required by law, Russel Metals does not undertake any obligation to update

forward-looking statements should assumptions related to these plans, estimates,

projections, beliefs and opinions change.

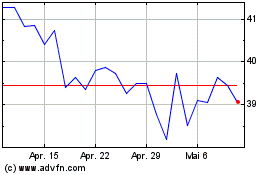

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024